Analog Security Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430419 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Analog Security Camera Market Size

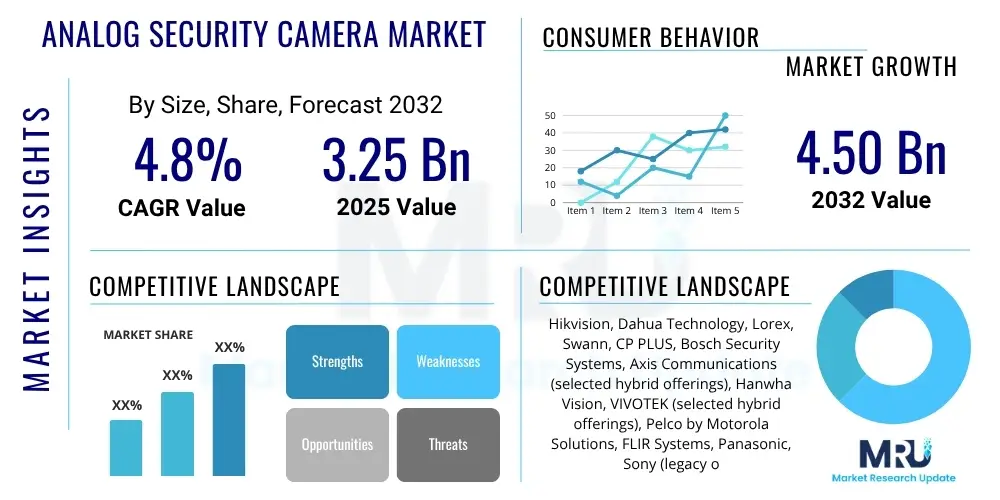

The Analog Security Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 3.25 Billion in 2025 and is projected to reach USD 4.50 Billion by the end of the forecast period in 2032.

Analog Security Camera Market introduction

The Analog Security Camera Market encompasses surveillance systems that capture video footage and transmit it over coaxial cables to a digital video recorder (DVR). These cameras primarily output a continuous video signal in a traditional analog format, which is then processed, stored, and displayed by a DVR. While often seen as a traditional technology, analog security cameras continue to hold significant market relevance, particularly in segments prioritizing cost-effectiveness, simplicity of installation, and robust performance in environments where advanced digital features are not the primary requirement. This market includes a range of products from standard definition (SD) to high-definition (HD) analog solutions, such as HD-CVI, HD-TVI, and AHD, which provide significantly improved image quality over traditional CVBS systems while leveraging existing coaxial infrastructure.

The products within this market offer a dependable and straightforward approach to video surveillance. Their core functionality involves converting light into an electrical signal, which is then sent directly to a recording device. Major applications for analog security cameras span across various sectors, including residential properties, small and medium-sized enterprises (SMEs), retail stores, educational institutions, and certain industrial facilities. These systems are particularly beneficial for basic monitoring needs, perimeter surveillance, and general security where comprehensive analytics and network capabilities are secondary concerns. The inherent simplicity of their plug-and-play installation often makes them a preferred choice for users seeking reliable security without complex network configurations.

Key benefits driving the continued adoption of analog security cameras include their lower initial cost compared to IP-based systems, their ease of maintenance, and their proven reliability in diverse operational conditions. The ability to utilize existing coaxial cabling infrastructure for upgrades to HD analog systems further reduces installation costs and time for many businesses and homeowners. Additionally, their robustness against network vulnerabilities makes them an attractive option for certain security-sensitive applications. Driving factors for this market include the persistent demand for affordable surveillance solutions, particularly in developing regions, the need for straightforward security installations, and the ongoing modernization of analog technology to offer higher resolutions, providing a competitive edge against the basic offerings of entry-level IP cameras.

Analog Security Camera Market Executive Summary

The Analog Security Camera Market is experiencing sustained demand, driven by its inherent cost-effectiveness, ease of deployment, and widespread applicability across various end-user segments. While digital IP cameras represent the cutting edge of surveillance technology, the analog market maintains a strong foothold, particularly with the advent of high-definition analog technologies such as HD-CVI, HD-TVI, and AHD. These innovations have breathed new life into the traditional analog framework, offering resolutions comparable to IP cameras while retaining the simplicity and infrastructure benefits of coaxial cabling. Businesses, especially small and medium-sized enterprises (SMEs), and residential users continue to favor analog systems for their straightforward functionality and lower initial investment, making them a cornerstone of accessible security solutions globally. This market thrives on the balance between performance and economic viability, catering to a significant demographic that prioritizes practical surveillance without extensive technical overhead.

Current business trends indicate a steady integration of analog systems with hybrid digital video recorders (DVRs) that can simultaneously support both analog and IP cameras, facilitating a smoother transition or a mixed security environment for end-users. This hybrid approach allows for phased upgrades and maximizes the utility of existing infrastructure, reducing the total cost of ownership. The market is also seeing increased demand for enhanced low-light performance and wider dynamic range in analog cameras, improving their effectiveness in challenging lighting conditions. Furthermore, manufacturers are focusing on producing more compact and aesthetically pleasing analog camera designs, broadening their appeal for discreet installations in retail and office environments. These strategic developments ensure analog cameras remain competitive by addressing key user pain points and adapting to evolving security requirements.

Regional trends reveal significant growth opportunities in emerging economies across Asia Pacific, Latin America, and the Middle East and Africa, where budget constraints often dictate technology choices and existing coaxial infrastructure is prevalent. These regions are experiencing rapid urbanization and increased security consciousness, driving robust demand for affordable and reliable surveillance solutions. In more developed regions like North America and Europe, the analog market primarily benefits from replacement cycles, hybrid system installations, and specific niche applications where simplicity and cost are paramount. Segment trends highlight a growing preference for HD analog solutions over traditional CVBS due to superior image quality without significant price hikes. The residential and retail sectors remain key segments, driven by both proactive security measures and regulatory compliance, ensuring a consistent and diverse customer base for analog security camera manufacturers and distributors.

AI Impact Analysis on Analog Security Camera Market

User questions regarding AI's impact on the Analog Security Camera Market frequently revolve around the feasibility and cost-effectiveness of integrating advanced analytics into traditional analog infrastructure. Key themes include concerns about whether legacy analog systems can truly benefit from AI without a complete overhaul, how to leverage existing coaxial cabling for AI functionalities, and the extent to which hybrid solutions can bridge the gap between analog video feeds and intelligent processing. Users are particularly interested in understanding if AI can enhance basic analog surveillance by providing features like intelligent motion detection, object classification, or facial recognition, without incurring the high costs associated with native IP camera intelligence. There is an expectation for practical, scalable, and affordable AI solutions that can either work alongside existing analog cameras or process their video streams effectively, thereby extending the lifecycle and utility of current installations and offering a 'smart upgrade' path.

- AI-powered DVRs/NVRs: Hybrid recorders can process analog video feeds using embedded AI algorithms for advanced analytics.

- Edge AI Gateways: External devices can be deployed to convert analog signals to digital, then apply AI analytics before sending processed data to a DVR or cloud.

- Enhanced Motion Detection: AI can reduce false alarms in analog systems by differentiating between humans/vehicles and environmental factors.

- Object Classification: Basic AI on hybrid recorders can identify and classify objects (e.g., person, vehicle) from analog streams, improving alert accuracy.

- Smart Search Capabilities: AI integration in DVRs allows for faster and more efficient searching of recorded analog footage based on events or object types.

- Predictive Maintenance: AI can monitor camera performance and identify potential issues, ensuring higher uptime for analog systems.

- Cost-effective Smart Surveillance: AI add-ons provide a more budget-friendly pathway to introduce intelligence to existing analog infrastructure, avoiding full system replacement.

- Hybrid System Integration: AI enables seamless blending of analog cameras with newer IP cameras, using a unified platform for analytics and management.

DRO & Impact Forces Of Analog Security Camera Market

The Analog Security Camera Market is shaped by a complex interplay of driving factors, inherent restraints, emerging opportunities, and significant impact forces that dictate its trajectory. A primary driver for this market is the persistent demand for cost-effective surveillance solutions, particularly in small and medium-sized enterprises (SMEs) and residential sectors where budget is a critical consideration. The relative simplicity of installation and operation, often leveraging existing coaxial infrastructure, significantly reduces deployment complexities and costs. Furthermore, the inherent reliability and robustness of analog systems, coupled with the advancements in high-definition analog technologies (HD-CVI, HD-TVI, AHD) that deliver megapixel resolutions, continue to make them a viable and attractive option for basic to moderate security needs across various industries and regions. These factors collectively contribute to a stable and foundational demand for analog surveillance equipment.

However, the market faces notable restraints, predominantly from the rapid technological advancements and increasing market penetration of IP (Internet Protocol) cameras. IP cameras offer superior resolution, network scalability, integrated analytics, Power over Ethernet (PoE) capabilities, and remote accessibility, which analog systems inherently lack or can only achieve through hybrid solutions. The limitations in advanced features, such as intelligent video analytics embedded directly within the camera, and the dependency on DVRs for recording and limited network functionalities, pose significant competitive challenges. Moreover, the perceived "legacy" status of analog technology, despite HD advancements, sometimes deters new installations in favor of future-proof IP solutions. These limitations can hinder the market's growth potential, especially in segments that require highly advanced, scalable, and fully integrated surveillance capabilities.

Despite these restraints, the Analog Security Camera Market is presented with distinct opportunities. The most significant opportunity lies in the development and adoption of hybrid DVRs and NVRs that seamlessly integrate both analog and IP camera feeds, offering users a flexible upgrade path and maximizing the utility of their existing investments. The demand for cost-effective retrofitting solutions for older surveillance systems, where replacing coaxial cabling with Ethernet is prohibitively expensive or disruptive, creates a strong niche for HD analog technologies. Furthermore, the expanding markets in developing countries, characterized by a preference for affordable and robust security solutions, offer substantial growth avenues. The impact forces acting on this market include the continuous innovation in IP camera technology, which constantly pushes the boundaries of performance and affordability, economic fluctuations affecting consumer and business spending on security, and evolving regulatory standards for surveillance, which may favor advanced digital features for compliance. The competitive landscape, with numerous manufacturers vying for market share, also drives innovation and pricing strategies, continually shaping the market dynamics.

Segmentation Analysis

The Analog Security Camera Market is meticulously segmented to provide a granular understanding of its diverse components, aiding in targeted strategies and market insights. These segments categorize cameras based on their design, resolution capabilities, underlying technology, and ultimate end-use applications. This comprehensive segmentation allows stakeholders to identify specific growth areas, understand competitive dynamics within distinct niches, and tailor product offerings to meet the varying demands of different customer groups. The market's structure reflects the broad spectrum of surveillance requirements, from basic visual monitoring to more advanced high-definition analog deployments across residential, commercial, and industrial landscapes, each requiring specialized camera types and features.

- By Type

- Bullet Camera

- Dome Camera

- PTZ (Pan-Tilt-Zoom) Camera

- Turret Camera

- Box Camera

- By Resolution

- Standard Definition (SD)

- High Definition (HD)

- 720p

- 1080p

- 5MP

- 8MP (4K)

- By Technology

- CVBS (Composite Video Broadcast Signal)

- AHD (Analog High Definition)

- HD-TVI (High Definition Transport Video Interface)

- HD-CVI (High Definition Composite Video Interface)

- By Application

- Residential

- Commercial

- Retail

- Offices

- Hospitality

- Banking and Finance

- Industrial

- Manufacturing Plants

- Warehouses

- Logistics

- Government and Public Infrastructure

- Education

Value Chain Analysis For Analog Security Camera Market

The value chain for the Analog Security Camera Market begins with upstream activities involving the sourcing and manufacturing of critical components. This segment includes suppliers of image sensors (CMOS/CCD), lenses, video processors, infrared (IR) LEDs, and other electronic components vital for camera functionality. These upstream players often specialize in producing specific parts, which are then assembled by camera manufacturers. The quality and cost of these components directly impact the final product's performance and price point, making strong supplier relationships and efficient procurement processes crucial for market competitiveness. Research and development in this stage focus on improving sensor sensitivity, lens clarity, and overall image processing capabilities to enhance camera performance while maintaining cost efficiency.

Midstream activities primarily involve the manufacturing and assembly of the analog security cameras and associated recording devices like DVRs. Manufacturers integrate the sourced components, perform quality control, and produce finished products, often differentiating themselves through brand reputation, product design, and specialized features such as weatherproofing or enhanced night vision. Following manufacturing, the distribution channel plays a pivotal role in reaching the end-users. This includes a mix of direct and indirect channels. Direct channels involve manufacturers selling directly to large enterprises or government entities. Indirect channels are more prevalent and include a network of wholesalers, distributors, system integrators, value-added resellers (VARs), and retailers. These intermediaries provide crucial logistics, installation services, and local support, making the products accessible to a wider range of customers, from individual homeowners to small businesses.

Downstream analysis focuses on the end-user adoption and post-sales support. This segment involves professional installers and system integrators who provide expert setup and configuration services, especially for more complex multi-camera installations. Retailers, both online and brick-and-mortar, serve the DIY market and smaller commercial clients. Post-sales activities include customer support, warranty services, and technical assistance, which are critical for customer satisfaction and brand loyalty. The effectiveness of the entire value chain hinges on efficient coordination between all stakeholders, from component suppliers to end-users, ensuring that products are manufactured cost-effectively, distributed widely, and supported adequately to meet market demands and maintain operational reliability for security applications.

Analog Security Camera Market Potential Customers

The Analog Security Camera Market caters to a broad spectrum of end-users and buyers who prioritize reliability, cost-effectiveness, and straightforward operation for their surveillance needs. Small and Medium-sized Enterprises (SMEs) represent a significant customer base, including retail shops, restaurants, small offices, and local businesses, which often operate within tighter budgets and require dependable security without the complexities of advanced IP networks. These businesses benefit from the lower initial investment and simpler installation processes associated with analog systems, making security accessible and manageable. Residential users, including homeowners and apartment dwellers, also constitute a substantial segment, seeking basic monitoring solutions for their properties, often valuing ease of use and affordability for peace of mind.

Beyond individual consumers and small businesses, the market finds potential customers in sectors with existing coaxial cabling infrastructure, where upgrading to IP systems would be prohibitively expensive or disruptive. This includes older commercial buildings, some industrial facilities, and certain public infrastructure projects that can significantly benefit from high-definition analog (HDA) solutions. Educational institutions and government facilities, particularly those with legacy systems, also represent key buyers, often opting for analog or hybrid solutions during phased upgrades to maximize their existing assets. The appeal of analog cameras for these diverse end-users lies in their proven track record, robustness, and the ability of modern HD analog technologies to deliver clear, detailed footage without demanding extensive IT knowledge or significant network bandwidth, thus providing a practical and reliable security foundation for a wide array of applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.25 Billion |

| Market Forecast in 2032 | USD 4.50 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hikvision, Dahua Technology, Lorex, Swann, CP PLUS, Bosch Security Systems, Axis Communications (selected hybrid offerings), Hanwha Vision, VIVOTEK (selected hybrid offerings), Pelco by Motorola Solutions, FLIR Systems, Panasonic, Sony (legacy offerings), Honeywell, Uniview, GeoVision, Ganz (CBC Americas), Longse Technology, TVT Digital Technology, Provision-ISR |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Analog Security Camera Market Key Technology Landscape

The technology landscape of the Analog Security Camera Market is fundamentally built upon coaxial cable infrastructure, which serves as the primary medium for transmitting video signals. Historically, this market was dominated by Composite Video Broadcast Signal (CVBS) technology, providing standard definition (SD) video quality. While CVBS remains present in legacy systems, the landscape has significantly evolved with the introduction of high-definition analog technologies. These advancements, including Analog High Definition (AHD), High Definition Transport Video Interface (HD-TVI), and High Definition Composite Video Interface (HD-CVI), have revolutionized analog surveillance by enabling the transmission of megapixel video resolutions over traditional coaxial cables. These technologies allow for sharper images, clearer details, and broader coverage compared to their SD predecessors, all while retaining the simplicity and cost-effectiveness of analog wiring. They are designed to be backward compatible in many cases, offering a seamless upgrade path for users with existing coaxial infrastructure.

At the core of these systems are the Digital Video Recorders (DVRs), which are essential for processing, storing, and managing the video feeds from analog cameras. Modern DVRs are no longer just recording devices; many are now hybrid video recorders (HVRs) or pentabrid DVRs, capable of supporting multiple analog formats (AHD, HD-TVI, HD-CVI, CVBS) as well as a limited number of IP cameras. This hybrid capability is a critical technological development, allowing for flexible system designs and phased upgrades. DVRs also incorporate features such as motion detection, scheduled recording, and remote access via network connectivity, enhancing the functionality of the overall analog surveillance system. Advanced DVRs can also integrate with cloud services, providing backup storage and limited remote analytics, further extending the capabilities of analog cameras into the realm of smart surveillance.

The continued innovation in image sensors, lens technology, and video compression within the analog framework also plays a crucial role. Manufacturers are developing analog cameras with improved low-light performance, wider dynamic range (WDR), and enhanced IR night vision capabilities to ensure clear imagery in diverse lighting conditions. While native analytics processing is typically limited in analog cameras, the intelligence is increasingly being shifted to the DVR or to hybrid edge devices. These external processors can apply AI-powered analytics to the analog video stream, adding functionalities like object detection, facial recognition, and perimeter intrusion detection. This symbiotic relationship between advanced analog camera hardware and intelligent DVR/HVR software ensures that analog security solutions remain competitive and relevant by offering a balance of performance, affordability, and evolving smart features to a broad customer base.

Regional Highlights

- North America: This region, comprising the United States and Canada, demonstrates a mature market with significant demand for hybrid surveillance solutions and system upgrades. While IP cameras dominate new high-end installations, analog cameras, especially HD analog variants, maintain relevance for cost-effective retrofits and small to medium-sized businesses. The market here is driven by the need for reliable, albeit simpler, security solutions and the gradual replacement of older analog systems.

- Europe: The European market, including countries such as Germany, the UK, France, and Italy, shows a steady demand for analog security cameras, particularly in Eastern and Southern Europe where budget sensitivity is higher. Western Europe focuses more on hybrid solutions and leveraging existing coaxial infrastructure for HD analog upgrades in residential and small commercial sectors. Regulatory compliance and the need for basic, robust surveillance systems are key drivers.

- Asia Pacific (APAC): APAC, encompassing China, India, Japan, South Korea, and Southeast Asian nations, is the largest and fastest-growing market for analog security cameras. Rapid urbanization, increasing security concerns, and the widespread presence of legacy infrastructure, coupled with a strong emphasis on cost-effective solutions, fuel the robust adoption of analog and HD analog systems across residential, commercial, and industrial applications.

- Latin America: Countries like Brazil, Mexico, and Argentina represent a growing market, driven by increasing security threats and the affordability of analog solutions. The market benefits from new installations in residential and small business segments, where budget constraints often prioritize initial investment over advanced features. Hybrid systems are also gaining traction for scalability.

- Middle East and Africa (MEA): The MEA region, including UAE, Saudi Arabia, South Africa, and Nigeria, exhibits significant potential. Economic development and heightened security awareness are driving demand for basic and reliable surveillance. Analog cameras are favored for their durability and cost-effectiveness in diverse environmental conditions, especially in new infrastructure projects and expansion of existing facilities within commercial and public sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Analog Security Camera Market.- Hikvision

- Dahua Technology

- Lorex Technology

- Swann Communications

- CP PLUS

- Bosch Security Systems

- Hanwha Vision

- Pelco by Motorola Solutions

- FLIR Systems

- Panasonic

- Honeywell International Inc.

- Uniview

- GeoVision Inc.

- Ganz (CBC Americas)

- Longse Technology

- TVT Digital Technology

- Provision-ISR

- KGuard Security

- Vitek Industrial Video Products Inc.

- Speco Technologies

Frequently Asked Questions

Are analog security cameras still relevant in today's market?

Yes, analog security cameras remain highly relevant, particularly with the advent of high-definition analog technologies (HD-CVI, HD-TVI, AHD). These modern analog cameras offer megapixel resolutions comparable to IP cameras, but leverage existing coaxial cabling, making them a cost-effective choice for upgrades and new installations in budget-conscious segments, small businesses, and residential users.

What is the main difference between analog and IP security cameras?

The main difference lies in how video signals are transmitted and processed. Analog cameras send continuous video signals over coaxial cables to a DVR, which then digitizes and stores the footage. IP cameras, on the other hand, digitize video at the camera itself and transmit data over a network (Ethernet or Wi-Fi), often with advanced features like Power over Ethernet (PoE) and built-in analytics, offering greater scalability and remote access capabilities.

Can analog cameras be integrated with smart home systems or AI analytics?

While traditional analog cameras lack native smart features, they can be integrated into smart home ecosystems or leverage AI analytics through hybrid solutions. Modern DVRs (Digital Video Recorders) or NVRs (Network Video Recorders) often support both analog and IP inputs, acting as a bridge. External AI-powered gateways can also convert analog feeds into digital data for intelligent processing, enabling features like enhanced motion detection or object classification without replacing the entire analog infrastructure.

What is HD over Coax technology and its benefits?

HD over Coax (e.g., AHD, HD-TVI, HD-CVI) refers to technologies that allow high-definition video signals (720p, 1080p, 5MP, 8MP) to be transmitted over traditional coaxial cables. The primary benefits include the ability to upgrade to high-resolution surveillance without replacing existing wiring, significantly reducing installation costs and time. It combines the simplicity of analog systems with the image quality benefits of digital, making it ideal for retrofitting older systems.

Are analog security cameras more affordable than IP cameras?

Generally, analog security cameras, especially the HD analog variants, offer a lower initial purchase cost compared to IP cameras with comparable resolutions. Furthermore, for installations with existing coaxial cabling, the overall system cost is significantly reduced as new wiring is often unnecessary. This makes analog systems a highly attractive and budget-friendly option for many consumers and businesses seeking reliable surveillance solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager