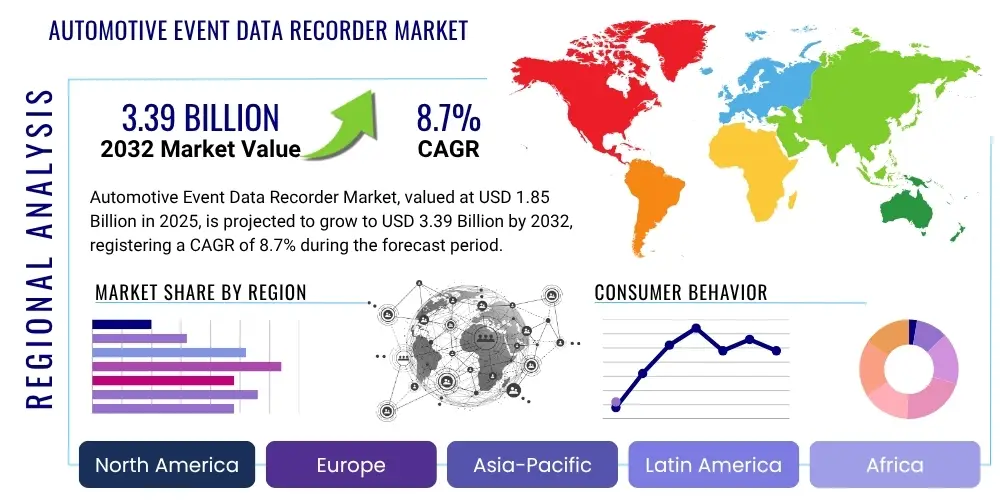

Automotive Event Data Recorder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428737 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Event Data Recorder Market Size

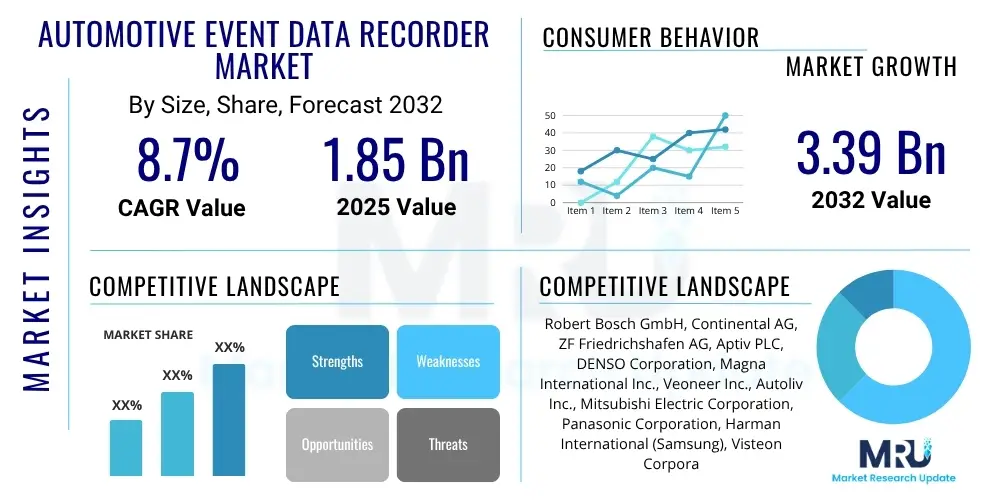

The Automotive Event Data Recorder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2032. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 3.39 Billion by the end of the forecast period in 2032.

Automotive Event Data Recorder Market introduction

The Automotive Event Data Recorder (EDR) market encompasses technologies designed to record critical vehicle data during a collision or an event preceding one. These devices are often referred to as "black boxes" for vehicles, akin to those found in aircraft. They capture a range of parameters including vehicle speed, engine RPM, brake status, airbag deployment timing, seatbelt usage, and steering input, providing an invaluable snapshot of the vehicle's dynamics immediately before, during, and after an impact. The primary product is the EDR module itself, integrated into the vehicle's electronic control unit (ECU) or as a standalone component.

Major applications for EDRs span across various sectors, significantly enhancing safety, insurance assessments, and accident reconstruction efforts. Law enforcement agencies and accident investigators utilize EDR data to understand collision dynamics, assign fault, and identify contributing factors, leading to more accurate incident reports. Insurance companies leverage this data for claims processing, risk assessment, and fraud detection, potentially reducing litigation times and costs. Furthermore, EDR data contributes significantly to automotive safety research, enabling manufacturers to refine vehicle designs and develop more effective safety systems.

The benefits of EDRs are multifaceted, extending from improved vehicle safety and accident investigation accuracy to potential reductions in insurance premiums for drivers with proven safe driving records. Key driving factors propelling market growth include the escalating global demand for enhanced vehicle safety features, stringent governmental regulations mandating EDR installation in new vehicles across various regions, and the continuous advancements in sensor technology and data analytics capabilities. The increasing complexity of modern vehicles and the rise of connected car ecosystems further underscore the importance of EDRs as a foundational element in future automotive safety paradigms.

Automotive Event Data Recorder Market Executive Summary

The Automotive Event Data Recorder market is poised for significant expansion, driven by a confluence of evolving business trends, stringent regulatory landscapes, and dynamic technological advancements across key segments. Business trends indicate a strong focus on integration capabilities, with EDR systems increasingly becoming an integral part of broader vehicle architectures, including advanced driver-assistance systems (ADAS) and telematics solutions. Automotive OEMs are investing heavily in developing proprietary EDR technologies that offer more comprehensive data capture and secure storage, aiming to differentiate their offerings based on enhanced safety features and data integrity. Furthermore, partnerships between EDR manufacturers, insurance providers, and data analytics firms are becoming prevalent, fostering innovative solutions for data utilization and value creation within the automotive ecosystem.

Regional trends highlight distinct growth patterns and regulatory environments. North America and Europe are leading the market due to early adoption of EDR mandates and a high degree of consumer awareness regarding vehicle safety. These regions are characterized by mature automotive industries and robust legal frameworks that support EDR data usage in accident investigations. The Asia Pacific region, particularly countries like China and India, is emerging as a high-growth market, propelled by rapidly expanding automotive production, increasing road safety concerns, and the gradual introduction of EDR regulations. Latin America and the Middle East and Africa are also expected to witness steady growth, albeit at a slower pace, as economic development and infrastructure improvements facilitate greater vehicle penetration and stricter safety standards.

Segment trends underscore the continuous innovation within the EDR market. By component, advanced sensor arrays and robust memory units are experiencing significant demand, reflecting the need for more granular and reliable data capture. The vehicle type segment shows passenger vehicles as the dominant category, driven by mass market adoption and regulatory compliance. However, commercial vehicles are expected to demonstrate strong growth due to increasing fleet management demands and enhanced safety protocols for logistics and transportation. Application-wise, accident reconstruction remains a primary use case, but the role of EDR data in insurance claims processing and predictive maintenance is expanding rapidly, transforming Eraw data into actionable insights for diverse stakeholders.

AI Impact Analysis on Automotive Event Data Recorder Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Automotive Event Data Recorder market often revolve around how AI can enhance EDR capabilities, concerns about data privacy and security with more sophisticated analysis, the potential for predictive accident prevention, and the integration of EDRs with autonomous driving systems. Users are keen to understand if AI can move EDRs beyond mere post-event recording to a more proactive role in vehicle safety, and how AI-driven insights from EDR data might influence insurance models, legal liabilities, and vehicle design. The key themes include augmentation of current EDR functions, ethical considerations of data usage, and the transformative potential for both reactive and proactive safety measures within the automotive landscape.

- AI integration enhances EDR data analysis, enabling quicker and more accurate accident reconstruction by identifying complex patterns and causal factors that might be overlooked by traditional methods.

- Predictive analytics powered by AI can analyze EDR data combined with real-time sensor inputs to identify pre-collision scenarios, potentially triggering preventive actions or warnings to mitigate impending accidents.

- AI algorithms can refine EDR data collection by intelligently filtering irrelevant information, thereby optimizing storage and retrieval processes and focusing on truly critical event parameters.

- Improved data security and integrity through AI-driven encryption and anomaly detection, safeguarding sensitive EDR information from unauthorized access or tampering, addressing privacy concerns.

- AI facilitates the integration of EDRs with advanced driver-assistance systems (ADAS) and autonomous driving platforms, providing crucial feedback for system improvement and validation in complex driving environments.

- Personalized insurance premiums and risk assessment models can be developed using AI to analyze historical EDR data, offering more granular insights into individual driving behaviors and accident probabilities.

- Autonomous vehicle black boxes, leveraging AI, can record intricate decision-making processes and sensor data streams, providing unparalleled transparency and accountability in the event of an incident involving self-driving cars.

DRO & Impact Forces Of Automotive Event Data Recorder Market

The Automotive Event Data Recorder market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively shaping its trajectory and impact forces. A primary driver is the global emphasis on enhancing road safety and reducing traffic fatalities and injuries. Governments and regulatory bodies worldwide are progressively mandating the inclusion of EDRs in new vehicles, recognizing their critical role in accident investigation and prevention. These legislative pushes, exemplified by regulations in the US, EU, and parts of Asia, create a foundational demand for EDR technology. Furthermore, the increasing complexity of modern vehicles, equipped with multiple electronic control units and sophisticated safety systems, necessitates a robust data recording mechanism to understand system performance during critical events.

However, the market faces notable restraints that could temper its growth. Data privacy and security concerns represent a significant hurdle; questions regarding who owns the EDR data, how it is stored, accessed, and used, and the potential for misuse, are prominent among consumers and privacy advocates. The cost of integrating advanced EDR systems, particularly for manufacturers operating on tight margins, can also be a deterrent, impacting vehicle pricing. Public acceptance and awareness, while growing, still require substantial education to fully embrace EDR technology, dispelling misconceptions and building trust in its benefits. Additionally, varying international standards and legal frameworks for EDR data can create complexities for global automotive manufacturers.

Opportunities within the EDR market are substantial and diverse. The burgeoning connected car ecosystem presents a vast opportunity for EDRs to integrate seamlessly with telematics, infotainment, and navigation systems, enabling real-time data transmission and cloud-based analytics. The evolution of autonomous vehicles and advanced driver-assistance systems (ADAS) creates a new imperative for more sophisticated EDRs capable of recording not just vehicle dynamics but also sensor fusion data, AI decision-making processes, and environmental context. This transition towards highly automated driving will necessitate EDRs that can provide comprehensive insights into complex system interactions. Moreover, the insurance industry is increasingly recognizing the value of EDR data for precise claim assessments, personalized policies, and fraud detection, fostering innovative partnerships and service offerings. The continuous advancements in sensor technology, miniaturization, and data storage solutions further create avenues for more capable and cost-effective EDR systems.

Segmentation Analysis

The Automotive Event Data Recorder (EDR) market is comprehensively segmented to provide a detailed understanding of its diverse components, applications, and end-user base. This segmentation allows for targeted analysis of market dynamics, identification of high-growth areas, and strategic planning for stakeholders across the value chain. Understanding these distinct segments is crucial for manufacturers to tailor product development, for suppliers to align their offerings, and for regulatory bodies to formulate effective policies that address specific market needs. The market is primarily bifurcated by component type, vehicle type, and application, each category revealing unique insights into market demands and technological preferences.

- By Component:

- Sensors (accelerometers, gyroscopes, pressure sensors, impact sensors)

- Memory Units (flash memory, EEPROM)

- Processors/Microcontrollers

- Communication Modules (CAN bus, Ethernet, wireless)

- Power Supply Units

- By Vehicle Type:

- Passenger Cars (sedans, SUVs, hatchbacks)

- Commercial Vehicles (light commercial vehicles, heavy commercial vehicles, buses, trucks)

- By Application:

- Accident Reconstruction

- Insurance Assessment & Claims

- Fleet Management & Driver Monitoring

- Automotive Safety Research

- Legal & Regulatory Compliance

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Automotive Event Data Recorder Market

The value chain for the Automotive Event Data Recorder market is complex and involves multiple stakeholders, from raw material suppliers to end-users, ensuring the development, production, distribution, and utilization of EDR systems. At the upstream end, the value chain begins with the procurement of critical components and raw materials. This includes semiconductor manufacturers providing processors and memory chips, sensor manufacturers supplying accelerometers, gyroscopes, and pressure sensors, and specialized companies producing connectivity modules, wiring harnesses, and casings. These suppliers are fundamental in dictating the technological capabilities, reliability, and cost-effectiveness of the final EDR units. Strong relationships and quality control at this stage are paramount for the overall performance of EDR systems.

Moving downstream, the value chain involves the design, development, and manufacturing of the EDR modules. This phase is primarily dominated by Tier 1 automotive suppliers and Original Equipment Manufacturers (OEMs). These entities integrate the procured components, develop proprietary software and algorithms for data recording and processing, and conduct extensive testing to ensure compliance with stringent automotive standards and regulatory mandates. The manufacturing process often involves complex assembly lines, quality assurance protocols, and calibration procedures. For aftermarket EDRs, specialized electronics manufacturers and telematics companies take on this role, often focusing on plug-and-play solutions or integrated dashboard camera systems with EDR capabilities.

Distribution channels for EDRs are primarily divided into direct and indirect routes. Direct distribution involves OEMs incorporating EDRs directly into new vehicles during the manufacturing process, making them an integral part of the vehicle's safety architecture. This constitutes the largest segment of the market. Indirect channels include aftermarket sales through automotive parts retailers, specialized electronics stores, and online platforms, catering to vehicle owners seeking to upgrade or install EDR functionality in older vehicles. Additionally, telematics service providers and fleet management companies act as key distribution partners by offering integrated EDR solutions as part of their broader service packages. These diverse channels ensure broad market reach and accessibility for various customer segments.

Automotive Event Data Recorder Market Potential Customers

The primary end-users and buyers of Automotive Event Data Recorder products and services represent a diverse ecosystem driven by safety, accountability, and data-driven insights. The largest segment of potential customers includes automotive Original Equipment Manufacturers (OEMs), who integrate EDRs as standard equipment into new passenger cars and commercial vehicles to comply with regulations and enhance vehicle safety ratings. OEMs are critical buyers, influencing market volumes and technological specifications through their design and procurement decisions. Beyond new vehicle sales, fleet operators, including logistics companies, public transportation services, and rental car agencies, are increasingly adopting EDRs and associated telematics systems to improve driver behavior, reduce accident rates, and optimize operational efficiency through continuous monitoring and data analysis.

Another significant group of potential customers comprises the insurance industry. Insurance providers are keen users of EDR data to accurately assess collision circumstances, expedite claims processing, determine fault, and combat fraudulent claims. The availability of objective, verifiable data from EDRs allows insurers to develop more precise risk profiles and potentially offer usage-based insurance (UBI) policies, thereby incentivizing safer driving. Furthermore, law enforcement agencies and accident investigation teams are crucial consumers of EDR data for forensic analysis, accident reconstruction, and the enforcement of traffic laws. Their reliance on EDRs for evidence makes them vital stakeholders in the market, driving demand for data integrity and accessibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2032 | USD 3.39 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Aptiv PLC, DENSO Corporation, Magna International Inc., Veoneer Inc., Autoliv Inc., Mitsubishi Electric Corporation, Panasonic Corporation, Harman International (Samsung), Visteon Corporation, Stoneridge Inc., LG Electronics, Honeywell International Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, ON Semiconductor Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Event Data Recorder Market Key Technology Landscape

The technological landscape of the Automotive Event Data Recorder market is characterized by continuous innovation aimed at enhancing data accuracy, reliability, and accessibility. Modern EDRs rely heavily on a sophisticated array of sensors that detect various physical parameters during a collision. These include high-precision accelerometers for measuring sudden changes in velocity and impact force, gyroscopes for rotational motion, and pressure sensors within airbag systems to detect deployment events. Advanced EDRs also integrate data from vehicle stability control (VSC) systems, anti-lock braking systems (ABS), and steering angle sensors to provide a comprehensive picture of vehicle dynamics leading up to and during an incident.

Data storage and processing constitute another critical aspect of the EDR technology landscape. Robust non-volatile memory units, such as flash memory and EEPROM (Electrically Erasable Programmable Read-Only Memory), are employed to securely store pre-crash, crash, and post-crash data. These memory solutions are designed to withstand extreme conditions, including high G-forces and temperature fluctuations, ensuring data integrity even in severe accidents. High-performance microcontrollers and specialized processors are essential for managing data acquisition from multiple sensors, executing complex algorithms for data compression, and securely recording information in real-time, often within milliseconds of an event.

Connectivity and communication technologies are increasingly pivotal within the EDR market. While traditionally EDR data was retrieved physically from the vehicle's diagnostic port (OBD-II), there is a growing trend towards integrated communication modules. These modules facilitate over-the-air (OTA) data transfer, allowing EDR data to be transmitted wirelessly to cloud platforms for remote analysis. This leverages cellular networks (4G/5G) and dedicated short-range communication (DSRC) protocols, particularly within connected car ecosystems. Furthermore, the integration with vehicle bus systems like CAN (Controller Area Network) and Ethernet allows EDRs to seamlessly interface with other electronic control units in the vehicle, extracting a wider range of relevant parameters and enhancing overall system intelligence and utility.

Regional Highlights

- North America: This region is a dominant force in the Automotive Event Data Recorder market, primarily driven by stringent safety regulations and high consumer awareness. The National Highway Traffic Safety Administration (NHTSA) in the United States has been a strong proponent of EDRs, leading to widespread adoption. Both the US and Canada exhibit mature automotive markets with advanced technological infrastructure, fostering innovation and integration of sophisticated EDR systems. The presence of major automotive OEMs and Tier 1 suppliers in this region further contributes to market growth and technological advancements, focusing on robust data security and expanded data parameters.

- Europe: The European market for EDRs is experiencing substantial growth, significantly bolstered by the European Union's General Safety Regulation which mandates the installation of EDRs in all new types of cars and vans from July 2022, and in all new vehicles sold from July 2024. This regulatory push provides a clear framework for market expansion. European countries demonstrate a strong emphasis on road safety and data privacy, influencing the design and implementation of EDR systems. Germany, France, and the UK are key markets, characterized by advanced automotive industries and a focus on integrating EDRs with advanced driver-assistance systems (ADAS) and intelligent transport systems.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for Automotive Event Data Recorders, fueled by the rapid expansion of the automotive industry, increasing disposable incomes, and growing concerns about road safety in countries like China, India, Japan, and South Korea. While regulatory mandates are still evolving in some parts of the region, the sheer volume of vehicle production and sales presents immense market potential. Japan and South Korea, with their technologically advanced automotive sectors, are early adopters of sophisticated EDR technologies, often integrating them with their domestic telematics and connected car initiatives. China and India are witnessing increasing implementation due to rising accident rates and government initiatives to improve road safety infrastructure.

- Latin America: The Automotive Event Data Recorder market in Latin America is in an emerging phase, with growth primarily driven by increasing vehicle production, urbanization, and a gradual rise in road safety awareness. Countries such as Brazil and Mexico are leading the adoption, spurred by both domestic automotive production and imports that often come equipped with EDRs. While specific EDR mandates are less pervasive compared to developed regions, the trend towards global vehicle safety standards and the influence of international automotive manufacturers are gradually pushing market expansion. Insurance companies in the region are also starting to recognize the value of EDR data for claims processing.

- Middle East and Africa (MEA): The MEA region represents a nascent but promising market for Automotive Event Data Recorders. Growth in this region is primarily attributed to economic diversification, increasing infrastructure development, and growing foreign investment in the automotive sector. Countries in the Gulf Cooperation Council (GCC), particularly Saudi Arabia and UAE, are showing early adoption due to a high volume of premium vehicle sales and a focus on smart city initiatives that incorporate advanced automotive technologies. The demand for enhanced fleet management solutions in the logistics and transportation sectors also contributes to the EDR market expansion, alongside a gradual increase in awareness regarding vehicle safety technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Event Data Recorder Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Aptiv PLC

- DENSO Corporation

- Magna International Inc.

- Veoneer Inc.

- Autoliv Inc.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Harman International (Samsung)

- Visteon Corporation

- Stoneridge Inc.

- LG Electronics

- Honeywell International Inc.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- ON Semiconductor Corporation

Frequently Asked Questions

What is an Automotive Event Data Recorder (EDR) and what data does it record?

An Automotive Event Data Recorder (EDR), often called a "black box," is a device that records critical vehicle parameters for a short period, typically seconds, before, during, and after a collision. It captures data such as vehicle speed, engine RPM, brake application, throttle position, seatbelt usage, airbag deployment timing, steering input, and forces of impact. This data helps reconstruct accident scenarios and assess vehicle performance.

Are Event Data Recorders mandatory in all new vehicles?

The mandatory installation of EDRs varies by region. In the United States, EDRs have been effectively mandatory since 2012 due to regulatory requirements for data recording. The European Union mandates EDRs in all new types of cars and vans from July 2022, and in all new vehicles sold from July 2024. Other regions are also gradually adopting similar regulations, making EDRs increasingly standard in new vehicles globally.

Who owns the data recorded by an EDR, and how is it protected?

The ownership and access rights to EDR data can be complex and are often subject to local laws and regulations. Generally, the data is considered to be part of the vehicle's property. While manufacturers design EDRs to be tamper-resistant, accessing the data typically requires specialized tools. Data privacy concerns are addressed through regulations that often specify who can access the data (e.g., vehicle owner, law enforcement, courts with a warrant) and under what circumstances, aiming to balance safety benefits with individual privacy rights.

How do EDRs benefit accident investigations and insurance claims?

EDRs significantly enhance accident investigations by providing objective, factual data that can accurately reconstruct the sequence of events before, during, and immediately after a collision. This data helps determine vehicle speed, brake application, and other crucial factors, aiding law enforcement in fault assessment. For insurance claims, EDR data expedites processing by offering clear evidence, potentially reducing disputes, combating fraud, and leading to more equitable settlements based on precise information rather than subjective accounts.

What are the future trends for the Automotive Event Data Recorder market?

Future trends in the EDR market include deeper integration with advanced driver-assistance systems (ADAS) and autonomous driving technologies, evolving into more comprehensive "vehicle black boxes" that record AI decision-making. Expect enhanced connectivity for over-the-air data retrieval, more sophisticated sensor arrays for granular data capture, and improved data security measures against cyber threats. EDR data will also increasingly be leveraged for predictive maintenance, personalized insurance policies, and advanced automotive safety research, moving beyond purely reactive accident analysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager