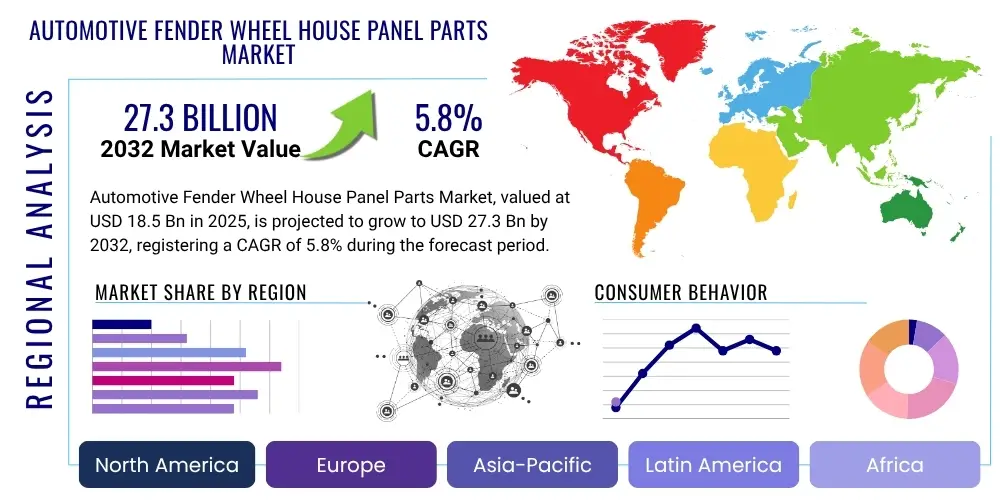

Automotive Fender Wheel House Panel Parts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430745 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Automotive Fender Wheel House Panel Parts Market Size

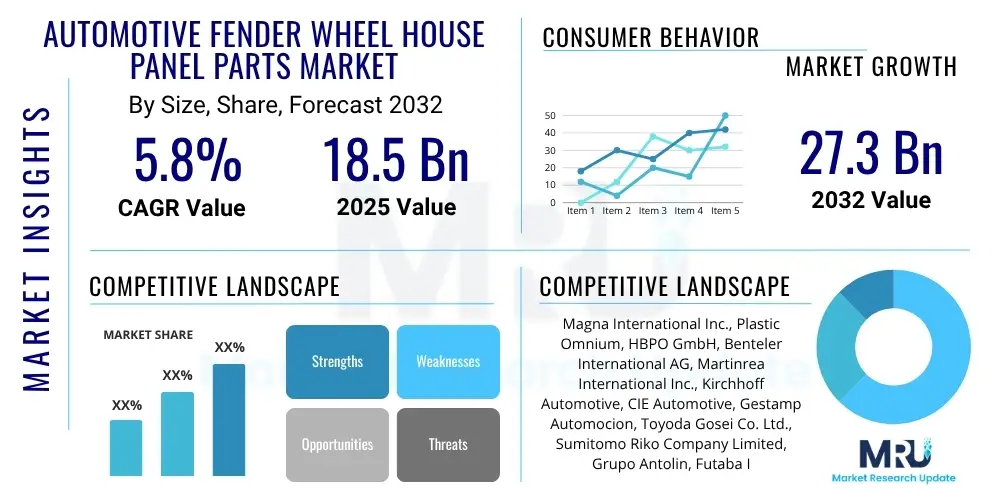

The Automotive Fender Wheel House Panel Parts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $18.5 Billion in 2025 and is projected to reach $27.3 Billion by the end of the forecast period in 2032.

Automotive Fender Wheel House Panel Parts Market introduction

The Automotive Fender Wheel House Panel Parts Market is a critical component of the global automotive industry, experiencing steady growth driven by increasing vehicle production and evolving design demands. These panels, encompassing both fenders and inner wheel house components, serve essential functions in protecting a vehicle's internal mechanisms from external elements like road debris, water, and mud, while also contributing significantly to the vehicle’s structural integrity and aesthetic appeal. The market is characterized by a continuous drive towards enhanced durability, reduced weight, and improved corrosion resistance, catering to the stringent requirements of modern vehicle manufacturing.

Fender wheel house panel parts are primarily manufactured from materials such as steel, aluminum, and various composite plastics, each selected based on specific vehicle requirements for strength, weight, and cost-effectiveness. Major applications span across passenger vehicles, including sedans, SUVs, and hatchbacks, as well as commercial vehicles like light and heavy-duty trucks, and the rapidly expanding electric vehicle segment. The benefits derived from these parts are multifaceted, offering crucial protection for sensitive engine and suspension components, improving vehicle aerodynamics, and maintaining the vehicle's overall structural safety and exterior finish.

Key driving factors propelling this market include the global expansion of the automotive manufacturing sector, particularly in emerging economies, coupled with increasing consumer demand for safer and more fuel-efficient vehicles. Stringent government regulations concerning vehicle safety standards and environmental emissions also play a significant role, pushing manufacturers to adopt advanced materials and innovative production techniques that enhance both performance and sustainability. The growing preference for SUVs and premium vehicles, which often feature larger and more complex fender assemblies, further contributes to market expansion.

Automotive Fender Wheel House Panel Parts Market Executive Summary

The Automotive Fender Wheel House Panel Parts Market is experiencing dynamic shifts, influenced by several overarching business trends. Manufacturers are increasingly focusing on automation and digitalization within production processes to improve efficiency, reduce costs, and enhance product quality. There is a growing trend towards the adoption of lightweight materials, such as advanced high-strength steel, aluminum alloys, and composite plastics, driven by stringent fuel efficiency standards and the proliferation of electric vehicles. Furthermore, strategic collaborations and mergers among component suppliers are becoming more common, aiming to consolidate market share and leverage technological advancements.

Regional trends significantly impact market dynamics, with Asia Pacific maintaining its position as the largest and fastest-growing market due to robust automotive production bases in countries like China, India, and Japan. North America and Europe are witnessing a substantial shift towards electric vehicle manufacturing, which, in turn, is driving demand for specific types of fender and wheel house components tailored for EV platforms, often prioritizing lightweighting and aerodynamic design. Latin America and the Middle East and Africa regions are showing steady growth, supported by expanding automotive assembly operations and increasing disposable incomes, leading to higher vehicle ownership.

Segmentation trends reveal that while steel remains a dominant material choice due to its cost-effectiveness and proven performance, the market share of aluminum and composite materials is steadily increasing, particularly in premium and electric vehicle segments, driven by their superior strength-to-weight ratio. The Original Equipment Manufacturer (OEM) channel continues to account for the largest share of sales, directly integrating these parts into new vehicle assembly lines. However, the aftermarket segment is also vital, catering to replacement and repair needs, sustained by the aging vehicle parc and increasing accident rates.

AI Impact Analysis on Automotive Fender Wheel House Panel Parts Market

Common user questions regarding AI's impact on the Automotive Fender Wheel House Panel Parts Market often revolve around how artificial intelligence can enhance design processes, optimize manufacturing efficiency, and improve quality control. Users are keen to understand if AI can contribute to the development of lighter, stronger, and more cost-effective materials, or if it can streamline supply chain logistics for these critical components. There is also significant interest in AI's potential to personalize or customize fender designs, addressing concerns about the investment required for AI integration and the expertise needed to manage these advanced systems. The overarching theme is how AI can drive innovation and competitiveness within a traditionally manufacturing-intensive sector.

- AI-powered generative design accelerates the development of optimized fender and wheel house panel geometries, reducing material usage and weight.

- Predictive analytics enhances manufacturing line maintenance, minimizing downtime and improving overall production efficiency for panel parts.

- Computer vision systems, driven by AI, conduct highly accurate and rapid quality inspections of finished panels, detecting minute defects.

- AI algorithms optimize supply chain and logistics for raw materials and finished parts, improving inventory management and delivery times.

- Advanced robotics with AI integration perform complex stamping, welding, and assembly tasks with greater precision and consistency.

- Material science AI assists in identifying and developing novel lightweight and high-strength materials for fender applications.

DRO & Impact Forces Of Automotive Fender Wheel House Panel Parts Market

The Automotive Fender Wheel House Panel Parts Market is significantly shaped by a combination of driving factors, restraints, opportunities, and inherent impact forces. Key drivers include the consistent growth in global automotive production, spurred by increasing urbanization and rising disposable incomes in developing regions. Furthermore, stringent safety regulations imposed by various governments worldwide necessitate the use of robust and impact-resistant fender and wheel house components. The escalating demand for lightweight vehicles to improve fuel efficiency and reduce emissions, alongside the rapid expansion of the electric vehicle (EV) market, which prioritizes aerodynamic and lightweight designs, further propels market growth. Aesthetic customization trends also contribute, as fenders are visible external parts critical to vehicle styling.

Despite these growth drivers, the market faces several restraints. The volatility of raw material prices, particularly for steel, aluminum, and petroleum-derived plastics, directly impacts production costs and profit margins for manufacturers. The high initial capital investment required for adopting advanced manufacturing technologies and automation, such as robotic stamping and composite molding, can be a barrier for smaller players. Additionally, intense competition among numerous component suppliers, both global and regional, often leads to price pressures and compressed margins. Complex global supply chain logistics and potential trade barriers also pose significant operational challenges.

Opportunities for market players are abundant, particularly in the realm of advanced material adoption, including high-strength steel, lightweight aluminum alloys, and multi-material composites, offering superior performance characteristics. The accelerating growth of the electric vehicle segment presents a substantial avenue for specialized fender and wheel house solutions designed for EV architectures. Furthermore, the integration of smart manufacturing principles (Industry 4.0), incorporating AI, IoT, and automation, promises to revolutionize production efficiency and quality. The increasing trend of vehicle personalization and modular design also offers scope for innovative product offerings. The impact forces at play include rapid technological advancements in materials science and manufacturing processes, shifting regulatory landscapes concerning vehicle safety and emissions, overall global economic conditions influencing consumer purchasing power and vehicle sales, and evolving consumer preferences for vehicle design and features.

Segmentation Analysis

The Automotive Fender Wheel House Panel Parts Market is comprehensively segmented to provide a detailed understanding of its diverse landscape. This segmentation allows for precise market analysis based on various product attributes, vehicle types, sales channels, and material compositions. Each segment exhibits unique characteristics and growth trajectories, influenced by technological advancements, regulatory mandates, and evolving consumer demands. Understanding these segments is crucial for stakeholders to identify lucrative opportunities and strategize effectively within the automotive supply chain.

- By Material Type

- Steel

- Aluminum

- Composites (Fiberglass, Carbon Fiber, Hybrid Composites)

- Plastics (Polypropylene, ABS)

- By Vehicle Type

- Passenger Vehicles

- Sedan

- SUV

- Hatchback

- Luxury Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Electric Vehicles (EVs)

- Passenger Vehicles

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Panel Position

- Front Fender

- Rear Fender

- Inner Wheel House

- Outer Wheel House

Value Chain Analysis For Automotive Fender Wheel House Panel Parts Market

The value chain for the Automotive Fender Wheel House Panel Parts Market is intricate, beginning with the sourcing of raw materials and extending through various stages of manufacturing, assembly, and distribution to the final end-users. Upstream activities involve the procurement of primary materials such as steel coils from steel mills, aluminum sheets from aluminum producers, and various resins, fibers, and polymers from chemical companies for composite and plastic parts. These raw material suppliers form the foundational layer, providing essential inputs that dictate the cost and quality characteristics of the final panel parts. The reliability and cost-effectiveness of these upstream suppliers are critical for the entire value chain.

Midstream in the value chain, specialized automotive component manufacturers transform these raw materials into finished fender and wheel house panels through processes like stamping, molding, welding, and surface treatment. These manufacturers often employ advanced technologies and precision engineering to meet the stringent design and quality specifications of automotive OEMs. Downstream activities primarily involve the distribution and sale of these finished parts. The dominant distribution channel is direct sales to Original Equipment Manufacturers (OEMs), where component suppliers provide parts for integration into new vehicle assembly lines. This OEM channel requires strong supplier relationships, just-in-time delivery capabilities, and adherence to specific contractual agreements.

In addition to the direct OEM channel, an important indirect channel caters to the aftermarket. This includes independent distributors, wholesalers, and automotive repair shops that source replacement parts for vehicle maintenance and accident repair. The aftermarket segment is characterized by a wider range of product specifications, often requiring inventory management for older vehicle models and competitive pricing. Both direct and indirect distribution channels are vital, ensuring the continuous supply of fender wheel house panel parts throughout the vehicle's lifecycle, from initial production to post-sale servicing. Efficiency in each stage of this value chain significantly impacts the overall cost, quality, and time-to-market for these essential automotive components.

Automotive Fender Wheel House Panel Parts Market Potential Customers

The primary potential customers for Automotive Fender Wheel House Panel Parts are the global Original Equipment Manufacturers (OEMs) of automobiles. These major automotive companies, including well-known brands across passenger and commercial vehicle segments, purchase large volumes of fender and wheel house panels directly from specialized component manufacturers for integration into their new vehicle assembly lines. Their demand is driven by new vehicle production schedules, design specifications for various models, and the need for high-quality, durable, and lightweight components that meet stringent safety and performance standards. The relationship with OEMs is often long-term and contractual, requiring suppliers to adhere to strict quality control, delivery schedules, and cost efficiency.

Beyond the OEM segment, the aftermarket represents another significant customer base. This includes a diverse group of buyers focused on vehicle repair and maintenance. Independent automotive repair shops, collision centers, and service garages are key customers within this segment, requiring replacement fender and wheel house panels due to accident damage, corrosion, or general wear and tear. Furthermore, large automotive parts retailers and wholesalers act as intermediaries, stocking and distributing these parts to smaller repair businesses and sometimes directly to end-consumers. The aftermarket demand is generally less predictable than OEM demand, but it provides a steady stream of sales driven by the existing vehicle parc and insurance claim trends.

Additionally, specialized customization and restoration shops also form a niche customer segment, seeking specific types of fender and wheel house panels, often for vintage vehicles or performance modifications. While smaller in volume compared to OEMs and the broader aftermarket, this segment values unique specifications and quality craftsmanship. The overarching need for all these customers is to procure reliable, high-quality, and appropriately priced fender and wheel house panels that ensure vehicle safety, structural integrity, and aesthetic appeal, ultimately contributing to vehicle longevity and resale value.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $18.5 Billion |

| Market Forecast in 2032 | $27.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magna International Inc., Plastic Omnium, HBPO GmbH, Benteler International AG, Martinrea International Inc., Kirchhoff Automotive, CIE Automotive, Gestamp Automocion, Toyoda Gosei Co. Ltd., Sumitomo Riko Company Limited, Grupo Antolin, Futaba Industrial Co. Ltd., Nanjing Changfeng Electromechanical Co. Ltd., Dongfeng Motor Parts and Components Group Co. Ltd., Aisin Seiki Co. Ltd., Samvardhana Motherson Automotive Systems Group (SMP), U.S. Auto Parts Network Inc., Gordon Auto Body Parts Co. Ltd., Depo Auto Parts Ind. Co. Ltd., TYC Brother Industrial Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Fender Wheel House Panel Parts Market Key Technology Landscape

The Automotive Fender Wheel House Panel Parts Market is continually evolving, driven by significant technological advancements aimed at enhancing product performance, manufacturing efficiency, and sustainability. Advanced stamping and forming techniques are paramount, allowing for the precise creation of complex geometries from various metal sheets with minimal material waste. Innovations like hot stamping for high-strength steel and hydroforming for aluminum are increasingly being adopted to produce lighter yet more rigid panels, which are crucial for meeting modern vehicle safety standards and lightweighting objectives. Robotic automation is a pervasive technology across manufacturing lines, ensuring high precision, speed, and consistency in processes such as welding, assembly, and material handling, thereby reducing labor costs and improving overall production throughput.

Material science and engineering play a pivotal role in shaping the technology landscape. The development and integration of multi-material designs, combining metals with advanced composites and plastics, are gaining traction to achieve optimal strength-to-weight ratios and improved crash performance. This includes the use of fiber-reinforced polymers (FRPs) and lightweight alloys, which offer superior energy absorption and corrosion resistance. Surface treatment technologies, such as advanced coatings for enhanced corrosion protection and aesthetic finishes, are also critical, extending the lifespan and visual appeal of the fender and wheel house components. These material innovations are essential for meeting the demands of electric vehicles, which require lightweight components to maximize battery range.

Emerging technologies like additive manufacturing (3D printing) are starting to influence prototyping and the production of low-volume, specialized parts, offering unparalleled design flexibility and rapid iteration capabilities. Furthermore, the adoption of digital twin technology and advanced simulation software allows manufacturers to virtually design, test, and optimize fender and wheel house panel performance before physical production, significantly reducing development cycles and costs. The integration of Industry 4.0 principles, including IoT sensors, data analytics, and artificial intelligence, is enabling smart factories that can monitor production processes in real-time, predict equipment failures, and optimize energy consumption, leading to more efficient and sustainable manufacturing operations within the automotive fender wheel house panel sector.

Regional Highlights

- North America: This region exhibits a mature automotive market with a strong emphasis on SUVs and light trucks, driving demand for larger and robust fender wheel house panels. The increasing adoption of electric vehicles and stringent safety regulations are accelerating the shift towards lightweight materials and advanced manufacturing processes. The presence of major OEMs and a robust aftermarket sector contribute to consistent demand.

- Europe: Characterized by stringent emission norms and a focus on luxury and performance vehicles, the European market prioritizes lightweighting, aerodynamic designs, and high-quality finishes. Germany, France, and the UK are key contributors, with a growing emphasis on electric vehicle production and advanced material integration like composites and aluminum.

- Asia Pacific (APAC): The largest and fastest-growing market globally, primarily driven by high vehicle production volumes in China, India, Japan, and South Korea. Rapid urbanization, increasing disposable incomes, and expanding middle-class populations fuel robust demand for both passenger and commercial vehicles. China's burgeoning EV market is a significant growth engine for specialized fender and wheel house components.

- Latin America: This region presents a developing automotive manufacturing base, particularly in Brazil and Mexico. Demand is influenced by economic stability and local production, often focusing on cost-effective solutions for mass-market vehicles. The market is gradually adopting modern technologies and materials as local industries mature and integrate into global supply chains.

- Middle East and Africa (MEA): An emerging market for automotive components, characterized by growing vehicle sales and increasing localized assembly operations. While currently smaller, this region shows potential for growth, driven by infrastructure development and rising consumer spending. Imports of finished vehicles and aftermarket parts remain significant, but local manufacturing is slowly expanding.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Fender Wheel House Panel Parts Market.- Magna International Inc.

- Plastic Omnium

- HBPO GmbH

- Benteler International AG

- Martinrea International Inc.

- Kirchhoff Automotive

- CIE Automotive

- Gestamp Automocion

- Toyoda Gosei Co. Ltd.

- Sumitomo Riko Company Limited

- Grupo Antolin

- Futaba Industrial Co. Ltd.

- Nanjing Changfeng Electromechanical Co. Ltd.

- Dongfeng Motor Parts and Components Group Co. Ltd.

- Aisin Seiki Co. Ltd.

- Samvardhana Motherson Automotive Systems Group (SMP)

- U.S. Auto Parts Network Inc.

- Gordon Auto Body Parts Co. Ltd.

- Depo Auto Parts Ind. Co. Ltd.

- TYC Brother Industrial Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Automotive Fender Wheel House Panel Parts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary materials used in automotive fender wheel house panels?

The primary materials used include steel, aluminum alloys, and various composite plastics such as polypropylene, ABS, and fiberglass, chosen for their balance of strength, weight, and corrosion resistance.

How does lightweighting impact the Automotive Fender Wheel House Panel Parts market?

Lightweighting significantly impacts the market by driving demand for advanced materials like aluminum and composites, reducing vehicle weight, improving fuel efficiency, and enhancing electric vehicle range.

What role do Electric Vehicles (EVs) play in the market growth?

EVs are a major growth driver, as their demand for lighter, more aerodynamic, and often uniquely designed fender and wheel house panels encourages innovation in materials and manufacturing processes.

What is the difference between OEM and aftermarket sales channels in this market?

OEM (Original Equipment Manufacturer) refers to parts supplied directly to car manufacturers for new vehicle assembly, while aftermarket refers to parts sold for vehicle repair and replacement after initial sale.

What key technological advancements are shaping the production of these parts?

Key advancements include advanced stamping and forming techniques, robotic automation, multi-material designs, surface treatment innovations, and the integration of AI and IoT for smart manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager