Automotive Engine Encapsulation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431192 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive Engine Encapsulation Market Size

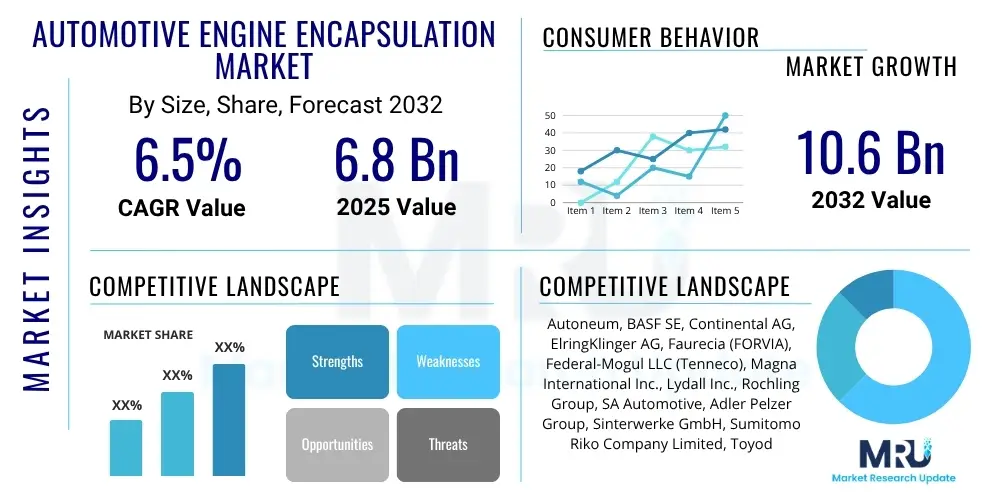

The Automotive Engine Encapsulation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 6.8 Billion in 2025 and is projected to reach USD 10.6 Billion by the end of the forecast period in 2032.

Automotive Engine Encapsulation Market introduction

The Automotive Engine Encapsulation Market is primarily defined by the design, manufacturing, and supply of sophisticated insulation systems integrated within the engine compartments of various vehicles. These systems are meticulously engineered to serve a dual purpose: significantly reducing engine noise, thereby enhancing cabin comfort and complying with stringent pass-by noise regulations, and effectively managing engine heat. The latter involves retaining heat during engine off periods to facilitate quicker warm-up cycles, which is critical for minimizing cold-start emissions and improving overall fuel efficiency. Products range from lightweight engine covers and shields to comprehensive engine compartment encapsulations, utilizing advanced materials such as specialized foams, high-performance felts, and composite structures. The market’s evolution is intrinsically linked to advancements in material science and automotive engineering, continuously seeking to balance performance, cost, and weight considerations.

Key applications of engine encapsulation span across a broad spectrum of the automotive industry. In passenger vehicles, from compact cars to luxury sedans and sport utility vehicles (SUVs), these systems are vital for delivering a premium driving experience by dampening engine noise and vibration (NVH). For commercial vehicles, including light and heavy-duty trucks, the benefits extend to driver comfort during long hauls and compliance with occupational noise exposure limits. Furthermore, with the accelerating shift towards hybrid and electric powertrains, engine encapsulation plays a crucial role in the precise thermal management of hybrid internal combustion components and potentially in optimizing battery temperatures in certain configurations. The versatility of these systems ensures their relevance across diverse automotive segments.

The benefits derived from engine encapsulation are multifaceted, impacting both environmental performance and user experience. Environmentally, by ensuring optimal engine operating temperatures, these systems contribute to a reduction in harmful exhaust emissions, especially during initial cold starts, and improve fuel economy, aligning with global sustainability goals. From a user perspective, the primary advantage is a quieter and more refined cabin environment, which directly translates to enhanced passenger comfort and reduced driver fatigue. The driving factors propelling this market forward include the increasingly stringent global regulatory landscape for noise and emissions, robust consumer demand for quieter and more fuel-efficient vehicles, and ongoing technological innovations in lightweight, high-performance insulation materials. These elements collectively underscore the indispensable role of engine encapsulation in modern automotive design.

Automotive Engine Encapsulation Market Executive Summary

The Automotive Engine Encapsulation Market is currently in a phase of dynamic growth, shaped by several overarching business trends. A significant trend involves the relentless pursuit of lightweighting solutions across the automotive industry, driving the adoption of advanced composite materials and innovative manufacturing techniques for encapsulation products. Manufacturers are increasingly focused on multi-functional materials that not only provide superior thermal and acoustic insulation but also offer durability and recyclability, addressing both performance and sustainability objectives. The emphasis on modular design and ease of assembly is another critical business trend, enabling OEMs to integrate encapsulation systems more efficiently into diverse vehicle platforms and streamline production processes. Collaboration between material suppliers, Tier 1 manufacturers, and automotive OEMs is intensifying to co-develop tailored solutions that meet specific vehicle architecture and performance requirements from the early design stages.

Regionally, the market exhibits varied growth trajectories and adoption rates. Europe and North America remain at the forefront, driven by well-established automotive industries, stringent environmental protection standards, and high consumer expectations for vehicle refinement and fuel efficiency. These regions often lead in the adoption of advanced and premium encapsulation technologies. The Asia Pacific region, particularly emerging economies like China and India, presents the most substantial growth opportunities. This surge is fueled by rapidly expanding vehicle production volumes, a growing middle class with increasing purchasing power, and the progressive implementation of stricter emission and noise regulations. Latin America and the Middle East & Africa regions are also experiencing gradual market penetration, albeit at a slower pace, as their automotive sectors mature and regulatory frameworks evolve.

From a segmentation perspective, the passenger vehicle segment continues to hold the dominant market share, primarily due to the sheer volume of production and the strong consumer demand for comfort and quietness. Within this segment, premium and luxury vehicles, along with the booming SUV category, represent particularly lucrative sub-segments for advanced and comprehensive encapsulation solutions. However, the commercial vehicle segment is poised for accelerated growth, as fleet operators recognize the benefits of encapsulation in improving fuel economy, reducing operational noise, and extending engine life, leading to lower total cost of ownership. The aftermarket segment, while smaller, offers niche opportunities for replacement and upgrade parts, driven by vehicle aging and consumer desire for improved performance in older models. These segment-specific trends underscore the diverse applications and strategic importance of engine encapsulation across the automotive ecosystem.

AI Impact Analysis on Automotive Engine Encapsulation Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the automotive engine encapsulation market, exploring its potential across design, material optimization, manufacturing, and operational efficiency. Common user questions often focus on AI's capability to predict material performance under extreme thermal and acoustic conditions, enabling rapid iteration and selection of optimal insulation compounds. There is significant interest in AI-powered generative design approaches for creating lightweight, complex encapsulation geometries that surpass human design capabilities. Furthermore, queries arise regarding AI's role in predictive maintenance for engine components affected by thermal stress, personalized acoustic tuning for vehicle cabins, and the optimization of supply chains for raw materials and finished products. The overarching expectation is that AI will drive unprecedented levels of precision, speed, and cost-effectiveness in developing next-generation encapsulation solutions, addressing the industry's evolving demands for efficiency and sustainability, while also prompting considerations about data security and the necessary skills gap for adoption.

- Material Discovery and Optimization: AI algorithms can analyze vast datasets of material properties, predicting optimal combinations for thermal and acoustic performance under specific engine operating conditions. This accelerates the discovery of novel composites, foams, and felts with enhanced insulation capabilities, reduced weight, and improved durability. Machine learning models can fine-tune material compositions to achieve desired characteristics, minimizing trial-and-error in R&D.

- Generative Design for Encapsulation Structures: AI-powered generative design tools can autonomously create highly complex and optimized encapsulation geometries. These designs can achieve superior acoustic baffling and thermal retention with minimal material usage, leading to significant weight reductions and improved space utilization within tight engine compartments, surpassing traditional human design limitations in terms of intricacy and efficiency.

- Predictive Performance Modeling: AI models can accurately simulate and predict the thermal and acoustic performance of encapsulation systems under various real-world driving scenarios. This includes predicting heat transfer, noise propagation, and material degradation over time, allowing engineers to virtually test and validate designs without extensive physical prototyping, drastically cutting development costs and time.

- Manufacturing Process Optimization: AI can monitor and optimize manufacturing processes for encapsulation components, such as thermoforming, injection molding, and bonding. Machine vision systems coupled with AI can detect defects in real-time, ensuring high quality control. Furthermore, AI can optimize machine parameters, reduce waste, and improve energy efficiency on production lines, leading to cost savings and more sustainable manufacturing.

- Supply Chain and Logistics Management: AI can enhance supply chain resilience and efficiency by accurately forecasting demand for encapsulation materials and finished products. Predictive analytics can identify potential disruptions in raw material supply, optimize inventory levels, and streamline logistics, ensuring a just-in-time delivery system that supports continuous automotive production lines.

- Acoustic Personalization and Tuning: AI algorithms can analyze vehicle interior acoustics and driver preferences to dynamically adjust or recommend optimal encapsulation configurations for different vehicle models or even individual driving modes. This could lead to personalized soundscapes within the cabin, further enhancing driver and passenger comfort.

- Condition Monitoring and Predictive Maintenance: For integrated encapsulation systems that may degrade over time, AI-driven sensors can monitor their condition. AI can predict potential failures or reductions in performance, enabling proactive maintenance and replacement. This ensures sustained efficiency and comfort throughout the vehicle's lifespan, preventing larger issues.

- Environmental Impact Analysis and Sustainability: AI can assist in evaluating the full lifecycle environmental impact of different encapsulation materials and designs, from raw material extraction to end-of-life recycling. This helps manufacturers make informed decisions to adopt more sustainable materials and processes, aligning with circular economy principles and reducing the overall carbon footprint of automotive components.

DRO & Impact Forces Of Automotive Engine Encapsulation Market

The Automotive Engine Encapsulation Market is primarily propelled by several powerful drivers that reflect both regulatory pressures and evolving consumer preferences. A paramount driver is the continuous tightening of global environmental regulations, specifically regarding vehicle emissions (e.g., Euro 7, CAFE standards) and noise pollution (e.g., UNECE R51-03 pass-by noise limits). These mandates compel automotive manufacturers to integrate advanced encapsulation solutions to ensure engines reach optimal operating temperatures faster, reducing cold-start emissions, and to significantly dampen engine noise. Additionally, the escalating consumer demand for quieter, more comfortable, and fuel-efficient vehicles directly fuels market growth. Buyers increasingly prioritize vehicles that offer a premium cabin experience and lower running costs, making engine encapsulation an attractive value proposition for OEMs. The ongoing global production growth of hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) also acts as a significant driver, as these powertrains specifically benefit from enhanced thermal management to optimize both internal combustion engine and electric motor performance, as well as battery health.

Despite robust growth drivers, the market faces notable restraints that could temper its expansion. The most significant restraint is the relatively high initial cost associated with manufacturing and integrating advanced engine encapsulation systems. These systems often utilize specialized, high-performance materials and require intricate design and molding processes, which can add to the overall vehicle manufacturing cost. This cost sensitivity can be a barrier for mass-market vehicle segments or in price-competitive emerging economies. Another restraint is the inherent complexity of integrating encapsulation systems into increasingly compact and diverse engine compartments. Varying engine designs, component layouts, and space constraints across different vehicle platforms demand highly customized and complex solutions, increasing design and engineering challenges, as well as lead times for implementation. The durability and long-term performance under extreme engine conditions also pose design challenges, requiring robust materials and secure installation methods.

Conversely, the Automotive Engine Encapsulation Market presents substantial opportunities for innovation and expansion. A key opportunity lies in the development of multi-functional materials that can offer not only superior thermal and acoustic insulation but also incorporate features such as electromagnetic shielding for hybrid/EV components, fire retardation, or even structural reinforcement. This integration of multiple benefits into a single solution enhances value and simplifies vehicle assembly. The accelerating trend towards vehicle electrification, while introducing new thermal management needs for batteries and electric motors, also creates opportunities for tailored encapsulation solutions specific to these components. The growing aftermarket segment, driven by vehicle aging and consumer desires for performance upgrades, also presents an avenue for specialized encapsulation products. Furthermore, the impact forces shaping this market include volatile raw material prices, particularly for polymers and specialized fibers, which can affect production costs and profitability. Geopolitical factors influencing global supply chains and trade policies also exert pressure. Rapid technological advancements in new materials and manufacturing techniques, alongside evolving partnerships between material scientists and automotive engineers, continually redefine the market landscape, pushing boundaries for performance and sustainability.

Segmentation Analysis

The Automotive Engine Encapsulation market is comprehensively segmented to provide a granular understanding of its diverse landscape, enabling stakeholders to pinpoint specific areas of growth, competition, and technological focus. This multi-dimensional segmentation facilitates strategic planning by breaking down the market into manageable components based on the inherent characteristics of the products, their applications, the types of vehicles they serve, and how they reach the end-user. Each segment and sub-segment reflects unique market dynamics, technological requirements, material preferences, and regulatory influences, all of which are crucial for a thorough market assessment. Understanding these differentiations allows for targeted product development, marketing strategies, and investment decisions across the value chain, from raw material suppliers to automotive OEMs and aftermarket providers. The intricate interplay between these classifications ultimately dictates market sizing, growth projections, and competitive positioning within the global automotive industry.

- By Material Type: This segment classifies encapsulation solutions based on the primary materials used, which dictates their thermal, acoustic, weight, and cost properties.

- Foamed Plastics (e.g., Polyurethane, Polypropylene, Polyethylene): Widely used due to their lightweight, excellent thermal insulation, and sound-absorbing characteristics. They offer design flexibility and are cost-effective for various applications.

- Felt (e.g., Polyester, Glass Fiber, Recycled Fibers): Valued for their superior acoustic dampening properties and heat resistance. Often used in multi-layered constructions for enhanced performance and are increasingly incorporating recycled content for sustainability.

- Elastomers (e.g., EPDM, Silicone): Employed for their flexibility, vibration dampening capabilities, and resistance to heat and chemicals. They are suitable for seals, gaskets, and components requiring resilience and durability in harsh engine environments.

- Composites (e.g., Glass Fiber Reinforced Thermoplastics, Carbon Fiber Composites): Offer high strength-to-weight ratio, excellent stiffness, and enhanced thermal stability. They are increasingly adopted for structural encapsulation components in premium vehicles and where extreme performance is required.

- Other Materials (e.g., Aerogels, Mineral Wool, Hybrid Materials): Includes specialized or emerging materials like aerogels for ultra-high thermal insulation in compact spaces, or mineral wool for specific high-temperature applications. Hybrid materials combine properties for optimized performance.

- By Product Type: This segmentation focuses on the specific form factor and area of engine encapsulation.

- Engine Compartment Encapsulation: Comprehensive systems that enclose a significant portion, or the entirety, of the engine bay. These provide maximum thermal and acoustic insulation and are often seen in premium vehicles or those with advanced thermal management needs (e.g., hybrids).

- Engine Side Encapsulation: Targets specific sides of the engine, often focusing on reducing noise radiation towards the cabin or critical components. These are more localized solutions offering a balance between performance and cost.

- Engine Shields: Protective barriers, typically installed underneath or around specific engine components, to deflect heat, reduce road noise intrusion, and protect against debris. They are crucial for thermal management and NVH.

- Engine Covers: Primarily visible components covering the top of the engine. While contributing to acoustics, they also serve aesthetic purposes, protect against dust, and often integrate sound-absorbing materials for additional NVH benefits.

- By Vehicle Type: Categorizes the market based on the end-use automotive platform, highlighting differing requirements and market volumes.

- Passenger Vehicles: The largest segment due to global production volumes and consumer demand for comfort.

- Hatchbacks: Focus on cost-effective, efficient solutions, often with basic encapsulation for noise reduction.

- Sedans: Higher emphasis on acoustic comfort and fuel efficiency, leading to more comprehensive encapsulation.

- SUVs: Driven by growing popularity, these vehicles often feature larger engine compartments, benefiting from extensive encapsulation for both NVH and thermal management.

- Luxury Cars: Demand premium, high-performance, and custom-engineered encapsulation for ultimate acoustic refinement and thermal optimization.

- Commercial Vehicles: Growing segment driven by fleet operational efficiency and driver comfort.

- Light Commercial Vehicles (LCV): Includes vans and pickup trucks, where encapsulation improves driver comfort during urban deliveries and reduces fuel consumption.

- Heavy Commercial Vehicles (HCV): Encompasses large trucks and buses, where engine encapsulation is critical for long-haul driver comfort, noise regulation compliance, and fuel efficiency in demanding operations.

- Passenger Vehicles: The largest segment due to global production volumes and consumer demand for comfort.

- By Sales Channel: Distinguishes between new vehicle integration and aftermarket replacement/upgrade.

- OEM (Original Equipment Manufacturer): The dominant channel, where encapsulation systems are supplied directly to automotive manufacturers for integration into newly produced vehicles. This channel demands high volumes, strict quality, and design integration.

- Aftermarket: Comprises sales of replacement or upgrade encapsulation components for existing vehicles. This channel is smaller but caters to vehicle maintenance, repair, and modification needs, often driven by wear-and-tear or desired performance enhancements.

Value Chain Analysis For Automotive Engine Encapsulation Market

The value chain for the Automotive Engine Encapsulation Market begins with a robust upstream segment focused on the sourcing and innovation of raw materials. This initial stage involves numerous specialized suppliers providing a diverse range of materials crucial for encapsulation products. These include polymer manufacturers supplying various grades of plastics (e.g., polypropylene, polyurethane, polyethylene) for foams and composites, fiber producers offering polyester, glass, and mineral fibers for felts, and chemical companies providing resins, binders, and additives that enhance material properties such as heat resistance, sound absorption, and durability. Research and development activities, often collaborative between material science firms and encapsulation manufacturers, are paramount here, focusing on developing lighter, more sustainable, and higher-performing materials that can withstand the harsh conditions within an engine bay while meeting stringent environmental standards. The quality, availability, and cost of these raw materials significantly influence the downstream manufacturing processes and the final product attributes.

Moving further down the value chain, the core transformation and manufacturing processes are undertaken by Tier 1 and Tier 2 automotive suppliers who specialize in insulation and acoustic solutions. This stage involves sophisticated manufacturing techniques such as injection molding, thermoforming, compression molding, and various lamination and bonding processes to convert raw materials into precisely shaped engine covers, shields, and full compartment encapsulations. These manufacturers invest heavily in advanced tooling and automation to ensure high volume production, consistent quality, and adherence to tight dimensional tolerances. Efficient production planning, lean manufacturing principles, and rigorous quality control are critical here to meet the exacting standards of automotive OEMs. The expertise in engineering design and material application during this phase is key to optimizing the thermal and acoustic performance of the final encapsulation system, ensuring seamless integration into complex vehicle architectures.

The distribution channel primarily operates as a direct-to-OEM model. Encapsulation manufacturers typically establish long-term supply agreements with automotive Original Equipment Manufacturers, integrating their products into the vehicle assembly lines during the new vehicle production phase. This direct channel requires strong technical collaboration, just-in-time delivery capabilities, and a deep understanding of OEM design cycles and specifications. While the OEM channel dominates, an indirect distribution channel also exists, catering to the aftermarket. This involves suppliers providing replacement or upgrade encapsulation components through automotive parts distributors, dealerships, and independent repair shops. The aftermarket segment, though smaller, is crucial for vehicle maintenance and extended component lifespan. The efficiency of logistics, supply chain management, and strong customer relationships are vital across both direct and indirect channels to ensure timely delivery and market responsiveness, contributing significantly to the overall value proposition of engine encapsulation solutions.

Automotive Engine Encapsulation Market Potential Customers

The primary potential customers for the Automotive Engine Encapsulation Market are the global automotive Original Equipment Manufacturers (OEMs). These companies, ranging from established giants to emerging electric vehicle manufacturers, are the direct buyers and integrators of encapsulation systems into their production lines for new vehicles. OEMs procure these solutions to address a multitude of critical objectives, including stringent regulatory compliance related to vehicle emissions and noise, enhancing the thermal management of engines and hybrid/electric components for improved efficiency, and delivering a superior in-cabin acoustic experience to their end consumers. The engineering and procurement departments within these OEMs meticulously evaluate suppliers based on material innovation, manufacturing capabilities, cost-effectiveness, and the ability to meet complex design specifications for a wide array of vehicle platforms, from compact passenger cars to heavy-duty commercial trucks.

Beyond the direct automotive OEMs, a secondary but growing customer segment includes aftermarket suppliers and distributors. These entities cater to the demand for replacement parts for existing vehicles or provide upgrade solutions for car owners looking to enhance the noise insulation or thermal efficiency of their older models. While this segment represents a smaller portion of the overall market, it plays a vital role in extending the lifespan of vehicles and offering customization options. Additionally, specialty vehicle manufacturers, such as those producing construction equipment, agricultural machinery, or marine engines, also represent potential customers. Although their volumes may be lower, their specific requirements for robust thermal and acoustic solutions in harsh operating environments often necessitate highly customized encapsulation products.

The decision-making process for these potential customers is complex and multi-layered. For OEMs, it typically involves extensive collaboration between their R&D, engineering, and procurement teams. The selection of an encapsulation supplier is often a long-term commitment, influenced by factors such as the supplier's technological capabilities, proven track record, ability to co-develop solutions, global manufacturing footprint, and competitive pricing. Performance criteria, including tested thermal conductivity, sound absorption coefficients, durability under extreme temperatures, and resistance to fluids, are paramount. For aftermarket customers, factors like product availability, ease of installation, and cost-effectiveness often take precedence. Understanding these diverse customer needs and their decision criteria is essential for market players to effectively position their offerings and secure long-term contracts within the automotive engine encapsulation ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.8 Billion |

| Market Forecast in 2032 | USD 10.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Autoneum, BASF SE, Continental AG, ElringKlinger AG, Faurecia (FORVIA), Federal-Mogul LLC (Tenneco), Magna International Inc., Lydall Inc., Rochling Group, SA Automotive, Adler Pelzer Group, Sinterwerke GmbH, Sumitomo Riko Company Limited, Toyoda Gosei Co Ltd, Woco Industrietechnik GmbH, Aspen Aerogels Inc., Morgan Advanced Materials, Saint-Gobain, Zotefoams plc, Treves S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Engine Encapsulation Market Key Technology Landscape

The Automotive Engine Encapsulation Market is characterized by a dynamic and evolving technology landscape, where innovation in material science and manufacturing processes is paramount. At the core are advanced materials designed to provide superior thermal and acoustic insulation properties while adhering to strict weight reduction targets. This includes the development of multi-layered composite structures that combine different material types, such as polymer foams, high-performance felts (e.g., glass fiber, polyester), and elastomeric layers, to achieve optimized performance. Nanotechnology is also emerging, enabling the creation of materials with enhanced insulating capabilities at lower densities. Furthermore, the focus is on developing materials that are flame-retardant, resistant to oils and chemicals, and capable of withstanding extreme temperature cycles, ensuring durability and safety within the harsh engine environment. The push for sustainability also drives the adoption of recycled and bio-based materials, alongside processes that minimize waste.

Manufacturing technologies play a crucial role in transforming these advanced materials into complex, precisely fitted encapsulation components. Key processes include intricate thermoforming and injection molding techniques for polymer-based parts, enabling the creation of customized shapes and integrated features. Compression molding is utilized for fiber-based composites and felts, allowing for high-density, high-performance structures. Robotic assembly and advanced bonding technologies are also essential for creating multi-component encapsulation systems that are lightweight yet robust. The ongoing automation in production lines aims to improve efficiency, reduce labor costs, and ensure consistent quality, which is critical for meeting the high volume demands of the automotive industry. Precision engineering ensures that components fit seamlessly into the compact and intricate engine bays of modern vehicles, contributing to ease of installation and overall system effectiveness.

Beyond materials and manufacturing, the technology landscape encompasses sophisticated design and simulation tools. Computational Fluid Dynamics (CFD) is extensively used to model heat transfer and airflow within the engine compartment, allowing engineers to optimize thermal management strategies. Finite Element Analysis (FEA) is applied to predict the structural integrity and vibration characteristics of encapsulation components, ensuring durability and effective noise dampening. Advanced acoustic simulation software helps in predicting sound propagation and identifying optimal placement and material combinations for noise reduction. These digital tools significantly reduce the need for physical prototyping, accelerating the development cycle, reducing costs, and enabling rapid iteration of designs to meet evolving performance requirements and regulatory standards. The integration of sensors for real-time monitoring of temperature and noise levels also represents a forward-looking technological area, potentially leading to adaptive encapsulation systems.

Regional Highlights

- North America: This region is a mature and significant market for automotive engine encapsulation, characterized by strong demand for premium vehicles that prioritize comfort, quietness, and fuel efficiency. Stringent emission regulations (such as CAFE standards) and increasing focus on NVH reduction drive the adoption of advanced encapsulation solutions. The presence of major automotive OEMs and a well-developed supply chain infrastructure contribute to consistent market growth. Innovation often centers on lightweighting and integrating multi-functional materials to cater to diverse vehicle types, including large SUVs and pickup trucks prevalent in the region.

- Europe: Europe stands as a leading market, distinguished by some of the world's most rigorous environmental and noise regulations, notably the Euro emissions standards and UNECE R51-03 for pass-by noise. This regulatory pressure, combined with a strong consumer preference for sophisticated and high-performance vehicles, propels the adoption of comprehensive and technologically advanced engine encapsulation systems. Countries like Germany, France, and the UK are pivotal, hosting significant research and development activities and a robust automotive manufacturing base that continually pushes the boundaries of thermal and acoustic management solutions. The push for electrification also creates new demands for precise thermal control.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, primarily fueled by the substantial and expanding automotive production volumes in countries such as China, India, Japan, and South Korea. Rising disposable incomes across the region lead to increasing consumer demand for vehicles with enhanced comfort features and improved fuel economy. Evolving and progressively stricter emission and noise standards in these nations further compel local and international OEMs to adopt advanced encapsulation technologies. While cost-effectiveness remains a key consideration, there is a growing emphasis on balancing affordability with high-performance insulation solutions.

- Latin America: The Latin American market for automotive engine encapsulation is experiencing moderate growth, largely influenced by increasing vehicle production capacities and a gradual maturation of regulatory frameworks in key countries like Brazil and Mexico. Economic stability, foreign direct investment in the automotive sector, and the expansion of local manufacturing capabilities are crucial determinants for market development. The demand here is often driven by a need for foundational acoustic and thermal management, with an increasing shift towards more advanced solutions as consumer expectations and environmental consciousness rise.

- Middle East and Africa (MEA): This region represents a nascent but steadily developing market for engine encapsulation. Growth is primarily underpinned by increasing vehicle sales, infrastructure development, and a gradual rise in demand for modern vehicles equipped with improved performance and comfort features. While the regulatory push for advanced encapsulation technologies might be slower compared to more developed regions, urbanization and a rising focus on imported vehicle standards are gradually influencing market dynamics. Suppliers entering this market often focus on robust, adaptable solutions suitable for diverse climatic conditions and local market demands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Engine Encapsulation Market.- Autoneum

- BASF SE

- Continental AG

- ElringKlinger AG

- Faurecia (FORVIA)

- Federal-Mogul LLC (Tenneco)

- Magna International Inc.

- Lydall Inc.

- Rochling Group

- SA Automotive

- Adler Pelzer Group

- Sinterwerke GmbH

- Sumitomo Riko Company Limited

- Toyoda Gosei Co Ltd

- Woco Industrietechnik GmbH

- Aspen Aerogels Inc.

- Morgan Advanced Materials

- Saint-Gobain

- Zotefoams plc

- Treves S.A.

Frequently Asked Questions

What is automotive engine encapsulation?

Automotive engine encapsulation involves surrounding an engine with thermal and acoustic insulation materials to manage heat, reduce noise, and improve vehicle efficiency and comfort.

Why is engine encapsulation important for modern vehicles?

It is crucial for meeting stringent noise and emission regulations, enhancing fuel economy by optimizing engine temperature, and improving cabin acoustics for passenger comfort and refinement.

What materials are commonly used for engine encapsulation?

Common materials include specialized foamed plastics (e.g., polyurethane, polypropylene), high-performance felts (e.g., polyester, glass fiber), elastomers, and advanced composite materials.

How does engine encapsulation contribute to fuel efficiency?

By retaining engine heat, encapsulation facilitates faster engine warm-up, reduces cold-start emissions, and enables more efficient operation, directly contributing to better fuel economy.

What are the key drivers for the growth of the engine encapsulation market?

Key drivers include stringent global emission and noise regulations, increasing consumer demand for quieter and more fuel-efficient vehicles, and the accelerating production of hybrid and electric vehicles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager