Automotive E-Compressor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429902 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Automotive E-Compressor Market Size

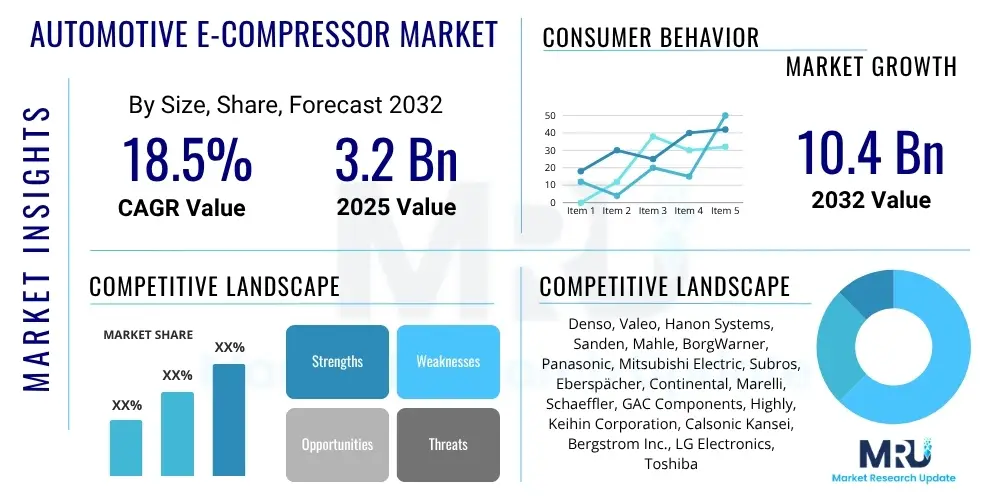

The Automotive E-Compressor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 3.2 Billion in 2025 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2032.

Automotive E-Compressor Market introduction

The Automotive E-Compressor Market represents a pivotal segment within the automotive industry, driven by the accelerating global transition towards vehicle electrification. These compressors are electrically powered units designed to replace conventional engine-driven compressors, primarily serving critical functions such as cabin climate control (HVAC) and thermal management for high-voltage batteries and power electronics in electric vehicles (EVs), hybrid electric vehicles (HEVs), and fuel cell vehicles (FCVs). Their significance stems from the need for independent operation from the internal combustion engine, offering superior energy efficiency and precise thermal regulation capabilities essential for optimal performance and longevity of electric powertrain components.

The product description of an automotive e-compressor emphasizes its sophisticated engineering, integrating an electric motor, inverter, and compressor mechanism into a compact, lightweight unit. Unlike traditional compressors that draw power directly from the engine crankshaft, e-compressors operate independently, powered by the vehicle's high-voltage battery system. This design allows for continuous and variable-speed operation, regardless of engine RPM, leading to more consistent cooling or heating performance, reduced parasitic losses, and enhanced fuel economy or extended electric range. These systems are crucial for maintaining comfortable cabin temperatures and ensuring the safe operating temperatures of vital EV components, which directly impacts vehicle efficiency, battery lifespan, and overall safety.

Major applications for automotive e-compressors span across various vehicle types, with a pronounced focus on battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Beyond cabin air conditioning, they are indispensable for managing the thermal environment of lithium-ion battery packs, preventing overheating during charging and discharging, and improving cold-weather performance. The benefits derived from these systems are substantial, including significant energy savings, reduced emissions in hybrid models, improved passenger comfort, enhanced system reliability, and more precise temperature control. Key driving factors propelling this market forward include stringent global emission regulations, the rapid adoption of electric and hybrid vehicles, increasing consumer demand for advanced comfort features, and the critical need for efficient battery thermal management to extend battery life and safety.

Automotive E-Compressor Market Executive Summary

The Automotive E-Compressor Market is experiencing robust growth, primarily fueled by the accelerating global shift towards electric mobility. Business trends indicate a strong emphasis on technological innovation, with manufacturers investing heavily in developing more compact, efficient, and higher-voltage e-compressors to meet the demands of advanced EV architectures. There is a discernible trend towards strategic collaborations and partnerships between traditional automotive suppliers, power electronics specialists, and EV manufacturers to integrate these complex systems seamlessly into new vehicle platforms. Supply chain resilience and localization of production are also emerging as critical business priorities to mitigate geopolitical risks and optimize manufacturing costs. The focus on developing modular and scalable solutions that can be adapted across a range of vehicle models is a key strategic imperative for leading market players.

Regional trends highlight Asia Pacific as the dominant and fastest-growing market, largely due to the rapid expansion of EV production and adoption in countries like China, Japan, and South Korea. Government incentives, robust manufacturing capabilities, and a large consumer base are contributing to this regional prominence. Europe and North America are also witnessing substantial growth, driven by stringent emission regulations, increasing investments in EV infrastructure, and growing consumer acceptance of electric vehicles. These regions are characterized by a strong focus on advanced technology integration and premium vehicle segments. Emerging markets in Latin America, the Middle East, and Africa are showing nascent potential, with increasing awareness and initial stages of EV adoption starting to drive demand for related components like e-compressors, though at a slower pace.

Segment trends underscore the increasing importance of high-voltage e-compressors, particularly 400V and 800V systems, as vehicle architectures evolve to support faster charging and higher performance. The application segment for battery thermal management is projected to exhibit the highest growth rate, reflecting the critical role e-compressors play in ensuring battery safety and longevity. Passenger vehicles continue to hold the largest market share, but commercial vehicles, especially electric buses and trucks, are emerging as significant growth areas. From a sales channel perspective, the OEM segment remains the primary driver, given the direct integration of e-compressors into new vehicle designs, while the aftermarket is expected to grow steadily as the installed base of EVs expands and maintenance needs arise. The market is dynamic, with continuous advancements in material science and control algorithms shaping future product developments.

AI Impact Analysis on Automotive E-Compressor Market

User inquiries regarding AI's impact on the automotive e-compressor market frequently center on how artificial intelligence can enhance efficiency, reliability, and integration within the broader vehicle ecosystem. Common questions explore how AI could optimize energy consumption for thermal management, enable predictive maintenance for critical components, or facilitate more adaptive and personalized cabin climate control. There is a strong interest in understanding AI's role in processing sensor data to anticipate thermal loads, diagnose system faults proactively, and seamlessly integrate e-compressor operations with other vehicle functions like advanced driver-assistance systems (ADAS) and powertrain management. Users are particularly keen to know if AI can lead to smarter, more responsive, and ultimately more durable e-compressor systems, improving the overall EV ownership experience and reducing operational costs.

- AI-driven predictive maintenance: Algorithms analyze operational data to forecast potential failures, optimizing maintenance schedules and reducing downtime for e-compressor systems.

- Optimized energy consumption: AI models learn driver behavior, environmental conditions, and route data to precisely control e-compressor output, minimizing energy draw from the battery.

- Adaptive climate control: AI enables intelligent cabin temperature regulation, adjusting to occupant preferences and external factors for personalized comfort with maximum efficiency.

- Enhanced fault diagnosis: AI can identify anomalies and diagnose issues within the e-compressor system more accurately and rapidly than traditional methods, improving repair efficiency.

- Integration with vehicle management systems: AI facilitates seamless communication and coordination between the e-compressor and other vehicle control units, contributing to holistic thermal management and overall vehicle performance.

- Improved performance and longevity: AI algorithms can optimize operating parameters to reduce wear and tear, thereby extending the lifespan of e-compressor units.

DRO & Impact Forces Of Automotive E-Compressor Market

The Automotive E-Compressor Market is profoundly shaped by a confluence of driving forces, restraints, and opportunities, all underscored by significant impact forces. Key drivers include the exponential growth in electric vehicle (EV) sales globally, necessitating advanced thermal management solutions for both cabin comfort and critical battery temperature regulation. Stringent global emission standards and fuel efficiency mandates further compel automotive manufacturers to adopt electric components, pushing e-compressors to the forefront. Moreover, rising consumer demand for enhanced in-cabin comfort, particularly in premium and luxury vehicle segments, where precise and rapid climate control is expected, significantly propels the market. The essential role of e-compressors in maintaining the optimal operating temperature of high-voltage battery packs, power electronics, and electric motors in EVs is a fundamental driver for market expansion.

However, the market also faces considerable restraints that could temper its growth trajectory. The relatively high initial cost of e-compressor units compared to conventional engine-driven compressors poses a challenge, particularly in cost-sensitive vehicle segments. The complexity associated with integrating these sophisticated electrical systems into existing vehicle architectures, including managing high voltage safety and electromagnetic compatibility, represents another significant hurdle for OEMs. Technical challenges related to efficiency losses, refrigerant compatibility, and the overall reliability of electronic components under harsh automotive operating conditions can also limit adoption. Furthermore, the specialized manufacturing processes and the need for a skilled workforce for installation and maintenance contribute to the overall cost and complexity.

Despite these challenges, numerous opportunities are emerging to foster market expansion. Advancements in power electronics, such as gallium nitride (GaN) and silicon carbide (SiC) semiconductors, promise to enhance the efficiency and reduce the size of e-compressor inverters, making them more attractive. The development of next-generation refrigerants with lower global warming potential (GWP) and improved thermodynamic properties presents a significant opportunity for innovation and compliance with environmental regulations. Furthermore, the growth of fuel cell electric vehicles (FCEVs) and shared mobility platforms, which demand robust and efficient thermal management solutions, opens new application avenues for e-compressors. Strategic investments in research and development aimed at improving cost-effectiveness, modularity, and system integration capabilities will unlock further growth potential.

The impact forces influencing this market are primarily regulatory pressures, technological innovation, and shifting consumer preferences. Government policies globally, including tax incentives for EVs and aggressive emission reduction targets, exert immense pressure on automakers to transition to electric powertrains, directly boosting e-compressor demand. Continuous technological advancements in motor design, control algorithms, and thermal management strategies are rapidly improving the performance and reducing the cost of these components. Finally, evolving consumer preferences for environmentally friendly vehicles, coupled with expectations for superior comfort and advanced features, dictate the pace and direction of product development and market adoption. Geopolitical factors affecting raw material availability and supply chain stability also represent significant, albeit less predictable, impact forces.

Segmentation Analysis

The Automotive E-Compressor Market is comprehensively segmented to provide a detailed understanding of its diverse landscape, reflecting variations in product design, technical specifications, vehicle applications, and sales channels. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas and tailor strategies effectively. The market is primarily categorized based on compressor type, voltage, the specific vehicle segment, its application within the vehicle, and the channel through which it reaches the end-user.

- By Type:

- DC E-Compressor

- AC E-Compressor

- By Voltage:

- 48V

- 400V

- 800V and Above

- By Vehicle Type:

- Passenger Vehicles

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

- Commercial Vehicles

- Electric Buses

- Electric Trucks

- Other Commercial EVs

- Passenger Vehicles

- By Application:

- HVAC (Cabin Cooling and Heating)

- Battery Thermal Management

- Fuel Cell Cooling

- Power Electronics Cooling

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive E-Compressor Market

The value chain for the Automotive E-Compressor Market begins with extensive upstream analysis, focusing on the procurement of critical raw materials and the manufacturing of sophisticated components. This stage involves suppliers of specialized metals like aluminum and copper for housings and windings, advanced plastics for seals and insulators, and complex semiconductor materials for inverters and control units. Key components such as electric motors (including permanent magnets), power electronics (IGBTs, MOSFETs), sensors, and precision mechanical parts are sourced from highly specialized manufacturers. The quality and reliability of these upstream suppliers directly impact the final product's performance and cost-effectiveness. Strategic partnerships with these component suppliers are vital for ensuring consistent quality, managing supply chain risks, and enabling technological advancements that contribute to lighter, more efficient e-compressor designs.

Moving downstream, the value chain encompasses the assembly of e-compressor units by Tier 1 automotive suppliers, who often integrate proprietary technologies and advanced manufacturing processes. These suppliers then deliver the finished e-compressors directly to Original Equipment Manufacturers (OEMs) for integration into new vehicle production lines. The downstream segment also includes the distribution channels for both OEM and aftermarket sales. For OEMs, distribution is primarily direct, involving established relationships and just-in-time delivery systems to align with vehicle assembly schedules. These relationships are often long-term and involve significant collaborative efforts in design and engineering to ensure perfect fit and function within complex automotive thermal management systems.

The distribution channels for the Automotive E-Compressor Market can be broadly categorized into direct and indirect routes. Direct distribution primarily involves sales from e-compressor manufacturers or Tier 1 suppliers directly to major automotive OEMs for new vehicle production. This channel is characterized by large volume contracts, stringent quality requirements, and often joint development projects. Indirect distribution, on the other hand, typically caters to the aftermarket segment, where replacement parts and service components are distributed through a network of authorized dealers, independent workshops, and automotive parts retailers. This involves a more complex logistics network, inventory management, and marketing efforts aimed at service providers and vehicle owners. Both channels require robust supply chain management to ensure product availability and timely delivery, but with different logistical and relationship dynamics.

Automotive E-Compressor Market Potential Customers

The primary potential customers and end-users of automotive e-compressors are predominantly within the automotive manufacturing sector and, increasingly, the automotive aftermarket. Original Equipment Manufacturers (OEMs) of electric vehicles (EVs), hybrid electric vehicles (HEVs), and, to a lesser extent, internal combustion engine (ICE) vehicles integrating advanced thermal management systems, represent the largest customer base. These OEMs, including global giants like Tesla, Volkswagen, GM, Toyota, and Mercedes-Benz, require e-compressors as essential components for their new vehicle platforms to manage cabin climate and critical battery temperatures. The intense focus on electrification strategies by these manufacturers drives continuous demand for innovative, efficient, and reliable e-compressor technologies, making them critical partners in the value chain.

Beyond new vehicle manufacturing, the growing installed base of electric and hybrid vehicles is expanding the potential customer pool to include the automotive aftermarket. This segment comprises independent repair shops, authorized service centers, and specialized EV maintenance providers who require replacement e-compressors for vehicle servicing and repairs. As electric vehicles age, the need for maintenance and replacement of specialized components like e-compressors will grow, creating a significant market opportunity for parts suppliers and distributors. Additionally, fleet operators of electric buses, trucks, and delivery vans also represent a substantial customer segment, as they require robust and durable e-compressors for their commercial vehicles to ensure uptime and operational efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2032 | USD 10.4 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Denso, Valeo, Hanon Systems, Sanden, Mahle, BorgWarner, Panasonic, Mitsubishi Electric, Subros, Eberspächer, Continental, Marelli, Schaeffler, GAC Components, Highly, Keihin Corporation, Calsonic Kansei, Bergstrom Inc., LG Electronics, Toshiba |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive E-Compressor Market Key Technology Landscape

The Automotive E-Compressor Market is characterized by a rapidly evolving technological landscape, driven by the relentless pursuit of higher efficiency, compactness, and integration capabilities for electric vehicles. A core technological advancement lies in the widespread adoption of high-voltage systems, particularly 400V and 800V architectures, which allow for faster charging, reduced current losses, and more powerful e-compressor operation. This necessitates sophisticated power electronics, including inverters utilizing advanced semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN), which offer superior switching speeds and thermal performance compared to traditional silicon-based components. The integration of these power electronics directly into the compressor unit helps reduce overall system size and complexity, improving packaging efficiency within cramped vehicle compartments.

Another significant technological trend is the development of variable-speed drives and highly efficient brushless DC (BLDC) motors, which enable precise control over compressor speed and, consequently, cooling or heating capacity. This precision allows e-compressors to operate only when needed and at the optimal output level, drastically reducing energy consumption and extending the electric range of EVs. Refrigerant innovations are also crucial, with a strong shift towards environmentally friendly refrigerants like R1234yf, which has a significantly lower global warming potential (GWP) than older refrigerants. Research into even more sustainable alternatives and CO2 (R744) systems continues, pushing the boundaries of ecological thermal management.

Furthermore, the automotive e-compressor market is seeing advancements in integrated thermal management modules, where the e-compressor is part of a larger, centrally controlled system that manages temperatures for the cabin, battery, and power electronics holistically. This integration relies heavily on advanced control algorithms and sensor technology to optimize energy flow and thermal exchange across different vehicle domains. Diagnostic and predictive maintenance technologies, often powered by AI, are also becoming integral, leveraging data analytics to monitor compressor health, predict potential failures, and optimize operational parameters for enhanced reliability and longevity. These technological advancements collectively contribute to making e-compressors an increasingly sophisticated and indispensable component in modern electric and hybrid vehicles.

Regional Highlights

- Asia Pacific (APAC): This region is currently the largest and fastest-growing market for automotive e-compressors, primarily due to the rapid expansion of electric vehicle manufacturing and adoption in countries like China, Japan, and South Korea. China, in particular, leads in both EV production and sales, supported by robust government policies and significant investments in EV infrastructure, making it a critical hub for e-compressor demand. The presence of numerous global and local automotive OEMs and component suppliers further strengthens the market.

- Europe: The European market demonstrates significant growth, driven by stringent emission regulations, ambitious electrification targets set by the European Union, and increasing consumer awareness regarding sustainable mobility. Germany, France, and Norway are at the forefront of EV adoption and related technological advancements, with a strong focus on high-performance and premium electric vehicle segments. Research and development activities, coupled with significant investments in new battery gigafactories, further accelerate the demand for advanced thermal management solutions.

- North America: This region is experiencing substantial growth in the e-compressor market, fueled by increasing investments in electric vehicle production by major automakers in the United States and Canada. Government incentives, expanding charging infrastructure, and a growing consumer preference for electric trucks and SUVs are key drivers. The demand for efficient and robust e-compressors is vital for ensuring optimal performance in varying climatic conditions across the continent and supporting the rapid scaling of EV production.

- Latin America, Middle East, and Africa (MEA): While currently smaller in market share, these regions are showing nascent growth potential for automotive e-compressors. Increasing awareness of environmental concerns, coupled with initial government initiatives and foreign investments in EV infrastructure development, are gradually stimulating demand. As EV adoption slowly gains traction in key countries within these regions, the need for related components, including e-compressors, is expected to grow steadily over the forecast period, albeit from a lower base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive E-Compressor Market.- Denso

- Valeo

- Hanon Systems

- Sanden

- Mahle

- BorgWarner

- Panasonic

- Mitsubishi Electric

- Subros

- Eberspächer

- Continental

- Marelli

- Schaeffler

- GAC Components

- Highly

- Keihin Corporation

- Calsonic Kansei

- Bergstrom Inc.

- LG Electronics

- Toshiba

Frequently Asked Questions

What is an automotive E-compressor?

An automotive e-compressor is an electrically driven compressor used in vehicles, particularly electric and hybrid models, for cabin air conditioning and vital thermal management of high-voltage batteries and power electronics, operating independently of the engine.

Why are E-compressors crucial for electric vehicles?

E-compressors are crucial for EVs as they provide efficient and precise thermal management for the cabin and, more importantly, for the high-voltage battery and power electronics, which significantly impacts battery lifespan, safety, and overall vehicle performance and range.

What are the main types of automotive E-compressors?

The main types of automotive e-compressors are classified by their motor type, such as DC (Direct Current) and AC (Alternating Current) e-compressors, and by their operating voltage, including 48V, 400V, and 800V systems, depending on the vehicle's electrical architecture.

How does an E-compressor improve vehicle efficiency?

An e-compressor improves vehicle efficiency by operating independently and at variable speeds, allowing for precise control of cooling or heating and reducing parasitic losses often associated with engine-driven compressors. This optimizes energy consumption and extends electric range.

What challenges does the Automotive E-Compressor market face?

The automotive e-compressor market faces challenges such as the high initial cost of these advanced units, the complexity of integrating high-voltage systems into vehicle architectures, and ongoing technical hurdles related to efficiency and reliability under diverse operating conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager