Atherectomy Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429780 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Atherectomy Devices Market Size

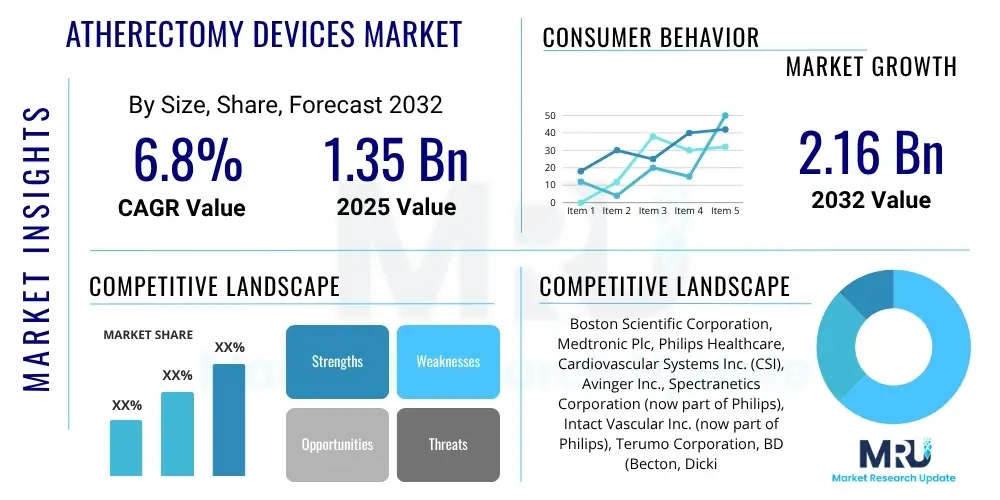

The Atherectomy Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 1.35 billion in 2025 and is projected to reach USD 2.16 billion by the end of the forecast period in 2032.

Atherectomy Devices Market introduction

The Atherectomy Devices Market encompasses a range of specialized medical instruments designed for the minimally invasive removal of atherosclerotic plaque from blood vessels. These devices are crucial in treating various cardiovascular and peripheral vascular diseases, offering an alternative to more invasive surgical interventions. They work by physically cutting, shaving, vaporizing, or pulverizing plaque within arteries, thereby restoring blood flow and improving patient outcomes, particularly in cases where balloon angioplasty or stenting alone may not be sufficient or appropriate. The ongoing advancements in catheter technology and imaging guidance systems are continuously enhancing the precision and safety of these procedures, broadening their applicability across different patient demographics and lesion types.

Product descriptions for atherectomy devices typically involve advanced catheter systems equipped with various mechanisms such as rotating blades, orbital sanding, or excimer lasers. Each design is tailored to address specific plaque characteristics and vessel anatomies. Major applications primarily include the treatment of Peripheral Artery Disease (PAD), particularly in the legs, and Coronary Artery Disease (CAD) in certain complex lesions. They are also increasingly used in chronic total occlusions (CTOs) and in-stent restenosis. The benefits of employing atherectomy devices are manifold, including reduced invasiveness compared to traditional bypass surgery, faster patient recovery times, preservation of future treatment options by minimizing vessel trauma, and the ability to debulk calcified lesions that are difficult to treat with balloon angioplasty alone. These advantages contribute significantly to enhanced patient quality of life and reduced healthcare burdens.

Driving factors propelling the atherectomy devices market include the escalating global prevalence of cardiovascular diseases and peripheral artery disease, largely attributable to aging populations and lifestyle factors such as diabetes, obesity, and smoking. There is a growing preference among both patients and clinicians for minimally invasive surgical procedures due to their inherent benefits of reduced recovery time and lower complication rates. Furthermore, continuous technological advancements in device design, materials science, and imaging integration are making atherectomy procedures safer, more effective, and applicable to a wider range of challenging vascular conditions. Increased healthcare expenditure in emerging economies and rising awareness regarding the benefits of early intervention for vascular conditions also significantly contribute to market expansion.

Atherectomy Devices Market Executive Summary

The atherectomy devices market is experiencing robust growth driven by an aging global population and the increasing incidence of cardiovascular and peripheral artery diseases. Key business trends include a strategic focus on research and development to introduce next-generation devices with enhanced precision and safety features, such as improved lesion crossing capabilities and reduced embolization risk. Consolidation through mergers and acquisitions is also prevalent, as larger medical device companies seek to expand their product portfolios and geographical reach. There is a noticeable shift towards specialized devices tailored for specific lesion types, including highly calcified or fibrotic plaques, as well as a greater emphasis on solutions that integrate seamlessly with advanced imaging modalities. Companies are also investing in comprehensive training programs for clinicians to ensure optimal adoption and utilization of these complex devices.

Regionally, North America continues to dominate the market due to its advanced healthcare infrastructure, high prevalence of vascular diseases, favorable reimbursement policies, and early adoption of innovative medical technologies. Europe also represents a significant market, propelled by an aging demographic and robust healthcare spending, with a strong focus on clinical outcomes and cost-effectiveness. The Asia Pacific region is projected to exhibit the highest growth rate during the forecast period, primarily attributed to improving healthcare access, rising disposable incomes, increasing awareness about vascular conditions, and a rapidly expanding patient pool. Latin America and the Middle East & Africa regions are emerging markets, characterized by ongoing healthcare infrastructure development and a growing demand for advanced interventional therapies.

Segment-wise, the market is characterized by distinct trends across product types, applications, and end-users. In terms of product type, directional atherectomy devices currently hold a substantial market share, but orbital and rotational atherectomy are witnessing significant growth due to their efficacy in treating calcified lesions. Laser atherectomy is also gaining traction for specific indications. Application-wise, Peripheral Artery Disease (PAD) remains the largest segment, driven by its high incidence and the increasing necessity for limb salvage procedures. Coronary Artery Disease (CAD) applications are expanding, particularly for complex lesions unsuitable for other interventions. Hospitals continue to be the primary end-user, however, ambulatory surgical centers (ASCs) and specialized cath labs are increasingly contributing to market revenue due to their cost-effectiveness and efficiency for elective procedures, reflecting a broader trend towards outpatient care where clinically appropriate.

AI Impact Analysis on Atherectomy Devices Market

User inquiries concerning AI's influence on the atherectomy devices market frequently revolve around its potential to revolutionize diagnostic accuracy, enhance procedural guidance, and optimize post-operative care. Users are eager to understand how AI can improve the identification of suitable lesions for atherectomy, predict treatment outcomes, and personalize therapeutic strategies. Key themes include the integration of AI with advanced imaging to create precise 3D vascular models, the application of machine learning for real-time procedural adjustments, and the role of AI in training interventional specialists. Concerns often center on data security, the regulatory landscape for AI-driven medical devices, and the necessary clinical validation to ensure safety and efficacy. Expectations are high for AI to reduce procedural complications, increase efficiency, and ultimately lead to superior patient results by making atherectomy procedures more predictable and tailored.

- Enhanced Diagnostic Precision: AI algorithms, integrated with intravascular ultrasound (IVUS) and optical coherence tomography (OCT) images, can provide more accurate and automated plaque characterization, helping clinicians better differentiate lesion types (calcified, fibrous, lipid-rich) and assess severity, thereby guiding optimal device selection and treatment planning. This leads to more targeted interventions and potentially improved long-term patency rates.

- Real-time Procedural Guidance: AI-powered navigation systems can offer real-time feedback during atherectomy procedures, analyzing device movement, tissue interaction, and vessel morphology to prevent complications such as perforation or dissection. This real-time intelligence can assist operators in maintaining optimal device position and pressure, reducing the learning curve for complex cases.

- Predictive Analytics for Outcomes: Machine learning models can analyze vast patient data, including comorbidities, lesion characteristics, and device selection, to predict the likelihood of successful plaque removal, restenosis, or adverse events. This enables clinicians to make more informed decisions, tailor treatment plans to individual patient risk profiles, and manage patient expectations effectively.

- Personalized Treatment Strategies: AI can process comprehensive patient data to recommend highly personalized atherectomy approaches, considering factors like plaque burden, vessel tortuosity, and patient-specific risk factors. This customization can optimize device type, cutting depth, and procedural sequence, maximizing efficacy while minimizing risks for each patient.

- Optimized Training and Simulation: AI-driven simulation platforms can provide realistic training environments for interventional cardiologists and vascular surgeons, allowing them to practice complex atherectomy procedures. These simulations can offer immediate, data-driven feedback on technique, improving operator proficiency and preparedness before performing procedures on actual patients.

- Robotic Assistance Integration: AI can augment robotic atherectomy systems by enhancing precision and control, allowing for micro-movements beyond human capability and potentially enabling remote procedures. AI algorithms can interpret sensor data to guide robotic arms, further refining the accuracy of plaque removal and reducing operator fatigue.

- Post-procedure Monitoring and Follow-up: AI can analyze post-procedure imaging and patient data to monitor recovery, detect early signs of restenosis or complications, and recommend follow-up interventions. This proactive approach can lead to timelier adjustments in patient care and improved long-term clinical outcomes.

DRO & Impact Forces Of Atherectomy Devices Market

The atherectomy devices market is significantly influenced by a dynamic interplay of driving factors, inherent restraints, and emerging opportunities, all shaped by various impact forces within the global healthcare ecosystem. The predominant drivers include the rapidly increasing prevalence of Peripheral Artery Disease (PAD) and Coronary Artery Disease (CAD) worldwide, primarily fueled by an aging population and the widespread adoption of sedentary lifestyles coupled with rising rates of diabetes, obesity, and hypertension. Concurrently, the growing patient and clinician preference for minimally invasive surgical procedures, which offer advantages such as reduced pain, shorter hospital stays, and quicker recovery, significantly propels the demand for atherectomy devices as a less aggressive alternative to open surgery. Continuous technological advancements, leading to the development of more efficacious, safer, and versatile atherectomy devices, also serve as a crucial market driver, expanding the applicability of these treatments to a broader range of complex lesions and patient profiles. Enhanced imaging integration, smarter catheter designs, and improved plaque removal mechanisms are making atherectomy a more attractive option.

However, the market faces notable restraints that temper its growth trajectory. The high cost associated with atherectomy devices, often coupled with the sophisticated and expensive equipment required for their operation, presents a significant barrier to adoption, particularly in developing economies or healthcare systems with budget constraints. Furthermore, the limited availability of skilled professionals, specifically interventional cardiologists and vascular surgeons trained in complex atherectomy procedures, poses a challenge to wider market penetration and optimal utilization of these advanced devices. Reimbursement challenges and varying coverage policies across different regions and insurance providers can also deter both healthcare facilities and patients from opting for atherectomy, influencing treatment choices. Finally, the inherent risk of complications, although generally low, such as vessel perforation, dissection, distal embolization, and vasospasm, can make clinicians cautious, impacting the overall adoption rate.

Despite these restraints, the atherectomy devices market is replete with significant opportunities. Emerging markets, characterized by improving healthcare infrastructure, increasing healthcare expenditure, and a burgeoning patient population with vascular diseases, represent fertile ground for market expansion. Strategic investments and partnerships in these regions can unlock substantial growth. The ongoing development of drug-coated atherectomy devices or combination therapies, integrating plaque removal with localized drug delivery, holds immense potential to reduce restenosis rates and improve long-term outcomes, thereby enhancing the value proposition of atherectomy. Moreover, the integration of advanced imaging modalities like Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT) directly into atherectomy catheters can provide superior real-time lesion assessment and procedural guidance, increasing safety and efficacy. The expanding indications for atherectomy, including chronic total occlusions and in-stent restenosis, further broaden the market's addressable patient population. The overarching impact forces include the global burden of cardiovascular diseases, healthcare expenditure trends, regulatory frameworks influencing device approval and market access, and the continuous drive for innovation within the medical device industry. Increased patient awareness through educational campaigns and direct-to-consumer marketing also plays a role in fostering demand for advanced vascular interventions.

Segmentation Analysis

The Atherectomy Devices Market is comprehensively segmented to provide granular insights into its multifaceted structure and dynamics. This segmentation facilitates a deeper understanding of market trends, competitive landscapes, and growth opportunities across various dimensions, including product type, application, and end-user. Each segment reflects distinct technological characteristics, patient needs, and clinical settings, contributing uniquely to the overall market valuation and growth trajectory. The market's evolution is heavily influenced by innovations within these segments, as manufacturers strive to develop devices that offer superior efficacy, safety, and ease of use for specific clinical indications, ensuring a tailored approach to vascular plaque removal. Understanding these segments is crucial for strategic decision-making and market forecasting.

- By Product Type

- Directional Atherectomy Devices: These devices feature a cutting blade or a rotational burr on one side of a catheter, allowing for precise plaque removal in a targeted direction. They are highly effective for eccentric lesions and for creating a channel in vessels.

- Rotational Atherectomy Devices: Employing a high-speed rotating burr, typically diamond-tipped, these devices pulverize calcified plaque into microscopic particles that are safely absorbed by the bloodstream. They are particularly effective for severely calcified and fibrotic lesions.

- Orbital Atherectomy Devices: Utilizing an eccentrically mounted, diamond-coated crown, these devices ablate plaque in a pulsatile, orbital motion, enlarging the vessel lumen. They are known for treating a wide range of calcified lesions in varying vessel diameters.

- Laser Atherectomy Devices: These devices use excimer lasers to vaporize plaque through photothermal and photochemical mechanisms, making them suitable for friable plaque, in-stent restenosis, and chronic total occlusions.

- Other Atherectomy Devices: This category includes a variety of specialized or emerging atherectomy technologies, potentially incorporating advanced imaging or novel plaque removal mechanisms.

- By Application

- Peripheral Artery Disease (PAD): Atherectomy devices are extensively used in the treatment of PAD, particularly in the lower extremities, to restore blood flow, alleviate symptoms, and prevent limb loss in patients with critical limb ischemia.

- Coronary Artery Disease (CAD): While less common than in PAD, atherectomy is employed in CAD cases, especially for complex, calcified, or diffuse lesions where balloon angioplasty or stenting might be challenging or less effective.

- By End-User

- Hospitals: Hospitals represent the largest end-user segment due to their comprehensive infrastructure, skilled personnel, and capacity to handle a wide range of complex vascular interventions, including emergencies.

- Ambulatory Surgical Centers (ASCs): ASCs are gaining prominence as cost-effective and efficient settings for elective atherectomy procedures, driven by shorter patient stays and lower overheads compared to traditional hospitals.

- Cath Labs & Specialty Clinics: Dedicated cardiac catheterization laboratories and specialized vascular clinics increasingly perform atherectomy procedures, offering focused expertise and advanced facilities for interventional cardiology and peripheral vascular treatments.

Value Chain Analysis For Atherectomy Devices Market

The value chain for the atherectomy devices market is a complex network involving several interdependent stages, from the sourcing of raw materials to the delivery and post-sales support of the final medical device. This intricate chain ensures the efficient production, distribution, and utilization of these highly specialized instruments. At the upstream end, the process begins with the procurement of high-quality raw materials such as biocompatible polymers, specialized metals (e.g., nitinol, stainless steel), sophisticated electronic components, and advanced coatings. These materials are sourced from specialized suppliers who adhere to stringent quality and regulatory standards for medical-grade inputs. Following this, component manufacturing involves the precision engineering of various parts, including miniature motors, cutting blades, laser components, catheter shafts, and guidewires, often requiring highly specialized manufacturing capabilities and cleanroom environments to maintain sterility and performance integrity. Research and development activities, which involve extensive preclinical and clinical trials, are integral at this stage to innovate new device designs and improve existing ones, ensuring efficacy and patient safety.

Moving downstream, the core activity involves the assembly and intricate manufacturing of the atherectomy devices themselves, often under strict regulatory oversight from bodies like the FDA or EMA. This stage typically incorporates advanced automation alongside skilled manual assembly to ensure the precision and reliability of each device. Post-manufacturing, quality control and testing are paramount, involving rigorous validation of device performance, sterility, and structural integrity. Distribution channels then play a critical role in reaching the end-users. Direct distribution involves manufacturers utilizing their own sales force to engage directly with major hospitals, large healthcare networks, and key opinion leaders. This approach allows for direct communication, specialized product training, and tailored customer support, which is essential for complex medical devices. Indirect distribution, conversely, leverages third-party distributors and wholesalers who have established networks and logistics capabilities to reach a broader base of smaller hospitals, ambulatory surgical centers, and specialty clinics, especially in geographically diverse or emerging markets. These distributors often handle warehousing, inventory management, and local sales support, streamlining the supply chain.

The final stages of the value chain involve the utilization of atherectomy devices by healthcare providers, primarily interventional cardiologists and vascular surgeons, within hospitals, ambulatory surgical centers, and specialized cath labs. This stage includes comprehensive training and education for clinicians provided by manufacturers or their distributors to ensure proper and safe device usage. Post-sales support, including technical assistance, maintenance, and ongoing clinical education, is also a crucial aspect, contributing to long-term customer satisfaction and brand loyalty. Reimbursement processes, which involve securing coverage from insurance providers, significantly influence the market's downstream dynamics, impacting access and affordability for patients. The efficiency and effectiveness of each stage in this value chain are critical to ensuring that innovative atherectomy devices reach patients who need them, ultimately driving market growth and improving clinical outcomes.

Atherectomy Devices Market Potential Customers

The primary potential customers and end-users for atherectomy devices are highly specialized medical professionals and the advanced healthcare facilities in which they practice. These devices are not consumer products but sophisticated tools designed for complex medical interventions. The core buyers are typically interventional cardiologists who specialize in treating coronary artery disease and other heart-related vascular conditions, and vascular surgeons or interventional radiologists who focus on peripheral artery disease and other non-cardiac vascular pathologies. These specialists require advanced training and expertise to safely and effectively operate atherectomy devices, making them the direct decision-makers and key influencers in the purchasing process for their respective departments or institutions. Their clinical preferences, experience with specific device types, and perceived efficacy directly impact adoption rates and market share for various manufacturers.

Beyond individual practitioners, the institutional buyers include a variety of healthcare settings. Hospitals, particularly those with dedicated cardiac catheterization laboratories (cath labs) and vascular surgery departments, represent the largest segment of end-users. These institutions possess the comprehensive infrastructure, multidisciplinary teams, and patient volume necessary to perform a wide range of complex atherectomy procedures. Their purchasing decisions are influenced by factors such as device cost, clinical outcomes, ease of integration with existing equipment, and the availability of robust training and support from manufacturers. The shift towards outpatient care is also elevating the importance of ambulatory surgical centers (ASCs) as significant potential customers. ASCs provide a more cost-effective and convenient setting for elective atherectomy procedures, appealing to both patients and payers. Their purchasing criteria often prioritize efficiency, patient throughput, and device simplicity, alongside clinical effectiveness.

Furthermore, specialized cath labs and vascular clinics, which may operate independently or as part of larger hospital networks, also constitute a vital customer base. These facilities are specifically equipped for diagnostic and interventional cardiovascular and peripheral procedures, making them natural adopters of advanced atherectomy technologies. Government healthcare systems and large integrated delivery networks (IDNs) are also major customers, procuring devices on a larger scale through centralized purchasing agreements, where factors like long-term cost-effectiveness, contract terms, and supply chain reliability become paramount. Lastly, academic and research institutions, while not primary purchasers for routine clinical use, serve as important centers for evaluating new atherectomy technologies, participating in clinical trials, and influencing future adoption patterns through their research and educational initiatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.35 billion |

| Market Forecast in 2032 | USD 2.16 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boston Scientific Corporation, Medtronic Plc, Philips Healthcare, Cardiovascular Systems Inc. (CSI), Avinger Inc., Spectranetics Corporation (now part of Philips), Intact Vascular Inc. (now part of Philips), Terumo Corporation, BD (Becton, Dickinson and Company), Abbott Laboratories, Penumbra Inc., Shockwave Medical Inc., AngioDynamics Inc., Cook Medical LLC, Getinge AB, Asahi Intecc Co. Ltd., B. Braun MelsuB. Braun Melsungen AG, Teleflex Incorporated, Merit Medical Systems Inc., Nipro Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Atherectomy Devices Market Key Technology Landscape

The technology landscape for the atherectomy devices market is characterized by continuous innovation aimed at enhancing device efficacy, improving patient safety, and expanding treatment applications. At the core are highly specialized catheter designs that enable precise navigation through complex and often tortuous vascular anatomies. These catheters incorporate advanced materials, such as flexible polymers and super-elastic alloys like Nitinol, to provide optimal steerability, trackability, and kink resistance, allowing for access to distal lesions. The plaque removal mechanisms themselves represent a diverse array of sophisticated technologies, including high-speed rotational burrs coated with diamond particles, directional cutting blades that can be oriented within the vessel, and eccentrically mounted orbital crowns designed to ablate calcified plaque. Laser atherectomy technology, utilizing excimer lasers, offers a unique approach by vaporizing plaque through photothermal and photochemical effects, particularly effective for softer plaque and in-stent restenosis. Each of these core technologies is continually refined to minimize vessel trauma and reduce the risk of complications such as embolization or perforation.

Beyond the core plaque removal components, the integration of advanced imaging modalities is a critical technological advancement shaping the market. Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT) are increasingly being incorporated, either as standalone imaging catheters used in conjunction with atherectomy, or, in some cases, directly integrated into the atherectomy catheter itself. These imaging technologies provide high-resolution, real-time visualization of the vessel lumen, plaque morphology, and device-vessel interaction, allowing interventionalists to precisely assess lesion characteristics, guide device selection, and monitor the immediate results of the procedure. This enhanced visualization significantly improves procedural accuracy and reduces reliance on fluoroscopy, thereby decreasing radiation exposure for both patients and clinicians. Furthermore, advancements in guidewire technology, including hydrophilic coatings and improved torque transmission, are crucial for navigating challenging lesions and ensuring device delivery.

Emerging technologies also include the development of active aspiration systems to reduce the risk of distal embolization by capturing ablated debris, improving procedural safety. There is a growing focus on integrating smart sensors within atherectomy devices to provide real-time feedback on parameters such as rotational speed, cutting depth, and pressure, allowing for more controlled and personalized plaque removal. Robotic-assisted atherectomy systems are also being explored, aiming to enhance precision, reduce operator fatigue, and potentially enable remote operations. The future landscape will likely see a greater emphasis on combination therapies, such as drug-coated atherectomy devices that combine plaque debulking with localized drug delivery to inhibit restenosis, offering a more comprehensive treatment approach. Additionally, biocompatible coatings and anti-thrombotic surfaces on device components are continually being developed to improve device performance and patient outcomes, collectively pushing the boundaries of minimally invasive vascular intervention.

Regional Highlights

- North America: The North American atherectomy devices market maintains a dominant position globally, driven by a confluence of factors including the high prevalence of cardiovascular and peripheral artery diseases, particularly in an aging population. The region benefits from highly advanced healthcare infrastructure, robust reimbursement policies that facilitate access to expensive interventional procedures, and a strong emphasis on early adoption of innovative medical technologies. Significant investments in research and development by key market players, coupled with a high awareness among both clinicians and patients regarding advanced treatment options, further solidify its leading market share. The United States, in particular, is a key contributor to this dominance, characterized by a sophisticated healthcare system and substantial healthcare expenditure.

- Europe: Europe represents a mature yet steadily growing market for atherectomy devices. The region's growth is underpinned by an increasing incidence of vascular diseases in its aging population, coupled with well-established healthcare systems and a strong focus on clinical excellence. Favorable government initiatives aimed at reducing the burden of cardiovascular diseases and improving access to innovative treatments also contribute to market expansion. While reimbursement policies can vary significantly between countries within Europe, the overall trend supports the adoption of minimally invasive procedures. Germany, France, and the United Kingdom are among the leading countries in terms of market size and technological adoption, with a growing emphasis on value-based healthcare.

- Asia Pacific (APAC): The Asia Pacific market is projected to be the fastest-growing region for atherectomy devices during the forecast period. This rapid expansion is attributed to several powerful drivers, including a massive and expanding patient pool afflicted with cardiovascular and peripheral vascular diseases, rapidly improving healthcare infrastructure, and a significant increase in healthcare expenditure across countries like China, India, and Japan. Rising disposable incomes, increasing awareness regarding advanced treatment options, and the growing trend of medical tourism further propel market growth. While reimbursement systems are still evolving in many parts of the region, the unmet medical needs and the increasing willingness to invest in advanced treatments present substantial opportunities for market players.

- Latin America: The Latin American atherectomy devices market is an emerging region demonstrating gradual growth. Factors contributing to this growth include improving economic conditions in key countries such as Brazil and Mexico, leading to increased healthcare spending and greater access to advanced medical technologies. Efforts to modernize healthcare infrastructure and the rising prevalence of chronic lifestyle diseases are also driving demand for interventional vascular procedures. Challenges such as limited reimbursement coverage in some areas and disparities in healthcare access across the region exist, but the overall trajectory points towards steady expansion as healthcare systems develop and become more sophisticated, fostering an environment for greater adoption of atherectomy devices.

- Middle East and Africa (MEA): The Middle East and Africa region currently holds a smaller share of the atherectomy devices market but is expected to witness moderate growth in the coming years. This growth is primarily fueled by increasing investments in healthcare infrastructure development, particularly in Gulf Cooperation Council (GCC) countries, and a rising awareness of vascular diseases. The growing prevalence of diabetes and hypertension, which are major risk factors for PAD and CAD, also contributes to the rising patient population requiring advanced interventions. However, market expansion faces hurdles such as varying healthcare regulations, limited access to advanced medical facilities in some sub-regions, and economic disparities, necessitating targeted market entry strategies and collaborative efforts to improve healthcare accessibility and affordability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Atherectomy Devices Market.- Boston Scientific Corporation

- Medtronic Plc

- Philips Healthcare (including Spectranetics Corporation and Intact Vascular Inc.)

- Cardiovascular Systems Inc. (CSI)

- Avinger Inc.

- Terumo Corporation

- BD (Becton, Dickinson and Company)

- Abbott Laboratories

- Penumbra Inc.

- Shockwave Medical Inc.

- AngioDynamics Inc.

- Cook Medical LLC

- Getinge AB

- Asahi Intecc Co. Ltd.

- B. Braun Melsungen AG

- Teleflex Incorporated

- Merit Medical Systems Inc.

- Nipro Corporation

- C. R. Bard Inc. (now part of BD)

- Johnson & Johnson (through subsidiaries)

Frequently Asked Questions

What is an atherectomy and when is it used?

Atherectomy is a minimally invasive procedure that uses a specialized catheter-based device to physically remove atherosclerotic plaque from inside an artery. It is primarily used to treat Peripheral Artery Disease (PAD) and certain types of Coronary Artery Disease (CAD), particularly when plaque is calcified or fibrotic, and when balloon angioplasty or stenting alone may not be effective. The goal is to restore blood flow and reduce symptoms without resorting to open surgical bypass.

How effective are atherectomy devices in treating vascular disease?

Atherectomy devices are highly effective in debulking or removing arterial plaque, particularly calcified lesions that are resistant to other treatments. Their efficacy is measured by improved blood flow, reduced symptoms, and prevention of re-narrowing (restenosis). Success rates vary based on lesion type, location, and patient factors, but atherectomy often provides immediate symptomatic relief and can facilitate successful subsequent balloon angioplasty or stenting by preparing the vessel. Long-term patency rates are continuously improving with device advancements.

What are the potential risks and complications associated with atherectomy procedures?

While generally safe, atherectomy procedures carry potential risks, including vessel perforation or dissection (tearing of the artery wall), distal embolization (plaque fragments traveling downstream and blocking smaller vessels), vasospasm, and bleeding or bruising at the access site. Serious complications are rare, and procedural safety is continuously enhanced through advanced imaging guidance, improved device designs, and increased operator experience. Patient selection and careful technique are crucial to minimize these risks.

How does atherectomy compare to other treatments like angioplasty and stenting?

Atherectomy differs from angioplasty and stenting as it physically removes plaque, whereas angioplasty compresses it against the vessel wall, and stenting props the vessel open. Atherectomy is often used as a preparatory step for angioplasty and stenting, especially for calcified or challenging lesions, to improve the effectiveness of these subsequent procedures. It can also be a standalone treatment in specific cases, particularly to minimize the need for a permanent implant like a stent or to treat in-stent restenosis.

What are the latest innovations driving the atherectomy devices market?

Recent innovations include the integration of advanced intravascular imaging (IVUS and OCT) directly into atherectomy catheters for real-time visualization and precise plaque removal guidance. Manufacturers are also developing devices with enhanced lesion crossing capabilities, improved aspiration systems to reduce embolization risk, and more sophisticated cutting mechanisms for various plaque morphologies. The future holds promise for drug-coated atherectomy devices and potential robotic assistance, aiming to further improve procedural efficacy, safety, and long-term patient outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager