Automotive Boot Release Cable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428867 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Automotive Boot Release Cable Market Size

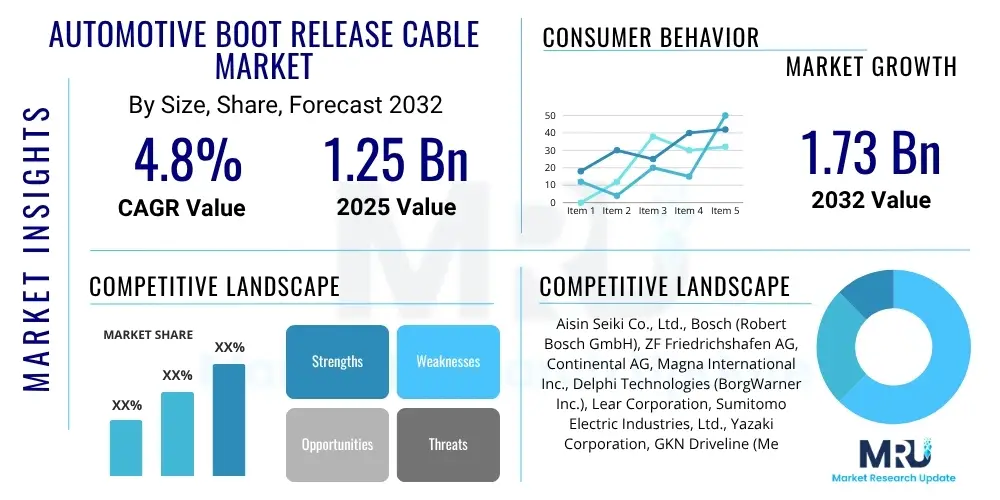

The Automotive Boot Release Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 1.25 Billion in 2025 and is projected to reach USD 1.73 Billion by the end of the forecast period in 2032.

Automotive Boot Release Cable Market introduction

The Automotive Boot Release Cable Market encompasses the production, distribution, and sale of mechanical or electronic cable systems designed to facilitate the opening of a vehicle's boot or trunk lid. These cables serve as crucial components within a vehicle's overall mechanical and safety architecture, providing a reliable and accessible means for cargo compartment access. Primarily, these systems ensure convenience for vehicle occupants and contribute to the vehicle's functional design. Modern iterations often integrate with central locking systems or smart access features, enhancing user experience and security. The market is driven by consistent global automotive production, consumer demand for enhanced convenience and safety features, and the ongoing need for maintenance and replacement parts in the aftermarket.

Product descriptions vary significantly, ranging from traditional steel wire cables encased in protective conduits for manual operation to more sophisticated electronic release mechanisms that utilize solenoids and electrical signals, often integrated with a vehicle's central electronics. Manual cables offer a simple, robust, and cost-effective solution, commonly found in older models or economy segments, providing a physical link from a lever inside the cabin or a keyhole outside to the boot latch. Electronic systems, on the other hand, provide keyless entry, remote access, and sometimes foot-activated sensors, leveraging advanced vehicle electronics for greater user convenience and integrating seamlessly into modern vehicle designs, especially in premium and luxury segments.

Major applications of automotive boot release cables span across all vehicle types, including passenger cars (sedans, hatchbacks, SUVs, luxury vehicles), light commercial vehicles, and some heavy-duty trucks where cargo access is essential. The benefits are primarily related to convenience, allowing effortless access to the boot for loading and unloading luggage or goods. They also play a role in vehicle security, preventing unauthorized access to the cargo area when properly integrated with locking mechanisms. The market is propelled by factors such as increasing global vehicle production, stringent safety regulations requiring internal emergency release mechanisms, and a growing consumer preference for advanced and convenient vehicle features. The aftermarket segment further fuels demand as vehicles age and components require replacement due to wear and tear or damage.

Automotive Boot Release Cable Market Executive Summary

The Automotive Boot Release Cable Market is experiencing steady growth, propelled by the consistent expansion of global automotive manufacturing and the rising consumer expectation for enhanced convenience and vehicle functionality. Business trends indicate a gradual shift towards electronic boot release systems in new vehicle models, particularly within the mid-range and luxury segments, driven by technological advancements and the integration of smart vehicle features. However, mechanical cable systems continue to maintain a significant presence, especially in cost-sensitive segments and the robust aftermarket, where durability and affordability are primary considerations. The industry is also witnessing innovations in material science, focusing on lightweight and corrosion-resistant components to improve product longevity and reduce overall vehicle weight, contributing to fuel efficiency and sustainability goals.

Regional trends highlight the Asia Pacific (APAC) region as a dominant force in market growth, attributed to its burgeoning automotive production hubs, increasing disposable incomes, and the rapid adoption of advanced vehicle technologies. Countries like China, India, and Japan are at the forefront of this expansion. Europe and North America represent mature markets characterized by stable demand, driven by vehicle replacement cycles and a strong aftermarket segment. These regions also exhibit a higher penetration of electronic and advanced boot release systems due to consumer demand for premium features and stricter safety standards. Latin America, the Middle East, and Africa are emerging markets showing promising growth as urbanization and vehicle ownership rates increase, leading to higher demand for both new vehicles and aftermarket components.

Segment trends reveal that while manual boot release cables remain essential for their reliability and cost-effectiveness, the electronic boot release segment is projected to exhibit a faster growth rate. This acceleration is fueled by the proliferation of smart access features, remote key systems, and integrated security solutions across various vehicle platforms. Within vehicle types, passenger cars, particularly SUVs and premium sedans, are key contributors to market revenue, driven by their larger production volumes and higher adoption of advanced features. The aftermarket segment plays a critical role in sustaining demand, offering repair and replacement solutions that ensure the continued functionality and safety of aging vehicle fleets. Strategic collaborations between cable manufacturers and automotive OEMs are becoming increasingly vital for co-developing innovative and integrated boot release solutions, further shaping market dynamics.

AI Impact Analysis on Automotive Boot Release Cable Market

User inquiries regarding AI's impact on the Automotive Boot Release Cable Market frequently center on whether mechanical components will become obsolete, how AI can enhance the functionality and safety of boot release systems, and its potential role in manufacturing and supply chain optimization. While AI's direct influence on the core mechanical or simple electronic function of a boot release cable is limited, its indirect impact is substantial and transformative. Users are keen to understand if AI-driven systems could offer predictive maintenance, identify potential cable failures before they occur, or integrate with advanced vehicle intelligence for smarter, more secure cargo access. The primary concerns revolve around the cost implications of AI integration, potential cyber security vulnerabilities in highly connected systems, and the practical benefits for a seemingly low-tech component. These questions reflect a broader industry trend towards intelligent vehicle systems and a desire to see how even foundational components can benefit from technological advancements.

AI's influence primarily manifests in areas surrounding the boot release cable rather than in the cable itself. For instance, AI algorithms can optimize the manufacturing processes for these cables, predicting equipment maintenance needs, improving quality control through automated inspection, and reducing waste. In the supply chain, AI can forecast demand more accurately, optimize logistics, and manage inventory for raw materials and finished products, ensuring a more efficient and resilient delivery of components to OEMs and the aftermarket. Moreover, AI powers the sophisticated electronic control units (ECUs) that manage keyless entry systems and power liftgates, which sometimes integrate with or replace traditional cable mechanisms. These AI-driven systems contribute to the overall user experience by offering features like foot-activated boot opening or personalized access controls, indirectly influencing the specifications and requirements for associated cable systems.

The future application of AI in this domain could extend to vehicle diagnostics, where AI could analyze data from various sensors to predict the wear and tear of mechanical components, including boot release cables, enabling proactive maintenance. This predictive capability would enhance vehicle reliability and reduce unexpected failures, improving consumer satisfaction. Additionally, AI can contribute to the development of highly secure access protocols, ensuring that only authorized individuals can operate the boot release, particularly in advanced electronic systems that are part of a broader connected car ecosystem. While the cable itself remains a physical link, the intelligence surrounding its operation, manufacturing, and maintenance is increasingly being shaped by AI, driving efficiencies and enhancing user safety and convenience indirectly.

- AI optimizes manufacturing processes for improved efficiency and quality control.

- Predictive analytics driven by AI can forecast demand and optimize supply chain logistics for cable components.

- AI-powered ECUs enhance electronic boot release systems, enabling smart features like keyless access and foot activation.

- Potential for AI in predictive maintenance of mechanical components, including boot release cables, based on vehicle data.

- AI contributes to enhanced security features within smart access systems, preventing unauthorized boot access.

- Automated visual inspection using AI improves quality assurance for cable manufacturing.

DRO & Impact Forces Of Automotive Boot Release Cable Market

The Automotive Boot Release Cable Market is shaped by a confluence of driving forces, inherent restraints, promising opportunities, and a dynamic interplay of impact forces. Drivers primarily include the consistent global production of automobiles across all segments, as every vehicle requires a reliable boot access mechanism. Consumer demand for enhanced convenience features, such as remote boot opening and power liftgates, directly fuels the adoption of more advanced electronic systems. Additionally, evolving automotive safety standards, which often mandate internal emergency release mechanisms for trunks, ensure a baseline demand for these components. The robust aftermarket segment also acts as a significant driver, requiring regular replacements due to wear, tear, or damage over a vehicle's lifespan, ensuring sustained demand even for older vehicle models.

However, the market faces several restraints that could impede its growth. A significant restraint is the ongoing technological shift towards fully electronic or even sensor-based boot release mechanisms that may entirely bypass traditional cables in premium and luxury vehicles. While mechanical cables offer cost-effectiveness, the trend towards integrated smart systems reduces their relative market share in new vehicle designs. Volatility in raw material prices, particularly for steel and plastics, can impact manufacturing costs and profitability for cable producers. Furthermore, complexities in the global supply chain, exacerbated by geopolitical tensions and logistics challenges, can lead to production delays and increased operational costs, affecting market stability. The design limitations of mechanical cables, such as susceptibility to kinks or corrosion, also present an ongoing challenge that electronic systems aim to overcome.

Opportunities within the market largely stem from the burgeoning electric vehicle (EV) sector, which requires unique design considerations for components and may open avenues for new types of integrated release mechanisms. The demand for lightweight materials that contribute to vehicle efficiency and reduced emissions presents an opportunity for innovation in cable construction. Furthermore, advancements in smart connectivity and IoT within vehicles could indirectly integrate boot release functionality into a broader ecosystem of intelligent vehicle features, offering new avenues for development in electronic release systems. Developing economies, with their expanding vehicle fleets and growing middle-class populations, present significant untapped potential for both OEM supply and aftermarket demand. The impact forces influencing the market include the strong bargaining power of large automotive OEMs, who dictate specifications and pricing to suppliers. The threat of substitutes, particularly from fully electronic or touchless systems, is moderate but growing. The threat of new entrants is relatively low due to the established supply chains and capital intensity, while competitive rivalry among existing cable manufacturers remains intense, driving continuous innovation and cost optimization.

- Drivers:

- Consistent global automotive production volumes.

- Increasing consumer demand for convenience features like remote boot opening.

- Adherence to evolving automotive safety regulations (e.g., internal emergency releases).

- Robust demand from the automotive aftermarket for replacement parts.

- Restraints:

- Technological shift towards fully electronic or sensor-based release systems, reducing reliance on cables.

- Volatility in raw material prices (steel, plastics).

- Complexities and disruptions in global supply chains.

- Design limitations of mechanical cables (e.g., corrosion, kinking).

- Opportunity:

- Growth in the Electric Vehicle (EV) market requiring new component designs.

- Development and adoption of lightweight and durable materials.

- Integration with smart connectivity and Internet of Things (IoT) in vehicles.

- Expansion in emerging automotive markets with increasing vehicle ownership.

- Impact forces:

- Bargaining power of buyers (automotive OEMs) is high.

- Bargaining power of suppliers (raw material providers) is moderate.

- Threat of new entrants is low due to capital intensity and established supply chains.

- Threat of substitutes (fully electronic systems) is moderate and increasing.

- Intensity of competitive rivalry among existing players is high.

Segmentation Analysis

The Automotive Boot Release Cable Market is comprehensively segmented to provide a detailed understanding of its diverse components and market dynamics. This segmentation allows for precise analysis of consumer preferences, technological advancements, and strategic opportunities across various product types, vehicle applications, and sales channels. By dissecting the market along these lines, stakeholders can identify key growth areas, understand competitive landscapes, and tailor their product offerings and marketing strategies more effectively. The primary segmentation includes categorizing boot release cables based on their operational mechanism, the type of vehicle they serve, and the sales channel through which they reach the end-user. Each segment reflects unique market characteristics, growth trajectories, and competitive forces that influence the overall market structure and future outlook.

Understanding these segments is crucial for strategic planning. For instance, the distinction between manual and electronic systems highlights the industry's progression towards automation and smart features, while also acknowledging the enduring demand for simpler, more robust solutions. Similarly, differentiating by vehicle type underscores the varying design requirements and feature expectations across different automotive segments, from mass-market passenger cars to specialized commercial vehicles. The segmentation by sales channel, namely OEM versus aftermarket, reveals the distinct supply chain dynamics and customer bases that manufacturers must address. This detailed analytical framework not only provides clarity on current market trends but also offers insights into potential shifts driven by technological innovation, regulatory changes, and evolving consumer behavior in the global automotive industry.

- Type

- Manual Boot Release Cable: Traditional mechanical cables, actuated by a lever or button, providing a direct physical link to the latch.

- Electronic Boot Release Cable: Cables integrated with electronic solenoids or actuators, triggered by electrical signals from remote keys, cabin buttons, or sensors.

- Vehicle Type

- Passenger Cars:

- Sedans

- Hatchbacks

- SUVs

- Luxury Vehicles

- Commercial Vehicles:

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Passenger Cars:

- Sales Channel

- Original Equipment Manufacturer (OEM): Cables supplied directly to automotive manufacturers for installation in new vehicles.

- Aftermarket: Cables sold as replacement parts through various distribution channels (e.g., auto parts stores, online retailers, independent workshops).

Value Chain Analysis For Automotive Boot Release Cable Market

The value chain for the Automotive Boot Release Cable Market commences with upstream activities involving the sourcing and processing of raw materials. This includes suppliers of high-tensile steel wire for the inner cable, various plastics (such as PVC or polyethylene) for the outer casing, and metals like brass or aluminum for connectors and end fittings. These raw material providers form the foundational layer, supplying components to specialized cable manufacturers. The manufacturing phase involves precision engineering, including wire drawing, extrusion for protective conduits, injection molding for plastic components, and assembly processes that ensure the durability and functional integrity of the final boot release cable product. Quality control and testing are critical at this stage to meet stringent automotive standards and ensure reliable performance.

Further along the value chain, the fabricated boot release cables are supplied to automotive component integrators or directly to Original Equipment Manufacturers (OEMs). OEMs incorporate these cables into their vehicle assembly lines, often as part of larger trunk lid or access systems. The downstream activities extend to the distribution and sale of vehicles equipped with these cables. For the aftermarket segment, finished cables are distributed through a network of wholesalers, regional distributors, and retail outlets, including specialized auto parts stores, online platforms, and independent garages. Installation and maintenance services by certified technicians at authorized service centers or independent repair shops constitute the final stage of the value chain, ensuring the long-term functionality of the boot release system for end-users.

The distribution channels are typically bifurcated into direct and indirect routes. Direct distribution primarily involves supply agreements between cable manufacturers and automotive OEMs, characterized by large volume orders and stringent quality specifications. This direct relationship ensures seamless integration into new vehicle production. Indirect distribution channels cater predominantly to the aftermarket, utilizing a network of third-party distributors, wholesalers, and retailers to reach independent garages, body shops, and individual consumers. This multi-tiered approach ensures widespread availability of replacement parts, crucial for maintaining the operational lifespan of vehicles and addressing component failures or upgrades. Both channels are vital for the overall market health, each serving distinct customer needs and contributing to the overall market revenue and sustainability.

Automotive Boot Release Cable Market Potential Customers

The potential customer base for the Automotive Boot Release Cable Market is diverse and extends across various stakeholders within the automotive ecosystem. Primarily, Original Equipment Manufacturers (OEMs) represent the largest segment of buyers, as every new vehicle manufactured requires a boot release cable system integrated into its design. These include global automotive giants producing passenger cars, SUVs, light commercial vehicles, and heavy-duty vehicles. OEMs demand high-quality, durable, and cost-effective solutions that meet their specific design requirements, safety standards, and production schedules, often establishing long-term supply contracts with cable manufacturers.

Beyond new vehicle production, the aftermarket constitutes another significant customer segment. This includes a broad array of entities such as independent automotive repair shops and garages that perform maintenance and repair services on existing vehicles. These establishments require replacement boot release cables to service customer vehicles where the original component has failed due to wear and tear, accident damage, or corrosion. Additionally, automotive parts retailers, both brick-and-mortar stores and online platforms, serve as crucial intermediaries, selling these cables directly to individual vehicle owners and smaller repair shops. These end-users are driven by the need for reliable and readily available replacement parts to ensure the continued functionality and safety of their vehicles.

Fleet operators and leasing companies also represent potential customers, as they maintain large inventories of vehicles and require efficient solutions for repairs and maintenance to minimize downtime. Furthermore, specialized vehicle modification companies or custom car builders may source boot release cables for bespoke projects or upgrades, contributing to a niche but important demand. The continuous churn of the global vehicle fleet, coupled with the need for ongoing maintenance, ensures a sustained and evolving customer base for manufacturers of automotive boot release cables.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.25 Billion |

| Market Forecast in 2032 | USD 1.73 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aisin Seiki Co., Ltd., Bosch (Robert Bosch GmbH), ZF Friedrichshafen AG, Continental AG, Magna International Inc., Delphi Technologies (BorgWarner Inc.), Lear Corporation, Sumitomo Electric Industries, Ltd., Yazaki Corporation, GKN Driveline (Melrose Industries Plc), Cable Manufacturing & Assembly Co. Inc., Orscheln Products LLC, Dura Automotive Systems, Ningbo Meishan Bond Cable Co., Ltd., Jinzhou Jinxing Automotive Components Co., Ltd., Sanwa Seiki Co., Ltd., Foton Motor Group, Zhejiang Jingke Auto Parts Co., Ltd., M.G.M. Motori Elettrici S.p.A., Suprajit Engineering Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Boot Release Cable Market Key Technology Landscape

The Automotive Boot Release Cable Market, while seemingly conventional, is underpinned by several key technological advancements and considerations that enhance its functionality, durability, and integration into modern vehicles. Material science plays a pivotal role, with ongoing research into lightweight yet robust materials for both the inner cable and outer conduit. High-strength, low-friction steel alloys are crucial for the cable's longevity and smooth operation, while advanced polymers are used for the outer casing to provide resistance against corrosion, abrasion, and temperature extremes. Innovations in these materials aim to reduce overall vehicle weight, contributing to improved fuel efficiency and lower emissions, aligning with current automotive industry trends.

Manufacturing technologies are also critical, focusing on precision engineering and automated assembly processes. Techniques like continuous wire drawing, extrusion for consistent casing thickness, and sophisticated injection molding for intricate end fittings ensure high dimensional accuracy and quality consistency. Automated testing systems are employed to verify tensile strength, fatigue resistance, and operational smoothness, ensuring that each cable meets stringent automotive safety and performance standards. These manufacturing efficiencies not only improve product reliability but also help control production costs, maintaining the competitive edge of mechanical solutions.

Furthermore, for electronic boot release systems, the technological landscape involves the integration of microcontrollers, solenoids, and various sensors. These components facilitate remote operation, keyless entry, and sometimes advanced features like foot-activated opening. The development of robust electrical connectors and wiring harnesses that are resistant to environmental factors and electromagnetic interference is also vital. While not directly part of the cable itself, the broader vehicle's electronic control unit (ECU) and communication networks (e.g., CAN bus) are integral to the operation of electronic boot release systems, highlighting an increasing reliance on sophisticated software and hardware integration for enhanced user experience and functionality. These technological advancements collectively contribute to the evolution of boot release mechanisms, balancing reliability, convenience, and safety.

Regional Highlights

- North America: A mature market characterized by a strong aftermarket demand and a focus on premium vehicle segments. The region exhibits high adoption of electronic boot release systems, driven by consumer preference for convenience and technological sophistication. Strict safety regulations also drive consistent demand for compliant components.

- Europe: Another well-established market with a significant presence of leading automotive OEMs and a strong emphasis on quality, safety, and environmental standards. Innovation in lightweight materials and integrated electronic systems is prominent. The region also has a robust aftermarket due to a large installed base of vehicles and regular maintenance requirements.

- Asia Pacific (APAC): The fastest-growing region, primarily driven by large-scale automotive production in countries like China, India, Japan, and South Korea. Rising disposable incomes and increasing vehicle ownership contribute to expanding OEM and aftermarket demand. The region is witnessing a blend of both manual and electronic systems, with a gradual shift towards advanced features in new vehicle models.

- Latin America: An emerging market with growing automotive manufacturing capabilities and an expanding consumer base. The demand for cost-effective and reliable manual boot release cables remains strong, though there is increasing adoption of basic electronic systems in newer vehicle models. Aftermarket growth is propelled by an aging vehicle fleet.

- Middle East and Africa (MEA): A developing region with varied market dynamics. Demand is influenced by vehicle imports and local assembly operations. The focus is often on durability and cost-efficiency for both OEM and aftermarket applications. Growth is steady, driven by urbanization and improvements in infrastructure leading to increased vehicle sales.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Boot Release Cable Market.- Aisin Seiki Co., Ltd.

- Bosch (Robert Bosch GmbH)

- ZF Friedrichshafen AG

- Continental AG

- Magna International Inc.

- Delphi Technologies (BorgWarner Inc.)

- Lear Corporation

- Sumitomo Electric Industries, Ltd.

- Yazaki Corporation

- GKN Driveline (Melrose Industries Plc)

- Cable Manufacturing & As

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager