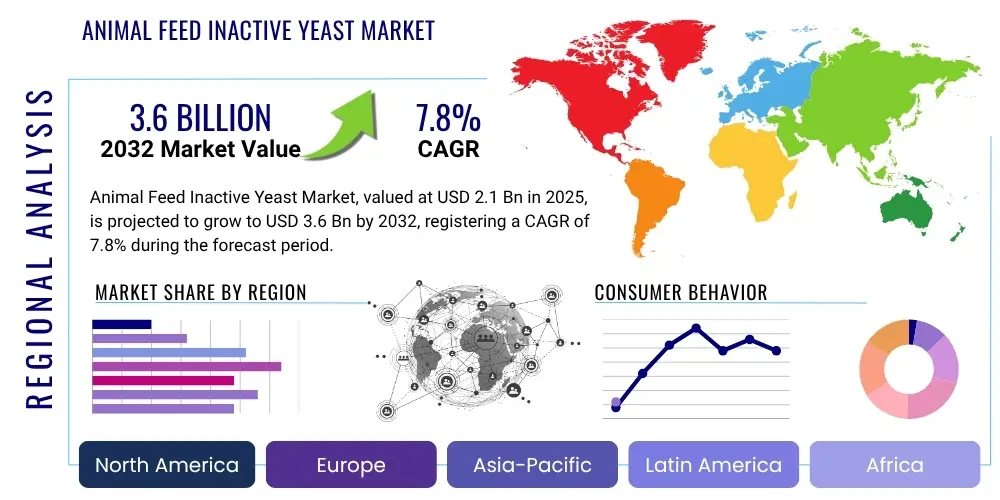

Animal Feed Inactive Yeast Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429985 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Animal Feed Inactive Yeast Market Size

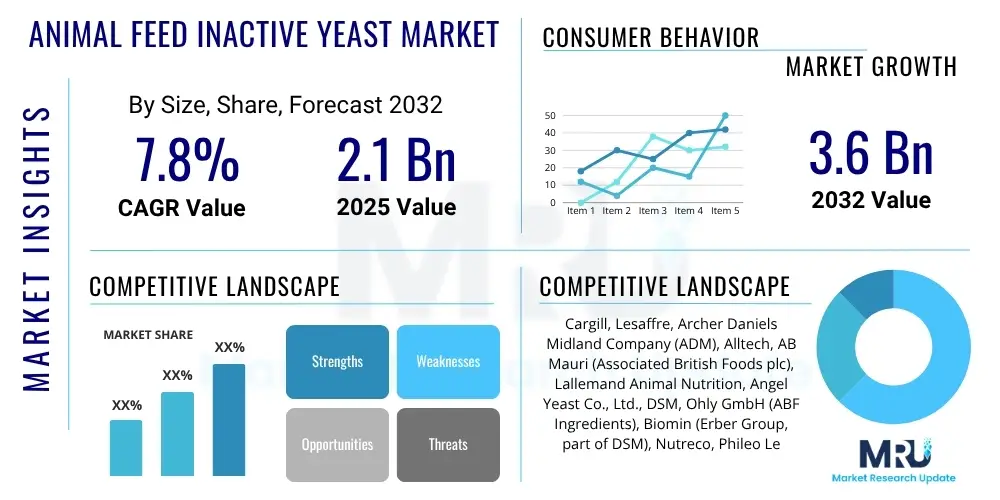

The Animal Feed Inactive Yeast Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $2.1 billion in 2025 and is projected to reach $3.6 billion by the end of the forecast period in 2032.

Animal Feed Inactive Yeast Market introduction

The Animal Feed Inactive Yeast market is experiencing robust expansion, driven by a paradigm shift towards natural, sustainable, and highly effective animal nutrition solutions. Inactive yeast, primarily derived from the carefully controlled fermentation of specific microbial strains such as Saccharomyces cerevisiae, represents a non-living biomass. Crucially, it does not contain viable microbial cells, distinguishing it from live yeast supplements, but retains an abundance of valuable nutritional components and functional properties. This product has emerged as a potent functional ingredient, systematically proven to enhance the overall health, well-being, and productivity of a diverse range of animals, including livestock, poultry, aquaculture species, and companion animals. Its increasing adoption across the globe is a direct and strategic response to escalating consumer demands for safer, higher-quality food production, coupled with a heightened focus on improving animal welfare standards and environmental sustainability in modern agriculture.

Product description highlights inactive yeast as an exceptionally versatile feed additive, distinguished by its rich composition. It is packed with high-quality proteins, providing essential amino acids crucial for growth and development across all animal species. Beyond protein, it is a significant source of B vitamins, which are vital co-factors in numerous metabolic processes, contributing to energy production and overall vitality. Furthermore, inactive yeast contains valuable nucleotides, the building blocks of DNA and RNA, which are particularly important for rapid cell proliferation and immune system development in young and stressed animals. Its cell wall components, notably beta-glucans and mannoproteins, are recognized for their immunomodulatory effects and ability to bind harmful mycotoxins, thereby improving gut integrity and disease resistance. These multifaceted components collectively contribute significantly to the nutritional and functional profile of animal feed, making inactive yeast an invaluable supplement for various animal species at different life stages, supporting optimal physiological functions and resilience.

The major applications of inactive yeast span the entire animal agriculture sector, demonstrating its broad utility. In poultry, it is utilized to achieve improved growth rates, enhance feed conversion efficiency, and boost egg production, while simultaneously strengthening birds' immune responses against common pathogens. For swine, inactive yeast is critical for enhancing gut health, particularly during weaning stress, improving immunity, and optimizing nutrient absorption, which translates to better growth and reduced mortality. In aquaculture, where disease outbreaks can be devastating, it plays a crucial role in improving disease resistance, enhancing feed intake, and optimizing feed conversion in fish and shrimp. For ruminants, it supports the stabilization of rumen function, aids in better digestion of fibrous feeds, and reduces metabolic stress. Beyond traditional farm animals, the rapidly expanding pet food industry increasingly integrates inactive yeast for its superior palatability, acting as a natural flavor enhancer, and for its proven health benefits, including digestive support and immune strengthening for companion animals. The driving factors propelling market growth include the escalating global demand for animal protein, driven by demographic shifts and rising incomes, increasing awareness among producers and consumers regarding animal health and food safety, and stringent regulatory pressures aimed at significantly reducing or completely eliminating the use of prophylactic antibiotics in livestock, thereby firmly positioning natural alternatives like inactive yeast as essential, indispensable components of modern animal feed formulations.

Animal Feed Inactive Yeast Market Executive Summary

The Animal Feed Inactive Yeast Market is characterized by highly dynamic business trends, significant and impactful regional shifts in demand and supply, and continuously evolving segmentation demands. Key business trends indicate a strong, unwavering focus on advanced research and development initiatives aimed at innovating new yeast strains. These new strains are meticulously engineered to possess enhanced functionalities, such as superior immunomodulatory properties, improved mycotoxin binding capabilities, or higher concentrations of specific beneficial nutrients. This R&D push is often coupled with strategic collaborations, joint ventures, and targeted mergers and acquisitions, all meticulously designed to expand product portfolios, diversify technological capabilities, and broaden geographical market reach. Companies are increasingly investing heavily in developing and promoting sustainable production practices, utilizing renewable energy sources and waste valorization techniques, and vigorously promoting the natural origin and clean label status of their inactive yeast products to align seamlessly with prevailing consumer preferences for transparently produced, high-quality animal protein. The accelerating global shift towards non-GMO and certified organic feed ingredients further shapes these sophisticated business strategies, compelling manufacturers to invest in certifying their production processes and ensuring ethical, traceable sourcing of raw materials. This intensely competitive yet innovative landscape fosters continuous product differentiation, value creation, and aggressive market penetration through sophisticated marketing campaigns and strategically optimized global distribution networks, all aimed at securing a competitive edge and driving sustained growth.

From a regional perspective, the market exhibits highly varied growth trajectories and adoption rates, reflecting diverse agricultural practices, economic development levels, and regulatory environments. Asia Pacific unequivocally stands out as the most dynamic and fastest-growing region, experiencing exponential growth propelled by the massive expansion of its livestock and aquaculture industries in economic powerhouses like China, India, Vietnam, and Indonesia. This growth is further fueled by rapidly rising disposable incomes, significant urbanization, and evolving dietary patterns that include higher per capita consumption of meat, dairy, and seafood. Conversely, North America and Europe, while representing mature and well-established markets, continue to demonstrate robust and steady growth. This sustained expansion is primarily driven by their stringent regulatory frameworks specifically aimed at phasing out antibiotic use, a strong and entrenched emphasis on animal welfare, and a continuous pursuit of advanced, high-performance nutritional solutions that optimize animal health and productivity without compromising food safety. Latin America and the Middle East and Africa (MEA) collectively represent burgeoning emerging markets, possessing considerable untapped potential. As these regions progressively modernize their agricultural infrastructure and practices, and as their populations experience increasing demand for high-quality animal protein, there is a commensurate and growing adoption of advanced, functional feed additives such as inactive yeast, signaling strong future growth prospects.

Analyzing segment trends reveals a particularly high and increasing demand for inactive yeast in both poultry and aquaculture feed applications. This robust demand is primarily attributed to the inherent characteristics of these industries, which are often characterized by intensive farming systems where animal density is high, making effective disease prevention and consistent growth promotion critically important. Inactive yeast's ability to boost immunity and improve gut integrity is invaluable in these environments. Swine feed also remains a profoundly significant and expanding segment, benefiting substantially from inactive yeast’s proven gut health-enhancing properties, especially during vulnerable periods like post-weaning stress. Beyond these traditional livestock categories, the pet food segment is witnessing unparalleled and rapid growth as pet owners globally increasingly seek premium, functional, and natural ingredients to support the health, longevity, and vitality of their companion animals. Furthermore, there is a discernible and accelerating trend towards specific product forms, such as highly palatable and easily dispersible powder and granular formulations, which offer unparalleled ease of incorporation into a wide array of feed types and processing methods. The application segments are overwhelmingly dominated by products explicitly focusing on immunomodulation and holistic gut health, unequivocally reflecting the animal feed industry's paramount priorities of enhancing animal resilience, mitigating disease risks, and significantly reducing reliance on medicinal interventions, thereby paving the way for a healthier and more sustainable future in animal agriculture.

AI Impact Analysis on Animal Feed Inactive Yeast Market

Common user questions regarding the profound and transformative impact of Artificial Intelligence (AI) on the Animal Feed Inactive Yeast Market frequently center on how these advanced technologies can revolutionize the entire value chain, from raw material sourcing to final product application. Users are intensely curious about how AI can be leveraged to meticulously optimize the complex production processes of inactive yeast, ensuring not only higher yields but also superior product quality and unwavering consistency. There is a strong desire to understand if AI can provide a more precise and accurate prediction of animal health outcomes, thereby enabling the development and implementation of highly personalized and targeted nutrition strategies that optimize the efficacy of yeast-based feed formulations for individual animal cohorts or even specific animals. Furthermore, stakeholders are keen to explore how AI can streamline intricate supply chain logistics, leading to enhanced market responsiveness, reduced waste, and improved overall operational efficiency. Concerns also predictably arise regarding the substantial initial capital investment required for comprehensive AI integration within existing feed manufacturing infrastructure, as well as the critical need for specialized expertise to effectively implement, manage, and continuously evolve such sophisticated advanced systems within what have traditionally been more conventional feed production environments. Nevertheless, the overwhelming and pervasive expectation is that AI will usher in unprecedented levels of efficiency, unparalleled precision, and profoundly data-driven insights, which will collectively elevate every facet of the inactive yeast value chain, ranging from the earliest stages of raw material sourcing and yeast cultivation to the precise application of feed additives and real-time monitoring of animal performance. This technological leap is anticipated to create entirely new paradigms for product development, quality assurance, and market delivery.

- AI-driven optimization of fermentation parameters, including nutrient levels, temperature, pH, and aeration rates, for significantly increased yeast biomass yield and precise concentration of desired functional components such as beta-glucans and mannoproteins.

- Predictive analytics leveraging historical and real-time data for raw material sourcing, ensuring consistent quality, mitigating supply chain risks, and achieving optimal cost efficiency in the production of inactive yeast, minimizing price volatility.

- Automated quality control systems utilizing sophisticated machine vision, hyperspectral imaging, and an array of sensor data to continuously monitor and ensure the absolute homogeneity, purity, and functional integrity of inactive yeast products throughout the production cycle.

- Development of sophisticated AI algorithms to dynamically tailor and recommend precise inactive yeast dosages based on a comprehensive analysis of individual animal health status, specific breed characteristics, age, weight, genetic predisposition, and prevailing environmental factors, moving towards precision nutrition.

- Enhanced supply chain optimization through AI-powered forecasting, accurately predicting demand fluctuations, minimizing waste, optimizing inventory management levels, and calculating the most efficient and sustainable distribution routes for global delivery of inactive yeast products.

- Acceleration of research and development for novel yeast strains by employing AI-powered bioinformatics and machine learning to rapidly screen, analyze, and select beneficial microbial properties from vast genetic databases, significantly shortening development cycles for new and improved products.

- Improved real-time animal performance monitoring and proactive, early disease detection by seamlessly integrating inactive yeast feed data with comprehensive AI-analyzed farm data, including animal activity patterns, precise feed intake measurements, growth rates, and behavioral anomalies.

DRO & Impact Forces Of Animal Feed Inactive Yeast Market

The Animal Feed Inactive Yeast Market is intricately shaped by a powerful and dynamic interplay of pervasive drivers, challenging yet surmountable restraints, and compelling opportunities, all continuously influenced by various external and internal impact forces. The primary and most significant drivers include the relentless and accelerating growth in the global human population, which directly translates into an exponentially increasing demand for animal protein sources such as meat, milk, and eggs. This escalating demand necessitates the adoption of more efficient, sustainable, and healthier livestock production practices globally. Furthermore, the worldwide regulatory mandate to significantly reduce or completely eliminate the prophylactic use of antibiotics in animal farming has acted as a monumental catalyst, propelling the widespread adoption of natural, functional feed additives like inactive yeast, which effectively serve as powerful immune boosters and gut health enhancers. Growing awareness among both progressive farmers and discerning consumers about paramount aspects of animal welfare, food safety, and the intrinsic quality of the final animal-derived food products further fuels this burgeoning demand for premium, scientifically validated, and functional feed additives. These synergistic factors collectively create an exceptionally robust and favorable environment for sustained market expansion, pushing manufacturers to continuously innovate, scale their operational capacities, and diversify their product offerings to meet evolving industry needs and consumer expectations.

Despite the strong and favorable market tailwinds, the Animal Feed Inactive Yeast market encounters several intrinsic restraints that require strategic navigation. A notable challenge is the relatively high production cost associated with inactive yeast, particularly when contrasted with more conventional, lower-cost feed ingredients. This cost differential can potentially pose a significant barrier to widespread adoption, especially in highly price-sensitive emerging markets or among smaller farming operations with limited capital. The competitive landscape is further intensified by the readily available supply of alternative feed additives, which include a broad spectrum of probiotics, prebiotics, enzymes, organic acids, and various botanical extracts. This diverse array of alternatives necessitates continuous product differentiation, rigorous scientific validation, and compelling cost-benefit analyses from inactive yeast manufacturers to maintain and expand their market share. Additionally, navigating the fragmented, diverse, and often complex regulatory frameworks governing feed additives across different geographical regions can be exceptionally challenging. These regulatory hurdles can significantly delay market entry, restrict product claims, or necessitate substantial investments in extensive compliance testing and documentation. Finally, consistently ensuring product quality, purity, and proven efficacy across varying production batches and diverse application environments presents a persistent technical challenge that manufacturers must continuously address through stringent quality control protocols, advanced analytical techniques, and robust formulation strategies to maintain unwavering market trust and deliver consistent product performance.

Notwithstanding these restraints, the market is replete with substantial and transformative opportunities for profound growth and innovation. Emerging economies, particularly those in Asia Pacific and Latin America, where livestock industries are undergoing rapid modernization and expansion, offer vast untapped potential for inactive yeast adoption. Extensive and continuous research and development efforts, specifically aimed at discovering novel yeast strains that possess superior and more targeted functional properties – such as enhanced anti-inflammatory capabilities, stronger antioxidant effects, or more potent pathogen-binding mechanisms – present profoundly significant market opportunities for high-value product differentiation. The burgeoning and increasingly influential organic and natural feed segment offers a premium market niche for certified inactive yeast products, perfectly aligning with global consumer demand for sustainably produced, chemical-free, and natural animal protein. Strategic collaborations, partnerships, and joint ventures between yeast producers, large-scale feed manufacturers, and leading research institutions can unlock entirely new applications, develop synergistic product formulations, and penetrate previously unaddressed market segments. Furthermore, the accelerating integration of advanced precision nutrition technologies, real-time digital farming platforms, and sophisticated data analytics into modern agricultural practices opens compelling new avenues for the development and deployment of customized inactive yeast solutions. These tailored solutions can address highly specific animal health challenges, optimize individual animal diets, and significantly solidify inactive yeast's indispensable role in the future of advanced, data-driven animal agriculture, contributing to enhanced profitability and environmental stewardship.

Segmentation Analysis

The Animal Feed Inactive Yeast market is meticulously segmented to provide incredibly granular insights into its diverse applications, various product forms, and the specific animal categories it serves, thereby enabling a profound and nuanced understanding of prevailing market dynamics and evolving consumer preferences. This comprehensive segmentation rigorously categorizes the market primarily based on the specific type of animal to which the functional feed additive is administered, reflecting the varied physiological and nutritional requirements across species. Furthermore, it differentiates products by the physical form of the inactive yeast, acknowledging the practical considerations for integration into different feed types and manufacturing processes. Lastly, segmentation by specific functional application within the animal's diet highlights the diverse benefits inactive yeast delivers, from immune support to digestive enhancement. Such a detailed and analytical breakdown is absolutely crucial for stakeholders across the entire value chain, empowering them to precisely identify lucrative niche markets, anticipate emerging demands, and strategically tailor their product development initiatives and marketing strategies to address the highly specific needs and challenges within the vast and complex animal agriculture landscape. Understanding these intricately defined segments is, therefore, not merely beneficial but essential for accurate market forecasting, robust strategic planning, and successful competitive positioning.

- By Animal Type

- Poultry: Broilers, Layers, Breeders, Turkeys

- Swine: Piglets, Weaners, Growers, Sows

- Ruminants: Dairy Cattle, Beef Cattle, Sheep, Goats

- Aquaculture: Fish (e.g., Salmon, Tilapia, Shrimp), Mollusks

- Pets: Dogs, Cats, Other Companion Animals

- Equine: Horses (performance, breeding, leisure)

- By Form

- Powder: Fine, homogeneous particles for easy mixing

- Granule: Larger, free-flowing particles for reduced dust and improved handling

- Liquid: Concentrated suspensions for specific applications and mixing systems

- Paste: High-viscosity formulations for targeted delivery or specific animal types

- By Application

- Immunomodulation: Enhancing the innate and adaptive immune responses

- Gut Health Enhancement: Promoting beneficial gut microbiota, improving gut barrier integrity

- Palatability Enhancer: Improving feed intake through natural flavor compounds

- Mycotoxin Binding: Adsorbing harmful mycotoxins in the digestive tract

- Nutritional Supplementation: Providing essential proteins, vitamins, and minerals

- Stress Reduction: Mitigating the physiological impacts of environmental or transport stress

Value Chain Analysis For Animal Feed Inactive Yeast Market

The value chain for the Animal Feed Inactive Yeast Market is an intricate and multi-staged process, meticulously engineered to transform raw materials into highly functional feed additives, beginning with crucial upstream activities that dictate the foundation of product quality and cost. Upstream analysis primarily focuses on the critical role of raw material procurement and the initial, highly specialized stages of yeast cultivation. This segment involves securing reliable and high-quality suppliers of primary fermentation substrates, which are typically rich carbohydrate sources such as molasses, corn steep liquor, various agricultural by-products, or other cost-effective sugar-based feedstocks. These raw materials are absolutely essential for robust yeast growth and subsequent biomass production. Simultaneously, this upstream phase also encompasses the highly specialized companies and scientific institutions involved in the meticulous selection, isolation, and controlled culturing of specific yeast strains, predominantly Saccharomyces cerevisiae, chosen for their superior growth characteristics and their ability to produce desired functional properties such as high beta-glucan or mannoprotein content. The unwavering quality, consistent supply, and cost-effectiveness of these foundational raw materials and yeast strains directly and profoundly impact the final product's efficacy, safety, and market competitiveness, making strategic supplier relationships, long-term procurement contracts, and proactive raw material price stability strategies truly crucial components of the initial value creation process within this industry.

The midstream activities represent the core manufacturing processes, which demand significant technological expertise, substantial capital investment, and rigorous process control. This stage commences with large-scale industrial fermentation, typically conducted in state-of-the-art bioreactors where environmental conditions (temperature, pH, oxygenation, nutrient supply) are precisely controlled to optimize yeast proliferation. Following fermentation, the yeast biomass undergoes efficient separation techniques, such as continuous centrifugation or advanced microfiltration, to isolate the yeast cells from the fermentation broth. A critical subsequent step is the inactivation process, most commonly achieved through carefully controlled heat treatment methods, which can include flash pasteurization, mild thermal shock, or gentle oven drying, all precisely calibrated to render the yeast non-viable while meticulously preserving the structural integrity and maximizing the bioavailability of its beneficial intracellular contents and functional cell wall components. Following inactivation, various sophisticated drying technologies are employed to remove moisture and create stable, shelf-stable product forms. Predominantly, highly efficient spray drying, drum drying, or advanced fluidized bed drying systems are utilized to produce fine powder or free-flowing granular forms. These drying methods are painstakingly optimized to minimize any potential thermal degradation of heat-sensitive bioactive compounds, thereby ensuring the maximum retention of nutritional value, functional activity, and overall product quality over extended storage periods, facilitating ease of handling and incorporation into diverse animal feed matrices.

Downstream analysis subsequently shifts focus to the intricate distribution networks and the ultimate application of the meticulously manufactured inactive yeast products within the animal agriculture ecosystem. The primary downstream consumers and end-users are large-scale industrial feed manufacturers, who formulate custom blends for various animal species, as well as vast integrated livestock and aquaculture operations that produce their own feed. Increasingly, specialized pet food manufacturers also constitute a significant and growing customer segment, incorporating inactive yeast into their premium pet food formulations for palatability and health benefits. Distribution channels for animal feed inactive yeast are highly varied and strategically employed, incorporating both direct and indirect approaches to maximize market reach. Direct sales models typically involve manufacturers engaging directly with large-scale feed mills or integrated farming enterprises that require substantial volumes, often seeking customized product specifications and technical support. Indirect channels, conversely, involve a comprehensive network of specialized distributors, agricultural agents, and local retailers who are instrumental in facilitating product reach to a multitude of smaller independent farms, individual livestock owners, and specialized animal feed stores. The efficiency of logistics, the robustness of inventory management systems, and the effectiveness of technical support and customer service across these diverse distribution pathways are absolutely vital for ensuring broad product availability, fostering sustained market growth, and ultimately connecting the advanced yeast producer directly to the end-user animal, thereby completing the entire value creation cycle.

Animal Feed Inactive Yeast Market Potential Customers

Potential customers for the Animal Feed Inactive Yeast market represent an incredibly broad and diverse spectrum of stakeholders across the global animal agriculture and companion animal sectors, all sharing a common imperative: to significantly enhance animal health, optimize productivity, and improve overall welfare through the strategic integration of advanced, scientifically validated nutritional solutions. The paramount end-users and primary buyers are unequivocally the large-scale commercial animal farms, which include expansive poultry operations specializing in broilers, layers, and turkeys. These operations demand consistent feed quality and highly effective additives for optimal bird growth, maximum egg production efficiency, and enhanced disease resistance, particularly in high-density environments. Similarly, large industrial swine production facilities are key and consistent buyers, strategically leveraging inactive yeast to robustly support gut health, substantially enhance immune function, and significantly improve feed conversion rates, especially during highly vulnerable and stress-intensive periods such as post-weaning transitions, which are critical for long-term animal performance and farm profitability.

Beyond the traditional livestock categories, aquaculture farms constitute a rapidly expanding and strategically important customer segment. With the global intensification and professionalization of fish, shrimp, and other aquatic species farming, there is an urgent and escalating need for functional feed additives that can powerfully bolster immune responses, reduce susceptibility to debilitating waterborne diseases, and enhance resilience in challenging aquatic environments, making inactive yeast an increasingly vital and indispensable ingredient in aquafeeds. Ruminant farms, encompassing large-scale dairy and beef operations, as well as sheep and goat farms, also represent exceptionally significant potential customers. These producers utilize inactive yeast to effectively stabilize rumen function, improve the digestion and utilization of fibrous feeds, and mitigate metabolic stress, thereby supporting overall herd health, milk production, and meat quality. The unique benefits of inactive yeast in maintaining digestive balance, optimizing nutrient utilization, and reducing the impact of environmental stressors make it an incredibly attractive and economically viable option for ruminant producers aiming to meticulously optimize their feeding strategies and improve animal longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2.1 billion |

| Market Forecast in 2032 | $3.6 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Lesaffre, Archer Daniels Midland Company (ADM), Alltech, AB Mauri (Associated British Foods plc), Lallemand Animal Nutrition, Angel Yeast Co., Ltd., DSM, Ohly GmbH (ABF Ingredients), Biomin (Erber Group, part of DSM), Nutreco, Phileo Lesaffre Animal Care, Chr. Hansen Holding A/S, Evonik Industries AG, Novus International, IFF (DuPont Nutrition & Biosciences), Kerry Group, BASF SE, Yeast Culture Bio-Engineering Co., Ltd., Leiber GmbH, Biorigin, Diamond V (A Cargill Company), ICC Brazil, ADM Alliance Nutrition, Solvay S.A., Oriental Yeast Co., Ltd., Kemin Industries, Bio-Vet, Inc., Global Bio-Chem Technology Group Company Limited, Impextraco NV |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Regional Highlights

- North America: This region consistently represents a mature yet profoundly innovative and strategically important market for animal feed inactive yeast. Its growth is primarily driven by exceptionally stringent regulations on the use of antibiotics in livestock production, the widespread adoption of advanced, science-based animal farming practices, and a deeply entrenched societal emphasis on animal welfare and sustainable agriculture. North American producers are increasingly integrating premium, highly specialized inactive yeast products into their feed formulations for poultry, swine, and dairy animals. There is a particularly strong and growing interest in certified organic and non-GMO inactive yeast solutions, reflecting consumer preferences for clean label animal products. Continuous innovation in feed formulation strategies and a remarkably high level of awareness among producers regarding the critical importance of gut health and immune support for animal performance significantly contribute to the sustained and robust demand across the United States and Canada.

- Europe: The European market is distinctly characterized by its exceptionally strict and comprehensive regulatory frameworks governing animal feed additives, coupled with a powerful and ingrained consumer preference for sustainably produced, high-welfare meat and dairy products. The landmark ban on antibiotic growth promoters, implemented across the European Union, has served as a monumental catalyst, substantially boosting the demand for natural, immune-boosting, and gut-health-enhancing alternatives like inactive yeast, especially within the intensive poultry and swine industries. Key agricultural powerhouses such as the Netherlands, Germany, France, and Spain are leading the charge, exhibiting a strong focus on collaborative scientific research and development initiatives. These efforts are aimed at rigorously enhancing the functional properties of yeast-based products and seamlessly integrating them into sophisticated, sustainable agricultural models, driving both innovation and adoption throughout the continent.

- Asia Pacific (APAC): The Asia Pacific region is unequivocally poised for the most dynamic and significant growth trajectory in the Animal Feed Inactive Yeast market. This exponential expansion is fueled by unprecedented rapid urbanization, continuously rising disposable incomes, and a burgeoning population base across economic giants like China, India, Vietnam, Indonesia, and Thailand, all driving an escalating and insatiable demand for animal protein. The vigorous expansion and modernization of intensive livestock and aquaculture farming, coupled with a burgeoning awareness among producers about the critical importance of animal health, disease prevention, and optimized nutrition, significantly accelerates the adoption of high-performance feed additives. Proactive government initiatives across many APAC countries, promoting sustainable agricultural practices and vigorously addressing the global challenge of antibiotic resistance, further accelerate market penetration and solidify inactive yeast's role in the region's rapidly evolving animal nutrition landscape.

- Latin America: This region presents a formidable and rapidly emerging market with considerable untapped potential for inactive yeast. Countries such as Brazil, Argentina, Mexico, and Chile possess vast and increasingly sophisticated livestock industries. As these economies continue to develop and integrate into global food supply chains, there is a discernable and accelerating trend towards modernizing animal nutrition practices and enhancing feed efficiency. The strategic focus in Latin America is squarely on improving overall animal health and maximizing feed efficiency to meet both surging domestic consumption and expanding international demand for high-quality meat and dairy products. Adoption rates of inactive yeast are steadily increasing as farmers become more educated and convinced about the compelling economic benefits and profound health advantages of strategically incorporating functional yeast ingredients into their animal feed formulations, driving sustainable growth in the agricultural sector.

- Middle East and Africa (MEA): The MEA region represents a nascent yet steadily growing market for animal feed inactive yeast. While still in earlier stages of widespread adoption compared to the more developed global regions, increasing governmental and private sector investment in modern agricultural infrastructure, coupled with a rising demand for locally produced animal protein to enhance food security, is driving significant growth. Economic development, rapidly improving agricultural technologies, and a greater awareness of international standards for animal health and food safety are progressively encouraging the widespread integration of advanced, functional feed additives like inactive yeast. This growing momentum signals substantial future expansion opportunities for inactive yeast manufacturers seeking to penetrate and establish a strong presence within the diverse and evolving agricultural sectors across the Middle East and various African nations, contributing to regional food sustainability initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Feed Inactive Yeast Market.- Cargill

- Lesaffre

- Archer Daniels Midland Company (ADM)

- Alltech

- AB Mauri (Associated British Foods plc)

- Lallemand Animal Nutrition

- Angel Yeast Co., Ltd.

- DSM

- Ohly GmbH (ABF Ingredients)

- Biomin (Erber Group, part of DSM)

- Nutreco

- Phileo Lesaffre Animal Care

- Chr. Hansen Holding A/S

- Evonik Industries AG

- Novus International

- IFF (DuPont Nutrition & Biosciences)

- Kerry Group

- BASF SE

- Yeast Culture Bio-Engineering Co., Ltd.

- Leiber GmbH

- Biorigin

- Diamond V (A Cargill Company)

- ICC Brazil

- ADM Alliance Nutrition

- Solvay S.A.

- Oriental Yeast Co., Ltd.

- Kemin Industries

- Bio-Vet, Inc.

- Global Bio-Chem Technology Group Company Limited

- Impextraco NV

Frequently Asked Questions

What is inactive yeast used for in animal feed and what are its primary components?

Inactive yeast in animal feed refers to non-viable yeast cells, predominantly derived from Saccharomyces cerevisiae, which are carefully processed to retain their nutritional and functional properties. Its primary components include high-quality proteins rich in essential amino acids, a comprehensive spectrum of B vitamins crucial for metabolism, valuable nucleotides vital for cellular growth and immune development, and significant amounts of complex cell wall carbohydrates such as beta-glucans and mannoproteins. It is strategically incorporated into animal feed formulations to enhance overall animal immunity, improve gut health and digestive function, increase feed palatability to encourage intake, effectively bind harmful mycotoxins present in feed, and provide essential nutritional supplementation, thereby consistently improving animal performance, productivity, and resilience against environmental stressors.

How does inactive yeast specifically benefit animal health and contribute to better animal performance?

Inactive yeast provides profound benefits to animal health and performance through several key mechanisms. Its unique composition, particularly the beta-glucans and mannoproteins in its cell wall, acts as a potent immunomodulator, stimulating and bolstering the animal's innate and adaptive immune responses, making them more resilient to pathogens. It significantly promotes a healthy and balanced gut microbiota, improving gut barrier integrity and reducing inflammatory responses in the digestive tract. This leads to superior nutrient absorption, enhanced feed conversion efficiency, and reduced incidence of digestive disorders. The presence of essential amino acids and B vitamins also supports overall physiological functions, resulting in improved growth rates, better reproductive performance, and an increased ability to cope with various forms of stress, ultimately translating into higher productivity and reduced veterinary costs for producers.

Which animal species primarily benefit from the inclusion of inactive yeast in their feed formulations?

Inactive yeast is widely beneficial across a diverse range of animal species, making it a versatile and sought-after feed additive. In poultry, including broilers, layers, and turkeys, it is extensively utilized for achieving accelerated growth rates, optimizing feed conversion ratios, maximizing egg production, and significantly enhancing resistance to common avian diseases. For swine, particularly piglets during the critical post-weaning period and growing-finishing pigs, inactive yeast is invaluable for supporting robust gut health, strengthening the immune system, and improving nutrient utilization. In aquaculture, encompassing various fish species (e.g., salmon, tilapia) and crustaceans (e.g., shrimp), it plays a crucial role in boosting disease resistance, improving feed intake, and promoting healthier growth in intensive farming systems. Ruminants, such as dairy cattle, beef cattle, sheep, and goats, benefit from stabilized rumen function, enhanced digestion of fibrous feeds, and reduced metabolic stress. Furthermore, companion animals like dogs, cats, and equines also show significant improvements in gut health, immune support, and overall vitality when inactive yeast is incorporated into their diets.

What are the key driving forces propelling the growth of the animal feed inactive yeast market globally?

The primary driving forces behind the robust growth of the global animal feed inactive yeast market are multifaceted and interconnected. Firstly, there is an escalating global demand for animal protein, driven by population growth and changing dietary patterns, which necessitates more efficient and sustainable animal production. Secondly, increasingly stringent global regulations and consumer pressures aimed at significantly reducing or phasing out the prophylactic use of antibiotics in animal agriculture have created an urgent need for effective, natural alternatives to support animal health and growth, a role perfectly fulfilled by inactive yeast. Thirdly, a heightened awareness among both animal producers and consumers regarding the critical importance of animal welfare, food safety, and the quality of animal-derived products further fuels the demand for premium, functional feed additives. Lastly, ongoing scientific advancements and continuous research demonstrating the clear benefits of inactive yeast in enhancing gut health, bolstering immunity, and improving overall animal performance are continuously expanding its adoption across various species and geographies, cementing its position as a vital component of modern animal nutrition strategies.

What are the significant future trends and opportunities expected to shape the animal feed inactive yeast market?

The animal feed inactive yeast market is anticipated to be shaped by several significant future trends and opportunities. Continuous innovation in research and development will lead to the discovery and commercialization of new, highly specialized yeast strains possessing enhanced and targeted functional properties, such as superior anti-inflammatory effects or more potent pathogen-binding capabilities. There will be an increasing emphasis on incorporating inactive yeast into organic and non-GMO certified feed formulations, aligning with growing consumer demand for natural and sustainably produced animal products. Greater integration with precision nutrition technologies, utilizing data analytics and AI to customize feed formulations based on individual animal needs, will become more prevalent. Furthermore, the market will witness expanded applications in less conventional animal species, and there will be an intensified focus on enhancing the sustainability and traceability of the entire inactive yeast production and supply chain, driven by both environmental concerns and evolving regulatory landscapes, paving the way for a more advanced and responsible animal nutrition industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager