Artificial Tendons and Ligaments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428538 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Artificial Tendons and Ligaments Market Size

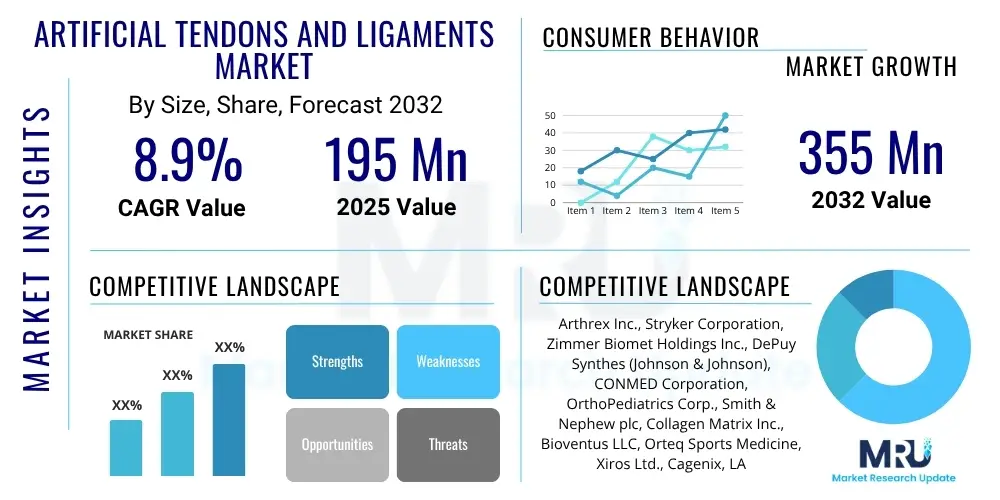

The Artificial Tendons and Ligaments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2032. The market is estimated at USD 195 million in 2025 and is projected to reach USD 355 million by the end of the forecast period in 2032.

Artificial Tendons and Ligaments Market introduction

The Artificial Tendons and Ligaments Market encompasses innovative medical devices designed to replace or augment damaged natural tendons and ligaments within the human body. These advanced prosthetics are crucial for restoring stability, mobility, and function in patients suffering from severe injuries, chronic degenerative conditions, or failed primary repairs. Utilizing a range of synthetic materials, biomaterials, and bio-integrative designs, these products address a critical need in orthopedic and sports medicine, offering alternatives to traditional autograft or allograft procedures that often come with limitations such as donor site morbidity or limited availability.

Key products within this market include synthetic grafts made from polymers like polyethylene terephthalate (PET) or polypropylene, which provide immediate mechanical strength, and increasingly sophisticated composite grafts that combine synthetic components with biological scaffolds to encourage tissue ingrowth and long-term integration. Major applications span a broad spectrum of orthopedic conditions, notably anterior cruciate ligament (ACL) reconstruction, rotator cuff repair, collateral ligament reconstruction, and Achilles tendon repair. The expanding scope of these applications is driven by their ability to provide stable, reproducible outcomes, particularly in cases where natural tissue options are insufficient or undesirable.

The primary benefits of artificial tendons and ligaments include reduced surgical time, avoidance of donor site complications, predictable mechanical properties, and often, faster rehabilitation protocols due to immediate structural stability. The market is propelled by several significant driving factors, including the escalating global incidence of sports-related injuries, particularly among athletes and an increasingly active aging population. Furthermore, advancements in biomaterial science, tissue engineering, and surgical techniques are continuously enhancing the efficacy and longevity of these prosthetic solutions, making them a more attractive option for both surgeons and patients seeking reliable and long-lasting functional restoration.

Artificial Tendons and Ligaments Market Executive Summary

The Artificial Tendons and Ligaments Market is undergoing transformative growth, primarily fueled by a surge in musculoskeletal injuries, an aging demographic prone to degenerative conditions, and continuous innovation in biomaterial science. Business trends indicate a strong focus on strategic collaborations between medical device manufacturers and research institutions to accelerate product development and regulatory approvals. Companies are also investing heavily in expanding their clinical evidence base to support market adoption and differentiate their offerings in a competitive landscape. There is a discernible trend towards minimally invasive surgical techniques, which is influencing the design and delivery mechanisms of new artificial tendon and ligament products, aiming for reduced patient recovery times and improved surgical precision.

Regionally, North America and Europe currently dominate the market due to advanced healthcare infrastructures, high incidence of sports injuries, and favorable reimbursement policies. However, the Asia Pacific region is rapidly emerging as a significant growth hub, driven by increasing healthcare expenditure, a rising awareness of advanced orthopedic treatments, and a growing geriatric population that contributes to a higher burden of orthopedic conditions. Countries like China and India, with their large populations and improving healthcare access, represent substantial untapped potential, attracting investments and market expansion strategies from global players. Latin America and the Middle East and Africa also present nascent opportunities, albeit with slower adoption rates influenced by economic factors and healthcare infrastructure development.

From a segmentation perspective, the market is seeing significant shifts. While synthetic materials have traditionally held a dominant share due to their immediate strength and availability, there is a growing interest and investment in bio-integrative and tissue-engineered solutions that promise more natural healing and long-term biological incorporation. Application-wise, anterior cruciate ligament (ACL) reconstruction remains a primary driver, but demand for rotator cuff repair and other major joint stabilization procedures is also expanding. End-user segments, particularly hospitals and ambulatory surgical centers, are witnessing increased patient volumes, necessitating a broader portfolio of artificial tendon and ligament options to cater to diverse patient needs and surgical preferences, thereby shaping segment-specific growth trajectories.

AI Impact Analysis on Artificial Tendons and Ligaments Market

Users frequently inquire about how artificial intelligence (AI) can revolutionize the design, surgical implementation, and post-operative management of artificial tendons and ligaments. Common questions revolve around AI's ability to optimize material selection for patient-specific implants, enhance surgical precision through robotics and navigation, and predict long-term outcomes to personalize treatment plans. There is significant interest in how AI can contribute to identifying suitable candidates for these procedures, monitoring implant performance, and potentially even accelerating the development of novel biomaterials through predictive modeling and simulation, ultimately aiming for safer, more effective, and durable solutions for patients worldwide.

- AI-driven material science: Optimizes biomaterial composition and structure for enhanced biocompatibility and mechanical properties, accelerating the development of next-generation implants.

- Personalized implant design: Utilizes patient-specific anatomical data from MRI or CT scans to design custom-fit artificial tendons and ligaments, improving surgical accuracy and reducing complications.

- Surgical planning and navigation: AI algorithms assist surgeons in pre-operative planning, identifying optimal implant placement, and guiding robotic systems for precise graft insertion during surgery.

- Predictive analytics for outcomes: Analyzes vast datasets of patient demographics, injury types, surgical techniques, and rehabilitation protocols to predict recovery trajectories and potential implant failures.

- Rehabilitation optimization: AI-powered applications monitor patient progress during physical therapy, providing personalized feedback and adjusting exercises to maximize functional recovery.

- Diagnostic accuracy: Enhances the interpretation of diagnostic imaging to more accurately assess tendon and ligament damage, aiding in the decision-making process for artificial graft implantation.

- Drug discovery and regenerative medicine: AI accelerates the identification of growth factors and cellular therapies that could promote better integration of artificial grafts or stimulate natural tissue regeneration.

DRO & Impact Forces Of Artificial Tendons and Ligaments Market

The Artificial Tendons and Ligaments Market is significantly shaped by a confluence of influential factors, encompassing strong growth drivers, inherent market restraints, and promising new opportunities, all influenced by various impact forces. The increasing global prevalence of sports-related injuries, a rapidly aging population prone to degenerative musculoskeletal conditions, and a growing demand for effective and minimally invasive surgical solutions collectively act as primary drivers for market expansion. Furthermore, continuous advancements in biomaterials science, tissue engineering, and surgical techniques are enhancing the efficacy and acceptance of artificial grafts, broadening their application spectrum and improving patient outcomes. These technological leaps are instrumental in developing more durable, biocompatible, and functionally superior products, thereby fostering market growth.

However, the market also faces considerable restraints that temper its growth trajectory. The high cost associated with advanced artificial tendons and ligaments, coupled with potentially complex surgical procedures and post-operative care, can limit accessibility, particularly in developing regions. Stringent regulatory approval processes for novel biomaterials and medical devices pose significant hurdles, prolonging product development cycles and increasing R&D expenses. Additionally, the risk of complications such as infection, implant failure, or inflammatory responses, though decreasing with technological improvements, remains a concern for both patients and healthcare providers. The availability of alternative treatments like autografts and allografts, despite their drawbacks, also presents competitive pressure, necessitating continuous innovation to justify the advantages of artificial implants.

Despite these challenges, the market is rich with opportunities. The untapped potential in emerging economies, driven by improving healthcare infrastructure, increasing disposable incomes, and rising health awareness, represents a substantial avenue for market expansion. The integration of artificial intelligence and machine learning in personalized medicine, leading to patient-specific implant designs and optimized surgical planning, offers a transformative opportunity for improved efficacy and reduced complications. Furthermore, ongoing research into bio-integrative materials that promote natural tissue ingrowth and regenerative approaches holds the promise of developing next-generation products that not only replace but also facilitate the regeneration of native tissue, opening new frontiers for long-term functional restoration. These opportunities, combined with the inherent impact forces of supplier and buyer power, competitive rivalry, and the threat of new entrants or substitutes, create a dynamic and evolving market landscape.

Segmentation Analysis

The Artificial Tendons and Ligaments Market is comprehensively segmented across various dimensions to provide a detailed understanding of its dynamics, adoption patterns, and growth potential. These segmentations allow for a granular analysis of market trends, aiding stakeholders in strategic planning and resource allocation. The primary segments include categorization by material type, which differentiates between synthetic and bio-integrative options; by application, focusing on specific anatomical repairs; by end-user, identifying the primary healthcare settings utilizing these products; and by geographic region, highlighting varying adoption rates and market maturity across the globe.

- By Material Type:

- Synthetic (e.g., PET, polypropylene, carbon fiber)

- Bio-integrative/Composite (e.g., combinations of synthetic materials with biological scaffolds)

- Allograft Based (processed human donor tissue for ligamentous repair)

- By Application:

- Anterior Cruciate Ligament (ACL) Reconstruction

- Rotator Cuff Repair

- Achilles Tendon Repair

- PCL Reconstruction

- Collateral Ligament Repair

- Other Tendon and Ligament Repairs (e.g., Patellar Tendon, Hand and Wrist ligaments)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Orthopedic Centers

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, South Korea, Rest of Asia Pacific)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Artificial Tendons and Ligaments Market

The value chain for the Artificial Tendons and Ligaments Market begins with upstream activities focused on the research, development, and sourcing of advanced raw materials. This stage is dominated by specialized chemical and biomaterial manufacturers that supply high-grade polymers, carbon fibers, or biological scaffolds crucial for producing durable and biocompatible implants. Research institutions and universities also play a significant role here, contributing to the fundamental science behind novel materials and tissue engineering techniques. The quality and availability of these specialized inputs directly influence the performance and cost-effectiveness of the final product, creating a strong dependency on a robust and innovative supply base.

Further along the chain, medical device manufacturers transform these raw materials into finished artificial tendons and ligaments through complex processes involving extrusion, weaving, sterilization, and rigorous quality control. This stage demands substantial capital investment in manufacturing facilities, skilled labor, and adherence to stringent regulatory standards such as FDA and CE mark certifications. Following manufacturing, the distribution channel plays a pivotal role in delivering these highly specialized products to end-users. This involves both direct and indirect sales strategies. Direct sales teams engage directly with hospitals, orthopedic surgeons, and sports medicine centers, providing product education, surgical support, and building strong professional relationships.

Indirect distribution often involves partnerships with regional and national distributors who have established logistics networks and market reach, particularly in geographically diverse or emerging markets. These distributors facilitate warehousing, inventory management, and timely delivery, ensuring product availability where and when needed. Downstream, the primary end-users are hospitals, ambulatory surgical centers, and specialty orthopedic clinics where surgical procedures are performed. The final stage involves post-sales support, including training for surgical staff, patient follow-up, and continuous research for product improvement based on clinical feedback. The efficiency and seamless integration across all these stages are critical for market penetration and sustained growth in this highly specialized medical device sector.

Artificial Tendons and Ligaments Market Potential Customers

The primary potential customers and end-users of artificial tendons and ligaments are predominantly within the healthcare sector, specifically entities and professionals involved in orthopedic and sports medicine. Hospitals, particularly those with well-equipped orthopedic departments and trauma centers, represent a significant customer base due to the high volume of surgical procedures performed for acute injuries and degenerative conditions. These institutions often require a broad range of implant sizes and types to cater to diverse patient populations and surgical needs, driven by a commitment to restoring patient mobility and reducing long-term disability.

Ambulatory Surgical Centers (ASCs) are another crucial segment of end-users. With the increasing shift towards outpatient procedures for cost-effectiveness and patient convenience, ASCs are progressively adopting advanced artificial tendon and ligament solutions for common orthopedic repairs, such as ACL reconstruction and rotator cuff repairs. These centers value products that facilitate efficient surgical workflows, allow for faster patient discharge, and offer predictable outcomes, making them discerning buyers seeking high-quality and reliable implants.

Beyond institutional buyers, individual orthopedic surgeons and sports medicine specialists are key decision-makers and influencers. Their clinical expertise, preferred surgical techniques, and patient outcomes heavily influence product adoption. They are constantly seeking innovative solutions that offer superior biomechanical properties, improved biocompatibility, and long-term durability. Additionally, an increasingly active aging population and professional athletes represent the ultimate beneficiaries, directly driving the demand for effective and rapid recovery solutions, thereby influencing the adoption rates of these advanced medical devices across the entire care continuum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 195 Million |

| Market Forecast in 2032 | USD 355 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arthrex Inc., Stryker Corporation, Zimmer Biomet Holdings Inc., DePuy Synthes (Johnson & Johnson), CONMED Corporation, OrthoPediatrics Corp., Smith & Nephew plc, Collagen Matrix Inc., Bioventus LLC, Orteq Sports Medicine, Xiros Ltd., Cagenix, LARS Ligament, Cousin Biotech, Artelon, Surgical Esthetics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Tendons and Ligaments Market Key Technology Landscape

The Artificial Tendons and Ligaments Market is heavily reliant on a dynamic and evolving technology landscape, driven by continuous advancements in material science, biomedical engineering, and surgical methodologies. A core technological pillar involves the development and refinement of biomaterials, which are foundational to the functionality and biocompatibility of these implants. This includes high-strength synthetic polymers such as polyethylene terephthalate (PET) and polypropylene, known for their mechanical durability and inertness, as well as more advanced bio-integrative materials like carbon fiber reinforced polymers and composite scaffolds that promote cellular ingrowth and tissue remodeling. The selection of these materials is critical for mimicking the complex biomechanical properties of natural tendons and ligaments, ensuring both immediate stability and long-term functional integration.

Another significant technological advancement lies in tissue engineering and regenerative medicine techniques. Researchers are increasingly focusing on developing scaffolds that not only provide mechanical support but also actively encourage the body's own cells to grow into and remodel the implant, potentially leading to a more natural and durable repair. This involves the incorporation of growth factors, stem cells, or unique surface modifications designed to enhance biological responses and reduce the risk of fibrous encapsulation or implant rejection. Furthermore, 3D printing and additive manufacturing technologies are emerging as game-changers, enabling the creation of patient-specific implants with customized geometries and porosity, which can precisely match individual anatomical requirements and optimize biomechanical performance, thus enhancing surgical outcomes and patient recovery.

Beyond implant design, surgical techniques and tools also form a vital part of the technology landscape. Minimally invasive surgical approaches, often guided by advanced imaging and navigation systems, reduce patient morbidity and accelerate recovery. Robotic assistance in surgery is also gaining traction, offering unparalleled precision in implant placement and tensioning, thereby minimizing human error and improving reproducibility. The integration of advanced diagnostics, such as high-resolution MRI and ultrasound, further contributes to better pre-operative planning and post-operative monitoring of artificial tendon and ligament performance. These interconnected technological innovations collectively push the boundaries of treatment possibilities, making artificial tendons and ligaments a more viable and effective option for a wider range of orthopedic indications.

Regional Highlights

- North America: This region holds a significant share of the artificial tendons and ligaments market, primarily due to its advanced healthcare infrastructure, high prevalence of sports injuries, and favorable reimbursement policies. The presence of key market players, high adoption rates of innovative medical technologies, and substantial investments in research and development further bolster its market leadership. The U.S. is a dominant country within this region, characterized by a large patient pool and widespread awareness of advanced orthopedic treatments.

- Europe: Europe represents another major market segment, driven by an aging population susceptible to degenerative musculoskeletal conditions, a sophisticated healthcare system, and increasing participation in sports activities. Countries such as Germany, the UK, and France are at the forefront, benefiting from strong medical device industries and government initiatives supporting healthcare innovation. The emphasis on quality of life for the elderly and continuous advancements in surgical techniques contribute to steady market growth.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate during the forecast period. This growth is attributed to improving healthcare infrastructure, rising disposable incomes, increasing awareness of orthopedic surgical options, and a vast patient base. Emerging economies like China and India are undergoing rapid modernization in their healthcare sectors, leading to greater adoption of advanced medical devices. The rising popularity of sports and a growing geriatric population are also significant growth drivers in this region.

- Latin America: This region shows promising growth potential, albeit at a slower pace compared to North America and Europe. Factors such as increasing healthcare spending, a growing awareness of modern treatment options, and improving access to medical facilities contribute to market expansion. Brazil and Mexico are leading the adoption of artificial tendons and ligaments, driven by a rising middle class and efforts to enhance healthcare quality.

- Middle East and Africa (MEA): The MEA region is expected to experience moderate growth, supported by increasing investments in healthcare infrastructure, particularly in GCC countries, and a growing incidence of musculoskeletal injuries. While market penetration may be slower due to varying economic conditions and healthcare disparities, the increasing focus on medical tourism and the adoption of advanced medical technologies present future opportunities for market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Tendons and Ligaments Market.- Arthrex Inc.

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- DePuy Synthes (Johnson & Johnson)

- CONMED Corporation

- OrthoPediatrics Corp.

- Smith & Nephew plc

- Collagen Matrix Inc.

- Bioventus LLC

- Orteq Sports Medicine

- Xiros Ltd.

- Cagenix

- LARS Ligament

- Cousin Biotech

- Artelon

- Surgical Esthetics

- Medtronic plc

- Integra LifeSciences Holdings Corporation

- Baxter International Inc.

- Meril Life Sciences Pvt. Ltd.

Frequently Asked Questions

What are artificial tendons and ligaments?

Artificial tendons and ligaments are synthetic or bio-integrative implants designed to replace or augment damaged natural tendons and ligaments, restoring stability and function to joints after injury or degenerative conditions. They are typically made from advanced polymers, carbon fibers, or composite materials and are used in orthopedic surgeries such as ACL reconstruction and rotator cuff repair.

What are the main advantages of using artificial tendons and ligaments over traditional grafts?

Key advantages include the avoidance of donor site morbidity associated with autografts, consistent mechanical properties, predictable availability unlike allografts, and often faster rehabilitation due to immediate structural stability. They can significantly reduce surgical time and eliminate the need for secondary surgeries to harvest graft tissue.

Which factors are driving the growth of the Artificial Tendons and Ligaments Market?

The market's growth is primarily driven by the rising incidence of sports-related injuries, an increasing aging population prone to musculoskeletal conditions, advancements in biomaterial science and surgical techniques, and growing awareness and acceptance of these innovative prosthetic solutions among patients and surgeons.

What are the key challenges or restraints in the Artificial Tendons and Ligaments Market?

Significant restraints include the high cost of advanced implants and associated surgical procedures, stringent regulatory approval processes that prolong market entry, and the potential for complications such as infection or implant failure, which necessitate ongoing research for improved biocompatibility and durability.

How is AI impacting the development and application of artificial tendons and ligaments?

AI is revolutionizing the field by optimizing biomaterial design, enabling patient-specific implant customization through 3D printing, enhancing surgical precision with AI-guided robotics, and improving post-operative outcomes through predictive analytics for personalized rehabilitation and risk assessment. It aims to make implants more effective and durable.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager