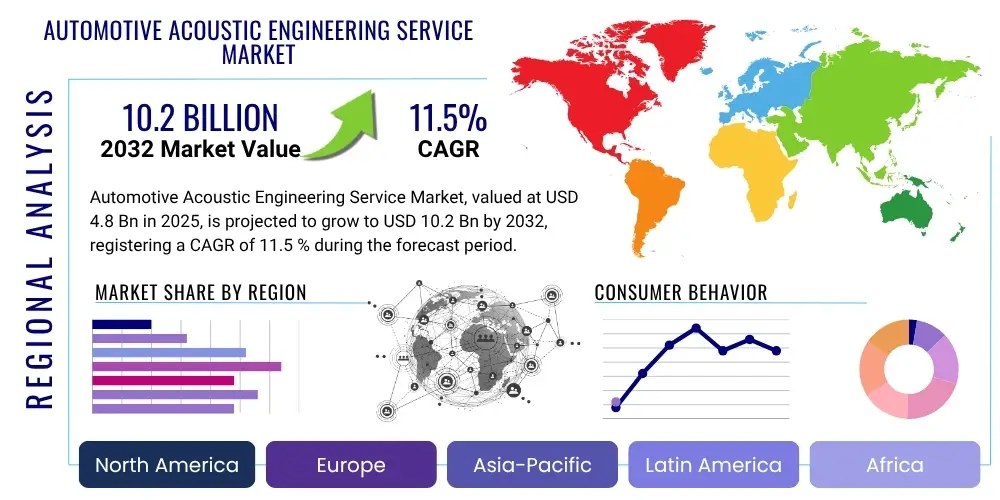

Automotive Acoustic Engineering Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428049 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Acoustic Engineering Service Market Size

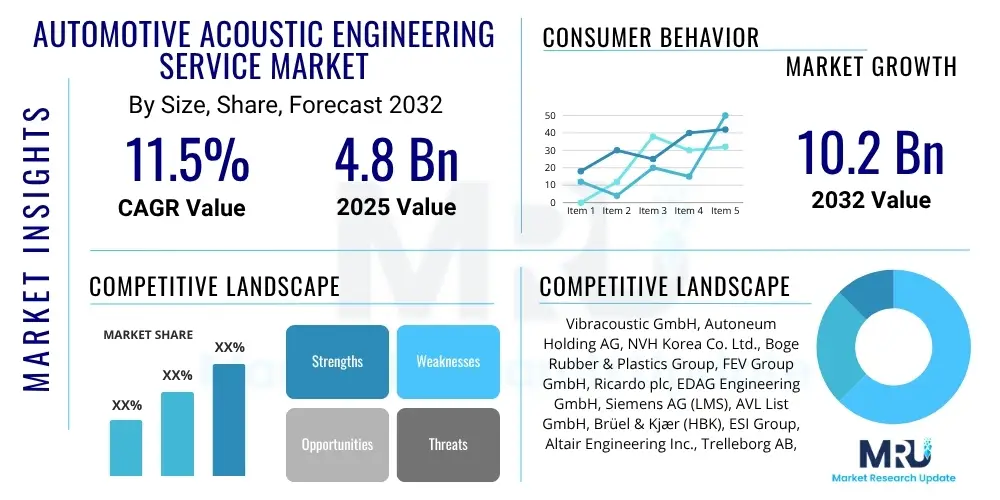

The Automotive Acoustic Engineering Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2032. The market is estimated at USD 4.8 Billion in 2025 and is projected to reach USD 10.2 Billion by the end of the forecast period in 2032. This robust expansion is fueled by an increasing demand for enhanced passenger comfort and safety, coupled with stringent global regulations on noise, vibration, and harshness (NVH) levels in vehicles. The electrification trend in the automotive industry also significantly contributes to this growth, as electric vehicles present unique acoustic challenges that require specialized engineering solutions.

The market's growth trajectory is further supported by the continuous advancements in material science, simulation software, and active noise control technologies. Automotive manufacturers are increasingly outsourcing acoustic engineering services to specialized firms to leverage their expertise, reduce in-house R&D costs, and accelerate product development cycles. This strategic shift allows OEMs to focus on core competencies while ensuring their vehicles meet evolving consumer expectations for premium acoustic performance.

Automotive Acoustic Engineering Service Market introduction

The Automotive Acoustic Engineering Service Market encompasses a specialized sector focused on designing, developing, and implementing solutions to manage sound, vibration, and harshness (NVH) characteristics within vehicles. These services are crucial for enhancing occupant comfort, improving driving dynamics, and ensuring compliance with stringent regulatory standards worldwide. The product description primarily involves expert consultation, advanced simulation and modeling, comprehensive testing, and the integration of sophisticated acoustic materials and systems.

Major applications of these services span across various vehicle types, including passenger cars, commercial vehicles, electric vehicles (EVs), and autonomous vehicles. For traditional internal combustion engine (ICE) vehicles, the focus is often on reducing engine and exhaust noise, road noise, and wind noise. In contrast, for electric vehicles, the absence of engine noise amplifies other sound sources such as tire noise, motor whine, and accessory sounds, necessitating precise acoustic tailoring to achieve a quiet and pleasant cabin environment. Furthermore, the advent of autonomous vehicles introduces new acoustic requirements related to human-machine interface (HMI) sounds and external pedestrian warning systems.

The benefits derived from these services are multifaceted. They include significantly improved passenger comfort through reduced unwanted noise and vibration, enhanced brand perception, and increased vehicle safety by ensuring optimal sound insulation and managing specific acoustic alerts. Key driving factors for this market's expansion include the escalating demand for premium vehicle experiences, stringent government regulations on noise emissions, the rapid transition to electric vehicles, and advancements in active noise control and sound design technologies. The competitive landscape pushes manufacturers to continually innovate and differentiate their offerings through superior acoustic performance.

Automotive Acoustic Engineering Service Market Executive Summary

The Automotive Acoustic Engineering Service Market is experiencing dynamic growth driven by evolving consumer preferences for comfort and the technological paradigm shift towards electric mobility. Business trends indicate a rising reliance of original equipment manufacturers (OEMs) on external acoustic engineering experts to manage complex NVH challenges, optimize design, and accelerate market entry. This outsourcing trend is amplified by the need for specialized software, testing facilities, and a deep understanding of psychoacoustics, which many OEMs find more cost-effective to acquire through service providers rather than developing in-house. Strategic partnerships and collaborations between engineering firms and material suppliers are also becoming more prevalent to offer integrated solutions.

Regional trends highlight North America and Europe as mature markets with established regulatory frameworks and a strong demand for luxury and high-performance vehicles, driving sophisticated acoustic requirements. Asia Pacific, particularly China, Japan, and India, represents the fastest-growing region, propelled by increasing vehicle production, rapid adoption of electric vehicles, and a burgeoning middle class demanding higher quality and comfort in their automotive purchases. Latin America, the Middle East, and Africa are also showing nascent growth, driven by urbanization and an expanding automotive sector, though at a slower pace compared to developed and emerging Asian markets.

Segmentation trends reveal significant growth in demand for services related to Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), as these platforms introduce unique acoustic profiles requiring specialized design and mitigation strategies. Active Noise Cancellation (ANC) and sound design services are gaining substantial traction as manufacturers seek to create distinct brand sound identities and further enhance cabin serenity. The market is also seeing a shift towards predictive acoustic engineering using advanced simulation tools earlier in the design cycle, minimizing costly physical prototypes and reducing development timelines. The integration of AI and machine learning for predictive modeling and real-time optimization is further refining these services across all segments.

AI Impact Analysis on Automotive Acoustic Engineering Service Market

The integration of Artificial Intelligence (AI) is rapidly transforming the Automotive Acoustic Engineering Service Market, addressing common user questions about efficiency, precision, and innovation. Users frequently inquire about AI's ability to streamline complex NVH analyses, reduce development cycles, and predict acoustic performance with greater accuracy. They are also keen to understand how AI can personalize cabin soundscapes and adapt to various driving conditions. Concerns often revolve around the initial investment in AI tools and the need for specialized expertise to leverage these technologies effectively. Overall, there is a strong expectation that AI will lead to more intelligent, adaptive, and customer-centric acoustic solutions, driving significant improvements in vehicle comfort and sound quality.

- AI-driven predictive modeling enables faster and more accurate NVH simulations, reducing the need for extensive physical prototyping.

- Generative design algorithms assist in optimizing acoustic component geometries and material selections for superior sound absorption and insulation.

- Real-time acoustic analysis and active noise control systems powered by AI dynamically adjust cabin sound to external conditions and passenger preferences.

- Machine learning algorithms enhance the interpretation of complex acoustic data, identifying critical noise sources and proposing optimal mitigation strategies.

- AI facilitates the creation of personalized sound experiences within the vehicle, including bespoke engine sounds for EVs or adaptive infotainment audio.

- Automated anomaly detection in acoustic testing data improves quality control and identifies potential issues earlier in the production process.

- Natural Language Processing (NLP) can be used to analyze customer feedback on vehicle acoustics, providing actionable insights for engineering improvements.

- AI supports the development of advanced external sound warning systems for electric and autonomous vehicles, enhancing pedestrian safety.

DRO & Impact Forces Of Automotive Acoustic Engineering Service Market

The Automotive Acoustic Engineering Service Market is shaped by a confluence of driving factors, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. A primary driver is the escalating global demand for enhanced passenger comfort and premium vehicle experiences, where a quiet and refined cabin environment is a key differentiator. Stricter environmental noise regulations and vehicle interior noise standards, such as those from the European Union and the United Nations Economic Commission for Europe (UNECE), compel manufacturers to invest heavily in advanced acoustic solutions. The rapid proliferation of electric vehicles (EVs) is another significant driver, as the absence of traditional engine noise amplifies other NVH issues like tire noise, motor whine, and aerodynamic sounds, creating new challenges and opportunities for acoustic engineers.

However, the market also faces considerable restraints. The high cost associated with advanced acoustic R&D, specialized testing equipment, and sophisticated simulation software can be a barrier for smaller manufacturers. The complexity of integrating diverse acoustic solutions into overall vehicle design, especially in compact spaces, presents technical challenges. Additionally, the increasing time-to-market pressures often conflict with the extensive testing and refinement cycles required for optimal acoustic performance. Economic downturns and fluctuations in automotive production can also temporarily impact demand for these specialized services, as OEMs may prioritize essential vehicle components over advanced acoustic refinements.

Despite these restraints, numerous opportunities are emerging that promise to propel the market forward. The continuous innovation in material science, leading to lighter and more effective sound-absorbing and damping materials, opens new avenues for performance improvements. The growing adoption of active noise control (ANC) systems, which use anti-phase sound waves to cancel unwanted noise, represents a significant growth area. Furthermore, the integration of artificial intelligence (AI) and machine learning into acoustic design and testing processes offers unprecedented opportunities for predictive analysis, rapid optimization, and personalized sound experiences. Emerging markets in Asia Pacific and Latin America, with their expanding automotive industries and increasing consumer purchasing power, also present substantial growth potential for acoustic engineering service providers.

Segmentation Analysis

The Automotive Acoustic Engineering Service Market is broadly segmented based on various factors including the type of service offered, the specific application areas within a vehicle, the type of vehicle, and the end-user industry. This comprehensive segmentation allows for a detailed understanding of market dynamics, identifying niche opportunities and prevailing trends. Each segment reflects distinct challenges and demands, influencing the specialized expertise and technological solutions required from service providers. The complex nature of NVH necessitates a granular approach to service delivery, tailored to specific client needs and vehicle characteristics, thereby promoting a diverse and innovative market landscape.

Understanding these segments is crucial for market participants to strategically position their offerings and address the evolving needs of the automotive industry. For instance, the transition to electric vehicles has created a unique set of acoustic challenges, leading to the emergence of dedicated service offerings for EV NVH management. Similarly, advancements in materials and simulation technologies have given rise to new service categories, indicating a continuous evolution of the market to meet technological progress and regulatory shifts. This intricate segmentation ensures that specialized engineering firms can cater to a wide spectrum of automotive manufacturers and their diverse product portfolios.

- By Service Type:

- Acoustic Material Development

- NVH Testing (e.g., Squeak and Rattle Testing, Road Noise Testing, Engine Noise Testing, Wind Noise Testing)

- Simulation & Modeling (e.g., Finite Element Analysis (FEA), Boundary Element Method (BEM), Statistical Energy Analysis (SEA))

- Active Noise Control (ANC) System Integration

- Sound Design & Quality Engineering

- Consulting & Advisory Services

- Vibration Damping Solutions

- Sound Package Optimization

- By Application:

- Interior Acoustics (Cabin Noise, HVAC Noise, Infotainment Acoustics)

- Exterior Acoustics (Pass-by Noise, Horn Noise, Pedestrian Warning Systems)

- Powertrain Acoustics (Engine Noise, Motor Whine, Transmission Noise)

- Chassis Acoustics (Tire/Road Noise, Suspension Noise, Brake Noise)

- HVAC Acoustics

- Aerodynamic Acoustics

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles, Buses)

- Electric Vehicles (Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), Plug-in Hybrid Electric Vehicles (PHEVs))

- Autonomous Vehicles

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Tier 1 Suppliers

- Component Manufacturers

- Aftermarket Companies

- Research & Development Institutions

Value Chain Analysis For Automotive Acoustic Engineering Service Market

The value chain for the Automotive Acoustic Engineering Service Market is a complex interplay of various stakeholders, spanning from raw material suppliers to the ultimate end-users. At the upstream analysis stage, the chain begins with providers of specialized acoustic materials such as sound-absorbing foams, damping sheets, insulators, and advanced composites. It also includes developers of sophisticated NVH testing equipment, such as accelerometers, microphones, data acquisition systems, and anechoic chambers, alongside software vendors offering advanced simulation and modeling tools like FEA, BEM, and SEA. These foundational elements are crucial for the development and execution of effective acoustic solutions. Access to cutting-edge technology and high-performance materials directly impacts the quality and efficacy of the services provided downstream.

The core of the value chain involves the acoustic engineering service providers themselves, which include specialized engineering firms, R&D departments of larger automotive suppliers, and in-house teams of OEMs. These entities leverage the upstream technologies and materials to conduct comprehensive NVH analysis, design innovative acoustic solutions, perform rigorous testing, and integrate these solutions into vehicle prototypes and production models. Their expertise lies in understanding complex sound propagation, vibrational mechanics, and psychoacoustics to optimize the cabin environment and external vehicle noise. The distribution channel for these services is predominantly direct, involving long-term contracts and project-based engagements between the service providers and automotive manufacturers or their Tier 1 suppliers.

Downstream analysis focuses on the end-users, primarily automotive Original Equipment Manufacturers (OEMs) who integrate the acoustic engineering solutions into their vehicle designs. Tier 1 and Tier 2 suppliers also play a crucial role by incorporating these acoustic specifications into their component designs and manufacturing processes. The ultimate beneficiaries are the vehicle buyers who experience enhanced comfort, safety, and brand perception due to superior acoustic performance. Both direct and indirect distribution channels are relevant; direct involves direct engagement between service providers and OEMs, while indirect can involve technology licensing to component manufacturers or specialized consultancies working through larger engineering consortiums. This integrated value chain ensures that the technical expertise and material innovation are effectively translated into tangible benefits for the automotive industry and its consumers.

Automotive Acoustic Engineering Service Market Potential Customers

The primary potential customers and end-users of Automotive Acoustic Engineering Services are a diverse group within the broader automotive ecosystem, all striving to enhance vehicle performance, comply with regulations, and meet evolving consumer demands. Original Equipment Manufacturers (OEMs) represent the largest segment of potential customers, ranging from global automotive giants to emerging electric vehicle startups. These manufacturers require comprehensive acoustic engineering support throughout the entire vehicle development lifecycle, from conceptual design to final production, to ensure their vehicles deliver optimal NVH performance, meet safety standards, and provide a premium user experience. Their needs span across all vehicle segments, including passenger cars, commercial vehicles, and increasingly, specialized electric and autonomous platforms.

Beyond OEMs, Tier 1 and Tier 2 automotive suppliers constitute a significant customer base. These suppliers are responsible for developing and manufacturing critical vehicle components and systems, such as seating, interior trim, HVAC systems, powertrain components, and chassis modules. Acoustic engineering services are essential for these suppliers to ensure their individual components contribute positively to the overall vehicle's NVH characteristics, integrating seamlessly with the OEM's acoustic targets. For instance, a seat manufacturer might engage acoustic engineers to optimize the sound absorption properties of their materials, or a powertrain supplier might require NVH analysis for their electric motors.

Furthermore, specialized component manufacturers, particularly those in the aftermarket or focused on niche vehicle segments like luxury or performance cars, also represent potential customers. Research and development institutions, government regulatory bodies, and independent testing laboratories may also engage with acoustic engineering service providers for advanced research, compliance verification, or specialized testing needs. The increasing complexity of automotive design, coupled with heightened consumer expectations for quiet and refined interiors, ensures a sustained and growing demand for these specialized engineering services across the entire automotive value chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2032 | USD 10.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vibracoustic GmbH, Autoneum Holding AG, NVH Korea Co. Ltd., Boge Rubber & Plastics Group, FEV Group GmbH, Ricardo plc, EDAG Engineering GmbH, Siemens AG (LMS), AVL List GmbH, Brüel & Kjær (HBK), ESI Group, Altair Engineering Inc., Trelleborg AB, Continental AG, HushMat, Sika AG, Henkel AG & Co. KGaA, 3M Company, Tenneco Inc. (DRiV), Faurecia SE (Forvia) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Acoustic Engineering Service Market Key Technology Landscape

The Automotive Acoustic Engineering Service Market is profoundly shaped by a continuously evolving technological landscape, with advancements driving innovation across all facets of NVH management. A critical component of this landscape is the sophisticated suite of simulation and modeling software. These tools, including Finite Element Analysis (FEA), Boundary Element Method (BEM), and Statistical Energy Analysis (SEA), enable engineers to virtually predict and optimize a vehicle's acoustic performance during the early design stages. This shift from physical prototyping to virtual testing significantly reduces development costs and time-to-market, allowing for more iterative and efficient design processes. The increasing computational power and fidelity of these simulations are paramount for addressing complex acoustic phenomena.

Another pivotal technological area involves advanced acoustic materials. Innovations in lightweight, high-performance sound-absorbing, insulating, and damping materials are crucial for meeting stringent NVH targets without adding excessive weight to vehicles, which is particularly vital for electric vehicles where range is a key concern. These materials include multi-layer laminates, micro-perforated absorbers, advanced foams, and smart composites designed to offer superior acoustic properties. The development of sustainable and recyclable acoustic materials is also gaining traction, aligning with broader automotive industry trends towards environmental responsibility. The ability to tailor these materials for specific frequency ranges and application areas is a significant technological advantage.

Furthermore, the market heavily relies on cutting-edge testing and measurement technologies. These include highly sensitive microphones, accelerometers, laser vibrometers, and advanced data acquisition systems housed within specialized facilities like anechoic and hemi-anechoic chambers. Real-time acoustic analysis, often enhanced by artificial intelligence and machine learning algorithms, provides invaluable insights into noise sources and propagation paths. Active Noise Cancellation (ANC) systems, which use microphones to detect unwanted sound and then generate anti-phase sound waves through vehicle speakers, represent a burgeoning technological segment. These systems are becoming increasingly sophisticated, offering adaptive noise reduction and even the capability for sound synthesis to enhance the driving experience, representing a significant technological leap in automotive acoustics.

Regional Highlights

- North America: A mature market characterized by high demand for premium and luxury vehicles, stringent safety and noise regulations, and significant investment in R&D. The robust presence of major automotive OEMs and a growing EV market drive demand for advanced acoustic engineering services, particularly in sound quality and active noise control.

- Europe: A leading region in automotive innovation and environmental regulations, with a strong focus on reducing vehicle emissions and noise pollution. Countries like Germany, France, and the UK are key hubs for automotive manufacturing and R&D, fostering demand for advanced NVH solutions, lightweight acoustic materials, and sophisticated simulation technologies.

- Asia Pacific (APAC): The fastest-growing market, primarily driven by rapid urbanization, increasing disposable incomes, and the booming automotive production in countries like China, Japan, India, and South Korea. This region is a major production base for EVs, leading to substantial investments in acoustic engineering to address new NVH challenges specific to electric powertrains and provide comfortable cabin experiences for a rapidly expanding consumer base.

- Latin America: An emerging market with growing automotive manufacturing capabilities, particularly in Brazil and Mexico. Demand for acoustic engineering services is driven by increasing vehicle sales, a rising middle class seeking improved vehicle comfort, and the gradual adoption of global NVH standards, albeit at a slower pace compared to developed regions.

- Middle East and Africa (MEA): A nascent but growing market influenced by foreign investments in the automotive sector and increasing vehicle imports. While currently smaller, the region presents long-term potential as infrastructure develops and consumer demand for higher-quality vehicles grows. Focus is currently on basic NVH mitigation and compliance with international standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Acoustic Engineering Service Market.- Vibracoustic GmbH

- Autoneum Holding AG

- NVH Korea Co. Ltd.

- Boge Rubber & Plastics Group

- FEV Group GmbH

- Ricardo plc

- EDAG Engineering GmbH

- Siemens AG (LMS)

- AVL List GmbH

- Brüel & Kjær (HBK)

- ESI Group

- Altair Engineering Inc.

- Trelleborg AB

- Continental AG

- HushMat

- Sika AG

- Henkel AG & Co. KGaA

- 3M Company

- Tenneco Inc. (DRiV)

- Faurecia SE (Forvia)

Frequently Asked Questions

What are the primary drivers for the Automotive Acoustic Engineering Service Market growth?

The key drivers include increasing demand for enhanced passenger comfort, stringent global noise and vibration regulations, the rapid shift towards electric vehicles, and continuous advancements in acoustic materials and active noise control technologies. These factors collectively compel automotive manufacturers to invest in specialized acoustic solutions.

How does the rise of Electric Vehicles (EVs) impact automotive acoustic engineering?

EVs profoundly impact acoustic engineering by eliminating traditional engine noise, which in turn amplifies other noise sources like tire noise, motor whine, and aerodynamic sounds. This necessitates new strategies for sound insulation, damping, and active noise cancellation, leading to increased demand for specialized EV acoustic services to ensure a quiet and comfortable cabin experience.

What role does AI play in Automotive Acoustic Engineering Services?

AI significantly enhances acoustic engineering through predictive modeling for faster NVH simulations, generative design for optimizing acoustic components, real-time active noise control, and intelligent data analysis for identifying noise sources. AI-driven solutions reduce development time, improve precision, and enable personalized in-cabin soundscapes.

Which regions are leading in the adoption of Automotive Acoustic Engineering Services?

North America and Europe are mature markets with high demand for premium acoustic solutions due to established regulations and luxury vehicle segments. Asia Pacific, particularly China, Japan, and India, is the fastest-growing region, driven by robust automotive production, rapid EV adoption, and increasing consumer demand for refined vehicle acoustics.

What are the major types of services offered in this market?

Major services include acoustic material development, comprehensive NVH testing (e.g., road noise, engine noise), advanced simulation and modeling (FEA, BEM), active noise control (ANC) system integration, sound design and quality engineering, and specialized consulting and advisory services tailored for various vehicle types and applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager