Automotive Constant Velocity Joint Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430487 | Date : Nov, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Constant Velocity Joint Market Size

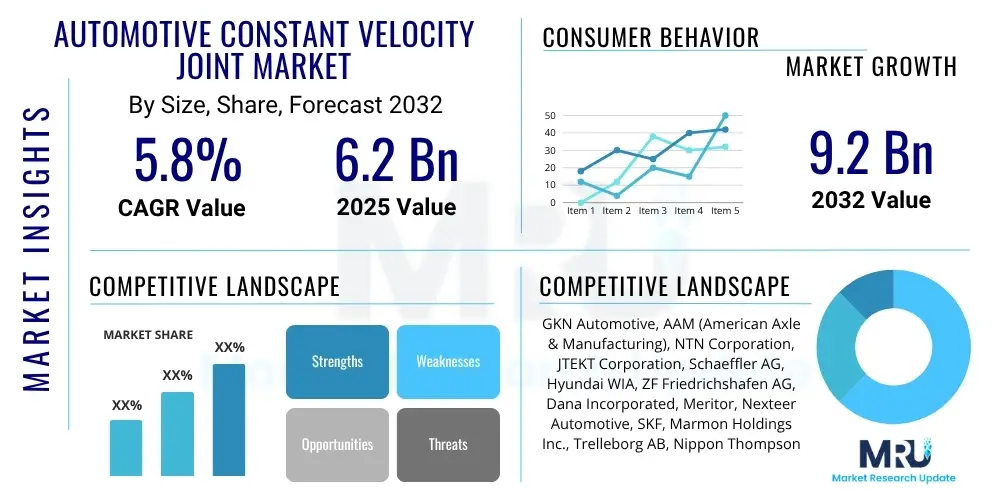

The Automotive Constant Velocity Joint Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $6.2 Billion in 2025 and is projected to reach $9.2 Billion by the end of the forecast period in 2032.

Automotive Constant Velocity Joint Market introduction

The Automotive Constant Velocity Joint Market plays a critical role in the functionality and performance of modern vehicles. Constant Velocity (CV) joints are essential mechanical components that transmit power from the transmission to the wheels at a constant rotational speed, even when the drive shaft is at an angle. This capability is paramount in front-wheel drive, all-wheel drive, and increasingly, rear-wheel drive vehicles, ensuring smooth power delivery and consistent wheel speed, especially during turns or suspension travel. Without CV joints, the drive shaft angle changes would cause vibrations and inconsistent power transfer, leading to poor vehicle handling and accelerated wear.

The primary function of a CV joint is to enable efficient power transfer while accommodating changes in angle and length between the differential and the wheel hub. Major applications include a broad spectrum of passenger cars, SUVs, light commercial vehicles, and heavy-duty vehicles. The benefits derived from these components are significant, encompassing enhanced driving comfort, improved vehicle stability, reduced noise and vibration, and superior traction. Key driving factors for this market include the global increase in vehicle production, the growing consumer preference for all-wheel-drive systems offering better traction and safety, and continuous advancements in materials and manufacturing processes that enhance joint durability and performance. The demand for lightweight and more efficient vehicles also propels innovation in CV joint design, impacting market dynamics.

Automotive Constant Velocity Joint Market Executive Summary

The Automotive Constant Velocity Joint Market is experiencing robust growth driven by consistent expansion in the global automotive industry and a burgeoning demand for advanced vehicle architectures. Business trends indicate a strong focus on research and development to produce more durable, lightweight, and compact CV joints capable of handling increased torque and varying operational angles, particularly in response to the proliferation of electric and hybrid vehicles. Strategic partnerships between component manufacturers and automotive OEMs are becoming more prevalent, aimed at co-developing customized solutions that meet evolving vehicle design and performance specifications. This collaborative approach is vital for maintaining competitive advantage and addressing the stringent quality and safety standards mandated across the industry.

Regional trends highlight Asia Pacific as the leading and fastest-growing market, primarily due to the region's significant automotive manufacturing base, increasing disposable incomes, and the rapid adoption of advanced vehicle technologies in countries like China, India, and Japan. North America and Europe continue to be strong markets, characterized by demand for premium vehicles, stringent emission regulations, and a robust aftermarket segment. Emerging markets in Latin America and the Middle East and Africa are also showing promising growth, fueled by rising vehicle parc and infrastructure development. Segment trends reveal that passenger vehicles dominate the market, while the all-wheel-drive application segment is projected to exhibit the highest growth rate, reflecting consumer demand for enhanced vehicle performance and safety features. The aftermarket segment is also demonstrating steady expansion, driven by the replacement demand for worn-out components and the increasing average age of vehicles on the road.

AI Impact Analysis on Automotive Constant Velocity Joint Market

Users frequently inquire about how Artificial Intelligence (AI) could revolutionize the manufacturing, design, and maintenance of Automotive Constant Velocity Joints. Common questions revolve around AI's ability to optimize production processes for greater efficiency and precision, predict component failures, and inform the design of next-generation CV joints. There is a strong interest in understanding AI's role in enhancing product quality, reducing manufacturing costs, and improving the overall lifespan and reliability of these critical automotive components. The key themes include predictive maintenance, intelligent design, and automation, reflecting expectations for AI to deliver smarter, more robust, and cost-effective solutions in the CV joint sector.

- AI-driven predictive maintenance systems can forecast CV joint failures, enabling proactive repairs and reducing vehicle downtime.

- AI algorithms can optimize manufacturing processes, enhancing precision, reducing waste, and improving production efficiency.

- Generative design tools powered by AI can create innovative and lightweight CV joint geometries, improving performance and fuel efficiency.

- AI can analyze vast datasets from vehicle sensors to refine CV joint designs for specific vehicle types and driving conditions.

- Automated quality control systems utilizing AI and machine vision can detect minute defects, ensuring higher product reliability.

- Supply chain optimization through AI can improve logistics, inventory management, and raw material procurement for CV joint manufacturers.

- AI could facilitate personalized or adaptive CV joint designs based on anticipated vehicle usage patterns and environmental factors.

DRO & Impact Forces Of Automotive Constant Velocity Joint Market

The Automotive Constant Velocity Joint Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities that shape its growth trajectory. Key drivers include the consistent growth of global automotive production, particularly the rising demand for passenger vehicles and SUVs across emerging economies. The increasing consumer preference for vehicles equipped with all-wheel-drive (AWD) and four-wheel-drive (4WD) systems, which inherently utilize more CV joints, acts as a significant catalyst for market expansion. Furthermore, ongoing technological advancements focused on enhancing fuel efficiency, reducing vehicle weight, and improving overall driving dynamics necessitate more sophisticated and durable CV joint designs. These innovations, coupled with stringent safety regulations worldwide, push manufacturers to invest in advanced materials and precision engineering, directly impacting market growth.

However, several restraints pose challenges to market proliferation. Volatility in raw material prices, such as steel and specialty alloys, can impact manufacturing costs and profit margins. The intricate and capital-intensive manufacturing processes required for high-precision CV joints also present a barrier, especially for new entrants. Furthermore, the automotive industry's increasing shift towards electric vehicles (EVs) introduces both opportunities and potential restraints. While EVs still require CV joints, particularly in their drivetrain, the architecture of some EV platforms might alter the specific design or number of joints required, potentially impacting demand for traditional CV joint types in the long run. The intense competition among established players also places downward pressure on pricing, affecting profitability.

Opportunities within the market primarily stem from the burgeoning automotive markets in Asia Pacific, Latin America, and the Middle East, where vehicle parc is rapidly expanding. The development and adoption of lightweight and high-strength materials, such as advanced steels and composites, offer avenues for product innovation that can improve fuel efficiency and performance. Moreover, the integration of CV joints with advanced vehicle control systems and autonomous driving technologies presents new design challenges and opportunities for specialized, high-performance components. The aftermarket segment also continues to offer substantial growth potential, driven by the replacement cycle of existing vehicles and the increasing average age of cars on the road, ensuring a steady demand for repair and maintenance parts.

Segmentation Analysis

The Automotive Constant Velocity Joint Market is broadly segmented based on various critical parameters, providing a detailed view of its diverse landscape and enabling a granular understanding of market dynamics. These segments help stakeholders identify key growth areas, consumer preferences, and technological shifts within the industry. Understanding these segmentations is crucial for strategic planning, product development, and market entry decisions, allowing manufacturers and suppliers to tailor their offerings to specific market needs and optimize their business strategies for maximum impact and competitive advantage.

- By Type

- Fixed CV Joint (e.g., Rzeppa, Birfield)

- Plunging CV Joint (e.g., Tripod, Double Offset)

- By Vehicle Type

- Passenger Vehicles (Sedans, Hatchbacks, SUVs)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- By Application

- Front Wheel Drive (FWD)

- Rear Wheel Drive (RWD)

- All Wheel Drive (AWD)

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Material

- Steel

- Alloy Steel

- Other Advanced Materials

Value Chain Analysis For Automotive Constant Velocity Joint Market

The value chain for the Automotive Constant Velocity Joint Market is an intricate network encompassing several stages, starting from raw material procurement and extending to end-user consumption and aftermarket services. The upstream segment involves the sourcing of critical raw materials such as steel, alloy steels, and specialized lubricants from various suppliers. These materials undergo initial processing before being supplied to component manufacturers. The quality and availability of these raw materials are pivotal, directly influencing the final product's performance and cost. Maintaining strong relationships with reliable material suppliers is essential for ensuring supply chain stability and controlling production expenses, while also adhering to increasingly stringent environmental and ethical sourcing standards.

Midstream activities primarily involve the design, engineering, and manufacturing of the CV joints. This stage is highly technology-intensive, requiring advanced machining, forging, heat treatment, and assembly processes to produce high-precision components. CV joint manufacturers often invest heavily in research and development to innovate designs, enhance durability, reduce weight, and improve efficiency. These manufactured CV joints are then supplied directly to automotive Original Equipment Manufacturers (OEMs) for integration into new vehicle assemblies, representing the direct distribution channel. The downstream segment includes the distribution channels, which can be direct to OEMs or indirect through a network of wholesalers, distributors, and retailers for the aftermarket. This indirect channel caters to replacement demand for repairs and maintenance, ensuring that spare parts are readily available to workshops and consumers globally.

The distribution network plays a crucial role in market penetration and customer reach. Direct channels emphasize long-term contractual relationships with major automotive manufacturers, often involving collaborative design and just-in-time delivery systems. Indirect channels, focused on the aftermarket, require extensive logistical networks to ensure wide availability and efficient delivery of replacement parts. This includes specialized automotive parts distributors, independent workshops, and increasingly, online retail platforms. The effectiveness of these channels, both direct and indirect, is paramount for market success, dictating the speed at which products reach end-users and the responsiveness to market demand for both new installations and repairs. Efficient logistics and robust inventory management are key competitive differentiators within these diverse distribution channels.

Automotive Constant Velocity Joint Market Potential Customers

The primary potential customers for the Automotive Constant Velocity Joint Market are diverse, encompassing various entities within the automotive ecosystem that require these critical components for vehicle assembly, maintenance, and repair. At the forefront are automotive Original Equipment Manufacturers (OEMs), including global giants such as Toyota, Volkswagen, Ford, General Motors, Hyundai, and BMW. These OEMs integrate CV joints into the drive shafts of new passenger cars, SUVs, light commercial vehicles, and heavy-duty trucks during their initial assembly. Their demand is directly tied to global vehicle production volumes and new model introductions, often requiring customized designs and large-volume orders with strict quality and performance specifications. They are focused on reliability, performance, and cost-effectiveness for mass production.

Beyond new vehicle production, a substantial customer base exists in the aftermarket segment. This includes a vast network of independent automotive repair shops, authorized service centers, and specialized garages that perform vehicle maintenance and repairs. These entities purchase CV joints as replacement parts for vehicles where existing components have worn out or failed. The demand from this segment is driven by the global vehicle parc, average vehicle age, and mileage. Additionally, automotive parts retailers, both brick-and-mortar stores and online platforms, serve as crucial intermediaries in supplying these replacement parts to end-users and repair professionals. Fleet operators of commercial vehicles also represent a significant customer group, as they consistently require durable and reliable CV joints for their vehicles to minimize downtime and maintain operational efficiency. Individual vehicle owners, while typically not direct purchasers from manufacturers, are the ultimate end-users whose needs drive the entire aftermarket supply chain, demonstrating the broad reach of the market's customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $6.2 Billion |

| Market Forecast in 2032 | $9.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GKN Automotive, AAM (American Axle & Manufacturing), NTN Corporation, JTEKT Corporation, Schaeffler AG, Hyundai WIA, ZF Friedrichshafen AG, Dana Incorporated, Meritor, Nexteer Automotive, SKF, Marmon Holdings Inc., Trelleborg AB, Nippon Thompson Co. Ltd., Bharat Forge, Federal-Mogul, Wanxiang Qianchao Co. Ltd., Metaldyne Performance Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Constant Velocity Joint Market Key Technology Landscape

The Automotive Constant Velocity Joint Market is continuously evolving, driven by advancements in materials science, manufacturing processes, and vehicle design demands. A key technological focus is on developing lightweight materials that can reduce overall vehicle weight, thereby improving fuel efficiency and reducing emissions, without compromising strength or durability. High-strength steels and advanced alloy compositions are increasingly being utilized to achieve these objectives. Furthermore, specialized heat treatment processes and surface coatings are employed to enhance wear resistance, reduce friction, and extend the operational life of CV joints, particularly under demanding driving conditions. These material and treatment innovations are crucial for meeting the performance expectations of modern high-power vehicles and the longevity requirements of consumers.

Another significant area of technological development involves precision manufacturing techniques aimed at achieving tighter tolerances and improved dimensional accuracy. This includes advanced forging, machining, and grinding technologies that minimize vibration and noise (NVH) levels, contributing to a smoother and quieter driving experience. Lubrication technology is also paramount; innovative grease formulations are designed to maintain optimal performance across a wide range of temperatures and operating speeds, ensuring consistent power transmission and protecting internal components from wear. Sealing technologies, such as advanced boot designs and materials, are critical for preventing contaminants from entering the joint and retaining lubricant, directly impacting the longevity and reliability of the CV joint assembly. The integration of sensor technologies for real-time monitoring of CV joint health, though nascent, represents a future trend, enabling predictive maintenance and further enhancing vehicle reliability and safety. All these advancements collectively contribute to more efficient, durable, and quieter drivetrain systems in contemporary automobiles.

Regional Highlights

- Asia Pacific: This region stands as the dominant market for automotive constant velocity joints, driven by robust automotive production, particularly in China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and the growing demand for passenger vehicles and SUVs fuel market growth. The region also benefits from a strong manufacturing base and the rapid adoption of new vehicle technologies, including electric and hybrid vehicles, leading to continuous demand for advanced CV joint solutions.

- North America: A mature market characterized by high demand for premium vehicles, light trucks, and SUVs, which often require sophisticated AWD systems. The region shows consistent demand for both OEM and aftermarket CV joints, driven by a large vehicle parc and a strong focus on vehicle performance and safety. Technological innovation and stringent quality standards are key characteristics of this market.

- Europe: This region demonstrates a significant market share, influenced by strict emission regulations, a strong emphasis on fuel efficiency, and high demand for luxury and performance vehicles. Countries like Germany, France, and the UK contribute substantially to market growth. The European market also benefits from a well-established aftermarket segment and ongoing advancements in automotive engineering aimed at improving vehicle dynamics and reliability.

- Latin America: An emerging market with growing automotive production and an expanding middle class. Countries such as Brazil and Mexico are key contributors to the market, with increasing sales of new vehicles driving OEM demand. The region also presents significant opportunities for the aftermarket due to an aging vehicle parc and varied road conditions that often necessitate component replacements.

- Middle East and Africa (MEA): This region is experiencing gradual growth, primarily due to increasing vehicle sales, infrastructural developments, and investments in the automotive sector. Demand is driven by expanding urban centers and a growing preference for SUVs and 4WD vehicles suited for diverse terrains. While smaller than other regions, it offers long-term growth potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Constant Velocity Joint Market.- GKN Automotive

- AAM (American Axle & Manufacturing)

- NTN Corporation

- JTEKT Corporation

- Schaeffler AG

- Hyundai WIA

- ZF Friedrichshafen AG

- Dana Incorporated

- Meritor

- Nexteer Automotive

- SKF

- Marmon Holdings Inc. (Accuride)

- Trelleborg AB

- Nippon Thompson Co. Ltd. (IKO)

- Bharat Forge

- Federal-Mogul (Tenneco)

- Wanxiang Qianchao Co. Ltd.

- Metaldyne Performance Group (MPG)

Frequently Asked Questions

What is a Constant Velocity (CV) Joint and its primary function?

A Constant Velocity (CV) Joint is a mechanical component in a vehicle's drivetrain that allows a drive shaft to transmit power at a constant rotational speed, regardless of the angle between the two shafts. Its primary function is to deliver smooth and consistent power from the transmission to the wheels, accommodating suspension travel and steering angles without causing vibrations or speed fluctuations, crucial for vehicle performance and driver comfort.

How long do automotive CV joints typically last?

The lifespan of an automotive CV joint can vary significantly depending on driving conditions, maintenance, and the quality of the component. Generally, a properly maintained CV joint can last 100,000 miles or more. However, damage to the protective rubber boot (CV boot) allowing dirt and moisture in, or loss of lubrication, can significantly shorten its life, leading to premature failure.

What are the common signs of a failing CV joint?

Common signs of a failing CV joint include a clicking or popping noise, particularly when turning or accelerating; a clunking sound when shifting from drive to reverse; and vibrations that can be felt through the steering wheel or floorboards. A visual inspection might also reveal a torn or damaged CV boot, indicating lubricant leakage and contamination, which are precursors to joint failure.

Are Constant Velocity Joints used in electric vehicles (EVs)?

Yes, Constant Velocity Joints are commonly used in electric vehicles (EVs). While the powertrain architecture differs, EVs still require CV joints to transmit torque from the electric motor to the drive wheels while accommodating suspension movement and steering. Their design might be adapted for the unique torque characteristics and packaging constraints of electric drivetrains, but the fundamental function remains essential.

What is the difference between an inner and outer CV joint?

An inner CV joint connects the drive shaft to the transmission or differential, typically designed to allow for axial movement (plunging) to accommodate changes in drive shaft length during suspension travel. An outer CV joint connects the drive shaft to the wheel hub, designed to handle larger articulation angles for steering and suspension movement while maintaining constant velocity power transmission to the wheel.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager