Ammonium Acetate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427609 | Date : Oct, 2025 | Pages : 254 | Region : Global | Publisher : MRU

Ammonium Acetate Market Size

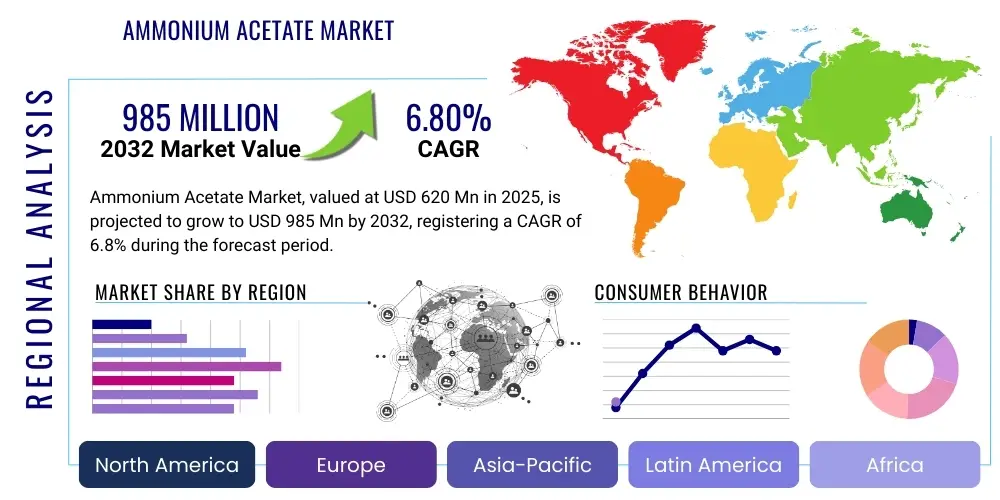

The Ammonium Acetate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 620 million in 2025 and is projected to reach USD 985 million by the end of the forecast period in 2032.

Ammonium Acetate Market introduction

Ammonium acetate is the ammonium salt of acetic acid, a white crystalline solid highly soluble in water with the chemical formula CH3COONH4. This versatile compound serves as a key ingredient across numerous industries due to its diverse properties, including its role as a buffering agent, a mild acid, and a source of nitrogen. Its benefits encompass biodegradability, relatively low toxicity, and exceptional efficacy in maintaining pH balance, driving its adoption in environmentally sensitive applications and precise chemical processes.

Major applications span agriculture, where it acts as an effective fertilizer and pH regulator; pharmaceuticals, where it is extensively used in the synthesis of drugs and as a critical buffer in various formulations; food processing, employed as a safe food additive and preservative; and laboratory reagents essential for analytical chemistry. The markets growth is predominantly fueled by increasing demand from the pharmaceutical and agricultural sectors, coupled with expanding industrial applications globally, particularly in emerging economies where chemical manufacturing and biotechnology research are experiencing significant expansion. This broad utility underscores its fundamental importance in modern industrial and scientific landscapes.

Ammonium Acetate Market Executive Summary

The ammonium acetate market is characterized by robust growth, propelled by evolving business trends that emphasize sustainability, efficiency, and technological integration in chemical processes. Significant regional trends indicate Asia-Pacific as a dominant and rapidly expanding market, driven by accelerated industrialization, advancements in the agricultural sector, and burgeoning pharmaceutical manufacturing capabilities. Meanwhile, North America and Europe maintain steady demand through continuous innovation, strict regulatory compliance, and a strong focus on high-value applications, ensuring a stable yet dynamic market presence.

Segmentation trends highlight a consistent and increasing demand for high-purity grades of ammonium acetate in sensitive applications such as pharmaceuticals and biotechnology, where product integrity and consistency are paramount. Concurrently, there is a broader uptake of industrial grades in sectors like agriculture and water treatment, driven by cost-effectiveness and bulk availability. The market navigates a landscape shaped by raw material price fluctuations, increasing environmental scrutiny on chemical production practices, and a rising imperative for eco-friendly solutions. Strategic investments in advanced research and development, capacity expansion, and the adoption of cutting-edge manufacturing technologies are critical for market players to effectively capitalize on emerging opportunities and mitigate potential restraints across all segments and geographical regions.

AI Impact Analysis on Ammonium Acetate Market

Common user questions regarding AIs impact on the Ammonium Acetate Market frequently focus on how artificial intelligence can optimize manufacturing processes, enhance supply chain resilience, accelerate research and development for new applications, and improve product quality and consistency. There is significant interest in AIs multifaceted role in predictive analytics for market demand forecasting, optimized raw material sourcing, and waste reduction strategies, directly addressing both economic efficiencies and environmental sustainability objectives. Users often inquire about the potential for AI to automate complex chemical synthesis, monitor real-time production parameters with precision, and contribute significantly to the development of more sustainable and cost-effective production methods for ammonium acetate.

The integration of AI technologies is poised to revolutionize several facets of the ammonium acetate market, leading to substantial operational improvements and strategic advantages for manufacturers and distributors alike. AI-driven solutions can significantly enhance process optimization within manufacturing facilities, allowing for real-time adjustments to critical reaction conditions such as temperature, pressure, and reactant ratios. This precise control maximizes yield, minimizes energy consumption, and reduces the generation of undesirable by-products. This capability is crucial for reducing overall production costs and improving operational efficiency, directly impacting the profitability of ammonium acetate producers. Furthermore, AIs advanced analytical prowess can be leveraged for predictive maintenance of complex manufacturing equipment, accurately identifying potential failures before they occur, which in turn reduces unplanned downtime and extends the lifespan of critical machinery, ensuring continuous and uninterrupted production cycles.

Beyond manufacturing floor improvements, AI holds immense potential in accelerating research and development efforts within the ammonium acetate domain, enabling the rapid screening of potential catalysts, optimizing synthesis routes for novel derivatives, and accurately predicting the properties of new formulations involving ammonium acetate, thereby drastically shortening development cycles. Its sophisticated application in supply chain management can lead to more accurate demand forecasting, optimized inventory levels, and enhanced logistics planning, resulting in reduced lead times and improved delivery reliability across global networks. Ultimately, AIs influence extends to stringent quality control, where advanced machine vision systems and data analytics can detect impurities or inconsistencies with unparalleled precision and speed, ensuring that the ammonium acetate produced meets stringent industry standards, especially for high-purity applications in pharmaceuticals and biotechnology, fostering both innovation and competitive differentiation.

- Optimized Production Processes: AI algorithms analyze vast datasets from manufacturing operations to fine-tune reaction parameters, leading to higher yields, reduced energy consumption, and lower operational costs.

- Predictive Maintenance: AI-powered sensors and analytics anticipate equipment failures, enabling proactive maintenance, significantly reducing unplanned downtime, and extending asset lifespan.

- Enhanced Quality Control: Machine learning models detect impurities and inconsistencies in ammonium acetate with superior accuracy and speed compared to traditional manual or basic automated methods.

- Accelerated Research and Development: AI simulates chemical reactions and screens potential new applications or synthesis methods, drastically shortening development cycles for novel formulations and derivatives.

- Supply Chain Efficiency: AI optimizes logistics, inventory management, and demand forecasting, resulting in reduced operational costs, improved delivery reliability, and enhanced supply chain resilience.

- Sustainability Improvements: AI helps identify opportunities for waste reduction, energy efficiency, and more sustainable raw material sourcing in ammonium acetate production, aligning with green chemistry principles.

DRO & Impact Forces Of Ammonium Acetate Market

The ammonium acetate market is significantly shaped by a complex interplay of driving forces, inherent restraints, and emerging opportunities, all of which are subject to various impact forces influencing its dynamic market landscape. Key drivers include the escalating demand from the pharmaceutical sector for its role as essential buffer solutions and in drug synthesis, the continuous and growing need for fertilizers and pH regulators in the global agricultural sector, and its expanding use in water treatment and diverse laboratory applications. These factors collectively propel market expansion, particularly as global populations grow and industrial activities intensify across various developing economies worldwide.

However, the market also faces several significant restraints that challenge its growth trajectory. Fluctuations in the prices of critical raw materials, such as acetic acid and ammonia, directly impact production costs and market pricing, introducing volatility and necessitating robust procurement and hedging strategies. Environmental regulations pertaining to chemical production processes and waste disposal methods pose substantial challenges, requiring significant investment in compliance, sustainable manufacturing practices, and advanced waste management technologies. Additionally, the availability of substitute chemicals for certain applications, while often less effective or more costly, presents a competitive pressure that can limit market growth in specific segments, mandating continuous product differentiation and innovation.

Despite these restraints, considerable opportunities exist for market players to achieve substantial growth. Innovations in production technologies aimed at reducing environmental impact and improving efficiency, alongside dedicated research into novel and high-value applications, present clear avenues for market expansion. The increasing adoption of precision agriculture techniques, which require precise chemical formulations and targeted nutrient delivery, and the robust expansion of the biotechnology industry, demanding high-purity reagents, offer lucrative prospects. Furthermore, strategic collaborations, mergers, and acquisitions can enable companies to consolidate market share, leverage synergies, and expand their geographical reach, thereby enhancing their competitive posture against market impact forces such as the bargaining power of buyers and suppliers, the omnipresent threat of new entrants, and the intensity of competitive rivalry within the industry.

Segmentation Analysis

The ammonium acetate market is comprehensively segmented to provide a detailed understanding of its diverse applications, varying purity requirements, and intricate geographical distribution. This meticulous segmentation enables stakeholders to identify key growth areas, understand specific customer needs with greater clarity, and tailor their product offerings and market strategies effectively for maximum impact. The primary segmentation often includes purity levels, reflecting the stringent demands of pharmaceutical and analytical applications versus the broader requirements of industrial uses; application areas, such as agriculture, pharmaceuticals, food and beverages, and chemical synthesis; and end-use industries, which further refine the target market demographics and consumption patterns.

Understanding these granular segments is crucial for market participants to navigate the competitive landscape successfully and capitalize on emerging trends. For instance, the demand for high-purity ammonium acetate is typically driven by the pharmaceutical and biotechnology sectors, where product integrity, consistency, and traceability are paramount for drug safety, efficacy, and regulatory compliance. In stark contrast, agricultural and general industrial applications often prioritize cost-effectiveness and bulk availability, allowing for broader market penetration based on competitive price points and efficient supply chain management. This differentiation necessitates distinct production and distribution strategies.

Geographical segmentation further highlights regional specificities in consumption patterns, local regulatory environments, and prevailing economic development, all of which profoundly influence market dynamics. Asia Pacific, for example, is characterized by rapid industrial growth and extensive agricultural expansion, leading to high demand across multiple segments. Conversely, North America and Europe emphasize advanced research, specialized applications, and a strong focus on value-added products and sustainable practices. This multi-faceted segmentation provides a robust and indispensable framework for comprehensive market analysis, strategic planning, and highly targeted investment decisions across the global ammonium acetate landscape.

- By Purity:

- Reagent Grade

- Pharmaceutical Grade

- Food Grade

- Industrial Grade

- By Application:

- Laboratory Reagents

- Pharmaceuticals and Biotechnology

- Food Additives and Preservatives

- Agriculture (Fertilizers, pH Regulators, Soil Conditioners)

- Water and Wastewater Treatment

- Textile Dyeing and Printing

- Chemical Synthesis (Buffer Solutions, Catalyst)

- Other Industrial Uses (Photography, Rubber, etc.)

- By End-Use Industry:

- Chemical Manufacturing

- Pharmaceutical and Biotechnology Industry

- Food and Beverage Processing

- Agriculture and Farming

- Research and Academic Institutions

- Textile Industry

- Water and Wastewater Treatment Plants

- Photography and Film Industry

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Australia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (South Africa, Saudi Arabia, UAE, Rest of Middle East and Africa)

Ammonium Acetate Market Value Chain Analysis

The value chain for the ammonium acetate market encompasses all crucial stages from raw material procurement to end-user consumption, providing a holistic view of the interconnected activities that systematically add value and collectively contribute to the final products market positioning and profitability. Upstream analysis focuses on the sourcing and production of key raw materials, primarily acetic acid and ammonia. These essential precursors are typically derived from petrochemical processes or fermentation for acetic acid, and industrial synthesis for ammonia. The efficiency, cost-effectiveness, and stability of securing these raw materials, along with managing their inherent price volatility, significantly influence the overall production cost of ammonium acetate, making robust supplier relationships and long-term contracts critical at this foundational stage.

Midstream activities involve the intricate chemical synthesis and rigorous purification of ammonium acetate. This stage often incorporates various advanced manufacturing processes specifically designed to achieve desired purity levels, ranging from high-volume industrial grades to highly specialized pharmaceutical and food grades. Investment in cutting-edge manufacturing technologies, stringent quality control measures, and strict adherence to regulatory standards (such as cGMP for pharmaceutical applications) are paramount here to ensure consistent product quality, batch-to-batch consistency, and sustained market competitiveness. Efficient process design, waste minimization strategies, and effective byproduct management practices at this stage are crucial for both economic viability and environmental compliance, driving sustainable operations.

Downstream analysis meticulously covers the diverse distribution channels and intricate end-user engagement strategies. Distribution can be direct, where manufacturers supply directly to large industrial consumers or specialized pharmaceutical companies, often ensuring tailored technical support, bespoke formulations, and direct customer service. Alternatively, indirect distribution involves a comprehensive network of distributors, wholesalers, and specialized chemical suppliers who cater to a broader base of smaller clients, including academic laboratories and local agricultural cooperatives, providing extensive market reach. The optimal choice of distribution channel depends critically on the scale of the customer, the required geographical reach, and the specific purity requirements of the ammonium acetate product. Effective logistics, a resilient supply chain, and strong customer service are absolutely essential for timely delivery, widespread market penetration, and maintaining a competitive advantage across the globally diverse end-use sectors.

Ammonium Acetate Market Potential Customers

Potential customers for ammonium acetate are remarkably diverse, reflecting its wide array of applications across various industries and its inherent versatility as a fundamental chemical compound. The primary end-users include pharmaceutical companies, which utilize it as a vital buffer in intricate drug formulations, a crucial reagent in complex chemical synthesis pathways, and for specialized protein purification processes. Its non-toxic and biodegradable nature makes it particularly suitable for these sensitive biomedical applications, driving consistent demand for high-purity grades and ensuring the utmost product integrity and patient safety.

Agricultural sectors constitute another major group of buyers, where ammonium acetate is highly valued as a key component in fertilizers due to its readily available nitrogen content, and as an effective soil pH regulator. Its increasing incorporation into liquid fertilizers and foliar sprays is gaining significant traction, especially with the growing global emphasis on precision agriculture and sustainable farming practices that aim to maximize crop yield while simultaneously minimizing environmental impact. Food and beverage manufacturers also represent a steady and growing customer base, employing it as a safe food additive (E264), a buffering agent to maintain desired acidity levels and flavor profiles, and a preservative to extend product shelf life, thereby contributing significantly to product stability and consumer satisfaction.

Furthermore, chemical laboratories and rigorous research institutions are significant consumers, using ammonium acetate as a versatile reagent for advanced analytical chemistry, various chromatography techniques, and a wide range of organic synthesis reactions. Textile industries incorporate it into dyeing processes, particularly as a mordant and buffering agent to ensure consistent color fixation, while water treatment facilities employ it for critical nitrogen removal and precise pH adjustment processes. The extensive breadth of its utility across these varied sectors ensures a broad, resilient, and continuously expanding customer base, making the market less susceptible to downturns in any single industry and highlighting its fundamental importance in industrial and scientific chemistry.

Ammonium Acetate Market Key Technology Landscape

The key technology landscape surrounding the ammonium acetate market primarily involves advanced synthesis methods, sophisticated purification techniques, and cutting-edge analytical instrumentation, all essential for ensuring unwavering product quality, consistency, and compliance with stringent industry and regulatory standards. Modern production processes are increasingly focused on optimizing complex reaction conditions—such as precise temperature control, pressure regulation, and efficient catalyst use—to maximize yield, minimize undesirable by-products, and significantly reduce overall energy consumption. The progressive adoption of continuous flow reactors and process intensification technologies is actively being explored and implemented to further enhance efficiency, dramatically reduce batch times, and enable more sustainable, eco-friendly manufacturing of ammonium acetate.

Purification technologies are critically important, especially for pharmaceutical, food-grade, and analytical-grade ammonium acetate, where extremely stringent purity standards must be met to ensure product safety and efficacy. Advanced techniques like multi-stage recrystallization, highly efficient solvent extraction, selective ion exchange, and precision membrane filtration are meticulously employed to remove even trace impurities and consistently achieve the desired grade. Innovations in these areas are focused on improving separation efficiency, significantly reducing solvent usage, lowering overall processing costs, and ensuring strict adherence to evolving environmental regulations. The development of greener purification methods, emphasizing reduced chemical waste generation and a minimized energy footprint, represents a significant and rapidly growing trend, aligning with broader industry goals for sustainability and eco-friendly chemical production.

Beyond synthesis and purification, advanced analytical technologies play an absolutely vital role in stringent quality control, comprehensive quality assurance, and continuous product development. High-performance liquid chromatography (HPLC), gas chromatography (GC), mass spectrometry (MS), and nuclear magnetic resonance (NMR) spectroscopy are routinely utilized to accurately characterize ammonium acetate, confirm its precise identity, and quantify impurities or degradation products with exceptional accuracy. The increasing integration of automation and sophisticated in-line analytical tools is also gaining significant traction, enabling real-time monitoring of production parameters and instant assessment of product quality, thereby enhancing overall process control, optimizing throughput, and significantly reducing the need for extensive post-production testing, leading to faster product release times and improved operational efficiency across the value chain.

Regional Highlights

- Asia Pacific: Dominant market share and projected to exhibit the fastest growth, driven by rapid industrialization, an expanding agricultural sector, burgeoning pharmaceutical manufacturing capabilities, and increasing investments in research and development across key economies such as China, India, and Japan. The region also benefits from a large consumer base and favorable government initiatives supporting domestic chemical production.

- North America: A mature market with steady and consistent demand, primarily supported by robust pharmaceutical and biotechnology industries, advanced agricultural practices focusing on efficiency and sustainability, and significant research activities in both academic and private sectors. High adoption of specialized and high-purity grades of ammonium acetate is characteristic of this technologically advanced region.

- Europe: A stable market characterized by stringent quality standards, a strong presence of pharmaceutical and specialized chemical manufacturing companies, and an increasing focus on sustainable chemical production and green chemistry initiatives. Countries like Germany, France, and the UK are key contributors to the regional market, with an emphasis on innovation and regulatory compliance.

- Latin America: An emerging market experiencing growing demand, particularly from its expanding agricultural sector in countries like Brazil and Argentina, which require fertilizers and soil amendments to boost crop yields. The region also sees developing chemical and pharmaceutical industries contributing to modest but consistent market growth.

- Middle East and Africa: A smaller but growing market, influenced by significant investments in industrial infrastructure development, expanding agricultural initiatives aimed at enhancing food security, and increasing healthcare spending. Countries like Saudi Arabia, UAE, and South Africa are leading the regional market expansion for various industrial and specialized applications of ammonium acetate.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ammonium Acetate Market.- Avantor Performance Materials, LLC

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Lonza Group AG

- BASF SE

- Spectrum Chemical Mfg. Corp.

- Alfa Aesar (part of Thermo Fisher Scientific)

- Finar Chemicals LLP

- Central Drug House (P) Ltd.

- GACL (Gujarat Alkalies and Chemicals Limited)

- Shree Nath Chemicals

- Macron Fine Chemicals (part of Avantor)

- Kanto Chemical Co., Inc.

- Wako Pure Chemical Industries, Ltd. (part of Fujifilm)

- ProChem, Inc.

Frequently Asked Questions

What is the projected growth rate for the Ammonium Acetate Market?

The Ammonium Acetate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032, reaching an estimated USD 985 million by the end of the forecast period.

What are the primary applications of Ammonium Acetate?

Ammonium Acetate is primarily utilized in pharmaceuticals as a buffer and reagent, in agriculture as a fertilizer and pH regulator, as a food additive, and as a versatile laboratory chemical.

How does AI impact the Ammonium Acetate Market?

AI significantly impacts the market by optimizing production processes, enabling predictive maintenance, enhancing quality control, accelerating R&D, and improving supply chain efficiency and sustainability.

Which region currently dominates the Ammonium Acetate Market?

The Asia Pacific region currently dominates the Ammonium Acetate Market in terms of market share and growth, driven by rapid industrialization, expanding agriculture, and a robust pharmaceutical sector.

What are the key drivers for the Ammonium Acetate Markets growth?

Key drivers include increasing demand from the pharmaceutical and agricultural sectors, its broad utility as a buffering agent, and its growing applications in water treatment and chemical synthesis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager