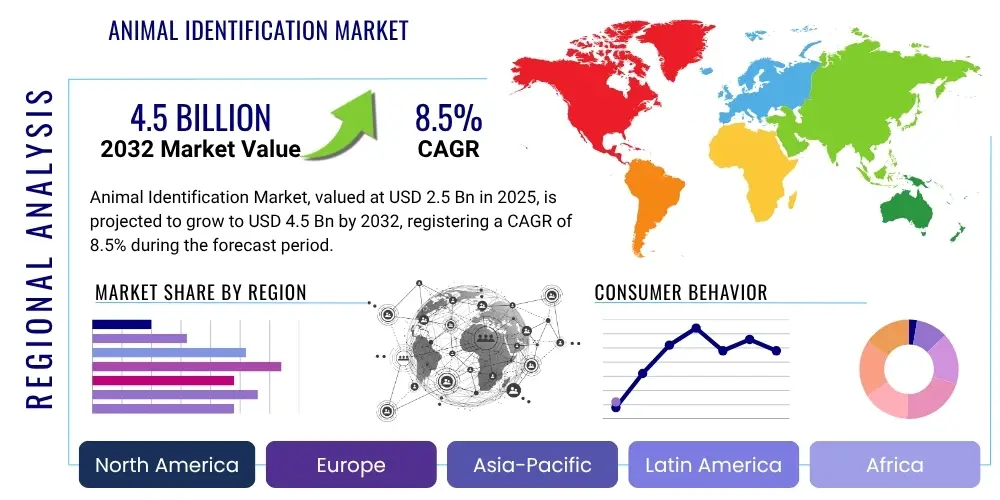

Animal Identification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430300 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Animal Identification Market Size

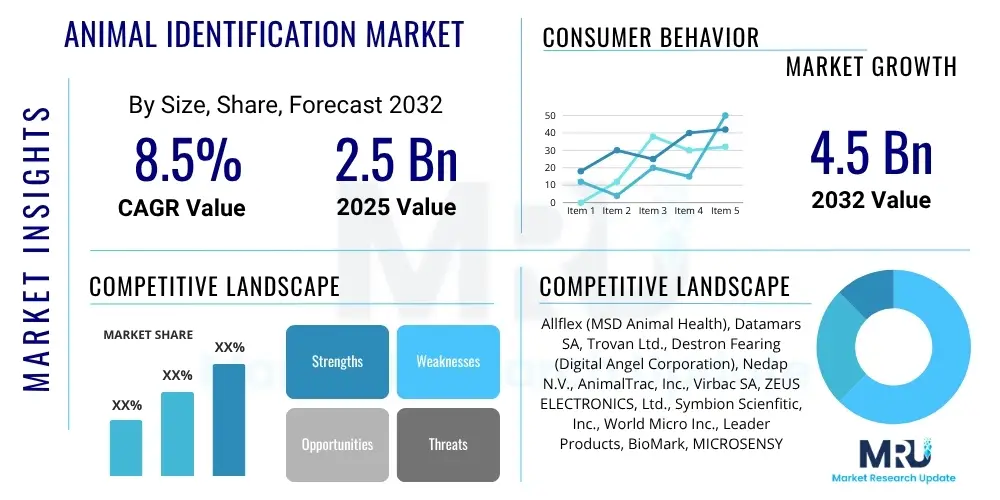

The Animal Identification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 2.5 Billion in 2025 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2032.

Animal Identification Market introduction

The Animal Identification Market encompasses a comprehensive range of technologies and solutions designed for tracking, monitoring, and managing animals across various sectors. This market is pivotal for ensuring animal welfare, improving livestock productivity, enhancing food safety traceability, and facilitating wildlife conservation efforts. Products typically include physical tags, electronic devices, and advanced biometric solutions that provide unique identifiers for individual animals, enabling efficient data collection and management throughout their lifecycles. The foundational purpose of these systems is to provide accurate and reliable identification, which is critical for health monitoring, breeding programs, theft prevention, and regulatory compliance, thereby supporting sustainable practices in animal husbandry and pet ownership.

The core product offerings within this market range from conventional visual ear tags and tattoos to sophisticated radio-frequency identification (RFID) tags, microchips, GPS trackers, and biometric recognition systems. These technologies are applied extensively across major applications such as commercial livestock farming, companion animal management, wildlife research and conservation, and disease surveillance programs. Benefits derived from the adoption of animal identification systems are multifaceted, including enhanced traceability from farm to fork, improved animal health and genetic management, streamlined record-keeping, and significant reductions in economic losses due to disease outbreaks or theft. The ability to quickly and accurately identify animals is a cornerstone of modern animal management practices, driving operational efficiencies and fostering accountability.

Several key factors are driving the robust growth of the Animal Identification Market. A surging global demand for animal protein, particularly from rapidly developing economies, necessitates more efficient and scalable livestock management solutions. Simultaneously, the rising trend of pet ownership worldwide, coupled with increasing awareness of pet health and safety, fuels the demand for microchips and GPS tracking devices. Furthermore, the imperative for stringent disease prevention and control, exemplified by outbreaks of zoonotic diseases, mandates robust identification systems for effective containment and eradication. Growing regulatory pressures from governmental bodies and international organizations for food safety and animal welfare also compel stakeholders across the animal industry to adopt advanced identification technologies, ensuring compliance and consumer confidence.

Animal Identification Market Executive Summary

The Animal Identification Market is currently experiencing a dynamic phase characterized by significant technological advancements and evolving consumer and regulatory demands. Key business trends indicate a strong move towards digitalization and the integration of smart technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), into traditional identification methods. Companies are increasingly focusing on developing integrated platforms that offer comprehensive data management alongside identification, enhancing efficiency and decision-making for end-users. Strategic partnerships and collaborations between technology providers and animal health organizations are also becoming prevalent, aiming to create more holistic and interoperable solutions. Furthermore, the market is witnessing a shift towards sustainability, with an emphasis on durable, reusable, and environmentally friendly identification products, aligning with global eco-conscious initiatives.

Regionally, the market exhibits diverse growth patterns and levels of maturity. North America and Europe currently hold significant market shares, driven by well-established livestock industries, high rates of pet ownership, and stringent regulatory frameworks for animal traceability and food safety. These regions are characterized by early adoption of advanced identification technologies and a strong focus on innovation. The Asia Pacific region is anticipated to demonstrate the highest growth rate during the forecast period, primarily due to expanding livestock populations, increasing disposable incomes leading to higher pet adoption rates, and governmental initiatives promoting modern animal husbandry practices. Latin America and the Middle East & Africa also present promising growth opportunities, propelled by agricultural development and growing awareness of animal health and welfare.

Segmentation trends reveal that electronic identification technologies, particularly RFID tags and readers, continue to dominate the market due to their superior accuracy, automation capabilities, and efficiency in large-scale operations. However, there is a growing interest and adoption of biometric solutions, such as retinal scans and facial recognition, especially for high-value animals and in controlled environments, owing to their enhanced security and tamper-proof nature. The livestock segment remains the largest application area, driven by industrial farming needs and food security concerns, while the companion animal segment is expanding rapidly, fueled by increasing pet humanization and the demand for effective pet tracking and recovery systems. The convergence of various technologies to create multi-functional identification devices is a notable trend, offering comprehensive solutions that address a wider range of needs for diverse animal types and applications.

AI Impact Analysis on Animal Identification Market

User inquiries about AI's impact on the Animal Identification Market frequently revolve around how artificial intelligence can enhance accuracy, streamline data processing, and provide predictive insights beyond basic identification. Common concerns include the integration challenges with existing legacy systems, the ethical implications of advanced surveillance, data privacy, and the cost-effectiveness of deploying AI-powered solutions, particularly for smaller operations. Users also express interest in AI's role in automating identification processes, facilitating real-time monitoring, and its potential to contribute to proactive animal health management and disease detection. The overarching expectation is that AI will transform animal identification from a static data collection process into a dynamic, intelligent system capable of delivering actionable intelligence and significantly improving animal welfare and productivity.

- AI enhances identification accuracy through advanced image recognition and biometric analysis, minimizing human error.

- Predictive analytics powered by AI enables early detection of health issues and behavioral changes, improving animal welfare and preventing disease spread.

- AI optimizes livestock management by automating data analysis from various sensors, providing insights into feeding patterns, growth rates, and reproductive cycles.

- Integration of AI with IoT devices allows for real-time monitoring and anomaly detection, transforming reactive management into proactive intervention.

- AI-driven systems contribute to robust traceability and food safety by cross-referencing identification data with health records and movement history, building consumer trust.

- Machine learning algorithms can personalize animal care by analyzing individual animal data, tailoring nutrition and environmental conditions for optimal growth and health.

- AI facilitates wildlife monitoring by processing vast amounts of camera trap data and tracking signals, enabling more efficient population surveys and anti-poaching efforts.

- Automated identification through AI reduces labor costs and increases efficiency in large-scale animal operations.

DRO & Impact Forces Of Animal Identification Market

The Animal Identification Market is significantly shaped by a confluence of drivers, restraints, and opportunities that collectively exert various impact forces. A primary driver is the escalating global concern over food security and safety, which mandates robust traceability systems for livestock to prevent foodborne illnesses and ensure product integrity from farm to consumer. Complementing this is the growing industrialization of livestock farming, which relies heavily on efficient identification for large-scale management, breeding, and health monitoring. Furthermore, the increasing adoption of companion animals globally and the subsequent emphasis on their welfare, tracking, and recovery fuel the demand for pet microchips and GPS solutions. Regulatory mandates from governmental and international bodies, particularly concerning animal disease prevention and control, livestock movement, and international trade, also act as powerful market drivers, compelling widespread adoption of identification technologies to comply with stringent standards and facilitate cross-border transactions.

Despite these strong tailwinds, the market faces several inherent restraints. High initial investment costs associated with advanced identification systems, including RFID infrastructure, biometric scanners, and sophisticated software, can be a significant barrier, especially for small and medium-sized farms or individual pet owners. Ethical concerns surrounding the invasive nature of certain identification methods, such as implantable microchips, and the potential for misuse of tracking data, also pose challenges to widespread acceptance. Technical limitations, such as signal interference in RFID systems or battery life constraints in GPS trackers, can sometimes hinder optimal performance. Data security and privacy issues related to sensitive animal health and location data are also emerging concerns, requiring robust solutions to prevent unauthorized access and protect information, especially as systems become more interconnected and complex.

Opportunities for growth in the Animal Identification Market are abundant and diverse. Emerging economies, particularly in Asia Pacific and Latin America, present vast untapped potential as their agricultural sectors modernize and disposable incomes for pet care increase. The integration of animal identification systems with other advanced technologies like the Internet of Things (IoT), blockchain, and big data analytics offers significant avenues for innovation, enabling more comprehensive data collection, immutable record-keeping, and advanced predictive insights. Expanding applications into new animal types, such as aquaculture for fish farm management, and further development of non-invasive identification methods like advanced biometric facial recognition, represent promising growth frontiers. Collaborations between technology developers, animal health experts, and regulatory bodies can also unlock new solutions that address specific market needs and overcome existing challenges, fostering a more integrated and efficient animal identification ecosystem.

Segmentation Analysis

The Animal Identification Market is comprehensively segmented across various dimensions, providing a granular view of its diverse components and applications. This segmentation allows for a detailed analysis of market dynamics, identifying specific growth drivers, competitive landscapes, and opportunities within each category. The primary segmentation criteria include product type, technology adopted, the specific animal type being identified, the application purpose, and the end-user base. Understanding these segments is crucial for stakeholders to tailor their strategies, develop targeted solutions, and effectively meet the varied demands of the global animal industry, ranging from large-scale commercial farming to individual pet ownership and specialized wildlife conservation efforts.

- By Product

- RFID Tags and Readers: Electronic tags (ear tags, injectable microchips, boluses) and devices that read data from them.

- Ear Tags: Visual ear tags (numbered, color-coded) and electronic ear tags (RFID-enabled).

- Microchips: Injectable transponders for companion animals and livestock.

- GPS Trackers: Devices for real-time location tracking, primarily for large animals or wildlife.

- Visual Tags: Leg bands, wing tags, collars, tattoos, and branding.

- Other Products: Retinal scanners, facial recognition cameras, biometric sensors.

- By Technology

- RFID Technology: Utilizes radio waves to wirelessly identify and track objects, prevalent in livestock and pet identification.

- Barcodes: Linear and 2D barcodes for simple visual scanning and data entry.

- Biometrics: Advanced identification using unique biological traits (retinal scans, facial recognition, nose prints).

- GPS Technology: Global Positioning System for accurate location tracking of animals over wide areas.

- Other Technologies: Near-Field Communication (NFC), blockchain for data integrity, IoT sensors.

- By Animal Type

- Livestock: Cattle, swine, poultry, sheep, goats, aquaculture species.

- Companion Animals: Dogs, cats, horses, exotic pets.

- Wildlife: Deer, birds, marine mammals, endangered species.

- Other Animals: Zoo animals, laboratory animals.

- By Application

- Livestock Management: Breeding, feeding, health monitoring, inventory, traceability for commercial farming.

- Pet Identification and Tracking: Lost pet recovery, vaccination records, ownership verification.

- Wildlife Monitoring: Population studies, migratory patterns, anti-poaching, disease surveillance.

- Disease Prevention and Control: Epidemic management, quarantine enforcement, health certifications.

- Research and Development: Genetic studies, behavioral analysis, drug trials.

- Other Applications: Animal athlete tracking, security, breeding certification.

- By End-User

- Farm Owners and Livestock Producers: Commercial and small-scale farmers.

- Pet Owners and Breeders: Individual owners, kennels, catteries.

- Veterinary Hospitals and Clinics: For pet and livestock health management.

- Zoos and Wildlife Sanctuaries: For managing captive and wild animal populations.

- Government Agencies: Agricultural departments, animal welfare organizations, public health authorities.

- Research Institutions: Universities, biological research labs.

- Food Processing Companies: For supply chain traceability and quality control.

Value Chain Analysis For Animal Identification Market

The value chain for the Animal Identification Market is intricate, involving multiple stages from raw material sourcing to the final deployment and service provision. At the upstream end, the process begins with the procurement of essential raw materials and components. This includes specialized plastics for ear tags, silicone and biocompatible materials for microchip encapsulation, semiconductor chips and antennas for RFID devices, and various metals for GPS tracker casings. Key players in this segment are typically chemical companies, electronics component manufacturers, and specialized material suppliers who provide the foundational elements required for identification product fabrication. The quality and availability of these upstream components directly influence the manufacturing efficiency and the durability and reliability of the final identification products, making strong supplier relationships crucial for market participants.

Moving further down the chain, manufacturers transform these raw materials and components into finished animal identification products. This stage involves sophisticated manufacturing processes, including injection molding for tags, microchip assembly, antenna integration, and stringent quality control. After manufacturing, products move through various distribution channels to reach their diverse end-users. Direct sales involve manufacturers selling directly to large corporate farms, government agencies, or large veterinary groups. Indirect channels are more varied, encompassing specialized distributors focused on agricultural supplies, veterinary product distributors, online retailers, and even pet supply stores. These channels ensure broad market reach and cater to the specific purchasing habits of different end-user segments, from individual pet owners to expansive commercial livestock operations.

The downstream segment of the value chain is focused on the implementation, integration, and ongoing support of animal identification systems. This involves system integrators who combine various hardware and software components to create comprehensive identification and management solutions. Veterinarians play a crucial role in implanting microchips and advising pet owners and farmers on appropriate identification methods. Service providers offer data management platforms, cloud storage, and technical support, ensuring the continuous functionality and efficacy of these systems. The continuous feedback from end-users, encompassing livestock farmers, pet owners, and wildlife researchers, is vital for product refinement and the development of new solutions that address evolving needs and challenges. This integrated approach across the value chain ensures effective deployment and sustained utility of animal identification technologies.

Animal Identification Market Potential Customers

The Animal Identification Market caters to a broad and diverse spectrum of potential customers, each with unique needs and motivations for adopting these technologies. The largest segment of end-users comprises livestock producers and farm owners, ranging from large-scale industrial farms managing thousands of animals to smaller, family-owned agricultural operations. These customers rely on animal identification for critical functions such as inventory management, tracking individual animal health records, optimizing breeding programs, monitoring feed intake and growth rates, and ensuring compliance with traceability regulations for food safety. For them, efficient identification directly translates to improved productivity, reduced disease transmission risks, and enhanced economic viability, making these solutions an indispensable part of modern farm management practices.

Another significant customer base includes pet owners and companion animal breeders. With increasing rates of pet adoption and the growing trend of pet humanization, owners are highly motivated to ensure the safety and well-being of their pets. Microchips are widely adopted for permanent identification, aiding in the recovery of lost pets and proving ownership. Additionally, GPS trackers are gaining popularity for real-time monitoring of pet location and activity. Breeders utilize identification systems for pedigree verification, managing breeding lines, and maintaining accurate health records for their animals. Veterinarians also serve as key intermediaries and customers, often recommending and implementing identification solutions during routine check-ups, vaccinations, and surgical procedures, further driving market penetration within the companion animal segment.

Beyond agricultural and companion animal sectors, governmental agencies, research institutions, and wildlife conservation organizations represent crucial potential customers. Government bodies, particularly agricultural and public health departments, utilize identification systems for disease surveillance, controlling animal movement, implementing vaccination programs, and ensuring adherence to international trade standards. Zoos and wildlife sanctuaries use these technologies for managing captive populations and monitoring individual animal health. Research institutions leverage identification for studying animal behavior, genetics, and ecology. Wildlife conservationists deploy advanced tracking devices, including GPS and satellite tags, for monitoring endangered species, studying migratory patterns, and combating poaching, highlighting the diverse and critical applications of animal identification technologies across multiple domains for various strategic and operational objectives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2032 | USD 4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allflex (MSD Animal Health), Datamars SA, Trovan Ltd., Destron Fearing (Digital Angel Corporation), Nedap N.V., AnimalTrac, Inc., Virbac SA, ZEUS ELECTRONICS, Ltd., Symbion Scienfitic, Inc., World Micro Inc., Leader Products, BioMark, MICROSENSYS GmbH, AGID Technologies, Inc., Dalton ID, Intervet Inc., Shearwell Data Ltd., AE ID Inc., Caisley International GmbH, National Band & Tag Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Animal Identification Market Key Technology Landscape

The Animal Identification Market is characterized by a rapidly evolving technological landscape, continuously pushing the boundaries of accuracy, efficiency, and data integration. Radio-Frequency Identification (RFID) remains a cornerstone technology, with advancements in tag durability, read range, and multi-frequency capabilities. RFID systems, encompassing both low-frequency (LF) and ultra-high-frequency (UHF) tags and readers, offer significant advantages in automated data capture, making them ideal for large-scale livestock operations and pet microchipping. Innovations in miniaturization and improved battery life for active RFID tags are expanding their application scope, while the development of more robust and tamper-proof tag designs enhances data integrity and security, crucial for regulatory compliance and preventing fraud across the supply chain.

Beyond traditional RFID, several emerging technologies are gaining traction and reshaping the market. Near-Field Communication (NFC) is seeing increased adoption for short-range identification, particularly with smart device integration, offering convenience for pet owners and small-scale livestock management. Global Positioning System (GPS) technology is advancing with more compact, energy-efficient trackers that provide highly accurate location data, vital for monitoring free-ranging livestock, valuable animals, and wildlife conservation efforts. The integration of IoT sensors with these identification devices is enabling real-time monitoring of various physiological parameters, environmental conditions, and behavioral patterns, transforming identification into a comprehensive health and management platform that offers predictive insights into animal welfare and productivity.

Perhaps the most transformative developments are occurring in biometrics and advanced data analytics. Biometric identification, including retinal scanning, facial recognition, and even nose print analysis, is becoming more sophisticated and reliable, offering non-invasive and highly secure identification methods for individual animals. These systems leverage artificial intelligence (AI) and machine learning algorithms to process complex image and data inputs, ensuring high accuracy even in challenging environmental conditions. Furthermore, the application of blockchain technology is emerging as a critical tool for creating immutable and transparent records of animal identity, health, and movement, enhancing traceability and trust throughout the animal product supply chain. These technological convergences are not only improving identification capabilities but also driving a shift towards smarter, data-driven animal management ecosystems.

Regional Highlights

- North America: This region holds a significant share of the Animal Identification Market, driven by a highly organized livestock industry, high pet ownership rates, and stringent regulatory frameworks concerning animal traceability and food safety. The early adoption of advanced technologies, substantial investments in R&D, and the presence of key market players contribute to its robust growth. Livestock identification for disease prevention and genetic management is paramount, while the demand for pet microchipping is consistently strong due to public awareness and veterinary recommendations.

- Europe: The European market is characterized by strict animal welfare regulations, comprehensive food safety standards, and a strong emphasis on traceability across the entire food supply chain. Countries like Germany, France, and the UK are prominent adopters of electronic identification for livestock, particularly RFID ear tags, to comply with EU directives. Growing concerns over zoonotic diseases and antibiotic resistance also accelerate the adoption of advanced identification systems, complemented by a substantial companion animal market that prioritizes microchip identification.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC is propelled by its enormous and expanding livestock populations, particularly in China and India, coupled with increasing demand for animal protein. Rising disposable incomes lead to higher pet adoption rates, stimulating the demand for pet identification solutions. Government initiatives to modernize agricultural practices, enhance food security, and control animal diseases are significantly contributing to market expansion, making it a lucrative region for market players.

- Latin America: This region is experiencing steady growth in the Animal Identification Market, primarily driven by the expansion and modernization of its agricultural sector. Countries like Brazil and Argentina, major beef exporters, are increasingly adopting identification systems for herd management, traceability for international trade, and disease control. While conventional methods like visual tags are still prevalent, there is a growing shift towards electronic identification to improve efficiency and meet global standards.

- Middle East and Africa (MEA): The MEA region presents emerging opportunities, with increasing awareness regarding animal health and welfare, particularly in the Gulf Cooperation Council (GCC) countries. Investments in modernizing livestock farming, driven by food security concerns, are fostering the adoption of identification technologies. However, challenges such as infrastructure limitations and varying regulatory landscapes mean the market is still in its nascent stages but holds considerable potential for future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Identification Market.- Allflex (MSD Animal Health)

- Datamars SA

- Trovan Ltd.

- Destron Fearing (Digital Angel Corporation)

- Nedap N.V.

- AnimalTrac, Inc.

- Virbac SA

- ZEUS ELECTRONICS, Ltd.

- Symbion Scienfitic, Inc.

- World Micro Inc.

- Leader Products

- BioMark

- MICROSENSYS GmbH

- AGID Technologies, Inc.

- Dalton ID

- Intervet Inc.

- Shearwell Data Ltd.

- AE ID Inc.

- Caisley International GmbH

- National Band & Tag Co.

Frequently Asked Questions

Analyze common user questions about the Animal Identification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is animal identification and why is it important?

Animal identification involves assigning a unique identifier to an animal, enabling tracking and management throughout its life. It is crucial for numerous reasons, including enhancing food safety by ensuring traceability from farm to fork, improving animal health management through individualized monitoring, facilitating genetic selection in breeding programs, preventing animal theft and aiding in lost pet recovery, and ensuring compliance with national and international regulations regarding animal movement and disease control. Effective identification systems are foundational to modern, efficient, and humane animal husbandry and pet ownership practices, contributing significantly to both economic productivity and animal welfare across various sectors.

What are the main technologies used in animal identification?

The Animal Identification Market employs a diverse range of technologies, varying in complexity and application. Traditional methods include visual ear tags, tattoos, and branding, offering simple visual identification. More advanced electronic methods encompass Radio-Frequency Identification (RFID) tags, which can be in the form of ear tags, injectable microchips, or boluses, allowing for automated data capture. GPS trackers provide real-time location data, especially for large animals or wildlife. Emerging technologies involve biometrics such as retinal scans and facial recognition, which offer non-invasive and highly secure identification. Each technology serves specific needs, balancing factors like cost, accuracy, automation, and environmental suitability, with RFID and microchips being particularly prevalent in commercial and companion animal sectors.

How does animal identification benefit livestock management?

Animal identification profoundly benefits livestock management by providing precise individual animal data, leading to enhanced operational efficiency and improved herd health. It enables farmers to accurately track individual animals for breeding records, vaccination schedules, medication administration, and feeding programs, thereby optimizing productivity and resource allocation. Traceability systems, often built on identification data, are vital for demonstrating compliance with food safety regulations, protecting against disease outbreaks, and facilitating international trade. By monitoring individual animal performance and health status over time, identification systems assist in early detection of issues, reducing economic losses from disease and improving overall herd welfare, which is critical for sustainable and profitable livestock farming operations.

What are the primary challenges in implementing animal identification systems?

Implementing animal identification systems can face several challenges, including the significant initial investment required for advanced technologies like RFID infrastructure or biometric scanners, which can be prohibitive for small and medium-sized enterprises. Technical limitations, such as signal interference in RFID systems, battery life constraints in GPS trackers, or the need for skilled personnel to operate and maintain sophisticated equipment, can also pose hurdles. Ethical concerns regarding the invasiveness of certain methods or the potential for misuse of sensitive animal data are important considerations. Furthermore, achieving seamless integration with existing farm management software and ensuring data security and privacy across complex value chains remain persistent challenges that need robust technological and policy solutions for widespread and effective adoption.

How is AI transforming the animal identification market?

Artificial Intelligence (AI) is fundamentally transforming the animal identification market by elevating capabilities beyond mere tracking to predictive insights and enhanced automation. AI-driven image recognition and biometric analysis significantly improve the accuracy and speed of identification, especially for non-invasive methods like facial recognition, reducing human error. Machine learning algorithms analyze vast datasets from identified animals, including health metrics, behavior patterns, and environmental factors, to provide predictive analytics for early disease detection, optimized feeding, and personalized care. AI integrates seamlessly with IoT sensors and real-time monitoring systems, turning raw data into actionable intelligence for proactive management. This shift enables more efficient resource allocation, improves animal welfare outcomes, and strengthens traceability throughout the supply chain, making identification systems more intelligent and impactful.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager