Automotive Circular Economy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428158 | Date : Oct, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Automotive Circular Economy Market Size

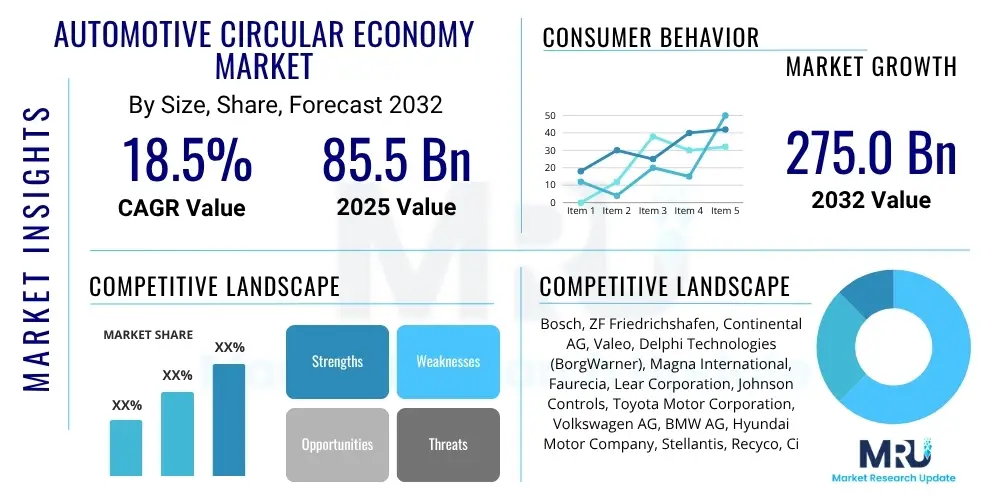

The Automotive Circular Economy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 85.5 billion in 2025 and is projected to reach USD 275.0 billion by the end of the forecast period in 2032.

Automotive Circular Economy Market introduction

The Automotive Circular Economy market represents a paradigm shift from the traditional linear "take-make-dispose" model towards a restorative and regenerative system. This innovative approach focuses on maximizing the value of automotive components and materials by keeping them in use for as long as possible, through processes such as remanufacturing, recycling, reuse, and repair. It encompasses the entire lifecycle of a vehicle, from design and production to end-of-life management, aiming to minimize waste, reduce resource consumption, and mitigate environmental impact. The overarching goal is to decouple economic growth from finite resource depletion, fostering a more sustainable and resilient automotive industry.

Product descriptions within this market include remanufactured engines, transmissions, electronic components, and batteries, which offer performance comparable to new parts at a reduced cost and environmental footprint. Major applications span across passenger vehicles, commercial fleets, and electric vehicles, where the focus is on extending component life and recovering critical raw materials. The benefits are multifold, ranging from significant cost savings for manufacturers and consumers, enhanced resource security, reduced carbon emissions, and the creation of new business models and job opportunities within the reverse logistics and remanufacturing sectors. These initiatives are fundamentally reshaping how vehicles are designed, produced, maintained, and ultimately decommissioned.

Driving factors for the adoption of the automotive circular economy are diverse and compelling. Escalating raw material prices and their volatile supply chains underscore the economic imperative to recover and reuse valuable resources like rare earth elements, lithium, and cobalt found in electric vehicle batteries. Increasingly stringent environmental regulations, particularly concerning vehicle emissions and waste management, compel manufacturers to adopt more sustainable practices. Furthermore, a growing global consumer consciousness regarding environmental sustainability and a demand for eco-friendly products are pushing automotive companies to prioritize circularity as a core business strategy, fostering innovation in materials science and processing technologies.

Automotive Circular Economy Market Executive Summary

The Automotive Circular Economy market is experiencing robust growth driven by a confluence of critical business trends. Manufacturers are increasingly integrating circular design principles into new vehicle development, emphasizing modularity, durability, and reparability to facilitate future reuse and recycling. The rise of "product-as-a-service" models, such as car-sharing and subscription services, inherently supports circularity by encouraging longer product lifespans and optimized resource utilization. Strategic investments in advanced recycling technologies, particularly for electric vehicle batteries and complex composite materials, are also prominent, aimed at establishing efficient closed-loop systems and mitigating supply chain risks associated with critical raw materials. Furthermore, collaborations between OEMs, recycling specialists, and technology providers are becoming essential to overcome technical and logistical challenges.

Regional trends indicate varied levels of maturity and adoption across the globe. Europe is leading the charge, bolstered by comprehensive regulatory frameworks like the End-of-Life Vehicles (ELV) Directive and significant investments in research and development for circular solutions. North America is witnessing growing momentum, particularly with advancements in battery recycling infrastructure driven by the accelerating electrification of its vehicle fleet. Asia Pacific, spearheaded by countries like China, Japan, and South Korea, is rapidly expanding its capabilities in materials recovery and remanufacturing, driven by domestic resource scarcity and ambitious sustainability goals. Latin America and the Middle East & Africa are emerging markets, with increasing awareness and initial investments in establishing foundational circular economy practices, often influenced by global automotive industry standards and local environmental pressures.

Segmentation trends reveal a dynamic landscape within the automotive circular economy. The remanufacturing segment continues to be a cornerstone, providing cost-effective and environmentally sound alternatives for various components, from engines to braking systems. The recycling segment, particularly for materials like steel, aluminum, plastics, and increasingly complex battery chemistries, is seeing significant innovation and investment. The growing penetration of electric vehicles is profoundly impacting the market, as the focus shifts towards sophisticated battery recycling and second-life applications for battery packs. This necessitates new infrastructure and technologies, creating distinct sub-segments for battery management and material recovery. Overall, the market is moving towards more integrated solutions that address entire vehicle systems rather than individual parts, emphasizing a holistic approach to circularity.

AI Impact Analysis on Automotive Circular Economy Market

Users frequently inquire about the transformative potential of Artificial Intelligence in revolutionizing the automotive circular economy, particularly concerning its ability to enhance efficiency, predictability, and scalability. Key themes revolve around how AI can optimize material traceability, improve the precision of sorting and dismantling processes, and predict component lifespan for timely remanufacturing or reuse. Concerns often include the data privacy implications of extensive tracking, the significant initial investment required for AI infrastructure, and the need for specialized skills to implement and manage AI-driven circular systems. Expectations are high for AI to unlock new levels of resource optimization, reduce waste substantially, and foster more intelligent and automated circular supply chains across the automotive sector.

- AI-powered predictive maintenance extends component lifespan, reducing the need for premature replacements and supporting remanufacturing cycles.

- Machine learning algorithms optimize sorting and dismantling processes for end-of-life vehicles, maximizing material recovery and purity.

- AI-driven supply chain management enhances traceability of components and materials, facilitating efficient reuse, repair, and recycling logistics.

- Computer vision and robotics, guided by AI, automate complex tasks in remanufacturing and material recovery, improving efficiency and safety.

- Generative AI supports circular design principles by simulating material choices and product architectures for easier disassembly and recyclability.

- Data analytics platforms, utilizing AI, provide insights into material flows, waste generation, and resource utilization, enabling informed decision-making for circular strategies.

DRO & Impact Forces Of Automotive Circular Economy Market

The Automotive Circular Economy market is profoundly shaped by a combination of powerful drivers, inherent restraints, and significant opportunities, which collectively constitute its impact forces. Primary drivers include the escalating global demand for finite raw materials and the corresponding volatility in their prices, compelling manufacturers to seek alternative, sustainable sourcing through circular models. This is further amplified by increasingly stringent environmental regulations and governmental mandates worldwide, which penalize waste and promote resource efficiency, forcing the automotive industry to reconsider its operational paradigms. Moreover, growing consumer and corporate sustainability consciousness is fostering a preference for eco-friendly products and services, creating market demand for circular automotive solutions. Technological advancements in areas such as advanced recycling, additive manufacturing, and digital tracking also act as crucial enablers for circular practices.

However, the market also faces considerable restraints that temper its growth trajectory. The high initial capital investment required for establishing new remanufacturing facilities, advanced recycling plants, and complex reverse logistics infrastructure poses a significant barrier to entry and expansion. There's also a pervasive challenge regarding the complexity of reverse logistics, which involves collecting, sorting, and transporting used components and materials efficiently across diverse geographical locations. A lack of standardized policies and clear regulatory frameworks across different regions can create inconsistencies and hurdles for cross-border circular operations. Furthermore, potential quality concerns associated with remanufactured parts, despite technological improvements, sometimes create skepticism among consumers and industry players, necessitating rigorous certification and quality assurance processes.

Despite these challenges, substantial opportunities abound within the automotive circular economy. The emergence of new business models, such as product-as-a-service and material leasing, presents avenues for value creation and sustainable revenue streams beyond traditional sales. The rapid global electrification of vehicles creates a massive opportunity in battery recycling and second-life applications, addressing a critical future resource challenge for materials like lithium, cobalt, and nickel. Digitalization, including the use of IoT, blockchain, and artificial intelligence, offers unprecedented capabilities for tracking materials, optimizing processes, and enhancing supply chain transparency, thereby improving the efficiency and effectiveness of circular systems. Furthermore, fostering cross-industry collaborations between automotive OEMs, waste management companies, technology providers, and material scientists can unlock innovative solutions and accelerate market adoption by leveraging diverse expertise and resources.

Segmentation Analysis

The Automotive Circular Economy market is comprehensively segmented to provide a detailed understanding of its diverse components, processes, and applications. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas, understand competitive dynamics, and tailor strategies to specific sub-markets. The primary segmentation criteria include the type of product involved, the specific circular process implemented, and the end-use application of the circular solutions. Each segment and sub-segment plays a crucial role in the overall ecosystem of sustainable automotive practices, reflecting varying levels of maturity, technological advancement, and market demand across the globe.

- By Product Type:

- Components (e.g., Engines, Transmissions, Batteries, Electronic Control Units (ECUs), Infotainment Systems, Steering Systems, Braking Systems)

- Materials (e.g., Steel, Aluminum, Plastics, Rubber, Glass, Composites, Critical Raw Materials)

- Vehicles (e.g., Passenger Cars, Commercial Vehicles, Electric Vehicles, Two-Wheelers, Buses, Trucks)

- By Process:

- Remanufacturing (e.g., Powertrain Remanufacturing, Component Remanufacturing)

- Recycling (e.g., Material Recycling, Battery Recycling, Scrap Metal Recycling)

- Reuse (e.g., Parts Reuse, Second-life Battery Applications)

- Repair (e.g., Component Repair, Vehicle Body Repair with Recycled Materials)

- Refurbishment (e.g., Aesthetic and Functional Restoration)

- By End-Use:

- Original Equipment Manufacturers (OEMs)

- Aftermarket (e.g., Independent Workshops, Retailers)

- Fleet Operators (e.g., Commercial Fleets, Rental Companies, Public Transport)

- Independent Service Providers

- Government and Public Sector

Value Chain Analysis For Automotive Circular Economy Market

The value chain of the Automotive Circular Economy market diverges significantly from traditional linear models, emphasizing reverse logistics and the continuous flow of resources. It commences with the upstream analysis, involving raw material extraction and component manufacturing, where the focus shifts towards designing products for durability, modularity, and ease of disassembly. This stage is critical for selecting sustainable and recyclable materials, and for incorporating features that enable efficient remanufacturing or recycling at the end of a component's or vehicle's initial lifespan. Sustainable sourcing practices, including the use of recycled content in new products, also form a crucial part of this upstream phase, laying the foundation for circularity.

Moving downstream, the value chain encompasses distribution channels that are often more complex than traditional ones. While direct channels involve OEMs managing their own remanufacturing and recycling programs, indirect channels leverage a network of third-party logistics providers, specialized recyclers, and independent remanufacturers. These channels are crucial for collecting end-of-life vehicles and components, processing them, and reintroducing recovered materials or remanufactured parts back into the supply chain. Effective management of these channels is paramount for the success of a circular economy, requiring robust IT systems for tracking, efficient transportation networks, and strong collaboration among diverse stakeholders to ensure maximum resource recovery and minimal waste.

Both direct and indirect distribution channels play vital roles. Direct channels allow OEMs greater control over quality and brand reputation for remanufactured parts, often integrating these operations into their existing service networks. Indirect channels, on the other hand, provide scalability and specialized expertise, particularly for complex recycling processes or for reaching a wider aftermarket. The interplay between these channels is evolving, with increasing partnerships and hybrid models emerging to optimize the flow of used components and materials. This interconnected web of collection, processing, and re-entry points defines the efficiency and reach of the automotive circular economy, aiming to close material loops and maximize economic value throughout the vehicle's lifecycle and beyond.

Automotive Circular Economy Market Potential Customers

The potential customers for the Automotive Circular Economy market are diverse, encompassing a wide array of end-users and buyers motivated by economic, environmental, and regulatory considerations. Original Equipment Manufacturers (OEMs) represent a significant customer segment, as they increasingly integrate circular practices into their production processes to meet sustainability targets, reduce raw material costs, and comply with environmental legislation. OEMs leverage circular solutions for designing vehicles with longer lifespans, utilizing recycled content, and managing the end-of-life of their products, particularly for electric vehicle batteries. Their interest lies in maintaining brand reputation, securing supply chains, and exploring new revenue streams through remanufactured parts and material recovery.

Another large segment includes the aftermarket, comprising independent workshops, authorized service centers, and retailers. These entities purchase remanufactured components and recycled materials for vehicle repair and maintenance, driven by the desire to offer cost-effective solutions to consumers while also addressing environmental concerns. Fleet operators, including commercial vehicle fleets, public transport authorities, and car rental companies, are also key customers. They benefit significantly from the durability and lower cost of remanufactured parts, which help reduce operational expenses and extend the lifespan of their vehicles, aligning with their operational efficiency and sustainability goals. This customer group often seeks long-term service contracts that incorporate circular economy principles.

Beyond traditional automotive players, the market also serves specialized recycling companies, material processors, and even technology providers who acquire end-of-life vehicles and components for advanced material recovery and innovation. Governments and municipalities are increasingly becoming indirect customers, influencing the market through procurement policies that favor sustainable options and by setting up infrastructure for vehicle recycling and waste management. Ultimately, individual consumers, though not direct buyers of the "circular economy" itself, are indirect beneficiaries and drivers, as their demand for more sustainable and affordable automotive products pushes the entire industry towards circularity, making them a crucial underlying force for market adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 85.5 billion |

| Market Forecast in 2032 | USD 275.0 billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, ZF Friedrichshafen, Continental AG, Valeo, Delphi Technologies (BorgWarner), Magna International, Faurecia, Lear Corporation, Johnson Controls, Toyota Motor Corporation, Volkswagen AG, BMW AG, Hyundai Motor Company, Stellantis, Recyco, Circular Metals, ReCellular Solutions, GreenAuto Parts, Terracycle, Suez |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Circular Economy Market Key Technology Landscape

The technological landscape of the Automotive Circular Economy market is rapidly evolving, driven by the imperative to enhance resource recovery, extend product lifecycles, and optimize circular processes. Advanced materials science plays a crucial role, focusing on developing new alloys, composites, and plastics that are inherently easier to recycle, disassemble, or biodegrade at their end-of-life. Innovations in lightweight materials and bio-based plastics are also critical for reducing environmental impact and improving resource efficiency throughout the vehicle's lifespan. These material innovations are coupled with advancements in manufacturing processes, such as additive manufacturing (3D printing), which enables on-demand production of spare parts, reducing waste and inventory, and facilitating localized repair and customization.

Digitization and automation are foundational pillars supporting the circular economy. Technologies like the Internet of Things (IoT) are deployed to monitor the condition and performance of vehicle components, enabling predictive maintenance and facilitating timely remanufacturing or repair, thereby extending their operational life. Blockchain technology is emerging as a powerful tool for ensuring transparency and traceability of materials and components throughout their entire lifecycle, from source to end-of-life and back into the supply chain. This enhances trust, proves compliance with regulations, and optimizes reverse logistics by providing granular data on material origins and properties. Robotics and advanced automation systems are being increasingly utilized in dismantling facilities and remanufacturing plants to efficiently sort, separate, and process complex automotive components, improving both speed and purity of recovered materials.

Furthermore, specialized recycling and remanufacturing technologies are undergoing significant innovation. For electric vehicles, advanced battery recycling technologies are paramount, focusing on efficiently recovering valuable metals such as lithium, cobalt, nickel, and manganese with high purity, often employing hydrometallurgical or pyrometallurgical processes. Remanufacturing processes benefit from sophisticated non-destructive testing (NDT) techniques, precise cleaning methods, and advanced surface engineering, which restore used components to "as-new" condition, ensuring reliability and performance. These technological advancements collectively enable the transition to a more efficient, less wasteful, and truly circular automotive industry, transforming challenges into opportunities for innovation and sustainable growth across the entire value chain.

Regional Highlights

- North America: This region is witnessing significant growth, particularly in the electric vehicle battery recycling sector, driven by increasing EV adoption and government incentives for sustainable manufacturing. Key countries like the United States and Canada are investing heavily in infrastructure for material recovery and remanufacturing, aiming to reduce reliance on foreign raw material imports.

- Europe: A global leader in circular economy initiatives, Europe benefits from robust regulatory frameworks such as the ELV Directive and ambitious targets for waste reduction and material recovery. Countries like Germany, France, and the Netherlands are at the forefront of remanufacturing and sustainable automotive design, with strong research and development investments.

- Asia Pacific (APAC): Characterized by rapid industrialization and a burgeoning automotive market, APAC is quickly adopting circular economy principles to address resource scarcity and environmental pollution. China, Japan, and South Korea are leading in developing advanced recycling technologies, particularly for metals and plastics, and establishing large-scale remanufacturing operations.

- Latin America: This region is an emerging market for the automotive circular economy, with increasing awareness and initial steps towards establishing sustainable practices. Brazil and Mexico are showing potential, driven by global automotive industry standards and local efforts to manage end-of-life vehicles and reduce landfill waste.

- Middle East and Africa (MEA): While still in nascent stages, the MEA region is demonstrating growing interest in circular economy models, particularly in response to environmental pressures and the desire for economic diversification. Countries like UAE and South Africa are exploring pilot projects and partnerships to develop local recycling and remanufacturing capabilities, particularly for materials used in automotive manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Circular Economy Market.- Bosch

- ZF Friedrichshafen

- Continental AG

- Valeo

- Delphi Technologies (BorgWarner)

- Magna International

- Faurecia

- Lear Corporation

- Johnson Controls

- Toyota Motor Corporation

- Volkswagen AG

- BMW AG

- Hyundai Motor Company

- Stellantis

- Recyco

- Circular Metals

- ReCellular Solutions

- GreenAuto Parts

- Terracycle

- Suez

Frequently Asked Questions

What is the Automotive Circular Economy?

The Automotive Circular Economy is a systemic approach that redesigns the entire lifecycle of vehicles and their components to minimize waste and maximize resource utilization. Instead of the traditional linear model of "take-make-dispose," it focuses on principles like reducing resource input, reusing components, remanufacturing parts to 'as-new' condition, repairing vehicles, and recycling materials at their end-of-life. This paradigm aims to keep products and materials in use for as long as possible, extracting their maximum value, and then recovering and regenerating materials, thereby decoupling economic growth from finite resource consumption and significantly reducing environmental impact.

Why is the Automotive Circular Economy important?

The Automotive Circular Economy is crucial for several reasons, primarily addressing pressing global challenges such as resource scarcity, environmental degradation, and climate change. It reduces reliance on finite virgin materials, mitigates the environmental impact of manufacturing and waste disposal, and lowers carbon emissions. Economically, it offers significant cost savings through the use of remanufactured parts and recovered materials, creates new business opportunities in reverse logistics and innovative processing, and enhances supply chain resilience against material price volatility. It also aligns with growing consumer demand for sustainable products and helps companies comply with evolving stringent environmental regulations, fostering a more sustainable and economically viable automotive sector.

What are the main processes in the Automotive Circular Economy?

The main processes in the Automotive Circular Economy typically include several interconnected strategies aimed at extending product and material lifecycles. These encompass remanufacturing, where used components are restored to 'as-new' condition with equivalent performance and warranty; recycling, which involves breaking down materials to their raw state for use in new products; reuse, directly utilizing components or materials without significant alteration; and repair, fixing damaged items to extend their operational life. Additionally, refurbishment, which restores aesthetics and functionality, and preventative maintenance, which proactively extends component life, are integral to maximizing the value of automotive resources within this circular system.

How does AI impact the Automotive Circular Economy?

Artificial Intelligence significantly impacts the Automotive Circular Economy by enhancing efficiency, optimizing processes, and enabling smart decision-making. AI-powered analytics can predict component failure, optimizing maintenance and remanufacturing schedules. Machine learning algorithms improve the precision of sorting and dismantling complex materials at end-of-life, maximizing recovery rates and purity. Furthermore, AI-driven platforms can track materials and components across the supply chain, facilitating robust traceability and improving reverse logistics. Generative AI assists in designing products for easier disassembly and recyclability, while robotics, guided by AI, automates intricate processes in recycling and remanufacturing, collectively accelerating the transition towards a truly circular automotive industry.

What are the key challenges for implementing a Circular Economy in the automotive sector?

Implementing a Circular Economy in the automotive sector faces several key challenges. These include the significant upfront investment required for new infrastructure, such as advanced recycling plants and remanufacturing facilities, and establishing efficient reverse logistics networks for collecting and processing used components. Technical complexities arise from the diverse materials and intricate assemblies in modern vehicles, making disassembly and separation challenging. A lack of standardized global policies and consistent regulatory frameworks can also create hurdles. Additionally, ensuring the quality and performance of remanufactured parts, overcoming consumer skepticism, and effectively managing data for material traceability across the value chain are crucial challenges that the industry is actively working to address through innovation and collaboration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager