Auto Collision Estimating Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431197 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Auto Collision Estimating Software Market Size

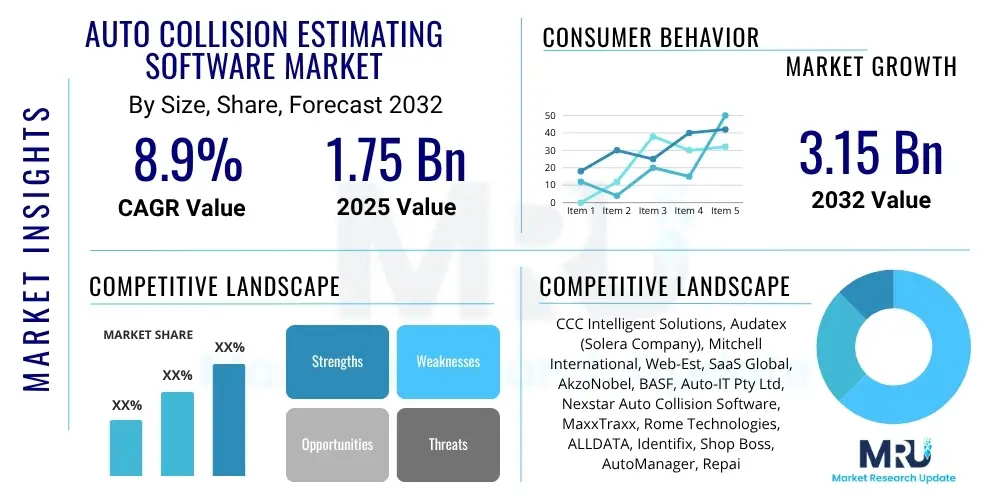

The Auto Collision Estimating Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2032. The market is estimated at USD 1.75 Billion in 2025 and is projected to reach USD 3.15 Billion by the end of the forecast period in 2032.

Auto Collision Estimating Software Market introduction

The Auto Collision Estimating Software Market encompasses specialized digital tools designed to streamline and standardize the process of assessing vehicle damage, calculating repair costs, and managing related workflows following an automobile collision. These sophisticated software solutions integrate extensive databases of vehicle specifications, parts pricing, labor rates, and repair procedures to generate accurate and consistent estimates. Their primary objective is to enhance efficiency, reduce manual errors, and provide transparent pricing for collision repair centers, insurance companies, and independent appraisers, thereby facilitating faster claim processing and improved customer satisfaction.

The product, auto collision estimating software, offers a robust platform for damage assessment, enabling users to visually identify and document vehicle damage, often through integrated photographic and 3D imaging capabilities. It automates the calculation of parts replacement or repair costs, accounting for both OEM and aftermarket components, and incorporates labor time guides for various repair operations. Major applications include use by auto body shops for customer estimates and repair planning, by insurance companies for claims verification and payout determination, and by independent adjusters for comprehensive damage appraisal.

The core benefits of adopting this software include significant improvements in estimation accuracy, substantial time savings in administrative tasks, enhanced consistency across multiple estimates, and better fraud detection capabilities. Key driving factors propelling market growth include the increasing complexity of modern vehicles, which necessitates precise damage assessment; the growing demand for faster and more transparent insurance claims processing; and the continuous advancement in digital technologies, including artificial intelligence and cloud computing, which are integrated into these solutions to offer more sophisticated functionalities and connectivity across the automotive ecosystem.

Auto Collision Estimating Software Market Executive Summary

The Auto Collision Estimating Software Market is currently experiencing robust growth, driven by several transformative business trends, including the accelerated adoption of digitalization across the automotive aftermarket and insurance sectors. A significant shift towards cloud-based solutions is evident, offering enhanced accessibility, scalability, and real-time data synchronization for collision centers and insurance providers alike. Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning is reshaping the landscape, promising greater accuracy, automation, and fraud detection capabilities in damage assessment and claims processing. The industry is also witnessing an emphasis on interoperability and seamless integration with broader shop management systems and telematics platforms, creating more holistic and efficient workflows.

Regionally, North America and Europe continue to dominate the market due to their established automotive infrastructures, high vehicle ownership rates, stringent insurance regulations, and early adoption of advanced technologies. However, the Asia Pacific region is emerging as a high-growth market, propelled by increasing disposable incomes, rising vehicle sales, improving road infrastructure, and a subsequent increase in collision rates. Latin America, the Middle East, and Africa are also demonstrating growth potential as these regions witness urbanization, expanding automotive sectors, and a gradual digitalization of their insurance and repair industries. Localized regulatory frameworks and varying levels of technological maturity continue to influence market dynamics across these diverse geographical landscapes.

Segment-wise, the market is seeing strong traction in the cloud-based deployment model due to its inherent advantages in flexibility and reduced infrastructure costs. Among applications, insurance companies are increasingly leveraging these solutions for efficient claims management and fraud prevention, while collision repair shops continue to be primary end-users, seeking to optimize their operational efficiency and customer service. The trend toward software-as-a-service (SaaS) models is particularly strong, allowing smaller independent repair shops to access sophisticated tools without significant upfront capital investment, thus democratizing access to advanced estimating capabilities and fostering broader market penetration.

AI Impact Analysis on Auto Collision Estimating Software Market

The integration of Artificial Intelligence (AI) into auto collision estimating software is a paramount concern for users, who frequently inquire about its potential to revolutionize the accuracy, speed, and fairness of damage assessments. Common user questions revolve around how AI can interpret complex damage patterns from images, its role in automating parts identification and labor calculations, and its effectiveness in flagging potentially fraudulent claims. There are also significant expectations regarding AI's ability to reduce human error, provide more consistent estimates across different adjusters, and integrate seamlessly with existing workflows. Conversely, users express concerns about data privacy, the potential for algorithmic bias in estimations, the necessity for human oversight, and the impact of AI on the job roles of human estimators and adjusters, indicating a desire for augmentation rather than complete replacement. The overarching theme is a quest for efficiency and precision without compromising ethical considerations or the critical human element of expert judgment.

- Enhanced Damage Detection: AI algorithms can analyze images and videos of vehicle damage to identify and categorize damage types with higher accuracy and speed than manual inspection.

- Automated Parts Identification: Machine learning can quickly identify necessary replacement parts, including variations due to trim levels and optional features, from visual data.

- Predictive Costing: AI can leverage vast datasets of historical repair costs, vehicle models, and damage types to provide highly accurate and predictive repair estimates.

- Fraud Detection: AI patterns recognition capabilities can identify anomalies or suspicious patterns in claims data, assisting in the prevention of insurance fraud.

- Streamlined Workflow: Automation of routine estimation tasks frees up human estimators to focus on complex cases and customer interaction, improving overall operational efficiency.

- Improved Consistency: AI-driven systems reduce variability in estimates across different assessors, leading to more standardized and fair appraisals.

- Integration with Telematics: AI can process real-time impact data from telematics systems to provide immediate preliminary damage assessments after an accident.

- Personalized Customer Experience: Faster and more accurate estimates lead to quicker claim settlements and a more transparent process for vehicle owners.

DRO & Impact Forces Of Auto Collision Estimating Software Market

The Auto Collision Estimating Software Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside various impact forces that continuously redefine its trajectory. A primary driver is the increasing complexity of modern vehicles, which incorporate advanced materials, intricate electronic systems, and sophisticated safety features, making damage assessment and repair inherently more challenging and demanding precise, software-driven solutions. Concurrently, the rising volume of road accidents globally, coupled with the persistent demand from both consumers and insurance providers for faster, transparent, and accurate claims processing, further fuels the adoption of these specialized software tools. Technological advancements, particularly in AI, machine learning, and cloud computing, also act as strong drivers, enabling more sophisticated features, enhanced accuracy, and greater accessibility for users across the ecosystem.

However, the market faces notable restraints that could impede its growth. The high initial investment required for implementing comprehensive estimating software, especially for smaller independent repair shops, can be a significant barrier to entry. Concerns regarding data security and privacy, particularly with sensitive vehicle and customer information, pose ongoing challenges for widespread adoption. Furthermore, the inherent resistance to change within traditional repair and insurance sectors, coupled with the need for continuous training and upskilling of personnel to effectively utilize these advanced tools, also acts as a dampener. The accuracy of the software is highly dependent on the quality and frequency of database updates, and any discrepancies can lead to distrust and inefficiencies.

Opportunities for market expansion are abundant, particularly in the realm of integrating these solutions with emerging technologies such as IoT devices, telematics systems, and advanced driver-assistance systems (ADAS) recalibration tools, which could create a more interconnected and automated repair ecosystem. There is also a substantial opportunity for market players to expand into untapped or underserved emerging economies, where digitalization efforts are still in nascent stages but rapidly accelerating. Additionally, the development of solutions offering enhanced predictive analytics, personalized customer experiences, and greater interoperability with existing enterprise resource planning (ERP) systems presents avenues for significant innovation and market differentiation. The continuous evolution of vehicle technology also presents a recurring opportunity for software providers to develop updated and more specialized estimating modules.

- Drivers: Increased vehicle complexity, rising collision rates, demand for faster claims processing, technological advancements (AI, ML, Cloud), stringent regulatory compliance.

- Restraints: High implementation costs, data security and privacy concerns, resistance to adopting new technologies, need for specialized training, reliance on accurate and up-to-date databases.

- Opportunity: Integration with IoT and telematics, expansion into emerging markets, development of predictive analytics features, personalized customer experience solutions, AR/VR integration for damage assessment, enhanced interoperability.

- Impact Forces: Regulatory changes in automotive and insurance industries, economic fluctuations impacting vehicle sales and repair volumes, rapid technological innovation, evolving consumer expectations for speed and transparency, competitive pressure from new entrants.

Segmentation Analysis

The Auto Collision Estimating Software Market is comprehensively segmented to provide a detailed understanding of its diverse components, applications, deployment models, and end-users. This segmentation allows for a granular analysis of market trends, growth drivers, and competitive landscapes across various sub-sectors. The market's structure reflects the different needs and operational scales of its participants, from individual repair shops to large insurance corporations, and the technological preferences influencing their software adoption decisions. Understanding these segments is crucial for stakeholders to tailor their product offerings, marketing strategies, and investment decisions, ensuring they address specific market demands effectively and capitalize on niche opportunities.

- By Component:

- Software (Cloud-based)

- Software (On-premise)

- Services (Consulting)

- Services (Implementation & Integration)

- Services (Support & Maintenance)

- By Application:

- Body Shops & Collision Repair Centers

- Insurance Companies

- Automotive Dealerships

- Independent Appraisers & Adjusters

- Fleet Operators

- By Deployment Model:

- Cloud-based

- On-premise

- By End User:

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For Auto Collision Estimating Software Market

The value chain for the Auto Collision Estimating Software Market is complex, beginning with upstream activities focused on data aggregation and software development, extending through various distribution channels, and culminating in the end-user application. Upstream, critical components include software developers who create and refine the core algorithms and user interfaces, and data providers who supply extensive databases containing vehicle specifications, parts information (OEM and aftermarket), labor rates, repair procedures, and paint codes. These data providers often collaborate with vehicle manufacturers, parts suppliers, and industry organizations to ensure accuracy and currency, which is foundational for the software's effectiveness. The quality and comprehensiveness of this data directly impact the reliability and competitive advantage of the estimating solutions.

Downstream, the value chain focuses on the delivery and application of the software to various end-users. This involves distribution channels, which can be direct, through the software vendor's sales force and online platforms, or indirect, via value-added resellers (VARs), integrators, and strategic partnerships with other automotive service providers. Direct channels offer greater control over sales and customer relationships, while indirect channels provide broader market reach and localized support. The final stage involves the actual utilization of the software by end-users—collision repair centers, insurance companies, and independent adjusters—who leverage the technology to perform damage assessments, generate estimates, manage workflows, and facilitate claims processing. The entire chain emphasizes the importance of accuracy, efficiency, and seamless information flow to deliver value to all stakeholders.

The distribution channel plays a crucial role in market penetration and customer reach. Direct sales allow software vendors to maintain close relationships with their clients, offering tailored solutions and direct support, which is often preferred by larger enterprises with complex requirements. Indirect channels, involving partners such as automotive parts distributors, industry associations, or independent consultants, are vital for reaching smaller repair shops and geographically dispersed markets. These partners often provide localized implementation, training, and ongoing support, acting as crucial intermediaries. Both direct and indirect models are essential for maximizing market coverage and ensuring that the software reaches its diverse potential customers effectively, considering their varying technological capabilities and business scales.

Auto Collision Estimating Software Market Potential Customers

The primary potential customers and end-users of Auto Collision Estimating Software are entities deeply involved in the post-collision vehicle repair and insurance claims processes. Collision repair centers, encompassing both independent body shops and large multi-location enterprises, represent a significant customer segment. These facilities rely on the software to accurately assess vehicle damage, generate detailed repair estimates for customers, manage repair workflows, order parts, and communicate with insurance providers. The efficiency and precision offered by these tools directly impact their profitability and customer satisfaction, making them essential for modern repair operations. The demand from these users is consistently high due to the continuous incidence of vehicular collisions.

Insurance companies constitute another critical customer base, leveraging the software for rapid and consistent claims processing, fraud detection, and accurate payout calculations. By utilizing standardized estimating platforms, insurers can streamline their claims management, reduce administrative overhead, and ensure fairness in settlements. This often involves integrating the estimating software with their internal claims management systems, enhancing overall operational synergy. Independent adjusters, who work on behalf of insurance companies or directly for clients, also depend on this software to conduct thorough and impartial damage appraisals, providing expert opinions that influence claim decisions and ensuring compliance with industry standards.

Beyond these core segments, automotive dealerships that operate their own body shops, and fleet operators managing large numbers of vehicles for businesses or rental purposes, also represent growing customer segments. Dealerships use the software to maintain brand-specific repair standards and ensure parts authenticity, while fleet operators utilize it for efficient damage assessment and repair planning to minimize vehicle downtime and optimize maintenance costs. As vehicle technology advances and the need for specialized repair knowledge grows, the spectrum of potential customers is expanding to include anyone involved in managing vehicle integrity post-collision, seeking efficiency, accuracy, and standardization in their operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.75 Billion |

| Market Forecast in 2032 | USD 3.15 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CCC Intelligent Solutions, Audatex (Solera Company), Mitchell International, Web-Est, SaaS Global, AkzoNobel, BASF, Auto-IT Pty Ltd, Nexstar Auto Collision Software, MaxxTraxx, Rome Technologies, ALLDATA, Identifix, Shop Boss, AutoManager, RepairCenter, AutoBody Management System (AMS), Car-O-Liner, Chief Automotive Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Auto Collision Estimating Software Market Key Technology Landscape

The Auto Collision Estimating Software Market is increasingly characterized by a sophisticated technological landscape, driven by the continuous pursuit of greater accuracy, efficiency, and automation. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, enabling software to analyze complex visual data, recognize damage patterns, automate parts identification, and predict repair costs with remarkable precision. These capabilities are powered by extensive datasets and advanced algorithms that learn from vast amounts of historical repair information, leading to more reliable and consistent estimates. AI also plays a crucial role in advanced fraud detection by identifying unusual patterns or discrepancies in claims, thus safeguarding against financial losses for insurance providers.

Cloud Computing forms another foundational technology, facilitating the transition from traditional on-premise installations to highly flexible, scalable, and accessible Software-as-a-Service (SaaS) models. Cloud-based solutions allow collision repair centers, insurance adjusters, and other stakeholders to access the software and collaborate on estimates from any location with an internet connection, promoting real-time data synchronization and improved workflow efficiency. This deployment model also reduces the upfront IT infrastructure costs for users, making advanced estimating tools accessible to a broader range of businesses, including small and medium-sized enterprises. Data Analytics, often integrated with AI, provides invaluable insights by processing the vast amounts of information collected through the estimating process. It helps in identifying repair trends, optimizing inventory management, and enhancing business intelligence for both repair shops and insurance companies, allowing for data-driven decision-making.

Furthermore, the market heavily relies on robust Application Programming Interfaces (APIs) for seamless integration with other essential automotive and insurance systems, such as shop management software, accounting platforms, customer relationship management (CRM) tools, and telematics systems. Mobile Integration is also key, with many software providers offering mobile applications that enable adjusters and technicians to perform damage assessments and generate estimates directly from the field using smartphones or tablets, enhancing mobility and reducing data entry time. Advanced imaging technologies, including 3D scanning and augmented reality (AR), are beginning to emerge, offering enhanced visual documentation of damage and more immersive assessment capabilities, promising to further refine the precision and speed of collision estimating processes.

Regional Highlights

- North America: Dominant market share due to high vehicle ownership, frequent collision rates, well-established insurance infrastructure, and early adoption of advanced automotive technologies. Stringent insurance regulations also drive the need for accurate estimating software.

- Europe: Significant market presence, driven by a large automotive industry, continuous technological advancements in vehicle safety, and a sophisticated insurance market. Strong emphasis on standardized repair procedures and data security also contributes to market growth.

- Asia Pacific (APAC): Fastest-growing region, fueled by increasing vehicle production and sales, expanding middle-class population, improving road infrastructure, and a rising number of road accidents. Rapid digitalization and increasing awareness of advanced estimating solutions among emerging economies in the region are key drivers.

- Latin America: Emerging market with substantial growth potential, supported by increasing urbanization, rising disposable incomes leading to higher vehicle ownership, and a gradual modernization of the automotive and insurance sectors. Adoption rates are picking up as businesses seek efficiency.

- Middle East and Africa (MEA): Growth driven by expanding automotive markets, significant infrastructure development, and a growing emphasis on adopting digital solutions in the insurance and repair industries. The presence of international automotive brands and insurance providers also influences technology adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Auto Collision Estimating Software Market.- CCC Intelligent Solutions

- Audatex (Solera Company)

- Mitchell International

- Web-Est

- SaaS Global

- AkzoNobel

- BASF

- Auto-IT Pty Ltd

- Nexstar Auto Collision Software

- MaxxTraxx

- Rome Technologies

- ALLDATA

- Identifix

- Shop Boss

- AutoManager

- RepairCenter

- AutoBody Management System (AMS)

- Car-O-Liner

- Chief Automotive Technologies

Frequently Asked Questions

What is Auto Collision Estimating Software?

Auto Collision Estimating Software is a specialized digital tool used by auto body shops, insurance companies, and adjusters to accurately assess vehicle damage after a collision, calculate repair costs, and generate detailed estimates based on extensive databases of parts, labor rates, and repair procedures.

How does AI impact the Auto Collision Estimating Software Market?

AI significantly enhances accuracy and efficiency by automating damage detection from images, identifying necessary parts, predicting repair costs, and flagging potential fraud. It streamlines workflows, improves consistency, and can integrate with telematics for real-time assessments, ultimately leading to faster and more precise estimates.

What are the primary benefits of using collision estimating software?

The main benefits include improved estimation accuracy, substantial time savings in administrative tasks, enhanced consistency across multiple estimates, better fraud detection capabilities, and increased transparency in the repair process for all stakeholders, leading to greater customer satisfaction.

What are the key challenges faced by the Auto Collision Estimating Software Market?

Key challenges include high initial investment costs for implementation, ongoing concerns regarding data security and privacy, resistance to new technology adoption among some users, the need for continuous training, and ensuring the constant accuracy and currency of vast underlying databases.

Which regions are leading the adoption of Auto Collision Estimating Software?

North America and Europe are currently leading the market due to their mature automotive industries, high collision rates, and early adoption of advanced digital solutions. However, the Asia Pacific region is experiencing the fastest growth, driven by increasing vehicle ownership and digital transformation initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager