Automotive Air Flow Sensors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430269 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Automotive Air Flow Sensors Market Size

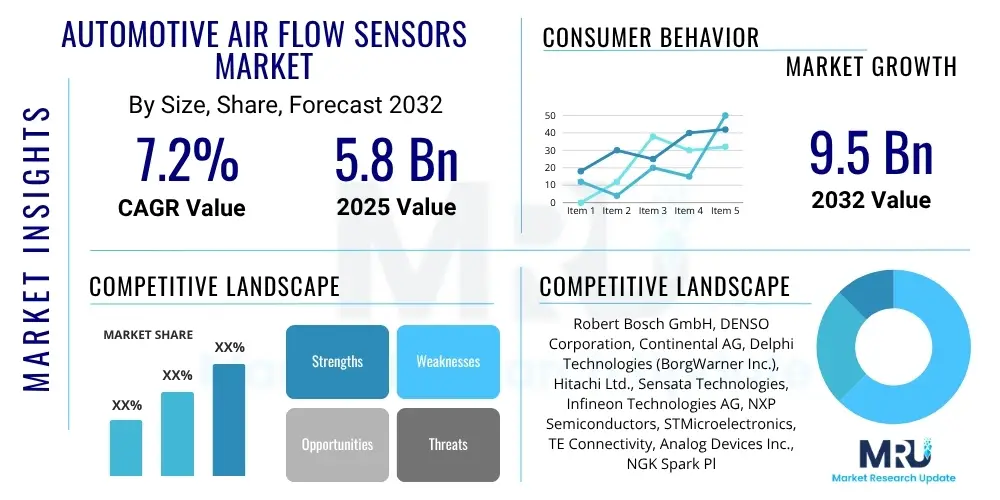

The Automotive Air Flow Sensors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 9.5 Billion by the end of the forecast period in 2032.

Automotive Air Flow Sensors Market introduction

The Automotive Air Flow Sensors Market encompasses a crucial segment of the automotive electronics industry, providing essential components for modern internal combustion engine management systems. These sophisticated devices, primarily including Mass Air Flow (MAF) sensors and Manifold Absolute Pressure (MAP) sensors, are engineered to precisely measure the volume or mass of air entering the engine's intake manifold. The accuracy of this measurement is paramount, as it directly influences the engine control unit's (ECU) ability to calculate the optimal fuel injection quantity, ensuring an ideal air-fuel ratio for combustion. This meticulous control is fundamental for maximizing engine efficiency, reducing harmful exhaust emissions, and enhancing overall vehicle performance, making air flow sensors indispensable for meeting contemporary automotive engineering and environmental standards.

Product descriptions for air flow sensors vary based on their underlying technology. Hot-wire and hot-film MAF sensors operate by sensing the cooling effect of air flowing past a heated element, directly correlating this change to air mass. MAP sensors, conversely, infer air mass by measuring the absolute pressure within the intake manifold, an indirect but equally vital parameter. Major applications span across passenger cars, light and heavy commercial vehicles, and various off-highway equipment, all requiring stringent control over engine operations. The tangible benefits derived from these sensors are extensive, including significantly improved fuel economy, enhanced engine responsiveness, smoother acceleration, and a substantial reduction in pollutant emissions, such as nitrogen oxides (NOx) and carbon monoxide (CO), which are critical for regulatory compliance and environmental sustainability. This advanced precision is a cornerstone of modern powertrain design.

The market's trajectory is primarily driven by several powerful factors. Foremost among these are the global proliferation of stringent environmental regulations, which mandate lower vehicle emissions and higher fuel efficiency, pushing manufacturers to adopt more sophisticated engine management technologies. Concurrently, the continuous growth in global vehicle production, particularly in rapidly industrializing regions like Asia Pacific, creates a consistent demand for these components in new vehicles. Furthermore, the increasing adoption of advanced engine designs, such as turbocharged, gasoline direct injection (GDI), and diesel engines, inherently requires highly accurate and reliable air flow sensors to optimize their complex operational parameters. These driving forces collectively underscore the market's robust growth potential, despite emerging shifts towards alternative propulsion systems like electric vehicles, as hybrid solutions and traditional combustion engines are expected to maintain a significant market presence for the foreseeable future, albeit with evolving technological requirements for their sensor systems.

Automotive Air Flow Sensors Market Executive Summary

The Automotive Air Flow Sensors Market is navigating a period of significant transformation, characterized by dynamic business trends, distinct regional growth patterns, and evolving segment demands. Business trends are largely influenced by the relentless pursuit of precision and reliability in engine management, leading to the increased integration of advanced Micro-Electro-Mechanical Systems (MEMS) technology for miniaturized and highly accurate sensors. There is a growing emphasis on smart sensors with enhanced diagnostic capabilities, enabling real-time data feedback and facilitating predictive maintenance strategies. Consolidation within the automotive supply chain and strategic partnerships between sensor manufacturers and Tier-1 suppliers are also prominent, aimed at optimizing production costs and fostering innovation. The transition towards electrification poses both a challenge and an opportunity, as manufacturers adapt sensor designs for hybrid powertrains and explore new applications within Battery Electric Vehicles (BEVs), such as thermal management or cabin air quality sensing.

Regionally, the market exhibits varied growth landscapes. The Asia Pacific region stands out as a primary growth engine, propelled by burgeoning automotive production, rising consumer purchasing power, and the gradual adoption of stricter emission standards in countries like China and India. This has led to substantial investments in manufacturing capabilities and R&D within the region. North America and Europe, while representing mature markets, demonstrate stable demand driven by stringent environmental regulations, a high prevalence of advanced vehicle technologies, and a significant aftermarket for replacement parts. Latin America and the Middle East & Africa are emerging markets, displaying promising growth potential fueled by increasing vehicle parc, urbanization, and improving economic conditions, although they often lag in the adoption of the most cutting-edge sensor technologies.

Segmentation trends reveal that the Original Equipment Manufacturer (OEM) channel continues to dominate due to the high volume of sensors integrated into new vehicle assemblies. However, the aftermarket segment is also experiencing steady expansion, driven by the aging vehicle parc and the increasing complexity of sensor replacement and repair. Within vehicle types, passenger cars represent the largest segment, with commercial vehicles showing consistent demand due to heavy-duty operational requirements and longer service lives. The technological shift from analog to digital sensors is a clear trend, offering improved signal integrity and better compatibility with modern ECUs. Overall, market stakeholders are strategically investing in R&D to develop future-proof sensor solutions that can adapt to hybrid, fuel cell, and potentially new electric vehicle architectures, focusing on modularity, connectivity, and data analytics capabilities to ensure long-term market relevance.

AI Impact Analysis on Automotive Air Flow Sensors Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Automotive Air Flow Sensors Market frequently center on several critical themes. Users are keen to understand how AI can elevate the precision and responsiveness of these sensors, questioning its role in optimizing complex engine control strategies for both performance and environmental compliance. Specific inquiries often relate to AI's ability to facilitate predictive maintenance for sensors, thereby extending their lifespan and reducing vehicle downtime, and its contribution to the broader ecosystem of autonomous driving technologies where precise environmental data is paramount. Additionally, there are concerns about the cybersecurity implications of integrating AI into sensor networks, the ethical use of sensor data, and the economic feasibility of implementing such advanced systems across various vehicle segments. The overarching expectation is that AI will unlock new levels of efficiency, reliability, and functionality from traditional air flow sensing.

Based on this analysis, AI is poised to revolutionize the automotive air flow sensors domain by enhancing data processing, enabling predictive analytics, and facilitating deeper integration into advanced vehicle systems. AI algorithms can analyze vast streams of sensor data in real-time, identifying subtle patterns indicative of optimal engine performance or impending sensor degradation, far beyond the capabilities of traditional fixed-logic systems. This allows for dynamic adjustments to fuel injection and ignition timing, leading to unprecedented levels of fuel efficiency and emissions reduction. For instance, AI can compensate for minor sensor drifts or environmental variables that would typically degrade performance over time, ensuring consistent accuracy. Furthermore, AI contributes significantly to the development of resilient and intelligent vehicle architectures, where sensors are not merely data providers but active components of an interconnected, self-optimizing system, laying groundwork for truly autonomous and efficient transportation.

- AI enables real-time, adaptive optimization of fuel-air mixture, enhancing combustion efficiency and reducing emissions by interpreting sensor data more dynamically.

- Predictive maintenance algorithms, powered by AI, can anticipate air flow sensor failures well in advance, minimizing unexpected breakdowns and maintenance costs.

- AI facilitates enhanced diagnostic capabilities, accurately pinpointing sensor anomalies or performance degradation for quicker and more precise vehicle servicing.

- Integration with advanced driver-assistance systems (ADAS) and autonomous driving platforms allows AI to use air flow data for holistic vehicle performance and safety assessments.

- AI contributes to personalized vehicle performance profiles by learning from aggregated sensor data and driver behavior, adjusting engine parameters for individual preferences.

- Machine learning models can compensate for environmental variables like altitude and humidity, ensuring consistent sensor accuracy across diverse operating conditions.

- AI supports the development of next-generation "smart" sensors with embedded intelligence, reducing reliance on external ECUs for initial data processing and decision-making.

DRO & Impact Forces Of Automotive Air Flow Sensors Market

The Automotive Air Flow Sensors Market is profoundly shaped by a complex interplay of drivers, restraints, opportunities, and impactful external forces. Chief among the market drivers is the global imperative to improve fuel efficiency and adhere to increasingly stringent emission regulations, such as Euro 7 and CAFE standards. These mandates compel automotive manufacturers to integrate highly precise and reliable air flow sensors into their engine management systems to optimize combustion and minimize pollutants. Concurrently, the consistent growth in global vehicle production, particularly in emerging economies with expanding middle classes and rising vehicle ownership, fuels a steady demand for these essential components in new vehicle assemblies. The proliferation of advanced engine technologies, including turbocharging, downsizing, and gasoline direct injection (GDI), also necessitates more sophisticated air flow sensors capable of operating under diverse and challenging conditions, further stimulating market growth.

However, the market also faces notable restraints. The relatively high cost associated with the research, development, and manufacturing of advanced sensor technologies, especially those incorporating MEMS or AI capabilities, can limit their adoption in cost-sensitive segments. Furthermore, the inherent volatility in raw material prices, particularly for semiconductors, platinum, and specialized plastics, poses supply chain challenges and can impact production costs and lead times. The most significant long-term restraint is the global automotive industry's accelerating transition towards electric vehicles (EVs). Battery Electric Vehicles (BEVs) do not utilize internal combustion engines and therefore eliminate the need for traditional air flow sensors, potentially eroding a significant portion of the market over the coming decades. This necessitates strategic adaptation and diversification for sensor manufacturers.

Despite these challenges, the market presents compelling opportunities. The continued growth of hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs), which combine electric motors with internal combustion engines, ensures a sustained demand for air flow sensors in these complex powertrains. Moreover, the integration of these sensors with advanced connectivity solutions (IoT) and AI for enhanced diagnostics, predictive maintenance, and real-time performance optimization represents a significant growth avenue. Development of entirely new types of sensors for monitoring non-combustion-related air quality within EV cabins or for fuel cell applications also opens new market segments. The overall impact forces include rapid technological advancements pushing sensor capabilities, evolving regulatory landscapes influencing design and performance, and global economic conditions impacting vehicle sales and production. Geopolitical stability and trade policies can also critically affect global supply chains and market access, necessitating robust risk management and strategic regional manufacturing footprints for key market players.

Segmentation Analysis

The Automotive Air Flow Sensors Market is meticulously segmented across various dimensions to provide a comprehensive and nuanced understanding of its intricate structure and diverse dynamics. This granular analysis is crucial for identifying distinct market niches, evaluating competitive intensity within specific categories, and uncovering both current demand patterns and future growth opportunities. By dissecting the market based on criteria such as sensor type, specific vehicle applications, and distribution channels, stakeholders can gain precise insights into where value is being created and consumed. This systematic approach allows for targeted strategies, whether for product development, market entry, or competitive positioning, ensuring that responses are tailored to the unique characteristics of each sub-segment.

Each segmentation criterion offers a unique perspective on market behavior. For instance, segmenting by sensor type (e.g., Hot Wire MAF, MAP) helps to understand technological preferences and performance requirements across different engine designs. Vehicle type segmentation (e.g., Passenger Cars vs. Commercial Vehicles) highlights varying demands influenced by vehicle volumes, usage patterns, and regulatory frameworks specific to each category. Furthermore, sales channel segmentation (OEM vs. Aftermarket) distinguishes between demand driven by new vehicle production and demand arising from replacement and maintenance needs over a vehicle's lifecycle. These detailed breakdowns are indispensable for market participants to formulate effective business strategies, adapt to evolving industry trends, and effectively allocate resources to areas with the highest potential for return on investment.

- By Type

- Hot Wire MAF Sensor: Utilizes a heated wire, often platinum, to measure air mass by sensing its cooling effect, known for high accuracy.

- Hot Film MAF Sensor: Similar to hot-wire but uses a ceramic substrate with a heated film, offering enhanced durability and resistance to contamination.

- MAP Sensor: Measures absolute pressure in the intake manifold to infer air density and mass, crucial for turbocharged engines.

- Karman Vortex MAF Sensor: Measures air flow by detecting pressure fluctuations caused by a Karman vortex street, less common in modern vehicles.

- By Vehicle Type

- Passenger Cars: The largest segment, including Sedans, SUVs, and Hatchbacks, driven by high production volumes and consumer demand for fuel efficiency.

- Commercial Vehicles: Encompasses Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs), demanding robust and durable sensors due to rigorous operating conditions.

- By Sales Channel

- OEM (Original Equipment Manufacturer): Sensors supplied directly to automotive manufacturers for integration into new vehicle assembly lines.

- Aftermarket: Replacement sensors sold through distributors, retailers, and service centers for vehicle repair and maintenance.

- By Technology

- Analog: Sensors providing continuous voltage signals, requiring external analog-to-digital conversion.

- Digital: Sensors providing discrete digital signals, often incorporating internal processing for direct communication with the ECU.

Value Chain Analysis For Automotive Air Flow Sensors Market

The value chain for the Automotive Air Flow Sensors Market is a multi-layered structure, beginning with highly specialized upstream activities involving the sourcing and processing of critical raw materials and components. This foundational stage encompasses the extraction and refining of semiconductor materials, such as silicon, as well as the production of high-purity plastics, specialized metals (e.g., platinum for hot wires, stainless steel for housings), and advanced ceramics. Key players in this segment are often global material suppliers and component manufacturers that specialize in microchip fabrication, MEMS component manufacturing, and precision-engineered mechanical parts. The quality and availability of these upstream materials significantly impact the performance, cost, and lead times of the final sensor products, necessitating robust supply chain management and long-term supplier relationships to ensure consistency and innovation in design and manufacturing processes.

Following the component manufacturing, the value chain moves into the core sensor manufacturing stage, where these diverse elements are meticulously assembled and integrated. This involves advanced manufacturing processes such as micro-fabrication, bonding, calibration, and extensive quality control to produce finished air flow sensors that meet stringent automotive standards for accuracy, durability, and reliability. Leading sensor manufacturers and Tier-1 automotive electronics suppliers dominate this stage, investing heavily in research and development to enhance sensor performance, miniaturization, and integration capabilities, often incorporating proprietary technologies for improved signal processing and environmental robustness. They also focus on creating modular designs that can be easily adapted for various engine types and vehicle platforms, optimizing production efficiency and reducing costs.

Downstream activities in the value chain primarily focus on the distribution and utilization of these completed sensors. For the Original Equipment Manufacturer (OEM) channel, sensors are typically supplied directly from sensor manufacturers or Tier-1 automotive suppliers to vehicle assembly lines. This direct distribution model is characterized by long-term contracts, precise logistical coordination, and just-in-time delivery to support mass production. Conversely, the aftermarket segment relies on a complex, multi-tiered indirect distribution channel. This involves independent distributors, wholesalers, and an extensive network of automotive parts retailers that supply replacement sensors to independent repair shops, authorized service centers, and directly to individual consumers. The aftermarket channel often requires different packaging, branding, and marketing strategies compared to OEM sales, catering to a diverse customer base with varying needs for accessibility, cost-effectiveness, and brand familiarity. This dual-channel approach ensures comprehensive market penetration and accessibility throughout the vehicle's lifecycle.

Automotive Air Flow Sensors Market Potential Customers

The Automotive Air Flow Sensors Market serves a diverse and expansive customer base, each segment possessing distinct needs and purchasing drivers. At the forefront are Original Equipment Manufacturers (OEMs), comprising global automotive giants that produce passenger cars, light commercial vehicles, and heavy-duty trucks. These manufacturers are the primary consumers of air flow sensors, integrating them directly into new vehicles during the assembly process to meet stringent design specifications, performance benchmarks, and regulatory compliance. OEMs prioritize reliability, precision, cost-effectiveness at scale, and seamless integration with their proprietary engine control systems, often entering into long-term supply agreements with sensor manufacturers to ensure consistent quality and supply chain stability. Their demand is directly tied to global vehicle production volumes and the evolution of powertrain technologies, including hybrid and advanced internal combustion engines.

Another critical customer segment includes Tier-1 automotive suppliers, who often purchase individual air flow sensors from specialized manufacturers and integrate them into larger, more complex engine management modules or sub-systems before supplying these complete assemblies to OEMs. These suppliers act as crucial intermediaries, adding value through system design, testing, and integration expertise. They demand sensors that are compatible with their larger system architectures, adhere to rigorous quality standards, and offer competitive pricing. Beyond new vehicle production, the aftermarket segment represents a substantial and growing customer base. This includes a vast network of independent repair shops, authorized service centers, and specialized garages that require replacement air flow sensors for vehicle maintenance, diagnostics, and repairs. These customers value availability, ease of installation, competitive pricing, and compatibility with a wide range of vehicle models, often relying on established brands with a reputation for quality and reliability.

Furthermore, fleet operators, managing large numbers of vehicles for logistical, corporate, or public transport purposes, constitute a significant customer group. Their demand is driven by the need for preventative maintenance and rapid repairs to minimize vehicle downtime and optimize operational efficiency. They often purchase sensors in bulk and prioritize durability and longevity to reduce overall running costs. Finally, individual vehicle owners who perform DIY maintenance or seek specific component upgrades also contribute to the aftermarket demand, typically purchasing through retail channels or online platforms. This broad spectrum of customers, from high-volume industrial buyers to individual consumers, underscores the pervasive need for automotive air flow sensors across the entire lifecycle of internal combustion and hybrid vehicles, emphasizing the importance of diverse product offerings and distribution strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2032 | USD 9.5 Billion |

| Growth Rate | CAGR 7.2% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, DENSO Corporation, Continental AG, Delphi Technologies (BorgWarner Inc.), Hitachi Ltd., Sensata Technologies, Infineon Technologies AG, NXP Semiconductors, STMicroelectronics, TE Connectivity, Analog Devices Inc., NGK Spark Plug Co. Ltd. (NTK Sensors), Visteon Corporation, Marelli (Calsonic Kansei Corp.), ZF Friedrichshafen AG, Eaton Corporation, Johnson Electric Holdings Ltd., ACDelco (General Motors), Hyundai Mobis, TI Automotive |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Air Flow Sensors Market Key Technology Landscape

The Automotive Air Flow Sensors Market is continuously evolving, driven by advancements in material science, micro-manufacturing, and digital processing, all aimed at enhancing sensor accuracy, durability, and integration. Micro-Electro-Mechanical Systems (MEMS) technology stands as a cornerstone, enabling the fabrication of highly miniaturized, robust, and cost-effective sensors with improved response times and lower power consumption. For Mass Air Flow (MAF) sensors, hot-wire and hot-film anemometry remain dominant. Hot-wire sensors, often utilizing platinum wires, are favored for their high sensitivity and rapid response. Hot-film sensors, which embed the sensing element on a ceramic substrate, offer enhanced robustness against contamination and vibration, making them suitable for diverse operating environments. Continuous refinement in these technologies focuses on improving long-term stability and reducing drift.

Manifold Absolute Pressure (MAP) sensors predominantly leverage piezoresistive or capacitive principles, where pressure changes cause a deformation in a diaphragm, altering electrical resistance or capacitance. Advancements in semiconductor manufacturing have allowed for greater precision, linearity, and temperature compensation in these sensors, ensuring accurate readings across a wide range of engine loads and ambient conditions. Beyond the core sensing element, significant technological strides are being made in signal processing. The integration of sophisticated digital signal processing (DSP) capabilities directly into the sensor module is becoming standard. This allows for onboard computation, filtering, and conversion of analog signals into digital outputs, improving signal integrity, reducing electromagnetic interference, and simplifying communication with the Engine Control Unit (ECU) via protocols like LIN or CAN bus.

The future technology landscape for air flow sensors is geared towards "smart" sensors with enhanced embedded intelligence. These sensors will not only measure air flow but also incorporate self-diagnosis, self-calibration, and predictive analytics functionalities, leveraging advancements in artificial intelligence and machine learning. There is an increasing focus on developing multi-parameter sensors that can simultaneously measure temperature, humidity, and pressure alongside air flow, providing a more comprehensive environmental profile for engine optimization. Furthermore, research into novel sensing principles, such as ultrasonic air flow measurement, although not yet widely adopted for direct engine intake, holds promise for niche applications or for applications in emerging powertrain technologies like fuel cells or advanced thermal management systems in electric vehicles. Overall, the trend is towards highly integrated, intelligent, and reliable sensor solutions that contribute to increasingly complex and autonomous vehicle systems.

Regional Highlights

- North America: This region represents a mature and technologically advanced automotive market, characterized by stringent emission regulations (e.g., EPA, CARB standards) and a strong consumer demand for high-performance and fuel-efficient vehicles. The demand for air flow sensors is driven by a large existing vehicle parc requiring replacement parts in the aftermarket, alongside the continuous integration of advanced sensor technologies into new vehicle models by major automotive OEMs present in the U.S., Canada, and Mexico. Significant R&D investment in engine technologies and vehicle electrification also influences sensor development.

- Europe: European countries are at the forefront of implementing some of the world's most rigorous emission standards, such as Euro 6d and upcoming Euro 7, along with Real Driving Emissions (RDE) testing. This regulatory environment is a primary catalyst for the demand for highly accurate and durable air flow sensors, critical for optimal engine combustion and emissions compliance. The region also boasts a robust automotive manufacturing base and a strong emphasis on innovation in hybrid and advanced internal combustion engine technologies, contributing to steady market growth and the adoption of cutting-edge sensor solutions.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, the APAC region is propelled by exponential growth in automotive manufacturing, particularly in economic powerhouses like China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and expanding vehicle sales contribute significantly to the OEM demand for air flow sensors. Moreover, the gradual tightening of emission regulations in these countries, often mirroring European standards, further stimulates the adoption of advanced sensor technologies across various vehicle segments, making it a key strategic region for market players.

- Latin America: The market in Latin America is influenced by fluctuating economic conditions, yet it demonstrates consistent growth driven by increasing vehicle ownership, infrastructure development, and a growing domestic automotive manufacturing presence, notably in Brazil and Mexico. While the adoption of the latest sensor technologies might be slower compared to more developed regions, there is a steady demand for reliable and cost-effective air flow sensors for both new vehicle production and a burgeoning aftermarket, supported by the need for vehicle maintenance and repairs.

- Middle East and Africa (MEA): The MEA region is an emerging market for automotive air flow sensors, characterized by expanding vehicle sales, diversification of economies away from oil, and increasing investments in automotive assembly plants. While currently smaller in market size compared to other regions, it offers considerable long-term growth potential as the automotive industries mature, regulatory frameworks evolve, and consumer awareness regarding vehicle performance and fuel efficiency increases. Imports of both new vehicles and aftermarket parts contribute significantly to sensor demand in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Air Flow Sensors Market.- Robert Bosch GmbH

- DENSO Corporation

- Continental AG

- Delphi Technologies (BorgWarner Inc.)

- Hitachi Ltd.

- Sensata Technologies

- Infineon Technologies AG

- NXP Semiconductors

- STMicroelectronics

- TE Connectivity

- Analog Devices Inc.

- NGK Spark Plug Co. Ltd. (NTK Sensors)

- Visteon Corporation

- Marelli (Calsonic Kansei Corp.)

- ZF Friedrichshafen AG

- Eaton Corporation

- Johnson Electric Holdings Ltd.

- ACDelco (General Motors)

- Hyundai Mobis

- TI Automotive

Frequently Asked Questions

Analyze common user questions about the Automotive Air Flow Sensors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an automotive air flow sensor and its primary function?

An automotive air flow sensor, commonly either a Mass Air Flow (MAF) or Manifold Absolute Pressure (MAP) sensor, is an integral component in modern engine management systems. Its primary function is to accurately measure the precise amount of air entering the engine's intake manifold. This critical data is then transmitted to the engine control unit (ECU), enabling it to precisely calculate and inject the optimal amount of fuel, thereby ensuring an efficient air-fuel mixture for combustion. This process is vital for achieving desired engine performance, maximizing fuel economy, and crucially, minimizing harmful exhaust emissions, aligning with stringent environmental regulations.

Why is a properly functioning air flow sensor critical for vehicle performance?

A properly functioning air flow sensor is paramount for maintaining optimal vehicle performance and engine health. Its accuracy directly influences the engine's ability to operate efficiently by ensuring the correct fuel-to-air ratio. When an air flow sensor malfunctions, it can lead to a cascade of negative effects, including noticeable reductions in engine power and acceleration, rough idling, decreased fuel efficiency due to incorrect fuel delivery, and an increase in pollutant emissions. Furthermore, a faulty sensor often triggers the "Check Engine" light and can cause engine stalling, compromising vehicle reliability and potentially leading to more extensive and costly repairs if left unaddressed.

What are the common signs of a failing automotive air flow sensor?

Detecting a failing automotive air flow sensor often involves observing specific symptoms related to engine performance. Common indicators include a significant reduction in engine power or sluggish acceleration, particularly noticeable when driving uphill or carrying heavy loads. Drivers might experience rough or erratic idling, where the engine RPM fluctuates abnormally, or even frequent engine stalling. A noticeable decrease in fuel economy is another key sign, as the engine struggles to maintain an efficient air-fuel mixture. The most overt indicator is often the illumination of the "Check Engine" light on the dashboard, usually accompanied by specific diagnostic trouble codes (DTCs) related to air flow or mixture irregularities that can be read with an OBD-II scanner, guiding technicians towards the issue.

How do emission regulations impact the demand for air flow sensors?

Emission regulations profoundly impact the demand for automotive air flow sensors by setting increasingly stringent limits on pollutants released from vehicle exhausts. These regulations, such as Euro standards in Europe or CAFE standards in North America, compel automotive manufacturers to design engines that achieve exceptionally precise control over the combustion process. Air flow sensors are indispensable in this effort, as they provide the fundamental data required by the ECU to meticulously manage the air-fuel ratio, ensuring optimal combustion and thereby significantly reducing the output of harmful gases like nitrogen oxides (NOx) and carbon monoxide (CO). As global environmental mandates tighten, the demand for highly accurate, reliable, and technologically advanced air flow sensors continues to escalate, driving innovation in the market.

What role does AI play in the future of automotive air flow sensors?

Artificial Intelligence (AI) is poised to transform the future of automotive air flow sensors by significantly enhancing their capabilities and integration within broader vehicle systems. AI will enable advanced real-time data analysis from sensors, allowing for dynamic and adaptive engine optimization that goes beyond pre-programmed parameters, resulting in superior fuel efficiency and ultra-low emissions. Furthermore, AI-powered predictive maintenance algorithms will utilize sensor data to forecast potential component failures, enabling proactive servicing and reducing unexpected vehicle downtime. AI will also facilitate more sophisticated diagnostics, pinpointing nuanced performance issues with greater accuracy. This integration will make sensors not just data providers, but intelligent components of an interconnected, self-optimizing vehicle, crucial for the development of autonomous driving and smart mobility solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager