Automotive Active Cornering System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429583 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Automotive Active Cornering System Market Size

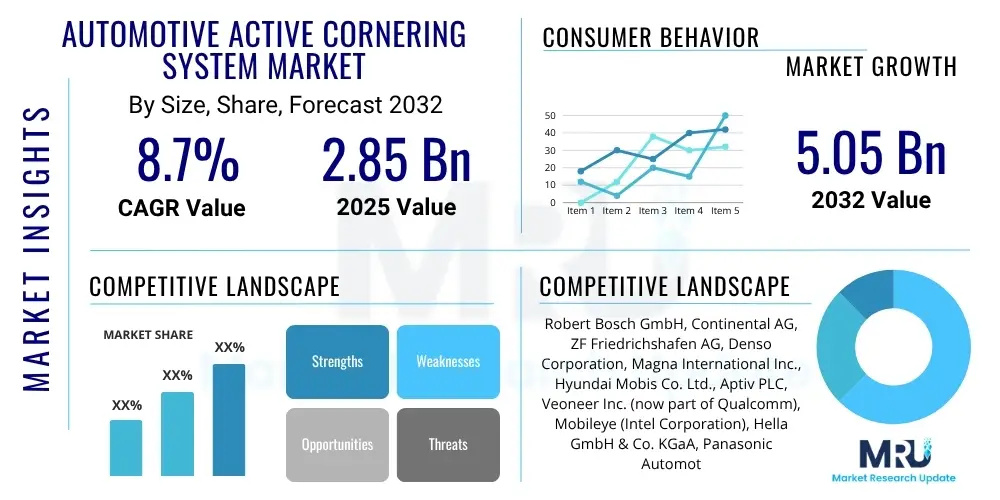

The Automotive Active Cornering System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2032. The market is estimated at USD 2.85 billion in 2025 and is projected to reach USD 5.05 billion by the end of the forecast period in 2032.

Automotive Active Cornering System Market introduction

The Automotive Active Cornering System Market encompasses advanced vehicular technologies designed to enhance a vehicle's stability, safety, and handling performance during turns and curves. These sophisticated systems proactively adjust vehicle parameters, such as steering angle, suspension damping, and headlight direction, in response to road conditions and driver input, thereby optimizing the vehicle's dynamic behavior. The core product description involves a synergistic integration of sensors, electronic control units (ECUs), and actuators that interpret real-time data on vehicle speed, steering input, yaw rate, and road curvature to make precise adjustments.

Major applications of active cornering systems are predominantly found in passenger vehicles, particularly within the premium, luxury, and sport utility vehicle (SUV) segments, where advanced safety and superior driving dynamics are key differentiators. These systems are also increasingly making their way into certain mid-range vehicles as technology becomes more cost-effective. The primary benefits include significantly enhanced vehicle safety by reducing the risk of skidding or loss of control, improved driving comfort through better stability, optimized visibility with adaptive headlights illuminating the curve ahead, and a more engaging driving experience due to refined handling characteristics and reduced driver fatigue.

The market is primarily driven by the global automotive industry's increasing emphasis on passenger safety, fueled by evolving and stringent regulatory mandates worldwide, particularly concerning active safety features. Furthermore, the rising consumer demand for vehicles equipped with advanced driver assistance systems (ADAS) and comfort-enhancing technologies plays a pivotal role. Continuous technological advancements in sensor fusion, real-time data processing, and sophisticated control algorithms are enabling more precise and responsive active cornering solutions, making them a crucial component in the evolution of modern vehicle dynamics and safety architecture.

Automotive Active Cornering System Market Executive Summary

The Automotive Active Cornering System Market is experiencing robust growth driven by a confluence of technological innovation and increasing safety awareness. Current business trends indicate a strong focus on strategic partnerships between Tier 1 suppliers and automotive OEMs, aiming to integrate more complex and software-defined active chassis systems. There is a discernible shift towards modular and scalable solutions that can be adapted across various vehicle platforms, from luxury sedans to performance-oriented SUVs. Furthermore, the market is witnessing significant investment in research and development, particularly in areas like AI-powered predictive control and enhanced sensor technologies, to further refine system responsiveness and reliability. This trend is also fostering a competitive environment where companies are vying for market share through innovation in system integration and cost optimization strategies.

From a regional perspective, the market's growth trajectory is heavily influenced by varying regulatory landscapes and consumer preferences. North America and Europe continue to be dominant markets, characterized by early adoption of advanced safety features, stringent vehicle safety standards, and a high concentration of premium and luxury vehicle sales. Asia Pacific, led by countries such as China, Japan, and India, is emerging as the fastest-growing region, propelled by expanding automotive production, increasing disposable incomes, and a rising demand for high-tech vehicle features. Emerging economies in Latin America and the Middle East and Africa are also showing promising growth, albeit from a smaller base, as infrastructure development and automotive market maturity progress.

Segmentation trends reveal that active steering systems and adaptive headlight systems currently hold significant market shares, but active suspension systems are gaining traction due to their profound impact on both comfort and handling. The integration of advanced sensors such as lidar and radar is becoming standard, replacing traditional ultrasonic sensors in higher-end applications. Vehicle type segmentation indicates that passenger cars, particularly SUVs and luxury sedans, remain the primary adopters, though light commercial vehicles are slowly incorporating some basic active cornering functionalities. The OEM channel dominates sales, reflecting the inherent complexity and factory integration required for these safety-critical systems, while the aftermarket remains niche but growing for certain component replacements and upgrades.

AI Impact Analysis on Automotive Active Cornering System Market

User inquiries into the impact of Artificial Intelligence on the Automotive Active Cornering System Market frequently revolve around how AI can enhance predictive capabilities, improve real-time decision-making, and contribute to the overall evolution of autonomous driving. Users are particularly keen on understanding the role of AI in processing vast amounts of sensor data to anticipate road conditions and vehicle dynamics more accurately than traditional rule-based systems. Concerns often include the reliability and safety of AI algorithms in critical situations, the potential for cybersecurity vulnerabilities within AI-driven systems, and the ethical implications of autonomous decision-making in cornering scenarios. There are high expectations for AI to deliver more seamless, adaptive, and personalized driving experiences, moving beyond reactive adjustments to proactive and intelligent control, which could redefine vehicle handling and occupant comfort.

- AI enables predictive analytics for anticipating road curves and traffic conditions, allowing systems to pre-emptively adjust.

- Real-time optimization of steering, suspension, and braking for dynamic performance based on AI processed sensor data.

- Enhanced sensor fusion capabilities, integrating data from cameras, radar, lidar, and ultrasonic sensors for a comprehensive environmental understanding.

- Personalized driving profiles through machine learning, adapting cornering characteristics to individual driver preferences and habits.

- Improved fault detection and diagnostics, with AI identifying potential system anomalies or failures proactively.

- Development of more sophisticated, self-learning algorithms that improve system performance over time and various driving scenarios.

- Potential for over-the-air (OTA) updates to enhance AI models, bringing continuous improvements and new features to existing vehicles.

DRO & Impact Forces Of Automotive Active Cornering System Market

The Automotive Active Cornering System Market is profoundly shaped by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the ever-increasing demand for advanced driver assistance systems (ADAS) as consumers prioritize safety and convenience. Stringent global vehicle safety regulations, mandating features that actively prevent accidents, are compelling manufacturers to integrate these systems. The escalating sales of premium and luxury vehicles, which often feature active cornering as standard, further fuel market expansion. Continuous technological advancements in sensor fusion, control algorithms, and mechatronic actuators are making these systems more effective, reliable, and capable of nuanced performance adjustments, thereby widening their adoption across vehicle segments.

Despite strong growth impetus, several restraints temper the market's full potential. The high cost associated with the research, development, and integration of these complex systems remains a significant barrier for mass-market adoption, especially in cost-sensitive segments. The intricate nature of integrating multiple electronic and mechanical components, coupled with software complexities, poses technical challenges for OEMs. A lack of universal standardization across different manufacturers can lead to interoperability issues and slow down broader adoption. Furthermore, potential cybersecurity threats to connected active systems, along with concerns about software glitches or system failures, necessitate rigorous testing and robust security protocols, adding to development costs and potentially impacting consumer trust.

Opportunities for market growth are abundant and include the ongoing transition towards autonomous driving technologies, where active cornering systems will play a foundational role in ensuring vehicle stability and maneuverability without human intervention. The expansion into emerging automotive markets, particularly in Asia Pacific and Latin America, presents significant untapped potential as these regions experience economic growth and increasing demand for modern vehicle features. The development of more cost-effective solutions through economies of scale and modular designs could facilitate wider adoption in mid-segment vehicles. Additionally, the possibility of integrating these systems with vehicle-to-everything (V2X) communication technology and the evolution of software-defined vehicles open new avenues for advanced functionalities and service offerings, enhancing the overall value proposition. Impact forces such as evolving consumer purchasing power, the competitive landscape driving innovation, and global supply chain resilience also significantly influence market dynamics.

Segmentation Analysis

The Automotive Active Cornering System Market is comprehensively segmented to provide a detailed understanding of its diverse components and applications. This segmentation allows for precise analysis of market trends, identifying growth drivers and opportunities across various categories. The market is typically analyzed by technology employed, the specific components utilized, the types of vehicles integrating these systems, and the sales channels through which they reach end-users. Each segment reflects different aspects of the market's evolution and adoption patterns, from advanced mechanical designs to sophisticated electronic controls and software algorithms.

Understanding these segments is crucial for stakeholders to tailor their product development, marketing strategies, and investment decisions. For instance, the growth in adaptive headlights may indicate a focus on immediate safety improvements and regulatory compliance, while the expansion of active suspension systems could point towards a market desire for enhanced comfort and dynamic performance. The interplay between these segments often dictates the overall innovation trajectory and market penetration rates for active cornering technologies, highlighting the multifaceted nature of this advanced automotive sector.

- By Technology:

- Adaptive Headlights (Adaptive Front Lighting System - AFS)

- Active Steering Systems (Rear-wheel Steering, Variable Gear Ratio Steering)

- Active Suspension Systems (Adaptive Damping, Air Suspension, Active Roll Stabilization)

- By Component:

- Sensors (Radar, Lidar, Camera, Ultrasonic)

- Electronic Control Units (ECUs)

- Actuators (Electric Motors, Hydraulic Cylinders, Electromechanical)

- Software & Algorithms

- Wiring & Harnesses

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks, Luxury Vehicles, Sports Cars)

- Commercial Vehicles (Light Commercial Vehicles)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Active Cornering System Market

The value chain for the Automotive Active Cornering System Market is characterized by a complex network of specialized entities, starting from raw material suppliers and extending to end-users. The upstream analysis begins with the provision of critical raw materials and components, including advanced semiconductors, electronic circuits, high-precision sensors (e.g., lidar, radar, camera modules), specialized plastics and metals for enclosures, and the sophisticated software platforms that drive the algorithms. Suppliers in this segment focus on high quality, reliability, and cost-efficiency to meet the stringent demands of the automotive industry. Research and development activities, often conducted by technology companies and specialized engineering firms, are also integral to the upstream, focusing on innovation in sensor technology, ECU processing power, and actuator design.

Moving downstream, the value chain involves Tier 2 and Tier 1 suppliers who are responsible for manufacturing and assembling the complete active cornering system modules. Tier 1 suppliers, such as major automotive component manufacturers, integrate various components into functional sub-systems, conducting rigorous testing and validation to meet OEM specifications. These integrated systems are then supplied directly to Original Equipment Manufacturers (OEMs), who incorporate them into their vehicle assembly lines. The distribution channel is predominantly direct from Tier 1 suppliers to OEMs, reflecting the high degree of integration and customization required for these safety-critical systems. There is also an indirect distribution path for spare parts and upgrades through authorized dealerships and specialized service centers, though this represents a smaller portion of the overall market.

The aftermarket for active cornering systems is relatively limited compared to the OEM channel, primarily focusing on replacement parts, software updates, and, in rare cases, high-performance upgrades. Direct distribution to OEMs ensures seamless integration and quality control, which is paramount for safety features. Indirect distribution via dealerships and authorized service centers primarily handles post-sale support, maintenance, and repairs, ensuring the continued functionality and safety of these complex systems throughout the vehicle's lifecycle. This intricate value chain emphasizes collaboration, technological expertise, and stringent quality control at every stage to deliver reliable and effective active cornering solutions to the automotive market.

Automotive Active Cornering System Market Potential Customers

The primary potential customers for Automotive Active Cornering Systems are major global automotive manufacturers, particularly those specializing in the premium, luxury, and high-performance vehicle segments. These OEMs seek to differentiate their brands through superior safety features, enhanced driving dynamics, and technological sophistication. Manufacturers are constantly looking for innovative solutions that can improve vehicle stability, handling precision, and driver confidence, making active cornering systems an attractive investment. As safety regulations become more stringent worldwide, and consumer expectations for advanced features rise, an increasing number of mainstream automotive brands are also exploring the integration of these systems into their higher-trim models, expanding the customer base beyond the traditional luxury segment.

Beyond the direct manufacturers, the end-users or buyers of vehicles equipped with these systems represent the ultimate beneficiaries. These include individual consumers who prioritize vehicle safety, driving comfort, and advanced technological features when purchasing a new car. Owners of luxury sedans, premium SUVs, and sports cars are particularly inclined towards vehicles that offer superior handling and stability during dynamic driving scenarios. Furthermore, fleet operators, especially those managing high-value or passenger-transporting fleets, are emerging as potential customers. Their focus on reducing accident rates, enhancing passenger safety, and minimizing insurance costs aligns well with the benefits offered by active cornering systems, making vehicles equipped with these technologies a more attractive option for their operational needs.

The evolving landscape of the automotive industry, characterized by the rise of software-defined vehicles and increasing connectivity, also points to technology integrators and software developers as indirect potential customers. These entities may seek to partner with active cornering system providers to develop synergistic solutions that combine advanced chassis control with autonomous driving functionalities or sophisticated vehicle-to-infrastructure (V2I) communication. As the market matures, the scope of potential customers may also broaden to include specialized aftermarket providers catering to performance enthusiasts or niche retrofit markets, although OEM integration remains the dominant and most impactful customer segment for these advanced safety and performance technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.85 billion |

| Market Forecast in 2032 | USD 5.05 billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Magna International Inc., Hyundai Mobis Co. Ltd., Aptiv PLC, Veoneer Inc. (now part of Qualcomm), Mobileye (Intel Corporation), Hella GmbH & Co. KGaA, Panasonic Automotive Systems, Nexteer Automotive, Knorr-Bremse AG, Aisin Corporation, Hitachi Astemo, Valeo SA, BorgWarner Inc., Gentex Corporation, NVIDIA Corporation, Qualcomm Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Active Cornering System Market Key Technology Landscape

The Automotive Active Cornering System Market is driven by a sophisticated and rapidly evolving technology landscape, central to which are advanced sensor technologies. Modern systems heavily rely on a fusion of data from various sensors, including radar for detecting distance and speed, lidar for precise 3D mapping of the environment, cameras for visual recognition of lanes and obstacles, and ultrasonic sensors for close-range detection. This multi-sensor approach provides a comprehensive real-time understanding of the vehicle's surroundings and its dynamic state, enabling the system to make informed decisions. The efficacy of these sensors is continuously being improved through advancements in resolution, range, and all-weather performance, ensuring robust operation in diverse driving conditions.

At the core of processing this vast amount of sensor data are powerful Electronic Control Units (ECUs) equipped with high-performance microprocessors and specialized AI/Machine Learning algorithms. These algorithms are crucial for predictive analytics, allowing the system to anticipate road curves, potential hazards, and optimal vehicle responses even before they occur. The integration of real-time control units is essential for executing instantaneous adjustments to vehicle parameters, such as the steering angle through steer-by-wire technology, or the damping force of adaptive suspensions. This computational prowess allows for dynamic adjustments to vehicle kinematics, improving both safety and ride comfort by actively counteracting forces like centrifugal acceleration and body roll.

Furthermore, the technology landscape includes the development of sophisticated actuators that translate the ECU's commands into physical actions. These range from electric motors for active steering systems that can adjust individual wheel angles, to hydraulic or electromechanical cylinders for active suspension systems that manage wheel articulation and body stability. Adaptive lighting technologies, which pivot headlights to illuminate around corners, also form a critical part of the active cornering system, directly enhancing visibility and safety. The ongoing trend towards software-defined vehicles and over-the-air (OTA) updates for system enhancements signifies a future where these technologies will be even more integrated, intelligent, and adaptable, capable of continuous improvement throughout the vehicle's lifespan.

Regional Highlights

- North America: This region is a leading market for Automotive Active Cornering Systems, characterized by high adoption rates of advanced safety features and a strong regulatory push towards enhancing vehicle safety. The presence of numerous luxury and high-performance vehicle manufacturers, coupled with significant research and development investments in ADAS technologies, drives market growth. Consumers in North America exhibit a high propensity for technologically advanced vehicles, further contributing to market expansion.

- Europe: Europe represents another key market, largely due to stringent vehicle safety standards set by organizations like Euro NCAP and a strong market for premium and luxury automobiles. European consumers prioritize both safety and driving dynamics, making active cornering systems a desirable feature. Countries such as Germany, with its robust automotive manufacturing base and innovation in engineering, are pivotal to the market's development and technological advancement within the region.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, driven by expanding automotive production bases, increasing disposable incomes, and a rising demand for advanced vehicle features in countries like China, Japan, South Korea, and India. Rapid urbanization and improving road infrastructure contribute to the adoption of sophisticated safety and comfort systems. Local and international OEMs are actively investing in the region to cater to this growing demand, fostering both production and sales growth.

- Latin America: This region is witnessing a gradual but steady increase in the adoption of active cornering systems, particularly in premium vehicle segments. Improving economic conditions and evolving vehicle safety regulations in countries like Brazil and Mexico are catalyzing market growth. While still a nascent market compared to North America and Europe, there is significant potential for expansion as consumer awareness and demand for advanced safety features grow.

- Middle East and Africa (MEA): The MEA market for active cornering systems is characterized by adoption primarily in the luxury vehicle segment. Economic diversification efforts and infrastructure development in countries like UAE and Saudi Arabia are supporting the growth of the automotive sector. While overall market penetration is lower, the region presents opportunities for high-end vehicle manufacturers and suppliers as consumer preferences shift towards more advanced and safer vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Active Cornering System Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Magna International Inc.

- Hyundai Mobis Co. Ltd.

- Aptiv PLC

- Veoneer Inc. (now part of Qualcomm)

- Mobileye (Intel Corporation)

- Hella GmbH & Co. KGaA

- Panasonic Automotive Systems

- Nexteer Automotive

- Knorr-Bremse AG

- Aisin Corporation

- Hitachi Astemo

- Valeo SA

- BorgWarner Inc.

- Gentex Corporation

- NVIDIA Corporation

- Qualcomm Technologies Inc.

Frequently Asked Questions

Analyze common user questions about the Automotive Active Cornering System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Automotive Active Cornering System?

An Automotive Active Cornering System is a suite of advanced technologies that enhance a vehicle's stability, safety, and handling performance by dynamically adjusting components like steering, suspension, and headlights during turns, based on real-time driving conditions and driver input.

How does an Active Cornering System enhance vehicle safety?

It enhances safety by actively managing vehicle dynamics to prevent skidding, improve traction, and provide better visibility around curves, thereby reducing the risk of accidents and helping the driver maintain control in challenging cornering situations.

What are the main components of these systems?

Key components typically include various sensors (radar, lidar, camera, ultrasonic) to gather environmental and vehicle data, Electronic Control Units (ECUs) for processing information and making decisions, and actuators (electric motors, hydraulic cylinders) to execute the necessary physical adjustments to steering, suspension, or lighting.

Which vehicle types commonly feature Active Cornering Systems?

These systems are most commonly found in premium, luxury, and high-performance passenger vehicles, including sedans, SUVs, and sports cars, where advanced safety features and superior driving dynamics are paramount. Their adoption is slowly expanding into higher trims of mainstream vehicles.

What is the future outlook for the Automotive Active Cornering System Market?

The market is poised for significant growth, driven by increasing integration with autonomous driving technologies, continuous advancements in AI and sensor fusion, and stricter global safety regulations. Future systems are expected to be more predictive, adaptive, and seamlessly integrated into the overall vehicle architecture, enhancing both safety and driver experience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager