Automotive Gear Reducer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428583 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Automotive Gear Reducer Market Size

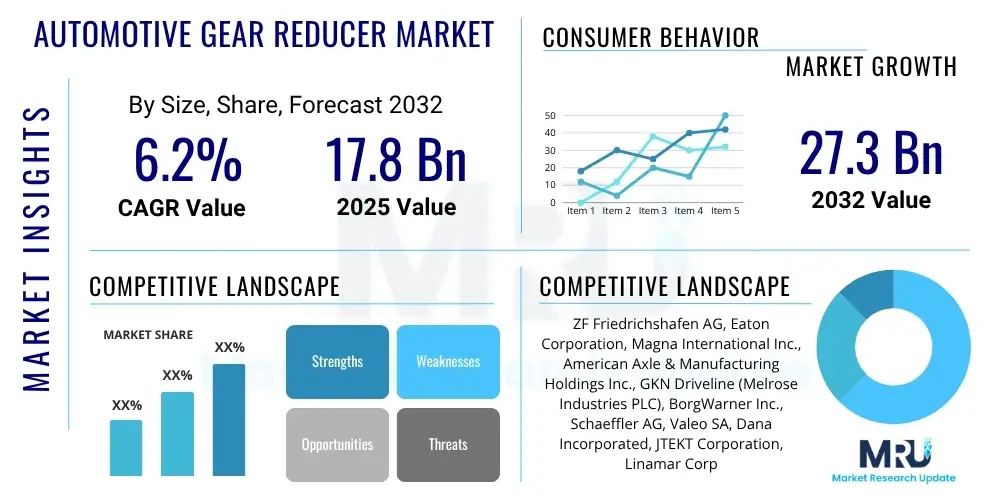

The Automotive Gear Reducer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. The market is estimated at USD 17.8 Billion in 2025 and is projected to reach USD 27.3 Billion by the end of the forecast period in 2032.

Automotive Gear Reducer Market introduction

The Automotive Gear Reducer Market encompasses components critical for power transmission in various vehicle types, facilitating efficient speed reduction and torque multiplication. These sophisticated mechanical devices are integral to modern automotive powertrains, ensuring optimal performance across diverse driving conditions. Primarily, a gear reducer converts high-speed, low-torque input from an engine or motor into low-speed, high-torque output, which is essential for vehicle propulsion and auxiliary systems.

Product descriptions vary widely, ranging from planetary gear sets known for their compact design and high efficiency, often favored in electric vehicles, to helical, worm, hypoid, and bevel gears predominantly used in conventional internal combustion engine (ICE) vehicles. Each type offers specific advantages in terms of space, noise, vibration, and harshness (NVH) characteristics, and load-bearing capacity. Major applications include main transmissions, differentials, transfer cases, and increasingly, dedicated electric drive units (EDUs) for electric and hybrid vehicles. The benefits derived from advanced gear reducers include enhanced fuel efficiency, improved acceleration, superior drivability, and reduced emissions, contributing significantly to overall vehicle performance and passenger comfort.

Driving factors for market growth are multifaceted, propelled by the accelerating global shift towards electric vehicles, which demand highly efficient and precise gear reduction mechanisms for their electric motors. Stricter emission regulations worldwide are pushing manufacturers to develop more fuel-efficient and environmentally friendly vehicles, increasing the importance of optimized gear systems in ICE vehicles as well. Furthermore, the rising demand for lightweight components to improve vehicle performance and reduce fuel consumption, coupled with advancements in manufacturing technologies and materials, continues to fuel innovation and expansion within the automotive gear reducer market.

Automotive Gear Reducer Market Executive Summary

The Automotive Gear Reducer Market is poised for substantial growth, driven by key business, regional, and segmental trends. From a business perspective, the industry is witnessing intensified research and development investments focused on lightweight materials, advanced manufacturing processes such as additive manufacturing, and noise, vibration, and harshness (NVH) reduction technologies to meet evolving performance and comfort standards. Strategic collaborations and partnerships between traditional gear manufacturers and electric vehicle powertrain developers are becoming increasingly common, reflecting the market's pivot towards electrification and the need for specialized electric vehicle (EV) gear solutions. Mergers and acquisitions are also playing a role in consolidating expertise and expanding market reach, particularly in nascent EV-specific component sectors. Companies are also prioritizing supply chain resilience and diversification in response to recent global disruptions, seeking to secure critical raw materials and manufacturing capabilities.

Regionally, Asia Pacific stands as the dominant market, primarily fueled by robust automotive production in countries like China, India, and Japan, coupled with the rapid adoption of electric vehicles in these economies. Europe is recognized for its strong emphasis on technological innovation and stringent environmental regulations, driving demand for high-efficiency and low-emission gear reducers, especially for premium and luxury vehicle segments and its burgeoning EV market. North America demonstrates stable growth, with a focus on both conventional and electric vehicle segments, alongside a rising demand for heavy-duty commercial vehicle applications. Emerging markets in Latin America and the Middle East and Africa are also showing promising growth potential, albeit from a lower base, as automotive manufacturing and vehicle ownership continue to expand in these regions.

Segmental trends highlight a significant shift towards planetary gear sets and single-speed reduction units, particularly within the electric vehicle segment due to their compact size, high power density, and efficiency, which are ideal for electric powertrains. Conventional gear types like helical and hypoid gears continue to dominate the internal combustion engine vehicle market, benefiting from ongoing innovations aimed at improving durability and reducing friction. The aftermarket segment is expected to maintain steady growth, driven by the aging vehicle fleet and the need for replacement parts, while the OEM segment continues to be the largest, directly influenced by global vehicle production volumes. This dynamic interplay of business strategies, regional strengths, and evolving segmental demands defines the current trajectory of the Automotive Gear Reducer Market.

AI Impact Analysis on Automotive Gear Reducer Market

User questions regarding AI's impact on the Automotive Gear Reducer Market frequently revolve around how artificial intelligence can enhance design, optimize manufacturing processes, improve predictive maintenance, and facilitate the development of smarter, more efficient components. Key themes include the potential for AI to shorten development cycles through simulation and generative design, reduce production costs by optimizing machine parameters, and extend product lifespan via advanced diagnostics. There is also a significant interest in how AI can contribute to the development of next-generation gear reducers, especially for electric vehicles, by enabling real-time performance monitoring and adaptive control, thereby addressing concerns about efficiency, noise, and durability. Users expect AI to revolutionize various stages of the product lifecycle, from concept to end-of-life, fostering a new era of intelligent manufacturing and sustainable product usage.

- AI-driven generative design for optimal gear geometries, reducing weight and improving performance.

- Predictive maintenance algorithms using sensor data to forecast gear reducer failures, minimizing downtime.

- AI-powered quality control systems for enhanced inspection during manufacturing, ensuring precision.

- Optimization of manufacturing parameters through machine learning for increased efficiency and reduced waste.

- Smart material selection aided by AI to identify the best alloys and composites for durability and weight reduction.

- AI in supply chain management for improved forecasting and logistics, ensuring timely component delivery.

- Development of adaptive gear shifting strategies for hybrid and electric vehicles using AI for improved energy efficiency.

- Real-time performance monitoring and diagnostics in vehicles, providing actionable insights for maintenance and operation.

DRO & Impact Forces Of Automotive Gear Reducer Market

The Automotive Gear Reducer Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces that shape its growth trajectory and competitive landscape. A primary driver is the accelerating global transition to electric vehicles (EVs) and hybrid vehicles, which necessitate specialized and highly efficient gear reduction units for their electric powertrains. Concurrently, stringent global emission standards and fuel efficiency mandates for internal combustion engine (ICE) vehicles continue to push manufacturers to develop more advanced and efficient traditional gear reducers. The overall increase in global automotive production, driven by rising disposable incomes and expanding urbanization, particularly in emerging economies, further bolsters demand for these critical components. Moreover, the growing consumer expectation for enhanced vehicle performance, reduced noise, vibration, and harshness (NVH), and improved driving comfort also fuels innovation and demand for high-quality gear reducers.

Conversely, several significant restraints challenge market expansion. The high initial manufacturing cost associated with precision engineering and specialized materials required for advanced gear reducers can limit broader adoption, especially in cost-sensitive market segments. Volatility in raw material prices, such as steel, aluminum, and specialty alloys, can significantly impact production costs and profit margins for manufacturers. The inherent complexity of designing and manufacturing sophisticated gear systems, which require extensive research and development, poses another barrier. Furthermore, the long product lifecycle of automotive components means that replacement cycles are relatively slow, potentially impacting aftermarket growth, while the capital-intensive nature of setting up and upgrading manufacturing facilities for gear reducers can deter new entrants and limit smaller players.

Opportunities for growth are abundant within this dynamic market. The continuous development of lightweight and high-strength materials, including advanced composites and specialized alloys, presents avenues for creating more fuel-efficient and durable gear reducers. Integration with hybrid vehicle architectures offers a fertile ground for innovation, requiring gear systems that can seamlessly manage power flow from both electric motors and ICEs. The adoption of advanced manufacturing technologies, such as additive manufacturing (3D printing) and precision machining, can lead to more complex geometries, improved performance, and reduced material waste. Additionally, the increasing demand for autonomous vehicles and advanced driver-assistance systems (ADAS) will necessitate new gear reducer designs capable of higher reliability and precision, opening up new application areas. Impact forces, such as evolving regulatory landscapes concerning emissions and safety, global economic conditions influencing vehicle sales, and rapid technological advancements in powertrain electrification, exert a profound influence on strategic decisions and market development, compelling continuous adaptation and innovation from market participants.

Segmentation Analysis

The Automotive Gear Reducer Market is comprehensively segmented to provide a detailed understanding of its diverse components and applications. This segmentation allows for precise analysis of market dynamics, identification of key growth areas, and understanding of competitive landscapes across different product types, vehicle applications, and end-user categories. The market is primarily bifurcated by the specific type of gear mechanism employed, the automotive application within the vehicle, the type of vehicle using the gear reducer, and the sales channel through which these components reach their buyers. Each segment reflects unique technological requirements, production volumes, and market growth drivers, contributing to a granular view of the overall industry.

- By Type

- Planetary Gear Reducers

- Helical Gear Reducers

- Worm Gear Reducers

- Hypoid Gear Reducers

- Bevel Gear Reducers

- Cycloidal Gear Reducers

- By Application

- Transmission Systems (Manual, Automatic, CVT, DCT)

- Differentials

- Transfer Cases

- Electric Drive Units (EDUs)

- Axle Drives

- Steering Systems

- By Vehicle Type

- Passenger Vehicles

- Sedans

- SUVs

- Hatchbacks

- Luxury Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Buses & Coaches

- Electric Vehicles (BEV, PHEV, FCEV)

- Passenger Vehicles

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Gear Reducer Market

The value chain for the Automotive Gear Reducer Market is a complex network spanning from raw material sourcing to end-use vehicle integration and aftermarket services, involving various stakeholders and processes that add value at each stage. The upstream analysis begins with the extraction and processing of essential raw materials, primarily high-strength steel, aluminum alloys, and other specialized metals and composites, which are crucial for the durability and performance of gear components. These materials are then supplied to component manufacturers specializing in bearings, seals, fasteners, and housing units, which are integral parts of a complete gear reducer assembly. Precision forging, casting, and machining operations are fundamental at this stage, converting raw materials into highly toleranced gear blanks and other parts.

Moving downstream, the manufactured gear components and assemblies are supplied directly to automotive original equipment manufacturers (OEMs). These OEMs integrate the gear reducers into the broader powertrain systems of their vehicles, including transmissions, differentials, and increasingly, electric drive units. This stage involves rigorous testing, assembly, and quality control to ensure seamless functionality within the complete vehicle system. Beyond new vehicle production, the aftermarket segment forms another critical downstream channel, catering to replacement parts and repair services for vehicles already on the road. Independent repair shops, authorized service centers, and spare parts distributors play a vital role in this segment, ensuring the longevity and continued performance of vehicles through the provision of replacement gear reducers.

Distribution channels for automotive gear reducers are primarily bifurcated into direct and indirect routes. Direct distribution typically involves long-term contracts and direct supply agreements between gear reducer manufacturers and large automotive OEMs, characterized by high volume and just-in-time delivery requirements. Indirect channels, predominantly serving the aftermarket, involve a network of independent distributors, wholesalers, and retailers who stock and sell replacement gear reducers to repair facilities and individual consumers. Online platforms and e-commerce are also gaining traction as indirect channels, offering greater accessibility and competitive pricing for aftermarket components. The efficiency and reliability of these distribution channels are paramount for ensuring timely availability of components across global markets, supporting both new vehicle production and ongoing maintenance needs.

Automotive Gear Reducer Market Potential Customers

The Automotive Gear Reducer Market caters to a diverse range of potential customers, each with specific requirements and purchasing behaviors that drive demand across different segments. Primary customers include global automotive Original Equipment Manufacturers (OEMs), who constitute the largest segment. These companies, such as General Motors, Ford, Toyota, Volkswagen, and Hyundai, require massive volumes of gear reducers for integration into their new passenger vehicles, commercial vehicles, and electric vehicle platforms. Their purchasing decisions are driven by stringent performance specifications, cost-effectiveness, supply chain reliability, and long-term partnership agreements. The shift towards electrification means that EV-focused OEMs like Tesla, BYD, and emerging EV startups are increasingly significant customers, demanding specialized, compact, and highly efficient gear reduction units for their electric drivetrains.

Beyond passenger car manufacturers, commercial vehicle manufacturers represent another substantial customer base. Companies producing light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), buses, and coaches require robust and durable gear reducers designed to withstand high torque loads and continuous heavy-duty operation. These customers prioritize reliability, longevity, and maintenance ease, given the critical role of their vehicles in logistics, transportation, and public services. Construction and agricultural equipment manufacturers, while sometimes considered part of the broader commercial vehicle sector, also represent specialized buyers for rugged gear reducers used in off-highway applications, demanding exceptional durability and performance under extreme conditions.

The aftermarket segment constitutes a crucial set of potential customers, comprising independent automotive repair shops, authorized service centers, fleet operators, and individual vehicle owners. These customers purchase replacement gear reducers for vehicle maintenance, repair, and upgrades as components wear out or fail over the lifespan of a vehicle. Their purchasing decisions are often influenced by availability, price, brand reputation, and compatibility with various vehicle models. Fleet operators, managing large numbers of vehicles, are particularly important as they seek durable and cost-effective replacement parts to minimize downtime and operational expenses. The expansion of the global vehicle fleet, coupled with aging vehicles, ensures a continuous and growing demand from the aftermarket segment, complementing the demand from new vehicle production.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 17.8 Billion |

| Market Forecast in 2032 | USD 27.3 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Eaton Corporation, Magna International Inc., American Axle & Manufacturing Holdings Inc., GKN Driveline (Melrose Industries PLC), BorgWarner Inc., Schaeffler AG, Valeo SA, Dana Incorporated, JTEKT Corporation, Linamar Corporation, Continental AG, Renold PLC, Bosch Rexroth AG, Nidec Corporation, Siemens AG, Sumitomo Heavy Industries Ltd., Kawasaki Heavy Industries Ltd., Bonfiglioli Riduttori S.p.A., Varvel S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Gear Reducer Market Key Technology Landscape

The Automotive Gear Reducer Market is characterized by a dynamic and evolving technology landscape, with innovations continually aimed at enhancing efficiency, durability, and performance while reducing weight and noise. One prominent technological trend is the advancement in material science, focusing on the development and application of lightweight, high-strength alloys such as advanced steels, aluminum alloys, and magnesium alloys. These materials contribute significantly to overall vehicle weight reduction, thereby improving fuel economy in ICE vehicles and extending range in electric vehicles. Furthermore, the use of composite materials is gaining traction for housing and other non-load-bearing components, offering further weight savings without compromising structural integrity.

Another critical area of technological development lies in advanced manufacturing processes. Precision machining techniques, such as gear hobbing, shaping, and grinding, are continuously refined to achieve tighter tolerances and superior surface finishes, which are crucial for reducing friction, wear, and noise. Additive manufacturing (3D printing) is emerging as a disruptive technology, enabling the creation of complex gear geometries and integrated structures that were previously impossible with traditional methods. This allows for optimized designs, rapid prototyping, and potentially customized components. Heat treatment and surface coating technologies, including nitriding, carburizing, and various PVD/CVD coatings, are also crucial for enhancing the hardness, wear resistance, and fatigue strength of gear teeth, extending the operational life of the reducers.

Moreover, the integration of noise, vibration, and harshness (NVH) reduction technologies is paramount, especially in the context of electric vehicles where powertrain noise is more noticeable due to the absence of engine sound. This involves sophisticated gear tooth profiling, optimized gear meshing, and the use of advanced damping materials and acoustic isolation techniques. Lubrication technologies are also seeing innovation, with the development of synthetic oils and specialized additives that reduce friction, manage heat more effectively, and improve efficiency across a wider range of operating temperatures. The incorporation of sensors for real-time monitoring of temperature, vibration, and lubrication status is also becoming more common, enabling predictive maintenance and enhancing overall system reliability, contributing to the development of smarter and more connected automotive gear reducer systems.

Regional Highlights

- North America: The North American market is characterized by a stable demand for both conventional and electric vehicle gear reducers. The United States and Canada are major contributors, driven by significant automotive production and a growing aftermarket. Investments in EV infrastructure and manufacturing facilities are fostering growth in electric drive unit applications. Stringent fuel efficiency standards continue to influence the development of advanced gear systems for ICE vehicles.

- Europe: Europe stands as a hub for technological innovation in the automotive sector, with countries like Germany, France, and the UK leading the charge. The region emphasizes high-efficiency, low-emission, and compact gear reducers, particularly for its premium vehicle segments and rapidly expanding electric vehicle market. Stringent environmental regulations and a strong push towards sustainable mobility are key drivers.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily dominated by China, India, Japan, and South Korea. This growth is fueled by massive automotive production volumes, rapid urbanization, and a burgeoning middle class increasing vehicle ownership. The region is at the forefront of electric vehicle adoption, driving substantial demand for specialized EV gear reducers and fostering significant domestic and international investment.

- Latin America: The Latin American market, including Brazil and Mexico, demonstrates steady growth in automotive production and sales. While primarily focused on conventional vehicles, there is a gradual increase in hybrid and electric vehicle adoption. Economic stability and foreign investments in manufacturing facilities are key factors influencing market expansion for gear reducers in the region.

- Middle East and Africa (MEA): The MEA region is an emerging market for automotive gear reducers, with growth driven by increasing vehicle ownership, infrastructure development, and nascent automotive manufacturing activities, particularly in countries like South Africa and Turkey. The demand is largely for conventional vehicle applications, with slow but steady progress in adopting electric mobility solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Gear Reducer Market.- ZF Friedrichshafen AG

- Eaton Corporation

- Magna International Inc.

- American Axle & Manufacturing Holdings Inc.

- GKN Driveline (Melrose Industries PLC)

- BorgWarner Inc.

- Schaeffler AG

- Valeo SA

- Dana Incorporated

- JTEKT Corporation

- Linamar Corporation

- Continental AG

- Renold PLC

- Bosch Rexroth AG

- Nidec Corporation

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- Kawasaki Heavy Industries Ltd.

- Bonfiglioli Riduttori S.p.A.

- Varvel S.p.A.

Frequently Asked Questions

What is the projected growth rate for the Automotive Gear Reducer Market?

The Automotive Gear Reducer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032, reaching USD 27.3 Billion by 2032.

How does the rise of electric vehicles impact the Automotive Gear Reducer Market?

The surge in electric vehicle (EV) adoption is a significant driver, shifting demand towards specialized, compact, and highly efficient planetary gear sets and single-speed reduction units tailored for electric powertrains, which is essential for maximizing range and performance.

What are the primary drivers of growth in the Automotive Gear Reducer Market?

Key drivers include accelerating electric vehicle adoption, stringent global emission regulations, increasing overall automotive production, and a continuous demand for enhanced vehicle performance and fuel efficiency.

Which region dominates the Automotive Gear Reducer Market?

Asia Pacific (APAC) currently dominates the Automotive Gear Reducer Market, fueled by robust automotive production in countries like China, India, and Japan, coupled with rapid electric vehicle adoption in the region.

What technological advancements are shaping the future of gear reducers?

Key technological advancements include the use of lightweight and high-strength materials, advanced manufacturing processes like additive manufacturing, enhanced NVH reduction techniques, and smart lubrication systems for improved efficiency and durability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager