Aspartic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429478 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Aspartic Acid Market Size

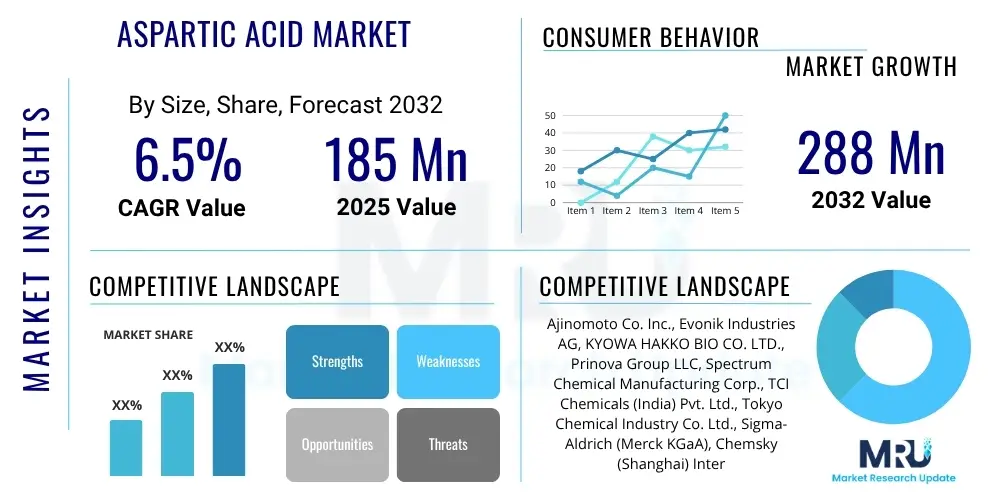

The Aspartic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 185 Million in 2025 and is projected to reach USD 288 Million by the end of the forecast period in 2032.

Aspartic Acid Market introduction

The Aspartic Acid Market is a dynamic sector within the global chemical and biochemical industries, driven by the versatile applications of this alpha-amino acid. Aspartic acid, also known as L-aspartic acid, is one of the 20 most common amino acids that are the building blocks of proteins. It is non-essential, meaning the human body can synthesize it, but it is also widely consumed through diet and supplements. Its unique chemical structure, featuring two carboxylic acid groups, makes it highly reactive and suitable for various industrial and biological processes. The market encompasses both chemically synthesized and biotechnologically produced forms, catering to a diverse array of end-user industries.

Aspartic acid serves as a crucial intermediate in the synthesis of various products, including artificial sweeteners like aspartame, biodegradable polymers, and pharmaceuticals. Its applications extend to food and beverages, where it acts as a flavor enhancer and nutritional supplement, as well as in cosmetics for skin conditioning and in agriculture as a plant growth stimulant. The benefits of aspartic acid are manifold, ranging from its role in the body’s energy production and neurotransmission to its industrial utility in creating environmentally friendly materials. Its ability to chelate metal ions also makes it valuable in certain industrial cleaning and water treatment applications, further broadening its market scope.

Driving factors for the aspartic acid market include the escalating demand for healthier food alternatives and natural ingredients, fueling its use in nutritional supplements and dietetic products. The increasing adoption of biodegradable polymers, driven by environmental concerns and stringent regulations against single-use plastics, significantly boosts the demand for aspartic acid as a key monomer. Furthermore, advancements in biotechnology and fermentation processes are enhancing production efficiency and cost-effectiveness, making aspartic acid more accessible for various industrial applications. The expanding pharmaceutical sector, particularly in drug synthesis and research, also contributes substantially to market growth, highlighting aspartic acid’s indispensable role across multiple high-growth industries.

Aspartic Acid Market Executive Summary

The Aspartic Acid Market is experiencing robust growth, primarily propelled by burgeoning demand from the food and beverage, pharmaceutical, and biodegradable polymer industries. Global business trends indicate a shift towards sustainable and bio-based products, which directly benefits aspartic acid as a key component in novel bioplastics and eco-friendly solutions. Manufacturers are increasingly focusing on optimizing fermentation processes to enhance yield and reduce production costs, thereby improving market competitiveness. Strategic collaborations, mergers, and acquisitions among key players are common strategies to expand product portfolios, strengthen market presence, and access new geographical markets. Additionally, the market is characterized by a growing emphasis on research and development to discover new applications and improve existing production methodologies, ensuring a steady pipeline of innovation.

Regional trends reveal Asia Pacific as the dominant and fastest-growing market for aspartic acid, driven by rapid industrialization, increasing population, and rising disposable incomes leading to higher consumption of processed foods and pharmaceuticals. Countries like China, India, and Japan are at the forefront of this growth, supported by substantial manufacturing capabilities and expanding end-use sectors. North America and Europe also hold significant market shares, primarily due to their advanced pharmaceutical industries, strong regulatory frameworks promoting sustainable products, and a high consumer awareness regarding health and nutrition. Latin America and the Middle East and Africa are emerging as promising markets, exhibiting steady growth propelled by developing industrial bases and increasing investments in healthcare and food processing infrastructure.

Segment trends highlight that the food and beverage application segment continues to be a major revenue contributor, owing to the widespread use of aspartame and other aspartic acid derivatives as artificial sweeteners and flavor enhancers. The pharmaceutical segment is witnessing substantial growth, driven by its utility in drug synthesis and as a nutritional supplement. The biodegradable polymer segment is poised for significant expansion, fueled by global environmental initiatives and the increasing need for sustainable packaging and industrial materials. By production method, bio-based fermentation is gaining traction over chemical synthesis due to its eco-friendly nature and cost-effectiveness for large-scale production, reflecting a broader industry trend towards greener manufacturing practices. These trends collectively underscore a positive outlook for the aspartic acid market, with sustained growth anticipated across all key segments and regions.

AI Impact Analysis on Aspartic Acid Market

Common user questions regarding AI's impact on the Aspartic Acid market frequently revolve around its potential to optimize production processes, accelerate research and development, and enhance supply chain efficiency. Users are keenly interested in how AI can lead to more cost-effective and sustainable manufacturing methods, particularly concerning fermentation, and whether it can uncover novel applications or improve the efficacy of existing ones. There is significant curiosity about AI's role in predictive analytics for market trends, raw material sourcing, and demand forecasting, as well as its capacity to personalize nutritional or pharmaceutical applications. Concerns often include the initial investment costs for AI integration, the need for specialized expertise, data privacy issues, and the ethical implications of autonomous systems in biomanufacturing, highlighting a blend of optimism for innovation and caution regarding implementation challenges.

The integration of Artificial intelligence (AI) and machine learning (ML) holds transformative potential for the Aspartic Acid market, particularly in refining biomanufacturing processes. AI algorithms can analyze vast datasets from bioreactors, including temperature, pH, nutrient levels, and microbial growth rates, to predict optimal conditions for maximum aspartic acid yield and purity. This predictive capability enables real-time adjustments, significantly reducing process variability and minimizing waste, thereby enhancing operational efficiency and lowering production costs. Furthermore, AI can model complex metabolic pathways within microorganisms used for fermentation, identifying genetic targets for engineering strains that produce aspartic acid more efficiently, pushing the boundaries of biotechnological innovation and sustainability within the industry.

Beyond production, AI's influence extends to accelerating research and development, supply chain management, and market intelligence for aspartic acid. In R&D, AI can rapidly screen molecular compounds for new applications, predict their properties, and simulate chemical reactions, drastically shortening the time and cost associated with drug discovery and material science innovations. For supply chains, AI-driven predictive analytics can forecast demand fluctuations, optimize inventory levels, and manage logistics more effectively, ensuring a stable supply of aspartic acid to end-use industries while mitigating risks from raw material volatility. This comprehensive impact positions AI as a pivotal technology for driving innovation, efficiency, and strategic decision-making across the entire Aspartic Acid market value chain, fostering sustainable growth and competitive advantage.

- Process Optimization: AI-driven algorithms can monitor and optimize fermentation parameters in real-time, leading to increased yields and reduced production costs for aspartic acid.

- Accelerated R&D: Machine learning models can predict molecular properties and identify new applications for aspartic acid in pharmaceuticals and materials, significantly shortening development cycles.

- Supply Chain Efficiency: AI enhances demand forecasting, inventory management, and logistics, ensuring timely and cost-effective delivery of aspartic acid.

- Quality Control: AI-powered analytical tools can detect impurities and ensure the high purity and consistency of aspartic acid products.

- Sustainable Production: AI can optimize resource consumption, minimize waste, and identify greener synthesis routes, contributing to environmentally friendly manufacturing processes.

- Market Intelligence: AI analytics provide insights into market trends, competitive landscapes, and emerging opportunities, aiding strategic business decisions.

- Personalized Applications: AI could enable customized formulations of aspartic acid-based products in nutrition and healthcare based on individual needs and metabolic profiles.

DRO & Impact Forces Of Aspartic Acid Market

The Aspartic Acid Market is significantly influenced by a confluence of drivers, restraints, and opportunities that shape its trajectory. Key drivers include the escalating global demand for artificial sweeteners, particularly aspartame, which heavily relies on aspartic acid as a primary raw material. The robust expansion of the pharmaceutical industry, marked by increased research into new drug formulations and the growing need for amino acid supplements, provides a consistent uplift for market growth. Furthermore, the rising consumer awareness regarding health and nutrition, coupled with a preference for natural and functional food ingredients, boosts the incorporation of aspartic acid into dietary supplements and fortified foods. The rapid growth of the biodegradable plastics sector, driven by stringent environmental regulations and a global push for sustainable alternatives to petrochemical-based plastics, positions aspartic acid as a critical building block for novel biopolymers, ensuring sustained demand in the long term.

Despite these strong driving forces, the market faces several notable restraints. Volatility in raw material prices, particularly for chemicals like ammonium fumarate and ammonia, can significantly impact the production costs of aspartic acid, leading to fluctuating profit margins for manufacturers. The complex and often capital-intensive nature of fermentation processes, which are increasingly favored for sustainable aspartic acid production, can deter new entrants and limit the scalability for smaller players. Additionally, strict regulatory frameworks and varying food safety standards across different regions pose challenges for market players, requiring significant investments in compliance and product certification. The availability of substitute products, though often less versatile, in certain applications can also exert downward pressure on pricing and market share, necessitating continuous innovation and differentiation to maintain competitiveness.

Opportunities within the aspartic acid market are abundant, particularly in the realm of sustainable production and new application development. Advancements in biotechnology, specifically in microbial fermentation and enzyme immobilization techniques, promise more efficient and cost-effective production methods, opening avenues for increased market penetration. The burgeoning demand for eco-friendly agricultural products presents an opportunity for aspartic acid derivatives as biostimulants and chelating agents, enhancing nutrient uptake in plants. Emerging markets in Asia Pacific, Latin America, and Africa offer untapped growth potential, driven by improving economic conditions, urbanization, and expanding industrial bases. Moreover, ongoing research into novel biomedical applications, such as targeted drug delivery systems and tissue engineering, could unlock entirely new high-value segments for aspartic acid, solidifying its importance as a foundational biochemical compound with diverse and evolving uses.

Segmentation Analysis

The Aspartic Acid market is comprehensively segmented based on various critical parameters, providing a detailed understanding of its dynamics and growth prospects across different categories. These segmentations typically include analyses by type, application, and production method, each revealing distinct market trends and opportunities. Analyzing these segments helps stakeholders identify lucrative areas for investment, understand consumer preferences, and tailor their product offerings and marketing strategies effectively. The market’s segmentation reflects the diverse utility of aspartic acid, from its specific enantiomeric forms to its wide array of industrial and consumer applications, and the technological processes employed for its manufacturing. This granular view is essential for navigating the complexities of the market and capitalizing on specific niches.

The segmentation by type primarily distinguishes between L-Aspartic Acid and D-Aspartic Acid, with L-Aspartic Acid being the more prevalent and commercially significant form due to its role in protein synthesis and as a precursor for various compounds. However, D-Aspartic Acid is gaining attention for its specific physiological roles, particularly in hormonal regulation, opening new avenues in nutritional supplements. Application-wise, the market is broadly divided into segments such as food and beverage, pharmaceuticals, animal feed, cosmetics, and industrial uses. Each application segment is driven by unique demand characteristics and regulatory environments. For instance, the food and beverage sector is dominated by artificial sweeteners, while pharmaceuticals increasingly leverage aspartic acid for drug synthesis and as an active ingredient.

Furthermore, the market is segmented by production method, typically categorizing between chemical synthesis and biotechnological processes, predominantly fermentation. While chemical synthesis offers a traditional and well-established route, biotechnological production, particularly using microbial fermentation, is rapidly gaining favor due to its environmental benefits, higher specificity, and potential for cost-effective large-scale manufacturing. This shift towards greener production methods is a significant trend influencing the market's technological landscape and competitive dynamics. Understanding these intricate segmentations allows for a precise evaluation of market forces, enabling businesses to align their strategies with prevailing demands and future growth areas within the global aspartic acid landscape.

- By Type

- L-Aspartic Acid: The most common and biologically active form, primarily used in pharmaceuticals, food and beverages, and as a raw material for aspartame and biodegradable polymers.

- D-Aspartic Acid: Gaining traction in nutritional supplements for its specific role in hormonal regulation and neurological functions, though a smaller market share compared to L-Aspartic Acid.

- By Application

- Food and Beverage: Primarily used as a precursor for artificial sweeteners (aspartame), flavor enhancers, and nutritional additives in dietetic products.

- Pharmaceuticals: Utilized in drug synthesis, as a raw material for amino acid infusions, and in various nutritional and medical supplements for human health.

- Animal Feed: Incorporated as a nutritional supplement to enhance animal growth and health, improving feed conversion ratios.

- Cosmetics and Personal Care: Employed in skincare products for its moisturizing properties, pH regulation, and as an ingredient in various hair and skin conditioning agents.

- Agriculture: Used as a chelating agent to improve nutrient availability to plants and as a component in certain biostimulants.

- Industrial: Applications include its use in biodegradable polymers, water treatment chemicals, and as an intermediate in various chemical processes.

- By Production Method

- Chemical Synthesis: Traditional method involving chemical reactions to produce aspartic acid, often from maleic anhydride or fumaric acid.

- Biotechnology (Fermentation): Utilizes microorganisms (e.g., bacteria like Brevibacterium flavum or Corynebacterium glutamicum) to produce aspartic acid through fermentation, known for its eco-friendliness and high purity.

- Enzymatic Conversion: A subset of biotechnology, involving the use of specific enzymes for the conversion of precursors into aspartic acid.

Value Chain Analysis For Aspartic Acid Market

The value chain for the Aspartic Acid Market begins with the upstream analysis, which primarily focuses on the sourcing and processing of key raw materials. The main raw materials include fumaric acid, maleic anhydride, and ammonia. Fumaric acid, a dicarboxylic acid, can be produced through chemical synthesis or fermentation, while maleic anhydride is typically derived from petroleum-based feedstocks. Ammonia is a widely available industrial chemical. The quality and purity of these initial precursors are critical as they directly influence the efficiency of subsequent synthesis steps and the final product quality of aspartic acid. Relationships with raw material suppliers are crucial for ensuring a stable and cost-effective supply, managing price volatility, and maintaining consistent production schedules, thus forming the foundational layer of the entire value chain.

Moving downstream, the value chain encompasses the manufacturing and synthesis processes, followed by distribution channels. Manufacturers acquire the raw materials and convert them into aspartic acid using either chemical synthesis (e.g., amination of maleic acid) or biotechnological methods (e.g., microbial fermentation). The choice of production method significantly impacts production costs, environmental footprint, and product characteristics. After synthesis, the aspartic acid undergoes purification, crystallization, and drying to meet specific industry standards and purity requirements. The finished product is then packaged and distributed through various channels. Direct distribution involves manufacturers selling directly to large industrial end-users like major pharmaceutical companies or biopolymer producers. This often involves long-term contracts and bulk deliveries, allowing for greater control over sales and customer relationships.

Indirect distribution, on the other hand, involves a network of distributors, wholesalers, and specialized chemical suppliers who bridge the gap between manufacturers and a broader range of smaller or geographically dispersed customers. These intermediaries play a vital role in market penetration, particularly for niche applications or in regions where manufacturers lack a direct presence. They often provide value-added services such as warehousing, logistics, technical support, and small-batch deliveries. The downstream part of the value chain culminates with the end-users across diverse sectors, including food and beverage, pharmaceuticals, animal feed, cosmetics, and industrial applications. Understanding these complex interconnections from raw material sourcing to final product delivery is essential for optimizing efficiency, managing costs, and fostering strong customer relationships throughout the Aspartic Acid market.

Aspartic Acid Market Potential Customers

The Aspartic Acid Market serves a diverse array of potential customers across various industries, reflecting its versatile chemical properties and biological significance. Primary end-users include manufacturers in the food and beverage sector, where aspartic acid is a critical precursor for artificial sweeteners such as aspartame. These customers are driven by consumer demand for low-calorie and sugar-free products, along with flavor enhancement for processed foods and beverages. Nutritional supplement companies also represent a significant customer base, leveraging aspartic acid for its role as an amino acid supplement, often included in formulations aimed at athletic performance, cognitive function, or general health and well-being. Their purchasing decisions are heavily influenced by product efficacy, regulatory compliance, and market trends in health and wellness.

Another substantial segment of potential customers is found within the pharmaceutical and biotechnology industries. Pharmaceutical companies utilize aspartic acid as a key building block in the synthesis of various active pharmaceutical ingredients (APIs) and as a component in intravenous amino acid solutions. Research institutions and biotech firms also procure aspartic acid for cell culture media and biochemical assays. For these customers, purity, consistency, and compliance with stringent pharmacological standards are paramount. The rapidly expanding bioplastics and biodegradable polymer industries constitute an emerging yet highly significant customer group, as aspartic acid serves as a monomer in the production of environmentally friendly materials, driven by global sustainability mandates and the push for eco-friendly packaging and industrial solutions.

Beyond these major sectors, the Aspartic Acid market caters to animal feed producers, who incorporate it as a nutritional additive to improve livestock growth and health, and cosmetic manufacturers, utilizing it in skin and hair care products for its conditioning and pH-balancing properties. Agricultural companies also form a niche customer base, employing aspartic acid as a chelating agent to enhance nutrient absorption in plants and as a component in biostimulants. These diverse end-user industries underscore the broad applicability of aspartic acid, with each customer segment driven by unique operational requirements, market demands, and regulatory considerations, all contributing to the compound’s pervasive and growing market presence. Companies targeting these customers must understand their specific needs and deliver tailored solutions to capture and maintain market share effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 185 Million |

| Market Forecast in 2032 | USD 288 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co. Inc., Evonik Industries AG, KYOWA HAKKO BIO CO. LTD., Prinova Group LLC, Spectrum Chemical Manufacturing Corp., TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co. Ltd., Sigma-Aldrich (Merck KGaA), Chemsky (Shanghai) International Co. Ltd., Anhui Goldenaterra Bioscience Co. Ltd., Zhejiang Changmao Biochemical Co. Ltd., Suzhou Tianyuan Chemical Co. Ltd., Jiaxing Kinglux Chemical Co. Ltd., Hebei Jinguang Chemical Co. Ltd., Nantong Sanyou Biochemical Co. Ltd., Shandong Jinyimeng Group Co. Ltd., Wuxi Bikang Bioengineering Co. Ltd., Daesang Corporation, NutraScience Labs, NOW Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aspartic Acid Market Key Technology Landscape

The technological landscape for the Aspartic Acid market is primarily dominated by two distinct production methods: chemical synthesis and biotechnological routes, particularly fermentation. Chemical synthesis, traditionally relying on the amination of maleic acid or fumaric acid, involves several steps including hydrogenation, hydrolysis, and crystallization. This method is well-established and offers predictable yields, but it can be less environmentally friendly due to the use of strong acids and bases, and the potential for racemic mixture formation, requiring additional steps for enantiomeric separation if L-aspartic acid is desired. Advancements in chemical catalysis and process intensification aim to improve the efficiency and selectivity of these conventional methods, reducing byproduct formation and energy consumption, yet the drive towards sustainability often pushes for alternative approaches.

Biotechnological production, predominantly through microbial fermentation, represents the forefront of modern aspartic acid manufacturing. This method utilizes various microorganisms, such as strains of Brevibacterium flavum or Corynebacterium glutamicum, which are engineered to overproduce L-aspartic acid from renewable carbon sources like glucose or molasses. Fermentation offers several advantages, including high enantioselectivity, leading directly to L-aspartic acid without the need for complex separation, and a more environmentally benign process profile. Ongoing research in this area focuses on strain improvement through genetic engineering and synthetic biology to enhance metabolic pathways, increase yield, and improve tolerance to high product concentrations, thereby reducing downstream processing costs and increasing overall economic viability.

Beyond traditional fermentation, enzymatic conversion methods are also playing a significant role in the technological landscape. These involve the use of specific enzymes, such as aspartase, to convert fumaric acid and ammonia into L-aspartic acid with high efficiency and specificity. Enzyme immobilization techniques further enhance the stability and reusability of these biocatalysts, making the process more continuous and cost-effective. Emerging technologies include the integration of artificial intelligence and machine learning for process optimization, predictive analytics in bioreactor management, and the development of continuous manufacturing systems. These innovations aim to reduce operational expenditures, minimize environmental impact, and accelerate the development of new aspartic acid products, ensuring the market remains dynamic and responsive to evolving industry demands for sustainable and high-purity ingredients.

Regional Highlights

- North America: This region demonstrates stable growth, primarily driven by a robust pharmaceutical sector and high demand for nutritional supplements. Significant investments in R&D, coupled with a growing consumer preference for health-conscious food products and increasing adoption of sustainable bioplastics, contribute to its steady market expansion. The presence of major industry players and advanced manufacturing capabilities further solidifies its position.

- Europe: Europe is a mature market characterized by stringent environmental regulations and a strong emphasis on sustainable practices. The demand for aspartic acid is propelled by its use in pharmaceuticals, cosmetics, and the burgeoning biodegradable polymer sector. Innovations in green chemistry and biotechnology, along with a focus on circular economy principles, are key drivers for market growth in countries such as Germany, France, and the UK.

- Asia Pacific (APAC): APAC is the fastest-growing and largest market for aspartic acid, fueled by rapid industrialization, increasing population, and rising disposable incomes. Countries like China, India, and Japan are major production hubs and consumption centers, driven by expanding food and beverage, pharmaceutical, and animal feed industries. Low production costs and growing consumer awareness further contribute to its dominant market share and projected high growth rate.

- Latin America: This region shows promising growth, primarily due to expanding industrial sectors and increasing investments in healthcare and food processing infrastructure. Brazil and Mexico are leading the market with rising demand for nutritional supplements and processed foods. Economic development and urbanization are key factors supporting the uptake of aspartic acid in various applications across the region.

- Middle East and Africa (MEA): The MEA market for aspartic acid is emerging, driven by increasing industrialization, particularly in the food and beverage and pharmaceutical sectors. Investments in manufacturing capabilities and a growing awareness of health and nutrition are contributing to gradual market expansion. While smaller in comparison to other regions, MEA presents significant untapped potential for future growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aspartic Acid Market.- Ajinomoto Co. Inc.

- Evonik Industries AG

- KYOWA HAKKO BIO CO. LTD.

- Prinova Group LLC

- Spectrum Chemical Manufacturing Corp.

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co. Ltd.

- Sigma-Aldrich (Merck KGaA)

- Chemsky (Shanghai) International Co. Ltd.

- Anhui Goldenaterra Bioscience Co. Ltd.

- Zhejiang Changmao Biochemical Co. Ltd.

- Suzhou Tianyuan Chemical Co. Ltd.

- Jiaxing Kinglux Chemical Co. Ltd.

- Hebei Jinguang Chemical Co. Ltd.

- Nantong Sanyou Biochemical Co. Ltd.

- Shandong Jinyimeng Group Co. Ltd.

- Wuxi Bikang Bioengineering Co. Ltd.

- Daesang Corporation

- NutraScience Labs

- NOW Foods

Frequently Asked Questions

What is Aspartic Acid used for in commercial applications?

Aspartic acid is widely used as a crucial raw material in the production of artificial sweeteners, primarily aspartame, for the food and beverage industry. It also serves as a key intermediate in the synthesis of various pharmaceuticals, an amino acid supplement in animal feed, and a building block for biodegradable polymers, among other industrial applications like cosmetics and agriculture. Its versatility stems from its unique chemical structure as an alpha-amino acid.

Is Aspartic Acid safe for consumption?

Yes, L-Aspartic acid is naturally occurring in the human body and is generally recognized as safe (GRAS) by regulatory bodies like the FDA when used as a food additive or in supplements within recommended dosages. It plays vital roles in metabolism and neurotransmission. However, excessive consumption, particularly through high doses of aspartame, can be a concern for individuals with specific metabolic disorders like phenylketonuria (PKU), who must limit its intake due to its phenylalanine component.

What are the primary drivers of growth for the Aspartic Acid market?

Key growth drivers include the increasing global demand for artificial sweeteners, driven by health-conscious consumers seeking low-calorie options. The robust expansion of the pharmaceutical sector, with its need for amino acids in drug synthesis and supplements, also significantly boosts demand. Additionally, the growing adoption of biodegradable polymers, fueled by environmental concerns and regulations, further contributes to market growth by utilizing aspartic acid as a sustainable building block.

Which production methods are commonly used for Aspartic Acid?

The two main production methods for aspartic acid are chemical synthesis and biotechnological processes, primarily microbial fermentation. Chemical synthesis typically involves the amination of maleic or fumaric acid. Biotechnological fermentation, using genetically engineered microorganisms, is increasingly favored due to its higher enantioselectivity, production of L-aspartic acid directly, and more environmentally friendly profile, aligning with sustainability trends in chemical manufacturing.

What is the future outlook for the Aspartic Acid market?

The future outlook for the Aspartic Acid market is highly positive, projecting sustained growth driven by innovation and expanding applications. Expected trends include continued demand from the food and pharmaceutical sectors, significant growth in the biodegradable polymers segment, and advancements in biotechnological production methods that enhance efficiency and sustainability. Emerging markets and new biomedical applications are also anticipated to open lucrative avenues, ensuring a robust market trajectory.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager