Automotive Ceramics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429190 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Ceramics Market Size

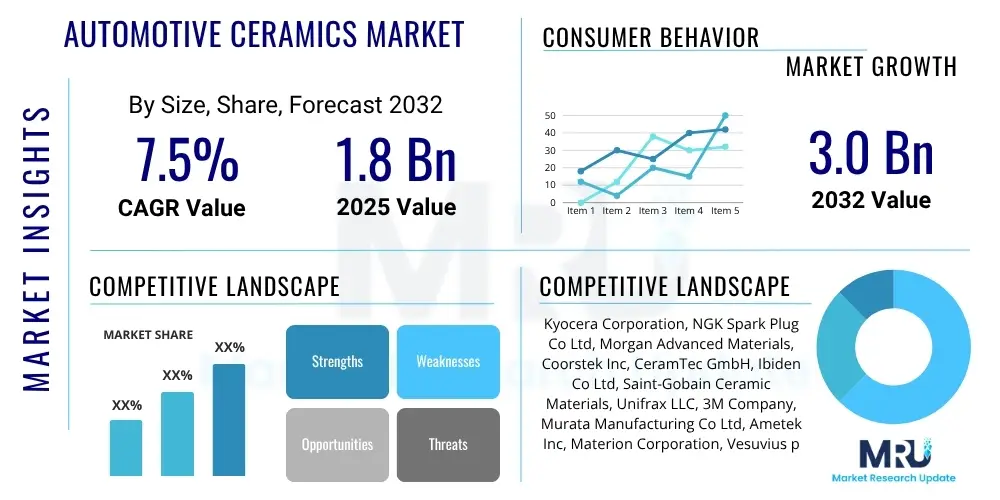

The Automotive Ceramics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at $1.8 billion in 2025 and is projected to reach $3.0 billion by the end of the forecast period in 2032.

Automotive Ceramics Market introduction

The Automotive Ceramics Market encompasses the production and utilization of advanced ceramic materials across various automotive applications. These materials, known for their superior mechanical, thermal, and electrical properties, are increasingly integrated into vehicle components to enhance performance, improve fuel efficiency, and reduce emissions. The market is driven by a global push towards more stringent environmental regulations, the rising demand for lightweight automotive parts, and the continuous innovation in vehicle design and powertrain technologies.

Automotive ceramics include materials such as alumina, zirconia, silicon nitride, and silicon carbide, which are chosen based on specific application requirements like high temperature resistance, wear resistance, corrosion resistance, and electrical insulation. Key applications range from critical engine components and exhaust systems to intricate sensor housings and brake systems, playing a vital role in both traditional internal combustion engine (ICE) vehicles and the rapidly expanding electric vehicle (EV) segment. The inherent benefits of these materials, including exceptional durability, reduced weight compared to metallic alternatives, and the ability to withstand extreme operating conditions, position them as indispensable for the future of the automotive industry.

The market's expansion is further propelled by ongoing advancements in material science and manufacturing processes, enabling the production of more cost-effective and performance-optimized ceramic components. As automotive manufacturers prioritize vehicle electrification and autonomous driving capabilities, the demand for advanced ceramics in battery systems, power electronics, and sophisticated sensor applications is expected to witness substantial growth. This strategic shift ensures that automotive ceramics remain at the forefront of innovation, supporting the industry's journey towards sustainable and high-performance mobility solutions.

Automotive Ceramics Market Executive Summary

The Automotive Ceramics Market is experiencing robust growth, primarily fueled by global mandates for reduced emissions and improved fuel economy, alongside the transformative shift towards electric vehicles. Business trends indicate a strong focus on research and development into novel ceramic composites and advanced manufacturing techniques, such as additive manufacturing, to overcome existing cost and processing limitations. Strategic collaborations between ceramic material suppliers, component manufacturers, and automotive OEMs are becoming increasingly common, aiming to accelerate the integration of high-performance ceramic solutions into next-generation vehicles. Consolidation within the supplier landscape is also observed, as companies seek to expand their product portfolios and geographical reach to cater to a diverse automotive market.

Regional trends highlight Asia Pacific as the leading growth hub, driven by its expansive automotive production base and the rapid adoption of electric vehicles, particularly in China and India. Europe maintains a significant market share due to stringent emission standards and a strong emphasis on premium and high-performance vehicle segments, which heavily utilize advanced ceramic components. North America also shows steady growth, propelled by the demand for improved vehicle performance and the increasing investment in EV infrastructure. These regional dynamics collectively underscore a vibrant market characterized by regional specialization and differentiated growth drivers.

Segmentation trends reveal significant growth in structural ceramics for engine and exhaust systems due to their durability and heat resistance, while the electrical and electronic components segment is projected to expand rapidly with the proliferation of electric and hybrid vehicles. Within vehicle types, electric vehicles are emerging as a pivotal growth category, requiring advanced ceramics for battery components, power electronics, and thermal management. This granular segmentation illustrates the diverse applications and underlying growth vectors within the automotive ceramics landscape, pointing towards sustained innovation and market expansion across various automotive sub-sectors.

AI Impact Analysis on Automotive Ceramics Market

Users frequently inquire about AI's potential to revolutionize material discovery, optimize manufacturing processes, enhance quality control, and predict component performance in the automotive ceramics sector. Key themes include the desire for faster innovation cycles, reduction in production costs, and the ability to tailor ceramic properties more precisely for specific automotive applications. Concerns often center around the initial investment required for AI integration, the need for specialized data scientists, and the potential for job displacement, although expectations generally lean towards AI being a powerful tool for efficiency and competitive advantage. There is a strong anticipation that AI will enable the development of ceramics with unprecedented properties and lead to more robust, reliable, and sustainable automotive components.

- AI driven material design and discovery: Accelerating the identification and synthesis of novel ceramic compositions with enhanced properties.

- Optimized manufacturing processes: AI algorithms refining parameters for sintering, pressing, and machining to reduce defects and improve yield.

- Predictive maintenance and performance analysis: AI models forecasting component degradation and optimizing maintenance schedules based on real-time data from ceramic sensors.

- Enhanced quality control and inspection: Computer vision and machine learning automating flaw detection and ensuring higher product consistency.

- Supply chain optimization: AI predicting demand fluctuations, managing inventory, and streamlining logistics for raw materials and finished ceramic parts.

- Personalized ceramic solutions: Enabling customized ceramic components based on specific vehicle design and performance requirements through AI-assisted engineering.

DRO & Impact Forces Of Automotive Ceramics Market

The Automotive Ceramics Market is primarily propelled by stringent global emission regulations, which necessitate lighter and more efficient components to reduce fuel consumption and environmental impact. The increasing demand for lightweight vehicles across all segments, from passenger cars to commercial vehicles, drives the adoption of ceramics due to their superior strength-to-weight ratio compared to traditional metals. The rapid expansion of the electric vehicle (EV) market presents a significant driver, as ceramics are crucial for high-performance battery components, power electronics, and efficient thermal management systems, which are vital for EV range and longevity. Furthermore, the continuous pursuit of enhanced vehicle performance, durability, and safety by automotive manufacturers acts as a fundamental driver for integrating advanced ceramic solutions, offering resilience in extreme operating conditions.

However, the market faces several restraints that could impede its growth. High manufacturing costs associated with the complex processing of ceramic materials, including high-temperature sintering and precision machining, pose a significant barrier to widespread adoption, especially in cost-sensitive segments. The inherent brittleness of many ceramic materials, leading to concerns about impact resistance and catastrophic failure under certain stress conditions, requires ongoing research and development to overcome. Additionally, competition from advanced metallic alloys and polymer composites, which are continuously evolving to offer improved performance at lower costs, presents a formidable challenge. These factors necessitate continuous innovation to enhance the cost-effectiveness and mechanical robustness of ceramic components.

Opportunities within the automotive ceramics market are abundant and are largely centered around material innovation and new application development. The development of advanced ceramic composites and hybrid materials that combine the benefits of ceramics with other materials could address brittleness concerns while maintaining performance advantages. Expanding applications in hybrid vehicles and the emerging hydrogen fuel cell vehicle segment offer untapped potential for specialized ceramic components. Furthermore, the integration of smart ceramics with embedded sensors for real-time monitoring of vehicle health and performance represents a significant technological opportunity. Additive manufacturing (3D printing) of ceramics is also poised to revolutionize prototyping and production, enabling complex geometries and customized parts with reduced lead times and material waste. The strategic impact forces include ongoing technological advancements in material science, evolving regulatory frameworks, and shifting consumer preferences towards more sustainable and high-performance automotive solutions.

Segmentation Analysis

The Automotive Ceramics Market is meticulously segmented to provide a granular understanding of its diverse applications, material types, and end-user adoption patterns. This segmentation allows for precise market analysis, identifying key growth areas and niche opportunities within the broader automotive industry. The market is typically analyzed across various dimensions including product type, application, vehicle type, and geographical region, reflecting the multifaceted nature of ceramic integration into modern vehicles. Each segment is influenced by distinct technological advancements, regulatory pressures, and consumer demands, shaping its individual growth trajectory and competitive landscape.

Understanding these segments is crucial for stakeholders, from raw material suppliers to automotive OEMs, as it informs strategic decisions regarding product development, market entry, and investment. For instance, the demand for specific ceramic types like silicon nitride might be higher in high-performance engine components, while zirconia ceramics could see greater adoption in oxygen sensors due to their electrical properties. Similarly, the rapid expansion of the Electric Vehicle segment is creating entirely new demand patterns for ceramics in battery systems and power electronics, distinct from traditional ICE vehicle applications. This detailed segmentation analysis, therefore, serves as a foundational tool for comprehending the market's current state and forecasting its future evolution.

- By Type:

- Alumina Ceramics

- Zirconia Ceramics

- Silicon Nitride Ceramics

- Silicon Carbide Ceramics

- Titanium Carbide Ceramics

- Boron Nitride Ceramics

- Other Advanced Ceramics

- By Application:

- Engine Components

- Glow Plugs

- Fuel Injector Parts

- Turbocharger Rotors

- Valve Components

- Exhaust Systems

- Oxygen Sensors

- Catalytic Converters

- Diesel Particulate Filters (DPF)

- Electrical and Electronic Components

- Sensors (Pressure, Temperature, Speed)

- Substrates

- Ignition System Components

- Power Module Substrates for EVs

- Bearings and Seals

- Ceramic Bearings

- Mechanical Seals

- Brake Systems

- Ceramic Brake Discs

- Brake Pads

- Other Components

- Thermal Insulators

- Wear Parts

- Optical Components

- Engine Components

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles (EVs)

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

Value Chain Analysis For Automotive Ceramics Market

The value chain for the Automotive Ceramics Market begins with the upstream activities involving the sourcing and processing of raw materials. This stage is critical as the quality and purity of raw ceramic powders, such as alumina, zirconia, silicon carbide, and silicon nitride, directly influence the performance and reliability of the final automotive components. Key players in this segment include mining companies, chemical processors, and specialized powder manufacturers who supply high-grade ceramic precursors. Intensive research and development in this upstream segment are focused on improving material properties, reducing impurity levels, and developing cost-effective synthesis methods to meet the stringent demands of automotive applications.

Moving downstream, these raw materials are transformed into finished automotive ceramic components through various manufacturing processes including pressing, sintering, machining, and surface treatment. This stage involves specialized ceramic component manufacturers who possess advanced technical expertise and equipment to produce complex shapes with high precision and tight tolerances. These manufacturers often work closely with automotive Tier 1 suppliers or directly with Original Equipment Manufacturers (OEMs) to design and customize ceramic parts according to specific vehicle requirements. The distribution channel predominantly involves direct sales from ceramic component manufacturers to automotive OEMs for high-volume and custom-designed parts, ensuring direct communication and technical support throughout the product lifecycle.

In parallel, an indirect distribution channel also exists, primarily through specialized distributors and agents who cater to smaller volume orders, aftermarket needs, or supply to Tier 2 and Tier 3 automotive suppliers. These intermediaries often provide a range of ceramic products and technical services, extending market reach and supporting various segments of the automotive supply chain. The efficiency of both direct and indirect channels is paramount for the timely delivery of components and maintaining responsiveness to dynamic market demands, ultimately ensuring the widespread adoption of automotive ceramics in vehicle production and aftermarket servicing.

Automotive Ceramics Market Potential Customers

The primary potential customers and end-users of automotive ceramic products are the Original Equipment Manufacturers (OEMs) across the passenger vehicle, commercial vehicle, and electric vehicle segments. These automotive manufacturers integrate ceramic components directly into their vehicle assembly lines for critical applications such as engine parts, exhaust systems, braking systems, and advanced electrical and electronic modules. Their demand is driven by the need to meet stringent regulatory standards for emissions and fuel efficiency, enhance vehicle performance and durability, and innovate in areas like lightweighting and thermal management. OEMs often engage in long-term contracts and collaborative R&D with ceramic component suppliers to develop customized solutions tailored to their specific vehicle platforms and future design requirements.

Beyond OEMs, Tier 1 suppliers within the automotive ecosystem represent another significant customer segment. These companies, which supply sub-assemblies and systems directly to OEMs, integrate ceramic components into larger modules such as engine systems, braking systems, or advanced driver-assistance systems (ADAS). For instance, a Tier 1 supplier might purchase ceramic substrates for power electronics from a ceramic manufacturer to then integrate into an EV inverter module, which is subsequently supplied to a car manufacturer. Their purchasing decisions are influenced by performance specifications, cost-effectiveness, and the ability of ceramic components to contribute to the overall efficiency and reliability of their integrated systems.

Furthermore, the aftermarket segment also constitutes a noteworthy group of potential customers. This includes independent garages, specialized performance tuning shops, and parts retailers who require replacement ceramic components or performance-enhancing ceramic upgrades. While typically lower in volume compared to OEM demand, the aftermarket plays a crucial role in maintaining the installed base of vehicles and catering to specific consumer demands for durability, performance improvements, or aesthetic enhancements, particularly for high-performance vehicles where ceramic brakes or specialized engine components are sought after. This diverse customer base underscores the broad applicability and value proposition of automotive ceramics across the entire vehicle lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.8 billion |

| Market Forecast in 2032 | $3.0 billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kyocera Corporation, NGK Spark Plug Co Ltd, Morgan Advanced Materials, Coorstek Inc, CeramTec GmbH, Ibiden Co Ltd, Saint-Gobain Ceramic Materials, Unifrax LLC, 3M Company, Murata Manufacturing Co Ltd, Ametek Inc, Materion Corporation, Vesuvius plc, Hitachi Metals Ltd, Denso Corporation, Nippon Steel Corporation, Bosch GmbH, Tenneco Inc, Faurecia SE, Continental AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Ceramics Market Key Technology Landscape

The automotive ceramics market is continuously evolving through significant advancements in materials science and manufacturing technologies. A crucial technological trend is the development of advanced ceramic composites and hybrid materials. These innovations aim to overcome traditional limitations of ceramics, such as brittleness, by combining ceramic matrices with reinforcing fibers or incorporating metallic phases. This approach enhances toughness, fracture resistance, and thermal shock performance, making them suitable for more demanding applications. Furthermore, surface engineering techniques, including advanced coatings and surface treatments, are being developed to improve wear resistance, reduce friction, and provide environmental protection for ceramic components, thereby extending their operational lifespan and performance efficiency in harsh automotive environments.

Another pivotal area in the technology landscape is the advent and refinement of additive manufacturing, commonly known as 3D printing, for ceramic materials. Technologies like stereolithography (SLA), binder jetting, and material extrusion are enabling the production of highly complex geometries, intricate internal structures, and customized ceramic parts with unparalleled precision. This not only facilitates rapid prototyping and design iterations but also opens avenues for mass customization and efficient manufacturing of components that were previously impossible or cost-prohibitive to produce using conventional methods. The ability to create lightweight, topology-optimized parts with reduced material waste is particularly attractive for automotive applications, contributing to overall vehicle efficiency and performance.

Beyond material processing, the integration of smart ceramics, which embed sensing capabilities directly into the component, is a growing technological frontier. These smart ceramics can monitor various parameters such as temperature, pressure, and strain in real-time, providing crucial data for vehicle diagnostics, predictive maintenance, and autonomous driving systems. This trend aligns with the broader move towards intelligent and connected vehicles, where embedded sensors made from ceramic materials offer high accuracy, durability, and resistance to extreme conditions. The ongoing research into nanotechnology also plays a vital role, enabling the creation of ceramic powders with finer grain sizes and superior properties, leading to higher performance and more reliable automotive ceramic components.

Regional Highlights

- North America: This region exhibits significant market share driven by a strong focus on high-performance vehicles, increasing adoption of electric vehicles, and stringent emission standards. The presence of major automotive OEMs and a robust research and development ecosystem contributes to the demand for advanced ceramic solutions in premium and performance segments. Investment in EV charging infrastructure and battery manufacturing further supports the growth of ceramic applications in power electronics and thermal management.

- Europe: Europe is a prominent market, characterized by strict environmental regulations, a strong emphasis on fuel efficiency, and a leading position in luxury and high-performance vehicle manufacturing. Countries like Germany, France, and the UK are at the forefront of automotive innovation and EV adoption, necessitating high-quality ceramic components for advanced engine systems, exhaust after-treatment, and electric powertrains. Robust governmental support for green mobility initiatives further propels market expansion.

- Asia Pacific (APAC): The Asia Pacific region stands as the largest and fastest-growing market for automotive ceramics, primarily due to its vast automotive production base, particularly in China, Japan, India, and South Korea. Rapid industrialization, increasing disposable incomes, and the massive shift towards electric vehicles in countries like China are key drivers. The region benefits from competitive manufacturing costs and a dynamic consumer market, leading to high volume production and widespread adoption of ceramic parts across various vehicle segments.

- Latin America: This region represents an emerging market with growing automotive production and increasing demand for advanced vehicle technologies. While smaller in scale compared to established markets, countries like Brazil and Mexico are experiencing expanding manufacturing capabilities and a gradual adoption of emission standards, which will incrementally drive the demand for automotive ceramics. Economic stability and foreign direct investment in the automotive sector will be crucial for sustained growth.

- Middle East and Africa (MEA): The MEA region is a nascent but growing market for automotive ceramics. The expansion of automotive assembly plants, particularly in countries like South Africa and Morocco, coupled with rising consumer purchasing power, contributes to market development. Increasing awareness regarding vehicle performance, fuel efficiency, and environmental regulations is expected to gradually boost the demand for ceramic components in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Ceramics Market.- Kyocera Corporation

- NGK Spark Plug Co Ltd

- Morgan Advanced Materials

- Coorstek Inc

- CeramTec GmbH

- Ibiden Co Ltd

- Saint-Gobain Ceramic Materials

- Unifrax LLC

- 3M Company

- Murata Manufacturing Co Ltd

- Ametek Inc

- Materion Corporation

- Vesuvius plc

- Hitachi Metals Ltd

- Denso Corporation

- Nippon Steel Corporation

- Bosch GmbH

- Tenneco Inc

- Faurecia SE

- Continental AG

Frequently Asked Questions

What are automotive ceramics?

Automotive ceramics are advanced inorganic, non-metallic materials utilized in various vehicle components due to their exceptional heat resistance, wear resistance, corrosion resistance, and lightweight properties. They include materials like alumina, zirconia, silicon nitride, and silicon carbide, engineered for high-performance and durability in demanding automotive environments.

Why are ceramics used in automotive applications?

Ceramics are chosen for automotive applications primarily to enhance performance, improve fuel efficiency, and reduce emissions. Their ability to withstand high temperatures and wear, coupled with their lightweight nature, makes them ideal for critical engine parts, exhaust systems, braking components, and electrical systems, contributing to vehicle longevity and reliability.

What are the main types of automotive ceramics?

The main types of automotive ceramics include Alumina ceramics for insulators and substrates, Zirconia ceramics for oxygen sensors and wear parts, Silicon Nitride ceramics for engine components and bearings due to high strength, and Silicon Carbide ceramics for brakes and turbocharger parts known for extreme hardness and thermal conductivity.

How do ceramics contribute to fuel efficiency and emission reduction?

Ceramics contribute to fuel efficiency by reducing component weight, which decreases overall vehicle mass and energy consumption. They reduce emissions by enabling higher operating temperatures in engines and exhaust systems, leading to more complete combustion and more efficient catalytic conversion of pollutants, thereby lowering harmful exhaust gases.

What challenges does the automotive ceramics market face?

The automotive ceramics market faces challenges such as high manufacturing costs due to complex processing, inherent brittleness of some materials requiring advanced engineering solutions, and intense competition from conventional metallic alloys and advanced polymer composites that offer alternative solutions at different price points.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager