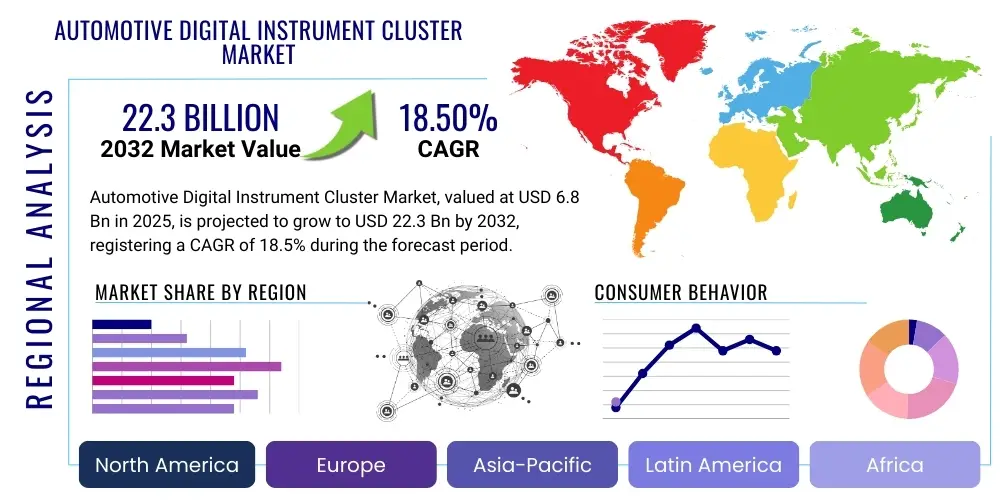

Automotive Digital Instrument Cluster Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427793 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Digital Instrument Cluster Market Size

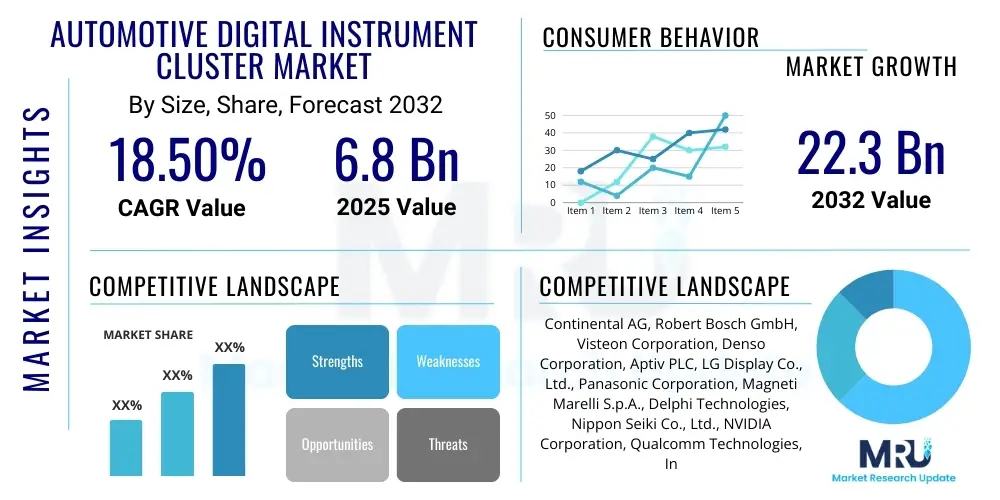

The Automotive Digital Instrument Cluster Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 6.8 billion in 2025 and is projected to reach USD 22.3 billion by the end of the forecast period in 2032.

Automotive Digital Instrument Cluster Market introduction

The Automotive Digital Instrument Cluster Market encompasses the design, development, manufacturing, and integration of advanced digital display systems replacing traditional analog gauges in vehicles. These clusters provide drivers with highly customizable and dynamic information displays, integrating data from various vehicle systems such as speed, RPM, fuel level, navigation, infotainment, and advanced driver-assistance systems (ADAS). The shift from mechanical to digital interfaces offers enhanced aesthetics, improved readability, and greater flexibility in presenting critical driving information, contributing significantly to a modern and connected driving experience. Early adoption was primarily seen in premium and luxury vehicles, but the technology is rapidly penetrating mid-range and even economy segments due to falling costs and increasing consumer demand for sophisticated in-cabin technologies.

The products major applications extend across passenger cars, commercial vehicles, and electric vehicles, each segment leveraging the technology for specific operational and user experience benefits. For passenger vehicles, the emphasis is on personalization, seamless integration with smartphone connectivity, and augmented reality overlays for navigation. In commercial vehicles, digital clusters enhance fleet management capabilities by displaying real-time diagnostics, route optimization, and driver performance metrics, crucial for operational efficiency and safety. Electric vehicles particularly benefit from these clusters, which efficiently display critical EV-specific information like battery state-of-charge, range prediction, and energy consumption patterns, which are vital for range anxiety mitigation and overall user confidence. The primary benefits include improved driver focus, reduced information overload through customizable displays, and the ability to update software over-the-air, thereby extending the clusters functional lifespan and introducing new features post-purchase. This adaptability ensures that the digital instrument cluster remains a central component in the evolving digital cockpit landscape.

Automotive Digital Instrument Cluster Market Executive Summary

The Automotive Digital Instrument Cluster Market is witnessing robust growth, driven by an accelerating trend towards vehicle digitalization and enhanced in-cabin user experience. Business trends indicate a strong focus on strategic partnerships between automotive OEMs, Tier 1 suppliers, and software developers to integrate advanced functionalities like augmented reality, haptic feedback, and AI-powered personalized interfaces. There is a clear move towards platform-based solutions that offer scalability and flexibility across different vehicle models, reducing development costs and accelerating time-to-market. Furthermore, the increasing consumer expectation for seamless connectivity and an intuitive digital environment akin to personal electronic devices is compelling manufacturers to invest heavily in advanced display technologies, sophisticated graphics processors, and robust cybersecurity measures to protect sensitive vehicle data. The aftermarket segment is also evolving, offering upgrade kits and customization options, though OEM-integrated solutions dominate due to their deep system integration and warranty benefits.

Regionally, Asia Pacific is emerging as the dominant market, propelled by high vehicle production volumes, rapid adoption of advanced automotive technologies, and a growing consumer base with a strong preference for feature-rich vehicles, particularly in China and India. Europe and North America continue to be key markets, characterized by stringent safety regulations driving ADAS integration, high luxury vehicle sales, and a mature ecosystem for technology innovation. These regions are also at the forefront of electric vehicle adoption, which inherently promotes digital instrument cluster integration. Segment trends reveal a significant shift from partial to full digital clusters, with larger display sizes becoming increasingly popular across all vehicle categories. The market is further segmented by display technology, with TFT-LCD dominating, but OLED and other advanced display technologies gaining traction due to superior contrast, faster response times, and design flexibility. The commercial vehicle segment is also experiencing a steady uptake, driven by regulatory demands for enhanced safety and fleet management efficiencies, making digital clusters an indispensable tool for modern logistics and transportation operations.

AI Impact Analysis on Automotive Digital Instrument Cluster Market

The integration of Artificial Intelligence (AI) is set to profoundly transform the Automotive Digital Instrument Cluster Market, moving beyond simple information display to intelligent, proactive, and personalized driver interfaces. Common user questions often revolve around how AI can enhance safety, personalize the driving experience, and simplify complex information. Users are keen to understand if AI will lead to more intuitive controls, reduce cognitive load, and provide more accurate, real-time insights, such as predictive maintenance alerts or optimized navigation based on current traffic and driver behavior. There is also a significant interest in how AI can integrate seamlessly with other in-vehicle systems, creating a truly unified and intelligent cockpit. Concerns sometimes arise regarding data privacy, the reliability of AI algorithms in critical driving scenarios, and the potential for information overload if not designed thoughtfully. However, the overarching expectation is that AI will elevate the digital instrument cluster from a mere display to a truly intelligent co-pilot, anticipating needs and delivering relevant information at the opportune moment, thereby improving both safety and convenience.

AIs influence will enable digital clusters to become adaptive interfaces, learning from individual driver preferences, habits, and even emotional states through eye-tracking and facial recognition technologies. This will allow the cluster to dynamically prioritize information, adjust display layouts, and provide contextual alerts that are highly relevant to the current driving situation and drivers needs. For instance, in a high-stress traffic scenario, less critical information might be temporarily suppressed, while essential safety alerts are highlighted. The ability of AI to process vast amounts of data from vehicle sensors, external sources like weather and traffic, and the driver’s personal profile means the digital cluster can offer predictive capabilities, such as forecasting potential hazards or suggesting optimal routes based on predicted road conditions. This level of personalized intelligence is key to differentiating future automotive offerings and enhancing overall user satisfaction, moving the cluster beyond static information presentation to dynamic, intelligent interaction.

- Enhanced Personalization: AI enables clusters to learn driver preferences, dynamically adjusting layouts, information priority, and theme based on individual habits, mood, and context.

- Predictive Analytics: AI-driven systems can anticipate driver needs, offer predictive maintenance alerts, optimize route suggestions considering real-time variables, and forecast potential hazards.

- Contextual Information Delivery: AI ensures only relevant information is displayed at critical moments, reducing cognitive load and improving driver focus, for example, during complex maneuvers or in adverse weather.

- Advanced Voice and Gesture Control: AI facilitates more natural and intuitive interaction with the cluster through sophisticated voice recognition and gesture control, minimizing manual input.

- Augmented Reality Integration: AI algorithms can seamlessly blend real-world views with digital overlays for navigation, ADAS alerts, and point-of-interest information, enhancing situational awareness.

- System Integration: AI acts as a central intelligence hub, integrating data from infotainment, ADAS, navigation, and vehicle diagnostics to present a cohesive, unified digital cockpit experience.

- Adaptive Safety Features: AI can monitor driver attention and fatigue, issuing proactive warnings or adjusting vehicle settings through the cluster to prevent accidents.

DRO & Impact Forces Of Automotive Digital Instrument Cluster Market

The Automotive Digital Instrument Cluster Market is propelled by several significant drivers. Chief among these is the escalating consumer demand for advanced in-vehicle technology and a premium user experience, mirroring the digitalization observed in personal electronics. Modern car buyers expect high-resolution, customizable displays that integrate seamlessly with their digital lives, offering connectivity features, intuitive navigation, and personalized infotainment. This expectation pushes OEMs to adopt digital clusters as a key differentiator. Furthermore, the rapid advancements in display technology, such as OLED and enhanced TFT-LCDs, coupled with decreasing hardware costs, make these systems more accessible and economically viable for broader market segments. The increasing integration of Advanced Driver-Assistance Systems (ADAS) and autonomous driving functionalities also necessitates sophisticated digital interfaces to communicate complex safety warnings, sensor data, and operational statuses effectively to the driver. Regulatory pressures for improved vehicle safety and efficiency further encourage the adoption of technologies that can present critical information clearly and intuitively.

However, the market also faces considerable restraints. High initial investment costs for research, development, and integration of these complex systems can be a barrier for some manufacturers, particularly smaller players. The complexity of software development, including graphical user interface (GUI) design, operating system integration, and cybersecurity protocols, demands specialized expertise and significant resources. Moreover, concerns regarding data security and privacy, as these systems collect vast amounts of user and vehicle data, require robust protective measures and compliance with evolving regulations like GDPR. Driver distraction remains another significant challenge; while digital clusters aim to reduce cognitive load, poorly designed interfaces or an overload of information can have the opposite effect, posing safety risks. The rapid pace of technological change also creates a challenge for maintaining product relevance and upgradability, necessitating over-the-air (OTA) update capabilities.

Opportunities within the market are vast and primarily centered on innovation and expansion into emerging applications. The growing market for electric vehicles (EVs) presents a substantial opportunity, as digital clusters are crucial for displaying EV-specific information like battery health, charging status, and range optimization, thereby addressing range anxiety. The development of augmented reality (AR) HUDs (Heads-Up Displays) and fully immersive digital cockpits offers new avenues for growth, integrating the instrument cluster into a broader, interconnected display ecosystem. Furthermore, the rise of shared mobility services and autonomous vehicles will necessitate digital clusters that can adapt to multiple users and provide information relevant to different levels of autonomy. Developing highly secure, customizable, and AI-powered interfaces that offer predictive capabilities and proactive assistance will be key to unlocking these opportunities. Strategic partnerships with semiconductor manufacturers, software developers, and cloud service providers will be instrumental in driving these innovations forward and addressing the complexities of next-generation digital instrument clusters, ensuring sustained market expansion and value creation.

Segmentation Analysis

The Automotive Digital Instrument Cluster Market is intricately segmented across various dimensions, including display size, vehicle type, display technology, and level of autonomy, reflecting the diverse applications and technological advancements within the automotive industry. This segmentation is crucial for understanding market dynamics, identifying specific growth pockets, and tailoring product development strategies to meet distinct end-user requirements. The shift from basic monochrome displays to advanced, full-color, and highly customizable interfaces is a primary driver across these segments. Each segment presents unique challenges and opportunities, influencing market penetration strategies and the competitive landscape. As vehicle architectures become more software-defined, the flexibility of digital clusters allows for unprecedented customization and feature updates, further enhancing their market appeal across all categories. The interplay between these segmentation factors ultimately shapes the trajectory of the market.

From a display size perspective, smaller displays (5-8 inches) are typically found in entry-level vehicles, offering essential information, while mid-sized (8-10 inches) and large displays (>10 inches) dominate premium, luxury, and electric vehicle segments, providing comprehensive infotainment and navigation integration. Vehicle type segmentation distinguishes between passenger cars (which hold the largest share), commercial vehicles, and electric vehicles, each with specific design and functionality demands. Display technology includes TFT-LCD, which is currently dominant due to cost-effectiveness and maturity, alongside emerging OLED technology, prized for its superior contrast, true blacks, and faster response times, especially relevant for high-end applications and advanced visualization. The level of autonomy (semi-autonomous, fully autonomous) also plays a critical role, as higher levels of autonomy require more sophisticated and dynamic digital interfaces to convey situational awareness and system handoff information effectively to the driver, ensuring safety and trust in autonomous functionalities. These segmentations are critical for market players to focus their R&D and marketing efforts, ensuring that their offerings are aligned with specific industry needs and consumer preferences.

- By Display Size:

- Below 5 Inches

- 5-8 Inches

- 8-10 Inches

- Above 10 Inches

- By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles (EVs)

- By Display Technology:

- TFT-LCD

- OLED

- Others (e.g., Micro-LED, Flexible Displays)

- By Level of Autonomy:

- Semi-Autonomous Vehicles

- Autonomous Vehicles (L3-L5)

- Conventional Vehicles

Automotive Digital Instrument Cluster Market Value Chain Analysis

The value chain for the Automotive Digital Instrument Cluster Market is complex and multi-layered, beginning with raw material suppliers and extending through to the end-users. At the upstream stage, key components include semiconductor manufacturers supplying microcontrollers, graphics processing units (GPUs), and memory chips; display panel manufacturers providing TFT-LCDs and OLED screens; and sensor manufacturers delivering various inputs like speed, RPM, and fuel level. Material suppliers for plastics, metals, and specialized glass also form a crucial part of this initial phase. The quality and availability of these upstream components directly impact the final products performance, cost-efficiency, and innovation potential. Strategic partnerships at this stage are vital for securing supply, leveraging technological advancements, and ensuring cost competitiveness, especially as global supply chains face increasing disruptions and demand fluctuations. The reliance on advanced semiconductor technology highlights the vulnerability of the value chain to global chip shortages.

Moving downstream, Tier 2 suppliers are responsible for integrating these raw materials and components into modules, such as display modules, circuit boards, and custom enclosures. Tier 1 suppliers then assemble these modules into complete digital instrument clusters, often incorporating proprietary software, graphical user interfaces (GUIs), and complex wiring harnesses. These Tier 1 players, like Continental, Bosch, and Visteon, act as critical intermediaries, translating OEM specifications into functional products. Their role extends to rigorous testing, quality assurance, and adherence to stringent automotive standards. The distribution channel primarily involves direct sales from Tier 1 suppliers to automotive OEMs for integration into new vehicles (original equipment manufacturing - OEM channel). This direct relationship is characterized by long-term contracts, collaborative design processes, and deep technical integration. For the aftermarket, distribution involves a network of authorized dealerships, independent repair shops, and online retailers offering replacement parts or upgrade kits, although this segment represents a smaller portion of the overall market.

Both direct and indirect channels play distinct roles. The direct channel, involving Tier 1 suppliers selling directly to OEMs, is the dominant force, shaping product development cycles, technological standards, and market volumes. This close collaboration ensures that clusters are perfectly integrated into the vehicles electrical and electronic architecture. The indirect channel, primarily focused on the aftermarket, caters to vehicle owners seeking replacements or upgrades. This channel often involves a more diverse set of distributors and retailers, providing flexibility but also facing challenges related to compatibility, installation, and warranty. The increasing complexity of digital clusters, driven by software-defined vehicles and over-the-air updates, emphasizes the importance of robust post-sales support, potentially leading to new service-oriented business models within the value chain. Cybersecurity also plays a critical role throughout the entire value chain, requiring adherence to security protocols from component design through to in-vehicle operation, safeguarding against potential vulnerabilities and ensuring system integrity.

Automotive Digital Instrument Cluster Market Potential Customers

The primary potential customers for the Automotive Digital Instrument Cluster Market are automotive original equipment manufacturers (OEMs). These companies, ranging from traditional combustion engine vehicle manufacturers to pure electric vehicle producers, are the direct buyers and integrators of digital instrument clusters into their new vehicle models. Their demand is driven by the need to differentiate their offerings, comply with evolving safety and emission regulations, and meet consumer expectations for advanced in-car technology and connectivity. OEMs purchase these clusters in large volumes, often through long-term contracts with Tier 1 suppliers, making them the cornerstone of the markets revenue. The decision-making process for OEMs involves extensive evaluation of technology, cost, reliability, design flexibility, and the suppliers ability to integrate with various vehicle platforms and software ecosystems. The increasing shift towards software-defined vehicles also means OEMs are looking for partners who can provide comprehensive software solutions alongside hardware.

Beyond the direct OEM market, the growing electric vehicle (EV) segment represents a highly specialized and rapidly expanding customer base. EV manufacturers, both established and emerging, have a distinct set of requirements for digital instrument clusters, particularly concerning the display of battery status, range estimation, charging information, and energy consumption patterns. These functionalities are critical for addressing consumer range anxiety and optimizing the EV driving experience. Therefore, suppliers capable of offering EV-specific cluster solutions with advanced analytics and predictive capabilities are highly sought after in this segment. The emphasis on sleek, minimalist interior designs in many EVs also favors large, highly integrated digital displays that can seamlessly blend with the overall aesthetic, further driving demand for sophisticated cluster technologies.

Furthermore, the commercial vehicle sector, including trucks, buses, and specialized utility vehicles, forms another significant customer segment. While their requirements may differ from passenger cars, focusing more on ruggedness, durability, and the display of operational metrics crucial for fleet management and logistics, the adoption of digital clusters is increasing. These vehicles benefit from enhanced diagnostic capabilities, driver performance monitoring, and integration with telematics systems. The aftermarket for automotive components also comprises potential customers, primarily vehicle owners looking to upgrade or replace their traditional analog clusters with digital alternatives. Although smaller in scale compared to the OEM market, this segment is driven by enthusiasts, technology early adopters, and individuals seeking to modernize older vehicles, creating opportunities for specialized retrofit solutions and service providers. This diverse customer landscape underscores the broad applicability and growing demand for digital instrument clusters across the entire automotive ecosystem.

Automotive Digital Instrument Cluster Market Key Technology Landscape

The Automotive Digital Instrument Cluster Market is characterized by a rapidly evolving technological landscape, driven by advancements in display science, semiconductor capabilities, and software innovation. At its core, the technology relies heavily on high-resolution display panels, primarily Thin-Film Transistor Liquid Crystal Displays (TFT-LCDs). These have evolved from simple monochrome to full-color, high-definition screens capable of displaying vibrant graphics and complex animations. More recently, Organic Light Emitting Diode (OLED) technology is gaining traction, particularly in premium segments, due to its superior contrast ratios, true black levels, faster response times, and wider viewing angles, which enhance readability and aesthetic appeal. Emerging technologies like Micro-LED are also on the horizon, promising even higher brightness, greater energy efficiency, and longer lifespan, potentially revolutionizing future display offerings. The continuous push for larger screen sizes and curved displays further highlights the display technology as a foundational element.

Beyond the display itself, the computational power enabling these clusters is critical. This involves sophisticated System-on-Chips (SoCs) and microcontrollers (MCUs) from leading semiconductor manufacturers, which house powerful Graphics Processing Units (GPUs) for rendering complex 2D and 3D graphics, alongside sufficient processing power for managing data from multiple vehicle sensors, ADAS, navigation, and infotainment systems. These processors must meet stringent automotive safety and reliability standards, often requiring ASIL (Automotive Safety Integrity Level) certification. Operating systems such as Linux, Android Automotive, and proprietary RTOS (Real-Time Operating Systems) form the software backbone, providing the framework for the user interface, application execution, and connectivity management. The increasing complexity of the software demands robust cybersecurity measures to protect against unauthorized access and ensure system integrity, making secure coding practices and encryption protocols essential components of the technology stack.

Connectivity and sensory integration are also pivotal. Digital clusters are designed to be an integral part of the vehicles overall digital cockpit, requiring seamless communication with various electronic control units (ECUs) via automotive networks like CAN (Controller Area Network), LIN (Local Interconnect Network), and increasingly, Ethernet for higher bandwidth. This allows for real-time display of critical vehicle diagnostics, performance metrics, and safety alerts. Furthermore, advanced features leverage sensor fusion technologies, incorporating data from cameras, radar, lidar, and ultrasonic sensors for ADAS functionalities, which are then visually communicated to the driver through the cluster. The future trajectory includes the integration of augmented reality (AR) capabilities, where digital information is overlaid onto the real-world view, either directly on the cluster or via an accompanying head-up display (HUD), creating a more immersive and intuitive driving experience. This convergence of display, processing, software, and connectivity technologies defines the cutting-edge landscape of the automotive digital instrument cluster market.

Regional Highlights

- North America: This region demonstrates a strong demand for advanced in-car technology, driven by affluent consumers and a robust automotive industry. The presence of major automotive OEMs and a high adoption rate of luxury and technologically advanced vehicles contribute significantly to market growth. Stringent safety regulations and the rapid integration of ADAS features further necessitate sophisticated digital clusters, establishing North America as a key market for innovation and high-value product adoption. The growing electric vehicle market in the U.S. and Canada is also a substantial driver, as EVs inherently rely on advanced digital displays for critical information.

- Europe: Characterized by a highly sophisticated automotive market with a strong emphasis on premium and luxury vehicle segments, Europe is a major adopter of digital instrument clusters. Germany, with its leading automotive manufacturers, plays a pivotal role in technological advancements and market penetration. Strict emission standards and safety mandates encourage the integration of cutting-edge automotive electronics, ensuring that digital clusters meet high standards for functionality, design, and environmental impact. The region also benefits from a robust supply chain and a strong focus on in-cabin user experience.

- Asia Pacific: Emerging as the largest and fastest-growing market, the Asia Pacific region is fueled by significant vehicle production volumes, particularly in China, Japan, and South Korea. Rapid economic growth, rising disposable incomes, and a strong consumer preference for feature-rich and technologically advanced vehicles are key drivers. China, in particular, is a dominant force, not only in terms of production and sales but also in the swift adoption of electric vehicles and smart cockpit solutions. India and Southeast Asian countries also show immense potential due to increasing urbanization and expanding middle-class populations.

- South America: While smaller compared to other regions, the South American market is witnessing steady growth, primarily driven by increasing vehicle sales and a growing demand for modern vehicle features in countries like Brazil and Argentina. Economic stability and the gradual adoption of global automotive trends are leading to a greater penetration of digital instrument clusters in mid-range and entry-level vehicles. Local manufacturing and assembly operations are increasingly incorporating these advanced components to remain competitive.

- Middle East and Africa: This region presents a nascent but promising market, particularly in the affluent Gulf Cooperation Council (GCC) countries where luxury vehicle sales are high, driving demand for premium in-car technologies. The automotive market in South Africa is also a significant contributor within the region. While adoption rates may vary, increasing urbanization, infrastructure development, and a gradual shift towards modern automotive technologies are paving the way for future market expansion, though political and economic instabilities can pose challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Digital Instrument Cluster Market.- Continental AG

- Robert Bosch GmbH

- Visteon Corporation

- Denso Corporation

- Aptiv PLC

- LG Display Co., Ltd.

- Panasonic Corporation

- Magneti Marelli S.p.A. (now part of Marelli)

- Delphi Technologies (now part of BorgWarner)

- Nippon Seiki Co., Ltd.

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Samsung Display Co., Ltd.

- Pioneer Corporation

- Harman International (a Samsung company)

Frequently Asked Questions

What is a digital instrument cluster in an automotive context?

A digital instrument cluster is an electronic display that replaces traditional analog gauges (speedometer, tachometer, fuel gauge) in a vehicle, providing customizable and dynamic information such as speed, navigation, infotainment, and advanced driver-assistance system (ADAS) data. It offers greater flexibility and personalization compared to conventional analog systems.

How is AI impacting the Automotive Digital Instrument Cluster Market?

AI is transforming digital instrument clusters by enabling personalized interfaces, predictive analytics for maintenance and navigation, contextual information delivery to reduce driver distraction, and advanced voice/gesture controls. It helps create an intelligent, adaptive cockpit that anticipates driver needs and enhances safety.

What are the primary drivers for the growth of this market?

Key drivers include increasing consumer demand for advanced in-vehicle technology, rapid advancements in display and semiconductor technologies, decreasing hardware costs, and the growing integration of ADAS and autonomous driving features. The expansion of the electric vehicle market also significantly boosts demand for digital clusters.

Which display technologies are most prevalent in digital instrument clusters?

TFT-LCD (Thin-Film Transistor Liquid Crystal Display) is currently the most prevalent technology due to its cost-effectiveness and maturity. However, OLED (Organic Light Emitting Diode) technology is gaining significant traction, particularly in premium vehicles, offering superior contrast, faster response times, and enhanced visual aesthetics.

What are the main challenges faced by the Automotive Digital Instrument Cluster Market?

The main challenges include high initial investment costs for R&D, the complexity of software development and integration, concerns over data security and privacy, and the potential for driver distraction if interfaces are poorly designed. Maintaining relevance with rapid technological advancements also requires continuous innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager