Automotive Decorative Exterior Trim Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428772 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Decorative Exterior Trim Market Size

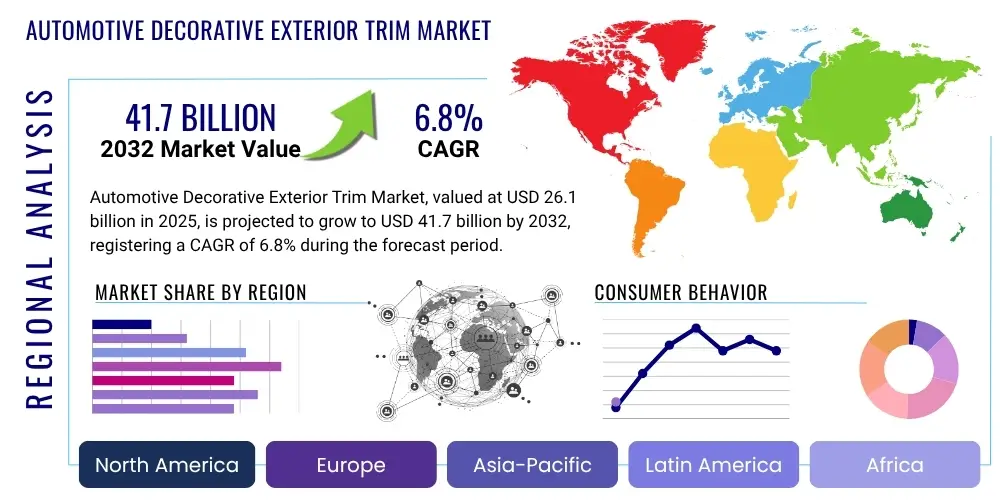

The Automotive Decorative Exterior Trim Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 26.1 billion in 2025 and is projected to reach USD 41.7 billion by the end of the forecast period in 2032.

Automotive Decorative Exterior Trim Market introduction

The Automotive Decorative Exterior Trim Market encompasses the design, manufacturing, and distribution of components that enhance the aesthetic appeal and overall styling of vehicles' exteriors. These trims, ranging from grille designs to window surrounds and side moldings, play a crucial role in vehicle differentiation and brand identity. They are integral to a vehicle's first impression, offering both visual enhancement and, in some cases, contributing to aerodynamic performance or protective functions. The market is driven by evolving consumer preferences for personalized and premium vehicle aesthetics, coupled with advancements in material science and manufacturing technologies that enable more intricate and durable designs.

Product descriptions within this market include a wide array of parts such as chrome accents, black trim packages, body-colored moldings, and specialized finishes for grilles, mirror caps, door handles, and window frames. Major applications span across passenger vehicles, including sedans, SUVs, and luxury cars, as well as light commercial vehicles, where durability and robust design are equally important. These decorative elements not only elevate a vehicle's visual appeal but also offer subtle benefits such as minor impact protection and weather resistance for underlying components, ultimately contributing to higher perceived quality and resale value.

Key driving factors for market expansion include the increasing demand for vehicle customization, rising disposable incomes leading to greater expenditure on premium vehicle features, and the continuous introduction of new vehicle models that incorporate sophisticated exterior styling as a primary selling point. Furthermore, technological advancements in material treatments and coating processes allow for the creation of more durable, lightweight, and visually striking trim options, catering to a diverse range of consumer tastes and regulatory requirements for vehicle safety and environmental performance.

Automotive Decorative Exterior Trim Market Executive Summary

The Automotive Decorative Exterior Trim Market is undergoing significant transformation driven by several key business, regional, and segment trends. Business trends highlight a strong emphasis on sustainability through the adoption of recycled and bio-based materials, alongside a growing focus on lightweighting strategies to enhance fuel efficiency and accommodate the demands of electric vehicles. Premiumization continues to be a dominant theme, with consumers seeking high-quality finishes and unique aesthetic touches that differentiate their vehicles in a competitive market. Furthermore, the push for vehicle personalization through customizable trim options is fostering innovation among manufacturers, leading to new design possibilities and advanced manufacturing techniques like 3D printing for rapid prototyping and limited-run components.

Regional trends indicate that Asia Pacific remains the largest and fastest-growing market, propelled by robust automotive production, increasing disposable incomes, and a burgeoning middle class in countries like China and India. Europe and North America exhibit mature markets characterized by a strong demand for premium and luxury vehicles, alongside stringent environmental regulations that encourage the development of eco-friendly and durable trim solutions. Latin America and the Middle East & Africa are emerging as promising markets, driven by urbanization, expanding infrastructure, and increasing foreign investments in the automotive sector, leading to a rising demand for vehicles equipped with modern exterior styling.

Segment trends reveal a shift towards advanced plastics and composite materials for their weight reduction benefits and design flexibility, although traditional metals like chrome-plated steel continue to hold a strong position in certain premium applications. The market is also seeing increased demand for sophisticated finishes such as matte black, satin chrome, and unique textured coatings, moving beyond conventional bright chrome. Original Equipment Manufacturers (OEMs) constitute the largest end-use segment, dictating design and material specifications, while the aftermarket segment experiences growth through personalization and replacement demand. The integration of advanced manufacturing processes, including robotics and automation, is enhancing production efficiency and quality across the entire value chain.

AI Impact Analysis on Automotive Decorative Exterior Trim Market

User inquiries regarding AI's influence on the Automotive Decorative Exterior Trim Market frequently revolve around how artificial intelligence can revolutionize design processes, enhance manufacturing efficiency, enable deeper personalization, and optimize supply chain management. Key themes include the potential for AI to accelerate material innovation, predict aesthetic trends, automate quality control, and facilitate highly customized trim production at scale. Concerns often touch upon the initial investment costs for AI integration and the need for a skilled workforce to leverage these advanced tools effectively, while expectations are high for AI to deliver unprecedented levels of precision, speed, and creative freedom in trim development.

- AI-driven generative design for novel trim shapes and patterns, optimizing aesthetics and aerodynamics.

- Predictive analytics for consumer trend forecasting, informing material choices and finish developments.

- Enhanced quality control through AI-powered visual inspection systems, detecting subtle defects in finishes and fit.

- Optimization of manufacturing processes, including injection molding and plating, for reduced waste and improved consistency.

- Personalized trim options enabled by AI, allowing customers to visualize and select unique configurations.

- Supply chain optimization using AI for demand forecasting, inventory management, and logistics efficiency.

- Robotics and automation, often guided by AI, improving precision and speed in assembly and finishing.

- AI-assisted material research to identify durable, sustainable, and aesthetically pleasing new composites and coatings.

DRO & Impact Forces Of Automotive Decorative Exterior Trim Market

The Automotive Decorative Exterior Trim Market is influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the ever-present consumer desire for aesthetically pleasing and distinctive vehicles, leading to increased demand for premium and customizable exterior trims. The continuous launch of new vehicle models, each striving for unique design language, fuels innovation in trim materials and finishes. Furthermore, rising disposable incomes in emerging economies enable consumers to opt for higher-spec vehicles featuring elaborate decorative elements. Advances in material science, offering lightweight, durable, and versatile options, also serve as significant market accelerators, allowing for more intricate and sustainable designs while meeting stringent environmental regulations and fuel efficiency targets.

However, the market faces several restraints that could impede its growth. The high cost associated with research, development, and manufacturing of advanced trim materials and complex finishing processes can be a barrier, particularly for mass-market vehicle segments. Stringent environmental regulations concerning material sourcing, chemical treatments, and waste disposal in the manufacturing of decorative trims pose compliance challenges and necessitate investment in eco-friendly alternatives. Moreover, fluctuations in raw material prices, disruptions in global supply chains, and economic uncertainties can impact production costs and market stability. The increasing complexity of vehicle designs also demands more sophisticated integration of trims, requiring higher precision and advanced engineering, which adds to manufacturing challenges.

Opportunities within this market are substantial, particularly with the global shift towards electric vehicles (EVs), which often feature distinctive exterior designs and require new trim aesthetics that differ from traditional internal combustion engine vehicles. The growing trend of vehicle personalization presents a lucrative avenue for custom trim solutions, including unique colors, textures, and even illuminated elements. The development of sustainable and recycled materials, such as bio-plastics and lightweight composites, offers manufacturers a chance to meet environmental goals and appeal to eco-conscious consumers. Emerging markets in Asia Pacific, Latin America, and Africa represent untapped potential for market expansion as automotive penetration increases and consumer preferences evolve towards more decorative vehicle exteriors. Smart trims incorporating sensors or lighting elements also offer a futuristic growth pathway.

Impact forces on the market extend beyond immediate drivers and restraints to include broader technological, economic, environmental, and social shifts. Technological advancements, particularly in manufacturing techniques like 3D printing and advanced coating technologies, continuously reshape possibilities for design and production. Economic conditions, including global GDP growth and consumer spending patterns, directly influence vehicle sales and, consequently, the demand for decorative trims. Environmental concerns are driving the adoption of sustainable practices and materials throughout the automotive supply chain. Finally, evolving consumer preferences, influenced by social media and global design trends, push manufacturers to innovate constantly and offer fresh, appealing exterior trim options that reflect contemporary styles and individual identities.

Segmentation Analysis

The Automotive Decorative Exterior Trim Market is comprehensively segmented based on various attributes to provide a detailed understanding of its dynamics and growth prospects across different categories. These segmentations allow for a granular analysis of market demand, material preferences, application areas, and regional consumption patterns, offering valuable insights for strategic decision-making. The market is typically broken down by material composition, the type of finish applied, specific product categories, the kind of vehicle it adorns, and the end-use channel through which it reaches the consumer. This multi-faceted approach helps in identifying lucrative niches and understanding competitive landscapes within the broader automotive industry.

- By Material:

- Plastic (ABS, Polypropylene, Polycarbonate)

- Metal (Aluminum, Stainless Steel, Chrome-plated Steel)

- Composites (Carbon Fiber, Glass Fiber Reinforced Polymers)

- Others (Rubber, Wood veneers, Ceramics)

- By Finish:

- Chrome Plated

- Black (Glossy Black, Matte Black)

- Body-color Painted

- Satin/Brushed Finishes

- Carbon Fiber Look

- Textured Finishes

- Other Specialty Finishes (e.g., iridescent, illuminated)

- By Product Type:

- Grilles & Grille Surrounds

- Window Trims (Beltline moldings, D-LO trims)

- Door Handles & Inserts

- Side Moldings & Claddings

- Wheel Arch Trims

- Bumper Trims & Accents

- Roof Rails & Rack Accents

- Exhaust Tip Finishes

- Emblems & Badges

- Other Exterior Accents

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks, Luxury Cars)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- Electric Vehicles (EVs)

- By End-Use:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement, Customization)

Value Chain Analysis For Automotive Decorative Exterior Trim Market

The value chain for the Automotive Decorative Exterior Trim Market is intricate, involving multiple stages from raw material sourcing to end-user delivery. Upstream analysis focuses on the suppliers of fundamental raw materials and basic components. This includes chemical companies providing polymers and plastics like ABS, PP, and PC; metal producers supplying aluminum, stainless steel, and specialty alloys; and chemical suppliers for coatings, paints, and plating solutions. These raw material providers form the foundation, dictating initial cost, material properties, and supply stability. Tier-2 suppliers then process these raw materials into semi-finished products or basic components, such as plastic pellets for molding or pre-cut metal sheets, before they reach the actual trim manufacturers.

Midstream activities involve the actual manufacturing and assembly of decorative exterior trims. This includes specialized processes such as injection molding for plastic parts, stamping and bending for metal components, various finishing techniques like chrome plating, vacuum metallization, painting, and hydrographic printing. Trim manufacturers often operate as Tier-1 suppliers to automotive OEMs, integrating complex production lines that ensure high precision, aesthetic consistency, and adherence to stringent automotive quality standards. These manufacturers are responsible for designing, prototyping, testing, and mass-producing the final decorative trim pieces, often incorporating advanced technologies for efficiency and sustainability.

Downstream analysis covers the distribution channels and the ultimate consumption of these trims. The primary distribution channel is direct sales from Tier-1 trim manufacturers to Original Equipment Manufacturers (OEMs). OEMs integrate these trims into their vehicle assembly lines during production. For the aftermarket segment, distribution involves a network of wholesale distributors, independent retailers, automotive parts stores, and online platforms, catering to vehicle owners seeking replacement parts, customization options, or upgrades. Direct and indirect sales pathways are both critical; direct sales to OEMs ensure seamless integration into new vehicle production, while indirect channels via distributors and retailers serve the diverse needs of the aftermarket for repairs, personalization, and restoration.

Automotive Decorative Exterior Trim Market Potential Customers

The primary potential customers and end-users of products within the Automotive Decorative Exterior Trim Market are overwhelmingly automotive manufacturers, known as Original Equipment Manufacturers (OEMs). These OEMs, including global giants like Toyota, Volkswagen, General Motors, Ford, Mercedes-Benz, BMW, and Hyundai, purchase decorative exterior trims in vast quantities for integration into their new vehicle production lines. Their demand is driven by new model launches, vehicle redesigns, and the continuous production of existing models, requiring trims that meet precise design specifications, quality standards, and cost targets. The relationship between trim manufacturers and OEMs is typically long-term and collaborative, often involving joint design and engineering efforts to ensure perfect fit and finish.

Beyond the OEM sector, the aftermarket segment represents another significant customer base. This includes individual vehicle owners who seek to replace damaged trims, upgrade their vehicle's aesthetics, or personalize their cars with unique styling elements. Customization shops, independent repair garages, and detailing centers also constitute key aftermarket buyers, purchasing trims for their clients. The demand here is driven by vehicle repairs due to accidents, wear and tear, or the desire for aesthetic modification and enhancement. Aftermarket customers often prioritize accessibility, a wide range of options, and competitive pricing, fostering a dynamic distribution network distinct from the OEM supply chain.

Furthermore, commercial vehicle manufacturers, who produce trucks, buses, and specialized vehicles, also procure decorative exterior trims, albeit sometimes with a greater emphasis on durability and functionality alongside aesthetics. While their volumes might be lower than passenger car OEMs, the specific requirements for robust and long-lasting trims present a specialized customer niche. The continuous evolution of vehicle design across all segments means that trim manufacturers must remain agile, offering innovative solutions to a diverse clientele with varying needs, quality expectations, and budgetary constraints, ensuring relevance and sustained growth in the broader automotive ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 26.1 billion |

| Market Forecast in 2032 | USD 41.7 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magna International Inc., Motherson Sumi Systems Limited, HBPO GmbH (a Plastic Omnium company), Faurecia SE, Grupo Antolin, Cooper Standard, Webasto Group, Hella GmbH & Co. KGaA, Continental AG, Lear Corporation, Toyoda Gosei Co., Ltd., Nifco Inc., Samvardhana Motherson Automotive Systems Group (SMRPBV), Visiocorp PLC, Minth Group Limited, Flex-N-Gate Corporation, Inteva Products, LLC, Yanfeng Automotive Interiors, Dakkota Integrated Systems, Plastic Omnium. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Decorative Exterior Trim Market Key Technology Landscape

The Automotive Decorative Exterior Trim Market is heavily influenced by a dynamic technological landscape that continuously pushes the boundaries of design, material science, and manufacturing efficiency. Advanced molding techniques, such as injection molding, overmolding, and two-shot injection molding, are critical for creating complex geometries and integrating multiple materials into a single trim piece, enhancing both aesthetics and functionality. These processes allow for precise replication of intricate designs and consistent quality, which is paramount in automotive applications. Furthermore, advancements in tool design and mold flow analysis contribute to reduced cycle times and improved part integrity, directly impacting production costs and speed to market.

Surface finishing technologies play an equally vital role in achieving the desired aesthetic and protective properties for decorative trims. Traditional chrome plating, while still prevalent, is being complemented by more environmentally friendly and diverse options such as vacuum metallization, sputtering, and physical vapor deposition (PVD), which offer a wider range of metallic finishes including satin, brushed, and colored chrome. Hydrographic printing (water transfer printing) and sophisticated painting processes with specialized clear coats enable intricate patterns, textures, and custom colors, providing extensive personalization options. These technologies are crucial for meeting diverse consumer preferences and differentiating vehicle models in a highly competitive market.

Beyond manufacturing and finishing, lightweighting technologies and the adoption of advanced materials are transforming the market. The use of high-performance plastics, fiber-reinforced composites (like carbon fiber and fiberglass), and lightweight aluminum alloys is becoming increasingly common to reduce overall vehicle weight, thereby improving fuel efficiency in internal combustion engine vehicles and extending the range of electric vehicles. Moreover, 3D printing (additive manufacturing) is gaining traction, primarily for rapid prototyping, design validation, and the production of highly customized, low-volume trim components, offering unparalleled design freedom and accelerating product development cycles. The integration of smart materials and embedded lighting or sensing capabilities represents a nascent but promising technological frontier for future decorative exterior trims.

Regional Highlights

- Asia Pacific: This region dominates the global automotive decorative exterior trim market, primarily driven by countries such as China, India, Japan, and South Korea. Robust automotive production, a burgeoning middle class, increasing disposable incomes, and a strong preference for vehicle customization and premium features fuel market growth. The region serves as a major manufacturing hub for automotive components, benefiting from cost-effective production and a large consumer base.

- Europe: Characterized by a strong demand for luxury and premium vehicles, Europe is a significant market for high-quality and technologically advanced decorative exterior trims. Stringent environmental regulations and a focus on sustainability drive innovation in eco-friendly materials and manufacturing processes. Germany, France, and the UK are key contributors, with a strong emphasis on sophisticated design and superior finish.

- North America: The market in North America is driven by a strong demand for SUVs and light trucks, where exterior aesthetics and personalization play a crucial role. Consumer preferences for rugged, yet stylish, designs and advanced trim options contribute to market expansion. The United States and Canada are leading markets, with a growing aftermarket segment for customization and upgrades.

- Latin America: This region presents emerging opportunities, with countries like Brazil and Mexico experiencing growth in automotive manufacturing and sales. Increasing urbanization, improving economic conditions, and a rising interest in vehicle aesthetics contribute to the demand for decorative exterior trims. The market is characterized by a balance of affordability and evolving consumer tastes.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth in the automotive sector, driven by infrastructure development, rising disposable incomes, and an expanding vehicle parc. Countries in the GCC (Gulf Cooperation Council) show a strong preference for luxury vehicles with high-end decorative features, while emerging markets in Africa offer long-term growth potential as automotive penetration increases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Decorative Exterior Trim Market.- Magna International Inc.

- Motherson Sumi Systems Limited

- HBPO GmbH (a Plastic Omnium company)

- Faurecia SE

- Grupo Antolin

- Cooper Standard

- Webasto Group

- Hella GmbH & Co. KGaA

- Continental AG

- Lear Corporation

- Toyoda Gosei Co., Ltd.

- Nifco Inc.

- Samvardhana Motherson Automotive Systems Group (SMRPBV)

- Visiocorp PLC

- Minth Group Limited

- Flex-N-Gate Corporation

- Inteva Products, LLC

- Yanfeng Automotive Interiors

- Dakkota Integrated Systems

- Plastic Omnium

Frequently Asked Questions

What are the primary drivers of growth for the Automotive Decorative Exterior Trim Market?

Key drivers include rising consumer demand for vehicle aesthetics and personalization, increasing disposable incomes, the continuous launch of new vehicle models with unique designs, and advancements in materials and manufacturing technologies.

How do electric vehicles (EVs) impact the Automotive Decorative Exterior Trim Market?

EVs create significant opportunities by often featuring distinctive exterior designs, requiring new trim aesthetics, and emphasizing lightweight, sustainable materials to optimize range and performance.

Which materials are predominantly used in automotive decorative exterior trims?

Common materials include various plastics (ABS, polypropylene), metals (aluminum, stainless steel, chrome-plated steel), and composites (carbon fiber), chosen for their aesthetic, durability, and lightweight properties.

What are the major challenges faced by manufacturers in this market?

Challenges include high production and R&D costs, stringent environmental regulations on materials and processes, volatility in raw material prices, and the need for complex integration into evolving vehicle designs.

What role does AI play in the future of automotive decorative exterior trims?

AI is expected to revolutionize trim design through generative tools, enhance manufacturing efficiency and quality control, facilitate advanced personalization options, and optimize supply chain operations for greater precision and speed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager