Automotive Exhaust Manifold Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428053 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Automotive Exhaust Manifold Market Size

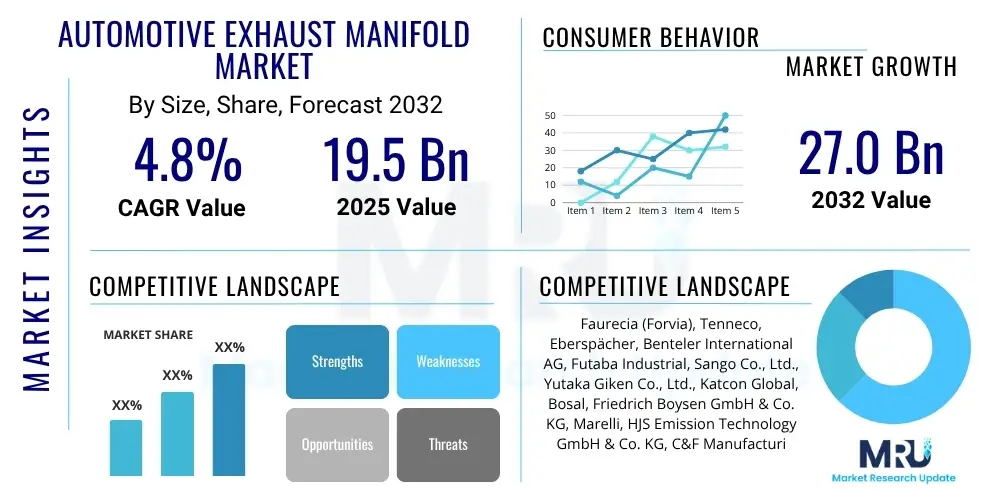

The Automotive Exhaust Manifold Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 19.5 billion in 2025 and is projected to reach USD 27.0 billion by the end of the forecast period in 2032.

Automotive Exhaust Manifold Market introduction

The automotive exhaust manifold is a critical component within a vehicle's exhaust system, playing a pivotal role in efficiently collecting exhaust gases from multiple engine cylinders and directing them into a single pipe for further processing, typically towards the catalytic converter. Its primary function is to optimize exhaust gas flow, minimize back pressure, and contribute significantly to emissions control and overall engine performance. Modern exhaust manifolds are engineered to withstand extreme temperatures and corrosive environments, often incorporating advanced materials and designs to enhance durability and efficiency, thereby impacting fuel economy and noise reduction.

The product encompasses a range of designs and materials, from traditional cast iron manifolds known for their robust heat retention capabilities to more advanced tubular designs made from stainless steel, often found in high-performance or modern vehicles for improved flow dynamics and weight reduction. Major applications span across light-duty passenger vehicles, heavy-duty commercial trucks, buses, and off-highway machinery, each requiring tailored manifold solutions to meet specific engine architectures and emission standards. The relentless pursuit of stringent global emission regulations, coupled with the continuous demand for enhanced engine efficiency and reduced noise, acts as a perpetual driving force behind innovation in manifold design and manufacturing processes.

The benefits derived from an optimally designed exhaust manifold are multifaceted, extending beyond mere gas collection to encompass improved engine responsiveness, enhanced fuel efficiency, and a significant reduction in harmful pollutant emissions. Technological advancements in manifold construction, such as integrated catalytic converters (close-coupled catalysts) and insulated designs, further amplify these benefits by accelerating catalyst light-off and maintaining higher exhaust gas temperatures for more effective emission treatment. The market is profoundly influenced by global vehicle production volumes, the accelerating shift towards stricter emission norms like Euro 7 and CAFE standards, and the growing consumer demand for vehicles that offer both robust performance and environmental consciousness.

Automotive Exhaust Manifold Market Executive Summary

The Automotive Exhaust Manifold Market is undergoing a significant transformation, driven by a confluence of evolving business trends, distinct regional dynamics, and specialized segment shifts. Business trends are largely shaped by the accelerating adoption of stringent global emission regulations, pushing manufacturers towards advanced materials like stainless steel and innovative designs such as tubular manifolds and integrated exhaust gas recirculation (EGR) systems to improve emission control efficiency and engine performance. There is also a growing emphasis on lightweighting solutions to contribute to overall vehicle fuel economy, even as the industry grapples with the long-term implications of electric vehicle (EV) penetration, which is expected to gradually impact demand for traditional exhaust components, though internal combustion engine (ICE) vehicles will remain dominant for the foreseeable future. Strategic partnerships between manifold manufacturers and automotive OEMs are becoming crucial for co-developing next-generation exhaust systems that meet future regulatory and performance requirements.

Regional trends highlight a divergence in growth trajectories. Asia Pacific, particularly China and India, continues to be the dominant growth engine for the market, propelled by escalating vehicle production volumes, expanding middle-class populations, and the gradual adoption of stricter emission standards mirroring those in developed economies. North America and Europe, while mature markets, are experiencing growth driven by the replacement aftermarket and the continuous upgrade cycle of existing ICE vehicle fleets to comply with the latest environmental mandates. These regions are also at the forefront of technological advancements, particularly in premium vehicle segments and performance applications. Latin America, the Middle East, and Africa are showing steady growth, primarily influenced by increasing vehicle parc and infrastructure development, which drives both OEM and aftermarket demand, albeit at a slower pace compared to Asia Pacific.

Segmentation trends reveal significant insights into market dynamics. By material type, stainless steel manifolds are gaining traction over traditional cast iron due to their superior corrosion resistance, lighter weight, and better flow characteristics, particularly in gasoline engines and high-performance applications. Cast iron, however, maintains a strong position in diesel engines and more cost-sensitive vehicle segments due to its durability and cost-effectiveness. By vehicle type, passenger cars represent the largest share, but commercial vehicles are a vital and growing segment, especially with the global focus on reducing emissions from heavy-duty transport. The aftermarket segment is demonstrating robust growth, driven by the aging vehicle population, increased vehicle miles traveled, and the necessity for replacement parts or performance upgrades, providing a stable revenue stream that complements OEM demand.

AI Impact Analysis on Automotive Exhaust Manifold Market

The integration of Artificial Intelligence (AI) across various stages of the automotive exhaust manifold market is generating considerable interest, with users frequently querying its potential to revolutionize design, manufacturing, quality control, and predictive maintenance. Common questions revolve around how AI can optimize complex manifold geometries for enhanced flow dynamics and thermal management, given the intricate balance required between performance and emissions reduction. There's also significant curiosity about AI's role in predictive analytics for manufacturing processes to minimize defects, improve material utilization, and predict component failures in operational vehicles. Users are keen to understand if AI can accelerate R&D cycles, reduce development costs, and ultimately lead to more durable, efficient, and environmentally compliant exhaust systems. The overarching themes include efficiency gains, cost reductions, enhanced product performance, and a proactive approach to maintenance and quality assurance through intelligent data analysis.

- AI-driven generative design optimizes complex manifold geometries for superior exhaust gas flow and back pressure reduction, leading to improved engine performance and fuel efficiency.

- Predictive analytics powered by AI enhances manufacturing process control, anticipating potential defects in welding, casting, or forming, thereby reducing scrap rates and improving overall product quality.

- AI algorithms analyze sensor data from vehicle exhaust systems to predict manifold wear, corrosion, or crack formation, enabling proactive maintenance and preventing costly breakdowns or emission non-compliance.

- Machine learning models can analyze vast datasets of material properties and operating conditions to suggest optimal material compositions or coating technologies for extended manifold lifespan and heat resistance.

- AI facilitates supply chain optimization for raw materials and components, predicting demand fluctuations and potential disruptions, ensuring timely delivery and cost-effectiveness for manifold manufacturers.

- Robotics integrated with AI vision systems automate intricate welding and assembly processes, improving precision, consistency, and speed in manifold production.

- AI assists in virtual simulation and testing environments, allowing for rapid iteration and validation of new manifold designs under various real-world conditions, significantly cutting down physical prototyping costs and time.

DRO & Impact Forces Of Automotive Exhaust Manifold Market

The Automotive Exhaust Manifold Market is significantly shaped by a dynamic interplay of drivers, restraints, opportunities, and powerful impact forces that influence its trajectory and operational landscape. Key drivers include the ever-tightening global emission regulations, such as Euro 7 in Europe, CAFE standards in North America, and evolving norms in Asia, which mandate automotive manufacturers to continuously improve exhaust gas treatment efficiency, directly leading to demand for advanced manifold designs and integrated catalytic converters. The steady growth in global vehicle production, particularly in emerging economies, alongside the increasing average age of vehicles in developed markets, fuels both OEM and aftermarket demand for manifolds. Furthermore, consumer demand for enhanced engine performance, fuel efficiency, and reduced noise, vibration, and harshness (NVH) levels drives innovation in manifold materials and design, pushing towards lighter, more durable, and acoustically optimized solutions.

However, several restraints challenge market growth. The most significant long-term restraint is the accelerating global shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs), which, in their purest form, do not require traditional exhaust manifolds. While the transition is gradual and ICE vehicles will dominate for decades, this trend introduces uncertainty and necessitates strategic diversification for manifold manufacturers. Rising raw material costs, particularly for high-grade stainless steel and specialized alloys, coupled with volatile supply chains, can exert significant pressure on profit margins. Intense competition from both established players and new entrants, alongside the commoditization of certain manifold types, also limits pricing power and demands continuous cost optimization without compromising quality or performance. The complexity of integrating manifolds with sophisticated engine management systems and emission control technologies adds another layer of design and manufacturing challenge.

Opportunities within the market abound for agile players. The development and adoption of advanced materials, such as lightweight composites and high-strength alloys, present avenues for creating more efficient and durable manifolds. Innovations in manufacturing processes like additive manufacturing (3D printing) for complex geometries and advanced hydroforming techniques offer possibilities for design flexibility, reduced weight, and improved thermal management. The growing aftermarket segment for replacement and performance-enhancing manifolds, driven by an aging vehicle parc and enthusiast demand, provides a stable and expanding revenue stream. Furthermore, the integration of smart sensors into manifolds for real-time monitoring of exhaust gas temperature and pressure offers opportunities for predictive maintenance and enhanced engine diagnostics, aligning with the broader trend of connected vehicles. The expansion into niche applications, such as high-performance vehicles and industrial engines, also represents untapped market potential.

The overarching impact forces influencing this market are primarily technological advancements, environmental pressures, and economic shifts. Technological advancements in materials science, manufacturing automation, and digital design tools are enabling more sophisticated and efficient manifold solutions. Environmental pressures, chiefly in the form of climate change concerns and air quality mandates, are the primary catalysts for innovation in emission reduction technologies integrated within or associated with the manifold. Economic shifts, including fluctuating fuel prices, disposable income levels, and global economic stability, directly affect vehicle sales and, consequently, manifold demand. Geopolitical factors influencing trade policies and supply chain resilience also play a critical role, as the automotive supply chain is inherently global and complex, making the market susceptible to international trade tensions and disruptions.

Segmentation Analysis

The Automotive Exhaust Manifold Market is meticulously segmented across various dimensions to provide a granular understanding of its structure and dynamics. These segmentations are critical for identifying specific market niches, understanding competitive landscapes, and formulating targeted business strategies. The primary segmentation criteria typically include material type, which dictates performance characteristics and cost, and vehicle type, reflecting diverse engine requirements and volume demands. Further breakdowns by sales channel delineate between original equipment manufacturers (OEMs) and the aftermarket, each with distinct supply chain and customer dynamics. Analyzing these segments helps stakeholders to pinpoint growth opportunities, assess market saturation, and adapt to evolving technological and regulatory environments within the broader automotive industry ecosystem.

- By Material Type:

- Cast Iron Manifolds: Traditionally dominant due to durability, cost-effectiveness, and heat retention properties, widely used in diesel and entry-level gasoline engines.

- Stainless Steel Manifolds: Gaining significant traction for superior corrosion resistance, lighter weight, better heat dissipation, and improved flow characteristics, prevalent in gasoline engines and high-performance vehicles.

- Tubular Manifolds: Often made from stainless steel, designed for optimized exhaust gas flow and reduced back pressure, enhancing engine performance and efficiency.

- Integrated Manifolds: Often part of the cylinder head casting, aiming for faster catalyst light-off and improved packaging, primarily in gasoline direct injection engines.

- By Vehicle Type:

- Passenger Cars: The largest segment, encompassing a wide range of vehicles from compacts to luxury sedans and SUVs, with varying demands for performance and emissions control.

- Commercial Vehicles: Includes light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs), requiring robust and durable manifolds for demanding operational cycles and stringent emission standards for diesel engines.

- Off-Highway Vehicles: Encompasses construction equipment, agricultural machinery, and industrial vehicles, necessitating extremely durable manifolds capable of withstanding harsh operating conditions.

- By Sales Channel:

- Original Equipment Manufacturer (OEM): Manifolds supplied directly to automotive manufacturers for new vehicle assembly, driven by design specifications, cost-efficiency, and long-term supply agreements.

- Aftermarket: Replacement manifolds sold through independent distributors, retailers, and service centers for vehicle repair, maintenance, or performance upgrades, characterized by a focus on availability, competitive pricing, and product range for older vehicle models.

- By Engine Type:

- Gasoline Engines: Often favor stainless steel or integrated manifolds for performance and emission characteristics.

- Diesel Engines: Typically use cast iron for durability and heat management, with increasing adoption of advanced materials for stricter particulate matter (PM) and NOx control.

Value Chain Analysis For Automotive Exhaust Manifold Market

The value chain for the Automotive Exhaust Manifold Market is an intricate network of interconnected stages, beginning with raw material extraction and extending all the way to the end-users, encompassing upstream, manufacturing, downstream, and distribution activities. Understanding this value chain is crucial for identifying cost efficiencies, points of value addition, and potential areas of competitive advantage or vulnerability. The upstream segment primarily involves the sourcing and processing of essential raw materials, such as various grades of steel (e.g., stainless steel, mild steel), cast iron, and specialized alloys like nickel-based superalloys, which are selected based on their thermal properties, corrosion resistance, and strength. Suppliers of these raw materials, often large metallurgical companies, play a foundational role, and their pricing and supply stability directly impact the manufacturers of exhaust manifolds. Additionally, suppliers of various coatings, gaskets, and sensor components also form a vital part of the upstream ecosystem, providing crucial sub-components that are integrated into the final product.

The manufacturing stage represents the core value-adding process where raw materials are transformed into finished exhaust manifolds. This involves a range of sophisticated processes including casting for cast iron manifolds, tube bending and welding for tubular stainless steel manifolds, hydroforming for complex geometries, and advanced machining. Leading manifold manufacturers invest heavily in R&D to optimize designs for better flow dynamics, thermal management, and emissions reduction, often integrating advanced simulation and testing capabilities. Quality control at this stage is paramount, as manifolds must withstand extreme temperatures, vibrations, and corrosive gases over the vehicle's lifespan, while also meeting precise dimensional and functional specifications dictated by automotive OEMs. Assembly of various components, such as flanges, oxygen sensor bungs, and heat shields, is also performed here, culminating in a ready-to-install product.

Downstream activities primarily involve the distribution and sales channels that bridge the gap between manifold manufacturers and end-users. Direct distribution is prevalent for the OEM segment, where manufacturers supply manifolds directly to automotive assembly lines based on long-term contracts and just-in-time delivery schedules. This channel is characterized by stringent quality requirements, high volume, and highly integrated supply chain management. For the aftermarket segment, indirect distribution channels are more common, involving a network of wholesalers, regional distributors, and automotive parts retailers. These intermediaries stock a wide range of manifolds for different vehicle makes and models, catering to repair shops, independent mechanics, and do-it-yourself consumers. The efficiency of these distribution channels, including logistics, warehousing, and inventory management, significantly impacts product availability and responsiveness to market demand. Additionally, specialized performance aftermarket channels exist for enthusiasts seeking upgrades.

The direct sales channel typically involves manifold manufacturers selling directly to automotive OEMs, where established relationships and collaborative design processes are crucial. This direct interaction allows for customized solutions, integration into specific engine platforms, and rigorous quality assurance throughout the development and production lifecycle. In contrast, the indirect channel is predominantly utilized for the aftermarket. This involves a multi-tiered distribution network where manifolds move from the manufacturer to large national or regional distributors, who then supply to smaller local wholesalers, retailers, and eventually to service centers or individual consumers. This indirect approach broadens market reach, but also introduces complexities in terms of inventory management, pricing strategies, and ensuring consistent product availability across diverse geographical areas. Both direct and indirect channels demand robust logistics and supply chain management to maintain efficiency and customer satisfaction.

Automotive Exhaust Manifold Market Potential Customers

The Automotive Exhaust Manifold Market serves a diverse range of potential customers, each with unique needs, purchasing behaviors, and influence on product development and market demand. The primary and largest customer segment consists of automotive original equipment manufacturers (OEMs), encompassing global giants that produce passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and off-highway equipment. These OEMs represent the direct buyers of new exhaust manifolds for integration into their vehicle assembly lines. Their demand is driven by new vehicle production volumes, specific engine designs, evolving emission regulations, and a constant pursuit of lightweighting, cost-efficiency, and performance enhancements. Manifold manufacturers typically engage in long-term contracts with OEMs, involving extensive R&D collaboration and adherence to rigorous quality and supply chain standards, making these relationships highly strategic and capital-intensive.

Another significant customer segment lies within the automotive aftermarket. This includes a broad spectrum of buyers, predominantly consisting of independent repair shops, authorized service centers, fleet maintenance operators, and retail customers who purchase manifolds for replacement purposes due to wear, damage, or regulatory compliance failures in older vehicles. The aftermarket is a stable and growing segment, influenced by the average age of vehicles on the road, increasing vehicle miles traveled, and the need for durable, readily available replacement parts. Furthermore, a niche but impactful part of the aftermarket comprises performance enthusiasts and tuning shops. These customers seek high-performance, often stainless steel tubular manifolds, to upgrade their vehicles for improved horsepower, torque, and a more aggressive exhaust note, driving demand for specialized and premium products.

Beyond traditional automotive applications, potential customers also extend to manufacturers of industrial engines and power generation equipment that utilize internal combustion engines. While smaller in volume compared to the automotive sector, these customers require robust and highly durable exhaust manifolds capable of operating under continuous heavy loads and often in harsh environments. Suppliers targeting this segment must focus on extreme reliability, thermal management, and compliance with industrial emission standards. Overall, the market for exhaust manifolds is characterized by a core base of OEM demand balanced by a resilient and growing aftermarket, with specialized applications offering further diversification opportunities for manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 19.5 Billion |

| Market Forecast in 2032 | USD 27.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Faurecia (Forvia), Tenneco, Eberspächer, Benteler International AG, Futaba Industrial, Sango Co., Ltd., Yutaka Giken Co., Ltd., Katcon Global, Bosal, Friedrich Boysen GmbH & Co. KG, Marelli, HJS Emission Technology GmbH & Co. KG, C&F Manufacturing Inc., GEDIA Automotive Group, Borla Performance Industries, MagnaFlow, AP Exhaust Technologies, Walker Exhaust, Dynomax Performance Exhaust, Cummins Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Exhaust Manifold Market Key Technology Landscape

The Automotive Exhaust Manifold Market is characterized by a rapidly evolving technological landscape, driven primarily by the relentless pursuit of stricter emission standards, enhanced engine performance, and improved fuel efficiency. One of the foremost technological advancements lies in material science, with a significant shift from traditional cast iron to various grades of stainless steel and high-temperature resistant alloys. Stainless steel, particularly austenitic grades like 304 and 321, offers superior corrosion resistance, better thermal fatigue properties, and allows for thinner wall constructions, leading to lightweighting benefits that contribute to overall vehicle efficiency. Furthermore, specialized alloys are being developed to withstand even higher operating temperatures, crucial for turbocharged engines and engines with advanced combustion cycles, ensuring long-term durability and reliability.

Manufacturing processes have also undergone substantial innovation to produce more complex and efficient manifold designs. Hydroforming, for instance, allows for the creation of intricate tubular geometries with superior flow characteristics and reduced weight, optimizing exhaust gas scavenging and minimizing back pressure. Advanced welding techniques, including robotic welding and laser welding, ensure high-integrity joints capable of withstanding extreme thermal cycling and vibrations, crucial for preventing leaks and extending product life. The advent of additive manufacturing (3D printing) using metals offers promising avenues for rapid prototyping and producing highly optimized, complex internal structures that were previously impossible with conventional manufacturing, potentially leading to bespoke performance manifolds and further gains in efficiency and design flexibility. These techniques allow for the creation of integrated catalytic converter housings directly within the manifold, accelerating catalyst light-off and improving cold-start emission performance.

Beyond materials and manufacturing, integrated technologies are also shaping the market. The incorporation of close-coupled catalytic converters directly into the manifold design is a key trend, reducing the thermal inertia of the catalyst and ensuring faster activation upon engine start-up, which is critical for meeting stringent cold-start emission limits. Exhaust Gas Recirculation (EGR) systems are increasingly integrated into or closely associated with the manifold to reduce NOx emissions, demanding precise design and material selection to manage the hot, corrosive recirculated gases. Furthermore, the use of advanced coatings, such as ceramic or plasma spray coatings, provides enhanced thermal insulation, reduces heat transfer to surrounding engine components, and improves resistance to oxidation and corrosion, extending the life of the manifold and improving its functional performance over time. Sensor integration, including exhaust gas temperature (EGT) and oxygen (O2) sensors, directly into the manifold or its immediate vicinity, provides crucial data for engine control units (ECUs) to optimize combustion and emission control strategies in real-time.

Regional Highlights

- Asia Pacific (APAC): Dominates the automotive exhaust manifold market, driven by robust vehicle production volumes, particularly in China, India, Japan, and South Korea. Rapid industrialization, expanding middle-class populations, and the gradual adoption of stricter emission standards fuel both OEM demand for new vehicles and a burgeoning aftermarket for replacement parts. China stands as the largest single market, while India exhibits strong growth potential. The region benefits from lower manufacturing costs and increasing local R&D investments, positioning it as a global hub for both production and consumption.

- Europe: A mature but technologically advanced market, characterized by stringent emission regulations (e.g., Euro 6/7) that necessitate high-performance, sophisticated exhaust manifold designs, often integrating advanced materials and close-coupled catalysts. Demand is stable, driven by the replacement aftermarket, the premium vehicle segment, and the continuous upgrade cycle for existing ICE vehicles. Germany, France, and the UK are key contributors, with a strong focus on innovation in materials and manufacturing processes to meet environmental targets.

- North America: A significant market with substantial demand from both OEM and aftermarket segments. The region's preference for larger vehicles, including SUVs and pickup trucks, drives demand for robust and durable exhaust manifolds. Stringent emissions standards (e.g., CAFE, EPA) push for advanced manifold technologies that support efficient combustion and emissions reduction. The aftermarket is particularly strong, fueled by an aging vehicle fleet and a culture of vehicle maintenance and performance upgrades. The United States leads the market, followed by Canada and Mexico.

- Latin America: An emerging market experiencing steady growth, influenced by increasing vehicle ownership, infrastructure development, and growing local automotive manufacturing. Brazil and Mexico are key markets, benefiting from foreign investment in automotive production. Demand is primarily driven by affordability and durability, though emission standards are gradually tightening, creating a future demand for more advanced manifold solutions. Both OEM and aftermarket segments contribute to market expansion.

- Middle East and Africa (MEA): Represents a growing but fragmented market. The Middle East shows demand driven by affluent consumers and a preference for large, powerful vehicles, while Africa's market is characterized by increasing vehicle parc and growing demand for affordable replacement parts. Economic development, urbanization, and improving road infrastructure contribute to market expansion. Emission regulations vary significantly across countries, influencing the technological sophistication of manifolds adopted.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Exhaust Manifold Market.- Faurecia (Forvia)

- Tenneco

- Eberspächer

- Benteler International AG

- Futaba Industrial

- Sango Co., Ltd.

- Yutaka Giken Co., Ltd.

- Katcon Global

- Bosal

- Friedrich Boysen GmbH & Co. KG

- Marelli

- HJS Emission Technology GmbH & Co. KG

- C&F Manufacturing Inc.

- GEDIA Automotive Group

- Borla Performance Industries

- MagnaFlow

- AP Exhaust Technologies

- Walker Exhaust

- Dynomax Performance Exhaust

- Cummins Inc.

Frequently Asked Questions

Analyze common user questions about the Automotive Exhaust Manifold market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an automotive exhaust manifold?

The primary function of an automotive exhaust manifold is to efficiently collect exhaust gases from multiple engine cylinders and channel them into a single pipe, directing them towards the catalytic converter for further processing. It is designed to optimize exhaust gas flow, minimize back pressure, and contribute significantly to overall engine performance, fuel efficiency, and emissions control by ensuring the smooth and rapid evacuation of combustion byproducts from the engine.

How do emission regulations impact the design and technology of exhaust manifolds?

Stringent global emission regulations, such as Euro 7 and various EPA/CAFE standards, are a major driving force behind advancements in exhaust manifold design and technology. These regulations necessitate the development of manifolds that support faster catalytic converter light-off, improved exhaust gas scavenging, and optimized thermal management. This often leads to the adoption of advanced materials like stainless steel, integrated catalytic converters (close-coupled catalysts), and sophisticated geometries to reduce harmful pollutants like NOx, CO, and unburnt hydrocarbons more effectively and quickly, particularly during cold start conditions.

What are the key material types used for exhaust manifolds and their benefits?

The primary material types for exhaust manifolds are cast iron and stainless steel. Cast iron manifolds are known for their robustness, excellent heat retention, and cost-effectiveness, making them prevalent in diesel engines and more budget-conscious gasoline applications. Stainless steel manifolds (e.g., 304, 321 grades) offer superior corrosion resistance, lighter weight, better heat dissipation, and allow for optimized tubular designs that enhance exhaust gas flow, significantly improving engine performance and efficiency, especially in modern gasoline and high-performance engines.

What is the future outlook for the exhaust manifold market considering the rise of electric vehicles?

While the long-term outlook for traditional exhaust manifolds faces a significant challenge from the accelerating global shift towards electric vehicles (EVs) which do not require them, the market is projected to grow moderately in the near to medium term. Internal combustion engine (ICE) vehicles are expected to dominate for decades, particularly in emerging markets and certain vehicle segments like heavy-duty commercial vehicles. Manufacturers are adapting by innovating in advanced ICE manifold technologies for efficiency, expanding into the aftermarket, and potentially diversifying into exhaust components for hybrid vehicles or niche industrial applications that still rely on ICE technology.

What role does the aftermarket play in the automotive exhaust manifold market?

The aftermarket plays a crucial and growing role in the automotive exhaust manifold market, providing a stable revenue stream alongside OEM demand. It primarily caters to the replacement needs of existing vehicles due to wear and tear, damage, or the need to meet inspection standards. Factors such as the aging vehicle parc, increasing vehicle miles traveled, and consumer demand for cost-effective repairs drive this segment. Additionally, a niche part of the aftermarket serves performance enthusiasts seeking upgrade manifolds to enhance their vehicle's power, torque, and sound, contributing to sustained market activity and product diversity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Exhaust Manifold Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Exhaust Manifold Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Single Wall, Double wall), By Application (Passenger Cars, Commercial Vehicles), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager