Automotive Air Intake Manifold Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430476 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automotive Air Intake Manifold Market Size

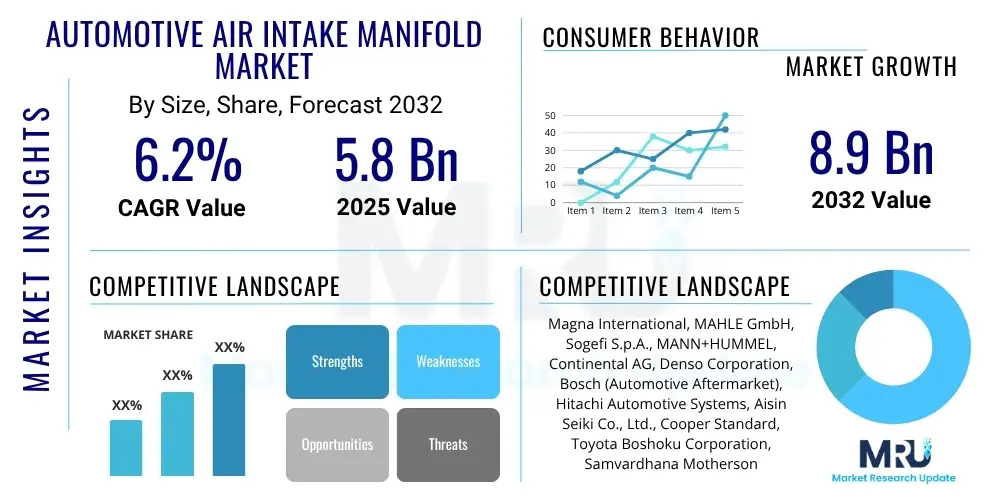

The Automotive Air Intake Manifold Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. The market is estimated at USD 5.8 Billion in 2025 and is projected to reach USD 8.9 Billion by the end of the forecast period in 2032.

Automotive Air Intake Manifold Market introduction

The Automotive Air Intake Manifold Market is crucial for internal combustion engine performance, acting as a vital conduit that directs air, or a fuel-air mixture, to the engine's cylinders. This critical component plays a pivotal role in optimizing engine efficiency, reducing emissions, and enhancing overall vehicle performance, making it indispensable in traditional powertrain architectures. Its design directly influences the volumetric efficiency and power output of an engine, adapting to various engine configurations and fuel types.

Product description highlights manifolds as assemblies of passages and runners that evenly distribute the combustion air to each cylinder. Initially, these were simple cast metal components, but modern advancements have led to complex designs incorporating variable geometry, resonators, and lightweight materials. Major applications span across passenger vehicles, commercial vehicles, and increasingly, off-highway and industrial vehicles, each demanding tailored design specifications to meet unique operational requirements and performance benchmarks. The benefits include improved fuel economy, enhanced engine power and torque, and significant contributions to meeting stringent global emission standards by ensuring optimal air-fuel mixing.

Driving factors propelling this market include the sustained growth in global automotive production, particularly in emerging economies, alongside a relentless focus on improving engine efficiency and reducing environmental impact. Automotive manufacturers are under constant pressure to innovate and integrate advanced manifold technologies to comply with increasingly strict regulatory landscapes for fuel consumption and emissions. This continuous drive for performance optimization and environmental compliance ensures a robust demand for sophisticated air intake manifold solutions.

Automotive Air Intake Manifold Market Executive Summary

The Automotive Air Intake Manifold Market is characterized by dynamic business trends centered on lightweighting, advanced material adoption, and integration with sophisticated engine management systems. Key industry players are focusing on research and development to introduce innovative variable intake manifold designs and utilize advanced plastics and composite materials, aiming for enhanced durability, reduced weight, and improved thermal efficiency. This strategic shift is driven by the industry's imperative to reduce vehicle weight and enhance fuel efficiency, thereby meeting stricter environmental regulations and consumer demands for more economical and powerful vehicles. Business models are increasingly emphasizing modular designs and partnerships with OEMs to co-develop custom solutions tailored to specific engine platforms.

Regional trends indicate significant growth in Asia Pacific, propelled by high volume automotive manufacturing and expanding vehicle fleets in countries like China and India. Europe and North America, while having mature markets, demonstrate strong demand for premium and technologically advanced air intake manifolds, driven by stringent emission norms and a preference for high-performance vehicles. These regions are leaders in adopting variable geometry and advanced material solutions. Latin America, the Middle East, and Africa are experiencing steady growth, benefiting from increasing urbanization, infrastructural development, and rising disposable incomes, leading to higher vehicle sales and a subsequent demand for automotive components.

Segment trends highlight the dominance of plastic air intake manifolds due to their cost-effectiveness, weight reduction benefits, and design flexibility compared to traditional aluminum or cast iron manifolds. Variable intake manifold technology is gaining considerable traction as it allows for optimized engine performance across a wider range of RPMs, enhancing both power and fuel economy. The Original Equipment Manufacturer (OEM) channel remains the largest segment for sales, given the direct integration into new vehicle production, while the aftermarket segment continues to grow, catering to replacement and performance upgrade demands as the global vehicle parc expands and ages.

AI Impact Analysis on Automotive Air Intake Manifold Market

Common user questions regarding AI's impact on the Automotive Air Intake Manifold Market often revolve around how artificial intelligence can optimize design, enhance manufacturing processes, improve material selection, and enable predictive maintenance. Users are keen to understand the extent to which AI can contribute to achieving higher performance, lower costs, and increased efficiency in the production and operation of these critical engine components. Concerns frequently include the initial investment required for AI integration, the necessary skill development for the workforce, and the potential for job displacement, alongside the overarching expectation that AI will usher in a new era of precision engineering and smart manufacturing within the automotive supply chain, ultimately leading to superior product quality and operational excellence.

AI's influence is transforming every stage of the automotive air intake manifold lifecycle, from initial concept to end-of-life considerations. In design, AI-driven generative design tools can rapidly explore thousands of optimal geometries, considering complex fluid dynamics, structural integrity, and manufacturing constraints, thereby accelerating innovation and reducing development cycles. Furthermore, AI algorithms are becoming instrumental in predictive maintenance, analyzing sensor data from manifolds in operational vehicles to identify potential failures before they occur, ensuring higher reliability and preventing costly breakdowns. This capability is particularly valuable in commercial and heavy-duty applications where uptime is critical.

Beyond design and maintenance, AI is also revolutionizing manufacturing processes and quality control. Machine learning models can monitor production lines in real-time, detecting anomalies and defects with unprecedented accuracy, minimizing scrap rates, and ensuring consistent product quality. Supply chain optimization, driven by AI, can forecast demand more accurately, manage inventory efficiently, and identify potential disruptions, leading to a more resilient and cost-effective production ecosystem. The integration of AI also supports the development of more personalized and adaptive components, allowing for customized performance characteristics based on vehicle models and regional operational demands.

- Generative design optimization for complex geometries and material efficiency.

- Predictive maintenance analytics to prevent manifold failures in operational vehicles.

- Real-time quality control and defect detection in manufacturing processes.

- Supply chain optimization for raw materials and finished product distribution.

- Advanced material selection and performance simulation through machine learning.

- Robot guidance and automation in manifold assembly lines for precision and speed.

- Data-driven insights for continuous product improvement and innovation.

DRO & Impact Forces Of Automotive Air Intake Manifold Market

The Automotive Air Intake Manifold Market is significantly influenced by a confluence of drivers, restraints, opportunities, and inherent impact forces shaping its trajectory. A primary driver is the persistent global growth in automotive production, particularly in developing economies, which inherently boosts demand for essential engine components. This is coupled with increasingly stringent governmental emission regulations worldwide, compelling manufacturers to adopt more advanced and efficient manifold designs that contribute to lower carbon footprints and improved fuel economy. The burgeoning demand for fuel-efficient vehicles, driven by rising fuel prices and environmental consciousness among consumers, further propels innovation in manifold technology. Moreover, continuous advancements in engine technology, such as direct injection and turbocharging, necessitate sophisticated air intake manifolds capable of handling higher pressures and temperatures, supporting optimized engine performance.

However, the market faces notable restraints that could impede its growth. Volatility in raw material prices, particularly for plastics, aluminum, and composite materials, directly impacts manufacturing costs and profit margins. The accelerating global shift towards electric vehicles (EVs) presents a long-term existential challenge, as EVs do not require traditional internal combustion engine components, potentially leading to a gradual decline in demand for air intake manifolds in new vehicle production over the next few decades. Furthermore, the complex manufacturing processes involved in producing advanced manifolds, requiring specialized equipment and skilled labor, can act as a barrier to entry for new players and limit production scalability.

Despite these challenges, substantial opportunities exist within the market. The ongoing development of innovative lightweight and high-performance materials, such as advanced polymers and composites, offers avenues for creating more efficient and durable manifolds. There is a growing demand for variable intake manifold technology, which optimizes air flow for different engine speeds, promising enhanced fuel efficiency and power delivery across a broader operational range. Additionally, the rapid growth in automotive markets of emerging economies presents significant untapped potential for manufacturers to expand their customer base and establish new production facilities. The continuous evolution of performance-enhancing technologies and the aftermarket segment for replacement and upgrade parts also provide steady revenue streams.

The overall impact forces shaping this market include global economic growth, which directly influences consumer purchasing power and vehicle sales. Regulatory landscapes, particularly those pertaining to emissions and fuel efficiency, are critical in dictating product development directions. Technological advancements, especially in material science, additive manufacturing, and engine control systems, continually redefine product capabilities. Lastly, evolving consumer preferences for vehicles that offer better performance, fuel economy, and lower environmental impact exert a strong influence on manufacturer strategies and product offerings, guiding the industry towards more advanced and sustainable air intake manifold solutions.

Segmentation Analysis

The Automotive Air Intake Manifold Market is comprehensively segmented based on material type, vehicle type, and sales channel, providing a granular understanding of market dynamics and catering to the diverse requirements of the automotive industry. This segmentation allows for targeted strategies and product development, addressing specific needs ranging from lightweighting in passenger cars to robust durability in commercial vehicles, and catering to both new vehicle assembly and the expanding aftermarket. Each segment reflects unique demand drivers and technological preferences, contributing to the overall market complexity and growth.

- By Material Type:

- Plastic: Dominant segment due to light weight, cost-effectiveness, and design flexibility, enabling complex geometries.

- Aluminum: Utilized for high-performance engines and applications requiring higher temperature and pressure resistance, though heavier.

- Composite Materials: Emerging segment offering superior strength-to-weight ratio and enhanced thermal properties, ideal for advanced applications.

- By Vehicle Type:

- Passenger Cars: Largest segment, driven by high production volumes and focus on fuel efficiency and emissions reduction.

- Commercial Vehicles: Includes light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and buses, prioritizing durability and reliability.

- Off-Highway Vehicles: Encompasses construction, agricultural, and mining equipment, demanding rugged and robust manifold solutions.

- By Sales Channel:

- OEM (Original Equipment Manufacturer): Primary channel, supplying manifolds directly to vehicle assembly lines for new cars.

- Aftermarket: Caters to replacement parts, repairs, and performance upgrades for existing vehicles, growing with vehicle parc.

Value Chain Analysis For Automotive Air Intake Manifold Market

The value chain for the Automotive Air Intake Manifold Market is a complex and interconnected network, beginning with raw material sourcing and extending through manufacturing, assembly, distribution, and ultimately to the end-users. At the upstream stage, it involves a diverse set of suppliers providing critical raw materials such as various grades of plastics (e.g., polyamide, polypropylene), aluminum alloys, and composite materials like carbon fiber. These raw material providers are crucial for the manifold manufacturers, impacting material properties, cost efficiency, and supply chain stability. Component manufacturers further refine these materials into sub-components, including gaskets, sensors, and actuators, which are integrated into the final manifold assembly. The performance and quality of these upstream components directly influence the overall integrity and functionality of the air intake manifold.

Moving downstream, the value chain primarily involves the automotive Original Equipment Manufacturers (OEMs) who integrate the finished air intake manifolds into their engine assemblies during vehicle production. These relationships are often long-term and involve significant collaborative design and engineering efforts to ensure perfect fit, optimal performance, and compliance with specific vehicle models and regulatory standards. Beyond new vehicle production, the aftermarket segment represents another significant downstream channel, where manifolds are sold for replacement and repair purposes through a network of distributors, wholesalers, and independent repair shops. This segment is characterized by a wider variety of product offerings and pricing structures, catering to an aging global vehicle parc.

Distribution channels for automotive air intake manifolds are primarily bifurcated into direct and indirect routes. Direct distribution involves manufacturers supplying directly to major OEMs, typically involving large volumes and just-in-time delivery systems to meet production schedules. This direct channel fosters close collaboration and ensures stringent quality control. Indirect distribution primarily serves the aftermarket, leveraging a network of specialized automotive parts distributors, wholesalers, and retailers. These intermediaries play a crucial role in ensuring widespread availability of replacement parts, managing inventory, and providing logistical support across various geographic regions. The effectiveness of both direct and indirect channels is paramount for market penetration and customer satisfaction, requiring robust logistics and efficient inventory management systems.

Automotive Air Intake Manifold Market Potential Customers

The primary potential customers for the Automotive Air Intake Manifold Market are broadly categorized into two main groups: Original Equipment Manufacturers (OEMs) and the aftermarket segment, which includes distributors, independent repair shops, and direct consumers seeking replacement or upgrade parts. OEMs represent the largest customer base, as they require high volumes of air intake manifolds for the assembly of new internal combustion engine vehicles. Their purchasing decisions are driven by factors such as product quality, performance specifications, compliance with emission regulations, supply chain reliability, and cost-effectiveness. Establishing strong, long-term relationships with global and regional automotive OEMs is critical for manifold manufacturers, often involving co-development partnerships and customized solutions to integrate seamlessly with specific engine designs.

The aftermarket segment constitutes the second significant customer base, catering to the ongoing maintenance, repair, and upgrade needs of existing vehicles. Within this segment, distributors and wholesalers play a pivotal role, procuring manifolds from manufacturers and supplying them to a vast network of independent garages, franchised workshops, and automotive parts retailers. These customers prioritize availability, pricing, and compatibility with a wide range of vehicle models. Additionally, individual vehicle owners or enthusiasts sometimes purchase performance-oriented air intake manifolds directly for vehicle customization or to enhance engine power and efficiency beyond factory specifications.

As the global vehicle parc continues to grow and age, the demand from the aftermarket segment is projected to remain robust, offering stable revenue streams even amidst the long-term transition towards electric vehicles in the OEM sector. Meeting the diverse needs of these potential customers requires a differentiated approach, balancing high-volume, cost-competitive production for OEMs with flexible, inventory-managed distribution for the aftermarket. Manufacturers must also stay abreast of evolving engine technologies and vehicle models to ensure their product portfolios remain relevant and competitive across both customer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2032 | USD 8.9 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magna International, MAHLE GmbH, Sogefi S.p.A., MANN+HUMMEL, Continental AG, Denso Corporation, Bosch (Automotive Aftermarket), Hitachi Automotive Systems, Aisin Seiki Co., Ltd., Cooper Standard, Toyota Boshoku Corporation, Samvardhana Motherson Group, Usui Kokusai Sangyo Kaisha Ltd., Rheinmetall Automotive AG (Kolbenschmidt Pierburg), Eaton Corporation, Delphi Technologies (BorgWarner), Hella GmbH & Co. KGaA, Valeo S.A., KSR International Co., Shandong Wulong Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Air Intake Manifold Market Key Technology Landscape

The Automotive Air Intake Manifold Market is constantly evolving, driven by innovations in material science, manufacturing processes, and engine management systems. One of the most significant technological advancements is the widespread adoption of variable intake manifold (VIM) technology. VIMs incorporate valves or movable runners that alter the length and volume of the intake tracts depending on engine speed and load. This dynamic adjustment optimizes air charge delivery to the cylinders across the entire RPM range, leading to improved torque at low speeds and increased power at high speeds, while simultaneously enhancing fuel efficiency and reducing emissions. The integration of electronic controls allows for precise management of these variable geometries, making VIMs a cornerstone of modern engine optimization.

Another critical area of technological advancement lies in the materials used for manifold construction. The shift from traditional cast aluminum and iron to advanced lightweight plastics and composite materials is a defining trend. Plastic injection molding techniques have become highly sophisticated, enabling the production of complex, multi-component manifolds with integrated features like resonators, throttle body mounts, and sensor ports. These plastic manifolds offer significant weight savings, contributing to overall vehicle lightness and fuel economy, alongside enhanced thermal insulation properties. Furthermore, the exploration of composite materials, such as fiberglass-reinforced polymers, is gaining traction for high-performance and high-temperature applications, offering superior strength-to-weight ratios and design flexibility.

Beyond materials and variable geometry, manufacturing technologies and analytical tools are also advancing rapidly. Lost core casting is a specialized process for creating intricate aluminum manifolds with internal passages that are difficult to achieve with conventional casting methods. Additive manufacturing, specifically 3D printing, is increasingly utilized for rapid prototyping and producing complex, customized manifold designs in limited runs, accelerating the development cycle. Moreover, the application of Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) software has become indispensable in the design phase. These simulation tools allow engineers to accurately model airflow dynamics, pressure drop, and structural integrity, ensuring optimal performance and durability before physical prototypes are even made, significantly reducing development time and costs.

Regional Highlights

- Asia Pacific (APAC): This region dominates the automotive air intake manifold market due to its robust and expanding automotive manufacturing base, particularly in countries like China, India, Japan, and South Korea. High vehicle production volumes, coupled with increasing consumer demand for personal and commercial transportation, fuel the consistent growth. The adoption of advanced engine technologies and local manufacturing capabilities further solidify APAC's leading position.

- Europe: Characterized by stringent emission regulations and a strong emphasis on fuel efficiency and advanced engine performance, Europe represents a mature but highly innovative market. Countries such as Germany, France, and the UK are at the forefront of adopting variable intake manifold technology and lightweight composite materials in premium and luxury vehicle segments. The demand is driven by a focus on sustainable mobility and technological superiority.

- North America: This region exhibits a steady demand, influenced by the large light truck and SUV market, which often requires robust and high-performance intake manifolds. The presence of major automotive OEMs and a strong aftermarket segment contribute significantly to market size. Innovation here is geared towards improving engine power, emissions compliance, and durability, with increasing interest in plastic and composite solutions.

- Latin America: The market in Latin America is witnessing moderate growth, driven by increasing vehicle production and sales in Brazil, Mexico, and Argentina. Economic development and urbanization are key factors expanding the regional automotive industry. While cost-effectiveness remains a priority, there is a gradual shift towards more technologically advanced and efficient manifold systems as regulations evolve.

- Middle East and Africa (MEA): This region is an emerging market for automotive air intake manifolds, with growth spurred by increasing investments in automotive assembly plants, particularly in countries like South Africa and Saudi Arabia. Rising disposable incomes and infrastructural development are boosting vehicle sales, leading to a growing demand for both OEM and aftermarket components. The market is still developing but shows promising future potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Air Intake Manifold Market.- Magna International

- MAHLE GmbH

- Sogefi S.p.A.

- MANN+HUMMEL

- Continental AG

- Denso Corporation

- Bosch (Automotive Aftermarket)

- Hitachi Automotive Systems

- Aisin Seiki Co., Ltd.

- Cooper Standard

- Toyota Boshoku Corporation

- Samvardhana Motherson Group

- Usui Kokusai Sangyo Kaisha Ltd.

- Rheinmetall Automotive AG (Kolbenschmidt Pierburg)

- Eaton Corporation

- Delphi Technologies (BorgWarner)

- Hella GmbH & Co. KGaA

- Valeo S.A.

- KSR International Co.

- Shandong Wulong Group

Frequently Asked Questions

What are the primary functions of an automotive air intake manifold?

The primary function of an automotive air intake manifold is to efficiently distribute a uniform air charge to each cylinder of an internal combustion engine. This intricate component ensures that the correct volume of air, or a precisely mixed air-fuel ratio in older carbureted systems, reaches the combustion chambers. Beyond simple distribution, modern intake manifolds are engineered to optimize airflow dynamics, which significantly impacts engine performance characteristics such as horsepower, torque, and fuel efficiency. They can also contribute to reducing emissions by promoting more complete combustion.

Many contemporary manifolds incorporate advanced features like variable geometry systems, which dynamically adjust the length and volume of the intake runners based on engine speed and load. This allows for optimized airflow across a broad RPM range, improving low-end torque and high-end power. Additionally, they often house sensors for air temperature and pressure, and provide mounting points for fuel injectors and the throttle body, acting as a central hub for engine air management. The design of the manifold is therefore critical for the overall efficiency and responsiveness of the engine, adapting to diverse driving conditions and environmental demands.

Furthermore, air intake manifolds play a crucial role in acoustic management, often integrating resonators and Helmholtz chambers to minimize undesirable engine noise and vibrations, thereby enhancing driving comfort. They also contribute to thermal management, especially plastic manifolds, which can insulate the incoming air from engine heat, leading to a denser air charge and improved engine output. Thus, an air intake manifold is not merely a passive conduit but an active, integral component of a sophisticated engine system, constantly being refined for optimal performance and environmental compliance.

How do material advancements impact the automotive air intake manifold market?

Material advancements have profoundly impacted the automotive air intake manifold market by driving innovation in design, manufacturing efficiency, and overall engine performance. The shift from traditional heavier metals like cast iron and aluminum to lightweight plastics and composite materials is a defining trend. Plastics, particularly reinforced polyamides and polypropylenes, offer significant weight reduction, which directly contributes to improved vehicle fuel efficiency and lower emissions, aligning with global regulatory pressures and consumer demand for economical vehicles. This lightweighting trend is crucial for automakers striving to meet stringent CO2 emission targets without compromising structural integrity.

Beyond weight savings, advanced plastics provide greater design flexibility, enabling the creation of complex geometries and integrated features that were challenging or impossible with metal casting. This allows for optimized airflow paths, reduced part count through component consolidation, and better acoustic dampening. The thermal insulation properties of plastics also help keep the intake air cooler, resulting in a denser charge and enhanced engine power. Composite materials, such as fiberglass or carbon fiber reinforced polymers, are further extending these benefits, offering superior strength-to-weight ratios and higher temperature resistance, making them ideal for high-performance and turbocharged applications.

The adoption of these materials also impacts manufacturing processes, favoring advanced injection molding techniques and additive manufacturing for prototyping and specialized production. This not only accelerates development cycles but also reduces tooling costs and waste. Consequently, material advancements are not just about component properties; they are central to modern engine design philosophy, fostering innovation, cost reduction, and environmental sustainability across the automotive industry by enabling the production of more efficient, lighter, and higher-performing air intake manifolds.

What role do variable intake manifolds play in engine performance?

Variable intake manifolds (VIMs) play a crucial and sophisticated role in optimizing engine performance across a wide range of operating conditions. Unlike fixed-geometry manifolds, VIMs are equipped with internal valves or movable runners that can dynamically alter the effective length and volume of the intake tracts feeding air to the engine cylinders. This adjustability allows the engine to exploit the phenomenon of resonant tuning, where air pulsations within the manifold can be timed to enhance cylinder filling at specific engine speeds, much like how an organ pipe's length affects its tone. By optimizing this resonance, VIMs significantly improve the engine's volumetric efficiency.

At lower engine RPMs, VIMs typically extend the effective length of the intake runners. This longer path helps create a stronger inertial ram effect, packing more air into the cylinders and boosting low-end torque. This is particularly beneficial for urban driving and initial acceleration, where strong pull-away power is desirable. Conversely, at higher RPMs, the VIM shortens the intake runners. This shorter path reduces airflow restriction and optimizes higher-frequency resonances, allowing the engine to breathe more freely and produce maximum horsepower at high speeds. The transition between these configurations is precisely managed by the engine's electronic control unit (ECU), which constantly monitors engine speed, load, and other parameters to select the optimal manifold geometry.

The ability of VIMs to provide a broad power band—good torque at low speeds and high power at high speeds—without requiring a larger displacement engine, translates into multiple benefits. These include improved fuel economy, as the engine operates more efficiently across its entire operating range, and reduced emissions due to more complete combustion. VIMs effectively allow a single engine to behave like two different engines, offering versatility and enhanced driving dynamics that are highly valued in modern vehicles. Their integration is a key technological enabler for downsizing engines while maintaining or even improving performance characteristics.

How does the shift to electric vehicles affect the demand for air intake manifolds?

The global shift towards electric vehicles (EVs) presents a significant long-term challenge to the demand for traditional automotive components, including air intake manifolds. As EVs operate solely on electric powertrains and do not rely on internal combustion engines (ICEs) for propulsion, they inherently do not require components like air intake manifolds. This fundamental difference means that with every new electric vehicle sold, the potential market for air intake manifolds in new vehicle production diminishes. This trend compels manufacturers within the air intake manifold market to re-evaluate their long-term strategies and diversify their product portfolios.

However, the impact is not immediate or absolute. The transition to EVs is a gradual process, and internal combustion engine vehicles are expected to constitute a substantial portion of the global vehicle parc for several decades to come. Therefore, while demand from new ICE vehicle production may eventually decline, the aftermarket segment for replacement and repair of existing ICE vehicles will continue to provide a significant revenue stream for air intake manifold manufacturers. Furthermore, hybrid vehicles, which combine an ICE with an electric motor, still require air intake manifolds, albeit potentially with design modifications to optimize efficiency within a hybrid powertrain.

Manufacturers in this market are actively responding to this paradigm shift by investing in research and development for lightweight and high-performance solutions for remaining ICE applications, exploring diversification into components for hybrid vehicles, or even pivoting to manufacturing parts for electric vehicle thermal management or battery systems. Strategic partnerships, mergers, and acquisitions are also becoming common as companies adapt to the evolving automotive landscape. While the long-term outlook for air intake manifolds in new pure ICE vehicles is one of eventual decline, the market will persist through the aftermarket and evolving hybrid technologies for the foreseeable future, necessitating adaptability and innovation from industry players.

Which region dominates the automotive air intake manifold market and why?

The Asia Pacific (APAC) region currently dominates the automotive air intake manifold market, and this dominance is attributable to several key factors. Primarily, APAC is the world's largest hub for automotive manufacturing and sales, with countries like China, India, Japan, and South Korea leading in vehicle production volumes. China, in particular, has consistently been the largest automotive market globally, driving immense demand for a wide array of automotive components, including air intake manifolds, for both passenger cars and commercial vehicles. The sheer scale of new vehicle assembly in this region naturally translates to higher consumption of these integral engine parts.

Secondly, the rapid economic development and urbanization across many APAC countries have led to a significant increase in disposable incomes and a growing middle class, spurring higher rates of vehicle ownership. This expansion of the vehicle parc creates sustained demand for both original equipment in new vehicles and a burgeoning aftermarket for replacement and repair parts. Local presence of numerous global and domestic automotive OEMs and Tier 1 suppliers further consolidates the region's position, fostering a robust supply chain and manufacturing ecosystem capable of meeting high volume demands efficiently.

Lastly, while regulatory landscapes in APAC are progressively becoming more stringent regarding emissions and fuel efficiency, driving technological advancements, the emphasis on cost-effectiveness in high-volume segments ensures a competitive market environment. Manufacturers in the region are adept at producing efficient and reliable air intake manifolds at competitive prices, serving both domestic and international markets. This combination of high production volumes, expanding consumer base, and strong manufacturing capabilities firmly establishes the Asia Pacific region as the leading market for automotive air intake manifolds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager