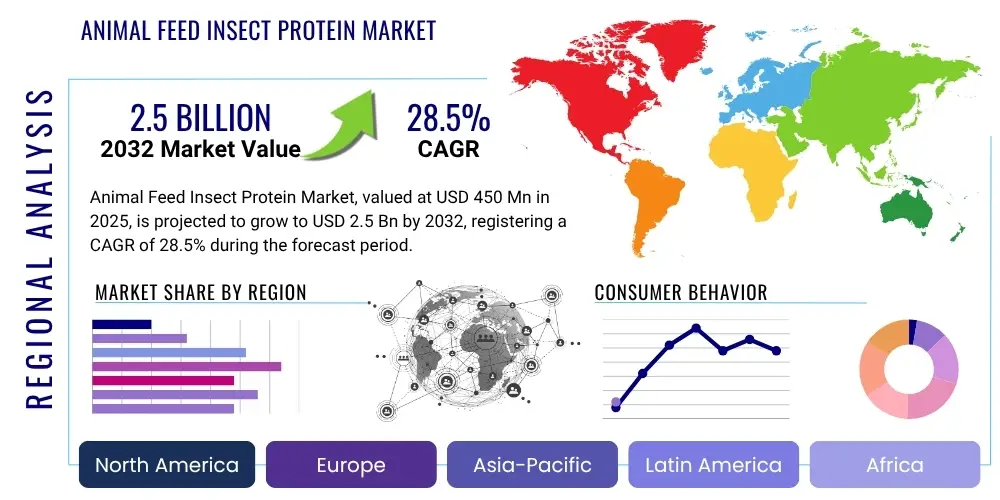

Animal Feed Insect Protein Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430038 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Animal Feed Insect Protein Market Size

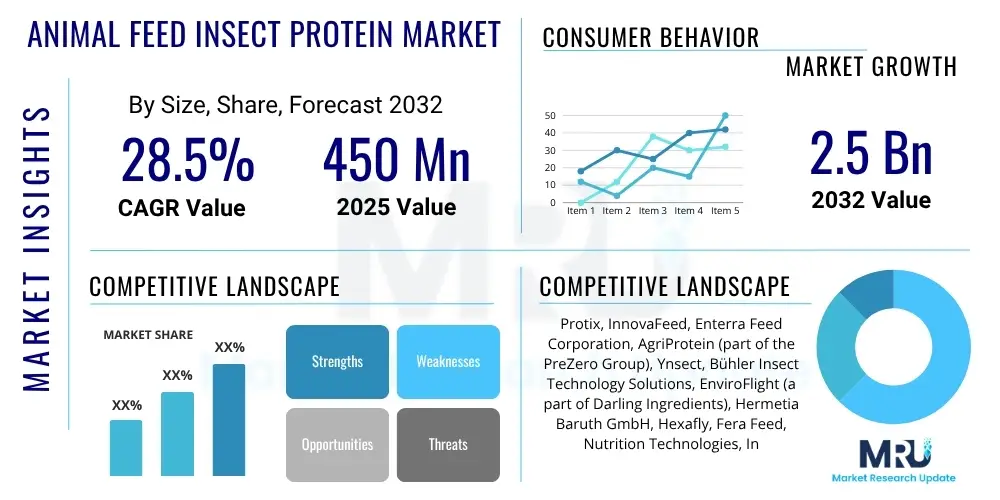

The Animal Feed Insect Protein Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2025 and 2032. The market is estimated at $450 Million in 2025 and is projected to reach $2.5 Billion by the end of the forecast period in 2032.

Animal Feed Insect Protein Market introduction

The Animal Feed Insect Protein Market is a rapidly emerging sector driven by the increasing global demand for sustainable and alternative protein sources in animal nutrition. This market encompasses the production and utilization of protein derived from various insect species, such as black soldier fly larvae, mealworms, and crickets, which are processed into highly nutritious ingredients for livestock, poultry, aquaculture, and pet food. These insect proteins offer a compelling solution to the environmental challenges associated with traditional protein sources like soy and fishmeal, providing a circular economy approach by converting organic waste into high-value feed.

The core product in this market includes insect meal, insect oil, and whole dried insects, each offering distinct nutritional profiles and functional benefits for different animal species. Insect meal, rich in protein and essential amino acids, serves as a high-quality substitute for fishmeal or soy protein concentrate, particularly in aquaculture and poultry diets. Insect oil, on the other hand, provides beneficial fatty acids and energy. Major applications span across a broad spectrum of animal agriculture, aiming to enhance animal health, improve feed conversion ratios, and contribute to more sustainable farming practices globally. The benefits extend beyond nutrition to include reduced land and water usage, lower greenhouse gas emissions, and waste valorization.

The market's growth is primarily fueled by a confluence of driving factors. These include rising concerns over environmental sustainability in conventional agriculture, the escalating costs and supply volatility of traditional protein ingredients, and growing regulatory acceptance in key regions like the European Union and North America. Furthermore, increasing consumer awareness about sustainable food systems and the functional benefits of insect proteins for animal health are contributing significantly to the market's expansion. Research and development efforts are continuously unlocking new applications and improving production efficiencies, positioning insect protein as a vital component in future animal feed formulations.

Animal Feed Insect Protein Market Executive Summary

The Animal Feed Insect Protein Market is experiencing dynamic growth, characterized by significant business trends, evolving regional landscapes, and diverse segment performance. Globally, the industry is witnessing substantial investment in advanced rearing and processing technologies, aimed at enhancing scalability and cost-efficiency. Strategic collaborations between insect farming companies, feed manufacturers, and research institutions are becoming commonplace, fostering innovation and accelerating market penetration. A notable business trend is the shift towards vertically integrated operations, allowing companies to control the entire value chain from insect breeding to final product formulation, thereby ensuring quality and consistency while optimizing production economics. Furthermore, a focus on certifications and sustainability credentials is gaining traction as companies aim to differentiate themselves in a competitive market and meet stringent regulatory and consumer expectations.

Regional trends indicate Europe as a frontrunner in market development, largely due to supportive regulatory frameworks and established aquaculture and poultry industries eager for sustainable alternatives. The European Union's approval of insect proteins for various animal feed applications has significantly spurred market growth and attracted substantial investments. Asia Pacific is emerging as a critical growth hub, driven by its vast aquaculture sector and increasing awareness of insect protein's potential. Countries such as China, Vietnam, and Thailand are seeing rapid expansion in insect farming operations, supported by a historical cultural familiarity with insects as a food source. North America, while somewhat slower in initial adoption, is now experiencing accelerated growth, particularly within the pet food segment, propelled by a strong consumer demand for natural and sustainable ingredients for companion animals. Latin America and the Middle East & Africa also present nascent but promising opportunities, fueled by regional efforts to enhance food security and promote sustainable agriculture.

Segmentation trends highlight aquaculture as the dominant application segment, where insect meal is proving to be a highly effective and sustainable substitute for fishmeal, alleviating pressure on marine resources. The poultry and swine segments are also demonstrating robust growth as producers seek to improve feed conversion ratios and animal welfare through novel protein sources. The pet food sector, however, stands out as the fastest-growing segment, driven by premiumization trends and pet owners' increasing willingness to invest in high-quality, hypoallergenic, and environmentally friendly diets for their pets. Among insect types, Black Soldier Fly (BSF) larvae protein continues to lead the market due to its efficient bioconversion capabilities and robust nutritional profile, followed closely by mealworms and crickets, each carving out specific niches based on application and regional preference. The market is thus poised for continued diversification and expansion across these key segments, underpinned by continuous research and development.

AI Impact Analysis on Animal Feed Insect Protein Market

User questions related to the impact of AI on the Animal Feed Insect Protein Market often revolve around how artificial intelligence can optimize production, ensure product quality, enhance supply chain efficiency, and contribute to the overall sustainability of insect farming. Common inquiries address the specific applications of AI in insect rearing, processing, and feed formulation, alongside concerns about the initial investment required and the technical expertise needed for implementation. Users frequently seek to understand AI's role in addressing scalability challenges, standardizing output, and managing complex biological systems for optimal growth and nutritional yield. The overarching expectation is that AI will unlock new levels of efficiency and precision, transforming a nascent industry into a highly sophisticated and globally competitive sector. This analysis reveals a clear desire among stakeholders to leverage AI for data-driven decision-making, predictive analytics, and automated processes to overcome inherent biological and operational complexities. There is particular interest in how AI can monitor insect health, optimize environmental conditions, and predict disease outbreaks, thereby safeguarding yields and ensuring biosecurity.

- AI-driven precision farming for optimized insect growth conditions (temperature, humidity, feed).

- Automated monitoring systems for insect health, behavior, and early detection of diseases or stress.

- Predictive analytics for feed conversion ratios, maximizing protein yield and resource efficiency.

- Enhanced quality control through AI-powered image analysis and sensor data for product consistency.

- Supply chain optimization and logistics management for efficient distribution of insect protein products.

- Development of personalized insect feed formulations based on AI analysis of animal nutritional needs.

- Automation of harvesting and processing operations to improve throughput and reduce labor costs.

- Data-driven breeding programs for genetic selection of high-performing insect strains.

DRO & Impact Forces Of Animal Feed Insect Protein Market

The Animal Feed Insect Protein Market is significantly shaped by a combination of key drivers, formidable restraints, and promising opportunities, all acting as powerful impact forces. A primary driver is the accelerating global demand for sustainable protein sources, stemming from environmental concerns associated with traditional livestock farming and overfishing. The high nutritional value and digestibility of insect proteins, coupled with their ability to efficiently convert organic waste into biomass, position them as an attractive alternative. Furthermore, the rising cost and volatile supply of conventional feed ingredients like fishmeal and soy have created a strong economic incentive for feed manufacturers to explore more stable and cost-effective alternatives. Regulatory frameworks, particularly in Europe, that increasingly permit and standardize insect protein use in animal feed, provide a crucial tailwind for market expansion, instilling confidence among producers and consumers alike. The compelling environmental footprint, including reduced land use, water consumption, and greenhouse gas emissions, further solidifies its position as a sustainable choice.

Despite these robust drivers, the market faces several significant restraints. One of the most prominent is the relatively high production cost of insect protein compared to established conventional feed ingredients, primarily due to the nascent stage of the industry and the need for significant initial capital investment in specialized infrastructure and technology. Scalability remains a challenge, as transitioning from pilot-scale production to large-scale industrial output requires overcoming hurdles in efficient rearing, harvesting, and processing. Consumer perception, although more directly impacting human consumption, can indirectly influence the animal feed market through a general acceptance or aversion to insect-derived products. Additionally, the lack of standardized global regulations for all insect species and applications can create market fragmentation and hinder international trade. Ensuring biosecurity and preventing potential pathogen transfer from insects to animals or humans also requires stringent controls, adding to operational complexities and costs. Addressing these restraints is crucial for the sustained growth and widespread adoption of insect protein in animal feed.

Amidst these dynamics, numerous opportunities are emerging that could dramatically reshape the market. Technological advancements in automation, AI, and genetic research are continuously improving the efficiency and sustainability of insect farming, driving down production costs and increasing yields. The exploration of novel insect species beyond the commonly used black soldier fly and mealworm presents potential for diversified nutritional profiles and expanded applications. Moreover, the development of new product formulations, such as specialized insect protein hydrolysates or fractions for specific animal life stages or health conditions, could unlock higher-value market segments. Geographic expansion into emerging markets, particularly in Asia Pacific and Latin America, where aquaculture and livestock production are rapidly growing, offers significant untapped potential. The increasing focus on circular economy principles and waste valorization positions insect farming as a key player in converting agricultural and food waste into valuable protein, aligning with global sustainability goals. Collectively, these drivers, restraints, and opportunities exert a powerful influence, directing research, investment, and strategic decisions, and ultimately charting the trajectory of the Animal Feed Insect Protein Market. The interplay of these forces mandates a nuanced understanding for effective navigation and strategic positioning within this evolving industry.

Segmentation Analysis

The Animal Feed Insect Protein Market is meticulously segmented to provide a granular understanding of its diverse components and dynamics. This comprehensive segmentation allows for a detailed analysis of market trends, competitive landscapes, and growth opportunities across various dimensions, including the specific insect types utilized, the end-user applications, and the physical forms in which the insect protein is supplied. Such categorization is crucial for stakeholders to identify key growth areas, tailor product offerings, and develop targeted marketing and distribution strategies. The market's structure reflects the evolving nature of animal nutrition, where specific dietary requirements for different animal species and the desire for sustainable, high-quality ingredients drive product development and adoption. Each segment offers unique characteristics and growth potential, influenced by technological advancements, regulatory changes, and regional preferences.

Analyzing these segments reveals important insights into market maturity and emerging niches. For instance, while certain insect types like Black Soldier Fly (BSF) dominate due to their established production efficiency and broad applicability, other types such as crickets and mealworms are gaining traction in specific high-value segments like pet food. Similarly, the aquaculture sector, being an early adopter, continues to be a major revenue generator, but the rapid expansion of the pet food segment indicates significant future growth. The form of the product, whether whole insects, meal, or oil, dictates its utility and integration into various feed formulations, impacting both processing requirements and end-product benefits. This detailed segmentation not only helps in benchmarking performance but also assists in forecasting future market trajectory by understanding the interconnectedness and individual growth drivers within each category. The regional segmentation further highlights disparities in adoption rates and regulatory environments, offering insights into strategic market entry and expansion.

- By Insect Type

- Black Soldier Fly (BSF)

- Mealworm

- Cricket

- Other Insects (e.g., Silkworms, Locusts, Hermetia illucens)

- By Application

- Aquaculture

- Poultry

- Swine

- Pet Food

- Other Animals (e.g., Equine, Exotic Animals)

- By Form

- Whole Insects

- Meal (Powder)

- Oil

- Other Forms (e.g., Hydrolysates, Live Larvae)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Animal Feed Insect Protein Market

The value chain for the Animal Feed Insect Protein Market is a complex and integrated system that begins with the upstream processes of insect breeding and rearing, extends through midstream activities of processing, and culminates in downstream distribution and end-use. Upstream analysis involves the selection of optimal insect strains, establishment of breeding colonies, and the meticulous management of rearing conditions, including feed substrates, temperature, and humidity, to ensure efficient growth and high-quality biomass production. This stage also encompasses the procurement and valorization of various organic side streams or waste products, such as agricultural by-products or food waste, which serve as sustainable feed for the insects, thereby closing the loop in a circular economy model. Key players in this phase focus on genetic optimization, biosecurity protocols, and developing scalable insect farming technologies.

Moving downstream, the value chain encompasses the processing of harvested insects into various protein forms. This typically involves steps such as drying, defatting, grinding, and often advanced techniques like hydrolysis to produce insect meal, insect oil, or more specialized protein fractions. Quality control and assurance are paramount at this stage to meet stringent feed safety standards and ensure consistent nutritional profiles. The distribution channel plays a critical role in connecting these processed ingredients with end-users. Direct sales are common for larger manufacturers supplying directly to major feed mills or aquaculture operations, allowing for customized orders and closer relationships. Indirect channels involve a network of distributors and brokers who facilitate wider market penetration, reaching smaller feed producers, pet food companies, or individual farmers, often providing logistical support and market intelligence. Both direct and indirect distribution strategies are employed to optimize market reach and ensure timely delivery of products.

The final stage involves the integration of insect protein products into animal feed formulations by a diverse array of end-users. This includes large-scale aquaculture farms, poultry and swine producers, and an expanding pet food industry. The effectiveness of the value chain is determined by the seamless flow of materials and information, efficient resource utilization, and strong collaboration among all participants. Optimizing each stage, from sustainable substrate sourcing to efficient processing and targeted distribution, is essential for reducing costs, enhancing product quality, and maximizing market acceptance of insect protein as a viable and sustainable alternative in animal nutrition. Innovation across this value chain is continuously seeking to improve bioconversion rates, reduce energy consumption in processing, and develop new, value-added insect-derived products to meet specific animal health and performance needs.

Animal Feed Insect Protein Market Potential Customers

The Animal Feed Insect Protein Market targets a diverse range of potential customers, primarily comprising various segments within the animal agriculture and pet care industries. The primary end-users or buyers of insect protein products are integrated animal feed manufacturers who are constantly seeking novel, cost-effective, and sustainable ingredients to formulate balanced diets for livestock, poultry, and aquatic species. These manufacturers represent a crucial gateway, as they incorporate insect meal and oil into their feed formulations before distribution to farms. Their demand is driven by the need to meet performance targets, comply with environmental regulations, and cater to consumer preferences for sustainably produced animal products.

Beyond feed manufacturers, direct consumers of insect protein include large-scale aquaculture operations, which utilize insect meal as a highly digestible and environmentally friendly alternative to fishmeal in diets for species like salmon, shrimp, and tilapia. Poultry farmers, particularly those in broiler and layer production, are increasingly adopting insect protein due to its high protein content, beneficial fatty acids, and chitin, which supports gut health and immunity. Swine producers are also exploring insect protein for its palatability and nutritional benefits, especially for young piglets. These agricultural end-users are driven by the desire for improved animal health, enhanced growth rates, and a reduced environmental footprint in their production systems.

Furthermore, the rapidly expanding pet food industry represents a significant and high-value customer segment. Pet food manufacturers are incorporating insect protein into premium, hypoallergenic, and sustainable pet diets, catering to a growing demographic of pet owners who prioritize natural ingredients, animal welfare, and environmental responsibility. Insect protein offers a novel protein source that can reduce allergic reactions in sensitive pets and aligns perfectly with the trend towards more sustainable pet nutrition. Specialized sectors, such as zoos, exotic animal breeders, and niche equine feed producers, also represent potential customers seeking high-quality, biologically appropriate, and novel protein sources for their specific animal populations. The increasing acceptance and regulatory clarity surrounding insect protein will only broaden this customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $450 Million |

| Market Forecast in 2032 | $2.5 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Protix, InnovaFeed, Enterra Feed Corporation, AgriProtein (part of the PreZero Group), Ynsect, Bühler Insect Technology Solutions, EnviroFlight (a part of Darling Ingredients), Hermetia Baruth GmbH, Hexafly, Fera Feed, Nutrition Technologies, Insect Technology Group (ITG), Beta Hatch, Aspire Food Group, NextProtein, Global Bugs, Ÿnsect, Chapul, Entomo Farms, Bioflytech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Animal Feed Insect Protein Market Key Technology Landscape

The Animal Feed Insect Protein Market is heavily reliant on a rapidly evolving technology landscape that underpins efficient, scalable, and sustainable insect production. A foundational aspect is the development and implementation of advanced automation systems within insect rearing facilities. This includes automated feeding, climate control, and waste removal systems, which minimize manual labor, optimize growth conditions, and reduce operational costs. Sensors and IoT (Internet of Things) devices play a crucial role in real-time monitoring of environmental parameters such as temperature, humidity, and oxygen levels, ensuring precise control over insect development and health. These technologies enable sophisticated data collection, which is then often processed and analyzed using artificial intelligence (AI) and machine learning algorithms to predict optimal harvesting times, identify potential disease outbreaks, and refine rearing protocols for maximum yield and nutritional quality.

Furthermore, innovative bioconversion technologies are central to the industry, focusing on the efficient transformation of various organic waste streams into high-quality insect biomass. This involves optimizing insect species selection, substrate formulation, and bioprocess engineering to maximize the conversion rate of low-value inputs into high-value protein. Research into genetic selection and breeding programs is also a key technological area, aiming to develop insect strains with enhanced growth rates, improved disease resistance, and superior nutritional profiles. Techniques like CRISPR-Cas9 are being explored to genetically optimize insects for specific traits, although ethical considerations and regulatory hurdles remain significant in this nascent field. The processing stage benefits from advanced drying, defatting, and grinding technologies that preserve nutritional integrity and ensure food safety, alongside novel protein extraction and hydrolysis methods that create specialized protein ingredients for different feed applications.

The technological landscape also extends to post-processing and product formulation. Advanced analytical techniques, such as near-infrared spectroscopy (NIRS) and mass spectrometry, are used for rapid and accurate assessment of the nutritional composition of insect meals and oils, ensuring product consistency and quality assurance. Research and development in feed extrusion and pelleting technologies are also critical to effectively incorporate insect proteins into palatable and digestible feed formats for various animal species. The integration of blockchain technology is also emerging as a way to enhance traceability and transparency across the entire value chain, from substrate sourcing to the final feed product, addressing consumer and regulatory demands for accountability. This continuous technological innovation is crucial for overcoming current production challenges, improving cost-effectiveness, and enabling the Animal Feed Insect Protein Market to scale and meet the increasing global demand for sustainable animal nutrition solutions.

Regional Highlights

- Europe: Leading the global market, driven by progressive regulatory frameworks and a strong emphasis on sustainable agriculture and circular economy principles. Countries like the Netherlands, France, and Belgium are at the forefront of insect farming technology and production, with significant investments from both private and public sectors. The European Union's approval of insect proteins for aquaculture, poultry, and swine feed has been a critical catalyst for market expansion, fostering research and development, and attracting major players. Consumer acceptance, while still evolving, benefits from a general trend towards sustainable and ethically sourced food and feed ingredients.

- North America: Experiencing accelerated growth, particularly in the pet food segment, where premiumization and demand for sustainable, hypoallergenic ingredients are strong. The United States and Canada are seeing increasing interest and investment in insect farming startups and research. While regulatory clarity has been somewhat slower than in Europe, approvals for specific insect species in poultry and aquaculture feed are paving the way for broader adoption. The region benefits from robust agricultural infrastructure and significant R&D capabilities, driving innovation in production and processing technologies.

- Asia Pacific (APAC): A rapidly emerging market with substantial growth potential, primarily driven by its vast aquaculture industry and growing livestock sectors, particularly in China, Vietnam, Thailand, and South Korea. Cultural familiarity with insects as a food source in many parts of the region contributes to higher acceptance levels. Governments are increasingly recognizing the potential of insect farming for waste valorization and food security. Investment in large-scale insect protein production facilities is on the rise, aiming to address regional protein deficits and reduce reliance on imported feed ingredients like fishmeal.

- Latin America: Showing promising signs of development, fueled by an abundance of agricultural by-products for insect rearing and a strong drive for sustainable agricultural practices. Brazil, Mexico, and Chile are key players, with growing interest in utilizing insect protein for poultry and aquaculture. The region's focus on resource efficiency and environmental protection aligns well with the benefits offered by insect farming, fostering local initiatives and small to medium-scale enterprises that are exploring its economic and ecological advantages.

- Middle East and Africa (MEA): A nascent market with significant long-term potential, driven by pressing food security concerns and the need for sustainable animal feed alternatives in arid and semi-arid regions. Insect farming offers a low-water, low-land-use solution for protein production, aligning with regional sustainability goals. While infrastructure and regulatory frameworks are still developing, early adopters and pilot projects are emerging, supported by international organizations and local governments seeking innovative solutions for feed self-sufficiency and waste management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Feed Insect Protein Market.- Protix

- InnovaFeed

- Enterra Feed Corporation

- AgriProtein (part of the PreZero Group)

- Ynsect

- Bühler Insect Technology Solutions

- EnviroFlight (a part of Darling Ingredients)

- Hermetia Baruth GmbH

- Hexafly

- Fera Feed

- Nutrition Technologies

- Insect Technology Group (ITG)

- Beta Hatch

- Aspire Food Group

- NextProtein

- Global Bugs

- Chapul

- Entomo Farms

- Bioflytech

- Koppert Biological Systems (with product lines incorporating insect solutions)

Frequently Asked Questions

What are the primary benefits of insect protein in animal feed?

Insect protein offers high nutritional value, rich in protein, essential amino acids, fats, and micronutrients, making it an excellent alternative to conventional protein sources like fishmeal and soy. Its benefits include improved animal growth rates, enhanced gut health due to chitin content, increased palatability, and a significantly reduced environmental footprint compared to traditional feed ingredients. It promotes a circular economy by valorizing organic waste into high-quality protein.

Which insect types are most commonly used in animal feed production?

The most commonly utilized insect types in animal feed production are Black Soldier Fly larvae (Hermetia illucens), mealworms (Tenebrio molitor), and crickets (Acheta domesticus). Black Soldier Fly larvae are particularly favored for their efficient bioconversion of organic waste and robust nutritional profile, making them suitable for a wide range of livestock and aquaculture applications. Mealworms and crickets also provide high-quality protein and are increasingly used, especially in the pet food segment.

What are the major challenges facing the insect protein market?

The primary challenges include high production costs, which can make insect protein less competitive than traditional feed ingredients, and the need for significant initial capital investment in large-scale rearing and processing facilities. Scalability remains a hurdle for many producers. Additionally, some regulatory landscapes are still evolving, and consumer perception, although improving, can sometimes pose indirect market resistance. Ensuring biosecurity and consistent product quality are also ongoing operational challenges.

How does insect protein contribute to sustainability?

Insect protein significantly contributes to sustainability by reducing reliance on finite resources like wild fish stocks (fishmeal) and arable land for crops (soy). Insect farming requires minimal land and water, produces fewer greenhouse gas emissions, and effectively converts organic waste streams into valuable protein, thereby reducing food waste and supporting a circular economy. This eco-friendly production method lessens the environmental burden of animal agriculture.

What is the regulatory landscape for insect protein in animal feed?

The regulatory landscape for insect protein in animal feed varies by region. The European Union has been a pioneer, approving specific insect species (like Black Soldier Fly, mealworms, crickets) and their derived products for aquaculture, poultry, and swine feed. North America is gradually expanding its approvals, with insect meal currently permitted in poultry and aquaculture feed in the US and Canada. Regulations typically focus on the insect species, the substrates used for rearing, and processing standards to ensure safety and quality, driving harmonization efforts globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager