Anti-aircraft Warfare Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427702 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Anti-aircraft Warfare Market Size

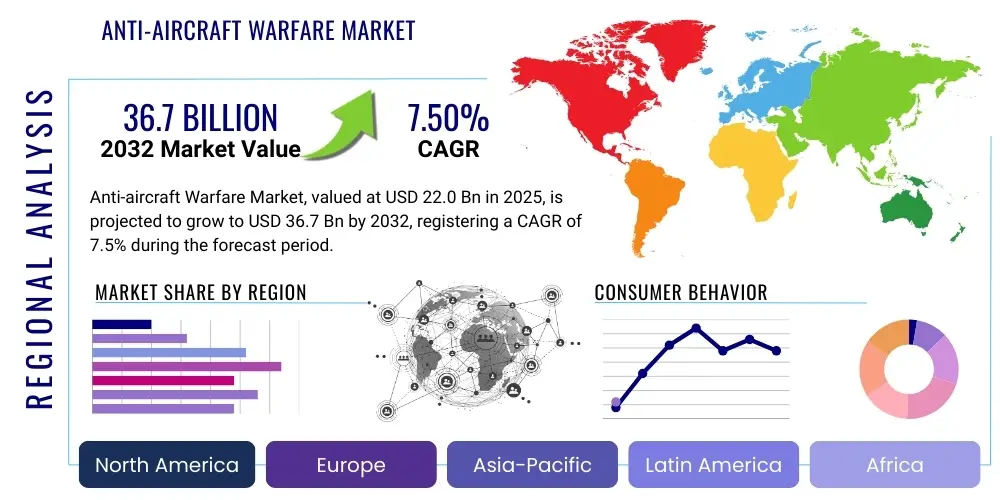

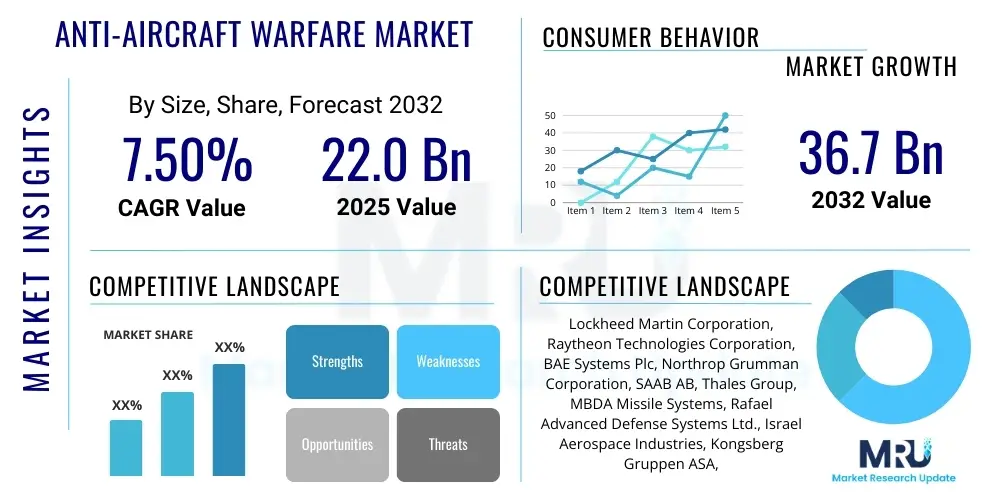

The Anti-aircraft Warfare Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at USD 22.0 Billion in 2025 and is projected to reach USD 36.7 Billion by the end of the forecast period in 2032.

Anti-aircraft Warfare Market introduction

Anti-aircraft warfare encompasses the systems and strategies designed to counter airborne threats, ensuring the protection of critical assets, personnel, and national airspace. This domain involves a sophisticated array of technologies, including missile systems, gun systems, advanced radars, command and control networks, and electronic warfare capabilities, all integrated to detect, track, intercept, and neutralize hostile aircraft, drones, and ballistic missiles. The fundamental objective is to establish air superiority and deny adversaries the ability to conduct air operations effectively.

The market is characterized by continuous innovation aimed at enhancing precision, range, and adaptability against evolving threats. Major applications span across military defense, securing strategic installations like airbases and naval fleets, and providing robust protection for ground troops during combat operations. The inherent benefits include safeguarding national security interests, preserving critical infrastructure, and maintaining operational freedom within a contested aerial environment. Key driving factors propelling market growth include escalating geopolitical tensions, the imperative for military modernization initiatives across various nations, and rapid technological advancements in sensor, effector, and data processing capabilities, which collectively demand more sophisticated air defense solutions.

Anti-aircraft Warfare Market Executive Summary

The Anti-aircraft Warfare Market is currently experiencing dynamic shifts driven by several overarching trends. Business trends highlight a significant emphasis on research and development into next-generation systems, with a focus on counter-unmanned aerial systems (C-UAS) and integrated air and missile defense (IAMD) capabilities. There is also a notable move towards international collaborations and partnerships to pool resources for complex system development and offset high R&D costs, alongside a consolidation among major defense contractors to enhance their portfolios. The market is highly competitive, with a continuous push for technological superiority and cost-effectiveness in procurement.

Regional trends indicate North America maintaining its dominance due to substantial defense budgets, robust indigenous research capabilities, and the presence of leading defense contractors. Asia-Pacific is projected to be the fastest-growing region, fueled by escalating regional conflicts, territorial disputes, and the widespread modernization of military forces by countries like China, India, and South Korea. Europe is actively investing in new air defense systems, often through multinational programs, to replace aging equipment and address emerging threats from drones and ballistic missiles. Segment trends reveal that missile systems continue to hold the largest share, driven by their effectiveness against a wide spectrum of aerial threats, while the C-UAS segment is experiencing explosive growth as nations grapple with the proliferation of small and medium-sized drones. Additionally, the increasing sophistication of radar and command and control systems, enhanced by artificial intelligence and machine learning, is pivotal to improving overall air defense effectiveness.

AI Impact Analysis on Anti-aircraft Warfare Market

User inquiries concerning the integration of Artificial Intelligence (AI) into the Anti-aircraft Warfare Market primarily revolve around its potential to enhance detection, tracking, and interception capabilities, as well as the ethical implications of autonomous decision-making in combat. Common questions include how AI can improve target recognition, reduce operator workload, and enable faster response times against advanced threats. There is significant interest in AIs role in processing vast amounts of sensor data, predicting adversary movements, and optimizing resource allocation. Concerns also frequently arise regarding the reliability of AI systems in high-stakes environments, the potential for algorithmic bias, and the framework for human oversight in systems capable of autonomous engagement. Users are keen to understand how AI will make air defense systems more resilient against swarming drones and hypersonic missiles, and what the long-term strategic advantages and challenges will be.

The overarching themes suggest a strong expectation that AI will be a transformative force, leading to more intelligent, adaptive, and efficient air defense systems. However, this optimism is tempered by valid questions about the responsible development and deployment of such powerful technologies. Users envision AI contributing to superior situational awareness, predictive defense, and the automation of certain functions, thereby allowing human operators to focus on higher-level strategic decisions. The markets future is seen as intrinsically linked to the successful and ethical integration of AI, balancing technological advancement with operational safety and adherence to international humanitarian law. This focus highlights the need for robust AI governance and transparent development practices within the defense sector.

- Enhanced Threat Classification and Prioritization: AI algorithms can rapidly analyze sensor data from multiple sources to identify, classify, and prioritize threats, distinguishing between friendly, neutral, and hostile aerial objects with greater accuracy and speed than human operators alone.

- Predictive Analytics and Decision Support: AI provides predictive insights into potential threat trajectories, enabling proactive defense measures and optimizing weapon system deployment. It aids human decision-makers by presenting optimal interception strategies in real-time.

- Autonomous or Semi-Autonomous Targeting and Engagement: AI-powered systems can autonomously track and engage targets once authorized, significantly reducing reaction times against fast-moving or swarming threats, particularly in counter-UAS operations where rapid response is critical.

- Improved Sensor Fusion and Situational Awareness: AI integrates and processes data from diverse sensors (radar, optical, acoustic, electronic warfare) to create a comprehensive, real-time picture of the battlespace, improving overall situational awareness and reducing false positives.

- Adaptive Learning and System Optimization: AI systems can learn from past engagements and adapt their operational parameters, improving performance over time in areas such as target recognition, tracking precision, and electronic counter-countermeasures.

- Logistics and Maintenance Optimization: AI can predict maintenance needs for complex air defense systems, optimizing supply chains for spare parts and scheduling preventative maintenance, thereby increasing system readiness and reducing downtime.

DRO & Impact Forces Of Anti-aircraft Warfare Market

The Anti-aircraft Warfare Market is profoundly shaped by a confluence of driving forces, restraining factors, and emerging opportunities, all operating under the influence of significant impact forces. Key drivers include the escalating global geopolitical instability, leading to increased defense spending by nations keen on enhancing their air defense capabilities against modern and asymmetric threats. The proliferation of advanced aerial platforms, such as stealth aircraft, hypersonic missiles, and sophisticated unmanned aerial systems (UAS), necessitates continuous investment in next-generation anti-aircraft solutions. Furthermore, ongoing military modernization programs across various countries, aimed at replacing aging equipment with state-of-the-art systems, significantly fuel market growth, alongside the rising demand for integrated air and missile defense (IAMD) capabilities to counter diverse threats simultaneously.

However, the market faces notable restraints that temper its expansion. The exorbitantly high costs associated with research, development, and procurement of advanced anti-aircraft systems pose a significant barrier, particularly for developing nations. The technical complexity involved in integrating diverse systems and ensuring interoperability among different platforms presents substantial challenges. Stringent government regulations and export controls on sensitive defense technologies can limit market access and international collaborations. Moreover, growing ethical concerns regarding the use of autonomous weapon systems, especially those powered by AI, are prompting debates and potentially stricter regulations that could impact future development. These factors collectively create a complex operational environment for market players.

Despite these challenges, numerous opportunities are emerging within the anti-aircraft warfare domain. The burgeoning market for Counter-UAS (C-UAS) systems, driven by the increasing threat from commercial and military drones, represents a significant growth area. The integration of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and big data analytics promises to revolutionize threat detection, tracking, and engagement. The development of directed energy weapons (DEW) and laser-based defense systems offers a potential paradigm shift, providing cost-effective and high-precision interception capabilities. Furthermore, international collaborations and joint ventures among defense contractors and nations offer avenues for sharing R&D burdens and accessing new markets, while the upgrade and retrofit market for existing air defense systems also provides sustained revenue streams.

The impact forces influencing the anti-aircraft warfare market are dynamic and multifaceted. The bargaining power of buyers, primarily national governments and defense ministries, is high due to the large-scale, strategic nature of procurements and the limited number of suppliers capable of delivering complex systems. This often leads to competitive bidding and demands for advanced features and robust performance. The bargaining power of suppliers, particularly for critical components like specialized sensors, advanced propulsion systems, and guidance technologies, can also be significant, especially for proprietary or niche technologies. The threat of new entrants is relatively low due to the immense capital investment, extensive R&D, strict regulatory requirements, and the need for proven military-grade expertise. However, smaller, agile companies specializing in niche technologies like C-UAS or AI for defense may emerge as disruptive forces. The threat of substitutes is moderate, as while alternative defense strategies exist, direct substitutes for robust air defense systems against sophisticated threats are limited. Finally, the competitive rivalry among existing players is intense, driven by the high stakes of national security contracts, the desire for technological leadership, and the need to secure long-term revenue streams through continuous innovation and customer retention.

Segmentation Analysis

The Anti-aircraft Warfare Market is comprehensively segmented across various parameters, allowing for a detailed understanding of its diverse components and applications. These segmentations are critical for analyzing market dynamics, identifying specific growth areas, and understanding the strategic priorities of defense organizations worldwide. The markets structure reflects the complexity and multifaceted nature of modern air defense, addressing threats ranging from low-flying drones to high-altitude ballistic missiles, across different operational environments and technological configurations.

Analyzing these segments provides insights into where investment is concentrated, which technologies are gaining traction, and how different end-users are adapting their defense postures. From the fundamental types of weapon systems employed to the sophisticated components that enable their operation, and the platforms on which they are deployed, each segment plays a crucial role in defining the overall market landscape. This detailed segmentation helps both market participants and stakeholders to grasp the nuanced demands and opportunities present within the global anti-aircraft warfare domain, facilitating targeted product development, strategic partnerships, and informed procurement decisions.

- By Type:

- Missile Systems (Surface-to-Air Missiles (SAMs), Air-to-Air Missiles (AAMs))

- Gun Systems (Artillery-based, Autocannon-based)

- Directed Energy Systems (Lasers, High-Power Microwaves)

- Counter-Unmanned Aerial Systems (C-UAS)

- By Component:

- Radar Systems (Active Electronically Scanned Array (AESA), Passive Electronically Scanned Array (PESA))

- Command and Control (C2) Systems

- Launchers and Effectors

- Sensors (Infrared, Electro-optical, Acoustic)

- Guidance and Navigation Systems

- By Platform:

- Land-based Systems (Mobile, Stationary)

- Naval Systems (Shipborne, Submarine-launched)

- Airborne Systems (Fighter Jets, Helicopters)

- By Range:

- Short-Range Air Defense (SHORAD)

- Medium-Range Air Defense (MRAD)

- Long-Range Air Defense (LRAD)

- By End-Use:

- Defense (Military)

- Homeland Security

Anti-aircraft Warfare Market Value Chain Analysis

The value chain for the Anti-aircraft Warfare Market is intricate and extends from fundamental research and development to the long-term support and maintenance of deployed systems. At the upstream end, the chain begins with raw material suppliers providing specialized metals, composites, and electronic components essential for manufacturing. This stage also includes manufacturers of highly sophisticated sub-components such as advanced sensors, microelectronics, propulsion systems, and guidance technology, which are often developed through intensive research and significant capital investment. These specialized suppliers are critical as their products form the technological backbone of modern air defense systems, demanding high precision and reliability. The upstream segment is characterized by a relatively small number of highly specialized companies with proprietary technologies.

Moving downstream, the value chain involves prime defense contractors and system integrators who assemble these components into complete anti-aircraft warfare systems, such as missile batteries, radar installations, or integrated command and control centers. These integrators are responsible for the complex task of ensuring interoperability, testing, and certification of the final product. Distribution channels are predominantly direct, involving government-to-government sales, foreign military sales (FMS) facilitated by national defense agencies, or direct procurement contracts with national defense ministries. Indirect channels may exist through strategic partnerships and collaborations where prime contractors work with local entities for final assembly or customization to meet specific national requirements. Post-deployment, the value chain extends to extensive training, maintenance, repair, and overhaul (MRO) services, as well as ongoing software upgrades and logistical support, ensuring the operational readiness and longevity of these critical defense assets throughout their lifecycle.

Anti-aircraft Warfare Market Potential Customers

The primary potential customers and end-users of anti-aircraft warfare products and services are national defense ministries and their affiliated armed forces across the globe. This includes national armies, navies, and air forces, each requiring specialized air defense capabilities tailored to their operational environments and strategic objectives. For instance, armies procure mobile short-range air defense (SHORAD) systems to protect ground troops and forward operating bases, while navies invest in shipborne air defense systems to safeguard naval fleets against aerial and missile threats. Air forces prioritize long-range air and missile defense (IAMD) systems for national airspace protection and critical asset defense. These entities represent the core demand for both new system acquisitions and the ongoing modernization and maintenance of existing fleets.

Beyond traditional military branches, other governmental agencies with national security mandates also constitute potential customers. This includes coast guards, border security agencies, and homeland security departments, particularly as the threat from unmanned aerial systems (UAS) and low-altitude incursions becomes more prevalent. These organizations may seek lighter, more portable, or specialized C-UAS solutions for protecting critical infrastructure, national borders, or public events. The procurement cycle for these customers is typically long and complex, involving extensive evaluations, competitive bidding, and strategic partnerships, driven by national defense priorities, geopolitical landscapes, and budgetary allocations.

Anti-aircraft Warfare Market Key Technology Landscape

The Anti-aircraft Warfare Market is characterized by a dynamic and continuously evolving technology landscape, driven by the imperative to counter increasingly sophisticated aerial threats. At the forefront are advanced radar systems, particularly Active Electronically Scanned Array (AESA) radars, which offer superior target detection, tracking, and multi-target engagement capabilities with enhanced resilience against electronic countermeasures. These are complemented by sophisticated electro-optical/infrared (EO/IR) sensors that provide passive tracking and identification, crucial for stealth detection and operation in contested electromagnetic environments. The integration of networked command and control (C2) systems forms the backbone of modern air defense, enabling real-time data fusion from multiple sensors and platforms to create a comprehensive air picture, facilitating rapid decision-making and coordinated responses across diverse defense assets.

Furthermore, the market is heavily investing in the development of advanced missile technologies, including highly maneuverable interceptors with multi-mode seekers (e.g., radar, infrared, semi-active laser) designed to defeat stealthy and hypersonic targets. Significant advancements are also being made in counter-unmanned aerial systems (C-UAS) technology, encompassing a range of solutions from jammers and kinetic interceptors to directed energy weapons. Artificial Intelligence (AI) and Machine Learning (ML) are becoming foundational, enabling predictive analytics, enhanced target recognition, autonomous threat classification, and optimization of system performance. Directed Energy Weapons (DEW), such as high-energy lasers and high-power microwaves, represent a disruptive technology offering potentially cost-effective, high-precision, and virtually unlimited engagement capabilities against a variety of aerial targets, marking a pivotal shift in the future of air defense.

Regional Highlights

- North America: This region consistently accounts for the largest share of the anti-aircraft warfare market, primarily driven by the substantial defense budgets of the United States and Canada. The presence of leading defense contractors, robust research and development capabilities, and continuous investment in advanced air and missile defense systems ensure its market dominance. The focus here is on integrated air and missile defense (IAMD), counter-hypersonic capabilities, and next-generation C-UAS solutions.

- Europe: The European market is characterized by significant modernization efforts across various nations, aimed at replacing aging Soviet-era equipment and strengthening defenses against evolving threats from Russia and the Middle East. Countries like the UK, France, Germany, and Italy are investing heavily in new missile defense systems, advanced radars, and collaborative defense projects such as MBDAs Common Anti-air Modular Missile (CAMM) family. Geopolitical tensions and the imperative to bolster NATO capabilities further drive market growth.

- Asia-Pacific: Projected to be the fastest-growing region, Asia-Pacifics market expansion is fueled by escalating geopolitical tensions, territorial disputes (e.g., South China Sea, India-Pakistan border), and the aggressive military modernization programs of countries like China, India, Japan, South Korea, and Australia. Increased defense spending, particularly for advanced missile defense and indigenous C-UAS development, characterizes this region. The threat landscape includes conventional aircraft, cruise missiles, and a rapidly expanding drone ecosystem.

- Middle East & Africa: This region represents a substantial market for imported anti-aircraft warfare systems, driven by ongoing regional conflicts, internal security challenges, and the need to protect critical oil and gas infrastructure. Countries such as Saudi Arabia, UAE, and Israel are major spenders, investing in advanced air defense systems to counter ballistic missiles, cruise missiles, and drone attacks. The market is highly dependent on foreign suppliers, with a growing emphasis on localized maintenance and technology transfer.

- Latin America: While smaller compared to other regions, Latin America exhibits a steady demand for anti-aircraft warfare systems, primarily for border security, counter-narcotics operations, and modernizing existing military forces. Countries like Brazil, Argentina, and Chile are making selective procurements of SHORAD and radar systems, often balancing cost-effectiveness with the need for improved air defense capabilities against conventional and illicit aerial activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anti-aircraft Warfare Market.- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- BAE Systems Plc

- Northrop Grumman Corporation

- SAAB AB

- Thales Group

- MBDA Missile Systems

- Rafael Advanced Defense Systems Ltd.

- Israel Aerospace Industries (IAI)

- Kongsberg Gruppen ASA

- Rostec (Almaz-Antey Concern)

- Rheinmetall AG

- L3Harris Technologies, Inc.

- General Dynamics Corporation

Frequently Asked Questions

What is anti-aircraft warfare and why is it important?

Anti-aircraft warfare refers to military strategies and systems designed to detect, track, intercept, and destroy hostile aircraft, missiles, and drones. It is crucial for national security as it protects critical assets, personnel, and airspace from aerial threats, ensuring military superiority and strategic defense.

How is AI transforming the anti-aircraft warfare market?

AI is revolutionizing air defense by enhancing threat classification, enabling predictive analytics, facilitating autonomous targeting (under human supervision), and improving sensor fusion for superior situational awareness. It significantly boosts the speed and accuracy of responses against complex and evolving aerial threats, including swarming drones and hypersonic missiles.

What are the main types of anti-aircraft systems?

The primary types include missile systems (Surface-to-Air Missiles - SAMs), gun systems (artillery and autocannon-based), directed energy weapons (lasers, high-power microwaves), and Counter-Unmanned Aerial Systems (C-UAS). These systems are often integrated with advanced radar and command and control networks.

Which regions are leading the growth in the anti-aircraft warfare market?

North America currently holds the largest market share due to substantial defense budgets and technological leadership. However, the Asia-Pacific region is projected to experience the fastest growth, driven by increasing geopolitical tensions and extensive military modernization efforts by countries like China, India, and South Korea.

What are the key challenges facing the anti-aircraft warfare market?

Key challenges include the high costs of research, development, and procurement of advanced systems, the technical complexity of system integration, stringent government regulations and export controls, and ethical concerns surrounding autonomous weapon systems. Adapting to rapidly evolving threats like hypersonic missiles and drone swarms also poses significant technological hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager