Anti-Lock Braking System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429642 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Anti-Lock Braking System Market Size

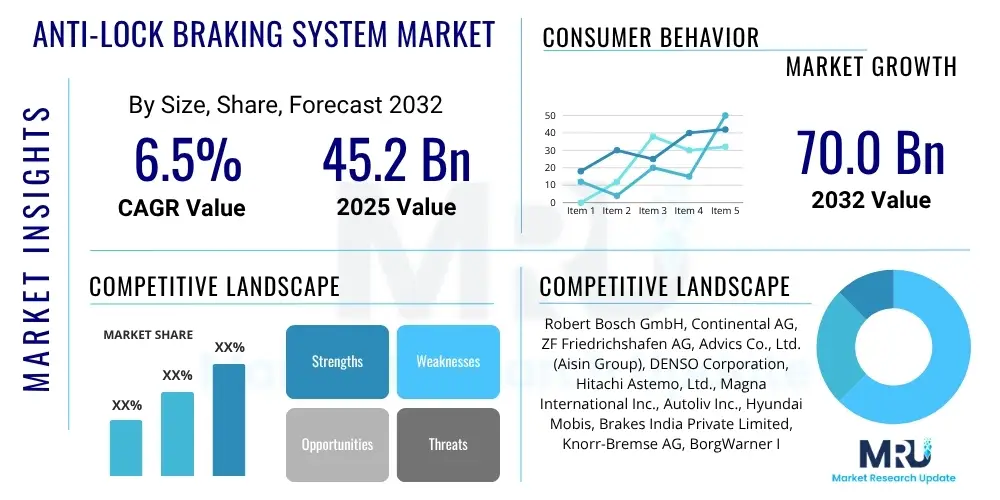

The Anti-Lock Braking System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 45.2 billion in 2025 and is projected to reach USD 70.0 billion by the end of the forecast period in 2032.

Anti-Lock Braking System Market introduction

The Anti-Lock Braking System (ABS) represents a critical safety innovation in the automotive industry, designed to prevent vehicle wheels from locking up during emergency braking. By continuously monitoring wheel speed and modulating brake pressure, ABS allows the driver to maintain steering control and reduce stopping distances, particularly on slippery surfaces. This fundamental safety feature has evolved significantly since its inception, moving from basic mechanical systems to highly sophisticated electronic control units that integrate seamlessly with other advanced driver-assistance systems (ADAS).

The core product, an ABS, typically comprises wheel speed sensors, an electronic control unit (ECU), and a hydraulic modulator. Wheel speed sensors continuously transmit data to the ECU, which detects any impending wheel lock-up during braking. Upon detection, the ECU signals the hydraulic modulator to rapidly open and close valves, precisely reducing and reapplying hydraulic pressure to the brake calipers. This pulsating action prevents the wheels from skidding, thereby enhancing vehicle stability and maneuverability, a pivotal benefit in avoiding collisions and improving overall road safety for both occupants and pedestrians.

ABS finds major applications across a broad spectrum of vehicle types, including passenger cars, commercial vehicles such as trucks and buses, and motorcycles. Its benefits extend beyond mere accident prevention, encompassing enhanced vehicle control, reduced tire wear, and greater driver confidence. The primary driving factors for the market's robust growth include increasingly stringent global automotive safety regulations, a rising consumer awareness regarding vehicle safety features, and the continuous growth in vehicle production worldwide, especially in emerging economies. Furthermore, the integration of ABS with advanced braking technologies, like electronic stability control (ESC) and traction control systems (TCS), further solidifies its indispensable role in modern automotive engineering.

Anti-Lock Braking System Market Executive Summary

The Anti-Lock Braking System market is characterized by dynamic business trends, propelled by a global shift towards enhanced vehicle safety and evolving regulatory landscapes. Key industry trends include the increasing integration of ABS with advanced driver-assistance systems (ADAS), such as automatic emergency braking (AEB) and adaptive cruise control, transforming ABS from a standalone safety feature into a foundational component of complex safety ecosystems. There is also a notable trend towards lightweight and compact ABS units, driven by the automotive industry's focus on vehicle electrification and fuel efficiency, alongside a push for more cost-effective solutions for mass-market adoption in developing regions.

Regional trends indicate significant growth opportunities, particularly in the Asia Pacific region, which continues to dominate the market owing to high vehicle production volumes, rapid urbanization, and the implementation of mandatory ABS regulations in countries like India and China. Europe and North America, as mature markets, maintain steady demand driven by stringent safety standards and a continuous focus on upgrading existing vehicle fleets with advanced safety technologies. Latin America and the Middle East & Africa are emerging as high-growth potential regions, spurred by increasing disposable incomes, expanding automotive manufacturing bases, and a growing recognition of the importance of vehicle safety, leading to the gradual adoption of regulatory mandates.

Segment trends within the ABS market reveal a strong upward trajectory for two-wheeler ABS adoption, a segment that has historically lagged but is now experiencing significant mandates and consumer demand, particularly in Asian markets. The passenger vehicle segment remains the largest contributor, driven by universal fitment regulations and consumer preference for advanced safety. Commercial vehicles are also seeing increased penetration of sophisticated ABS and related braking systems, essential for managing heavier loads and ensuring safety in diverse operating conditions. Furthermore, the OEM channel consistently leads in market share due to standard fitment in new vehicles, while the aftermarket segment continues to serve older vehicles and repair needs, presenting steady but comparatively slower growth.

AI Impact Analysis on Anti-Lock Braking System Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Anti-Lock Braking System (ABS) market often revolve around how AI can enhance traditional ABS capabilities, whether it will lead to predictive or more adaptive braking, and the implications for vehicle safety and autonomy. Users are keen to understand if AI can move beyond reactive braking to proactive hazard mitigation, improve performance in complex scenarios, and contribute to the overall intelligence of autonomous driving systems. Concerns also include the reliability and security of AI-driven braking systems, the ethical considerations of autonomous decision-making in critical situations, and the potential for increased system complexity and cost. Expectations are high for AI to deliver unparalleled levels of safety, efficiency, and driver comfort by integrating ABS functions with other vehicle sensors and intelligence for a holistic approach to braking control.

- AI enables predictive braking, anticipating potential skidding conditions before they occur by analyzing real-time sensor data from various vehicle systems, road conditions, and environmental factors.

- Integration with Advanced Driver-Assistance Systems (ADAS) allows AI to enhance ABS by coordinating braking with features like automatic emergency braking (AEB), lane-keeping assist, and adaptive cruise control, leading to more cohesive safety responses.

- Adaptive braking algorithms powered by AI can dynamically adjust braking parameters based on driver behavior, vehicle load, tire wear, and specific road surface characteristics, optimizing stopping performance across diverse situations.

- Improved fault detection and diagnostics become possible through AI, allowing for real-time monitoring of ABS components, predicting potential failures, and enabling proactive maintenance, thus increasing system reliability and uptime.

- AI contributes to the development of sophisticated vehicle dynamics control, where ABS is just one component in a network of systems that leverage AI to maintain optimal vehicle stability and control in highly challenging driving scenarios.

- Enhanced decision-making for autonomous vehicles relies on AI-driven ABS, providing precise control over individual wheel braking to execute complex maneuvers, emergency stops, and path adjustments with greater accuracy and safety.

- The development of 'learning' ABS systems can adapt and improve their performance over time through machine learning, optimizing braking strategies based on accumulated driving data and environmental interactions.

DRO & Impact Forces Of Anti-Lock Braking System Market

The Anti-Lock Braking System market is primarily driven by escalating global mandates for vehicle safety, which compel automotive manufacturers to equip new vehicles with ABS as a standard feature across various vehicle categories. Consumer demand for safer vehicles, heightened by increased awareness and marketing efforts by automotive brands, further propels market expansion. Technological advancements, particularly in sensor technology, electronic control units, and hydraulic systems, contribute significantly to the evolution and improved performance of ABS, making them more efficient, compact, and integrated with other ADAS. Additionally, the continuous growth in global vehicle production and sales, especially in developing economies, provides a robust market base for ABS adoption.

Despite strong drivers, the market faces several restraints. The relatively high cost of implementing advanced ABS technologies, especially for entry-level and compact vehicles, can hinder wider adoption in price-sensitive markets. The complexity of integrating ABS with diverse vehicle platforms and other electronic systems requires significant engineering effort and can pose challenges during manufacturing. Moreover, the aftermarket segment faces hurdles related to standardization, quality assurance for replacement parts, and the technical expertise required for installation and maintenance. Potential malfunctions of sensors or electronic components, though rare, can also impact consumer confidence and present challenges for manufacturers, necessitating rigorous testing and quality control protocols.

Opportunities for growth in the ABS market are abundant, particularly with the ongoing transition towards electric vehicles (EVs) and autonomous vehicles (AVs). ABS is a foundational technology for these future mobility solutions, providing critical control for regenerative braking in EVs and precise stopping capabilities for AVs. The proliferation of ADAS offers avenues for deeper integration and functional expansion of ABS, leveraging shared sensor data for more intelligent and predictive braking. Emerging markets, characterized by increasing vehicle penetration and evolving regulatory frameworks, present significant untapped potential for ABS deployment. Furthermore, advancements in connected vehicle technology and data analytics can lead to smarter, more adaptive ABS systems capable of real-time performance optimization based on environmental data.

Segmentation Analysis

The Anti-Lock Braking System market is comprehensively segmented to provide a detailed understanding of its diverse applications and technological nuances. This segmentation allows for precise market analysis, identifying distinct demand patterns, growth drivers, and competitive landscapes across various product types, vehicle applications, and sales channels. Each segment plays a crucial role in the overall market dynamics, influenced by regulatory mandates, technological innovations, and consumer preferences. Understanding these segments is vital for stakeholders to formulate targeted strategies, optimize product development, and address the specific needs of different market niches within the global automotive industry.

- By System Type

- 2-Channel ABS: Typically found in two-wheelers and some light commercial vehicles, controlling braking for front and rear wheels independently or in pairs.

- 3-Channel ABS: Common in light commercial vehicles and some passenger cars, providing individual control for each front wheel and combined control for both rear wheels.

- 4-Channel ABS: Predominantly used in passenger cars and heavier commercial vehicles, offering independent control over all four wheels for optimal braking performance and stability.

- By Vehicle Type

- Passenger Cars: The largest segment, driven by universal safety mandates and consumer expectations for advanced safety features.

- Commercial Vehicles: Includes light, medium, and heavy commercial vehicles, where ABS is critical for heavy loads and diverse operating conditions, often mandated by regulations.

- Two-Wheelers: A rapidly growing segment, particularly in Asia Pacific, due to increasing regulatory requirements and enhanced safety awareness for motorcycles and scooters.

- By Sales Channel

- Original Equipment Manufacturer (OEM): Represents the primary sales channel, where ABS units are integrated as standard or optional equipment in newly manufactured vehicles.

- Aftermarket: Includes replacement ABS components, modules, or complete systems sold for repair, maintenance, or upgrade of existing vehicles.

Value Chain Analysis For Anti-Lock Braking System Market

The value chain for the Anti-Lock Braking System market is intricate, involving multiple stages from raw material sourcing to end-user consumption, with each stage adding value and influencing the final product's cost and quality. The upstream segment of the value chain is critical, focusing on the procurement of essential raw materials such as specialized steels for hydraulic components, engineering plastics for casings, rubber for seals, and various electronic components including semiconductors, microcontrollers, and sensors. Key suppliers in this phase include metal manufacturers, plastic resin producers, and a specialized ecosystem of electronic component suppliers, who must meet stringent quality and performance standards mandated by automotive-grade specifications.

Following raw material procurement, the manufacturing stage involves sophisticated processes for producing the core ABS components: wheel speed sensors, electronic control units (ECUs), and hydraulic modulators. This stage includes precision machining, assembly of electronic circuits, software development for ECU algorithms, and rigorous testing. Leading automotive Tier 1 suppliers, such as Bosch, Continental, and ZF, play a dominant role in this segment, often integrating multiple components and functionalities to deliver complete ABS modules to vehicle manufacturers. These manufacturers invest heavily in research and development to innovate and optimize system performance, miniaturization, and cost-effectiveness, constantly adapting to evolving vehicle architectures and safety standards.

The downstream segment of the value chain primarily involves the distribution and integration of ABS into finished vehicles, followed by aftermarket sales and service. Original Equipment Manufacturers (OEMs) are the largest direct customers, integrating ABS units into their new passenger cars, commercial vehicles, and two-wheelers during the assembly process. The distribution channel to OEMs is typically direct, involving long-term supply agreements and close collaboration on design and engineering. For the aftermarket, distribution often occurs through a network of authorized distributors, independent workshops, and spare parts retailers, serving the needs for replacement parts, repairs, and sometimes upgrades. Effective service and support are crucial in the aftermarket to ensure proper functionality and safety throughout the vehicle's lifespan, highlighting the importance of technician training and diagnostic tools.

Anti-Lock Braking System Market Potential Customers

The primary potential customers and end-users of Anti-Lock Braking Systems are concentrated within the global automotive industry, encompassing a broad spectrum of manufacturers and vehicle owners. Automotive Original Equipment Manufacturers (OEMs) represent the largest and most direct customer segment. These include major global car manufacturers producing passenger vehicles, heavy-duty truck and bus manufacturers in the commercial vehicle sector, and prominent two-wheeler manufacturers. These OEMs purchase ABS units directly from Tier 1 suppliers to integrate them as standard or optional safety features in their newly produced vehicles, driven by regulatory compliance, brand reputation, and consumer demand for enhanced safety. The decision to integrate ABS is often made early in the vehicle design and development phase, involving extensive collaboration with system suppliers.

Beyond new vehicle production, other significant potential customers exist in the aftermarket segment. This includes fleet operators of commercial vehicles who prioritize safety and reliability to minimize accidents and downtime, thereby seeking high-quality replacement ABS components for their existing fleets. Individual vehicle owners, through repair shops and service centers, also constitute a vital customer base when their ABS units require maintenance, repair, or replacement due to wear and tear or malfunction. These customers often seek reliable, durable, and cost-effective solutions to maintain the safety integrity of their vehicles, influencing the demand for aftermarket parts and specialized diagnostic services.

Furthermore, government bodies and regulatory agencies, while not direct buyers, significantly influence the market by mandating ABS installation in specific vehicle categories, effectively creating a captive market for manufacturers. This top-down approach ensures widespread adoption and makes ABS an indispensable component across various transportation segments. The increasing focus on road safety initiatives globally means that these regulatory influences continue to expand, pushing for ABS in vehicle types and regions where it might not yet be universally adopted, thereby consistently broadening the customer base indirectly by creating demand for OEMs. Additionally, vehicle customization and performance tuning segments also represent niche potential customers who might upgrade or modify braking systems, including ABS, for enhanced performance or safety requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 45.2 billion |

| Market Forecast in 2032 | USD 70.0 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Advics Co., Ltd. (Aisin Group), DENSO Corporation, Hitachi Astemo, Ltd., Magna International Inc., Autoliv Inc., Hyundai Mobis, Brakes India Private Limited, Knorr-Bremse AG, BorgWarner Inc., Brembo S.p.A., Mando Corporation, Tenneco Inc. (DRiV Automotive), Eberspächer Group, GKN Driveline, FTE automotive GmbH (Valeo) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anti-Lock Braking System Market Key Technology Landscape

The Anti-Lock Braking System market is underpinned by a sophisticated array of technologies that have continuously evolved to enhance vehicle safety and performance. At its core, modern ABS relies on advanced microcontrollers and embedded software that serve as the brain of the Electronic Control Unit (ECU). These ECUs process data from multiple wheel speed sensors, typically inductive or Hall-effect sensors, which precisely monitor the rotational speed of each wheel. The data is then fed into complex algorithms that determine if a wheel is about to lock up, necessitating a rapid and precise modulation of hydraulic pressure to the brake calipers. This real-time decision-making and actuation are crucial for maintaining traction and steering control during emergency braking maneuvers, illustrating the blend of hardware and software innovation.

Beyond the fundamental components, the technology landscape extends to advanced hydraulic modulators, which utilize an intricate system of solenoid valves and pumps to achieve ultra-fast and precise pressure adjustments at each wheel. These modulators are designed for durability and minimal response time, critical for effective ABS operation. Furthermore, the integration of ABS with vehicle communication networks, such as the CAN (Controller Area Network) bus, allows it to share data and coordinate seamlessly with other vehicle systems like Electronic Stability Control (ESC), Traction Control Systems (TCS), and more recently, Advanced Driver-Assistance Systems (ADAS). This interoperability enables a holistic approach to vehicle dynamics and safety, forming a layered defense against loss of control.

Emerging technological trends are propelling the ABS market towards even greater intelligence and connectivity. These include the development of predictive braking systems that leverage AI and machine learning algorithms to anticipate potential skidding conditions by analyzing various sensor inputs, including radar, lidar, and camera data, long before conventional ABS would react. Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) communication technologies are also being explored to allow ABS systems to receive real-time information about road conditions or hazards ahead, further optimizing braking performance. Additionally, the miniaturization and cost reduction of components continue to drive the adoption of ABS in a wider range of vehicles, including smaller cars and two-wheelers, making advanced safety more accessible and universal across the global automotive fleet.

Regional Highlights

- Asia Pacific: This region is the largest and fastest-growing market for Anti-Lock Braking Systems, primarily driven by robust automotive production, increasing disposable incomes, and the widespread implementation of mandatory ABS regulations in countries like India, China, and ASEAN nations. The significant volume of two-wheeler sales also contributes substantially to the market, as ABS becomes a standard safety feature or is mandated for motorcycles.

- Europe: A mature market characterized by stringent safety regulations, high consumer awareness, and technological leadership in automotive engineering. European countries like Germany, France, and the UK have high penetration rates of ABS and continue to drive innovation, particularly in integrating ABS with advanced driver-assistance systems (ADAS) and electric vehicle technologies.

- North America: This region shows stable growth, propelled by strong regulatory frameworks and a consistent demand for advanced vehicle safety features. The United States and Canada are key markets, with a focus on passenger cars and light commercial vehicles, and an increasing emphasis on incorporating ABS into autonomous driving platforms and connected vehicle ecosystems.

- Latin America: An emerging market experiencing significant growth due to increasing vehicle production, a rising middle class, and evolving safety regulations. Countries such as Brazil and Mexico are leading the adoption, though market penetration rates for ABS still offer considerable growth potential compared to developed regions, particularly in the aftermarket segment.

- Middle East and Africa (MEA): This region is a nascent but growing market for ABS, driven by expanding automotive sales, government initiatives to improve road safety, and increasing foreign investment in automotive manufacturing. While starting from a smaller base, the demand for advanced safety features is steadily increasing, offering long-term growth prospects for ABS manufacturers and suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anti-Lock Braking System Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Advics Co., Ltd. (Aisin Group)

- DENSO Corporation

- Hitachi Astemo, Ltd.

- Magna International Inc.

- Autoliv Inc.

- Hyundai Mobis

- Brakes India Private Limited

- Knorr-Bremse AG

- BorgWarner Inc.

- Brembo S.p.A.

- Mando Corporation

- Tenneco Inc. (DRiV Automotive)

- Eberspächer Group

- GKN Driveline

- FTE automotive GmbH (Valeo)

Frequently Asked Questions

What is an Anti-Lock Braking System (ABS) and how does it work?

An Anti-Lock Braking System (ABS) is a safety system designed to prevent vehicle wheels from locking up during emergency braking. It works by monitoring wheel speed and automatically modulating brake pressure to each wheel independently when it detects an impending lock-up. This pulsating action allows the driver to maintain steering control and reduces stopping distances, especially on slippery road surfaces, significantly enhancing overall vehicle safety.

Why is ABS considered a crucial safety feature in modern vehicles?

ABS is crucial because it dramatically improves vehicle stability and maneuverability during hard braking. By preventing wheel lock-up, it enables the driver to steer around obstacles while braking, a capability often lost with conventional brakes. This not only reduces the likelihood of skidding and loss of control but also can shorten stopping distances under certain conditions, thereby playing a vital role in accident prevention and occupant safety.

Is ABS mandatory in all new vehicles globally?

The mandating of ABS varies by region and vehicle type. While it is widely mandated for passenger cars in developed regions like North America, Europe, and many parts of Asia Pacific, its implementation for commercial vehicles and two-wheelers is also becoming increasingly common through regulatory pushes in many countries. However, universal global mandatory fitment across all vehicle categories is still evolving, with emerging markets gradually adopting similar safety standards.

What are the main components of an ABS, and what is the role of each?

The main components of an ABS are wheel speed sensors, an Electronic Control Unit (ECU), and a hydraulic modulator. Wheel speed sensors continuously measure the rotational speed of each wheel and send this data to the ECU. The ECU acts as the brain, processing this information and determining if a wheel is about to lock. If so, it instructs the hydraulic modulator, which contains valves and a pump, to rapidly adjust brake fluid pressure to the individual wheel, preventing it from skidding while maintaining optimal braking force.

How is Artificial Intelligence (AI) influencing the evolution of ABS technology?

AI is transforming ABS by enabling predictive and adaptive braking capabilities. Instead of just reacting to wheel lock-up, AI-powered systems can analyze vast amounts of data from various sensors (radar, lidar, cameras, etc.) to anticipate hazardous situations and optimize braking proactively. This integration with ADAS allows for more intelligent, coordinated safety responses, making ABS a foundational element for future autonomous driving systems and enhancing overall vehicle dynamics control and safety performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager