Automotive Engineering Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428427 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Engineering Services Market Size

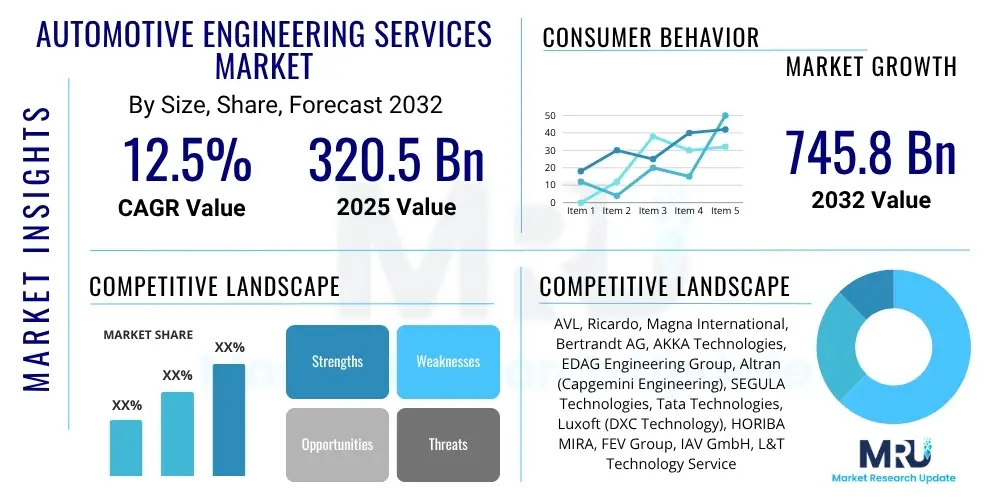

The Automotive Engineering Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 320.5 Billion in 2025 and is projected to reach USD 745.8 Billion by the end of the forecast period in 2032.

Automotive Engineering Services Market introduction

The Automotive Engineering Services market encompasses a broad spectrum of specialized technical and intellectual capabilities provided to automotive manufacturers and suppliers throughout the entire vehicle lifecycle, from conceptualization and design to manufacturing, testing, and post-production support. These services are crucial for developing innovative, efficient, and compliant vehicles in a rapidly evolving industry. They involve the application of scientific and technological principles to design, develop, and operate automotive systems, components, and vehicles, addressing intricate challenges related to performance, safety, sustainability, and connectivity. The scope extends across various domains, including mechanical, electrical, software, and systems engineering, providing critical support for complex product development cycles.

Product description within this market primarily refers to the diverse range of services offered, rather than a tangible physical product. These services include, but are not limited to, concept development, styling, computer-aided design (CAD), computer-aided engineering (CAE) for simulation and analysis, prototyping, testing and validation, powertrain development (for internal combustion engines, hybrid, and electric vehicles), chassis engineering, body-in-white (BiW) development, and advanced driver-assistance systems (ADAS) development. Furthermore, with the advent of software-defined vehicles, significant emphasis is now placed on embedded software development, cybersecurity, and connectivity solutions. These offerings are tailored to assist clients in overcoming technical hurdles, optimizing designs, and ensuring regulatory compliance, thereby accelerating their product development timelines and reducing overall costs.

Major applications for automotive engineering services span across passenger cars, commercial vehicles, electric vehicles, and autonomous driving platforms. The benefits of utilizing these services are manifold, including access to specialized expertise, reduced time-to-market for new vehicle models, cost efficiencies through outsourcing, enhanced product quality, and improved compliance with increasingly stringent global regulations. Key driving factors propelling market growth include the rapid technological advancements in electric vehicles (EVs), autonomous driving (AD), and connected car technologies. Additionally, the escalating complexity of vehicle architectures, coupled with the pressure for manufacturers to innovate while optimizing resources, further fuels the demand for these specialized engineering services across the global automotive landscape.

Automotive Engineering Services Market Executive Summary

The Automotive Engineering Services market is undergoing profound transformations, driven by a confluence of technological advancements, evolving consumer demands, and regulatory shifts. Current business trends indicate a significant pivot towards software and electronics engineering services, reflecting the industry's focus on software-defined vehicles, advanced infotainment systems, and robust cybersecurity solutions. The increasing adoption of digital twin technology, cloud-based engineering platforms, and artificial intelligence for simulation and testing is optimizing development cycles and enhancing product innovation. Furthermore, partnerships and collaborations between traditional automotive players and technology firms are becoming more prevalent, aimed at sharing expertise and resources to accelerate the development of next-generation mobility solutions, underscoring a strategic shift in market dynamics towards integrated and collaborative ecosystems.

Regional trends highlight distinct growth patterns and innovation hubs across the globe. Asia Pacific, particularly countries like China and India, is emerging as a dominant force due to its burgeoning automotive manufacturing base, increasing investments in electric vehicle production, and a strong pool of skilled engineering talent available at competitive costs. North America and Europe, while representing mature markets, are at the forefront of innovation, leading in the development of autonomous driving technologies, advanced powertrain solutions, and sophisticated software platforms. These regions are characterized by stringent regulatory environments that necessitate advanced engineering solutions for emissions reduction and safety enhancements, thereby sustaining demand for high-value-added services. Latin America and the Middle East and Africa regions are experiencing steady growth, driven by localized manufacturing expansions and increasing vehicle parc, leading to a demand for services tailored to regional market needs.

Segment trends within the Automotive Engineering Services market reveal dynamic shifts. While traditional areas like design and styling, along with product engineering, continue to hold substantial market share, the fastest growth is observed in the software and electronics engineering segment. This surge is directly attributable to the escalating complexity of in-vehicle electronics, the demand for sophisticated ADAS features, and the imperative for secure and seamless connectivity. Powertrain engineering is also experiencing a significant transformation, with a pronounced shift from internal combustion engine (ICE) focus towards battery electric vehicle (BEV), hybrid electric vehicle (HEV), and fuel cell electric vehicle (FCEV) development. Testing and validation services are gaining importance as vehicle systems become more integrated and complex, requiring rigorous verification across hardware, software, and real-world conditions to ensure reliability and safety, thus reflecting a holistic demand for comprehensive lifecycle support.

AI Impact Analysis on Automotive Engineering Services Market

Common user questions regarding the impact of Artificial Intelligence on the Automotive Engineering Services market frequently center on its potential to revolutionize vehicle design, development, and testing processes. Users are keen to understand how AI can accelerate product innovation, reduce development costs, and improve vehicle safety and performance. Specific inquiries often involve AI's role in autonomous driving system development, predictive maintenance, optimizing manufacturing processes, and creating personalized in-car experiences. Concerns often touch upon data privacy and security implications, the ethical considerations of AI in critical systems, the potential for job displacement among engineers, and the significant investment required for AI infrastructure and talent acquisition. Expectations are generally high, anticipating that AI will serve as a powerful enabler for next-generation automotive solutions, leading to smarter, safer, and more efficient vehicles, while also streamlining complex engineering workflows and fostering new service offerings tailored to an increasingly digital automotive landscape.

The integration of Artificial Intelligence (AI) into Automotive Engineering Services is fundamentally reshaping the industry, offering unprecedented capabilities for efficiency, innovation, and problem-solving. AI-driven simulation and modeling tools significantly reduce the need for physical prototypes, allowing engineers to iterate designs rapidly and explore a wider range of possibilities virtually. This accelerates the design and development phases, enabling faster time-to-market for new vehicle features and models. AI algorithms are particularly adept at analyzing vast datasets generated during vehicle testing, identifying anomalies, predicting failures, and optimizing performance parameters with a precision unattainable through traditional methods. This leads to more robust and reliable vehicle components and systems, enhancing overall product quality and reducing warranty costs for manufacturers.

Furthermore, AI is pivotal in the development of advanced driver-assistance systems (ADAS) and fully autonomous driving (AD) technologies. Machine learning algorithms power perception systems, decision-making processes, and path planning, continuously learning and improving from real-world driving data. This requires specialized engineering services focused on data annotation, algorithm development, validation in virtual and real environments, and ensuring the safety and ethical considerations of AI deployment. Beyond autonomous functions, AI is also transforming manufacturing engineering by optimizing production lines through predictive maintenance of machinery, quality control via computer vision, and efficient resource allocation. The demand for engineering services skilled in AI integration, data science, and machine learning model deployment is therefore escalating rapidly, necessitating a significant upskilling and refocusing of the automotive engineering workforce to meet these advanced technological requirements.

- Accelerated Design and Development: AI-powered generative design and simulation tools drastically reduce design cycles, enabling rapid iteration and optimization of components and systems.

- Enhanced Predictive Maintenance: AI algorithms analyze vehicle sensor data to predict component failures, optimizing maintenance schedules and reducing downtime for vehicles.

- Improved Autonomous Driving Systems: Machine learning models are crucial for developing robust perception, planning, and control modules for self-driving vehicles, requiring extensive data processing and algorithm refinement.

- Optimized Manufacturing Processes: AI-driven analytics and robotics improve efficiency, quality control, and fault detection in automotive production lines, minimizing waste and increasing throughput.

- Personalized In-Car Experiences: AI enables customized user interfaces, intelligent assistants, and adaptive vehicle settings based on driver preferences and behavior, enhancing occupant comfort and convenience.

- Advanced Data Analytics and Insights: AI provides deep insights from vast amounts of vehicle data, aiding in design improvements, performance optimization, and understanding usage patterns for future product development.

- Cybersecurity Enhancements: AI-powered threat detection and anomaly recognition improve the cybersecurity posture of connected vehicles, proactively identifying and mitigating potential vulnerabilities.

DRO & Impact Forces Of Automotive Engineering Services Market

The Automotive Engineering Services market is shaped by a complex interplay of drivers, restraints, and opportunities, all influenced by various impact forces. Key drivers include the relentless pace of technological innovation, particularly in electrification, autonomous driving, and connectivity, which necessitate highly specialized engineering expertise beyond the in-house capabilities of many OEMs. The global push for stringent emission regulations and enhanced safety standards also compels manufacturers to invest heavily in advanced engineering solutions, driving demand for services that can ensure compliance and performance. Moreover, the increasing complexity of modern vehicle architectures, coupled with the desire for faster product development cycles and cost optimization, further incentivizes outsourcing engineering tasks to specialized service providers, who can leverage economies of scale and expertise to deliver efficient and cutting-edge solutions.

However, the market also faces significant restraints. The substantial capital investment required for state-of-the-art R&D facilities, advanced software tools, and testing equipment can be prohibitive for smaller firms. Intellectual property concerns and the need for robust data security measures are paramount when outsourcing sensitive design and development work, posing challenges in establishing trust and secure collaboration. A persistent talent gap, particularly for highly specialized skills in areas like AI, machine learning, and cybersecurity within automotive contexts, limits the availability of qualified personnel and can drive up labor costs. Furthermore, intense competition among service providers, coupled with global macroeconomic uncertainties and geopolitical tensions, can impact market stability and growth projections, necessitating agile business strategies and continuous innovation to maintain competitive edge.

Despite these restraints, numerous opportunities are emerging, promising substantial growth for the market. The rise of new mobility solutions, such as shared mobility, micro-mobility, and subscription-based vehicle services, presents fresh avenues for engineering support in developing tailored platforms and ecosystems. Expanding into high-growth emerging markets, particularly those with nascent but rapidly developing automotive industries, offers significant potential for service providers. The widespread adoption of digital twin technology and advanced simulation platforms enables comprehensive virtual testing and validation, reducing physical prototyping costs and accelerating development. Moreover, the increasing demand for end-to-end cybersecurity solutions for connected vehicles, and the integration of sustainable engineering practices throughout the product lifecycle, represent lucrative growth areas. These impact forces collectively push the industry towards continuous innovation, specialization, and strategic partnerships, fundamentally redefining the value proposition of automotive engineering services providers.

Segmentation Analysis

The Automotive Engineering Services market is comprehensively segmented across various dimensions, including service type, application, location, and end-user, providing a granular view of market dynamics and specialized demand areas. This detailed segmentation helps in understanding the diverse requirements of clients across the automotive value chain and allows service providers to tailor their offerings to specific market niches. The primary aim of this segmentation is to categorize the vast array of engineering support functions and their deployment models, reflecting the multi-faceted nature of modern vehicle development and the increasingly specialized expertise required to address complex technological challenges.

- By Service Type:

- Design & Styling: Conceptualization, industrial design, HMI (Human-Machine Interface) design, interior and exterior styling, visualization, CAD modeling.

- Product Engineering: Concept development, architecture design, CAE (Computer-Aided Engineering) for structural analysis, crash simulation, NVH (Noise, Vibration, Harshness) analysis, CAD (Computer-Aided Design), DFM (Design for Manufacturability), material selection.

- Powertrain Engineering: Internal Combustion Engine (ICE) development and optimization, hybrid powertrain systems engineering, battery electric vehicle (BEV) powertrain development, fuel cell electric vehicle (FCEV) integration, transmission design, emissions control.

- Body in White (BiW) Engineering: Structural design, lightweighting solutions, material optimization, joining technologies, crashworthiness enhancements, rigidity and durability analysis.

- Chassis Engineering: Suspension design, steering systems, braking systems, vehicle dynamics, ride and handling optimization, wheel and tire engineering.

- Manufacturing Engineering: Production line planning and optimization, process automation, tooling and fixture design, quality control systems, supply chain integration, assembly sequence planning.

- Testing & Validation: Prototype testing, component testing, system validation, environmental testing, durability testing, performance evaluation, regulatory compliance testing, ADAS/AD validation.

- Software & Electronics Engineering: Embedded software development, ECU (Electronic Control Unit) design, infotainment systems, telematics, sensor integration, control systems, diagnostics, firmware development.

- Connectivity Services: V2X (Vehicle-to-Everything) communication, telematics units, cloud integration, IoT solutions, in-car Wi-Fi, over-the-air (OTA) updates, fleet management systems.

- Cybersecurity Services: Threat analysis and risk assessment (TARA), secure coding practices, penetration testing, intrusion detection systems, secure boot, data encryption, compliance with automotive cybersecurity standards.

- Aftermarket & Service Engineering: Diagnostics tools development, service manual creation, spare parts engineering, field defect analysis, warranty management support, technical training.

- By Application:

- Passenger Cars: Sedans, SUVs, hatchbacks, luxury vehicles, sports cars, catering to individual mobility needs and comfort.

- Commercial Vehicles: Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), buses, trucks, vans, focusing on utility, payload, and operational efficiency.

- Electric Vehicles (EVs): Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Fuel Cell Electric Vehicles (FCEV), covering all aspects of electrification, from battery management systems to charging infrastructure integration.

- Autonomous Vehicles: Level 2 to Level 5 autonomous driving systems, encompassing sensor fusion, AI algorithms, decision-making software, and validation for self-driving functionalities.

- Special Purpose Vehicles: Construction equipment, agricultural machinery, military vehicles, emergency vehicles, requiring highly specialized engineering for specific operational environments and safety standards.

- By Location:

- On-shore: Services delivered within the client's domestic country, often preferred for highly sensitive projects requiring close collaboration, immediate access, and strong cultural alignment.

- Off-shore: Services delivered from a foreign country, typically leveraged for cost advantages, access to a larger talent pool, and round-the-clock development cycles due to time zone differences.

- By End-User:

- Original Equipment Manufacturers (OEMs): Major automotive companies that design, build, and sell vehicles under their own brand, utilizing engineering services for new platform development, vehicle launches, and technology integration.

- Tier 1 Suppliers: Companies that directly supply parts or systems to OEMs, relying on engineering services for component design, system integration, and advanced manufacturing solutions.

- Technology Companies: Non-traditional automotive players, including software firms, AI specialists, and semiconductor manufacturers, entering the automotive space to develop new mobility services, autonomous platforms, and digital solutions.

- Startups: Emerging companies focused on niche automotive technologies, such as EV battery innovations, autonomous shuttle services, or specialized sensor development, seeking external engineering expertise to accelerate their product development and market entry.

Value Chain Analysis For Automotive Engineering Services Market

The value chain for the Automotive Engineering Services market is a complex ecosystem, characterized by intricate relationships between various stakeholders, from upstream technology providers to downstream end-users. At the upstream level, the value chain begins with providers of foundational technologies and tools essential for engineering processes. This includes developers of CAD, CAE, CAM software, Product Lifecycle Management (PLM) systems, simulation and modeling platforms, and specialized testing equipment. These technology providers form the bedrock upon which engineering services are built, offering the sophisticated instruments and platforms that enable complex design, analysis, and validation activities. The quality and innovation of these upstream inputs directly impact the efficiency and effectiveness of the engineering services delivered, fostering a continuous feedback loop for improvement and development of new capabilities.

Mid-stream in the value chain are the automotive engineering service providers themselves. These companies leverage the upstream tools and their own human capital—comprising highly skilled engineers, designers, and software developers—to offer a wide array of services. This includes everything from conceptual design and prototyping to advanced simulation, powertrain development, software integration, and comprehensive testing and validation. These providers add significant value by translating client requirements into actionable engineering solutions, optimizing vehicle performance, ensuring regulatory compliance, and accelerating time-to-market. Their expertise often spans multiple engineering disciplines, allowing them to tackle integrated challenges such as the development of electric vehicle platforms or complex autonomous driving systems, acting as crucial extensions of the client's internal R&D capabilities.

Downstream in the value chain are the end-users, primarily Original Equipment Manufacturers (OEMs), Tier 1 suppliers, and increasingly, technology companies entering the automotive sector. OEMs engage engineering service providers to augment their internal R&D teams, access specialized expertise, and manage peak workloads during new product development cycles. Tier 1 suppliers rely on these services for the development and optimization of components and sub-systems that they supply to OEMs. Distribution channels for these services are predominantly direct, involving long-term strategic partnerships and project-based contracts established directly between service providers and their clients. Indirect channels may involve consultancy firms or industry consortiums that facilitate connections, though the highly specialized nature of the services often necessitates a direct engagement model to ensure clear communication, intellectual property protection, and customized solution delivery across the global automotive industry.

Automotive Engineering Services Market Potential Customers

The Automotive Engineering Services market primarily caters to a diverse range of end-users and buyers who seek specialized expertise and capabilities to navigate the intricate and rapidly evolving landscape of vehicle development. The most prominent potential customers are Original Equipment Manufacturers (OEMs), who constantly strive to innovate and bring new models to market, ranging from traditional combustion engine vehicles to advanced electric and autonomous platforms. OEMs require comprehensive engineering support across the entire product lifecycle, from initial concept development and styling to sophisticated system integration, rigorous testing, and manufacturing process optimization. They often face challenges in maintaining broad in-house expertise across all emerging technologies, making outsourcing a strategic imperative to access cutting-edge skills and accelerate their development timelines while managing costs effectively.

Another significant segment of potential customers comprises Tier 1 suppliers, who are crucial partners in the automotive ecosystem, responsible for designing, developing, and manufacturing critical components and sub-systems for OEMs. These suppliers frequently engage engineering service providers for specialized tasks such as advanced material research, component design validation, embedded software development for their specific systems, and ensuring compliance with stringent automotive standards. As vehicle architectures become more complex and integrated, Tier 1 suppliers increasingly need advanced engineering support to develop highly sophisticated modules like ADAS sensors, battery management systems, and infotainment units, necessitating external expertise to stay competitive and meet their customers' demanding specifications.

Beyond traditional automotive players, a rapidly expanding customer base includes technology companies, software developers, and startups that are increasingly entering the automotive space. These entities are focused on developing new mobility solutions, autonomous driving software, advanced connectivity platforms, and novel in-car digital experiences. Their engineering needs often revolve around AI and machine learning integration, cybersecurity for connected vehicles, cloud infrastructure development, and sophisticated software testing and validation. These new entrants often lack deep automotive domain knowledge and manufacturing expertise, making engineering service providers indispensable partners for bringing their innovative technologies to market effectively and efficiently, fostering a synergistic relationship that drives innovation across the entire mobility sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 320.5 Billion |

| Market Forecast in 2032 | USD 745.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AVL, Ricardo, Magna International, Bertrandt AG, AKKA Technologies, EDAG Engineering Group, Altran (Capgemini Engineering), SEGULA Technologies, Tata Technologies, Luxoft (DXC Technology), HORIBA MIRA, FEV Group, IAV GmbH, L&T Technology Services, KPIT Technologies, Wipro Limited, HCL Technologies, Alten Group, Semcon, Technica Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Engineering Services Market Key Technology Landscape

The Automotive Engineering Services market relies heavily on a sophisticated and continuously evolving technology landscape, which forms the backbone of modern vehicle development. Central to this are Computer-Aided Design (CAD), Computer-Aided Engineering (CAE), and Computer-Aided Manufacturing (CAM) tools. These software suites enable engineers to design, analyze, simulate, and optimize vehicle components and systems virtually, significantly reducing the need for physical prototypes and accelerating the design iteration process. CAE, in particular, allows for complex simulations such of crashworthiness, structural integrity, fluid dynamics, and noise, vibration, and harshness (NVH), providing critical insights into vehicle performance and safety long before physical production. The continuous advancements in these tools, including integration with cloud computing, allow for more complex simulations and collaborative engineering across geographically dispersed teams, thereby enhancing efficiency and precision.

Product Lifecycle Management (PLM) software plays a crucial role in managing the entire lifecycle

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager