Automatic Emergency Braking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429552 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automatic Emergency Braking Market Size

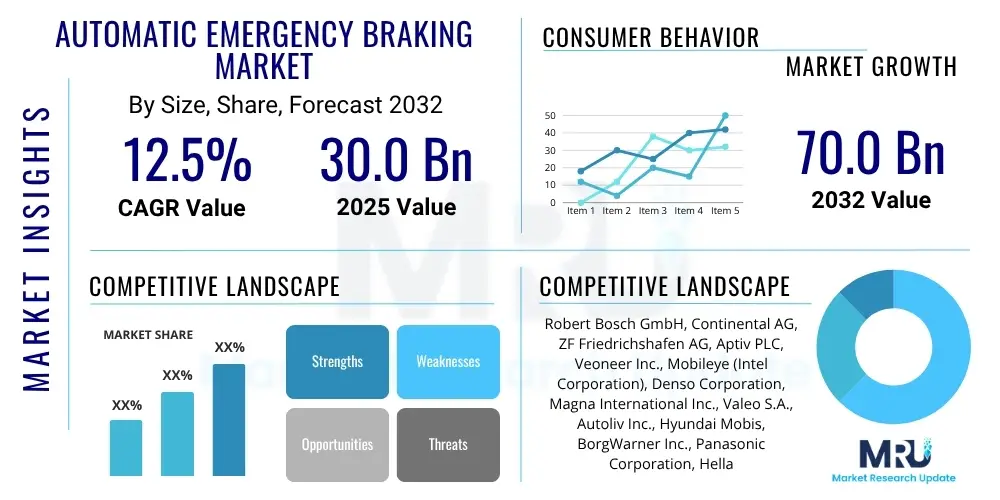

The Automatic Emergency Braking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 30.0 Billion in 2025 and is projected to reach USD 70.0 Billion by the end of the forecast period in 2032.

Automatic Emergency Braking Market introduction

The Automatic Emergency Braking (AEB) market encompasses advanced driver-assistance systems designed to prevent or mitigate collisions by automatically applying the vehicle's brakes when a potential collision is detected. These systems utilize a combination of sensors, including radar, cameras, and sometimes lidar, to monitor the road ahead for obstacles such as other vehicles, pedestrians, and cyclists. Upon detecting an imminent threat and if the driver does not react adequately, the AEB system intervenes, issuing warnings and ultimately initiating braking to avoid or lessen the impact.

The primary product in this market consists of integrated sensor suites, electronic control units (ECUs), and actuation mechanisms that interface with the vehicle's braking system. Major applications span across passenger vehicles, light commercial vehicles, and heavy-duty trucks, offering a crucial layer of safety. The significant benefits of AEB systems include a substantial reduction in accident frequency and severity, lower injury rates, and decreased economic costs associated with property damage and healthcare. These systems are increasingly becoming a standard feature, driven by stringent safety regulations and growing consumer awareness regarding vehicle safety.

Driving factors for the AEB market's expansion include the global push for enhanced road safety standards, mandates from regulatory bodies such as Euro NCAP and NHTSA, and the integration of AEB as a foundational technology for higher levels of autonomous driving. Continuous advancements in sensor technology, artificial intelligence for improved object detection and classification, and the development of more robust and reliable system architectures further fuel market growth. Furthermore, consumer demand for vehicles equipped with cutting-edge safety features, coupled with favorable insurance premiums for AEB-equipped cars, significantly contributes to market acceleration.

Automatic Emergency Braking Market Executive Summary

The Automatic Emergency Braking market is experiencing robust expansion, primarily propelled by increasing global road safety regulations and a surge in consumer demand for advanced safety features in vehicles. Business trends indicate a strong push towards sensor fusion technologies, combining radar, camera, and lidar data for enhanced accuracy and reliability in diverse driving conditions. Automotive OEMs are increasingly integrating AEB systems as standard equipment across a wider range of vehicle models, moving beyond premium segments. Strategic partnerships between Tier 1 suppliers and software developers are also becoming prevalent, focusing on refining algorithms and system integration for next-generation AEB capabilities.

Regionally, Asia Pacific is emerging as a significant growth hub due to burgeoning automotive production, rising disposable incomes, and the gradual adoption of stricter safety norms, particularly in countries like China, India, and Japan. Europe continues to lead in AEB penetration, driven by mandatory safety ratings and proactive regulatory frameworks like the European General Safety Regulation, which makes AEB compulsory for all new vehicles. North America also demonstrates consistent growth, fueled by consumer advocacy for safety and the pursuit of autonomous driving technologies that inherently rely on advanced braking systems.

In terms of segment trends, camera-based AEB systems are gaining traction due to their cost-effectiveness and ability to classify objects, while radar-based systems remain crucial for long-range detection and adverse weather conditions. The market is also witnessing a shift towards sophisticated fusion systems that leverage multiple sensor inputs to overcome individual sensor limitations, leading to more robust and reliable emergency braking. Passenger vehicles currently dominate the market, but the commercial vehicle segment, including trucks and buses, is projected to exhibit significant growth as fleet operators increasingly prioritize safety and operational efficiency.

AI Impact Analysis on Automatic Emergency Braking Market

Common user questions regarding AI's impact on the Automatic Emergency Braking Market often revolve around the accuracy and reliability of object detection, the potential for false positives or negatives, the ability of systems to differentiate between critical and non-critical obstacles, and the overall intelligence in complex traffic scenarios. Users frequently express concerns about how AI algorithms can improve response times, reduce the likelihood of avoidable collisions, and adapt to varying environmental conditions. Furthermore, there is considerable interest in how AI contributes to the seamless integration of AEB with other advanced driver-assistance systems (ADAS) and its role in the evolution towards fully autonomous vehicles, alongside questions about cybersecurity implications and ethical considerations of AI-driven decisions in critical situations.

- Enhanced object detection and classification capabilities through deep learning.

- Improved predictive braking and trajectory analysis to prevent collisions.

- Superior sensor fusion algorithms for more accurate environmental understanding.

- Adaptive braking responses tailored to dynamic traffic conditions and driver behavior.

- Reduced false positive activations by distinguishing irrelevant objects from critical threats.

- Faster processing of complex scenarios, leading to quicker and more precise interventions.

- Facilitation of AEB integration into higher levels of autonomous driving systems.

- Continuous learning and improvement of AEB performance through data analysis and OTA updates.

- Cybersecurity enhancements to protect AI models and data from malicious attacks.

- Ethical decision-making frameworks for AI in collision avoidance scenarios.

DRO & Impact Forces Of Automatic Emergency Braking Market

The Automatic Emergency Braking market is significantly shaped by a confluence of driving forces, inherent restraints, and emerging opportunities, all interacting to define its growth trajectory. Key drivers include the global imperative for enhanced road safety, manifesting in stringent governmental regulations and safety ratings from organizations like Euro NCAP and NHTSA, which increasingly mandate or incentivize AEB adoption. Consumer awareness regarding vehicle safety and the desire for advanced protective features also plays a pivotal role, pushing manufacturers to integrate these systems. Technological advancements in sensor technology, processing power, and AI algorithms continue to improve system accuracy and reliability, further propelling market growth by making AEE more effective and accessible.

Despite strong growth drivers, the market faces several restraints. The high cost associated with advanced sensor suites, complex software, and integration processes can make AEB systems expensive, particularly for entry-level vehicles, potentially limiting broader market penetration. Technical limitations, such as the performance degradation of sensors in adverse weather conditions (heavy rain, snow, fog) or in specific lighting scenarios, can lead to false positives or missed detections, eroding consumer trust. Moreover, the complexity of calibrating and maintaining these sophisticated systems, along with potential cybersecurity vulnerabilities, also presents challenges that manufacturers must address to ensure widespread adoption and public confidence.

Opportunities for the AEB market are abundant, particularly with the accelerating development of autonomous vehicles, where AEB forms a critical foundational layer. The integration of Vehicle-to-Everything (V2X) communication technologies promises to enhance AEB capabilities by providing vehicles with information beyond their direct sensor range, enabling proactive collision avoidance. Furthermore, the expansion into aftermarket solutions and the growing demand from emerging markets, where road safety infrastructure is rapidly improving, present new avenues for market players. The continuous refinement of sensor fusion, predictive analytics, and machine learning will unlock new levels of performance and reliability, ensuring AEB systems become even more integral to future mobility solutions.

Segmentation Analysis

The Automatic Emergency Braking market is meticulously segmented to provide a granular understanding of its diverse components, technologies, and applications. This segmentation allows for precise analysis of market dynamics, identification of key growth areas, and strategic decision-making for stakeholders across the value chain. The market can be broadly categorized based on technology, vehicle type, level of autonomy, and sales channel, each offering unique insights into market behavior and future potential. Understanding these segments is crucial for manufacturers to tailor their product development, for suppliers to align their offerings, and for consumers to make informed purchasing decisions about the safety features in their vehicles.

Each segment presents distinct characteristics and growth patterns. For instance, advancements in sensor technologies directly influence the performance and cost structures, impacting their adoption rates across different vehicle types. The increasing integration of AEB as a mandatory feature, particularly in new vehicle models, highlights the importance of the OEM sales channel. Furthermore, the evolution of autonomous driving levels significantly shapes the demand for more sophisticated and robust AEB systems, moving beyond simple forward collision warning to complex multi-object detection and adaptive braking solutions. This layered approach to segmentation ensures a holistic view of the market landscape.

- Technology

- Camera-based AEB

- Radar-based AEB

- Lidar-based AEB

- Sensor Fusion (Camera + Radar, Camera + Lidar, Radar + Lidar, Multi-Sensor)

- Vehicle Type

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Level of Autonomy

- L1 (Driver Assistance)

- L2/L2+ (Partial Automation)

- L3 (Conditional Automation)

- Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

- Application

- Forward Collision Warning (FCW)

- Pedestrian Detection

- Cyclist Detection

- Rear Automatic Emergency Braking

- Intersection AEB

Value Chain Analysis For Automatic Emergency Braking Market

The value chain for the Automatic Emergency Braking market is intricate, involving multiple layers of specialized suppliers, integrators, and distributors that collectively bring these advanced safety systems to market. At the upstream level, the chain begins with the fundamental component manufacturers, including developers of sophisticated sensors such as radar transceivers, high-resolution cameras, and lidar units. This stage also encompasses providers of microcontrollers, electronic control units (ECUs), and specialized semiconductor components essential for processing vast amounts of sensor data. Software development companies, crucial for creating and refining the complex algorithms that enable object detection, classification, and predictive braking, also form a critical part of the upstream segment.

Moving downstream, Tier 2 and Tier 1 suppliers play a pivotal role. Tier 2 suppliers often provide specific modules or sub-systems, such as power management units or communication interfaces, to Tier 1 integrators. Tier 1 suppliers, such as major automotive electronics companies, are responsible for integrating various sensors, ECUs, and software components into a complete AEB module or system. They conduct rigorous testing and validation to ensure the system meets performance and safety standards before delivering it to the original equipment manufacturers (OEMs). OEMs then integrate these comprehensive AEB systems into their vehicle architectures, ensuring seamless functionality with other vehicle systems like steering, powertrain, and infotainment.

The distribution channels for AEB systems are primarily direct, with Tier 1 suppliers selling directly to automotive OEMs for factory installation. This is the dominant model, reflecting the complex integration requirements and the critical safety implications of AEB technology. Indirect channels, though significantly smaller, exist in the aftermarket segment, where specialized companies may offer AEB retrofit solutions or upgrades, often targeting older vehicle models or commercial fleets. However, due to the critical nature and deep integration of AEB systems, the OEM channel remains the most influential and significant route to market, driving economies of scale and ensuring rigorous quality control.

Automatic Emergency Braking Market Potential Customers

The primary potential customers and end-users of Automatic Emergency Braking systems are the automotive Original Equipment Manufacturers (OEMs), encompassing manufacturers of passenger vehicles, light commercial vehicles, and heavy commercial vehicles. These OEMs are the direct buyers from Tier 1 suppliers, integrating AEB systems as standard or optional safety features into their new vehicle models to meet regulatory mandates, improve safety ratings, and cater to consumer demand for advanced driver assistance systems. Their purchasing decisions are heavily influenced by cost-effectiveness, system reliability, integration complexity, and the ability of AEB solutions to enhance their brand's safety reputation and competitive positioning in the global automotive market.

Beyond direct OEM integration, fleet operators represent another significant segment of potential customers. This includes large logistics companies, ride-sharing services, public transportation authorities, and governmental agencies managing extensive vehicle fleets. For these entities, the adoption of AEB systems, whether through new vehicle purchases or aftermarket retrofits, translates directly into reduced accident rates, lower insurance premiums, minimized vehicle downtime, and enhanced safety for their drivers and cargo. The economic benefits derived from accident prevention make AEB an attractive investment for optimizing operational costs and ensuring business continuity.

While less direct, regulatory bodies and consumer safety organizations also exert considerable influence as "customers" in shaping the market by establishing safety standards, conducting crash tests, and promoting public awareness. Their initiatives effectively drive demand for AEB technology among OEMs and end-consumers. Ultimately, the broader driving public, as the eventual occupants and owners of vehicles, are the ultimate beneficiaries and indirect customers, as their purchasing preferences and safety concerns inform the entire value chain, driving the continuous innovation and adoption of AEB systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 30.0 Billion |

| Market Forecast in 2032 | USD 70.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Aptiv PLC, Veoneer Inc., Mobileye (Intel Corporation), Denso Corporation, Magna International Inc., Valeo S.A., Autoliv Inc., Hyundai Mobis, BorgWarner Inc., Panasonic Corporation, Hella GmbH & Co. KGaA, Renesas Electronics Corporation, NXP Semiconductors, Infineon Technologies AG, Texas Instruments, NVIDIA Corporation, Hitachi Astemo, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Emergency Braking Market Key Technology Landscape

The Automatic Emergency Braking market is characterized by a rapidly evolving technological landscape, driven by continuous innovation in sensing, processing, and actuation systems. At the core, various sensor technologies form the primary input for AEB systems. Radar sensors, particularly long-range and short-range radars, are extensively used for detecting distances and relative speeds of objects, excelling in adverse weather conditions like fog or heavy rain. Complementing radar are camera systems, which utilize advanced image processing and computer vision algorithms to classify objects (e.g., vehicles, pedestrians, cyclists), identify lane markings, and interpret traffic signs. More recently, lidar technology is gaining traction for its high-resolution 3D mapping capabilities, offering superior spatial awareness and precision, especially in complex urban environments.

A significant trend in the AEB technology landscape is sensor fusion, where data from multiple sensor types (e.g., radar and camera) are combined and processed to create a more comprehensive and robust understanding of the vehicle's surroundings. This fusion approach mitigates the limitations of individual sensors, enhancing detection accuracy, reducing false positives, and improving overall system reliability across a wider range of driving conditions. Artificial intelligence and machine learning algorithms are pivotal to this fusion process, enabling real-time object recognition, trajectory prediction, and intelligent decision-making for braking initiation. These AI-powered systems are constantly learning from vast datasets, leading to continuous improvements in performance and adaptability.

Beyond sensing and processing, the technology landscape also includes sophisticated electronic control units (ECUs) that host the AEB algorithms and manage the system's operations. These ECUs must be highly powerful and reliable to execute complex calculations in milliseconds. Actuation systems, which interface directly with the vehicle's braking system, are also crucial. These include advanced hydraulic control units, electronic stability control (ESC) systems, and specialized brake-by-wire technologies that allow for rapid and precise application of braking force. The synergistic development and integration of these diverse technologies are fundamental to the effectiveness and widespread adoption of Automatic Emergency Braking systems, paving the way for safer and more autonomous vehicles.

Regional Highlights

- North America: Characterized by strong consumer demand for safety features and proactive initiatives from organizations like NHTSA and IIHS promoting AEB. The United States and Canada are leading in adoption, driven by technological readiness and high vehicle production.

- Europe: A pioneer in AEB implementation, largely due to stringent regulatory mandates from the European Union and influential safety rating programs like Euro NCAP, which makes AEB a standard requirement for achieving top safety ratings for new vehicles. Germany, the UK, and France are key markets.

- Asia Pacific (APAC): The fastest-growing region, fueled by expanding automotive manufacturing bases, increasing disposable incomes, and a rising focus on road safety in populous countries like China, India, Japan, and South Korea. Government initiatives to curb road fatalities are driving AEB adoption.

- Latin America: Experiencing nascent but steady growth, with increasing awareness and the gradual introduction of safety standards. Brazil and Mexico are emerging markets, influenced by global automotive production shifts and regional safety advocacy.

- Middle East and Africa (MEA): Showing potential for future growth, particularly in technologically advanced and economically stable countries within the GCC region. Adoption is driven by luxury vehicle sales and improving road safety infrastructure, though overall market penetration remains lower than in developed regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Emergency Braking Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Aptiv PLC

- Veoneer Inc.

- Mobileye (Intel Corporation)

- Denso Corporation

- Magna International Inc.

- Valeo S.A.

- Autoliv Inc.

- Hyundai Mobis

- BorgWarner Inc.

- Panasonic Corporation

- Hella GmbH & Co. KGaA

- Renesas Electronics Corporation

- NXP Semiconductors

- Infineon Technologies AG

- Texas Instruments

- NVIDIA Corporation

- Hitachi Astemo, Ltd.

Frequently Asked Questions

What is Automatic Emergency Braking (AEB)?

Automatic Emergency Braking (AEB) is an active safety system that detects potential collisions with obstacles like vehicles, pedestrians, or cyclists and automatically applies the brakes if the driver does not react in time, aiming to prevent or mitigate the severity of an accident.

How does an AEB system work?

AEB systems use sensors such as radar, cameras, or lidar to monitor the road ahead. When a potential collision is detected, the system first provides an audible or visual warning. If the driver does not respond, the AEB system intervenes by initiating partial or full braking to avoid or reduce impact speed.

What are the main benefits of having AEB in a vehicle?

The primary benefits of AEB include a significant reduction in front-to-rear collisions, fewer injuries to vehicle occupants and vulnerable road users, lower repair costs, and potentially reduced insurance premiums. It enhances overall road safety and acts as a crucial layer of protection.

Are there any limitations to Automatic Emergency Braking?

Yes, AEB systems can have limitations, including reduced performance in adverse weather conditions (heavy rain, snow, fog), during low light, or when sensors are obstructed. False positives, though rare, can also occur. System effectiveness can vary based on speed differentials and obstacle types.

Is Automatic Emergency Braking mandatory in all new vehicles?

AEB is becoming increasingly mandatory in many regions. For instance, in Europe, the General Safety Regulation makes AEB systems compulsory for all new vehicle types. While not universally mandated, safety ratings and consumer demand strongly incentivize its inclusion globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager