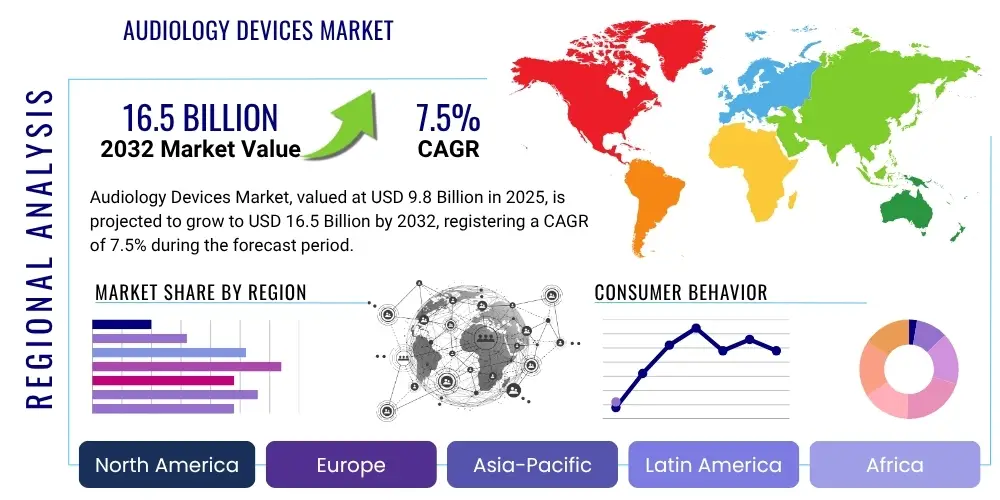

Audiology Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429014 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Audiology Devices Market Size

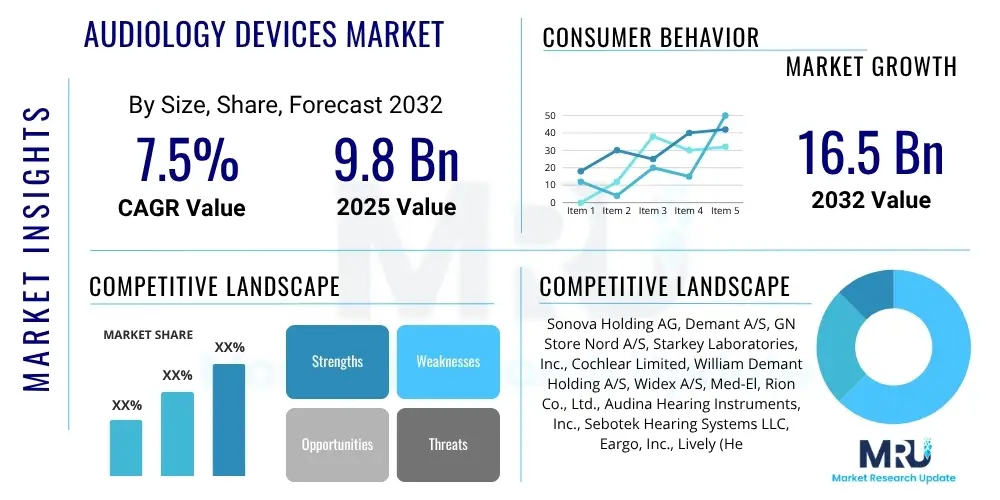

The Audiology Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at USD 9.8 Billion in 2025 and is projected to reach USD 16.5 Billion by the end of the forecast period in 2032.

Audiology Devices Market introduction

The Audiology Devices Market encompasses a wide range of medical instruments and technologies designed for the diagnosis, treatment, and management of hearing impairments and balance disorders. This market includes products such as hearing aids, cochlear implants, bone-anchored hearing systems, diagnostic audiometers, and otoacoustic emission (OAE) devices. These devices are crucial in enhancing the quality of life for individuals suffering from hearing loss, providing them with improved communication capabilities and better integration into social and professional environments. The continuous evolution of these technologies, driven by advancements in digital signal processing, miniaturization, and connectivity, significantly contributes to their efficacy and user acceptance.

Major applications of audiology devices span across various settings, including hospitals, audiology clinics, private practices, and consumer homes. Hearing aids, for instance, are primarily used by individuals with mild to severe hearing loss to amplify sounds, while cochlear implants offer a solution for profound sensorineural hearing loss by directly stimulating the auditory nerve. Diagnostic tools are vital for early detection and precise characterization of hearing and balance conditions, enabling timely intervention. The benefits extend beyond hearing restoration, encompassing improved cognitive function, reduced social isolation, and enhanced overall well-being, directly addressing significant public health challenges associated with an aging global population.

Driving factors for the audiology devices market include the escalating global prevalence of hearing loss, especially among the elderly population, and the increasing awareness regarding the importance of early diagnosis and intervention. Technological advancements, such as the integration of artificial intelligence, Bluetooth connectivity, and rechargeable batteries into hearing aids, are making these devices more user-friendly and effective. Furthermore, supportive government initiatives and reimbursement policies in developed economies are playing a pivotal role in increasing accessibility and affordability. The growing adoption of telehealth services for audiology care also represents a significant growth catalyst, expanding reach to underserved populations and improving patient convenience.

Audiology Devices Market Executive Summary

The audiology devices market is experiencing robust growth, primarily fueled by an aging global population and a rising incidence of hearing impairments across all age groups. Business trends indicate a strong emphasis on product innovation, with manufacturers heavily investing in research and development to introduce advanced features such as AI-powered noise reduction, seamless smartphone integration, and extended battery life. Strategic collaborations between device manufacturers and healthcare providers, along with increased merger and acquisition activities, are shaping the competitive landscape, aiming to consolidate market share and expand geographical presence. Additionally, a shift towards direct-to-consumer sales models and subscription-based services is emerging, particularly for entry-level hearing aids, enhancing market accessibility and affordability.

Regional trends highlight North America and Europe as dominant markets, attributed to sophisticated healthcare infrastructure, high awareness levels, and favorable reimbursement policies. However, the Asia Pacific region is anticipated to exhibit the fastest growth rate, driven by a large untapped patient pool, improving healthcare expenditure, and increasing awareness campaigns in developing economies like China and India. Latin America, the Middle East, and Africa are also showing promising growth potential, albeit from a smaller base, due to rising medical tourism, expanding urban populations, and gradual improvements in healthcare access. Cultural factors and socio-economic disparities, however, continue to influence market penetration rates across these diverse geographies, necessitating tailored marketing and distribution strategies.

Segment trends reveal a significant demand for digital hearing aids, which offer superior sound processing capabilities and customization options. Within hearing aids, receiver-in-canal (RIC) and behind-the-ear (BTE) models remain popular due to their versatility and power, while in-the-ear (ITE) and completely-in-canal (CIC) models cater to aesthetic preferences. The cochlear implant segment is witnessing steady growth due to technological refinements improving speech perception outcomes and expanding candidacy criteria. Diagnostic devices are also experiencing advancements, with portable and automated screening tools gaining traction, facilitating early detection in primary care settings and schools. The distribution channels are evolving, with a growing reliance on online platforms and tele-audiology services complementing traditional clinic-based sales, underscoring a broader shift towards patient-centric and convenient care delivery models.

AI Impact Analysis on Audiology Devices Market

Users frequently inquire about how artificial intelligence (AI) is transforming audiology devices, focusing on improvements in sound quality, personalized hearing experiences, and accessibility. Common questions revolve around AI’s ability to filter background noise more effectively, adapt to different sound environments automatically, and whether it can assist in early diagnosis or remote hearing care. There is also considerable interest in the potential for AI to make hearing solutions more discreet, comfortable, and affordable, along with concerns about data privacy and the complexity of these advanced technologies for everyday users. The overarching expectation is that AI will make audiology devices smarter, more intuitive, and ultimately more effective in addressing the diverse and complex needs of individuals with hearing loss.

- AI-powered noise reduction algorithms significantly improve speech clarity in challenging listening environments by differentiating speech from background noise.

- Adaptive sound processing allows devices to automatically adjust settings based on the user's acoustic surroundings, offering a seamless and personalized listening experience.

- Machine learning models enable personalized sound profiles by analyzing user preferences and listening patterns over time, leading to highly customized amplification.

- Tele-audiology platforms leverage AI for remote diagnostics, device programming, and fine-tuning, expanding access to care, especially in underserved areas.

- AI assists in predictive analytics for hearing health, potentially identifying individuals at risk of hearing loss earlier through data analysis from connected devices.

- Integration of AI into diagnostic tools enhances the accuracy and speed of hearing assessments, aiding clinicians in more precise diagnoses.

- Natural language processing (NLP) in some advanced hearing aids can interpret spoken commands or translate languages, adding utility beyond basic amplification.

- AI facilitates the development of intelligent feedback cancellation systems, preventing annoying whistling sounds often associated with hearing aids.

- Personalized amplification strategies can be developed by AI algorithms, optimizing sound delivery based on individual ear canal acoustics and hearing profiles.

- AI contributes to the miniaturization and efficiency of chipsets within devices, allowing for more powerful processing in smaller form factors and extended battery life.

DRO & Impact Forces Of Audiology Devices Market

The audiology devices market is propelled by significant drivers, including the global rise in the prevalence of hearing loss across all age groups, a phenomenon closely tied to an aging population and increasing exposure to noise-induced hearing damage. Continuous technological advancements, such as the integration of artificial intelligence, superior digital signal processing, and enhanced connectivity options, are making devices more effective, comfortable, and appealing to users, thus stimulating demand. Furthermore, growing public awareness campaigns about hearing health, coupled with favorable government initiatives and reimbursement policies in key regions, are fostering early diagnosis and greater adoption of audiology solutions. These factors collectively create a robust growth environment, encouraging innovation and market expansion.

Despite strong growth drivers, the market faces several restraints. The high cost of advanced audiology devices, particularly cochlear implants and premium hearing aids, presents a significant barrier to adoption, especially in developing economies or for individuals without comprehensive insurance coverage. Social stigma associated with wearing hearing aids, although gradually diminishing, still dissuades some potential users from seeking help. Additionally, the lack of skilled audiologists and hearing healthcare professionals in many parts of the world limits access to proper diagnosis, fitting, and follow-up care, impeding market penetration. The complex regulatory landscape and lengthy approval processes for new devices also pose challenges for manufacturers, extending time-to-market.

Opportunities within the audiology devices market are abundant and diverse. The burgeoning market in emerging economies, characterized by large untapped populations and improving healthcare infrastructure, offers substantial growth potential for affordable and accessible solutions. The increasing adoption of tele-audiology and remote care services presents a transformative opportunity to expand access to diagnosis and device management, overcoming geographical barriers. Furthermore, the development of over-the-counter (OTC) hearing aids in certain regions aims to reduce costs and increase accessibility for individuals with mild to moderate hearing loss, potentially expanding the overall market size. Innovations in personalized medicine and wearable technology integration also open new avenues for highly customized and integrated hearing health solutions.

The impact forces influencing this market are multifaceted. Demographic shifts, particularly the global increase in the geriatric population, inherently drive demand for hearing restoration technologies. Technological breakthroughs, especially in digital signal processing and AI, continuously reshape product offerings, leading to more sophisticated and user-friendly devices. Economic factors, including healthcare expenditure levels and disposable incomes, directly affect purchasing power and device affordability. Sociocultural aspects, such as evolving perceptions of hearing aids and increasing health consciousness, influence adoption rates. Finally, regulatory frameworks and government health policies significantly impact market entry, product development, and the overall accessibility and pricing of audiology devices, collectively creating a dynamic and responsive market environment.

Segmentation Analysis

The audiology devices market is broadly segmented based on product type, end user, and distribution channel, reflecting the diverse range of solutions and target demographics within the hearing health landscape. This segmentation allows for a detailed analysis of market dynamics, competitive positioning, and growth opportunities across various categories. Each segment exhibits unique characteristics driven by technological advancements, patient needs, and healthcare delivery models. Understanding these distinctions is crucial for strategic planning and resource allocation within the industry. The market's complexity necessitates a granular approach to identify specific areas of growth and challenges, guiding product development and market expansion strategies.

- By Product Type

- Hearing Aids

- Behind-The-Ear (BTE) Hearing Aids

- In-The-Ear (ITE) Hearing Aids

- Receiver-In-Canal (RIC) Hearing Aids

- Completely-In-Canal (CIC) Hearing Aids

- Invisible-In-Canal (IIC) Hearing Aids

- Open-Fit Hearing Aids

- Cochlear Implants

- Bone-Anchored Hearing Systems (BAHS)

- Diagnostic Devices

- Audiometers

- Tympanometers

- Otoacoustic Emission (OAE) Devices

- Auditory Evoked Potential (AEP) Devices

- Hearing Protection Devices

- Hearing Aids

- By End User

- Hospitals

- Audiology Clinics

- Home Care Settings

- Research Institutes

- ENT Clinics

- Academic Institutions

- By Distribution Channel

- Retail Sales

- Wholesale/Distributor

- E-commerce/Online Stores

- Hospital Pharmacies

- Specialty Clinics

- Government Tenders

Value Chain Analysis For Audiology Devices Market

The value chain for the audiology devices market begins with upstream activities involving the research and development of core technologies and components. This stage includes sourcing specialized microelectronics, digital signal processors, advanced transducers, and miniaturized battery technologies. Key players in this phase are often specialized component manufacturers and technology innovators who supply the intricate parts required for high-performance hearing devices. Extensive investment in materials science, acoustic engineering, and software development is critical here, ensuring the foundation for effective and innovative audiology solutions. Quality control and intellectual property protection are paramount at this foundational level to maintain competitive advantage.

Moving downstream, the value chain encompasses the manufacturing, assembly, and distribution of finished audiology devices. Manufacturers integrate the sourced components into final products like hearing aids, cochlear implants, and diagnostic equipment, adhering to stringent medical device regulations. This phase also involves extensive product testing, quality assurance, and regulatory approvals before market release. Distribution channels are diverse, including direct sales to audiology clinics and hospitals, partnerships with wholesalers and distributors, and an increasing reliance on e-commerce platforms for over-the-counter and entry-level devices. Effective logistics and inventory management are essential to ensure timely delivery and market penetration across various geographical regions, catering to both direct and indirect sales models.

The direct distribution channel often involves manufacturers selling directly to large hospital networks, specialized audiology clinics, or through their own branded retail stores. This model allows for greater control over pricing, branding, and customer service, fostering direct relationships with healthcare professionals and end-users. Conversely, indirect distribution relies on third-party wholesalers, distributors, and retail chains that handle sales to smaller clinics, independent audiologists, and consumer markets. This approach leverages established networks to achieve wider market reach, especially in regions where manufacturers lack a direct presence. Both channels are vital for comprehensive market coverage, with the choice often depending on product complexity, target market, and strategic objectives, while the rise of online platforms further blurs the lines, offering a hybrid direct-to-consumer approach for many segments.

Audiology Devices Market Potential Customers

Potential customers for audiology devices are primarily individuals experiencing various degrees of hearing loss, ranging from mild to profound, and those with balance disorders. The largest segment of end-users includes the geriatric population, as presbycusis (age-related hearing loss) is a widespread condition affecting a significant portion of older adults globally. Beyond the elderly, children and adults with congenital hearing impairments, noise-induced hearing loss from occupational or recreational exposure, and those with hearing loss resulting from medical conditions or ototoxic medications also form a substantial customer base. Early identification and intervention are critical for younger populations to support speech and language development.

Healthcare professionals and institutions also represent a key customer segment for diagnostic audiology devices. Hospitals, audiology clinics, private ENT practices, and primary care facilities are consistent buyers of audiometers, tympanometers, OAE devices, and AEP systems for screening, diagnosis, and monitoring of hearing health. Educational institutions, particularly those with special education programs, and occupational health departments in industries with high noise exposure, also utilize these devices for routine screenings and protective measures. The increasing demand for early detection in pediatric populations, as well as regular check-ups for adults, ensures a continuous need for sophisticated diagnostic equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 9.8 Billion |

| Market Forecast in 2032 | USD 16.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sonova Holding AG, Demant A/S, GN Store Nord A/S, Starkey Laboratories, Inc., Cochlear Limited, William Demant Holding A/S, Widex A/S, Med-El, Rion Co., Ltd., Audina Hearing Instruments, Inc., Sebotek Hearing Systems LLC, Eargo, Inc., Lively (Hear.com), Earlens Corporation, Inc., WS Audiology A/S, Nurotron Biotechnology Co. Ltd., Advanced Bionics AG, Horentek S.R.L., Amplifon S.p.A., Beltone |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Audiology Devices Market Key Technology Landscape

The audiology devices market is characterized by a rapidly evolving technological landscape, driven by advancements aimed at enhancing sound quality, user comfort, and connectivity. Digital signal processing (DSP) remains a cornerstone, enabling sophisticated algorithms for noise reduction, feedback cancellation, and speech enhancement, which are critical for improving clarity in complex listening environments. Miniaturization techniques allow for increasingly discreet and comfortable devices, fitting within smaller ear canals without compromising performance. Furthermore, the integration of rechargeable battery technology has significantly improved user convenience and reduced the environmental impact of disposable batteries, addressing a common pain point for hearing aid users.

Connectivity solutions are transforming the user experience, with Bluetooth low energy (LE) emerging as a standard for seamless direct streaming of audio from smartphones, televisions, and other media devices to hearing aids. This capability enhances the utility of hearing aids beyond mere amplification, turning them into versatile personal audio devices. Tele-audiology platforms, powered by secure cloud computing and advanced data analytics, facilitate remote fitting, adjustments, and follow-up care, significantly expanding access to audiology services, particularly in rural or underserved areas. These platforms often incorporate AI to guide users through self-fitting processes or provide personalized advice, revolutionizing the delivery of hearing healthcare.

The advent of artificial intelligence (AI) and machine learning (ML) is profoundly impacting the capabilities of audiology devices. AI algorithms are employed for highly adaptive noise classification and reduction, allowing devices to intelligently differentiate between various soundscapes and optimize settings in real-time. Machine learning models contribute to personalized amplification by learning user preferences and acoustic environments over time, thereby delivering a truly bespoke listening experience. Advanced diagnostic devices are also leveraging AI for faster, more accurate interpretation of audiometric data, supporting clinicians in precise diagnosis and treatment planning. This continuous innovation across hardware, software, and connectivity is redefining the standards of hearing care, making devices more intuitive, effective, and integrated into daily life.

Regional Highlights

- North America: Dominant market share due to high prevalence of hearing loss, advanced healthcare infrastructure, high awareness, favorable reimbursement policies, and significant R&D investment by key players.

- Europe: Second largest market, driven by an aging population, robust healthcare systems, government support for hearing health programs, and high adoption of advanced hearing technologies, particularly in Western European countries.

- Asia Pacific (APAC): Fastest growing region, fueled by a large untapped patient population, increasing healthcare expenditure, rising awareness initiatives, improving economic conditions, and expanding access to healthcare in countries like China, India, and Japan.

- Latin America: Emerging market with steady growth potential, attributed to improving economic stability, expanding healthcare access, and rising awareness about hearing health, though adoption rates remain lower compared to developed regions.

- Middle East and Africa (MEA): Exhibiting nascent growth, driven by increasing government investments in healthcare infrastructure, growing medical tourism, and a rising awareness among the urban population regarding hearing loss and available solutions.

- United States: A major contributor to the North American market, characterized by innovative product launches, strong consumer demand, and a well-established regulatory framework supporting market growth.

- Germany: A key European market with a strong emphasis on technology and R&D, coupled with a well-funded healthcare system and high patient acceptance of audiology devices.

- China: The largest market in APAC, experiencing rapid growth due to its immense population, increasing healthcare spending, and governmental efforts to improve hearing health services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Audiology Devices Market.- Sonova Holding AG

- Demant A/S

- GN Store Nord A/S

- Starkey Laboratories, Inc.

- Cochlear Limited

- William Demant Holding A/S

- Widex A/S

- Med-El

- Rion Co., Ltd.

- Audina Hearing Instruments, Inc.

- Sebotek Hearing Systems LLC

- Eargo, Inc.

- Lively (Hear.com)

- Earlens Corporation, Inc.

- WS Audiology A/S

- Nurotron Biotechnology Co. Ltd.

- Advanced Bionics AG

- Horentek S.R.L.

- Amplifon S.p.A.

- Beltone

Frequently Asked Questions

What is the projected growth rate for the Audiology Devices Market?

The Audiology Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032, driven by an aging population and technological advancements.

What are the primary drivers of growth in the Audiology Devices Market?

Key drivers include the increasing global prevalence of hearing loss, continuous technological advancements such as AI integration, rising awareness about hearing health, and supportive government initiatives and reimbursement policies.

How is AI impacting the development of audiology devices?

AI is significantly impacting audiology devices by enabling advanced noise reduction, adaptive sound processing, personalized hearing experiences, remote diagnostics through tele-audiology, and improved accuracy in diagnostic tools.

Which geographical region is expected to show the fastest growth in this market?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest growth rate in the Audiology Devices Market, primarily due to its large untapped patient pool, increasing healthcare expenditure, and rising awareness campaigns.

What are the main types of audiology devices available in the market?

The main types include various styles of hearing aids (BTE, ITE, RIC, CIC), cochlear implants, bone-anchored hearing systems, and diagnostic devices such as audiometers, tympanometers, and otoacoustic emission (OAE) devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager