Automotive Electronic Brake Force Distribution System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430822 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Electronic Brake Force Distribution System Market Size

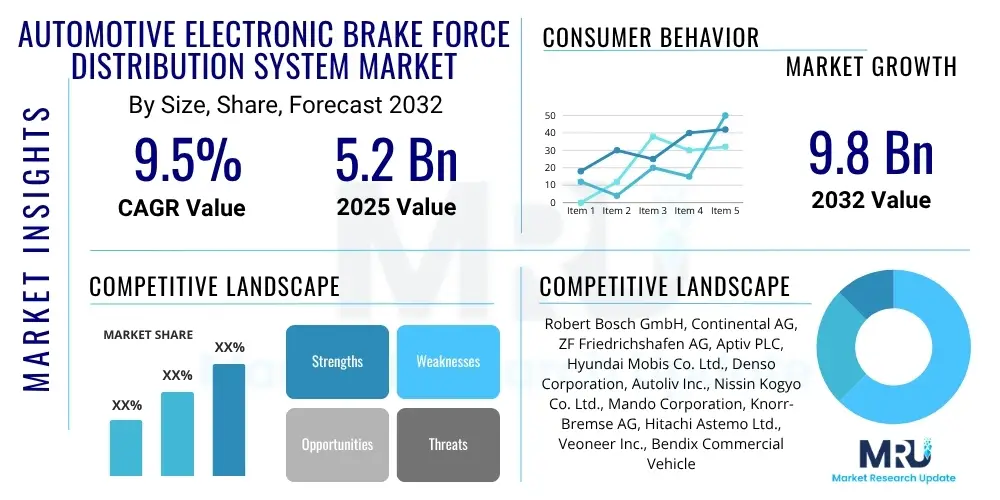

The Automotive Electronic Brake Force Distribution System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at $5.2 Billion in 2025 and is projected to reach $9.8 Billion by the end of the forecast period in 2032.

Automotive Electronic Brake Force Distribution System Market introduction

The Automotive Electronic Brake Force Distribution (EBFD) System represents a pivotal advancement in active vehicle safety technology, intricately designed to optimize the allocation of braking force across individual wheels. Functioning in harmonious concert with the Anti-lock Braking System (ABS), EBFD's primary objective is to prevent premature wheel lock-up, a common precursor to skidding and loss of control, thereby significantly augmenting vehicle stability during diverse braking scenarios. This sophisticated system meticulously monitors various parameters, including vehicle speed, wheel slip, and driver input, to dynamically adjust the hydraulic pressure delivered to the front and rear brakes. By achieving a precisely balanced distribution of braking power, especially under conditions where weight transfer occurs, such as emergency braking or cornering, EBFD plays a critical role in minimizing stopping distances while ensuring the vehicle maintains its intended trajectory. This intelligent allocation of force is fundamental to enhancing overall driving safety and performance across a broad spectrum of operational environments, from routine commutes to high-stress maneuvers, contributing substantially to accident prevention and mitigation.

The scope of major applications for EBFD systems is extensive, encompassing a vast array of vehicle categories. These systems are now standard or optional features in passenger cars, including compact sedans, mid-size family vehicles, and luxury automobiles, alongside sports utility vehicles (SUVs), light commercial vehicles (LCVs) such as vans and pickups, and increasingly, heavy commercial vehicles (HCVs) like trucks and buses. The inherent benefits of EBFD are multifold; paramount among them is the enhanced vehicle control and stability it offers, preventing dangerous fishtailing or nose-diving during sudden deceleration. Furthermore, it contributes to significantly shorter stopping distances, a crucial factor in avoiding collisions, and reduces tire wear by preventing uneven braking. Key driving factors propelling this market forward are profoundly influenced by evolving global legislative landscapes that continuously impose more stringent automotive safety regulations, often mandating the inclusion of advanced active safety systems. Concurrently, escalating consumer demand for vehicles equipped with cutting-edge safety features, alongside the imperative for EBFD to serve as a foundational element within sophisticated advanced driver-assistance systems (ADAS) and emerging autonomous vehicle platforms, collectively underpin the robust expansion of the market. Its proven efficacy in accident reduction solidifies its position as an indispensable technology in contemporary automotive engineering.

Automotive Electronic Brake Force Distribution System Market Executive Summary

The Automotive Electronic Brake Force Distribution System Market is poised for substantial expansion, underpinned by a compelling blend of technological innovation, regulatory impetus, and shifting consumer preferences. Key business trends indicate a concentrated effort among market leaders and emerging players alike to refine EBFD algorithms, improve sensor accuracy, and develop more compact and cost-effective hardware solutions. This strategic focus is often realized through collaborative partnerships between Tier-1 automotive suppliers, who specialize in developing and integrating these complex systems, and Original Equipment Manufacturers (OEMs), aiming to achieve seamless integration into next-generation vehicle architectures. The ongoing paradigm shift towards electric vehicles (EVs) and highly automated or autonomous driving systems represents a significant opportunity, as EBFD must adapt to new braking dynamics, including regenerative braking, and contribute to the fail-operational redundancy required for driverless operation. Investment in R&D for software-defined EBFD solutions, enabling over-the-air updates and greater customization, is also a prominent trend, reflecting the industry's move towards more flexible and upgradeable automotive electronics.

Regional trends reveal a diverse yet generally positive outlook across major global markets. The Asia Pacific (APAC) region, driven by burgeoning automotive production in countries like China and India, coupled with rising disposable incomes and an increasing awareness of vehicle safety, is anticipated to exhibit the most rapid growth. North America and Europe, characterized by mature automotive markets, stringent safety mandates, and a robust consumer base willing to invest in advanced safety features, will continue to be primary demand generators and innovation hubs. In these developed regions, the emphasis is often on premium segment vehicles and the integration of EBFD within comprehensive ADAS packages. Segment trends highlight the enduring dominance of passenger cars in terms of market share, given their high production volumes, but also indicate a significant upward trajectory in the commercial vehicle segment. Here, fleet operators are increasingly recognizing the economic benefits of enhanced safety through reduced accident rates and lower insurance premiums. The aftermarket segment is also demonstrating steady growth, driven by the need for maintenance, repair, and upgrades for the ever-growing global vehicle parc, ensuring long-term market vitality and sustained demand for EBFD components and servicing. Overall, the market is characterized by a strong push for integration, intelligence, and adaptability to meet future mobility needs.

AI Impact Analysis on Automotive Electronic Brake Force Distribution System Market

User inquiries about AI's influence on the Automotive Electronic Brake Force Distribution System Market frequently center on how artificial intelligence can transcend conventional reactive braking mechanisms to offer more proactive and predictive capabilities. Users are keen to understand if AI integration will lead to a significant leap in braking system intelligence, allowing EBFD to anticipate potential hazards and optimize force distribution even before a critical situation fully develops. There are considerable expectations for AI to enhance the precision and responsiveness of EBFD, enabling it to adapt instantaneously to highly dynamic driving conditions, intricate road surfaces, and idiosyncratic driver behaviors. Furthermore, a key area of inquiry revolves around the seamless interoperability of AI-powered EBFD with other advanced driver-assistance systems and, crucially, with the complex decision-making processes inherent in autonomous driving platforms. Underlying these expectations are also concerns regarding the robustness, reliability, and cybersecurity of AI algorithms in safety-critical applications, alongside questions about the computational resources required and the implications for data privacy. The overarching theme is a desire for braking systems that are not just safe, but intelligently safe, capable of learning and adapting, thereby significantly improving overall vehicle safety and performance in complex scenarios.

- AI enables predictive braking by analyzing vast streams of sensor data, including radar, lidar, camera, and vehicle telemetry, to foresee potential collision risks or loss of traction situations before they physically manifest, allowing EBFD to pre-condition or subtly adjust braking.

- Adaptive braking algorithms powered by AI enhance responsiveness to constantly changing road conditions, such as sudden rain or gravel, and varying driver input styles, providing more intuitive and effective brake force modulation by learning from past scenarios.

- Integration with advanced driver-assistance systems (ADAS) features like adaptive cruise control, lane-keeping assist, and automatic emergency braking becomes more sophisticated, allowing EBFD to work in a more coordinated and intelligent manner within a broader safety ecosystem.

- AI facilitates advanced diagnostics and anomaly detection within the EBFD system, continuously monitoring component health and performance to identify potential issues proactively, thereby improving system reliability and reducing maintenance costs through predictive insights.

- Optimized energy recuperation in electric vehicles through AI-controlled EBFD allows for more efficient blending of regenerative braking with friction braking, maximizing energy recovery without compromising braking performance or driver feel, leading to extended range.

- Enhanced cybersecurity measures for AI-driven braking systems are crucial to prevent unauthorized access, manipulation, or malfunction, safeguarding the integrity and safety of these critical vehicle functions in an increasingly connected automotive landscape.

- AI supports the development of personalized braking profiles, adapting EBFD characteristics to individual driver preferences or specific vehicle loads, contributing to a more customized and comfortable driving experience while maintaining stringent safety standards.

- Real-time traffic and environmental data integration allows AI-enhanced EBFD to adjust performance based on external factors like traffic density, visibility, and weather forecasts, moving towards truly contextual and intelligent braking decisions.

DRO & Impact Forces Of Automotive Electronic Brake Force Distribution System Market

The Automotive Electronic Brake Force Distribution System Market is profoundly influenced by a dynamic interplay of drivers, restraints, opportunities, and pervasive impact forces. A primary driver is the accelerating global imperative for enhanced vehicle safety, which has translated into progressively stringent governmental regulations and safety ratings (e.g., Euro NCAP, NHTSA) worldwide. These mandates often necessitate the inclusion of advanced braking technologies like EBFD as standard equipment in new vehicles. Concurrently, the burgeoning integration of advanced driver-assistance systems (ADAS) serves as a critical growth catalyst; EBFD is not merely a standalone feature but a foundational component essential for the effective operation of functionalities such as Automatic Emergency Braking (AEB), Adaptive Cruise Control (ACC), and Electronic Stability Control (ESC), which rely on precise brake modulation. Furthermore, the sustained growth in global automotive production, particularly in rapidly industrializing regions, inherently expands the addressable market for EBFD systems as more vehicles are manufactured. Finally, increasing consumer awareness and preference for vehicles equipped with superior active safety features, often highlighted in marketing campaigns, directly fuels demand, as buyers prioritize personal and passenger safety, making EBFD a sought-after feature.

Despite these robust drivers, the market navigates several notable restraints. The relatively high manufacturing costs associated with the intricate hardware components (sensors, ECUs, hydraulic modulators) and sophisticated software development for EBFD systems contribute to increased vehicle pricing, potentially deterring adoption in price-sensitive market segments or entry-level vehicles. The inherent technical complexity in designing, calibrating, and seamlessly integrating EBFD with other vehicle control systems (VCS) presents significant engineering challenges, requiring specialized expertise, extensive research, and rigorous testing protocols to ensure optimal performance and compatibility. Moreover, while rare, the potential for software glitches, electronic malfunctions, or cybersecurity vulnerabilities in safety-critical braking systems poses a considerable concern for both manufacturers and regulators, necessitating robust validation processes, continuous updates, and strong security protocols, which add to development overheads. This complexity and the associated costs can act as a barrier to entry for new players and potentially slow down the pace of innovation in some areas. Furthermore, maintenance and repair costs associated with these advanced electronic systems can also be higher than conventional braking components, influencing long-term vehicle ownership costs for consumers.

Conversely, the market is replete with significant opportunities. The global shift towards electric vehicles (EVs) and highly automated/autonomous vehicles presents a transformative growth avenue. EVs necessitate sophisticated EBFD systems that can effectively blend regenerative braking with friction braking for optimized energy recovery and seamless performance, while autonomous vehicles demand ultra-reliable and redundant braking systems capable of fail-operational performance to ensure continuous safety. The vast, untapped potential in emerging markets, particularly in Asia Pacific and Latin America, offers considerable scope for market expansion as these regions experience rapid motorization, increasing disposable incomes, and a growing emphasis on vehicle safety standards. Additionally, the continuous evolution of smart vehicle technologies, including vehicle-to-everything (V2X) communication, advanced mapping, and predictive analytics, opens doors for EBFD systems to become even more intelligent and proactive, anticipating braking needs based on real-time environmental data and networked vehicle information. These opportunities underscore the market's long-term growth potential, pushing innovation boundaries and broadening application horizons beyond traditional safety functions.

Pervasive impact forces exert a continuous influence on the EBFD market, shaping its trajectory and competitive landscape. Technological advancements stand as a primary force, continually pushing the boundaries of what EBFD systems can achieve in terms of precision, responsiveness, and integration capabilities. Innovations in miniaturized and more accurate sensor technology, faster and more powerful ECU processing power, and increasingly sophisticated software algorithms are paramount, driving performance improvements and cost reductions. Regulatory pressures are another undeniable force, with governments globally enacting and updating safety standards that directly influence the mandatory inclusion and technical specifications of EBFD systems, forcing manufacturers to adapt and innovate. Consumer safety awareness, increasingly amplified by public safety campaigns, readily available vehicle safety ratings, and social media, drives demand from the end-user perspective, compelling OEMs to prioritize and highlight advanced safety features. Economic factors, such as disposable income levels, vehicle affordability, and fluctuating raw material costs, indirectly impact vehicle sales and thus EBFD adoption rates. Finally, the intense competitive landscape among Tier-1 suppliers and automotive OEMs fosters rapid innovation, continuous product differentiation, and cost optimization, ensuring a dynamic and evolving market environment where only the most adaptable and technologically superior solutions thrive.

Segmentation Analysis

The Automotive Electronic Brake Force Distribution System Market is intricately segmented across various dimensions to facilitate a granular understanding of its composition, growth trajectories, and competitive dynamics. This comprehensive segmentation is instrumental for market participants to identify lucrative niches, formulate targeted product development strategies, and position their offerings effectively within the broader automotive ecosystem. By categorizing the market based on its core components, the diverse vehicle types that integrate EBFD systems, and the predominant sales channels through which these systems reach end-users, stakeholders gain invaluable insights into the specific drivers and challenges pertinent to each segment. This multi-faceted analytical approach allows for a deeper dive into market trends, technological requirements, and consumer demand patterns, enabling more informed decision-making and strategic investments across the entire value chain. Such a detailed breakdown ensures that market research and strategic planning are grounded in a thorough comprehension of the underlying market structure, fostering a robust and resilient industry outlook capable of adapting to future changes.

Understanding these segments is crucial for predicting market shifts and adapting business models effectively. For instance, the continuous evolution of sensor technologies directly impacts component suppliers, requiring them to innovate and offer higher precision and reliability, thereby influencing the 'By Component' segment. Similarly, the proliferation of electric vehicles and autonomous driving capabilities drastically alters the requirements for EBFD systems, influencing the 'By Vehicle Type' segment by demanding solutions optimized for regenerative braking and fail-operational performance. Moreover, the growing importance of the aftermarket for repairs and replacements necessitates different distribution and service strategies compared to direct OEM sales, impacting the 'By Sales Channel' segment. Each segment, therefore, presents unique opportunities and challenges that demand tailored approaches, contributing to the overall complexity and dynamism of the EBFD market. This detailed breakdown ensures that market research and strategic planning are grounded in a thorough comprehension of the underlying market structure, fostering a robust and resilient industry outlook capable of capitalizing on growth opportunities.

- By Component: This segment delineates the market based on the fundamental hardware and software elements that collectively constitute an EBFD system, each playing a crucial role in its precise and reliable functionality.

- Sensors: Essential for gathering real-time data on vehicle movement and wheel dynamics. This includes Wheel Speed Sensors (measuring rotational speed of each wheel to detect potential lock-up), Yaw Rate Sensors (detecting rotational motion around the vehicle's vertical axis to gauge stability), and Steering Angle Sensors (determining the driver's intended direction of travel), all critical for accurate force distribution calculations.

- Electronic Control Units (ECUs): The brain of the EBFD system, responsible for processing the voluminous sensor data, executing complex algorithms, and generating precise commands for the actuators to adjust brake pressure instantaneously. Advances in ECU processing power, memory, and robust embedded software are vital for swift responsiveness and intelligent decision-making.

- Actuators: Physical components that translate ECU electrical commands into mechanical action to control hydraulic pressure. These primarily comprise Hydraulic Modulators (which contain a series of valves and pumps to control the flow and pressure of brake fluid to each wheel caliper) and Solenoid Valves (electrically controlled valves that precisely regulate hydraulic flow within the modulator to achieve desired pressure adjustments).

- Software & Algorithms: The sophisticated programming and logical frameworks embedded within the ECU that interpret sensor data, calculate the optimal brake force distribution based on dynamic conditions (load, road grip, speed), and manage system interaction with ABS, ESC, and other vehicle control systems. Continuous refinement of these algorithms enhances performance, adaptability, and predictive capabilities.

- By Vehicle Type: This segmentation highlights the varying adoption rates and specific requirements of EBFD systems across different categories of automobiles, reflecting diverse performance and safety needs.

- Passenger Cars: Represents the largest market share, encompassing a wide range of vehicles including Sedans, SUVs, Hatchbacks, MPVs, and luxury vehicles. EBFD is increasingly a standard safety feature due to stringent governmental regulations, high consumer demand for enhanced safety, and its integration within comprehensive ADAS packages.

- Commercial Vehicles: A rapidly growing segment comprising both Light Commercial Vehicles (LCVs) like vans, pickups, and small trucks, and Heavy Commercial Vehicles (HCVs) such as large trucks, buses, and trailers. EBFD in commercial vehicles is particularly crucial for maintaining stability and improving braking efficiency when carrying heavy or shifting loads, significantly enhancing safety for fleet operators and drivers.

- By Sales Channel: This segment differentiates between how EBFD systems or their constituent components are procured, distributed, and ultimately reach the end-users within the automotive industry.

- Original Equipment Manufacturer (OEM): The dominant channel where complete EBFD systems are directly supplied by Tier-1 suppliers to vehicle manufacturers for integration into new vehicles during the assembly line process. This involves long-term strategic contracts, collaborative development, and customized solutions tailored to specific vehicle platforms and models.

- Aftermarket: Involves the sale of EBFD components (e.g., replacement sensors, ECUs, or hydraulic modulators) for repair, maintenance, or upgrade purposes after the vehicle has been sold to the end-consumer. This channel caters to independent repair shops, authorized service centers, and specialized parts retailers, ensuring the long-term functionality and safety of the installed base of EBFD-equipped vehicles.

Value Chain Analysis For Automotive Electronic Brake Force Distribution System Market

The value chain for the Automotive Electronic Brake Force Distribution System Market is a complex, multi-tiered structure that begins with fundamental raw material extraction and culminates in the delivery and servicing of integrated EBFD systems to end-users, creating value at each stage. The upstream segment involves the foundational supply of various critical raw materials. This includes specialized metals such as steel, aluminum, and copper for hydraulic components, wiring, and sensor housings; advanced plastics and polymers for electronic casings, connectors, and protective elements; and crucial semiconductor materials like silicon for microcontrollers and integrated circuits within the Electronic Control Units (ECUs). These raw materials are processed and refined before being supplied to component manufacturers. Tier-2 suppliers then specialize in producing the intricate sub-components, such as precise pressure sensors, electromagnetic solenoid valves, intricate wiring harnesses, and various electronic modules. This stage is characterized by high precision manufacturing, stringent quality control to meet automotive-grade reliability, and often significant capital investment in advanced production technologies to ensure the robustness and performance of individual parts that are critical to the safety function of EBFD systems. Research and development activities, particularly in materials science and microelectronics, are vital at this initial phase.

Following the upstream component manufacturing, the value chain progresses to the integration and assembly stage, primarily driven by Tier-1 automotive suppliers. These prominent companies procure the specialized components from various Tier-2 suppliers and meticulously integrate them into complete EBFD modules. This crucial stage involves sophisticated engineering, including the development and rigorous calibration of proprietary software algorithms that govern the EBFD system's intelligence, responsiveness, and interaction with other vehicle control systems. Extensive testing and validation, often spanning millions of kilometers and diverse environmental conditions, are performed to ensure compliance with global automotive safety standards (e.g., ISO 26262 for functional safety) and seamless interoperability with other vehicle systems like ABS, ESC, and ADAS. These fully integrated EBFD modules are then predominantly supplied directly to automotive Original Equipment Manufacturers (OEMs). This direct distribution channel forms the backbone of the market, where long-term supply contracts are forged, and systems are customized to specific vehicle platforms during the new vehicle assembly process. The direct relationship between Tier-1 suppliers and OEMs is characterized by intensive collaborative development, strict quality assurances, just-in-time delivery models, and deep technical support, ensuring efficient production flows and technological alignment.

The downstream segment of the value chain focuses on the distribution and servicing of EBFD systems to end-users. While the primary channel is direct to OEMs for new vehicle integration, the aftermarket plays an increasingly vital and growing role in sustaining the installed base. For the aftermarket, EBFD components and replacement parts are distributed through a complex network comprising independent distributors, automotive parts wholesalers, and various retail channels (both physical stores and e-commerce platforms). These entities then supply authorized service centers, independent automotive repair shops, and even direct-to-consumer platforms. This indirect distribution ensures that vehicles on the road can receive necessary repairs, maintenance, or potential upgrades to their EBFD systems throughout their operational lifespan, which can extend for many years. Additionally, specialized software updates, diagnostic tools, and technical training for technicians are also distributed through these channels to maintain the system's optimal performance and address any emerging issues. The efficiency and reliability of both direct and indirect distribution channels are paramount for ensuring widespread adoption, maintaining high vehicle safety standards, and providing ongoing support for the ever-growing global fleet of vehicles equipped with EBFD technology, ultimately reinforcing consumer trust and market growth and contributing to overall road safety.

Automotive Electronic Brake Force Distribution System Market Potential Customers

The primary and most significant potential customers for Automotive Electronic Brake Force Distribution Systems are the global automotive Original Equipment Manufacturers (OEMs). These include large-scale passenger car manufacturers (e.g., Toyota, Volkswagen, General Motors, Ford, Hyundai-Kia), luxury car brands (e.g., BMW, Mercedes-Benz, Audi), and increasingly, electric vehicle specialists (e.g., Tesla, BYD, Nio, Rivian). OEMs are driven by a compelling mix of factors: stringent governmental safety regulations that often mandate advanced braking systems as standard features to achieve high safety ratings; the competitive necessity to offer cutting-edge safety features to attract discerning consumers and differentiate their product lines; and the foundational role EBFD plays in integrating with more complex advanced driver-assistance systems (ADAS) and autonomous driving platforms. Their procurement decisions are based on a rigorous evaluation of system reliability, performance capabilities, ease of integration with existing vehicle architectures, scalability for different models, and overall cost-effectiveness. OEMs typically seek long-term strategic partnerships with Tier-1 suppliers who can not only provide robust hardware but also sophisticated software solutions and comprehensive technical support throughout the entire vehicle development and production lifecycle, ensuring a seamless and reliable end-product.

Beyond the core OEM market, another critical segment of potential customers comprises large fleet operators, encompassing companies managing commercial vehicles such as trucking companies, logistics firms, public transport authorities (buses), construction fleets, and ride-sharing services. For these entities, vehicle safety is paramount not only for legal and ethical reasons but also for operational efficiency and profitability. EBFD systems contribute directly to reducing accident rates, which translates into tangible economic benefits such as lower insurance premiums, fewer vehicle repair costs, reduced vehicle downtime for repairs, and enhanced driver and cargo safety. The motivation for fleet operators is strongly tied to total cost of ownership (TCO) and reputation management, as accidents can lead to significant financial losses and damage to brand image. Investing in vehicles equipped with advanced EBFD features ensures greater operational continuity, compliance with safety standards, and improved driver morale. Furthermore, these operators often have specific requirements for durability, robustness, and ease of maintenance, given the high mileage and demanding usage conditions of their commercial vehicles, influencing their purchasing decisions for new vehicles or aftermarket upgrades.

Individual vehicle owners also represent a significant, albeit often indirect, customer segment, particularly within the aftermarket. While they typically acquire EBFD systems as an integrated part of a new vehicle purchase directly from an OEM, their ongoing need for maintenance, repair, and potential upgrades of these critical safety systems positions them as consumers of EBFD components and services over the lifespan of their vehicle. When EBFD components require servicing or replacement due to wear and tear, age, or malfunction, these owners rely on a network of authorized service centers, independent automotive repair shops, and specialized parts retailers. Consequently, these repair and service establishments, which procure EBFD parts from distributors, also function as indirect customers, ensuring they have access to genuine or certified aftermarket EBFD components. This ensures the sustained functionality and safety performance of vehicles throughout their entire lifespan on the road, highlighting the importance of a robust aftermarket supply chain to support the installed base of EBFD-equipped vehicles and maintain consumer trust in these critical safety technologies, ultimately enhancing road safety for all users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $5.2 Billion |

| Market Forecast in 2032 | $9.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Aptiv PLC, Hyundai Mobis Co. Ltd., Denso Corporation, Autoliv Inc., Nissin Kogyo Co. Ltd., Mando Corporation, Knorr-Bremse AG, Hitachi Astemo Ltd., Veoneer Inc., Bendix Commercial Vehicle Systems LLC, Advics Co. Ltd., Wabco Holdings Inc., Magna International Inc., Aisin Corporation, Hella GmbH & Co. KGaA, BorgWarner Inc., Brembo S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Electronic Brake Force Distribution System Market Key Technology Landscape

The Automotive Electronic Brake Force Distribution System Market is underpinned by a rapidly evolving technological landscape, driven by the relentless pursuit of enhanced vehicle safety, performance, and seamless integration within increasingly complex automotive architectures. At the core of EBFD systems are highly sophisticated sensor technologies. These include precise Wheel Speed Sensors that monitor the rotational speed of each wheel, crucial for detecting incipient lock-up and wheel slip; accurate Yaw Rate Sensors that measure the vehicle's angular velocity around its vertical axis, indicating potential oversteer or understeer tendencies; and Steering Angle Sensors that detect the driver's intended direction. These sensors have seen significant advancements in accuracy, durability, miniaturization, and resistance to environmental factors like temperature extremes and moisture, ensuring reliable data acquisition under diverse driving conditions. The voluminous real-time data generated by these sensors is then fed to powerful Electronic Control Units (ECUs), which serve as the central processing hubs of the EBFD system. Modern ECUs feature high-speed multi-core microcontrollers, robust memory capacities, and specialized processors capable of executing complex proprietary software algorithms with millisecond precision. These algorithms are the intelligence behind EBFD, dynamically calculating and commanding the optimal brake pressure required for each individual wheel to maximize braking efficiency while preserving vehicle stability and directional control in real-time.

Further integral to this technological framework are advanced hydraulic actuators and robust communication protocols. The actuators, primarily comprising electro-hydraulic modulators equipped with precision solenoid valves, are responsible for translating the ECU's electrical commands into precise and rapid adjustments of hydraulic pressure to each wheel caliper. Innovations in these mechanical components focus on achieving faster response times, greater modulation accuracy to prevent abrupt braking, and enhanced durability to withstand demanding operational cycles over the vehicle's lifespan. The seamless, high-speed data exchange between the EBFD system and other critical vehicle control units, such as the Anti-lock Braking System (ABS), Electronic Stability Control (ESC), and traction control systems, is facilitated by robust in-vehicle communication networks, most notably the Controller Area Network (CAN) bus. As vehicles become more connected and intelligent, new communication architectures like automotive Ethernet are also being explored for even higher bandwidth and lower latency, crucial for future ADAS and autonomous driving applications where massive data throughput is required. The burgeoning trend towards software-defined vehicles is profoundly influencing EBFD, enabling features like over-the-air (OTA) updates for software refinements, personalized braking profiles based on driver behavior, and more flexible integration with emerging autonomous driving stacks. This shift allows for continuous improvement and adaptation of EBFD functionalities throughout the vehicle's lifespan without requiring physical hardware changes, making systems more agile and future-proof.

Looking ahead, the technological evolution of EBFD systems is increasingly converging with Artificial Intelligence (AI) and Machine Learning (ML). Future EBFD systems are expected to leverage AI for predictive braking capabilities, analyzing vast datasets from various onboard sensors, navigation systems, external traffic data, and even vehicle-to-everything (V2X) communication to anticipate braking needs before a driver even perceives a hazard. This proactive approach will significantly enhance safety and efficiency by preparing the braking system in advance. AI will also play a crucial role in developing highly adaptive algorithms that can learn from diverse driving scenarios and continuously optimize brake force distribution based on real-time environmental conditions, nuanced road surface friction coefficients, and dynamic vehicle load changes, leading to superior braking performance. Furthermore, advanced diagnostic capabilities powered by ML will enable EBFD systems to self-monitor component health, predict potential component failures, and provide preventative maintenance alerts, thereby improving overall system reliability, reducing unforeseen downtime, and enhancing the system's resilience. The ultimate goal is to evolve EBFD from a reactive safety system into a proactive, intelligent, and integral part of a holistic vehicle control architecture, crucial for enabling safer, more efficient, and ultimately fully autonomous mobility solutions that can operate reliably in complex and unpredictable environments.

Regional Highlights

- North America: This region stands as a significant market for Automotive Electronic Brake Force Distribution Systems, primarily due to the early adoption of advanced safety features, a robust and innovative automotive industry, and the strict enforcement of stringent regulatory mandates by bodies like the National Highway Traffic Safety Administration (NHTSA). A strong presence of major automotive OEMs, coupled with high consumer demand for premium and technologically advanced vehicles that prioritize safety, further drives market growth. Continuous investments in research and development for autonomous driving technologies and the increasing penetration of ADAS in mainstream vehicles also provide substantial impetus to the EBFD market, making North America a key innovation hub for active safety systems.

- Europe: Europe is characterized by its exceptionally rigorous vehicle safety standards, exemplified by organizations like Euro NCAP, and a strong cultural emphasis on automotive innovation and engineering excellence. Countries such as Germany, France, Italy, and the UK are prominent hubs for automotive technology development and manufacturing, leading to widespread and often mandatory adoption of EBFD as a standard safety feature across all vehicle segments. The region's ambitious push towards electric vehicles (EVs) and sustainable mobility solutions also significantly supports EBFD market expansion, as these systems are crucial for optimizing regenerative braking, enhancing overall EV safety, and meeting stringent emissions targets.

- Asia Pacific (APAC): Projected to be the fastest-growing region in the EBFD market, APAC's expansion is fueled by an unprecedented increase in automotive production, particularly in economic powerhouses like China, India, Japan, and South Korea. Rising disposable incomes across these nations contribute to a burgeoning middle class demanding safer and more technologically equipped vehicles. Simultaneously, there is a rapidly growing awareness of vehicle safety among consumers and a proactive stance from governments to implement safety regulations and road safety programs, catalyzing the widespread adoption of EBFD systems. Local manufacturing capabilities and competitive pricing strategies further bolster market penetration in this dynamic and evolving region.

- Latin America: Representing an emerging market for EBFD systems, Latin America is experiencing gradual but consistent growth driven by increasing automotive sales volumes and a burgeoning focus on vehicle safety technologies. While the pace of adoption might be slower compared to developed regions, regulatory efforts to enhance automotive safety standards across key countries like Brazil, Mexico, and Argentina are steadily impacting market dynamics and encouraging the inclusion of EBFD. Economic development, increasing foreign direct investments in the automotive sector, and the modernization of vehicle fleets are also contributing factors to the greater integration of advanced safety features.

- Middle East and Africa (MEA): This region constitutes a smaller but steadily expanding market for EBFD, with growth primarily concentrated in urban centers and economically stronger nations within the Gulf Cooperation Council (GCC) countries and parts of South Africa. Increasing investments in infrastructure development, a gradual shift towards modern vehicle technologies, and a growing influx of international automotive brands are stimulating demand for advanced safety features. While regulatory frameworks for vehicle safety are still evolving in many parts of MEA, the rising awareness of global safety benchmarks and consumer preferences for safer and technologically equipped vehicles are slowly but surely driving the adoption of Electronic Brake Force Distribution Systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Electronic Brake Force Distribution System Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Aptiv PLC

- Hyundai Mobis Co. Ltd.

- Denso Corporation

- Autoliv Inc.

- Nissin Kogyo Co. Ltd.

- Mando Corporation

- Knorr-Bremse AG

- Hitachi Astemo Ltd.

- Veoneer Inc.

- Bendix Commercial Vehicle Systems LLC

- Advics Co. Ltd.

- Wabco Holdings Inc. (now part of ZF)

- Magna International Inc.

- Aisin Corporation

- Hella GmbH & Co. KGaA

- BorgWarner Inc.

- Brembo S.p.A.

- Wabash National Corporation

- Haldex AB

- Chassis Brakes International (part of Hitachi Astemo)

- Akebono Brake Industry Co., Ltd.

Frequently Asked Questions

What is an Automotive Electronic Brake Force Distribution System and how does it function?

An EBFD system is a critical active safety feature that dynamically optimizes the braking force applied to each wheel of a vehicle. It works in conjunction with the Anti-lock Braking System (ABS) by continuously monitoring wheel speed, vehicle load, and driver input to precisely distribute braking pressure front-to-rear and sometimes side-to-side. This intelligent distribution prevents premature wheel lock-up, particularly during heavy braking, cornering, or driving on surfaces with varying grip, thereby enhancing vehicle stability, maintaining steering control, and significantly reducing stopping distances. Its core function is to maximize braking efficiency by ensuring each wheel receives the optimal braking force without skidding, leading to safer and more controlled deceleration.

How does EBFD contribute to overall vehicle safety and performance?

EBFD substantially improves vehicle safety by preventing skidding and loss of directional control during braking, especially under challenging conditions like uneven loads, varying road surface grip, or emergency stop maneuvers. By dynamically distributing braking force optimally to each wheel, it reduces the risk of the vehicle fishtailing (rear wheels losing grip) or nose-diving (excessive front brake bias), thus maintaining directional stability. This critical function leads to demonstrably shorter, more controlled stopping distances and allows the driver to retain better steering capability while braking, which is crucial for accident avoidance. In terms of performance, it ensures maximum braking power is utilized efficiently and smoothly, translating into a more predictable, stable, and safer driving experience for occupants and other road users.

What are the primary factors driving the growth of the EBFD market?

The EBFD market is primarily driven by three key factors: increasingly stringent global automotive safety regulations and crash test ratings that mandate advanced braking systems as standard features in new vehicles; the accelerating integration of EBFD into advanced driver-assistance systems (ADAS) where it serves as a foundational component for functionalities like automatic emergency braking, adaptive cruise control, and electronic stability control; and a growing consumer demand for vehicles equipped with cutting-edge active safety features. Additionally, the overall increase in global automotive production, particularly in emerging economies, and the rising emphasis on road safety initiatives worldwide contribute significantly to market expansion, positioning EBFD as an indispensable technology in modern vehicle design and engineering.

What impact is Artificial Intelligence expected to have on EBFD systems in the future?

Artificial Intelligence (AI) is projected to revolutionize EBFD systems by introducing predictive capabilities, moving beyond reactive adjustments to anticipatory actions. AI will enable EBFD to analyze vast sensor data, external traffic information, and driver behavior patterns to foresee braking needs, thus pre-conditioning or optimizing brake force distribution even before a critical situation fully materializes. It will also facilitate highly adaptive algorithms that can learn from diverse driving scenarios, offering more precise, personalized, and context-aware braking. Furthermore, AI will enhance seamless integration with autonomous driving systems by providing critical fail-operational redundancy and decision-making, improve system diagnostics for proactive maintenance, and optimize energy recuperation in electric vehicles, making EBFD systems significantly more intelligent, responsive, and proactive contributors to overall vehicle safety.

Which geographical regions are demonstrating the highest adoption and growth for EBFD systems?

North America and Europe currently exhibit high adoption rates for EBFD systems, primarily due to their mature automotive markets, highly stringent safety regulations, and strong consumer demand for premium safety features and advanced driver-assistance systems. However, the Asia Pacific (APAC) region is poised for the fastest growth, driven by burgeoning automotive production in countries like China, India, Japan, and South Korea, increasing disposable incomes, and a rapidly escalating awareness of vehicle safety among consumers. Latin America and the Middle East & Africa are also emerging markets, showing gradual but consistent growth in EBFD adoption as their respective automotive industries mature and local safety standards improve, catching up with global benchmarks for vehicle safety technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager