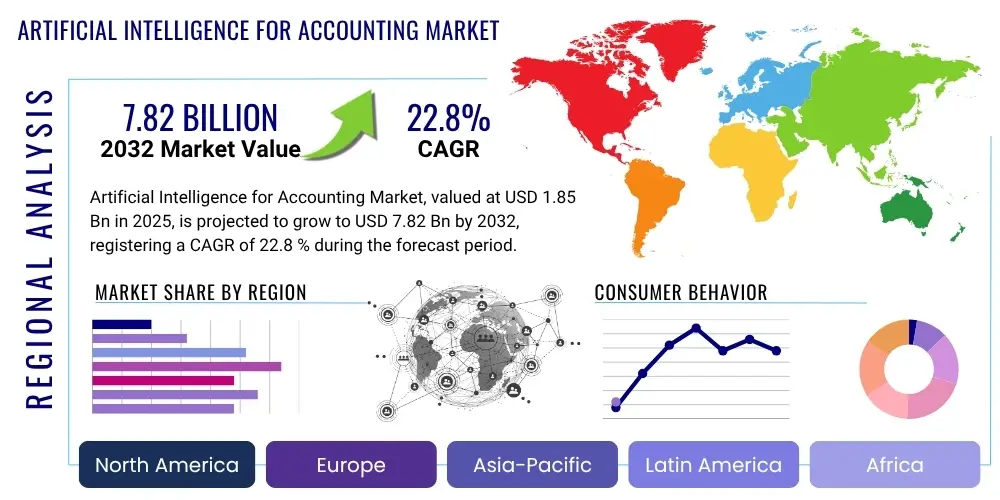

Artificial Intelligence for Accounting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428054 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Artificial Intelligence for Accounting Market Size

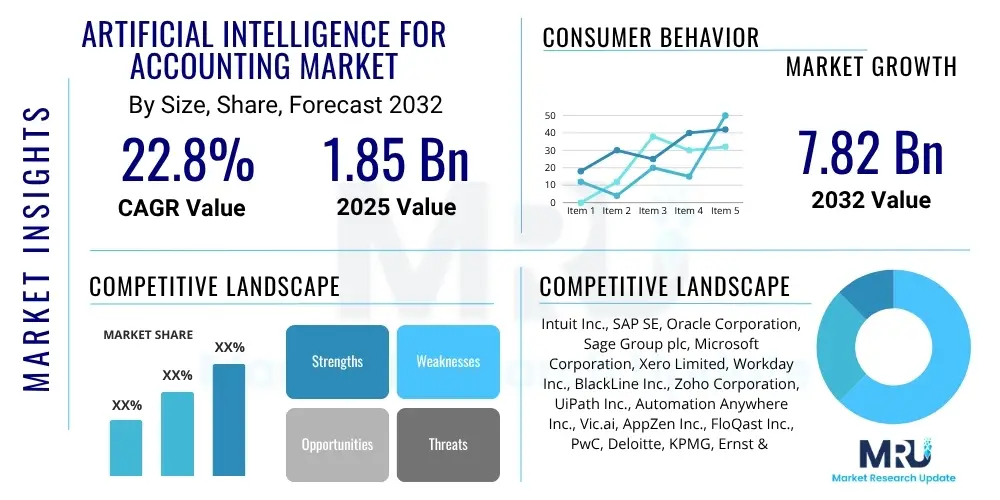

The Artificial Intelligence for Accounting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.8% between 2025 and 2032. The market is estimated at USD 1.85 billion in 2025 and is projected to reach USD 7.82 billion by the end of the forecast period in 2032.

Artificial Intelligence for Accounting Market introduction

The Artificial Intelligence for Accounting market is experiencing transformative growth, driven by the increasing need for operational efficiency, enhanced data accuracy, and strategic financial insights across enterprises. This market encompasses a wide array of AI-driven tools and solutions designed to automate, streamline, and optimize traditional accounting functions. These technologies leverage machine learning, natural language processing, and robotic process automation to handle tasks such as data entry, reconciliation, invoice processing, expense management, fraud detection, and financial reporting, fundamentally altering how financial operations are conducted.

Product descriptions within this market often highlight solutions ranging from AI-powered audit tools and intelligent automation platforms for tax compliance to sophisticated predictive analytics for financial forecasting. Major applications span across various business functions, including automating routine bookkeeping, enhancing forensic accounting capabilities, improving cash flow management, and providing real-time financial insights for better decision-making. The core benefits for businesses adopting these solutions include significant reductions in manual errors, accelerated processing times, substantial cost savings, and the ability to reallocate human capital to more complex, value-added tasks requiring critical thinking and strategic oversight.

Several key driving factors underpin the robust expansion of this market. The exponential growth in financial data volume necessitates advanced analytical capabilities that traditional methods cannot efficiently provide. Furthermore, the pervasive trend of digital transformation across industries pushes companies to adopt innovative technologies to maintain a competitive edge. The increasing pressure for regulatory compliance and robust fraud detection mechanisms also fuels demand for AI solutions that can rapidly identify anomalies and ensure adherence to complex financial standards. Lastly, the desire for greater business agility and the need for proactive financial planning in dynamic economic environments are compelling factors for businesses to invest in AI for accounting.

Artificial Intelligence for Accounting Market Executive Summary

The Artificial Intelligence for Accounting market is characterized by dynamic business trends, marked by a rapid shift towards automation and intelligent process optimization. Enterprises across various scales are recognizing the imperative to integrate AI solutions to navigate increasingly complex financial landscapes, manage vast datasets, and fulfill stringent regulatory requirements. Key business trends include the rising adoption of cloud-based AI accounting software due to its scalability and accessibility, a heightened focus on solutions that offer predictive analytics for strategic planning, and a growing emphasis on AI tools that enhance cybersecurity and compliance in financial operations. The market is witnessing increased collaboration between established software vendors and AI startups, leading to innovative product offerings and specialized functionalities tailored to specific accounting challenges.

Regional trends indicate North America and Europe as leading markets, primarily due to early adoption of advanced technologies, a robust presence of key market players, and significant investments in research and development. However, the Asia Pacific region is rapidly emerging as a high-growth market, driven by accelerated digital transformation initiatives, increasing foreign investments, and a burgeoning number of small and medium-sized enterprises (SMEs) eager to leverage AI for operational efficiency. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as digital infrastructure improves and awareness of AI's benefits in accounting increases.

Segmentation trends highlight a strong demand for AI software solutions over services, although consulting and implementation services remain critical for successful deployment. Cloud-based deployments are dominating the market due to their flexibility and lower upfront costs, making them particularly attractive to SMEs. Application-wise, fraud detection, invoice processing, and financial reporting are experiencing significant growth, as these areas benefit immensely from AI's ability to process large volumes of data with precision and speed. Large enterprises are currently the primary adopters due to their extensive financial operations and greater capital for investment, but tailored, cost-effective solutions are increasingly making AI accessible to small and medium enterprises, further broadening the market's reach and ensuring sustained growth across diverse business segments.

AI Impact Analysis on Artificial Intelligence for Accounting Market

The impact of Artificial Intelligence on the Accounting market is a central theme of user inquiry, often revolving around the transformative effects on job roles, the accuracy and efficiency of financial processes, and the strategic capabilities it unlocks. Users frequently question whether AI will lead to widespread job displacement or, conversely, create new, higher-value roles for accountants. There's significant interest in how AI can improve the precision of financial data, reduce audit times, and enhance the detection of fraudulent activities, along with its potential to provide deeper, predictive insights beyond traditional reporting. Concerns about data security, integration challenges with legacy systems, and the ethical implications of AI in sensitive financial operations are also prevalent. Overall, users anticipate a paradigm shift where AI empowers accountants to move from transactional tasks to more analytical, advisory, and strategic functions, driving greater business value.

- Automation of repetitive tasks: AI significantly automates routine accounting functions such as data entry, reconciliation, and ledger management, reducing human effort and processing time.

- Enhanced data accuracy and integrity: Machine learning algorithms can identify and correct errors, anomalies, and inconsistencies in financial data with greater precision than manual methods.

- Superior fraud detection and prevention: AI systems analyze vast transactional datasets to detect patterns indicative of fraudulent activities, offering real-time alerts and stronger preventative measures.

- Advanced predictive analytics: AI empowers financial professionals with robust forecasting capabilities, utilizing historical data to predict future financial trends, risks, and opportunities for strategic planning.

- Optimized audit processes: AI tools streamline auditing by automating data collection, performing continuous monitoring, and identifying high-risk areas, leading to more efficient and comprehensive audits.

- Personalized financial insights and advisory: AI can process diverse financial information to provide tailored insights, aiding businesses and individuals in making informed financial decisions and offering personalized advice.

- Improved regulatory compliance: AI solutions help companies navigate complex and evolving regulatory landscapes by automating compliance checks, ensuring adherence to standards, and reducing the risk of penalties.

- Streamlined expense management and invoice processing: AI automates the categorization, approval, and reconciliation of expenses and invoices, drastically reducing administrative overhead and processing delays.

- Shift in accountant roles: AI transforms the role of accountants from data processors to strategic advisors, focusing on analysis, interpretation, and leveraging insights to guide business strategy.

DRO & Impact Forces Of Artificial Intelligence for Accounting Market

The Artificial Intelligence for Accounting market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers fueling market expansion include the escalating demand for operational efficiency and automation across financial departments, driven by the need to manage increasing volumes of complex financial data. The imperative for greater accuracy in financial reporting, coupled with stringent regulatory compliance requirements, further propels the adoption of AI solutions. Businesses are also increasingly seeking competitive advantages through data-driven insights and cost reduction, which AI effectively delivers by streamlining processes and minimizing human error. The pervasive digital transformation initiatives globally are creating a fertile ground for AI integration within accounting frameworks, making it a cornerstone for modern financial operations.

However, the market also faces considerable restraints that temper its growth trajectory. The high initial investment costs associated with implementing sophisticated AI technologies, including software licenses, hardware upgrades, and integration services, can be a significant barrier for many organizations, particularly small and medium-sized enterprises (SMEs). Data security and privacy concerns are paramount, as financial data is highly sensitive, and breaches can lead to severe reputational and financial damage. The shortage of skilled professionals capable of developing, implementing, and managing AI accounting systems poses a significant challenge, requiring substantial investment in training and talent acquisition. Furthermore, resistance to change within traditional accounting cultures and the complexities of integrating new AI solutions with existing legacy systems often hinder seamless adoption, necessitating careful change management strategies.

Despite these challenges, the Artificial Intelligence for Accounting market is rich with opportunities. The expansion into new service lines, such as advanced predictive modeling for risk assessment and personalized financial advisory services, presents significant growth avenues for providers. The democratization of financial insights through user-friendly AI tools can empower a broader range of businesses, including those without dedicated financial experts. Furthermore, the integration of AI with emerging technologies like blockchain offers potential for enhanced data immutability, transparency, and security in financial transactions. The development of specialized, scalable AI solutions tailored for niche markets and specific industry verticals, such as healthcare or retail, represents another promising opportunity for market differentiation and expansion. These forces collectively shape the market's evolution, demanding continuous innovation and strategic adaptation from all stakeholders.

Segmentation Analysis

The Artificial Intelligence for Accounting market is comprehensively segmented to provide a detailed understanding of its varied facets and dynamics, allowing for a nuanced analysis of adoption patterns, technological preferences, and end-user requirements. These segmentations are critical for identifying key growth areas, understanding competitive landscapes, and tailoring solutions to specific market needs. The segmentation strategy typically considers factors such as the nature of the AI solution (software versus services), how it is deployed (cloud versus on-premise), the specific accounting functions it addresses, the size of the enterprise adopting the technology, and the industry vertical it serves. Each segment presents unique opportunities and challenges, reflecting the diverse needs of businesses ranging from small startups to large multinational corporations, all striving to leverage AI for improved financial performance and strategic decision-making.

- By Component

- Software: AI-powered platforms, modules, and applications for various accounting tasks.

- Services: Implementation, consulting, training, maintenance, and support services related to AI accounting solutions.

- By Deployment Type

- Cloud-based: Solutions hosted on remote servers and accessed via the internet, offering scalability and flexibility.

- On-premise: Software installed and operated from within an organization's internal IT infrastructure, providing greater control.

- By Application

- Tax Automation: AI tools for tax preparation, compliance, and optimization.

- Payroll Management: Automated payroll processing, deductions, and compliance.

- Fraud Detection: AI algorithms to identify and prevent financial fraud and anomalies.

- Invoice Processing: Automated capture, categorization, and approval of invoices.

- Expense Management: AI-driven solutions for tracking, processing, and reconciling employee expenses.

- Financial Reporting: AI for generating accurate and timely financial statements and reports.

- Audit Automation: AI tools assisting in audit planning, execution, and analysis to enhance efficiency and accuracy.

- Cash Flow Management: AI for forecasting and optimizing cash flows, identifying liquidity risks.

- Reconciliation: Automated matching and reconciliation of financial transactions across various accounts.

- By Enterprise Size

- Small and Medium Enterprises (SMEs): Businesses with limited resources seeking cost-effective and scalable AI solutions.

- Large Enterprises: Corporations with complex financial structures requiring comprehensive and integrated AI systems.

- By End-Use Industry

- BFSI (Banking, Financial Services, and Insurance): Financial institutions leveraging AI for risk management, compliance, and customer service.

- Retail and E-commerce: Businesses using AI for inventory accounting, sales forecasting, and transaction processing.

- Healthcare: Organizations utilizing AI for revenue cycle management, claims processing, and budget analysis.

- Manufacturing: Companies applying AI for cost accounting, supply chain finance, and production planning.

- Government and Public Sector: Public entities using AI for budget management, fraud prevention, and public financial transparency.

- Others (e.g., IT & Telecom, Professional Services): Diverse sectors adopting AI for their specific accounting needs.

Value Chain Analysis For Artificial Intelligence for Accounting Market

The value chain for the Artificial Intelligence for Accounting market is a complex ecosystem, starting from the foundational development of AI technologies and extending to the ultimate delivery and utilization by end-users. At the upstream stage, the value chain begins with core technology providers, including companies specializing in advanced AI algorithms, machine learning frameworks, natural language processing (NLP) libraries, and robotic process automation (RPA) tools. These entities are responsible for the fundamental innovation and infrastructure that powers AI accounting solutions. Data providers, offering aggregated and anonymized financial datasets, also play a crucial upstream role, as high-quality data is essential for training and refining AI models. Infrastructure providers, such as cloud computing services, form another critical component, offering the scalable computational resources necessary for AI model deployment and operation.

Moving downstream, the value chain involves the development and integration of specific AI for accounting solutions. This stage includes specialized AI accounting software developers who design and build applications tailored for various accounting functions, such as tax automation, fraud detection, and financial reporting. System integrators and IT consulting firms are vital at this juncture, responsible for customizing these solutions to fit specific organizational needs, integrating them with existing enterprise resource planning (ERP) systems and legacy accounting software. These integrators ensure seamless deployment and functionality, addressing the unique challenges faced by different businesses and industries. The distribution channels for these solutions are diverse, encompassing both direct sales and indirect approaches.

Direct distribution typically involves large AI solution providers or accounting software companies selling their products and services directly to end-user businesses or large accounting firms through their internal sales teams. This approach allows for direct client relationships, tailored demonstrations, and bespoke solution configurations. Indirect distribution channels are extensive and include partnerships with value-added resellers (VARs), managed service providers (MSPs), and cloud marketplaces. These partners extend the market reach of AI accounting solutions, providing local support, specialized implementation expertise, and bundle offerings. Accounting firms themselves also act as crucial intermediaries, both as end-users of AI tools for their internal operations and as consultants advising their clients on AI adoption, thus influencing widespread market penetration and ensuring the effective utilization of AI in financial processes.

Artificial Intelligence for Accounting Market Potential Customers

The Artificial Intelligence for Accounting market serves a broad and diverse spectrum of potential customers, all seeking to enhance their financial operations through advanced technological capabilities. Predominantly, accounting firms, ranging from small local practices to large multinational professional services networks, represent a significant customer base. These firms leverage AI to automate auditing processes, streamline tax preparation, improve client advisory services, and manage vast amounts of client financial data with greater efficiency and accuracy. By adopting AI, they can reduce operational costs, enhance compliance, and offer more value-added services, thereby maintaining a competitive edge in a rapidly evolving professional landscape.

Beyond traditional accounting firms, corporate finance departments within businesses of all sizes are prime candidates for AI accounting solutions. Large enterprises, with their complex financial structures, extensive transaction volumes, and stringent regulatory requirements, are early and major adopters. They utilize AI for comprehensive financial reporting, real-time cash flow management, sophisticated fraud detection across global operations, and predictive analytics for strategic financial planning. AI helps these organizations manage their intricate financial ecosystems, ensuring robust compliance and providing critical insights for executive decision-making. These businesses aim to optimize their financial performance, mitigate risks, and achieve operational excellence through intelligent automation.

Small and Medium-sized Enterprises (SMEs) are an increasingly important segment of potential customers, driven by the need to optimize limited resources and achieve efficiencies traditionally only accessible to larger corporations. SMEs are particularly interested in cloud-based AI accounting solutions that offer scalability, affordability, and ease of implementation. These businesses seek AI to automate routine bookkeeping, simplify payroll management, streamline expense tracking, and improve overall financial visibility without the need for extensive in-house IT infrastructure or a large financial team. AI empowers SMEs to reduce manual errors, save time, and gain better control over their finances, allowing them to focus on core business growth and innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2032 | USD 7.82 Billion |

| Growth Rate | 22.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intuit Inc., SAP SE, Oracle Corporation, Sage Group plc, Microsoft Corporation, Xero Limited, Workday Inc., BlackLine Inc., Zoho Corporation, UiPath Inc., Automation Anywhere Inc., Vic.ai, AppZen Inc., FloQast Inc., PwC, Deloitte, KPMG, Ernst & Young, IBM, AWS |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Intelligence for Accounting Market Key Technology Landscape

The technological landscape of the Artificial Intelligence for Accounting market is rich and rapidly evolving, primarily centered around several core AI disciplines that collectively empower intelligent financial automation and analysis. Machine Learning (ML) stands as a foundational technology, employing various algorithms such such as supervised, unsupervised, and reinforcement learning, to enable systems to learn from financial data, identify patterns, make predictions, and adapt over time. This is critical for tasks like fraud detection, predictive financial forecasting, and anomaly detection. Natural Language Processing (NLP) is another pivotal technology, facilitating the understanding and processing of human language, which is essential for extracting information from unstructured financial documents like invoices, contracts, and legal texts, as well as for developing intelligent chatbots for financial inquiries.

Robotic Process Automation (RPA) plays a significant role in automating highly repetitive, rule-based accounting tasks that do not necessarily require complex intelligence but benefit immensely from speed and accuracy. RPA bots can interact with existing software applications to perform data entry, generate reports, and conduct reconciliations, acting as a bridge between legacy systems and advanced AI. Beyond these, predictive analytics leverages historical financial data, combined with ML models, to forecast future trends, risks, and opportunities, thereby supporting strategic decision-making and proactive financial management. Big data analytics technologies are indispensable for processing and extracting insights from the enormous volumes of financial and operational data that modern businesses generate.

Furthermore, cloud computing infrastructure provides the scalable, flexible, and cost-effective backbone necessary for deploying and operating AI accounting solutions, enabling access from anywhere and reducing the need for significant on-premise IT investments. The integration of blockchain technology is also emerging as a critical trend, offering immutable ledger capabilities that enhance transparency, security, and auditability in financial transactions, particularly for areas like supply chain finance and intercompany reconciliations. These technologies, often deployed in conjunction, collectively form the advanced toolkit that is reshaping the efficiency, accuracy, and strategic impact of artificial intelligence in the accounting domain, continuously pushing the boundaries of what is possible in financial management.

Regional Highlights

- North America: This region is a dominant force in the AI for Accounting market, characterized by early technology adoption, a robust presence of major software vendors and innovative startups, and significant investments in R&D. The U.S. and Canada lead in leveraging AI for enhanced financial compliance, fraud detection, and operational efficiency across large enterprises and growing tech sectors.

- Europe: The European market demonstrates strong growth, driven by increasing regulatory complexities (e.g., GDPR, IFRS), a push for digital transformation in traditional industries, and a focus on solutions that ensure data privacy and security. Countries like the UK, Germany, and France are key adopters, particularly in integrating AI with existing ERP systems and for tax automation.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid economic development, increasing digitalization initiatives across industries, and a burgeoning SME sector. Countries such as China, India, Japan, and Australia are making substantial investments in AI technology to modernize their financial processes, driven by competitive pressures and expanding digital economies.

- Latin America: This region represents an emerging market with significant growth potential, driven by increasing internet penetration, digital transformation efforts, and a growing awareness of AI's benefits in improving financial transparency and efficiency. Brazil and Mexico are at the forefront of AI adoption in accounting, particularly in automating routine tasks and improving compliance.

- Middle East and Africa (MEA): The MEA market is gradually expanding, supported by government-led digital initiatives, diversification efforts away from traditional industries, and increasing foreign investments in technology infrastructure. Countries in the UAE, Saudi Arabia, and South Africa are exploring AI for financial risk management, budgeting, and public sector accounting reforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Intelligence for Accounting Market.- Intuit Inc.

- SAP SE

- Oracle Corporation

- Sage Group plc

- Microsoft Corporation

- Xero Limited

- Workday Inc.

- BlackLine Inc.

- Zoho Corporation

- UiPath Inc.

- Automation Anywhere Inc.

- Vic.ai

- AppZen Inc.

- FloQast Inc.

- PwC

- Deloitte

- KPMG

- Ernst & Young

- IBM

- AWS (Amazon Web Services)

Frequently Asked Questions

What is Artificial Intelligence for Accounting?

Artificial Intelligence for Accounting refers to the application of AI technologies, such as machine learning, natural language processing, and robotic process automation, to automate, optimize, and enhance traditional accounting functions and financial processes, leading to improved efficiency and accuracy.

How does AI benefit accounting professionals?

AI benefits accounting professionals by automating repetitive, manual tasks like data entry and reconciliation, freeing them to focus on higher-value activities such as strategic analysis, financial forecasting, and advisory services, thereby transforming their roles into more analytical and strategic functions.

What are the primary applications of AI in accounting?

Primary applications of AI in accounting include automated invoice processing, expense management, fraud detection, tax compliance, payroll management, financial reporting, and enhanced audit procedures, all aimed at increasing efficiency and accuracy.

What are the main challenges in adopting AI for accounting?

Key challenges in adopting AI for accounting include the high initial implementation costs, concerns regarding data security and privacy, the shortage of skilled professionals, resistance to change within organizations, and the complexities of integrating AI solutions with existing legacy systems.

Which regions are leading the adoption of AI in accounting?

North America and Europe are currently leading in the adoption of AI for accounting due to early technological advancements and significant investments, while the Asia Pacific region is rapidly emerging as a high-growth market driven by accelerated digital transformation initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager