Automotive Green Tires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429081 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Green Tires Market Size

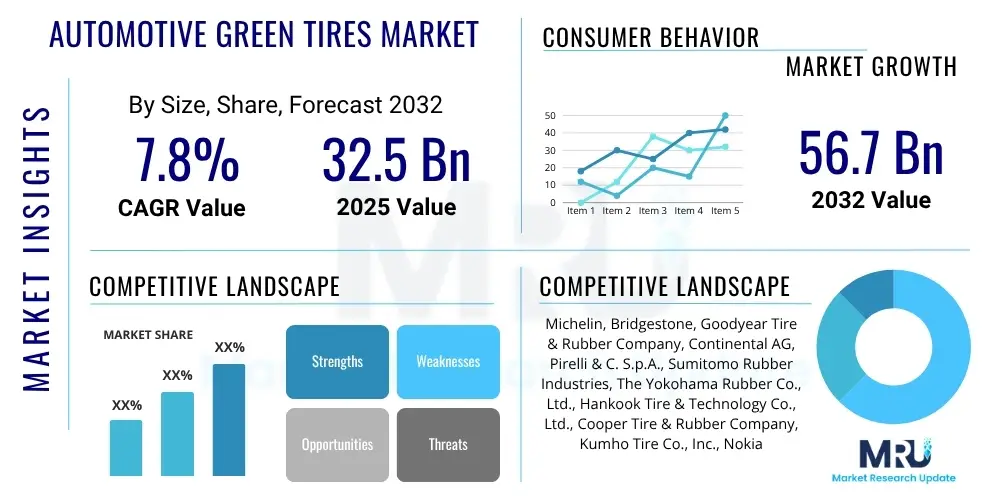

The Automotive Green Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at $32.5 Billion in 2025 and is projected to reach $56.7 Billion by the end of the forecast period in 2032.

Automotive Green Tires Market introduction

The Automotive Green Tires Market is experiencing robust expansion driven by increasing environmental consciousness, stringent regulatory frameworks aimed at reducing carbon emissions, and the global shift towards sustainable transportation solutions. Green tires, also known as low rolling resistance tires, are specifically engineered to minimize energy loss when the tire rolls, primarily by reducing the deformation of the tire and the heat generated during movement. This innovative design directly translates into improved fuel efficiency for internal combustion engine vehicles and extended range for electric vehicles, making them a crucial component in achieving broader sustainability goals within the automotive sector. The market encompasses a wide array of products designed for various vehicle types and applications, from passenger cars to commercial fleets, each contributing significantly to the overall reduction of environmental impact associated with road transportation.

Product descriptions for green tires often emphasize their unique material composition and advanced structural designs. These tires typically incorporate higher proportions of silica compounds, specialized polymers, and other sustainable materials that replace traditional carbon black, which is known for higher rolling resistance. The enhanced material blend, coupled with optimized tread patterns and lightweight construction, allows green tires to maintain excellent grip and safety performance while offering superior fuel economy. Manufacturers are continually investing in research and development to further refine these characteristics, seeking to strike an optimal balance between low rolling resistance, durability, wet grip, and braking performance. The advancements in manufacturing processes and material science are pivotal in the continuous evolution and market penetration of these environmentally friendly tire solutions.

Major applications for automotive green tires span the entire spectrum of road vehicles, with substantial adoption in passenger cars, light commercial vehicles, heavy-duty trucks, and especially electric vehicles (EVs). For passenger cars, green tires offer immediate benefits in terms of reduced fuel consumption and lower operational costs for consumers, aligning with economic as well as environmental incentives. In commercial fleets, the cumulative savings from enhanced fuel efficiency across numerous vehicles can be substantial, leading to significant operational cost reductions and a smaller carbon footprint. The benefits extend beyond mere fuel savings, encompassing reduced greenhouse gas emissions, a longer tire lifespan due to less heat generation, and often enhanced handling characteristics. Driving factors for this market include tightening global emission standards, rising fuel prices that compel consumers and businesses to seek more economical solutions, growing consumer awareness regarding environmental impact, and the rapid global adoption of electric vehicles which critically depend on efficient tires for optimal range and energy consumption. These multifaceted drivers collectively propel the sustained growth and innovation within the automotive green tires market.

Automotive Green Tires Market Executive Summary

The Automotive Green Tires Market is characterized by dynamic business trends reflecting a strong industry-wide commitment to sustainability and innovation. Key players are increasingly focusing on strategic partnerships with automotive manufacturers to integrate green tire technology as original equipment (OE) from the factory floor, thereby securing long-term supply agreements and expanding market reach. This collaboration often involves co-development of advanced tire solutions optimized for specific vehicle models, particularly electric vehicles where tire efficiency is paramount for range. Furthermore, there is a noticeable trend towards vertical integration, with tire manufacturers investing in sustainable raw material sourcing and recycling initiatives to create a more circular economy for their products. This not only enhances their brand image but also mitigates supply chain risks and aligns with evolving regulatory demands for product lifecycle management. The market is also witnessing consolidation, with larger entities acquiring smaller, specialized technology firms to gain expertise in advanced materials and digital manufacturing processes, accelerating innovation cycles.

Regional trends indicate Europe and North America as mature markets with high adoption rates, driven by stringent environmental regulations, high consumer awareness, and significant governmental incentives for green technologies. These regions are pioneers in setting emissions targets and promoting EV infrastructure, which directly translates into higher demand for green tires. The Asia Pacific region, particularly China, India, and Japan, is emerging as a critical growth hub, propelled by rapid industrialization, expanding automotive production bases, and a burgeoning middle class increasingly prioritizing fuel-efficient and environmentally friendly vehicles. Governments in APAC are also beginning to implement stricter emission standards, further stimulating market demand. Latin America and the Middle East and Africa (MEA) are showing promising growth, albeit at an earlier stage, influenced by growing urbanization, increasing vehicle parc, and a nascent but rising awareness of sustainable automotive solutions. Each region presents unique opportunities and challenges, requiring tailored market entry and growth strategies focused on local regulatory landscapes and consumer preferences.

Segmentation trends highlight distinct patterns in market evolution. By vehicle type, the passenger car segment continues to hold the largest share, but electric vehicles (EVs) represent the fastest-growing sub-segment, as EV manufacturers prioritize specialized green tires to maximize battery range and efficiency. In terms of sales channels, the Original Equipment Manufacturer (OEM) segment is expanding significantly due to the integration of green tires as standard features in new vehicles, particularly EVs, while the aftermarket segment remains robust, driven by consumer demand for replacement tires that offer fuel efficiency benefits. Material segmentation shows a strong shift towards advanced silica compounds and bio-based materials, moving away from conventional carbon black, as manufacturers seek to enhance performance characteristics while reducing environmental impact. The ongoing innovation in material science is a crucial determinant of competitive advantage. These segment-specific dynamics underscore the complexity and diversified growth avenues within the automotive green tires market, requiring nuanced approaches for market players to capitalize on emerging opportunities and mitigate potential risks across different product lines and geographic areas.

AI Impact Analysis on Automotive Green Tires Market

Common user questions regarding AI's impact on the Automotive Green Tires Market frequently revolve around how artificial intelligence can enhance tire performance, improve manufacturing efficiency, optimize supply chains, and contribute to sustainable development. Users are keen to understand if AI can lead to breakthrough tire designs, predict tire wear accurately, or make production processes more environmentally friendly. There is significant interest in AI's role in the development of "smart tires" with integrated sensors and how this data can be utilized for predictive maintenance and enhanced safety. Concerns often surface regarding the initial investment required for AI integration, potential job displacement in traditional manufacturing roles, and the ethical implications of data privacy when tires become connected devices. Overall, users expect AI to usher in an era of highly customized, ultra-efficient, and intelligent tire solutions that cater to the evolving demands of the automotive industry, particularly with the proliferation of electric and autonomous vehicles, while also addressing environmental sustainability.

- AI algorithms significantly optimize tire design and material composition, enabling engineers to simulate countless variations of tread patterns, sidewall structures, and compound blends to achieve optimal low rolling resistance, wet grip, and durability without extensive physical prototyping. This reduces development time and costs while accelerating the introduction of next-generation green tire products.

- Predictive analytics driven by AI enhances manufacturing processes by monitoring machinery performance, anticipating potential failures, and optimizing production schedules to minimize waste and energy consumption. This leads to more efficient resource utilization and a reduction in the carbon footprint of tire production facilities.

- AI-powered supply chain management improves the efficiency of raw material procurement and finished product distribution, predicting demand fluctuations and optimizing logistics routes. This minimizes transportation emissions and reduces inventory holding costs, contributing to overall market sustainability and operational resilience.

- Integration of AI with smart tire technology enables real-time monitoring of tire pressure, temperature, and wear levels, providing drivers and fleet managers with crucial data for proactive maintenance. This extends tire lifespan, reduces the frequency of replacements, and prevents premature disposal, aligning with circular economy principles.

- AI facilitates the development of self-learning tire systems that adapt to various driving conditions and driver behaviors, dynamically adjusting performance characteristics to maintain optimal fuel efficiency and safety. This personalized optimization further enhances the "green" attributes of automotive tires in real-world scenarios.

- Quality control in tire manufacturing is revolutionized by AI-driven visual inspection systems that detect microscopic defects with unparalleled accuracy and speed, ensuring consistently high-quality products. This reduces product recalls and manufacturing waste, improving resource efficiency and brand reputation.

- AI assists in the development of advanced recycling processes for end-of-life tires by identifying and separating different material components more effectively. This innovation is crucial for promoting a sustainable lifecycle for tires, minimizing landfill waste, and recovering valuable resources for new production.

DRO & Impact Forces Of Automotive Green Tires Market

The Automotive Green Tires Market is significantly influenced by a complex interplay of drivers, restraints, and opportunities, all contributing to its evolving impact forces. Key drivers propelling market growth include increasingly stringent global environmental regulations, such as those related to CO2 emissions and fuel economy standards, which compel automotive manufacturers to adopt components that contribute to overall vehicle efficiency. The escalating prices of crude oil and, consequently, conventional fuels also serve as a strong impetus for both consumers and fleet operators to seek out fuel-efficient tire solutions that reduce operational costs. Furthermore, the rapid global expansion of the electric vehicle (EV) market is a major catalyst, as green tires play a crucial role in maximizing EV range and optimizing energy consumption. Growing consumer awareness regarding environmental sustainability and a preference for eco-friendly products are also driving adoption, with purchasers increasingly willing to invest in tires that offer both performance and ecological benefits. These factors collectively create a powerful push for innovation and market expansion within the green tire segment.

Despite the strong growth drivers, the market faces several notable restraints. One primary challenge is the higher manufacturing cost associated with green tires, largely due to the use of specialized materials like advanced silica compounds and more complex production processes. This often translates into a higher initial purchase price for consumers compared to conventional tires, which can be a barrier to widespread adoption, particularly in price-sensitive markets. Additionally, there can be perceived performance trade-offs, with some early green tire designs exhibiting slightly reduced grip or accelerated wear under certain extreme driving conditions, although ongoing technological advancements are rapidly addressing these concerns. The initial market adoption hurdles also include a lack of comprehensive consumer education in some regions regarding the long-term economic and environmental benefits of green tires, leading to slower conversion from traditional options. Furthermore, the availability and cost volatility of specialized raw materials, such as specific types of natural rubber or synthetic polymers, can pose supply chain challenges and impact production stability.

However, significant opportunities exist that are poised to accelerate market expansion. Emerging economies in Asia Pacific, Latin America, and Africa present vast untapped potential as automotive markets in these regions experience rapid growth and an increasing focus on sustainable development. Advanced material research and development is opening new avenues for even greener and more performant tires, including the integration of bio-based materials, smart sensors, and self-repairing compounds that further enhance efficiency and durability. The ongoing trend towards vehicle lightweighting and aerodynamic optimization also creates synergistic opportunities for green tires, as their low rolling resistance complements these design philosophies. The continuous integration of smart tire technology, which leverages IoT and AI for real-time monitoring and predictive maintenance, not only enhances safety and extends tire life but also provides valuable data for further efficiency improvements. Strategic collaborations between tire manufacturers, automotive OEMs, and technology providers are crucial for capitalizing on these opportunities, driving innovation, and overcoming existing restraints, thereby solidifying the market's long-term growth trajectory and impact on global sustainability.

Segmentation Analysis

The Automotive Green Tires Market is comprehensively segmented to provide a detailed understanding of its diverse landscape and growth dynamics across various categories. This segmentation enables businesses to identify specific niches, tailor product development strategies, and target marketing efforts more effectively, responding to the varied needs of different customer groups and vehicle applications. The primary segmentation criteria include vehicle type, sales channel, tire type, material composition, and application area, each revealing unique market characteristics and growth trajectories. Analyzing these segments is essential for stakeholders to grasp the nuanced shifts within the market, from the increasing demand for specialized tires for electric vehicles to the material innovations driving performance and sustainability. This structured approach helps in forecasting future trends and assessing competitive landscapes within each distinct segment.

- By Vehicle Type

- Passenger Cars: Represents the largest segment due to the sheer volume of passenger vehicles globally, driven by consumer demand for fuel efficiency and reduced emissions in daily commuting.

- Commercial Vehicles: Includes light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs) where fuel savings from green tires translate into significant operational cost reductions for fleet operators, fostering strong adoption.

- Electric Vehicles (EVs): The fastest-growing segment, as green tires are critical for maximizing battery range and energy efficiency, directly impacting the usability and appeal of electric mobility solutions.

- By Sales Channel

- Original Equipment Manufacturer (OEM): Involves tires supplied directly to automotive manufacturers for installation on new vehicles, a segment heavily influenced by regulatory pressures and OEM sustainability commitments.

- Aftermarket: Consists of replacement tires purchased by vehicle owners, fleet operators, and service centers, driven by consumer awareness of benefits and economic incentives.

- By Tire Type

- Radial Tires: Dominates the market due to their superior performance characteristics, including better fuel economy, longer tread life, and improved handling compared to bias-ply tires.

- Bias Tires: Primarily used in specific off-road or industrial applications where robustness and load-bearing capacity are prioritized over rolling resistance.

- By Material

- Silica: A key material replacing carbon black, significantly reducing rolling resistance and enhancing wet grip, forming the backbone of modern green tire technology.

- Carbon Black: While traditional, its use is being optimized and sometimes reduced in green tires, often combined with other materials to balance performance and sustainability.

- Natural Rubber: A renewable resource essential for tire elasticity and durability, with increasing focus on sustainable sourcing practices.

- Synthetic Rubber: Engineered for specific performance characteristics like wear resistance and grip, complementing natural rubber in specialized compounds.

- Others (e.g., Bio-based materials, Recycled content): Emerging materials and advanced additives aimed at further reducing environmental impact and enhancing specific properties.

- By Application

- On-Road: Covers tires designed for regular road use, including passenger cars, commercial vehicles, and motorcycles, where fuel efficiency and safety are paramount.

- Off-Road: Includes tires for construction, agriculture, and other heavy-duty applications, where specific green tire innovations focus on durability and reduced soil compaction alongside efficiency.

Value Chain Analysis For Automotive Green Tires Market

The value chain for the Automotive Green Tires Market begins with a comprehensive upstream analysis, focusing on the sourcing and processing of raw materials crucial for tire production. This segment involves a diverse group of suppliers providing natural rubber, synthetic rubbers such as styrene-butadiene rubber (SBR) and polybutadiene rubber (BR), and critical fillers like advanced silica and carbon black. Chemical suppliers provide essential additives, accelerators, and antioxidants that impart specific performance characteristics to the rubber compounds. Steel and textile manufacturers supply high-tensile steel cord and various fabrics used in the tire's internal structure. The quality, sustainability, and cost-effectiveness of these upstream inputs directly influence the final product's performance, environmental footprint, and market competitiveness. Key considerations at this stage include ethical sourcing, supply chain transparency, and the increasing demand for bio-based and recycled materials to enhance the green credentials of the end product, reflecting a strong push towards sustainable practices from the very beginning of the value chain.

Moving downstream, the value chain encompasses the manufacturing, distribution, and eventual sale of green tires. Tire manufacturers are at the heart of this stage, transforming raw materials into finished tires through complex processes involving compounding, mixing, calendering, cutting, building, and vulcanization. This phase is characterized by significant investment in R&D to develop innovative tread patterns, sidewall designs, and compound formulations that optimize rolling resistance without compromising safety and durability. After manufacturing, the distribution channel plays a critical role in bringing products to market. This includes both direct and indirect channels. Direct distribution often involves tire manufacturers supplying Original Equipment Manufacturers (OEMs) for installation on new vehicles, establishing long-term partnerships and integrating tires as standard components. This channel is crucial for securing significant volume and influence over vehicle design. Indirect distribution involves a network of wholesalers, independent distributors, regional warehouses, and a vast array of retail outlets, including specialized tire dealers, automotive service centers, and online platforms. These channels cater to the aftermarket demand, providing replacement tires to consumers and commercial fleets.

The interaction between direct and indirect distribution channels is vital for market penetration and customer reach. Direct sales to OEMs ensure that green tires are integrated into new vehicle models, aligning with manufacturer sustainability goals and regulatory compliance. This strategy helps to establish green tires as a benchmark for performance and efficiency. Indirect channels, on the other hand, are essential for serving the aftermarket, providing convenience and accessibility for consumers and fleet operators seeking to replace their existing tires with more environmentally friendly options. Online sales platforms are increasingly gaining traction, offering competitive pricing, wider product selection, and direct-to-consumer delivery, which bypasses traditional intermediaries. Effective management of this multi-channel distribution strategy requires robust logistics, strong dealer relationships, and proactive marketing to educate both direct buyers (OEMs) and indirect consumers about the benefits of green tires. Ultimately, a well-optimized value chain, from sustainable raw material sourcing to efficient distribution and customer service, is paramount for the sustained growth and success of the Automotive Green Tires Market, ensuring products reach end-users effectively while adhering to environmental and economic imperatives.

Automotive Green Tires Market Potential Customers

The Automotive Green Tires Market serves a broad spectrum of potential customers, primarily segmented into two major categories: Original Equipment Manufacturers (OEMs) and the aftermarket segment, which includes individual vehicle owners, fleet operators, and various commercial entities. OEMs, comprising major global automotive manufacturers, represent a critical segment. These companies integrate green tires into their new vehicle production lines, driven by stringent environmental regulations, corporate sustainability goals, and the growing demand for fuel-efficient and electric vehicles. For OEMs, green tires are not merely a component but a strategic element that enhances a vehicle's overall performance metrics, contributes to lower emissions ratings, and extends the range of electric models, thus boosting their market competitiveness and brand image. Partnerships with tire manufacturers at the design and development stage are common, ensuring optimal tire-vehicle synergy from the outset. This customer group values innovation, consistent quality, reliable supply chains, and adherence to specific vehicle performance criteria.

The aftermarket segment constitutes a substantial portion of potential customers, characterized by diverse needs and purchasing motivations. Individual vehicle owners are increasingly becoming informed consumers who seek out green tires for their personal vehicles due to the promise of reduced fuel costs, longer tire life, and a desire to lessen their environmental footprint. This group is influenced by marketing campaigns, reviews, and the recommendations of tire retailers and service providers. Their purchasing decisions are often a balance between initial cost, perceived value, and brand reputation. As environmental awareness grows and fuel prices fluctuate, the aftermarket demand from individual consumers for replacement green tires is expected to steadily increase. Accessibility through a wide network of distributors, independent tire shops, and online platforms is crucial for effectively reaching this segment.

Beyond individual consumers, fleet operators and commercial entities represent a significant and growing customer base for automotive green tires. This includes logistics and transportation companies, public transport operators, taxi services, and various businesses running large vehicle fleets. For these customers, the economic benefits of green tires, such as substantial fuel savings across numerous vehicles and extended tire longevity, directly impact their operational profitability. Reduced downtime for tire changes and improved fleet efficiency are also compelling factors. Sustainability reporting and corporate social responsibility (CSR) initiatives further motivate commercial entities to adopt green tire solutions to demonstrate their commitment to environmental stewardship. Their purchasing decisions are often driven by total cost of ownership (TCO) analyses, bulk purchasing agreements, and long-term performance guarantees. Therefore, manufacturers targeting this segment must emphasize quantifiable economic benefits, robust product performance, and comprehensive after-sales support to cater to the specific demands of large-scale commercial operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $32.5 Billion |

| Market Forecast in 2032 | $56.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Bridgestone, Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Sumitomo Rubber Industries, The Yokohama Rubber Co., Ltd., Hankook Tire & Technology Co., Ltd., Cooper Tire & Rubber Company, Kumho Tire Co., Inc., Nokian Tyres PLC, Toyo Tire Corporation, Apollo Tyres Ltd., MRF Tyres, Maxxis International, ZC Rubber (Zhongce Rubber Group Co., Ltd.), Sailun Group Co., Ltd., Giti Tire Corporation, Linglong Tire, Triangle Tyre Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Green Tires Market Key Technology Landscape

The Automotive Green Tires Market is fundamentally shaped by a dynamic and evolving technology landscape focused on enhancing efficiency, sustainability, and performance. One of the most critical technological advancements is in advanced compounding, particularly the increased use of high-performance silica instead of traditional carbon black. Silica, when combined with specialized coupling agents, drastically reduces rolling resistance by minimizing energy dissipation, while simultaneously improving wet grip and durability. Research is continuously pushing the boundaries of silica technology, exploring nano-silica and functionalized polymers to create even more efficient and robust rubber compounds. Beyond silica, the industry is investing in bio-based materials, such as natural rubber derived from guayule or dandelions, and recycled content from end-of-life tires, aiming to reduce dependence on fossil-based resources and close the material loop, thereby bolstering the environmental credentials of green tires and contributing to a circular economy in tire manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager

Our Clients

About us

Market Research Update is market research company that perform demand of large corporations, research agencies, and others. We offer several services that are designed mostly for Healthcare, IT, and CMFE domains, a key contribution of which is customer experience research. We also customized research reports, syndicated research reports, and consulting services.

Usefull Links

Contact Us

Market Research UpdateIndia : Office no - 406, 4th floor, Suratwala Mark Plazzo, Hinjewadi, Pune 411057

Japan: 16-8, Higashi 1-chome, Shibuya-ku, Tokyo 150-0011, Japan

(UK) +1-252-552-1404

sales@marketresearchupdate.com

SUBSCRIBE

Get the latest news and insights from MRU delivered to your inbox

Trust Online