Antiglare Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427992 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Antiglare Glass Market Size

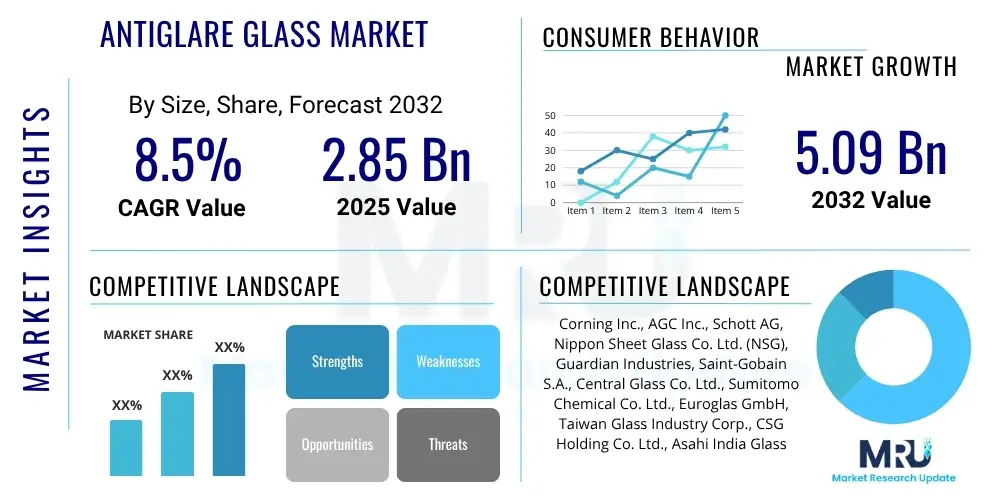

The Antiglare Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 2.85 billion in 2025 and is projected to reach USD 5.09 billion by the end of the forecast period in 2032.

Antiglare Glass Market introduction

The Antiglare Glass Market encompasses the production and distribution of specialized glass designed to minimize reflections and glare from light sources, thereby improving visual clarity and reducing eye strain. This innovative glass technology is crucial in an era dominated by digital displays, ensuring optimal viewing experiences across a multitude of applications. Antiglare glass achieves its effect through various surface treatments, such as chemical etching or the application of specialized coatings, which diffuse incident light rather than reflecting it directly. The primary objective is to create a matte finish that significantly reduces mirror-like reflections, making screens and surfaces easier to view in brightly lit environments or under direct sunlight.

Major applications for antiglare glass are incredibly diverse, spanning consumer electronics, automotive displays, medical equipment, architectural installations, and industrial control panels. In consumer electronics, it is vital for smartphones, tablets, laptops, and televisions, enhancing user experience by providing clear visuals even outdoors or in well-lit interiors. Within the automotive sector, antiglare glass is integral to infotainment systems, instrument clusters, and head-up displays, improving driver safety and comfort. Medical devices benefit from its clarity for accurate diagnostics and patient monitoring. Furthermore, architectural uses include specialized windows and displays where minimizing reflection is paramount for aesthetics and functionality. The increasing reliance on digital interfaces across nearly every industry underscores the growing demand for effective antiglare solutions.

The benefits of antiglare glass extend beyond mere aesthetic appeal; they directly impact user comfort, productivity, and safety. By reducing reflections, it mitigates eye fatigue, a common complaint associated with prolonged screen use. This enhanced visual comfort is a significant driving factor for its adoption in professional settings and personal devices. The market is primarily driven by the relentless proliferation of display-centric devices, the continuous innovation in display technologies demanding superior optical properties, and the expanding automotive industry's integration of advanced digital cockpits. The pursuit of enhanced human-machine interaction and the imperative for clear, readable displays in various environmental conditions further propel market expansion, positioning antiglare glass as a critical component in modern technological ecosystems.

Antiglare Glass Market Executive Summary

The Antiglare Glass Market is experiencing robust growth, propelled by the pervasive digitalization across industries and a rising consumer demand for superior display experiences. Key business trends indicate a strong focus on advanced manufacturing techniques, including nanocoatings and innovative etching processes, to achieve enhanced durability, light transmission, and antiglare effectiveness. Manufacturers are also increasingly investing in research and development to create customized solutions for niche applications, such as high-contrast displays for medical imaging or ruggedized screens for industrial environments. Strategic partnerships between glass manufacturers and original equipment manufacturers (OEMs) are becoming common, aimed at integrating antiglare solutions early in product design cycles, thereby optimizing performance and cost efficiency. Furthermore, there is a noticeable shift towards sustainable production practices and materials, responding to growing environmental concerns and regulatory pressures.

From a regional perspective, the Asia Pacific (APAC) region continues to dominate the Antiglare Glass Market, primarily due to its status as a global manufacturing hub for consumer electronics and automotive components, coupled with a vast consumer base and rapid economic development. Countries like China, Japan, South Korea, and Taiwan are at the forefront of both production and consumption. North America and Europe also represent significant markets, characterized by high adoption rates of advanced technologies in the automotive, healthcare, and industrial sectors, alongside strong innovation ecosystems. Emerging economies in Latin America, the Middle East, and Africa are showing promising growth, driven by increasing disposable incomes, urbanization, and the expanding penetration of smartphones and digital devices. These regions offer substantial opportunities for market players to expand their footprint and cater to evolving local demands for antiglare solutions.

Segmentation trends highlight a diverse and evolving market landscape. By type, chemically etched antiglare glass and coated antiglare glass remain prominent, with innovations in coating materials offering superior performance and thinness. Application-wise, consumer electronics continue to be the largest segment, driven by new product launches and replacement cycles for smartphones, tablets, and laptops. However, the automotive segment is rapidly gaining traction, fueled by the proliferation of larger and more sophisticated in-car displays and head-up display systems. The medical and industrial sectors are also expanding, demanding specialized antiglare properties for high-precision and rugged applications. The market is thus characterized by a continuous drive for specialization and performance enhancement, catering to the unique requirements of each end-use industry, ensuring sustained growth across its various segments.

AI Impact Analysis on Antiglare Glass Market

User inquiries regarding the impact of Artificial Intelligence on the Antiglare Glass Market frequently revolve around how AI can optimize manufacturing processes, enhance product quality, and potentially influence the demand for antiglare solutions in AI-powered devices. Users are keenly interested in whether AI can lead to more precise coating applications, faster defect detection, and the development of new materials with superior optical properties. Concerns also arise about the integration of antiglare technology into future AI-centric displays, such as those in augmented reality (AR) and virtual reality (VR) headsets, and how AI might drive the need for even more advanced, adaptive antiglare solutions. The overarching theme is the expectation that AI will bring about efficiencies and innovations, leading to higher-performing and more cost-effective antiglare products, while simultaneously shaping the characteristics of the devices that will utilize this specialized glass.

- AI-driven process optimization: AI algorithms can analyze vast datasets from manufacturing lines, optimizing parameters for etching, coating, and polishing processes, leading to reduced waste, improved consistency, and higher throughput in antiglare glass production.

- Enhanced quality control: Computer vision and machine learning can enable automated, high-speed defect detection on glass surfaces, identifying microscopic imperfections that affect antiglare performance with greater accuracy than traditional methods.

- Material innovation and design: AI can accelerate the discovery and design of novel coating materials and surface structures with advanced antiglare and anti-reflective properties, simulating performance before physical prototypes are created.

- Predictive maintenance for equipment: AI-powered analytics can predict equipment failures in glass manufacturing, minimizing downtime and ensuring continuous, high-quality production of antiglare substrates.

- Personalized display experiences: As AI integrates into displays, there might be a future demand for "smart" antiglare surfaces that dynamically adjust their light diffusion properties based on ambient light conditions and user preferences, enabled by AI-driven sensors and actuators.

- Supply chain optimization: AI can optimize the entire supply chain for antiglare glass components, from raw material procurement to distribution, enhancing efficiency and responsiveness to market demands.

DRO & Impact Forces Of Antiglare Glass Market

The Antiglare Glass Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces that collectively shape its trajectory. Among the primary drivers is the escalating global demand for electronic displays across various sectors, including consumer electronics like smartphones, laptops, and televisions, as well as the rapidly evolving automotive industry with its integration of sophisticated infotainment systems and digital dashboards. The continuous pursuit of enhanced visual comfort and reduced eye strain for users, especially in professional and educational settings, further fuels adoption. Moreover, advancements in display technologies, such as OLED and mini-LED, which often necessitate superior antiglare solutions to optimize their visual performance, act as a persistent catalyst for market growth. The increasing pervasiveness of smart devices and digital interfaces in daily life reinforces the foundational need for clear, glare-free viewing experiences, making antiglare glass an indispensable component.

Despite the strong growth drivers, the market faces several restraints. The relatively high manufacturing cost associated with producing high-quality antiglare glass, particularly for advanced chemically etched or multi-layered coated varieties, can sometimes limit its widespread adoption in highly price-sensitive segments. The complexity of the production processes, which involve precise surface treatments and material application, also contributes to higher costs and can pose technical challenges for new entrants. Furthermore, competition from alternative display enhancement technologies, such as polarizing filters or optical bonding techniques that offer some glare reduction, presents a competitive hurdle. Economic downturns or supply chain disruptions can also impact the availability and cost of raw materials, thereby affecting production volumes and market stability. These factors necessitate continuous innovation to achieve cost-effectiveness without compromising performance.

Opportunities for growth are abundant and diverse. The burgeoning markets for augmented reality (AR) and virtual reality (VR) devices, smart wearables, and advanced medical diagnostics present significant new application areas where antiglare properties are critical for immersive and accurate user experiences. Research and development into novel materials, such as nanocoatings and advanced composite glasses, offer avenues for developing more durable, thinner, and highly efficient antiglare solutions that can meet future demands. Expanding into emerging economies, where digital device penetration is rapidly increasing, also offers untapped market potential. The broader impact forces include the rapid pace of technological advancements, particularly in display and material science, which constantly redefines performance expectations. Regulatory standards concerning user safety and environmental impact, evolving consumer preferences for ergonomic and high-quality digital interactions, and the dynamics of global supply chains all exert significant influence, shaping market strategies and product development trajectories.

Segmentation Analysis

The Antiglare Glass Market is meticulously segmented to provide a comprehensive understanding of its diverse landscape, categorizing products, applications, and end-use industries to highlight specific market dynamics and growth drivers. This segmentation allows for targeted strategic planning and development, enabling manufacturers and suppliers to address distinct customer needs with tailored solutions. The market is primarily broken down by the type of antiglare treatment employed, the specific applications where the glass is utilized, and the broader end-use industries that integrate these solutions into their products or infrastructure. Each segment possesses unique characteristics, performance requirements, and market demand patterns, reflecting the specialized nature and varied utility of antiglare glass across different sectors.

- By Type:

- Etched Antiglare Glass: Achieves glare reduction through a chemical etching process that creates a micro-textured surface, diffusing light.

- Coated Antiglare Glass: Involves applying a specialized film or layer onto the glass surface that scatters or absorbs light to reduce reflections.

- Diffused Antiglare Glass: Utilizes specific glass formulations or surface treatments to achieve a diffused light reflection.

- By Application:

- Consumer Electronics: Includes smartphones, tablets, laptops, televisions, digital cameras, and smart wearables, where visual clarity is paramount for user experience.

- Automotive: Encompasses infotainment systems, head-up displays (HUDs), instrument clusters, rear-view mirror displays, and panoramic roofs, focusing on safety and driver comfort.

- Medical Devices: Covers diagnostic equipment displays, patient monitors, surgical displays, and medical imaging screens, requiring high precision and minimal reflection for accurate interpretation.

- Architectural: Involves building facades, interior partitions, display cases, and smart windows, where aesthetic appeal and functional clarity are key.

- Industrial: Used in control panels, touch screen HMIs (Human-Machine Interfaces), public kiosks, and ruggedized displays, demanding durability and readability in harsh environments.

- Others: Includes digital signage, avionic displays, marine displays, and educational interactive whiteboards.

- By End-Use Industry:

- Electronics Industry: Major consumer of antiglare glass for various display components.

- Automotive Industry: Integrates antiglare glass into vehicle cockpits and exteriors.

- Healthcare Industry: Utilizes antiglare glass for medical equipment and patient care.

- Construction Industry: Incorporates antiglare glass in modern building designs and interior spaces.

- Retail Industry: Employs antiglare solutions for point-of-sale systems and digital displays.

- Defense and Aerospace: Uses antiglare glass for specialized displays in critical applications.

Value Chain Analysis For Antiglare Glass Market

The value chain for the Antiglare Glass Market is intricate, involving several distinct stages from raw material sourcing to final product distribution, each adding value to the end product. The upstream segment of the value chain is dominated by suppliers of critical raw materials such as high-purity silica sand, various chemicals for etching and coating, and specialized glass substrates. These suppliers play a fundamental role in determining the initial quality and cost of the base glass, which is then processed to achieve antiglare properties. Innovations at this stage, particularly in developing new chemical formulations or more sustainable raw materials, can significantly impact the overall efficiency and environmental footprint of the final product. Strong relationships with reliable raw material providers are essential for maintaining consistent production quality and managing supply chain risks in a volatile global market.

The midstream segment involves the core manufacturing and processing of antiglare glass. This stage includes specialized glass manufacturers who take the raw glass substrates and apply various antiglare treatments, such as chemical etching, vacuum deposition for thin-film coatings, or advanced spray coating techniques. These processes transform standard glass into a high-performance antiglare product, adding significant value through advanced optical engineering and surface modification. Manufacturers in this segment often invest heavily in research and development to improve antiglare effectiveness, durability, light transmission, and aesthetic properties. The complexity and precision required at this stage mean that specialized technical expertise and advanced production facilities are critical for success, with process efficiency and yield optimization being key competitive factors.

The downstream segment encompasses the distribution and sales channels, bringing the finished antiglare glass to end-users and product integrators. This involves a network of distributors, wholesalers, and direct sales channels to original equipment manufacturers (OEMs). Direct sales are common for large-volume customers, particularly in the consumer electronics and automotive industries, where customized solutions and direct technical support are often required. Indirect channels, through specialized distributors, cater to smaller manufacturers or diverse application needs, offering a broader reach and logistical support. The effectiveness of the distribution channel is vital for market penetration and customer accessibility. The final stage involves the integration of antiglare glass into end products by various industries, such as electronics companies for displays, automotive manufacturers for vehicle interiors, and construction firms for specialized architectural applications, thereby completing the value creation cycle from raw material to a functional component in a final product.

Antiglare Glass Market Potential Customers

The Antiglare Glass Market serves a broad and diverse range of potential customers, spanning multiple industries that rely heavily on display technologies and visual clarity. These end-users and buyers are primarily companies that integrate display components into their final products or utilize specialized glass solutions in their infrastructure. A major segment comprises manufacturers within the consumer electronics industry, including global giants producing smartphones, tablets, laptops, televisions, and wearables. These companies are constantly seeking high-performance antiglare glass to enhance user experience, improve visual comfort, and ensure optimal display readability in varying light conditions, which is crucial for competitive differentiation and customer satisfaction in a saturated market.

Another significant customer base is the automotive industry, where the proliferation of advanced digital cockpits, infotainment systems, head-up displays, and instrument clusters has created a substantial demand for antiglare solutions. Automotive OEMs require glass that not only provides exceptional clarity and reduces glare for driver safety and comfort but also meets stringent durability and aesthetic standards. Similarly, the healthcare industry represents a vital market, with manufacturers of medical devices, diagnostic equipment, and patient monitoring systems requiring antiglare glass for displays that offer critical clarity and precision, especially in well-lit clinical environments where accurate visual information is paramount for patient care and diagnosis. The demands here often include specific optical properties and resistance to cleaning agents.

Beyond these, potential customers include manufacturers in the industrial sector for control panels, human-machine interfaces (HMIs), and public kiosks that need rugged and readable displays in challenging environments. The architectural and construction industries also represent a growing segment, utilizing antiglare glass for specialized windows, display cases, and building facades to enhance aesthetics and manage light. Furthermore, niche markets such as defense and aerospace, for avionic displays and military equipment, and the retail sector for digital signage and point-of-sale systems, continuously seek customized antiglare solutions. The common thread among all these potential customers is the fundamental need for displays or surfaces that minimize distracting reflections, thereby improving functionality, safety, and user satisfaction, driving a consistent and expanding demand for high-quality antiglare glass.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.85 Billion |

| Market Forecast in 2032 | USD 5.09 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Inc., AGC Inc., Schott AG, Nippon Sheet Glass Co. Ltd. (NSG), Guardian Industries, Saint-Gobain S.A., Central Glass Co. Ltd., Sumitomo Chemical Co. Ltd., Euroglas GmbH, Taiwan Glass Industry Corp., CSG Holding Co. Ltd., Asahi India Glass Ltd., LGD Display Co. Ltd., 3M Company, Abrisa Technologies, Dynaglass, Luoyang Glass Co. Ltd., Xinyi Glass Holdings Limited, Planar Systems Inc., Gentex Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antiglare Glass Market Key Technology Landscape

The Antiglare Glass Market is characterized by a dynamic and evolving technology landscape, with continuous innovation driving performance improvements and expanding application possibilities. At the core of antiglare functionality are various surface treatment technologies designed to scatter or absorb incident light rather than reflecting it directly. One of the most established methods is chemical etching, which involves exposing the glass surface to specific chemical solutions to create a microscopic texture. This texture diffuses light, thereby reducing glare. Advancements in chemical etching focus on achieving more uniform textures, better light transmission, and enhanced durability, ensuring the treated surface maintains its integrity over time and under various environmental stresses.

Another prominent technological approach is the application of specialized coatings. These can range from thin-film coatings applied via vacuum deposition techniques, such as sputtering or evaporation, to sol-gel processes and advanced spray coatings. Nanocoatings, in particular, represent a significant area of innovation, utilizing nanoscale materials and structures to achieve superior antiglare and anti-reflective properties while maintaining high optical clarity and transparency. These coatings can be engineered to be ultra-thin, highly durable, and resistant to scratches, smudges, and chemicals, addressing critical performance requirements for modern displays. Research is also progressing in developing multi-functional coatings that not only offer antiglare properties but also provide oleophobic (fingerprint-resistant) or antimicrobial features, adding further value to the end product.

Beyond etching and coating, other advanced technologies contribute to the antiglare glass market, including plasma treatment and specialized glass substrate formulations. Plasma treatment can modify the surface energy and structure of the glass, enhancing its antiglare characteristics or preparing it for more effective coating adhesion. In terms of glass substrates, developments in ultra-thin, lightweight, and flexible glass materials are opening new avenues for antiglare applications in foldable devices and futuristic displays. The integration of these various technologies, often in combination, allows manufacturers to tailor antiglare glass solutions to specific performance criteria, balancing factors like glare reduction, light transmission, haze, and durability. The ongoing convergence of material science, optical engineering, and advanced manufacturing processes continues to push the boundaries of what is possible in antiglare glass technology, creating a highly competitive and innovative environment.

Regional Highlights

- North America: This region is a significant market driven by technological innovation, high adoption of advanced displays in automotive, healthcare, and consumer electronics, and strong investment in R&D. The presence of major tech companies and automotive manufacturers fuels demand for high-quality antiglare solutions.

- Europe: Characterized by stringent quality standards and a strong automotive industry, Europe showcases a robust demand for antiglare glass, particularly in premium vehicle displays and industrial HMI applications. The region also exhibits growth in smart home and architectural applications.

- Asia Pacific (APAC): Dominant in both production and consumption, APAC is the largest market due to its position as a global manufacturing hub for consumer electronics and automotive parts, coupled with a massive population and increasing disposable incomes driving display adoption. Countries like China, Japan, and South Korea are key players.

- Latin America: An emerging market experiencing steady growth driven by increasing penetration of smartphones and digital devices, urbanization, and a developing automotive sector. The region offers significant opportunities for market expansion as its economies mature.

- Middle East and Africa (MEA): This region is a nascent but rapidly growing market, influenced by urbanization, infrastructure development, and rising demand for consumer electronics and automotive displays. Investments in smart city initiatives are also contributing to the demand for specialized glass.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antiglare Glass Market.- Corning Inc.

- AGC Inc.

- Schott AG

- Nippon Sheet Glass Co. Ltd. (NSG)

- Guardian Industries

- Saint-Gobain S.A.

- Central Glass Co. Ltd.

- Sumitomo Chemical Co. Ltd.

- Euroglas GmbH

- Taiwan Glass Industry Corp.

- CSG Holding Co. Ltd.

- Asahi India Glass Ltd.

- LGD Display Co. Ltd.

- 3M Company

- Abrisa Technologies

- Dynaglass

- Luoyang Glass Co. Ltd.

- Xinyi Glass Holdings Limited

- Planar Systems Inc.

- Gentex Corporation

Frequently Asked Questions

Analyze common user questions about the Antiglare Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of antiglare glass?

Antiglare glass is primarily used in consumer electronics (smartphones, tablets, laptops, TVs), automotive displays (infotainment, HUDs), medical devices (patient monitors, diagnostic screens), architectural installations, and industrial control panels to enhance visual clarity and reduce eye strain by minimizing reflections.

How does antiglare glass differ from anti-reflective glass?

Antiglare glass reduces reflections by diffusing incident light through a textured surface, resulting in a matte finish. Anti-reflective (AR) glass, conversely, minimizes reflections by applying thin-film optical coatings that reduce light bouncing off the surface, maintaining high transparency and clarity without diffusion, making it ideal for high-resolution displays.

What are the key drivers for the growth of the antiglare glass market?

The market's growth is primarily driven by the escalating global demand for digital displays across all sectors, continuous advancements in display technologies, the increasing integration of sophisticated digital interfaces in the automotive industry, and a heightened focus on user visual comfort and ergonomic design to combat eye fatigue.

What are the main types of antiglare glass available?

The main types include chemically etched antiglare glass, which creates a micro-textured surface to diffuse light, and coated antiglare glass, which uses specialized films or layers applied to the glass surface to achieve glare reduction. Diffused antiglare glass may also be achieved through specific glass formulations or other surface treatments.

Which geographical region currently dominates the antiglare glass market?

The Asia Pacific (APAC) region currently dominates the antiglare glass market. This leadership is attributed to the region's strong presence as a global manufacturing hub for consumer electronics and automotive components, coupled with a large consumer base and rapid economic development in countries like China, Japan, and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager