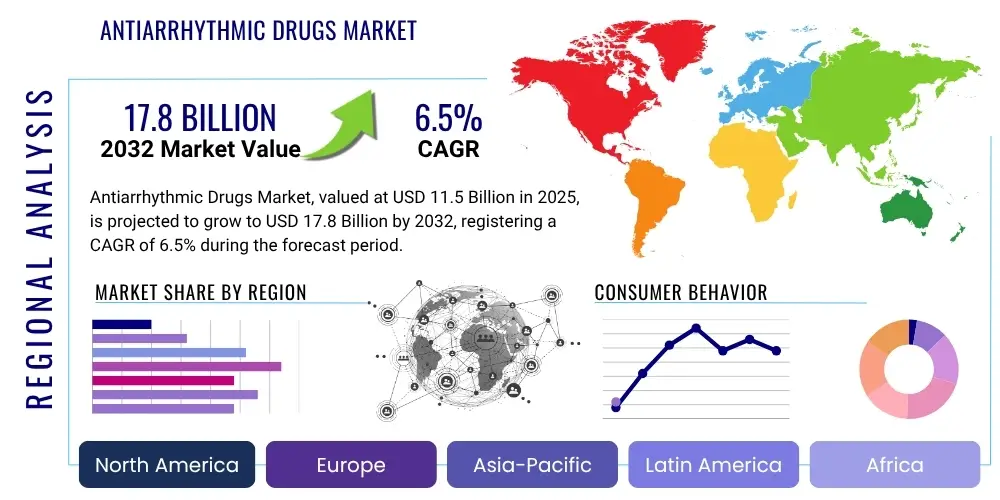

Antiarrhythmic Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428661 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Antiarrhythmic Drugs Market Size

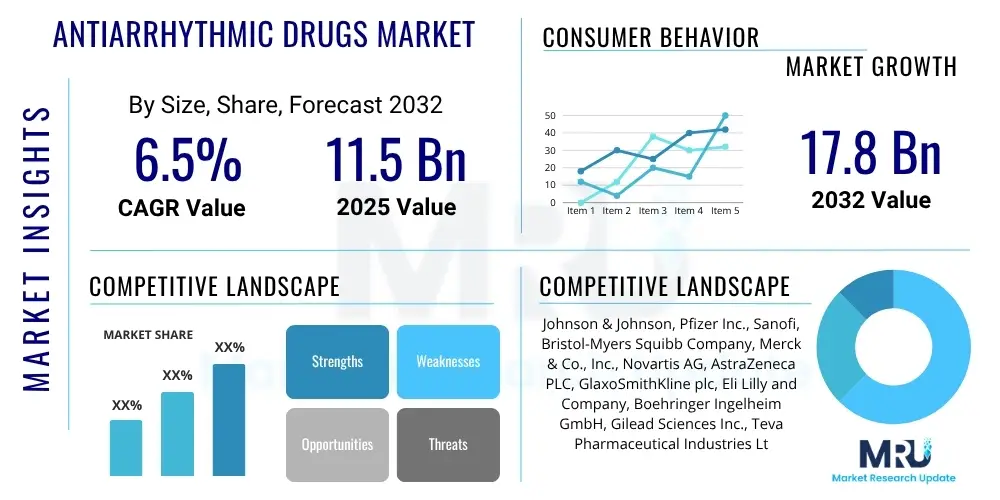

The Antiarrhythmic Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 11.5 Billion in 2025 and is projected to reach USD 17.8 Billion by the end of the forecast period in 2032.

Antiarrhythmic Drugs Market introduction

The Antiarrhythmic Drugs Market encompasses pharmaceuticals designed to treat cardiac arrhythmias, which are conditions characterized by irregular heartbeats. These drugs work by restoring normal heart rhythm, preventing life-threatening arrhythmias, and improving cardiac function. Arrhythmias can manifest as tachycardia (fast heart rate), bradycardia (slow heart rate), or irregular patterns, often stemming from underlying cardiovascular diseases, genetic predispositions, or other medical conditions. The primary goal of antiarrhythmic drug therapy is to stabilize the electrical activity of the heart, thereby reducing symptoms such as palpitations, dizziness, and shortness of breath, and mitigating the risk of serious complications like stroke or sudden cardiac death.

Products within this market are broadly categorized into several classes based on their specific mechanisms of action on cardiac ion channels, including sodium channel blockers (Class I), beta-blockers (Class II), potassium channel blockers (Class III), and calcium channel blockers (Class IV). Beyond these traditional classifications, novel agents and combination therapies are continually being explored to offer improved efficacy and safety profiles. Major applications for antiarrhythmic drugs include the management of atrial fibrillation (AF), ventricular tachycardia (VT), supraventricular tachycardia (SVT), and other complex rhythm disturbances. The therapeutic benefits extend to enhancing patients' quality of life, prolonging survival in certain high-risk populations, and reducing the need for more invasive procedures such as catheter ablation or implantable devices.

Driving factors for the growth of this market are multifactorial. A significant contributor is the escalating global prevalence of cardiovascular diseases, particularly atrial fibrillation, which affects millions worldwide and is projected to increase further due to an aging global population. Advancements in diagnostic technologies, allowing for earlier and more accurate detection of arrhythmias, also contribute to increased treatment rates. Furthermore, growing awareness among both healthcare professionals and the general public about the serious health implications of untreated arrhythmias, coupled with continuous research and development efforts by pharmaceutical companies to introduce more effective and safer drug options, are propelling market expansion. The shift towards personalized medicine, utilizing genetic profiling to tailor drug therapies, also presents a substantial growth opportunity, promising to optimize treatment outcomes and minimize adverse effects.

Antiarrhythmic Drugs Market Executive Summary

The Antiarrhythmic Drugs Market is experiencing robust growth, driven by a confluence of demographic, clinical, and technological advancements. Business trends indicate a strong focus on research and development, particularly for drugs with improved safety profiles and novel mechanisms of action to address unmet clinical needs in complex arrhythmias. Pharmaceutical companies are increasingly investing in personalized medicine approaches, leveraging genetic insights to optimize drug selection and dosage, thereby enhancing therapeutic efficacy and reducing adverse drug reactions. Generic competition remains a significant factor, leading to pricing pressures in mature drug classes, while the pipeline for innovative, proprietary drugs focuses on conditions like refractory atrial fibrillation and challenging ventricular arrhythmias. Strategic collaborations between pharmaceutical firms and academic institutions, as well as biotechnology companies, are common, aimed at accelerating drug discovery and clinical development.

Regionally, North America and Europe continue to dominate the market due to established healthcare infrastructures, high prevalence of cardiovascular diseases, and significant R&D spending. However, the Asia Pacific region is rapidly emerging as a high-growth market, propelled by its large and aging population, increasing disposable incomes, improving healthcare accessibility, and growing awareness of cardiovascular health. Latin America and the Middle East & Africa regions are also witnessing steady growth, albeit from a smaller base, attributed to expanding healthcare investments and the rising burden of non-communicable diseases. Regulatory landscapes vary by region, impacting market access and drug approval timelines, necessitating tailored market strategies for global players.

Segment-wise, the market is primarily driven by the Class III antiarrhythmic drugs, known for their efficacy in managing atrial and ventricular arrhythmias, though concerns regarding side effects continue to prompt demand for safer alternatives. The increasing incidence of atrial fibrillation is a key indicator for market growth, driving demand across all drug classes. Distribution channels are evolving, with a growing prominence of online pharmacies alongside traditional hospital and retail pharmacies, reflecting shifting consumer preferences and healthcare delivery models. Innovation in drug delivery systems and combination therapies also represent a critical trend, aiming to improve patient compliance and therapeutic outcomes. The market is poised for continued expansion, underpinned by sustained investment in clinical research and a growing patient pool requiring long-term arrhythmia management.

AI Impact Analysis on Antiarrhythmic Drugs Market

The impact of Artificial intelligence (AI) on the Antiarrhythmic Drugs Market is a rapidly evolving area, drawing significant attention from users seeking to understand its potential to revolutionize diagnosis, drug discovery, and personalized treatment. Common user inquiries revolve around how AI can enhance the accuracy and speed of arrhythmia detection, particularly through analysis of ECG data and wearable device information. There is considerable interest in AI's role in accelerating the drug development pipeline, from identifying novel drug targets and predicting molecular efficacy to optimizing clinical trial design and patient selection. Users also frequently express concerns and expectations regarding the ethical implications of AI in healthcare, the potential for bias in algorithms, data privacy, and the seamless integration of AI tools into existing clinical workflows. The overarching theme is an expectation that AI will lead to more precise, effective, and safer antiarrhythmic therapies, addressing current limitations and improving patient outcomes.

The application of AI in the antiarrhythmic space promises to optimize various stages of drug development and patient care. By leveraging machine learning algorithms, researchers can analyze vast datasets of genomic, proteomic, and clinical information to identify novel biomarkers and therapeutic targets more efficiently. This data-driven approach can significantly reduce the time and cost associated with traditional drug discovery methods, accelerating the identification of promising compounds. Furthermore, AI's predictive capabilities can be employed to forecast drug-drug interactions and potential side effects, allowing for earlier refinement of drug candidates and a more robust safety profile during preclinical development.

In clinical practice, AI offers substantial potential for personalized arrhythmia management. Algorithms can analyze individual patient data, including medical history, genetic makeup, and real-time physiological metrics from wearables, to predict an individual's risk of specific arrhythmias and tailor drug regimens accordingly. This precision medicine approach can optimize drug selection, dosage, and timing, leading to better therapeutic responses and a reduction in adverse events. Beyond treatment, AI-powered diagnostic tools can interpret complex cardiac signals from ECGs, Holter monitors, and smart devices with higher accuracy and speed than human analysis, enabling earlier intervention and proactive management of arrhythmias. The integration of AI also extends to monitoring patient adherence and treatment effectiveness, allowing for timely adjustments to therapy. However, the successful implementation of AI requires robust data infrastructure, regulatory clarity, and validation in diverse patient populations to ensure equitable and reliable clinical benefits.

- Enhanced arrhythmia detection and diagnosis through advanced ECG analysis.

- Accelerated drug discovery by identifying novel targets and lead compounds.

- Personalized medicine approaches for antiarrhythmic drug selection and dosage.

- Predictive analytics for identifying patients at high risk of arrhythmias or adverse drug reactions.

- Optimization of clinical trial design and patient stratification for antiarrhythmic therapies.

- Improved patient monitoring and adherence tracking using AI-powered wearables.

- Reduction in drug development costs and time frames.

DRO & Impact Forces Of Antiarrhythmic Drugs Market

The Antiarrhythmic Drugs Market is profoundly shaped by a dynamic interplay of drivers, restraints, and opportunities, all influenced by various impact forces. Key drivers include the escalating global prevalence of cardiac arrhythmias, particularly atrial fibrillation, which is exacerbated by an aging population and increasing incidence of associated risk factors such as hypertension, obesity, and diabetes. Continuous advancements in medical technology, including improved diagnostic tools and a deeper understanding of cardiac electrophysiology, are also propelling market growth by enabling earlier and more accurate diagnosis, thereby expanding the treatable patient pool. Furthermore, rising healthcare expenditure across developed and emerging economies, coupled with growing awareness about the severe consequences of untreated arrhythmias, fuels demand for effective pharmaceutical interventions.

Despite these strong drivers, the market faces significant restraints. The high cost associated with the research and development of new antiarrhythmic drugs, coupled with stringent regulatory approval processes, often results in lengthy and expensive product development cycles. Many existing antiarrhythmic drugs are associated with considerable side effects, leading to challenges in patient compliance and the need for careful monitoring, which can deter widespread use. The entry of generic versions of established antiarrhythmic drugs following patent expirations exerts significant pricing pressure, impacting the revenue potential for innovative manufacturers. Additionally, the increasing adoption of non-pharmacological interventions like catheter ablation and the growing prominence of implantable devices like pacemakers and defibrillators present alternative treatment pathways that can limit the growth of the pharmaceutical segment.

Opportunities for market expansion lie in the development of highly targeted and safer antiarrhythmic agents, particularly those with reduced proarrhythmic risks and fewer systemic side effects. The burgeoning field of personalized medicine, utilizing genetic and phenotypic profiling to tailor drug therapies, offers a significant avenue for optimizing treatment outcomes and minimizing adverse reactions. Emerging markets in Asia Pacific, Latin America, and Africa present substantial growth potential due to their large underserved populations and improving healthcare infrastructures. Investment in gene therapy and advanced drug delivery systems also represents a futuristic opportunity to address the underlying causes of arrhythmias more effectively. The overarching impact forces include demographic shifts (aging population), technological progress (diagnostics, AI in drug discovery), regulatory environments (drug approval, pricing controls), and evolving healthcare economics (insurance coverage, treatment guidelines), all of which continuously reshape the market landscape.

Segmentation Analysis

The Antiarrhythmic Drugs Market is comprehensively segmented based on various critical parameters, including drug class, indication, distribution channel, and route of administration, to provide a granular understanding of its diverse landscape. This segmentation allows for a detailed analysis of market dynamics, competitive intensity, and potential growth opportunities within specific therapeutic areas and patient populations. Each segment is influenced by distinct clinical needs, therapeutic preferences, regulatory considerations, and market access strategies, highlighting the complexity and multi-faceted nature of arrhythmia management.

- By Drug Class

- Class I (Sodium Channel Blockers)

- Class IA (Quinidine, Procainamide, Disopyramide)

- Class IB (Lidocaine, Mexiletine, Phenytoin)

- Class IC (Flecainide, Propafenone)

- Class II (Beta-Blockers)

- Atenolol

- Metoprolol

- Propranolol

- Esmolol

- Class III (Potassium Channel Blockers)

- Amiodarone

- Sotalol

- Dofetilide

- Ibutilide

- Dronedarone

- Class IV (Calcium Channel Blockers)

- Verapamil

- Diltiazem

- Others (Adenosine, Digoxin, Ivabradine)

- Class I (Sodium Channel Blockers)

- By Indication

- Atrial Fibrillation (AF)

- Ventricular Tachycardia (VT)

- Supraventricular Tachycardia (SVT)

- Atrial Flutter

- Premature Ventricular Contractions (PVCs)

- Other Arrhythmias

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By Route of Administration

- Oral

- Intravenous

- Other Routes

Value Chain Analysis For Antiarrhythmic Drugs Market

The value chain for the Antiarrhythmic Drugs Market involves a sequence of interconnected activities, beginning with research and development and culminating in patient access to medications. The upstream segment primarily focuses on raw material sourcing and active pharmaceutical ingredient (API) manufacturing. This involves specialized chemical companies supplying high-purity compounds, which are then synthesized into APIs under strict quality controls. Innovation in this stage is critical, as the purity and stability of APIs directly influence the safety and efficacy of the final drug product. Companies often invest heavily in securing reliable suppliers and ensuring compliance with global manufacturing standards to avoid supply chain disruptions and maintain product integrity.

The core of the value chain involves pharmaceutical manufacturing, where APIs are formulated into finished dosage forms, such as tablets, capsules, and injectables. This stage requires significant capital investment in manufacturing facilities, advanced processing technologies, and adherence to Good Manufacturing Practices (GMP). Following manufacturing, the distribution channel plays a pivotal role in bringing the drugs to end-users. This network typically includes a mix of direct and indirect channels. Direct distribution involves pharmaceutical companies selling directly to large hospital systems or government agencies, often for specialized or high-cost drugs. Indirect distribution, more common for widely used medications, relies on wholesalers and distributors who manage inventory, logistics, and supply to retail pharmacies, hospital pharmacies, and increasingly, online pharmacy platforms.

The downstream segment of the value chain focuses on market access, prescription, and patient care. This involves marketing and sales activities aimed at educating healthcare professionals and patients, securing formulary inclusions with payers, and managing pricing and reimbursement strategies. Healthcare providers, including cardiologists, electrophysiologists, and general practitioners, prescribe these drugs, and pharmacists dispense them to patients. Patient education, adherence programs, and post-market surveillance are critical components at this stage, ensuring optimal therapeutic outcomes and monitoring for adverse events. The efficiency and robustness of each stage in the value chain are crucial for the timely and effective delivery of antiarrhythmic drugs to patients in need, thereby impacting both market competitiveness and public health.

Antiarrhythmic Drugs Market Potential Customers

Potential customers in the Antiarrhythmic Drugs Market primarily comprise various healthcare entities and individual patients who require therapeutic interventions for cardiac rhythm disorders. The most significant end-users are hospitals and cardiology clinics, which treat a high volume of patients presenting with acute arrhythmias or requiring long-term management under specialist supervision. These institutions procure drugs in bulk, often through institutional contracts, and administer them to inpatients and outpatients. The demand from hospitals is driven by the prevalence of cardiovascular emergencies, surgical interventions that can induce arrhythmias, and the need for specialized care units equipped to handle complex cardiac conditions. Cardiology clinics, including those focused on electrophysiology, serve as key prescribing centers for maintenance therapy and diagnosis.

Beyond institutional settings, individual patients diagnosed with chronic arrhythmias, such as atrial fibrillation or supraventricular tachycardia, represent a substantial segment of potential customers. These patients typically obtain their prescriptions from retail pharmacies or, increasingly, through online pharmacies for convenience and accessibility. The decision-making process for these patients is heavily influenced by their prescribing physicians, health insurance coverage, drug efficacy, side effect profiles, and overall cost. As awareness of arrhythmia symptoms and the importance of early intervention grows, a larger proportion of the general population exhibiting risk factors for cardiovascular disease may also be considered indirect potential customers, as they would eventually seek diagnosis and treatment.

Specialty pharmacies and long-term care facilities also constitute important customer segments. Specialty pharmacies often handle high-cost, complex medications that require specific handling and patient support, making them critical for newer, more advanced antiarrhythmic therapies. Long-term care facilities, catering to an elderly population with a higher incidence of comorbidities and arrhythmias, represent a steady demand for these drugs. The patient population's growing understanding of their conditions, coupled with the increasing availability of information through digital health platforms, empowers them to engage more actively in treatment decisions, making them informed consumers in collaboration with their healthcare providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 11.5 Billion |

| Market Forecast in 2032 | USD 17.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Pfizer Inc., Sanofi, Bristol-Myers Squibb Company, Merck & Co., Inc., Novartis AG, AstraZeneca PLC, GlaxoSmithKline plc, Eli Lilly and Company, Boehringer Ingelheim GmbH, Gilead Sciences Inc., Teva Pharmaceutical Industries Ltd., Mylan N.V., Amgen Inc., AbbVie Inc., Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Cipla Ltd., Lupin Limited, Daiichi Sankyo Company Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antiarrhythmic Drugs Market Key Technology Landscape

The Antiarrhythmic Drugs Market is significantly influenced by a dynamic and evolving technology landscape, driving innovation in both drug discovery and patient management. A crucial aspect of this landscape involves advanced pharmaceutical research and development techniques, particularly those utilizing high-throughput screening and combinatorial chemistry. These methodologies enable pharmaceutical companies to rapidly synthesize and evaluate vast numbers of compounds, significantly accelerating the identification of potential antiarrhythmic drug candidates. The focus is increasingly on developing drugs that selectively target specific ion channels or cellular pathways implicated in arrhythmias, minimizing off-target effects and improving safety profiles. Furthermore, sophisticated in-vitro and in-vivo models are being developed to better mimic human cardiac physiology, allowing for more predictive preclinical testing.

The advent of precision medicine and personalized therapeutics is another cornerstone of the technological evolution in this market. Genomic and proteomic technologies play a vital role in identifying genetic predispositions to arrhythmias and individual responses to specific drugs. Pharmacogenomics, in particular, helps in predicting drug efficacy and the likelihood of adverse drug reactions based on a patient's genetic makeup, thereby enabling tailored treatment regimens. This personalized approach aims to optimize therapeutic outcomes by ensuring the right drug is administered to the right patient at the right dose. Bioinformatics and computational biology are integral to interpreting the massive datasets generated by these 'omics' technologies, translating complex biological information into actionable clinical insights for drug development and patient care.

Beyond drug development, the technology landscape extends to innovative drug delivery systems and digital health solutions. Novel drug delivery technologies, such as sustained-release formulations or targeted delivery systems, aim to improve patient compliance, reduce dosing frequency, and minimize systemic side effects. The rise of digital health, including wearable devices, mobile health applications, and remote patient monitoring platforms, is transforming arrhythmia management. These technologies allow for continuous or intermittent monitoring of cardiac rhythm, facilitating early detection of arrhythmias, tracking treatment effectiveness, and improving patient engagement in their care. The integration of artificial intelligence and machine learning algorithms with these digital tools enhances diagnostic accuracy and provides predictive analytics, further shaping the future of antiarrhythmic drug therapy.

Regional Highlights

- North America: This region, particularly the United States and Canada, holds a dominant share in the Antiarrhythmic Drugs Market, primarily due to a high prevalence of cardiovascular diseases, an aging population, and well-established healthcare infrastructure with high diagnostic and treatment rates. Strong R&D activities, significant investments by major pharmaceutical companies, and favorable reimbursement policies contribute to the market's robust growth. The early adoption of advanced medical technologies and personalized medicine approaches also positions North America at the forefront of the market.

- Europe: The European market for antiarrhythmic drugs is substantial, driven by an aging demographic that is highly susceptible to cardiac arrhythmias, coupled with universal healthcare systems in many countries that ensure broad access to treatment. Countries like Germany, the UK, France, and Italy are key contributors, benefiting from strong regulatory frameworks, advanced clinical research, and a high level of patient awareness regarding cardiac health. However, pricing pressures and the availability of generics in some countries can influence market dynamics.

- Asia Pacific (APAC): The APAC region is projected to exhibit the fastest growth over the forecast period. This accelerated expansion is attributed to a massive and rapidly aging population, increasing prevalence of lifestyle diseases contributing to arrhythmias, improving healthcare infrastructure, and rising disposable incomes. Countries such as China, India, Japan, and Australia are witnessing significant growth due to expanding patient pools, increasing healthcare expenditure, and a growing focus on early diagnosis and treatment of cardiovascular conditions. Local manufacturing capabilities and increasing pharmaceutical R&D investments also play a crucial role.

- Latin America: The market in Latin America is characterized by steady growth, driven by expanding access to healthcare, rising awareness of cardiovascular diseases, and increasing government initiatives to improve public health. Brazil, Mexico, and Argentina are key markets within this region. While healthcare infrastructure is still developing compared to Western counterparts, the growing middle class and increasing investments in medical facilities are fueling demand for antiarrhythmic drugs.

- Middle East and Africa (MEA): The MEA region represents a nascent but growing market for antiarrhythmic drugs. Growth is primarily driven by improving healthcare expenditure, increasing incidence of cardiovascular diseases, and the development of modern medical facilities in key economies like Saudi Arabia, UAE, and South Africa. Challenges include varying levels of healthcare access, lower awareness, and economic disparities, but increasing investment in healthcare infrastructure is expected to unlock further potential in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antiarrhythmic Drugs Market.- Johnson & Johnson

- Pfizer Inc.

- Sanofi

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- Novartis AG

- AstraZeneca PLC

- GlaxoSmithKline plc

- Eli Lilly and Company

- Boehringer Ingelheim GmbH

- Gilead Sciences Inc.

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Amgen Inc.

- AbbVie Inc.

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Cipla Ltd.

- Lupin Limited

- Daiichi Sankyo Company Limited

Frequently Asked Questions

What are antiarrhythmic drugs used for?

Antiarrhythmic drugs are medications specifically designed to treat cardiac arrhythmias, which are abnormal heart rhythms. They work by correcting the heart's electrical activity to restore normal rhythm, slow down a fast heart rate, or speed up a slow heart rate, thereby preventing serious cardiac complications like stroke or sudden cardiac death.

How is the antiarrhythmic drugs market growing?

The antiarrhythmic drugs market is experiencing steady growth, projected at a CAGR of 6.5% between 2025 and 2032. This growth is primarily fueled by the increasing global prevalence of cardiac arrhythmias, particularly atrial fibrillation, an aging population, and continuous advancements in diag

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager