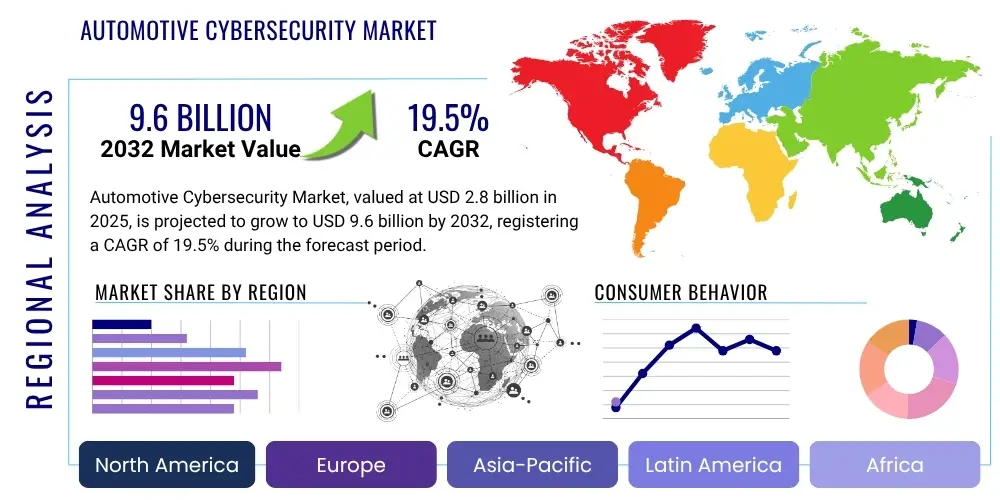

Automotive Cybersecurity Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429126 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Cybersecurity Market Size

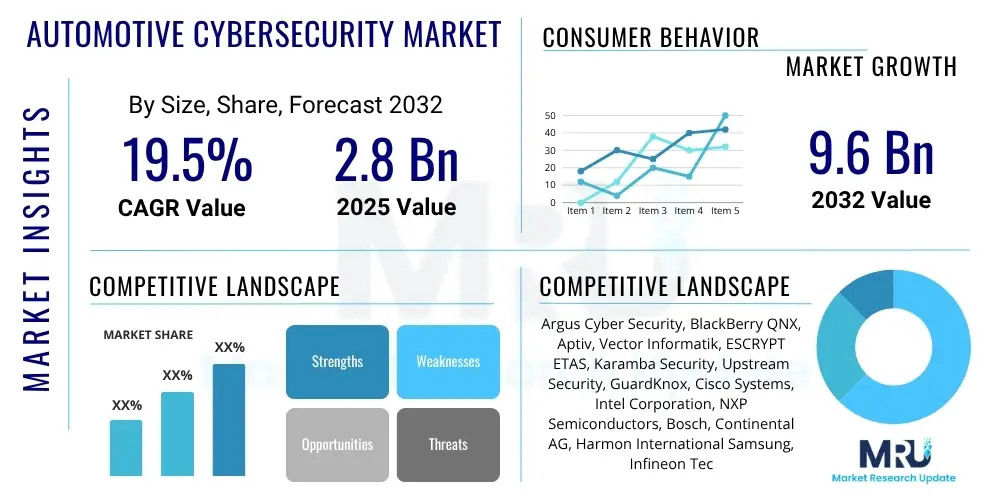

The Automotive Cybersecurity Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2025 and 2032. The market is estimated at $2.8 billion in 2025 and is projected to reach $9.6 billion by the end of the forecast period in 2032.

Automotive Cybersecurity Market introduction

The Automotive Cybersecurity Market encompasses the technologies and services designed to protect vehicles from unauthorized access, manipulation, and cyber threats. As modern vehicles become increasingly connected and autonomous, they integrate numerous electronic control units (ECUs), sophisticated software, and communication systems that are vulnerable to various cyberattacks. These solutions safeguard critical vehicle functions, personal data, and infrastructure communications against malicious actors, ensuring the safety, privacy, and reliability of automotive systems.

The core products and services within this market include specialized software for intrusion detection and prevention, hardware security modules (HSMs), secure boot mechanisms, and over-the-air (OTA) update security. Major applications span across advanced driver-assistance systems (ADAS), infotainment systems, telematics, vehicle-to-everything (V2X) communication, and powertrain management. The primary benefits derived from robust automotive cybersecurity solutions are enhanced passenger safety, protection of sensitive user data, compliance with evolving international regulations, and maintenance of vehicle brand reputation. The market is primarily driven by the escalating demand for connected cars, the rapid development of autonomous driving technologies, and the increasing sophistication of cyber threats targeting the automotive ecosystem.

Automotive Cybersecurity Market Executive Summary

The Automotive Cybersecurity Market is experiencing substantial growth, propelled by the pervasive integration of connectivity and automation in modern vehicles. Key business trends indicate a strong move towards strategic partnerships and collaborations between traditional automotive original equipment manufacturers (OEMs), Tier 1 suppliers, and specialized cybersecurity firms. There is an increasing focus on developing comprehensive, multi-layered security architectures that address threats across the entire vehicle lifecycle, from design and manufacturing to operational deployment and end-of-life. This includes a shift towards proactive threat intelligence and predictive analytics to anticipate and mitigate vulnerabilities before they can be exploited.

Regionally, North America and Europe continue to lead in market adoption, driven by stringent regulatory frameworks such as UNECE WP.29 and a high consumer expectation for secure vehicles. The Asia Pacific region is rapidly emerging as a significant growth hub, fueled by the massive production volumes of connected and electric vehicles in countries like China, Japan, and South Korea, coupled with increasing governmental emphasis on cyber-resilience. Segment-wise, the software and services components are anticipated to witness the highest growth, as these offer dynamic and adaptable solutions required to counter an ever-evolving threat landscape. Hardware security remains foundational, but the emphasis is shifting towards intelligent software-defined protection and managed security services to provide continuous monitoring and rapid response capabilities.

AI Impact Analysis on Automotive Cybersecurity Market

Users frequently inquire about how Artificial Intelligence (AI) will transform automotive cybersecurity, focusing on its potential for both defense and offense. Common questions revolve around AI's ability to detect novel threats, automate security responses, and predict vulnerabilities in complex vehicle systems. Concerns are also raised regarding the emergence of AI-powered cyberattacks and how security systems can defend against such sophisticated, adaptive threats. Users are particularly interested in the balance between AI's capacity to enhance vehicle security and the new attack surfaces or vulnerabilities that AI itself might introduce into automotive software and hardware architectures.

The integration of AI in automotive cybersecurity is primarily seen as a dual-edged sword. On one hand, AI and machine learning algorithms are invaluable for enhancing threat detection capabilities, allowing systems to identify anomalous behaviors and potential intrusions with greater speed and accuracy than traditional rule-based methods. This includes predicting attack patterns and automating real-time responses to neutralize threats. On the other hand, the complexity and 'black box' nature of some AI models can introduce new vulnerabilities, such as adversarial attacks designed to trick AI-driven security systems or the potential for AI itself to be exploited to orchestrate more sophisticated attacks. Therefore, balancing the benefits of AI with the need for robust AI security remains a critical challenge for the industry.

- Enhanced threat detection and anomaly identification through machine learning

- Predictive analytics for anticipating future cyberattack vectors and vulnerabilities

- Automated incident response and remediation in real-time

- Optimization of security updates and patches through intelligent analysis

- Creation of more complex and adaptive attack surfaces via adversarial AI

- Potential for AI algorithms to be manipulated or compromised

- Increased demand for AI-specific security testing and validation

DRO & Impact Forces Of Automotive Cybersecurity Market

The Automotive Cybersecurity Market is propelled by several key drivers, primarily the escalating connectivity of modern vehicles and the widespread adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies. These advancements significantly increase the attack surface, necessitating robust security measures. Furthermore, stringent regulatory mandates, exemplified by UNECE WP.29, are compelling automotive manufacturers to implement comprehensive cybersecurity management systems throughout the vehicle lifecycle. The persistent and growing threat landscape, characterized by increasingly sophisticated cybercriminals, also acts as a powerful driver, pushing for continuous innovation in defense mechanisms. Consumers are also becoming more aware of data privacy and vehicle security, contributing to market demand.

Despite the strong drivers, the market faces notable restraints. The high cost associated with developing, integrating, and maintaining advanced cybersecurity solutions can be a significant barrier for some manufacturers, especially smaller players. The inherent complexity of automotive software and hardware architectures, involving numerous ECUs and diverse suppliers, makes a unified security approach challenging. A persistent global shortage of skilled cybersecurity professionals with specific automotive expertise also hampers effective implementation. Moreover, the lack of universally standardized cybersecurity protocols across the diverse automotive industry can lead to fragmentation and interoperability issues, complicating the deployment of holistic security solutions. Addressing these challenges requires collaborative industry efforts and significant investment in talent development.

Opportunities in this market are abundant, particularly with the proliferation of over-the-air (OTA) update capabilities, which enable rapid deployment of security patches and new features without physical recalls. The rapid growth of electric vehicles (EVs) and vehicle-to-everything (V2X) communication technologies presents new avenues for security innovation, requiring specialized protection for charging infrastructure, smart grid integration, and inter-vehicle communication. The demand for managed security services is also rising, as OEMs seek external expertise to handle complex security operations. The impact forces shaping this market include the evolving regulatory landscape which continuously sets new benchmarks for security, the rapid pace of technological advancements in both automotive and cybersecurity domains, the dynamic nature of threat actors and their methodologies, and growing consumer expectations for secure and private vehicle experiences.

Segmentation Analysis

The Automotive Cybersecurity Market is broadly segmented based on security type, component, application, vehicle type, and form factor, reflecting the diverse approaches and needs within vehicle protection. Each segment addresses specific aspects of a vehicle's architecture or operational environment, offering tailored solutions to combat a wide array of cyber threats. Understanding these segmentations is crucial for stakeholders to identify market niches, develop targeted products, and strategically position their offerings in this rapidly evolving landscape. The market's complexity necessitates a multi-layered security strategy, often combining elements from various segments to create a resilient defense system against sophisticated attacks.

- Security Type

- Endpoint Security

- Application Security

- Network Security

- Cloud Security

- Wireless Security

- Data Security

- Hardware Security

- Component

- Software

- Hardware

- Services

- Application

- ADAS Autonomous Driving Systems

- Infotainment System

- Telematics System

- Powertrain System

- Body Electronics System

- Communication Modules V2X

- Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

- Form Factor

- In-Vehicle Security

- External Cloud Security

- OEM Security

- Aftermarket Security

Value Chain Analysis For Automotive Cybersecurity Market

The value chain for the Automotive Cybersecurity Market begins with upstream activities involving foundational technology providers. This includes semiconductor manufacturers who produce secure microcontrollers and hardware security modules (HSMs), specialized software developers creating operating systems and cryptographic libraries, and sensor technology companies that feed data into the security systems. These upstream players provide the fundamental building blocks upon which automotive cybersecurity solutions are built, ensuring the integrity and authenticity of vehicle components from the ground up. Their contributions are critical for establishing a trusted computing base within the vehicle's architecture.

Moving downstream, the value chain involves a complex interplay between Tier 1 suppliers and original equipment manufacturers (OEMs). Tier 1 suppliers integrate various components and software into modules and subsystems (e.g., infotainment units, ADAS controllers) and are increasingly responsible for implementing cybersecurity at their level. OEMs then integrate these subsystems into the complete vehicle, ensuring end-to-end security, often with their own internal cybersecurity teams and processes. Further downstream, service providers offer ongoing cybersecurity monitoring, threat intelligence, incident response, and over-the-air (OTA) security updates, extending protection throughout the vehicle's operational lifecycle. These services are crucial for adapting to new threats and maintaining vehicle security over time.

Distribution channels in this market are predominantly direct, with cybersecurity solution providers working closely with OEMs and Tier 1 suppliers during the design and development phases. This direct engagement ensures deep integration and customization of security features tailored to specific vehicle platforms. However, indirect channels also exist, particularly in the aftermarket segment, where third-party solution providers offer cybersecurity upgrades or add-ons for existing vehicles. Partnerships and collaborations between automotive players and dedicated cybersecurity firms are also a common form of distribution, facilitating knowledge transfer and enabling comprehensive security offerings. The increasing complexity of connected vehicles mandates a collaborative approach across the entire value chain to achieve robust cybersecurity.

Automotive Cybersecurity Market Potential Customers

The primary potential customers and end-users of automotive cybersecurity products and services are vehicle manufacturers, also known as Original Equipment Manufacturers (OEMs). These companies are directly responsible for designing, building, and delivering secure vehicles to consumers. Their need for cybersecurity is paramount, driven by regulatory compliance, brand reputation, and the functional safety of their products. OEMs seek comprehensive solutions that can be integrated throughout the vehicle development lifecycle, from concept to production and post-sale maintenance, covering all electronic control units, communication networks, and external interfaces.

Another significant segment of potential customers includes Tier 1 and Tier 2 automotive suppliers. These companies develop and provide various components and systems such as infotainment units, telematics modules, ADAS sensors, and braking systems to OEMs. As the integration of advanced technologies at the component level increases, these suppliers must ensure that their products are inherently secure to prevent vulnerabilities from propagating up the supply chain. Compliance with OEM security requirements and industry standards is a critical driver for their adoption of cybersecurity solutions. Additionally, fleet management companies and mobility service providers, operating large fleets of connected or autonomous vehicles, represent a growing customer base. They require robust cybersecurity to protect their assets, operational data, and ensure the safety of their services, often opting for managed security services to handle their complex security needs. Individual vehicle owners also represent an indirect customer, as their demand for secure vehicles influences OEM decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2.8 billion |

| Market Forecast in 2032 | $9.6 billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Argus Cyber Security, BlackBerry QNX, Aptiv, Vector Informatik, ESCRYPT ETAS, Karamba Security, Upstream Security, GuardKnox, Cisco Systems, Intel Corporation, NXP Semiconductors, Bosch, Continental AG, Harmon International Samsung, Infineon Technologies, Renesas Electronics, STMicroelectronics, Visteon Corporation, ZF Friedrichshafen |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Cybersecurity Market Key Technology Landscape

The automotive cybersecurity market is defined by a rapidly evolving technological landscape, driven by the need for robust protection against increasingly sophisticated cyber threats. Core technologies include Intrusion Detection and Prevention Systems (IDPS), which monitor vehicle networks for suspicious activities and block malicious traffic. These systems are often deployed at various layers, from individual ECUs to the vehicle's central gateway, ensuring comprehensive coverage. Another foundational technology is Public Key Infrastructure (PKI) and cryptographic solutions, vital for secure communication, authentication of components, and ensuring the integrity of software updates. Secure boot mechanisms and Hardware Security Modules (HSMs) provide hardware-based roots of trust, protecting critical boot processes and cryptographic keys from tampering.

Beyond these foundational elements, the market is seeing significant advancements in software-defined security and embedded security solutions. Firmware Over-the-Air (FOTA) and Software Over-the-Air (SOTA) update technologies, while enhancing vehicle functionality, also require strong security protocols to prevent malicious code injection. Therefore, secure update mechanisms are a critical part of the technology stack. Machine learning and artificial intelligence are increasingly being integrated into cybersecurity solutions for anomaly detection, predictive threat analysis, and automated incident response, moving from reactive to proactive security postures. These AI-powered systems can analyze vast amounts of data from vehicle sensors and networks to identify subtle indicators of compromise.

Further innovation is observed in the realm of Vehicle-to-Everything (V2X) communication security, which addresses vulnerabilities arising from vehicle interactions with infrastructure, other vehicles, and personal devices. This includes secure communication protocols and identity management solutions crucial for autonomous driving and smart city integrations. Cloud-based security platforms are also gaining traction, offering centralized threat intelligence, security operations centers (SOCs) for continuous monitoring, and scalable solutions for managing vast fleets of connected vehicles. The convergence of these technologies forms a multi-layered, adaptive security framework essential for protecting the complex and dynamic automotive ecosystem.

Regional Highlights

- North America: This region is a frontrunner in automotive cybersecurity adoption, driven by early integration of advanced connected car features and autonomous driving technologies. Stringent regulatory environments and a high level of consumer awareness regarding data privacy and vehicle safety further accelerate market growth. The presence of major automotive OEMs and technology providers fosters innovation and significant R&D investments in cybersecurity solutions.

- Europe: Europe stands out due to its proactive regulatory approach, particularly with the implementation of UNECE WP.29 regulations, which mandate cybersecurity management systems for all new vehicles. This has created a strong demand for compliant solutions and services. European countries also have a robust automotive industry with a focus on advanced engineering and security, leading to the development of sophisticated in-vehicle security technologies.

- Asia Pacific (APAC): The APAC region is experiencing rapid expansion in the automotive cybersecurity market, primarily due to the massive growth in electric vehicle (EV) production and the increasing penetration of connected cars, especially in countries like China, Japan, and South Korea. Government initiatives to promote smart mobility and the development of local technology ecosystems are significant drivers. The region is also becoming a hub for automotive software development, leading to a higher demand for application and network security.

- Latin America: This region is an emerging market for automotive cybersecurity. While adoption rates are lower compared to North America and Europe, increasing foreign investment in automotive manufacturing and a growing demand for connected vehicles are gradually driving market growth. Cybersecurity awareness is on the rise, paving the way for future market expansion, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): The MEA market for automotive cybersecurity is in its nascent stages but shows significant potential. Investments in smart city projects and developing advanced transportation infrastructures are creating opportunities. Gulf Cooperation Council (GCC) countries, in particular, are focusing on adopting modern technologies, including connected vehicles, which will inevitably necessitate robust cybersecurity measures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Cybersecurity Market.- Argus Cyber Security

- BlackBerry QNX

- Aptiv

- Vector Informatik

- ESCRYPT ETAS

- Karamba Security

- Upstream Security

- GuardKnox

- Cisco Systems

- Intel Corporation

- NXP Semiconductors

- Bosch

- Continental AG

- Harmon International Samsung

- Infineon Technologies

- Renesas Electronics

- STMicroelectronics

- Visteon Corporation

- ZF Friedrichshafen

Frequently Asked Questions

Why is automotive cybersecurity important for modern vehicles?

Automotive cybersecurity is crucial because modern vehicles are highly connected computers on wheels, susceptible to cyberattacks that can compromise safety, privacy, and functionality. Protecting these systems ensures passenger safety, prevents data breaches, maintains operational integrity, and complies with evolving regulations.

What are the main types of cyberattacks on vehicles?

Common cyberattacks include remote unauthorized access to critical systems, manipulation of ADAS functionalities, theft of personal data from infotainment units, ransomware attacks on vehicle networks, and denial-of-service attacks affecting communication systems or operational capabilities.

How do regulations like UNECE WP.29 impact automotive cybersecurity?

UNECE WP.29 mandates that vehicle manufacturers establish and implement a comprehensive Cybersecurity Management System (CSMS) throughout the vehicle's lifecycle, from design to post-production. This regulation compels OEMs to prioritize cybersecurity, ensuring vehicles are designed and built with security in mind and remain secure through updates.

What role does AI play in automotive cybersecurity?

AI significantly enhances automotive cybersecurity by enabling advanced threat detection, predictive vulnerability analysis, and automated response capabilities. Machine learning algorithms can identify anomalous behavior and new attack patterns more effectively than traditional methods, though AI itself can also introduce new attack vectors.

Who is primarily responsible for securing connected vehicles?

Vehicle manufacturers (OEMs) bear the primary responsibility for securing connected vehicles, ensuring cybersecurity throughout the vehicle's lifecycle. However, Tier 1 suppliers, software developers, and even network providers also play crucial roles in delivering secure components and services within the broader automotive ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager