Automotive Evaporative Emission Control System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430285 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Automotive Evaporative Emission Control System Market Size

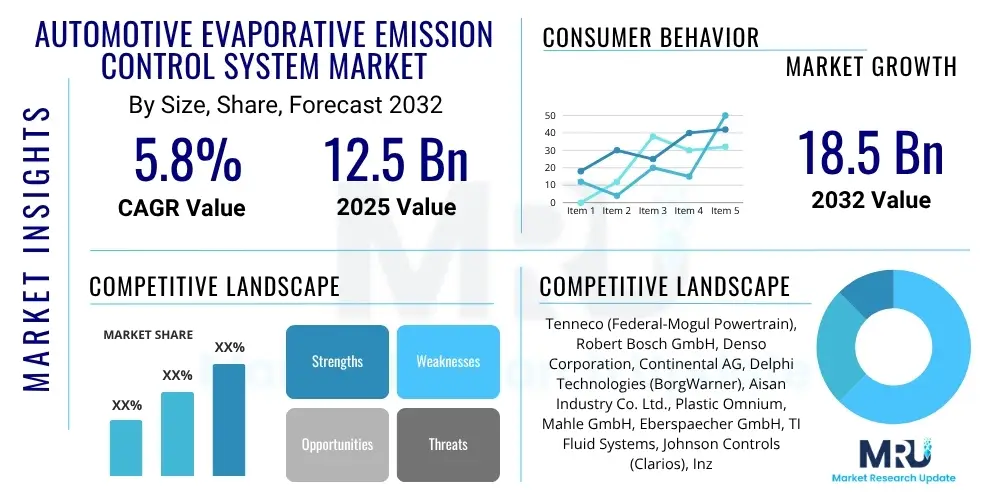

The Automotive Evaporative Emission Control System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 12.5 Billion in 2025 and is projected to reach USD 18.5 Billion by the end of the forecast period in 2032.

Automotive Evaporative Emission Control System Market introduction

The Automotive Evaporative Emission Control (EVAP) System market is a critical segment within the automotive industry, primarily driven by stringent global environmental regulations aimed at reducing air pollution from vehicle emissions. This system is meticulously designed to prevent gasoline vapors, which are harmful volatile organic compounds (VOCs), from escaping into the atmosphere from the fuel tank and fuel system components. The primary product components include activated charcoal canisters, which absorb fuel vapors; purge valves, which control the flow of captured vapors to the engine for combustion; fuel tank pressure sensors, which monitor the pressure within the fuel system to detect leaks; and an intricate network of hoses and lines connecting these components to the engine and fuel tank, all managed by the vehicle's electronic control unit (ECU). These systems are predominantly applied in gasoline-powered passenger vehicles and various commercial vehicle types, including light-duty and heavy-duty vehicles, as well as hybrid electric vehicles that still utilize internal combustion engines. The fundamental benefits of EVAP systems extend beyond regulatory compliance, significantly contributing to improved air quality by minimizing ozone-forming pollutants and certain greenhouse gases, while also indirectly aiding fuel efficiency by returning previously vented fuel vapors to the engine for consumption. The market is fundamentally driven by the continuous tightening of emission standards across major automotive markets, the ongoing increase in global vehicle production, and sustained technological advancements in system components that enhance efficiency, durability, and diagnostic capabilities. These advancements often involve smart materials, integrated sensor technologies, and optimized system architectures that ensure robust performance over the vehicle's operational lifespan, necessitating consistent investment in research and development by key players in the value chain.

Automotive Evaporative Emission Control System Market Executive Summary

The Automotive Evaporative Emission Control System market is experiencing a dynamic phase characterized by evolving business trends, significant regional shifts, and diverse segmental growth. Key business trends indicate a strong emphasis on developing more compact, lightweight, and highly efficient EVAP components, driven by the overall automotive industry's push for vehicle electrification and weight reduction to improve fuel economy and reduce emissions. There is also an increasing focus on integrated diagnostic capabilities within EVAP systems, leveraging advanced sensors and software to detect leaks or malfunctions proactively, thus ensuring continuous compliance and enhancing vehicle reliability. Strategic partnerships between component manufacturers and original equipment manufacturers (OEMs) are becoming prevalent, fostering innovation in materials and system design, particularly as manufacturers strive to meet Euro 7 and CAFE standards. From a regional perspective, Asia Pacific, led by China and India, represents the largest and fastest-growing market due due to booming vehicle production, rising disposable incomes, and the gradual implementation of stricter emission regulations. North America and Europe continue to be mature markets characterized by exceptionally stringent existing regulations, driving demand for advanced and highly compliant systems, with a strong aftermarket presence for replacement parts. Latin America, the Middle East, and Africa are emerging as significant growth territories, spurred by increasing urbanization, expanding automotive fleets, and the progressive adoption of global emission norms. Segment-wise, the canister segment, particularly those utilizing advanced activated carbon formulations, is poised for robust growth due to its central role in vapor absorption, alongside innovations in purge valves for precision control. The passenger car segment remains the dominant vehicle type due to higher production volumes, although commercial vehicles are increasingly incorporating sophisticated EVAP technologies. The OEM channel continues to account for the largest share, reflecting the integration of these systems during vehicle manufacturing, while the aftermarket segment grows steadily for maintenance and repairs, offering opportunities for specialized component suppliers and service providers.

AI Impact Analysis on Automotive Evaporative Emission Control System Market

User inquiries regarding the impact of Artificial Intelligence on the Automotive Evaporative Emission Control System market frequently explore how AI can enhance system efficiency, reliability, and diagnostic capabilities. Common questions focus on predictive maintenance, the ability of AI to interpret complex sensor data for early fault detection, and its role in optimizing purge cycles for fuel economy. Users also express interest in how AI could facilitate compliance with increasingly stringent regulations through smarter system management and whether AI integration could lead to more robust and less failure-prone EVAP systems. There's also a curiosity about the potential for AI to optimize EVAP system performance in varying environmental conditions and integrate seamlessly with broader vehicle management systems, contributing to overall vehicle intelligence and sustainability goals. The overarching themes revolve around leveraging AI to transition EVAP systems from reactive fault detection to proactive performance optimization and predictive analytics, ultimately reducing warranty costs, improving vehicle longevity, and contributing to cleaner emissions. Users expect AI to bring unprecedented levels of precision and foresight to EVAP system management, moving beyond conventional rule-based diagnostics to a data-driven, adaptive approach, addressing concerns about system complexity and long-term durability in real-world driving conditions.

- AI-driven Predictive Maintenance: Enables early detection of potential EVAP system failures by analyzing real-time sensor data and historical performance patterns, reducing unplanned downtime and maintenance costs.

- Optimized Purge Control: AI algorithms can dynamically adjust purge valve operations based on driving conditions, fuel levels, engine load, and ambient temperature, maximizing fuel efficiency and emission control.

- Enhanced Diagnostic Accuracy: AI can interpret complex fault codes and sensor readings more accurately than traditional methods, pinpointing the exact cause of EVAP system issues, improving repair efficiency.

- Anomaly Detection: Machine learning models can identify subtle anomalies in EVAP system behavior that might indicate impending component degradation or leaks, even before they trigger standard diagnostic trouble codes.

- Integration with Vehicle Telematics: AI can facilitate seamless data exchange between the EVAP system and broader vehicle telematics platforms, allowing for remote monitoring, over-the-air updates, and fleet-wide performance analysis.

- Adaptive Compliance Strategies: AI can help EVAP systems adapt to varying regional emission standards and fuel compositions, ensuring continuous regulatory compliance through intelligent system adjustments.

- Supply Chain Optimization: AI can analyze demand patterns and predict component failures, aiding manufacturers in optimizing production, inventory management, and distribution of EVAP system parts.

DRO & Impact Forces Of Automotive Evaporative Emission Control System Market

The Automotive Evaporative Emission Control System market is significantly influenced by a confluence of drivers, restraints, and opportunities, shaped by powerful impact forces. A primary driver is the relentless tightening of global emission regulations, such as Euro 7 in Europe, LEV III in North America, and China 6, which mandate increasingly lower limits for evaporative emissions, compelling automakers to integrate more sophisticated EVAP systems into their vehicles. The continuous growth in global vehicle production, particularly in emerging economies where vehicle ownership is rising, further fuels demand for these essential pollution control systems. Moreover, ongoing technological advancements, including the development of advanced activated carbon materials for canisters, smart purge valves with enhanced precision, and more robust pressure sensors, are improving system efficiency and diagnostic capabilities, thereby acting as a strong market impetus. However, the market faces notable restraints, including the inherent complexity and relatively high manufacturing costs associated with integrating these multi-component systems into vehicle platforms, which can pressure profit margins for OEMs and component suppliers. A significant long-term restraint is the accelerating adoption of Battery Electric Vehicles (BEVs), which, by their nature, do not require evaporative emission control systems, posing a future challenge to market growth in conventionally fueled vehicles. Diagnostic reliability issues and difficulties in accurately identifying the source of EVAP system malfunctions can also lead to increased warranty claims and consumer dissatisfaction. Despite these challenges, significant opportunities exist for market expansion. The development of advanced 'smart' EVAP systems capable of real-time monitoring, predictive diagnostics, and adaptive control, possibly integrating with AI-driven vehicle health systems, presents a major growth avenue. Opportunities also arise from the potential for optimizing EVAP systems to work synergistically with overall vehicle thermal management, thereby improving total energy efficiency. Furthermore, the expansion into emerging markets, which are progressively adopting more stringent emission standards, offers new frontiers for companies to introduce their proven and advanced EVAP technologies. The market is ultimately impacted by governmental regulatory bodies that dictate emission standards, consumer awareness and demand for environmentally friendly vehicles, and the pace of technological innovation by component manufacturers and research institutions.

Segmentation Analysis

The Automotive Evaporative Emission Control System market is broadly segmented to provide a granular view of its various components, applications, and distribution channels, enabling a comprehensive understanding of market dynamics and growth trajectories. This segmentation allows for precise analysis of demand patterns, technological preferences, and competitive landscapes across different product types, vehicle categories, and geographical regions. Understanding these distinct segments is crucial for stakeholders, including component manufacturers, automotive OEMs, and aftermarket service providers, to tailor their product offerings, sales strategies, and investment decisions. The market can be dissected based on the specific components that constitute the EVAP system, the type of vehicle in which these systems are installed, the fuel type of the vehicles, and the channels through which these systems and their parts are sold to end-users. Each segment and its sub-segments exhibit unique growth drivers and market potential, influenced by technological advancements, regulatory changes, and consumer preferences. This structured approach to market segmentation highlights areas of high growth, identifies niche opportunities, and uncovers potential challenges across the entire value chain. The prominence of certain components like canisters or specific vehicle types such as passenger cars can be clearly evaluated, providing strategic insights for market participants. The segmentation also helps to delineate market shares and competitive intensity within each specific category, aiding in the formulation of targeted market entry and expansion strategies for companies operating in or looking to enter the automotive EVAP system market.

- By Component

- Canister (Activated Carbon Canister)

- Purge Valve (Solenoid Valve)

- Fuel Tank Pressure Sensor (FTPS)

- Solenoid Valves (Vent Solenoid, etc.)

- Hoses and Lines

- Fuel Tank (integrated with EVAP elements)

- Other Sensors and Components (e.g., fuel level sensor, check valve)

- By Vehicle Type

- Passenger Car

- Sedan

- SUV

- Hatchback

- Minivan

- Commercial Vehicle

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Passenger Car

- By Fuel Type

- Gasoline

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Evaporative Emission Control System Market

A comprehensive value chain analysis for the Automotive Evaporative Emission Control System market reveals a complex interplay of various stages, from raw material sourcing to the end-use by consumers, highlighting critical dependencies and value addition at each step. The upstream segment of the value chain is dominated by raw material suppliers providing essential inputs such as various grades of plastics for housing components, specialty metals for valves and sensors, rubber and advanced elastomers for hoses and seals, and crucially, highly porous activated carbon for the canisters. These suppliers play a foundational role, as the quality and cost of these raw materials directly impact the final product's performance and manufacturing economics. Manufacturers then process these materials into individual EVAP components like canisters, purge valves, and pressure sensors, often incorporating specialized technologies and intellectual property. The midstream involves the assembly of these components into complete EVAP systems, typically by Tier 1 automotive suppliers who then deliver these integrated systems to Original Equipment Manufacturers (OEMs). The downstream segment primarily consists of the automotive OEMs, who integrate these EVAP systems into their passenger cars and commercial vehicles during the vehicle assembly process, selling the finished products to dealerships and ultimately to end-consumers. Post-sale, the aftermarket forms a significant part of the downstream, encompassing independent garages, authorized service centers, and spare parts retailers who provide replacement EVAP components for maintenance and repair purposes throughout the vehicle's lifespan. Distribution channels are largely direct from Tier 1 suppliers to OEMs for new vehicle production, ensuring seamless integration and compliance with strict quality standards. For the aftermarket, distribution is more indirect, involving a network of wholesalers, distributors, and retailers who supply parts to service providers and individual consumers. The efficiency and reliability of both direct and indirect channels are crucial for ensuring timely availability of components, supporting both new vehicle production schedules and critical repair needs, ultimately influencing market responsiveness and customer satisfaction.

Automotive Evaporative Emission Control System Market Potential Customers

The primary potential customers for Automotive Evaporative Emission Control Systems and their components are diverse, encompassing various entities across the automotive ecosystem. The largest and most influential customer segment comprises automotive Original Equipment Manufacturers (OEMs), including global giants producing passenger cars, SUVs, light commercial vehicles, and heavy-duty trucks. These OEMs require EVAP systems for integration into their new vehicle models to meet stringent regional and international emission standards before the vehicles can be sold to the public. Their purchasing decisions are driven by factors such as system reliability, cost-effectiveness, compliance with specific regulatory requirements, ease of integration into vehicle architectures, and long-term durability, often involving complex supplier qualification processes and long-term contracts. Beyond new vehicle production, the aftermarket segment represents a substantial and steadily growing customer base. This includes independent repair shops, authorized service centers, fleet maintenance operators, and individual vehicle owners who require replacement EVAP components due to wear and tear, damage, or system malfunctions that trigger diagnostic trouble codes. For the aftermarket, factors such as part availability, pricing, brand reputation, and ease of installation are paramount. Specialized automotive parts distributors and wholesalers also act as intermediaries, purchasing EVAP components from manufacturers to supply the vast network of repair shops and retail outlets. As vehicles age, the demand for aftermarket replacement parts for EVAP systems naturally increases, creating a continuous revenue stream independent of new vehicle sales cycles. Furthermore, government agencies, particularly those focused on environmental compliance and vehicle inspection programs, indirectly influence demand by enforcing regulations that necessitate functional EVAP systems, pushing both OEMs and vehicle owners to ensure their systems are operational. The rise of hybrid electric vehicles also means that their manufacturers are potential customers, as these vehicles still rely on internal combustion engines and thus require EVAP systems. Essentially, anyone involved in the manufacturing, maintenance, or ownership of gasoline-powered or hybrid vehicles constitutes a potential customer for these critical emission control technologies, driven by a universal need for environmental responsibility and regulatory adherence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 12.5 Billion |

| Market Forecast in 2032 | USD 18.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tenneco (Federal-Mogul Powertrain), Robert Bosch GmbH, Denso Corporation, Continental AG, Delphi Technologies (BorgWarner), Aisan Industry Co. Ltd., Plastic Omnium, Mahle GmbH, Eberspaecher GmbH, TI Fluid Systems, Johnson Controls (Clarios), Inzi Controls, Posco, Kautex Textron, Saargummi, Sakata Inx, DSM, Freudenberg Sealing Technologies, Magna International, Hyundai Mobis |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Evaporative Emission Control System Market Key Technology Landscape

The Automotive Evaporative Emission Control System market is continuously evolving through significant advancements in its underlying technology landscape, driven by the dual objectives of enhanced emission reduction and improved system efficiency and durability. At the core of these innovations are advanced activated carbon materials used in canisters, which are being developed with higher adsorption capacities and improved regeneration properties, allowing for more effective capture and release of fuel vapors even under challenging environmental conditions. Manufacturers are also focusing on designing canisters that are more compact and lightweight, utilizing advanced polymers and composite materials to meet evolving vehicle packaging constraints and contribute to overall vehicle weight reduction for better fuel economy. Another crucial technological area involves the development of 'smart' purge valves and vent solenoid valves, which incorporate highly precise electronic controls and sensor feedback to optimize the timing and duration of purge cycles. These smart valves can dynamically adapt to various engine operating conditions, ambient temperatures, and fuel tank pressure readings, ensuring that captured vapors are introduced to the engine for combustion in the most efficient manner possible, thereby maximizing fuel utilization and minimizing emissions. Furthermore, significant progress is being made in fuel tank pressure sensors and leak detection modules, with new designs offering greater accuracy, faster response times, and enhanced resistance to fuel contaminants. These sensors are vital for early detection of even minute leaks in the EVAP system, which is a critical requirement for regulatory compliance and preventing atmospheric pollution. The integration of robust on-board diagnostic (OBD) systems with these components is also paramount, utilizing sophisticated algorithms to monitor the entire EVAP system's integrity and function, providing real-time feedback to the vehicle's ECU and alerting drivers to potential issues. Future technological advancements are expected to focus on further miniaturization, increased modularity for easier integration and servicing, and the incorporation of more predictive analytics and self-learning capabilities, potentially leveraging AI, to ensure the EVAP system operates at peak efficiency throughout the vehicle's entire lifespan, adapting to varying fuel compositions and environmental factors. These innovations collectively aim to make EVAP systems not just compliant, but also intelligent, reliable, and integral to the vehicle's broader environmental performance strategy.

Regional Highlights

- North America: This region represents a mature yet highly significant market for Automotive Evaporative Emission Control Systems, primarily driven by exceptionally stringent emission regulations enforced by bodies like the EPA and CARB. The United States and Canada are pioneers in emission control technologies, leading to high adoption rates of advanced EVAP systems. The robust automotive manufacturing base and a substantial aftermarket for vehicle maintenance contribute significantly to market demand. Ongoing efforts to meet future CAFE standards continue to push for innovative and efficient EVAP solutions, maintaining a consistent demand for sophisticated components and diagnostic capabilities.

- Europe: The European market is characterized by a strong regulatory framework, notably the Euro 6 and upcoming Euro 7 emission standards, which mandate comprehensive evaporative emission control. Countries like Germany, France, and the UK are major contributors to regional market growth due to their significant automotive production and a strong emphasis on environmental protection. The increasing penetration of hybrid electric vehicles, which still require EVAP systems, also sustains market demand. European manufacturers are at the forefront of developing compact, high-performance EVAP components to integrate into diverse vehicle platforms, balancing compliance with fuel efficiency.

- Asia Pacific (APAC): APAC stands as the largest and fastest-growing market for Automotive Evaporative Emission Control Systems, fueled by rapid industrialization, burgeoning vehicle production, and rising disposable incomes, particularly in China, India, Japan, and South Korea. The region has seen a progressive adoption of stringent emission standards, mirroring those in developed economies (e.g., China 6), driving significant demand for EVAP technologies. The presence of numerous global and domestic automotive manufacturers, coupled with expanding vehicle sales, makes APAC a critical region for both OEM and aftermarket EVAP component suppliers.

- Latin America: The market in Latin America is witnessing steady growth, largely influenced by increasing automotive production and the gradual implementation of stricter emission regulations in key countries such as Brazil, Mexico, and Argentina. While regulatory frameworks may lag behind North America or Europe, the trend towards adopting international standards is creating a growing need for compliant EVAP systems. The region's expanding vehicle parc also contributes to a developing aftermarket segment for replacement components, offering opportunities for manufacturers to penetrate these evolving markets.

- Middle East and Africa (MEA): This region is an emerging market for Automotive Evaporative Emission Control Systems, primarily driven by increasing urbanization, economic diversification, and the nascent adoption of international emission standards in some countries. Countries within the GCC (Gulf Cooperation Council) and South Africa are leading the charge, exhibiting a growing demand for modern vehicles equipped with advanced emission control. While the market is currently smaller compared to other regions, the rising awareness of environmental issues and the potential for regulatory harmonization present long-term growth opportunities for EVAP system providers, especially in the aftermarket as vehicle fleets expand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Evaporative Emission Control System Market.- Tenneco (Federal-Mogul Powertrain)

- Robert Bosch GmbH

- Denso Corporation

- Continental AG

- Delphi Technologies (BorgWarner)

- Aisan Industry Co. Ltd.

- Plastic Omnium

- Mahle GmbH

- Eberspaecher GmbH

- TI Fluid Systems

- Johnson Controls (Clarios)

- Inzi Controls

- Posco

- Kautex Textron

- Saargummi

- Sakata Inx

- DSM

- Freudenberg Sealing Technologies

- Magna International

- Hyundai Mobis

Frequently Asked Questions

What is an Automotive Evaporative Emission Control System and why is it essential?

An Automotive Evaporative Emission Control (EVAP) System is designed to capture and store fuel vapors that evaporate from the vehicle's fuel tank and fuel system. It is essential because these vapors contain harmful volatile organic compounds (VOCs) that contribute to air pollution and ground-level ozone formation, making the EVAP system crucial for meeting environmental regulations and improving air quality.

How do EVAP systems prevent gasoline vapors from polluting the atmosphere?

EVAP systems prevent pollution by utilizing an activated charcoal canister to absorb fuel vapors when the engine is off. When the engine is running, a purge valve opens, allowing these captured vapors to be drawn into the engine's intake manifold and burned during the combustion process, thereby converting them into less harmful exhaust gases and preventing their release into the atmosphere.

What are the main components of a typical Automotive Evaporative Emission Control System?

The main components of an EVAP system include the activated charcoal canister for vapor storage, a purge valve that regulates vapor flow to the engine, a vent solenoid valve that controls fresh air intake, a fuel tank pressure sensor (FTPS) for leak detection, and an intricate network of hoses and lines, all monitored and controlled by the vehicle's Engine Control Unit (ECU).

What are common issues or malfunctions associated with EVAP systems?

Common EVAP system issues include faulty purge or vent valves, cracks in hoses or the fuel filler cap, a saturated charcoal canister, or a malfunctioning fuel tank pressure sensor. These problems often trigger the "Check Engine" light, leading to failed emission tests, as they compromise the system's ability to contain and process fuel vapors effectively.

How are EVAP systems adapting to modern vehicle technology, including hybrids?

Modern EVAP systems are becoming more sophisticated, featuring advanced materials for lighter, more efficient canisters and electronically controlled valves for precise vapor management. In hybrid vehicles, EVAP systems are crucial as the gasoline engine may cycle on and off frequently, requiring more dynamic vapor management to prevent emissions during both engine operation and shutdown phases, integrating closely with the hybrid powertrain's ECU for optimal performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager