Application Delivery Controller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428363 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Application Delivery Controller Market Size

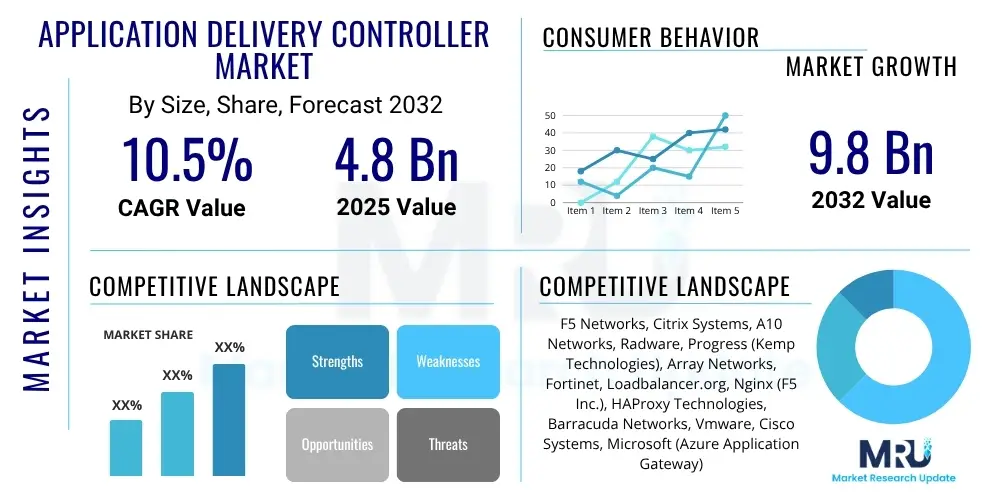

The Application Delivery Controller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at $4.8 Billion in 2025 and is projected to reach $9.8 Billion by the end of the forecast period in 2032.

Application Delivery Controller Market introduction

The Application Delivery Controller (ADC) market encompasses solutions designed to optimize the performance, security, and resilience of applications across various network environments. ADCs act as a crucial intermediary between users and application servers, ensuring efficient traffic management, high availability, and robust security. These devices or software solutions intelligently distribute incoming network traffic across multiple servers, preventing server overload and enhancing application responsiveness. The market has evolved significantly from traditional hardware appliances to virtualized and cloud-native solutions, reflecting the broader shift towards cloud computing and microservices architectures.

ADCs provide a comprehensive suite of functionalities including load balancing, SSL/TLS offloading, application acceleration, deep packet inspection, and web application firewall (WAF) services. Major applications span across critical enterprise environments, e-commerce platforms, cloud service providers, and telecommunications networks, where uninterrupted application access and optimal performance are paramount. The inherent benefits of ADC deployment include enhanced application availability, improved user experience through faster response times, increased security against various cyber threats, and optimized resource utilization across server infrastructures. As organizations continue their digital transformation journeys, ADCs remain indispensable for managing complex application ecosystems.

Driving factors for the Application Delivery Controller market include the escalating demand for high-performance and always-on applications, the pervasive trend of cloud migration and multi-cloud adoption, and the ever-increasing sophistication of cyberattacks. The proliferation of mobile devices and IoT endpoints further amplifies network traffic, necessitating robust ADCs to maintain service quality and security. Additionally, the shift towards microservices and containerized applications, coupled with the need for agile and scalable infrastructure, is propelling the adoption of modern, software-defined, and cloud-native ADC solutions capable of integrating seamlessly into dynamic IT environments.

Application Delivery Controller Market Executive Summary

The Application Delivery Controller market is experiencing dynamic shifts, primarily driven by the acceleration of digital transformation initiatives, extensive cloud adoption, and the increasing complexity of application architectures. Business trends indicate a strong move towards hybrid and multi-cloud deployments, fostering demand for ADCs that can operate consistently across diverse environments, from on-premise data centers to public cloud infrastructure. There is a notable emphasis on software-defined and virtual ADC solutions, which offer greater flexibility, scalability, and integration capabilities with modern IT automation and orchestration tools. Cybersecurity remains a top concern, leading to higher investments in ADCs with integrated web application firewalls, DDoS protection, and advanced threat intelligence.

Regional trends reveal North America and Europe as mature markets, characterized by established IT infrastructure and early adoption of advanced ADC functionalities, though growth continues through upgrades and cloud migration projects. The Asia Pacific region is emerging as a high-growth market, propelled by rapid industrialization, widespread digital transformation across various sectors, and significant investments in cloud computing and data center expansion, particularly in countries like China, India, and Japan. Latin America, the Middle East, and Africa are showing steady growth, driven by increasing internet penetration, governmental digital initiatives, and growing enterprise demand for robust application performance and security.

Segment trends highlight a significant pivot from hardware-centric ADCs to virtual and cloud-native ADCs, reflecting the agility requirements of modern DevOps practices and containerized environments. Software-defined networking (SDN) and network function virtualization (NFV) are profoundly influencing ADC deployments, enabling greater programmability and elasticity. The demand for integrated security features within ADCs, such as WAF, bot management, and API security, is intensifying as applications become prime targets for cyberattacks. Furthermore, the market is seeing increased adoption of AI and machine learning capabilities within ADCs for predictive analytics, automated traffic management, and proactive threat detection, moving towards more intelligent and autonomous application delivery systems.

AI Impact Analysis on Application Delivery Controller Market

Common user questions regarding AI's impact on the Application Delivery Controller market frequently revolve around how artificial intelligence can enhance traditional ADC functionalities, address growing security threats more effectively, and simplify complex management tasks. Users are keen to understand the practical applications of AI in areas such as predictive analytics for traffic patterns, automated anomaly detection, and intelligent resource allocation to ensure optimal application performance and availability. Concerns often include the integration challenges of AI-driven ADCs into existing infrastructures, the reliability and accuracy of AI algorithms in real-time decision-making, and the potential for increased complexity in configuration and troubleshooting. Expectations are high for AI to deliver self-optimizing and self-healing ADC solutions that can adapt autonomously to changing network conditions and threat landscapes, ultimately reducing operational overhead and improving overall application resilience and security posture.

- Predictive analytics for anticipating traffic spikes and resource needs, enabling proactive scaling and load balancing adjustments.

- Real-time anomaly detection and behavioral analysis to identify and mitigate sophisticated cyber threats and zero-day attacks more effectively than signature-based methods.

- Intelligent traffic routing and optimization, utilizing machine learning algorithms to make dynamic decisions based on latency, server health, and content type for improved user experience.

- Automated security policy enforcement and adaptation, allowing ADCs to learn from threat patterns and adjust WAF rules or access controls in real-time without human intervention.

- Self-optimizing network performance by continuously analyzing application performance metrics and adjusting configurations to maintain service level agreements (SLAs).

- Enhanced capacity planning and resource utilization through AI-driven insights into historical and projected application demands.

- Simplified management and operational efficiency by automating routine tasks, troubleshooting, and configuration changes, reducing the need for manual intervention.

DRO & Impact Forces Of Application Delivery Controller Market

The Application Delivery Controller market is shaped by a confluence of influential factors, encompassing robust drivers, inherent restraints, and promising opportunities that collectively define its growth trajectory and competitive landscape. The primary drivers include the relentless pace of digital transformation across industries, compelling organizations to modernize their IT infrastructure for improved agility and efficiency. The pervasive shift towards cloud computing, particularly hybrid and multi-cloud strategies, necessitates advanced ADCs capable of ensuring consistent application delivery and security across distributed environments. Furthermore, the escalating volume and sophistication of cyberattacks, targeting applications and APIs, mandate the deployment of ADCs with integrated, intelligent security functionalities to protect critical assets and data. The demand for seamless user experiences and always-on applications in a highly connected world also fuels the adoption of ADCs for performance optimization and high availability.

Despite these strong growth catalysts, the market faces several notable restraints. The significant initial capital expenditure associated with high-end ADC hardware appliances can be a barrier for Small and Medium-sized Enterprises (SMEs) or organizations with limited IT budgets. The inherent complexity involved in deploying, configuring, and managing advanced ADC solutions, especially in highly distributed or multi-cloud environments, often requires specialized technical expertise, which can be a challenge for many IT departments. Moreover, concerns around vendor lock-in, where organizations become heavily reliant on a single vendor's ecosystem, can limit flexibility and increase long-term costs. The increasing availability of open-source load balancing alternatives, while sometimes lacking the comprehensive features of commercial ADCs, presents a cost-effective option that can siphon market share in certain segments, particularly for basic load balancing needs.

Conversely, the market is rich with opportunities that are set to propel its evolution. The deep integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities into ADCs offers a transformative pathway for predictive analytics, automated security, and intelligent traffic management, paving the way for self-optimizing application delivery systems. The proliferation of edge computing and the advent of 5G networks present new frontiers for ADCs, requiring distributed and highly responsive solutions closer to data sources and users, thereby creating demand for new form factors and deployment models. The continued growth of the Software-as-a-Service (SaaS) model for application delivery, where ADCs are offered as managed services, provides simplified consumption, reduced operational overhead, and greater scalability, appealing to a broader range of enterprises seeking agility without extensive infrastructure investments. These opportunities underscore a future where ADCs are more intelligent, flexible, and deeply integrated into the fabric of modern, distributed application architectures.

Segmentation Analysis

The Application Delivery Controller market is comprehensively segmented across several key dimensions, providing a granular view of its structure and evolving dynamics. This segmentation aids in understanding diverse market demands, technological preferences, and adoption patterns across different organizational profiles and industry verticals. The market can be dissected by product type, deployment model, organization size, and the specific end-user industry, each revealing distinct growth drivers and competitive landscapes. Analyzing these segments helps stakeholders tailor their strategies to address specific customer needs, identify untapped opportunities, and navigate the complexities of a rapidly evolving digital infrastructure landscape.

- By Type:

- Hardware ADCs: Traditional physical appliances offering high performance and dedicated resources.

- Software ADCs: Virtual appliances deployed on standard servers or hypervisors, providing flexibility and scalability.

- Virtual ADCs: A subset of software ADCs specifically designed to run on virtualized infrastructure.

- Cloud-Native ADCs: Optimized for containerized environments and microservices architectures, typically deployed within public or private clouds.

- By Deployment:

- On-Premise: Solutions deployed within an organization's own data center infrastructure.

- Cloud: ADCs offered as a service or deployed directly within public cloud environments (e.g., AWS, Azure, GCP).

- Hybrid: A combination of on-premise and cloud deployments, allowing for flexible workload distribution.

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs): Companies with fewer resources often seeking cost-effective, easy-to-manage solutions.

- Large Enterprises: Organizations requiring robust, high-performance, and feature-rich ADCs for complex, mission-critical applications.

- By End-User Industry:

- IT and Telecom: Driving innovation with high traffic volumes and complex network architectures.

- BFSI (Banking, Financial Services, and Insurance): Prioritizing security, compliance, and high availability for financial transactions.

- Government: Focusing on secure and reliable access to public services and data.

- Healthcare: Requiring secure, high-performance access to patient data and critical applications.

- Retail and E-commerce: Ensuring seamless online shopping experiences and protecting against cyber threats.

- Manufacturing: Supporting industrial IoT applications and digital factory initiatives.

- Media and Entertainment: Managing large volumes of streaming content and user traffic.

Value Chain Analysis For Application Delivery Controller Market

The value chain for the Application Delivery Controller market encompasses a series of interconnected activities, beginning from the development of core components to the ultimate deployment and ongoing management of these solutions by end-users. This chain highlights the various stages where value is added and illustrates the complex interplay between different stakeholders involved in bringing ADC products and services to market. Understanding this value chain is crucial for identifying key cost drivers, potential areas for optimization, and strategic opportunities for collaboration or differentiation within the industry. It starts with upstream activities involving foundational technology providers and extends through product manufacturing, distribution, integration, and post-sales support, directly impacting the overall market dynamics and end-customer satisfaction.

Upstream analysis typically involves the suppliers of essential hardware components such as specialized processors, memory modules, network interface cards, and chassis for physical ADC appliances. It also includes software development companies that provide operating systems, network protocols, and cryptographic libraries that form the core of ADC software and virtual solutions. These suppliers play a critical role in innovation, performance, and cost-efficiency of the final ADC product. Further along the chain, ADC manufacturers and developers integrate these components and software to create their proprietary hardware, virtual, or cloud-native ADC offerings, investing heavily in research and development to incorporate advanced features like AI/ML capabilities, enhanced security modules, and support for modern application architectures such as microservices and containers.

Downstream analysis focuses on how these ADC solutions reach their ultimate end-users. The distribution channels are diverse, including direct sales from the manufacturer, where large enterprises often engage directly with vendors for customized solutions and support. Indirect channels are equally significant, leveraging a network of value-added resellers (VARs), system integrators, managed service providers (MSPs), and cloud service providers (CSPs). VARs and system integrators often provide integration services, consultation, and localized support, tailoring ADC deployments to specific client needs. MSPs offer ADCs as part of a broader managed service, simplifying operations for customers, while CSPs integrate ADCs as native services within their cloud platforms or offer marketplace options for third-party virtual ADCs. This multi-faceted distribution strategy ensures market penetration across different segments, from large enterprises requiring bespoke solutions to SMEs and cloud-centric organizations preferring subscription-based, managed services.

Application Delivery Controller Market Potential Customers

The Application Delivery Controller market serves a broad and diverse range of potential customers, all of whom share a common need for high-performance, secure, and highly available application delivery. These end-users are typically organizations that rely heavily on their digital applications for core business operations, customer engagement, or internal productivity. The increasing complexity of modern IT environments, characterized by distributed applications, hybrid cloud deployments, and sophisticated cyber threats, makes ADCs indispensable for maintaining optimal service levels. Consequently, decision-makers such as CIOs, IT Directors, Network Architects, DevOps Engineers, and Security Managers within these organizations are key target buyers, focusing on solutions that can address their specific performance, security, and scalability challenges.

Potential customers span across virtually every industry vertical, reflecting the universal reliance on applications in today's economy. In the IT and Telecom sector, service providers, internet service providers (ISPs), and large enterprises are critical buyers, utilizing ADCs to manage massive volumes of traffic, ensure network stability, and deliver services with high reliability. The Banking, Financial Services, and Insurance (BFSI) sector prioritizes ADCs for securing sensitive financial transactions, ensuring compliance with stringent regulatory requirements, and maintaining the high availability of critical banking applications. Government agencies and public sector organizations are increasingly adopting ADCs to protect citizen data, ensure secure access to public services, and manage the extensive internal application landscape that supports their operations.

Furthermore, the Retail and E-commerce industry represents a significant customer base, where ADCs are vital for handling peak traffic during promotional events, optimizing website performance for an enhanced customer experience, and defending against web application attacks that could disrupt sales or compromise customer data. The Healthcare sector leverages ADCs to secure access to electronic health records (EHRs), optimize telemedicine applications, and ensure the continuous operation of mission-critical hospital systems. Manufacturing companies are adopting ADCs to support their Industry 4.0 initiatives, manage IoT device traffic, and secure their operational technology (OT) environments. Finally, Media and Entertainment companies depend on ADCs for efficient content delivery, managing high-volume streaming, and ensuring a smooth user experience for online platforms. This widespread demand underscores the fundamental role ADCs play in the digital infrastructure of modern enterprises.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.8 Billion |

| Market Forecast in 2032 | $9.8 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F5 Networks, Citrix Systems, A10 Networks, Radware, Progress (Kemp Technologies), Array Networks, Fortinet, Loadbalancer.org, Nginx (F5 Inc.), HAProxy Technologies, Barracuda Networks, Vmware, Cisco Systems, Microsoft (Azure Application Gateway), Amazon Web Services (AWS ELB), Google Cloud (Load Balancing), Alibaba Cloud, Huawei Technologies, Sangfor Technologies, Riverbed Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Application Delivery Controller Market Key Technology Landscape

The Application Delivery Controller market is continuously shaped by rapid advancements in network and application technologies, leading to a dynamic key technology landscape. Traditional ADCs, primarily hardware-based, have evolved to incorporate virtualized and software-defined capabilities, enabling greater agility and scalability. Software-Defined Networking (SDN) and Network Function Virtualization (NFV) are foundational to this transformation, allowing ADC functionalities to be decoupled from proprietary hardware and run as virtualized network functions (VNFs) on commodity servers. This shift provides enterprises with unprecedented flexibility to deploy, manage, and scale ADCs dynamically, integrating seamlessly into existing virtualized infrastructures and cloud environments. The move towards API-driven management is also paramount, facilitating automation and orchestration of ADC services within modern DevOps pipelines and Infrastructure-as-Code practices, further enhancing operational efficiency and reducing manual intervention.

The rise of containerization technologies like Docker and Kubernetes, coupled with microservices architectures, has profoundly influenced the ADC technology landscape. Cloud-native ADCs are specifically designed to operate within these dynamic, distributed environments, offering ingress control, service mesh integration, and load balancing for containerized applications. These solutions are lightweight, highly scalable, and can be deployed as sidecars or dedicated instances, providing granular traffic management and security at the application layer within cloud-native ecosystems. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is becoming a critical differentiator, enabling ADCs to perform advanced functions such as predictive traffic analytics, real-time threat detection, and automated policy adjustments. AI-powered ADCs can learn from network behavior and application performance patterns to proactively optimize resource allocation, identify anomalies, and neutralize sophisticated cyber threats, moving towards a more autonomous and intelligent application delivery infrastructure.

Another significant technological trend is the increasing focus on security features directly embedded within ADCs. Beyond traditional SSL/TLS offloading and basic access controls, modern ADCs incorporate robust Web Application Firewalls (WAFs), bot management capabilities, API security gateways, and advanced DDoS protection mechanisms. These integrated security layers are essential for protecting against the expanding attack surface presented by web and API-driven applications. The growing importance of edge computing also influences the ADC technology landscape, necessitating the development of lightweight, highly efficient ADCs that can be deployed closer to users and data sources, minimizing latency and improving performance for distributed applications and IoT devices. Overall, the key technology landscape for ADCs is characterized by a drive towards virtualization, automation, intelligence, and comprehensive security, all designed to support the complex, dynamic, and distributed nature of modern application environments.

Regional Highlights

- North America: This region represents a mature and dominant market for Application Delivery Controllers, driven by early adoption of advanced technologies, the presence of major technology providers, and high spending on IT infrastructure and cybersecurity. The strong focus on digital transformation, cloud computing, and robust data protection regulations fuels consistent demand for sophisticated ADC solutions.

- Europe: The European market for ADCs is characterized by stringent data privacy regulations like GDPR, driving demand for secure and compliant application delivery solutions. Hybrid cloud adoption is a significant trend, alongside increasing investments in modernizing legacy IT infrastructure across various industries, including BFSI, healthcare, and government.

- Asia Pacific (APAC): APAC is the fastest-growing market for ADCs, propelled by rapid economic growth, massive digital transformation initiatives, and increasing penetration of cloud computing and mobile internet across diverse economies such as China, India, Japan, and Southeast Asian countries. Investments in data centers and public cloud infrastructure are catalyzing substantial ADC deployments.

- Latin America: An emerging market, Latin America is experiencing steady growth in ADC adoption driven by increasing internet penetration, governmental digitalization efforts, and growing enterprise awareness of the benefits of optimized application performance and security. Brazil and Mexico are leading the regional market expansion.

- Middle East and Africa (MEA): The MEA region is witnessing growing investments in digital infrastructure, smart city projects, and cloud services, particularly in the GCC countries. This development, coupled with an increasing emphasis on cybersecurity, is creating a fertile ground for ADC market expansion, though adoption rates vary across the diverse sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Application Delivery Controller Market.- F5 Networks

- Citrix Systems

- A10 Networks

- Radware

- Progress (Kemp Technologies)

- Array Networks

- Fortinet

- Loadbalancer.org

- Nginx (F5 Inc.)

- HAProxy Technologies

- Barracuda Networks

- Vmware

- Cisco Systems

- Microsoft (Azure Application Gateway)

- Amazon Web Services (AWS ELB)

- Google Cloud (Load Balancing)

- Alibaba Cloud

- Huawei Technologies

- Sangfor Technologies

- Riverbed Technology

Frequently Asked Questions

What is an Application Delivery Controller (ADC) and why is it important?

An Application Delivery Controller (ADC) is a network device or software solution that manages and optimizes how applications are delivered to users. It is crucial for ensuring high availability, performance, and security of applications by performing functions like intelligent load balancing, SSL/TLS offloading, application acceleration, and integrated security features such as web application firewalls.

How is the ADC market evolving with the rise of cloud computing and microservices?

The ADC market is rapidly shifting from traditional hardware appliances to virtualized and cloud-native solutions. With cloud computing, ADCs are becoming integrated as services within public cloud platforms (e.g., AWS ELB, Azure Application Gateway). For microservices and containerized applications, cloud-native ADCs and service meshes provide granular traffic management and security directly within dynamic, distributed environments.

What are the primary security benefits of using an ADC?

ADCs offer robust security benefits including integrated Web Application Firewalls (WAFs) to protect against common web exploits, DDoS attack mitigation, bot management, API security, and secure SSL/TLS termination and offloading. They act as a critical front-line defense, inspecting traffic and enforcing security policies before it reaches application servers.

What role does AI and Machine Learning play in modern ADCs?

AI and Machine Learning are increasingly integrated into ADCs to enable predictive analytics for traffic patterns, real-time anomaly detection for security threats, intelligent load balancing based on learned behavior, and au

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Data Centre Networking Market Statistics 2025 Analysis By Application (Banking financial services and insurance, Government, Information technology, Healthcare, Telecommunication, Retail, Academics, Media and Entertainment), By Type (Ethernet Switches, Storage Area Network (San) Routers, Application Delivery Controller (ADC), Network Security Equipment, Wan Optimization Appliance), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Data Center Networks Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ethernet Switches, Storage Area Network (San) Routers, Application Delivery Controller (ADC), Network Security Equipment, Wan Optimization Appliance), By Application (Enterprises, Cloud service providers, Telecom service providers), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager