Artillery Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428173 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Artillery Systems Market Size

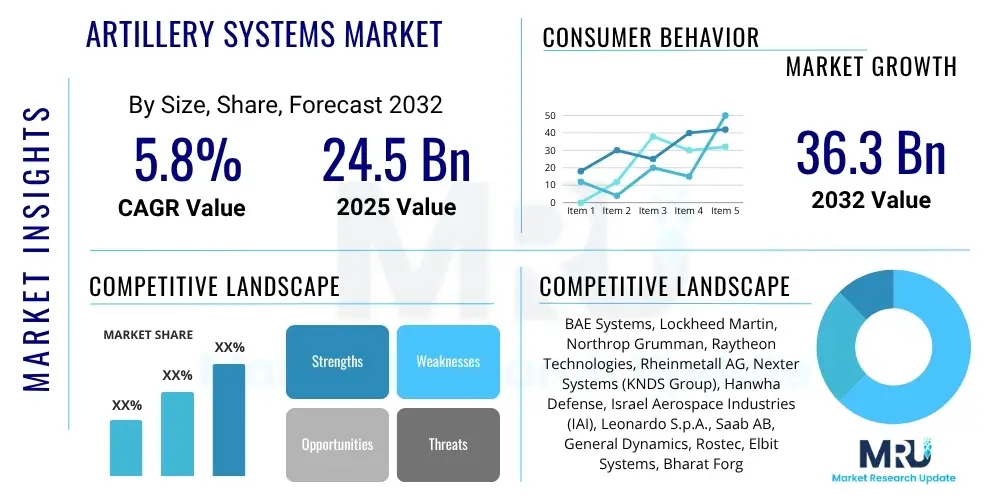

The Artillery Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 24.5 Billion in 2025 and is projected to reach USD 36.3 Billion by the end of the forecast period in 2032.

Artillery Systems Market introduction

The Artillery Systems Market encompasses the global industry involved in the research, development, manufacturing, and deployment of weapon systems designed to fire projectiles beyond the range of small arms. These systems are crucial for modern warfare, providing indirect fire support, area denial, and precision strike capabilities across diverse operational environments. Products within this market segment range from traditional towed howitzers and self-propelled artillery units to advanced rocket artillery and guided multiple launch rocket systems (MLRS), each fulfilling specific tactical and strategic objectives. Modern artillery systems integrate sophisticated fire control, navigation, and targeting technologies to enhance accuracy, responsiveness, and lethality, making them indispensable assets for national defense forces worldwide. The continuous evolution of conflict dynamics and the demand for enhanced battlefield effectiveness are key drivers shaping this market.

Major applications of artillery systems span a wide array of military operations, including close air support, counter-battery fire, suppression of enemy air defenses (SEAD), interdiction, and deep strike missions against high-value targets. They are fundamental in both conventional warfare and asymmetric engagements, offering scalable firepower tailored to mission requirements. Benefits derived from advanced artillery systems include superior range and destructive power, the ability to operate in adverse weather conditions, and reduced exposure for personnel through autonomous or semi-autonomous operation. These systems contribute significantly to maintaining military deterrence, projecting power, and protecting ground forces by neutralizing threats from a safe distance, thereby minimizing friendly casualties and optimizing operational outcomes. The versatility of modern artillery ensures its continued relevance in the evolving landscape of military strategies and defense doctrines globally.

The market is driven by several critical factors, primarily escalating geopolitical tensions and regional conflicts that compel nations to modernize and expand their conventional artillery capabilities. Defense budget increases in many countries, particularly those facing perceived threats or engaged in military modernization programs, directly fuel demand for new and upgraded systems. Technological advancements, including improvements in munitions (e.g., guided projectiles, smart munitions), fire control systems, automation, and networked battlefield integration, are also significant drivers, enhancing the effectiveness and precision of artillery. Furthermore, the growing adoption of unmanned ground vehicles (UGVs) and artificial intelligence (AI) in military applications presents opportunities for integrating these technologies into future artillery platforms, promising more autonomous, efficient, and lethal systems. These collective factors underpin the sustained growth and innovation within the global artillery systems market.

Artillery Systems Market Executive Summary

The Artillery Systems Market is experiencing robust growth driven by a confluence of geopolitical instability, military modernization initiatives, and rapid technological advancements. Business trends indicate a strong emphasis on precision-guided munitions, longer-range capabilities, and enhanced system automation to reduce crew exposure and increase operational efficiency. Original equipment manufacturers (OEMs) are focusing on modular designs that allow for easier upgrades and customization, catering to diverse national defense requirements. Strategic partnerships and collaborations between leading defense contractors and technology providers are becoming increasingly prevalent, aiming to integrate cutting-edge solutions like AI-driven targeting and autonomous logistics into artillery platforms. Furthermore, the push for indigenous production capabilities in several emerging economies is shaping the supply chain dynamics, leading to technology transfer agreements and licensed manufacturing to bolster national defense industries and reduce reliance on foreign suppliers.

Regional trends reveal varied investment patterns and priorities across different geographies. North America and Europe continue to lead in terms of R&D and advanced system procurement, driven by substantial defense budgets and ongoing efforts to counter sophisticated adversaries. The Asia-Pacific region, however, is emerging as a significant growth hub, propelled by military build-ups in countries like China, India, and South Korea, which are expanding and modernizing their artillery arsenals to address regional security concerns. Latin America, the Middle East, and Africa are also witnessing increased demand, albeit at a slower pace, primarily for conventional and cost-effective artillery solutions for internal security and border defense. The Middle East, in particular, demonstrates a strong appetite for advanced systems due to persistent regional conflicts and strategic interests, often importing state-of-the-art technology from global leaders. These regional disparities create distinct opportunities and challenges for market players, necessitating tailored market entry and growth strategies.

Segmentation trends highlight a shift towards self-propelled artillery (SPA) systems due to their superior mobility, protection, and rapid deployment capabilities compared to traditional towed systems. The demand for rocket artillery, especially those capable of launching precision-guided rockets, is also surging as nations seek to enhance their deep strike and area saturation capabilities. In terms of caliber, there is a sustained demand for both medium and heavy calibers, with an increasing focus on extending range and accuracy for existing platforms. Component-wise, advancements in fire control systems, sensor integration, and battlefield management systems are critical, driving innovation in data processing and target acquisition. The integration of these advanced components is aimed at creating more networked and interoperable artillery units that can seamlessly communicate and coordinate with other battlefield assets, thereby enhancing overall operational effectiveness and contributing to the strategic superiority of modern armed forces. This holistic approach to system development is redefining the future of artillery warfare.

AI Impact Analysis on Artillery Systems Market

The integration of Artificial Intelligence (AI) is poised to revolutionize the Artillery Systems Market by addressing common user questions about enhanced precision, reduced human error, and improved operational efficiency. Users frequently inquire about how AI can accelerate target acquisition, optimize firing solutions, and predict equipment failures to improve readiness. There's also significant interest in AI's role in autonomous operation, specifically in minimizing crew exposure to danger zones while maintaining or even increasing lethality. Concerns often revolve around the ethical implications of autonomous decision-making in combat, the security of AI systems against cyber threats, and the complexities of integrating AI into legacy platforms. Overall, users anticipate AI to deliver a leap in battlefield capabilities, making artillery systems smarter, faster, and more adaptable, though with a cautious eye on the practical and ethical challenges of implementation.

AI's influence is expected to dramatically enhance the operational lifecycle of artillery systems, from initial deployment to sustained combat operations. Its ability to process vast amounts of battlefield data – including reconnaissance imagery, sensor feeds, and environmental conditions – can provide commanders with unprecedented situational awareness. This data-driven approach allows for dynamic target prioritization, optimal weapon selection, and real-time adjustment of firing parameters, significantly increasing the probability of a first-round hit. Moreover, AI algorithms can predict enemy movements and counter-fire threats with greater accuracy, enabling proactive defensive maneuvers and more effective offensive planning. The cognitive burden on human operators is simultaneously reduced, allowing them to focus on critical strategic decisions rather than complex calculations, thereby enhancing overall operational tempo and effectiveness in high-stress combat scenarios.

Looking ahead, the ongoing development of AI-powered analytics and machine learning models will continue to push the boundaries of artillery capabilities. This includes the potential for fully autonomous systems that can identify, track, and engage targets with minimal human intervention, pending ethical and regulatory frameworks. AI will also play a crucial role in predictive maintenance, analyzing operational data to anticipate component failures and schedule preventative repairs, thus maximizing system uptime and reducing logistical overheads. The future of artillery will likely feature highly interconnected, AI-enabled networks where individual artillery pieces, sensors, and command centers communicate seamlessly, sharing intelligence and coordinating fire missions with unprecedented speed and precision. This transformation ensures that artillery remains a dominant and decisive factor in future conflicts, continuously adapting to new threats and operational demands through intelligent automation.

- Enhanced Target Recognition and Prioritization: AI algorithms rapidly analyze sensor data to identify and prioritize targets with greater accuracy than human operators.

- Optimized Firing Solutions: AI processes environmental data, ballistics, and target kinematics to calculate precise firing parameters in real-time, improving hit probability.

- Predictive Maintenance: AI monitors system health, predicts component failures, and recommends maintenance schedules, increasing operational readiness and reducing downtime.

- Autonomous Logistics: AI can optimize ammunition resupply routes and inventory management, ensuring continuous operational support.

- Threat Detection and Counter-Battery Fire: AI analyzes incoming fire trajectories to quickly pinpoint enemy positions and recommend counter-fire solutions.

- Swarm Coordination: AI enables multiple artillery units to coordinate fire missions as a cohesive force, overwhelming defenses or striking dispersed targets effectively.

- Decision Support for Commanders: AI provides real-time strategic insights, risk assessments, and scenario planning, aiding in critical combat decisions.

- Reduced Crew Workload: Automation of complex tasks through AI frees human operators to focus on strategic oversight and mission planning.

- Adaptive Learning: AI systems learn from past engagements and operational data to continuously refine their performance and adapt to new battlefield conditions.

DRO & Impact Forces Of Artillery Systems Market

The Artillery Systems Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively form its Impact Forces. Key drivers include the pervasive threat of geopolitical instability and escalating regional conflicts, compelling nations to invest heavily in modernizing their defense capabilities. Furthermore, ongoing military modernization programs across various countries, aimed at replacing aging equipment and integrating advanced technologies, significantly fuel market growth. Technological advancements in munitions, fire control systems, and battlefield communication further enhance the attractiveness and effectiveness of new artillery platforms. The rising demand for precision strike capabilities and extended-range firepower, particularly in urban and asymmetric warfare scenarios, also serves as a potent driver, pushing manufacturers to innovate and deliver more sophisticated systems. These factors create a fertile ground for sustained investment and development in artillery technology.

However, the market also faces considerable restraints that temper its growth trajectory. The exceptionally high cost of research and development (R&D) for advanced artillery systems, coupled with equally high manufacturing expenses, poses a significant barrier for many nations, particularly those with constrained defense budgets. Strict export controls and regulatory frameworks imposed by international treaties and national governments also limit market access and technology transfer, hindering wider adoption. Public opposition to defense spending and increasing scrutiny over military expenditures in some democratic nations can also slow down procurement processes. Additionally, the long procurement cycles inherent in defense contracting, often spanning several years, introduce uncertainties and delays in project execution, impacting market predictability and manufacturers' ability to respond rapidly to emerging demands. These restraints necessitate strategic planning and a thorough understanding of the global regulatory landscape for market participants.

Despite the challenges, numerous opportunities exist that can propel the market forward. The increasing integration of Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) systems with artillery platforms offers avenues for enhanced battlefield effectiveness and situational awareness. Emerging economies, driven by national security concerns and a desire to build indigenous defense industrial bases, represent significant untapped markets for both new procurements and technology transfers. The development of advanced guided munitions, including smart artillery shells and loitering munitions, promises to expand the tactical utility and precision of artillery, opening new revenue streams. Furthermore, the growing focus on asymmetric warfare and counter-insurgency operations creates a demand for versatile, rapidly deployable, and precision-capable artillery systems that can operate effectively in non-traditional combat environments. These opportunities highlight potential growth areas and strategic directions for innovation and market expansion within the artillery systems sector.

Segmentation Analysis

The Artillery Systems Market is comprehensively segmented across various critical dimensions, allowing for a detailed understanding of its complex dynamics and specific demand drivers. These segmentations typically include classifications by Type, distinguishing between traditional towed and highly mobile self-propelled systems, as well as the increasingly prevalent rocket artillery. Further divisions by Caliber differentiate between light, medium, and heavy weapons, each suited for different tactical roles and ranges. The market is also analyzed by Component, breaking down the intricate elements that comprise an artillery system, such as the weapon itself, its ammunition, sophisticated fire control systems, and various auxiliary support systems. Additionally, segmentation by Platform categorizes systems based on their operational environment, encompassing land-based, naval, and air-launched variants. Finally, the End-User segmentation identifies the primary consumers of these systems, predominantly defense forces and, to a lesser extent, homeland security agencies globally. This multi-faceted approach provides invaluable insights into market structure, competitive landscapes, and future growth opportunities within each specialized niche.

- By Type

- Towed Artillery Systems

- Self-Propelled Artillery Systems

- Rocket Artillery Systems (e.g., MLRS, HIMARS)

- By Caliber

- Light Caliber Artillery (e.g., 105mm)

- Medium Caliber Artillery (e.g., 155mm)

- Heavy Caliber Artillery (e.g., 203mm, larger rocket systems)

- By Component

- Weapon System (Barrel, Breech, Recoil System, Carriage/Platform)

- Ammunition (Projectiles, Propellant Charges, Fuzes)

- Fire Control System (FCS) (Computers, Sensors, Navigation, Communication)

- Auxiliary Systems (Loading Systems, Power Units, Diagnostic Tools)

- By Platform

- Land-based Artillery (Wheeled, Tracked)

- Naval Artillery (Ship-mounted guns)

- Air-launched Artillery (Limited applications, e.g., AC-130 gunships)

- By End-User

- Defense Forces (Armies, Navies, Air Forces)

- Homeland Security (Limited, specialized applications)

Value Chain Analysis For Artillery Systems Market

The value chain for the Artillery Systems Market is a complex and multi-layered structure, beginning with extensive upstream activities focused on raw material sourcing and the production of highly specialized components. This stage involves suppliers of high-grade steel alloys for barrels and carriages, advanced composites for lighter structures, and sophisticated electronics for fire control systems, sensors, and navigation units. Research and development, often a collaborative effort between defense contractors, government agencies, and academic institutions, is also a crucial upstream activity, driving innovation in ballistics, munitions, and system integration. The quality and reliability of these upstream inputs directly impact the performance and durability of the final artillery systems, emphasizing the importance of robust supply chain management and stringent quality control throughout this initial phase. Secure and stable access to these specialized materials and technologies is paramount for manufacturers.

Midstream activities encompass the manufacturing, assembly, and testing of the artillery systems. This involves precision engineering to produce barrels, breech mechanisms, and recoil systems, followed by the integration of complex electronic components for fire control and communication. Assembly processes are highly specialized, often requiring advanced robotics and skilled labor to ensure the integrity and functionality of the entire system. Rigorous testing and qualification procedures, including live-fire exercises and environmental testing, are mandatory to meet stringent military standards and ensure operational readiness and safety. This stage also includes the production of a diverse range of ammunition, from conventional high-explosive shells to advanced precision-guided munitions (PGMs), which often involve separate, specialized manufacturing lines due to their distinct technological requirements and safety protocols. Vertical integration or strong partnerships are common strategies at this stage to control quality and cost.

Downstream activities focus on the distribution, deployment, and post-sales support of artillery systems. Distribution channels are predominantly direct, involving direct procurement contracts between prime defense contractors and national defense ministries or armed forces. Indirect channels are less common but can involve international military sales organizations or government-to-government agreements for technology transfer and licensed production, particularly for smaller nations or those seeking to build indigenous defense capabilities. Post-sales support is a critical component of the value chain, encompassing training for military personnel, maintenance and repair services, spare parts provision, and system upgrades throughout the operational life of the equipment. Given the long service life of artillery systems, ongoing support contracts represent a significant and stable revenue stream for manufacturers, reinforcing customer relationships and ensuring the continued operational effectiveness of these strategic military assets. The comprehensive nature of this downstream support is integral to the long-term success and reputation of manufacturers in this market.

Artillery Systems Market Potential Customers

The primary and most significant potential customers for artillery systems are national defense ministries and their respective armed forces across the globe. These include armies, marines, and occasionally naval forces for coastal defense or specialized ship-mounted systems, and even air forces for applications like AC-130 gunships. The procurement decisions are driven by a nation's defense doctrines, geopolitical considerations, perceived external and internal threats, and the need to maintain a credible deterrence capability. Modernization programs, replacement cycles for aging equipment, and the expansion of military capabilities in response to regional power shifts or emerging conflicts are key factors influencing purchasing decisions. These governmental entities are sophisticated buyers, typically engaging in extensive research, evaluation, and competitive bidding processes to ensure they acquire systems that meet rigorous performance, reliability, and interoperability standards, often requiring custom configurations and integrated support packages.

Beyond traditional defense establishments, a secondary but increasingly important segment of potential customers includes specialized security forces or paramilitary organizations, particularly those involved in homeland security or border protection. While their requirements are generally less extensive than conventional armies, they may seek lighter, more mobile artillery systems for specific roles such as suppressing insurgencies, securing critical infrastructure, or providing limited fire support in domestic security operations. These buyers often prioritize ease of use, lower logistical footprints, and cost-effectiveness. The procurement processes for these organizations can vary, sometimes mirroring military acquisition methods, while at other times being more streamlined due to immediate operational needs or specific legislative mandates. The global rise in internal conflicts and asymmetric threats has broadened the scope of potential customers beyond just state-level defense departments, opening new niches for manufacturers with versatile offerings.

Furthermore, international alliances and collective security organizations can also act as indirect customers, influencing procurement decisions among member states by promoting interoperability and common equipment standards. While they don't directly purchase artillery systems, their recommendations and frameworks can guide individual national procurements. Additionally, nations aiming to establish or bolster their domestic defense industrial bases often act as customers seeking technology transfer and licensed production agreements. These countries are not just looking to acquire finished products but also the intellectual property and manufacturing know-how to produce their own artillery systems, thereby reducing foreign dependence and stimulating local industry. This particular customer segment represents a dual opportunity for manufacturers – selling current systems while also potentially licensing technologies for future production. The diverse landscape of buyers underscores the need for flexible sales and partnership strategies within the Artillery Systems Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 24.5 Billion |

| Market Forecast in 2032 | USD 36.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BAE Systems, Lockheed Martin, Northrop Grumman, Raytheon Technologies, Rheinmetall AG, Nexter Systems (KNDS Group), Hanwha Defense, Israel Aerospace Industries (IAI), Leonardo S.p.A., Saab AB, General Dynamics, Rostec, Elbit Systems, Bharat Forge, Denel Land Systems, ST Engineering, KMW (KNDS Group), Patria, China North Industries Group Corporation (NORINCO), Roketsan |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artillery Systems Market Key Technology Landscape

The Artillery Systems Market is characterized by a dynamic and evolving technology landscape, constantly pushing the boundaries of range, precision, and operational efficiency. A core technological advancement is in precision-guided munitions (PGMs), transforming traditional "dumb" artillery shells into highly accurate, GPS or laser-guided projectiles capable of striking specific targets with minimal collateral damage. Technologies like course-correction fuzes and projectile-mounted navigation systems significantly improve accuracy over extended ranges. Additionally, advanced propellant technologies, including modular charge systems and insensitive munitions, enhance safety, simplify logistics, and increase the maximum range of existing artillery platforms. The integration of smart ammunition capable of fusing data from multiple sensors to identify and engage targets autonomously represents another significant leap, addressing the need for enhanced effectiveness in complex battlefield scenarios and reducing the logistical burden on forces.

Another crucial aspect of the technology landscape involves sophisticated Fire Control Systems (FCS) and battlefield management software. Modern FCS leverage advanced computing algorithms, inertial navigation systems (INS), and GPS capabilities to calculate highly accurate firing solutions in real-time, accounting for environmental factors like wind and temperature, as well as target movement. These systems are increasingly integrated with Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) networks, allowing for seamless data exchange between artillery units, forward observers, and command centers. This network-centric approach enhances situational awareness, shortens the sensor-to-shooter loop, and enables rapid, coordinated fire missions. Furthermore, automated loading systems and robotic platforms are being developed to increase the rate of fire, reduce crew fatigue, and minimize the number of personnel exposed to direct combat risks, thereby improving survivability and sustained operational tempo.

The future technology landscape is further shaped by the increasing adoption of Artificial Intelligence (AI) and machine learning (ML) for various functions, including target recognition, predictive maintenance, and optimized tactical deployment. AI-powered analytics can process vast amounts of battlefield data to provide commanders with predictive insights, enabling more effective strategic planning and resource allocation. Materials science innovations are also playing a vital role, with the development of lighter, stronger materials for barrels and carriages that improve system mobility and reduce wear and tear, extending the operational lifespan of artillery pieces. Directed energy weapons and hypervelocity projectiles, while still largely in research and development phases, represent disruptive technologies that could fundamentally alter the long-range fire support paradigm in the longer term. These continuous technological advancements underscore a market driven by innovation, seeking to equip armed forces with superior firepower and strategic advantage in future conflicts.

Regional Highlights

- North America: This region, particularly the United States, represents a dominant force in the Artillery Systems Market, driven by a substantial defense budget, continuous investment in R&D, and extensive modernization programs for its armed forces. The focus here is on developing and acquiring highly advanced, precision-guided, and networked artillery systems, including self-propelled howitzers and advanced rocket artillery, ensuring technological superiority and maintaining a strategic advantage globally.

- Europe: European nations are heavily investing in upgrading their artillery capabilities, largely due to escalating geopolitical tensions on their eastern flank and the need for NATO interoperability. Countries like Germany, France, and the UK are prioritizing indigenous production and collaborative development of next-generation systems, emphasizing extended range, improved mobility, and enhanced protection for crews, reflecting a renewed focus on conventional deterrence and readiness.

- Asia Pacific (APAC): The APAC region is experiencing the fastest growth, propelled by significant military modernization efforts in countries such as China, India, South Korea, and Japan. Rising territorial disputes, increasing defense expenditures, and a strong drive for indigenous defense manufacturing are fueling demand for a diverse range of artillery systems, from conventional towed and self-propelled units to advanced multiple launch rocket systems, catering to diverse regional security challenges.

- Latin America: This region demonstrates a more moderate demand for artillery systems, primarily focused on maintaining existing inventories and acquiring cost-effective solutions for internal security, border control, and counter-insurgency operations. While large-scale procurements of cutting-edge systems are less frequent, there is a steady market for upgrades, refurbishment, and limited acquisitions of reliable, proven technologies to enhance national defense capabilities within budgetary constraints.

- Middle East and Africa (MEA): The MEA region is a critical market, driven by persistent geopolitical instability, regional conflicts, and substantial defense spending, particularly in the Arabian Gulf states. There is a strong demand for advanced, high-performance artillery systems, including precision-guided munitions and long-range rocket artillery, often sourced from leading international manufacturers to bolster national security and project influence in a complex operational environment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artillery Systems Market.- BAE Systems

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- Rheinmetall AG

- Nexter Systems (KNDS Group)

- Hanwha Defense

- Israel Aerospace Industries (IAI)

- Leonardo S.p.A.

- Saab AB

- General Dynamics

- Rostec

- Elbit Systems

- Bharat Forge

- Denel Land Systems

- ST Engineering

- KMW (KNDS Group)

- Patria

- China North Industries Group Corporation (NORINCO)

- Roketsan

Frequently Asked Questions

What are the primary types of artillery systems dominating the market?

The market is primarily dominated by Self-Propelled Artillery (SPA) systems due to their superior mobility and protection, alongside Rocket Artillery Systems, which offer significant deep strike and area saturation capabilities. Towed artillery systems continue to hold relevance for specific operational requirements due to their cost-effectiveness and transportability.

How is AI transforming modern artillery systems?

AI is revolutionizing artillery by enhancing target acquisition, optimizing firing solutions with real-time data analysis, enabling predictive maintenance, and reducing human workload through automation. It significantly improves precision, operational efficiency, and overall battlefield effectiveness, moving towards more intelligent and networked systems.

Which regions are leading the growth in the Artillery Systems Market?

The Asia Pacific (APAC) region is experiencing the fastest growth, driven by extensive military modernization and increasing defense expenditures. North America and Europe remain key regions due to continuous R&D investment and high-tech procurement, while the Middle East is also a significant market due to ongoing conflicts and strategic investments.

What are the main challenges faced by manufacturers in this market?

Manufacturers face significant challenges including high R&D costs for advanced systems, stringent export controls and regulatory hurdles, and long, complex procurement cycles inherent in defense contracting. Geopolitical sensitivities and the need for extensive customization for diverse client requirements also add complexity.

What role do precision-guided munitions play in the Artillery Systems Market?

Precision-guided munitions (PGMs) are crucial, transforming artillery by allowing highly accurate strikes with minimal collateral damage over extended ranges. They integrate GPS, inertial navigation, or laser guidance, significantly enhancing the lethality and effectiveness of artillery, making it a more versatile and precise weapon system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager