Automotive Fuel Cell Monitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429602 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Automotive Fuel Cell Monitor Market Size

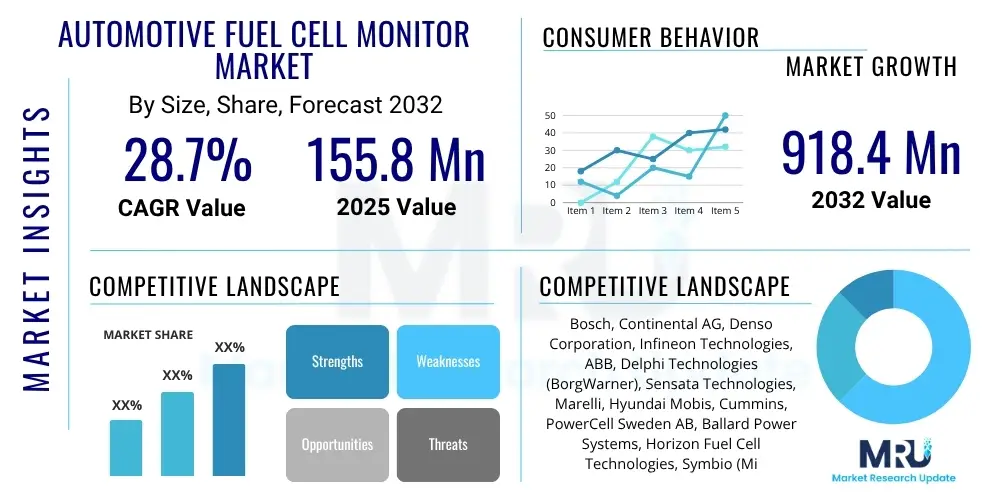

The Automotive Fuel Cell Monitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.7% between 2025 and 2032. The market is estimated at USD 155.8 Million in 2025 and is projected to reach USD 918.4 Million by the end of the forecast period in 2032.

Automotive Fuel Cell Monitor Market introduction

The Automotive Fuel Cell Monitor Market is witnessing significant expansion, driven by the increasing global emphasis on sustainable transportation and the rapid development of hydrogen fuel cell electric vehicles (FCEVs). These specialized monitoring systems are crucial components that ensure the safe, efficient, and reliable operation of fuel cell stacks and their associated subsystems within automotive applications. As governments worldwide implement more stringent emission regulations and offer incentives for zero-emission vehicles, the adoption of FCEVs is accelerating, directly fueling the demand for advanced monitoring solutions. The core function of an automotive fuel cell monitor is to continuously track critical operational parameters, diagnose potential faults, and optimize the overall performance and longevity of the fuel cell system.

The product encompasses a range of sophisticated hardware and software components designed to provide real-time data on parameters such as cell voltage, current, temperature, reactant gas flow, and humidity. These monitors help identify anomalies, predict maintenance needs, and prevent catastrophic failures, thereby enhancing vehicle safety and operational uptime. Major applications for these systems span across various vehicle types, including passenger cars, heavy-duty commercial vehicles like buses and trucks, and specialized material handling equipment such as forklifts. The primary benefits derived from integrating these monitors include improved vehicle performance, extended lifespan of expensive fuel cell components, enhanced safety through early fault detection, and compliance with strict automotive industry standards and safety regulations. These systems act as the central nervous system for fuel cells, providing intelligence essential for their robust operation. The market's growth is predominantly driven by increasing research and development investments in fuel cell technology, efforts to reduce component costs, and the urgent global imperative to decarbonize the transportation sector. Additionally, the continuous advancements in sensor technology and data analytics play a pivotal role in refining the capabilities of these monitoring solutions, making them more accurate, responsive, and indispensable for the widespread adoption of FCEVs.

Automotive Fuel Cell Monitor Market Executive Summary

The Automotive Fuel Cell Monitor Market is poised for substantial growth, reflecting broader shifts towards clean energy and advanced vehicle technologies. Current business trends highlight a strong focus on strategic collaborations between automotive original equipment manufacturers (OEMs) and specialized technology providers to integrate cutting-edge sensor arrays and sophisticated AI-driven diagnostic software into fuel cell vehicles. There is an increasing emphasis on developing modular and scalable monitoring solutions that can be adapted across diverse vehicle platforms, from compact passenger cars to heavy-duty commercial trucks. This collaborative approach aims to accelerate innovation, reduce development costs, and ensure compatibility and interoperability across the nascent FCEV ecosystem. Furthermore, companies are investing heavily in data analytics platforms that can harness the vast amounts of real-time operational data generated by these monitors, transforming raw data into actionable insights for performance optimization, predictive maintenance, and enhanced safety protocols. The competitive landscape is characterized by both established automotive electronics suppliers leveraging their existing expertise and agile startups introducing novel monitoring technologies and software solutions, fostering a dynamic environment for technological advancement.

Regional trends indicate that the Asia-Pacific region, particularly countries such as Japan, South Korea, and China, is at the forefront of market adoption, primarily due to robust government support, substantial investments in hydrogen infrastructure, and aggressive targets for FCEV deployment. These countries are leading in both the production and uptake of fuel cell vehicles, which directly translates into higher demand for monitoring systems. Europe is also demonstrating significant growth, driven by stringent emission regulations and ambitious decarbonization goals, with increasing governmental and private sector investments in hydrogen production and distribution networks across the continent. North America is experiencing a steady ascent, fueled by pilot projects for heavy-duty fuel cell trucks and buses, alongside expanding hydrogen refueling infrastructure in key states. These regional dynamics are further influenced by varying regulatory frameworks, consumer acceptance levels, and the pace of technological infrastructure development. The market segments are exhibiting distinct growth patterns; while hardware components such as specialized sensors and electronic control units (ECUs) currently constitute a larger share of the market value, the software and services segment, including advanced diagnostic algorithms and predictive maintenance platforms, is projected to demonstrate a faster compound annual growth rate. This accelerated growth in software is indicative of the increasing sophistication required for managing complex fuel cell systems and the growing demand for data-driven insights to optimize vehicle performance and ensure long-term reliability. Passenger vehicles currently dominate the application segment, but commercial vehicles, especially heavy-duty trucks and buses, are anticipated to experience robust growth as fleet operators seek more sustainable and efficient logistics solutions.

AI Impact Analysis on Automotive Fuel Cell Monitor Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the efficiency and safety of automotive fuel cell systems, particularly regarding predictive maintenance capabilities and autonomous fault detection. Common questions include whether AI can accurately predict component failures before they occur, how AI integrates with existing monitoring hardware, what specific data points AI algorithms analyze, and if the implementation of AI will make fuel cell monitors more complex or more affordable. There is a strong expectation that AI will deliver significant improvements in operational costs by reducing unscheduled downtime and optimizing fuel cell performance across diverse driving conditions. Furthermore, users are keen to understand AI's role in enhancing the overall safety profile of FCEVs by proactively identifying anomalies that could lead to critical failures. Overall, the prevalent themes center around AI's potential to transform reactive maintenance into proactive strategies, its ability to provide deeper, real-time insights into system health, and its implications for the economic viability and widespread adoption of fuel cell vehicles, alongside underlying concerns about data security, algorithm transparency, and the potential for increased system complexity.

- Predictive Analytics and Maintenance: AI algorithms analyze historical and real-time operational data from fuel cell monitors to identify subtle patterns indicative of impending component degradation or failure. This enables proactive maintenance scheduling, minimizing unscheduled downtime and extending the lifespan of expensive fuel cell stacks and associated components, thereby reducing overall operational costs for fleet operators and individual owners.

- Real-Time Diagnostics and Anomaly Detection: AI enhances the diagnostic capabilities of fuel cell monitors by rapidly processing complex data streams from multiple sensors. It can detect anomalies that human operators or rule-based systems might miss, instantly alerting drivers or fleet managers to critical issues, which is crucial for preventing system damage and ensuring vehicle safety.

- Optimized Energy Management: AI systems can learn optimal operating parameters for fuel cells under varying load demands and environmental conditions. By dynamically adjusting power output, thermal management, and reactant gas supply, AI contributes to maximizing fuel efficiency, improving power delivery, and enhancing the overall performance characteristics of the FCEV.

- Autonomous System Calibration and Adaptation: AI facilitates the autonomous calibration of fuel cell monitoring systems and the adaptive adjustment of control strategies. This allows the system to continuously learn and optimize its behavior over time, compensating for wear and tear, and adapting to different driving styles or environmental factors without manual intervention, leading to consistent performance.

- Enhanced Safety Protocols: By providing immediate and intelligent insights into the health of the fuel cell, AI significantly bolsters vehicle safety. It can trigger failsafe modes or issue critical warnings well in advance of a potential incident, providing an additional layer of protection for vehicle occupants and the surrounding environment, crucial for public acceptance of FCEVs.

DRO & Impact Forces Of Automotive Fuel Cell Monitor Market

The Automotive Fuel Cell Monitor Market is influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the accelerating global adoption of Fuel Cell Electric Vehicles (FCEVs), fueled by ambitious targets set by numerous governments and automotive manufacturers to transition towards zero-emission transportation. This shift is strongly supported by increasingly stringent environmental regulations and carbon emission standards worldwide, which necessitate the deployment of advanced powertrain technologies and their accompanying sophisticated monitoring systems. Furthermore, significant technological advancements in fuel cell stack efficiency, durability, and cost reduction are making FCEVs more commercially viable, directly translating into greater demand for reliable and accurate monitoring solutions. Government incentives, subsidies for FCEV purchases, and investments in hydrogen infrastructure also play a crucial role in stimulating market growth, creating a supportive ecosystem for fuel cell technology adoption and the related monitoring systems.

Despite these strong drivers, the market faces several significant restraints. The high initial purchase cost of FCEVs remains a substantial barrier for many consumers and fleet operators, making the total cost of ownership less competitive compared to conventional internal combustion engine vehicles or even battery electric vehicles in certain segments. Another major restraint is the underdeveloped and sparse hydrogen refueling infrastructure globally. The limited availability of hydrogen stations creates range anxiety and logistical challenges, hindering widespread FCEV adoption, which in turn dampens the demand for fuel cell monitors. Public perception and safety concerns regarding hydrogen storage and handling, although largely unfounded with modern safety standards, can also create apprehension among potential buyers. Moreover, the inherent complexity of fuel cell systems, requiring specialized knowledge for maintenance and diagnostics, poses challenges for wider market penetration, necessitating highly sophisticated and user-friendly monitoring solutions.

Opportunities within this market are abundant and promising. The ongoing research and development aimed at reducing fuel cell costs and improving performance continues to create new avenues for monitor integration. Emerging markets, particularly in Asia and parts of Europe, present significant growth potential as their governments actively promote clean energy initiatives and invest in hydrogen infrastructure development. The expansion of FCEVs into heavy-duty applications such as long-haul trucks, buses, trains, and marine vessels offers a substantial new market segment for robust and specialized fuel cell monitoring systems. Furthermore, the integration of these monitors with Vehicle-to-Everything (V2X) communication technologies and advanced telematics can unlock new services, such as predictive fleet maintenance, remote diagnostics, and optimized route planning. The development of standardized communication protocols and data exchange formats for fuel cell monitoring systems also represents a significant opportunity to streamline integration and foster market interoperability, simplifying the development and deployment process for OEMs and suppliers.

Several external impact forces are profoundly shaping the Automotive Fuel Cell Monitor Market. The overarching regulatory push for zero-emission vehicles, including a global shift away from fossil fuels, creates a powerful impetus for FCEV development and, by extension, the demand for their monitoring systems. Rapid advancements in sensor technology, including miniaturization, increased accuracy, and enhanced durability, continuously improve the capabilities and reduce the cost of monitoring hardware. Concurrently, the decreasing cost of green hydrogen production through renewable energy sources is making hydrogen fuel more economically attractive, directly influencing the long-term viability and growth of FCEVs. The global shift towards sustainable mobility solutions across all transportation sectors, driven by environmental consciousness and energy security concerns, underpins the market's fundamental trajectory. Geopolitical developments and energy policy decisions can also significantly impact hydrogen supply chains and the overall pace of FCEV infrastructure deployment, thereby indirectly affecting the fuel cell monitor market.

Segmentation Analysis

The Automotive Fuel Cell Monitor Market is comprehensively segmented to provide a detailed understanding of its diverse components, applications, and technological approaches. This segmentation allows for a granular analysis of market dynamics, growth drivers, and competitive landscapes across different product categories and end-use sectors within the rapidly evolving fuel cell vehicle industry. The intricate nature of fuel cell systems necessitates specialized monitoring solutions tailored to specific operational requirements and vehicle types, leading to a rich and varied market structure. Understanding these segments is critical for stakeholders to identify lucrative opportunities, develop targeted product strategies, and adapt to the specific demands of various automotive applications. The primary segmentation dimensions include the type of components that constitute the monitoring system, the various vehicle categories in which these systems are deployed, the underlying fuel cell technologies being monitored, and the specific functions or applications these monitors serve within the vehicle's operational framework.

The market's segmentation by component differentiates between the physical hardware and the intelligent software that together form a complete monitoring system. Hardware includes all the tangible sensors, electronic control units, and communication modules responsible for data acquisition and preliminary processing, representing the foundational layer of the monitoring infrastructure. Conversely, the software segment encompasses the sophisticated algorithms, diagnostic tools, and predictive maintenance platforms that interpret raw data, identify anomalies, and provide actionable insights, which are increasingly powered by AI and machine learning. Segmentation by vehicle type categorizes the market based on its application in passenger cars versus commercial vehicles, with further distinctions within commercial vehicles to differentiate between light-duty and heavy-duty applications, each presenting unique monitoring challenges and requirements. The technology-based segmentation acknowledges the various types of fuel cells, such as Proton Exchange Membrane Fuel Cells (PEMFC) and Solid Oxide Fuel Cells (SOFC), each requiring specific monitoring approaches due to their distinct operational characteristics. Finally, the application segmentation delineates the specific functionalities of the monitors, which typically include performance optimization, safety assurance, and comprehensive diagnostics and fault detection, each playing a vital role in the overall integrity and efficiency of the fuel cell vehicle.

- By Component:

- Hardware (Sensors, Electronic Control Units (ECUs), Wiring Harnesses, Communication Modules)

- Software (Diagnostic Algorithms, Predictive Maintenance Platforms, Data Analytics Solutions)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy-Duty Vehicles - Trucks, Buses)

- By Technology:

- Proton Exchange Membrane Fuel Cells (PEMFC)

- Solid Oxide Fuel Cells (SOFC)

- Others (e.g., Alkaline Fuel Cells, Phosphoric Acid Fuel Cells)

- By Application:

- Performance Monitoring (Efficiency, Output Optimization)

- Safety Monitoring (Leak Detection, Overheating Prevention)

- Diagnostics and Fault Detection (Proactive Problem Identification, Root Cause Analysis)

Value Chain Analysis For Automotive Fuel Cell Monitor Market

The value chain for the Automotive Fuel Cell Monitor Market involves a complex network of activities, starting from the sourcing of raw materials and extending to the final integration and aftermarket services. The upstream segment of the value chain is critical, focusing on the procurement and processing of specialized raw materials and the manufacturing of foundational components. This includes suppliers of precious metals like platinum for catalysts, specialized carbon paper, polymer membranes, and various electronic components such as microcontrollers, memory chips, and communication modules that form the backbone of the monitoring hardware. These suppliers often operate in highly specialized niches, providing essential inputs that meet stringent automotive quality and durability standards. Key players in this stage are semiconductor manufacturers, sensor technology companies, and material science firms. The quality and availability of these upstream components directly impact the performance, cost, and reliability of the final fuel cell monitor.

Moving downstream, the value chain encompasses the integration of these components into complete monitoring systems, followed by their distribution to vehicle manufacturers and eventual end-users. Original Equipment Manufacturers (OEMs) of automotive fuel cell monitors play a pivotal role in assembling, testing, and calibrating these systems, often developing proprietary software and algorithms that interface with the hardware. These integrated monitoring solutions are then supplied directly to Automotive OEMs (vehicle manufacturers) who incorporate them into their FCEV production lines. The distribution channel involves both direct sales, where monitor manufacturers supply directly to large automotive OEMs for factory installation, and indirect channels, where component distributors, system integrators, and authorized resellers facilitate the provision of modular monitoring solutions or replacement parts to aftermarket service providers, independent workshops, and smaller vehicle converters. Direct sales are prevalent for fully integrated, bespoke solutions, emphasizing close collaboration between the monitor supplier and the vehicle manufacturer to ensure seamless integration and optimized performance. Indirect distribution channels cater more to the aftermarket and specialized vehicle segments, offering flexibility and broader accessibility to components and services.

Automotive Fuel Cell Monitor Market Potential Customers

The Automotive Fuel Cell Monitor Market primarily targets a diverse group of end-users and buyers who are either directly involved in the manufacturing of fuel cell vehicles or in their operation and maintenance. The largest and most significant segment of potential customers comprises Automotive Original Equipment Manufacturers (OEMs). These include major global car manufacturers, truck and bus manufacturers, and specialized vehicle producers who are developing and integrating fuel cell technology into their vehicle platforms. These OEMs require advanced, reliable, and integrated fuel cell monitoring systems that can be seamlessly incorporated into their production processes and meet rigorous safety and performance standards. Their purchasing decisions are often driven by factors such as system reliability, integration capabilities, compliance with regulatory standards, and the overall cost-effectiveness of the monitoring solutions, as they aim to deliver robust and competitive FCEVs to the market.

Beyond the direct vehicle manufacturers, other key potential customers include fuel cell system integrators and specialized technology providers who develop complete fuel cell powertrains for various applications. These integrators often act as intermediaries, sourcing individual components, including monitors, and combining them into a complete, optimized system for smaller vehicle manufacturers or for non-automotive applications that utilize fuel cell technology. Fleet management companies and public transportation authorities also represent a growing customer base. As they increasingly adopt fuel cell electric buses and trucks for their operations, the need for sophisticated monitoring systems that enable predictive maintenance, optimize operational efficiency, and ensure vehicle uptime becomes paramount. These customers are particularly interested in solutions that offer remote diagnostics, real-time performance tracking, and data analytics capabilities to manage their large fleets effectively. Additionally, research and development institutions focused on advancing fuel cell technology, as well as independent workshops specializing in electric and hydrogen vehicles, constitute smaller but significant customer segments, requiring monitoring tools for testing, analysis, and specialized maintenance services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 155.8 Million |

| Market Forecast in 2032 | USD 918.4 Million |

| Growth Rate | CAGR 28.7% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental AG, Denso Corporation, Infineon Technologies, ABB, Delphi Technologies (BorgWarner), Sensata Technologies, Marelli, Hyundai Mobis, Cummins, PowerCell Sweden AB, Ballard Power Systems, Horizon Fuel Cell Technologies, Symbio (Michelin & Faurecia JV), Plug Power, Intelligent Energy, Toyota, Honda, Weidmüller, TE Connectivity |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Fuel Cell Monitor Market Key Technology Landscape

The Automotive Fuel Cell Monitor Market is characterized by a sophisticated and rapidly evolving technology landscape, where continuous innovation is crucial for enhancing system performance, reliability, and safety. At the core are advanced electrochemical sensors designed specifically to withstand the harsh operating environments of fuel cells, capable of precisely measuring critical parameters such as individual cell voltage, stack temperature, hydrogen and air flow rates, and humidity levels. These sensors are paramount for providing the raw data necessary for accurate monitoring. Complementing these sensors are highly integrated embedded systems and Electronic Control Units (ECUs) that process this data in real-time. These ECUs are equipped with powerful microcontrollers and memory, executing complex algorithms for data acquisition, filtering, and preliminary diagnostics, often developed to meet stringent automotive functional safety standards like ISO 26262 to ensure fail-safe operation. The communication within the vehicle typically relies on robust in-vehicle networking protocols such as CAN bus, LIN bus, and increasingly Ethernet, enabling efficient data exchange between the monitor and other vehicle systems.

The intelligence layer of fuel cell monitors heavily leverages cloud-based data analytics and advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These technologies are utilized for developing sophisticated predictive maintenance models, allowing for the anticipation of potential failures before they occur, thereby minimizing downtime and optimizing maintenance schedules. AI algorithms can also perform real-time anomaly detection, identifying subtle deviations from normal operating patterns that might indicate an emerging issue. Furthermore, the integration of Internet of Things (IoT) connectivity is becoming a key trend, enabling remote monitoring, over-the-air (OTA) updates, and telematics services for fleet management. This connectivity allows for continuous data streaming to centralized platforms, facilitating comprehensive analysis, system optimization across an entire fleet, and proactive customer support. The development of advanced thermal management systems, fault-tolerant architectures, and sophisticated power electronics also plays a critical role in enhancing the overall reliability and performance of both the fuel cell monitor and the fuel cell system it oversees. As fuel cell technology matures, the emphasis on robust, intelligent, and interconnected monitoring solutions will only intensify, pushing the boundaries of automotive electronics and software innovation.

Regional Highlights

- North America: This region is experiencing steady growth in the Automotive Fuel Cell Monitor Market, primarily driven by increasing investments in hydrogen refueling infrastructure and supportive government policies aimed at promoting zero-emission vehicles. There is a strong focus on electrifying commercial fleets, particularly heavy-duty trucks and buses, where fuel cells offer a compelling solution for range and payload requirements. Key states and provinces are actively funding hydrogen production and distribution projects, fostering an environment conducive to FCEV adoption and the associated demand for advanced monitoring systems.

- Europe: Europe stands as a significant market, propelled by highly ambitious carbon emission reduction targets and robust research and development initiatives in green hydrogen production. Strict regulations encourage automotive manufacturers to accelerate the transition to FCEVs. Collaborative efforts between major automotive players and energy companies are creating a cohesive ecosystem for hydrogen mobility. Public transportation sectors, especially, are increasingly deploying fuel cell buses, requiring reliable and sophisticated monitoring technologies to ensure safety and operational efficiency.

- Asia Pacific (APAC): The APAC region is a dominant force in the Automotive Fuel Cell Monitor Market, characterized by rapid FCEV adoption, strong governmental incentives, and substantial investments in hydrogen technologies. Countries like Japan, South Korea, and China are leading in both the manufacturing and deployment of fuel cell vehicles, supported by extensive national hydrogen strategies. This region benefits from large-scale manufacturing capabilities and a growing consumer base that is increasingly receptive to innovative clean energy transportation solutions, making it a critical hub for market growth and technological advancements.

- Latin America: While nascent, the Automotive Fuel Cell Monitor Market in Latin America is showing promising signs of growth. Increasing awareness regarding environmental sustainability and the potential for hydrogen production from abundant renewable energy sources (e.g., hydropower, solar) are stimulating initial interest and pilot projects. Governments in countries like Chile and Brazil are exploring hydrogen as a key component of their future energy matrices, which could gradually lead to increased FCEV adoption and, consequently, demand for monitoring systems as infrastructure develops.

- Middle East and Africa (MEA): The MEA region represents an emerging market for automotive fuel cell monitors, driven by long-term strategic goals for economic diversification away from fossil fuels and a commitment to sustainable development. Significant investments in renewable energy projects provide a foundation for green hydrogen production. While FCEV adoption is currently limited to pilot programs and niche applications, the region's strong financial capacity and strategic vision for a hydrogen economy suggest substantial potential for future growth in both FCEV deployment and the associated monitoring technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Fuel Cell Monitor Market.- Bosch

- Continental AG

- Denso Corporation

- Infineon Technologies

- ABB

- Delphi Technologies (BorgWarner)

- Sensata Technologies

- Marelli

- Hyundai Mobis

- Cummins

- PowerCell Sweden AB

- Ballard Power Systems

- Horizon Fuel Cell Technologies

- Symbio (Michelin & Faurecia JV)

- Plug Power

- Intelligent Energy

- Toyota

- Honda

- Weidmüller

- TE Connectivity

Frequently Asked Questions

What is an automotive fuel cell monitor and how does it function?

An automotive fuel cell monitor is a specialized electronic system designed to continuously track, analyze, and diagnose the operational parameters and health of a vehicle's fuel cell stack and its associated subsystems. It functions by collecting real-time data from various sensors measuring cell voltage, temperature, gas flow, and humidity, then processing this information to ensure optimal performance, safety, and longevity of the fuel cell system.

Why are fuel cell monitors considered crucial for the widespread adoption of Fuel Cell Electric Vehicles (FCEVs)?

Fuel cell monitors are crucial because they provide essential real-time diagnostics, enable predictive maintenance, and ensure the safety and reliability of complex fuel cell systems. By detecting potential malfunctions early, optimizing energy management, and extending the lifespan of expensive fuel cell components, they mitigate risks and enhance the overall value proposition of FCEVs, thereby bolstering consumer and industry confidence for broader adoption.

How does Artificial Intelligence (AI) specifically contribute to advancements in automotive fuel cell monitoring?

AI significantly enhances fuel cell monitoring by enabling advanced capabilities such as predictive analytics for proactive maintenance, real-time anomaly detection for critical fault identification, and optimized energy management for improved efficiency. AI algorithms process vast sensor data to identify patterns and forecast issues, transforming reactive troubleshooting into intelligent, proactive system management and enhancing overall performance and safety.

What are the primary challenges hindering the growth of the Automotive Fuel Cell Monitor Market?

Key challenges for the Automotive Fuel Cell Monitor Market include the high initial cost of Fuel Cell Electric Vehicles, which affects overall market penetration; the underdeveloped global hydrogen refueling infrastructure, limiting FCEV practicality; and the inherent complexity of integrating sophisticated monitoring systems into diverse vehicle platforms, requiring specialized expertise and development resources.

Which geographical regions are currently leading in the development and adoption of automotive fuel cell monitors?

The Asia Pacific region, particularly countries like Japan, South Korea, and China, is currently leading in both the development and adoption of automotive fuel cell monitors, driven by strong governmental support and rapid FCEV deployment initiatives. Europe and North America are also significant and growing markets, propelled by stringent emission regulations and increasing investments in hydrogen infrastructure and FCEV technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager