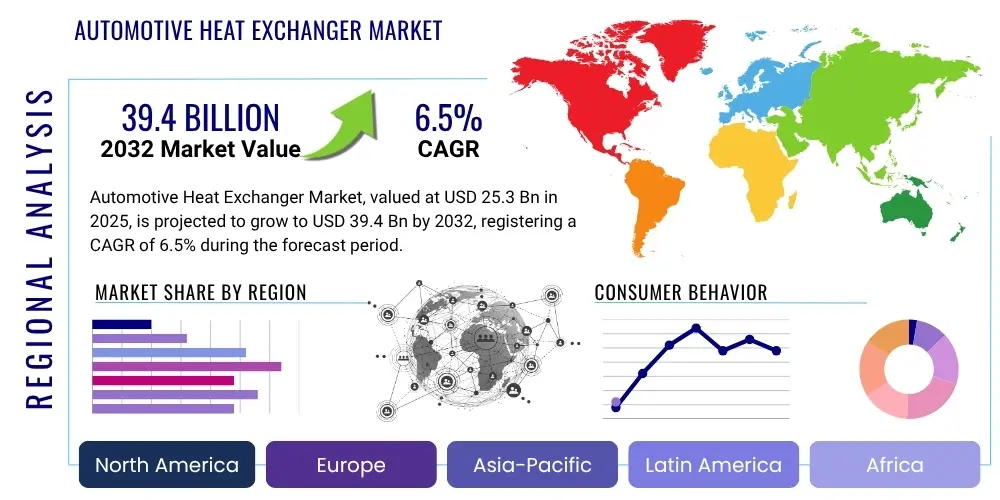

Automotive Heat Exchanger Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431088 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive Heat Exchanger Market Size

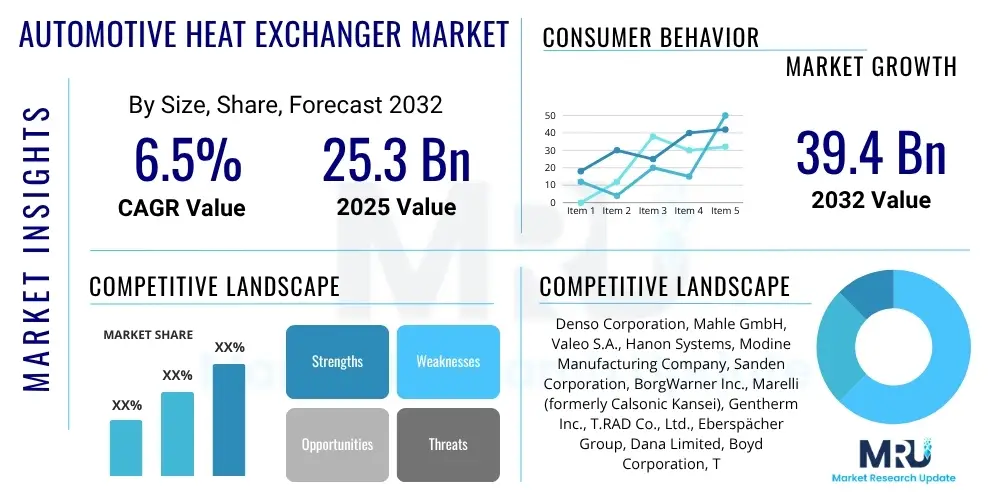

The Automotive Heat Exchanger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at 25.3 Billion USD in 2025 and is projected to reach 39.4 Billion USD by the end of the forecast period in 2032.

Automotive Heat Exchanger Market introduction

The Automotive Heat Exchanger Market constitutes a cornerstone of modern vehicle engineering, focusing on the design, manufacturing, and distribution of components essential for thermal management across diverse automotive systems. These critical devices facilitate the transfer of heat between fluids with differing temperatures, ensuring that various vehicle components operate within their optimal temperature ranges. This function is vital not only for traditional internal combustion engine (ICE) vehicles, where they manage engine and transmission temperatures, but also increasingly for the rapidly expanding segment of electric vehicles (EVs) and hybrid electric vehicles (HEVs), where precise thermal regulation of battery packs, power electronics, and electric motors is paramount for performance, safety, and longevity. The evolution of automotive technology, from early radiators to sophisticated multi-functional thermal modules, underscores the market's dynamic nature and its integral role in vehicle efficiency and reliability.

The product portfolio within this market is extensive, encompassing a wide array of specialized heat exchangers such as radiators for engine cooling, condensers and evaporators for air conditioning systems, intercoolers for turbocharger efficiency, oil coolers for engine and transmission lubrication, and increasingly, dedicated thermal management units for electric vehicle batteries and power inverters. Each of these components is engineered to meet specific thermal requirements and operational stresses. The fundamental benefits provided by these heat exchangers are multifaceted: they ensure optimal engine and transmission performance, contribute significantly to fuel efficiency and reduced emissions by maintaining ideal operating temperatures, enhance passenger comfort through effective climate control, and extend the lifespan of critical vehicle components by preventing thermal degradation. Moreover, in the context of EVs, efficient thermal management directly impacts battery range, charging speed, and overall vehicle safety, making these components indispensable for the transition to sustainable mobility.

Several key factors are driving the robust growth of the Automotive Heat Exchanger Market. The most significant driver is the global paradigm shift towards vehicle electrification, leading to a surge in demand for sophisticated thermal management systems specifically designed for electric powertrains. Concurrently, stringent global regulations on vehicle emissions, such as Euro 7 and CAFE standards, continue to push ICE vehicle manufacturers to develop more efficient engines, which, in turn, requires advanced heat exchange solutions to optimize combustion and reduce pollutants. Furthermore, rising consumer expectations for enhanced in-cabin comfort, rapid climate control response, and improved vehicle safety features are fueling demand for high-performance HVAC systems. The pursuit of lightweight vehicle designs to improve fuel economy and reduce emissions also necessitates the development of compact and efficient heat exchangers made from advanced, lighter materials, collectively propelling market innovation and expansion.

Automotive Heat Exchanger Market Executive Summary

The Automotive Heat Exchanger Market is experiencing dynamic shifts, characterized by significant business trends that reflect the industry's rapid evolution. There is an increasing emphasis on developing integrated thermal management modules that consolidate multiple cooling and heating functions into a single unit, simplifying vehicle architecture and improving overall energy efficiency. This trend is driven by the complexity of modern vehicles, particularly electric and hybrid models that require precise thermal control for numerous subsystems. Furthermore, manufacturers are investing heavily in advanced materials and manufacturing processes, such as additive manufacturing and microchannel technologies, to produce lighter, more compact, and highly efficient heat exchangers. Strategic collaborations and partnerships between heat exchanger suppliers and automotive OEMs are becoming more prevalent, fostering co-development initiatives to create tailored thermal solutions that meet specific vehicle design and performance requirements. This collaborative approach helps mitigate the significant research and development costs associated with next-generation thermal systems.

From a regional perspective, the Asia Pacific region continues to assert its dominance in the Automotive Heat Exchanger Market, primarily owing to its substantial automotive production base, rapid adoption of electric vehicles, and supportive governmental policies promoting sustainable mobility and manufacturing. Countries like China, India, Japan, and South Korea are major contributors to market growth, serving both domestic demand and acting as significant export hubs. North America and Europe are also demonstrating steady growth, driven by stringent environmental regulations, a strong consumer preference for advanced vehicle features, and significant investments in EV infrastructure and production. These regions are characterized by a demand for premium, high-performance heat exchangers that comply with rigorous safety and environmental standards. Meanwhile, emerging markets in Latin America and the Middle East and Africa present opportunities for gradual market expansion, primarily focused on conventional vehicle segments and the aftermarket, as vehicle parc grows and infrastructure develops.

Analysis of segment trends reveals a notable acceleration in the demand for specialized heat exchangers dedicated to electric vehicle battery thermal management and power electronics cooling. These components are critical for optimizing battery performance, extending lifespan, ensuring safety, and maximizing charging efficiency in EVs. The HVAC system segment remains a cornerstone of the market, driven by the continuous need for advanced climate control and the transition to more environmentally friendly refrigerants. In terms of material usage, aluminum maintains its leading position due to its optimal balance of thermal conductivity, lightweight properties, and cost-effectiveness. However, there is growing interest and investment in exploring other advanced materials and composite solutions to meet ever-evolving performance and weight reduction targets. Overall, the market is moving towards highly optimized, modular, and intelligently controlled thermal systems that address the multifaceted demands of modern automotive applications.

AI Impact Analysis on Automotive Heat Exchanger Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Automotive Heat Exchanger Market frequently explore how this technology can revolutionize the entire lifecycle of these crucial components, from initial design and manufacturing to operational efficiency and predictive maintenance. Users are particularly interested in understanding the practical applications of AI in optimizing complex heat exchanger geometries, minimizing material usage while maximizing thermal transfer, and enabling smarter, more responsive thermal control systems within vehicles. Questions also often arise regarding AI's ability to analyze vast datasets from vehicle operation to predict potential failures, thereby enhancing reliability and extending component lifespan. Furthermore, there is a keen interest in how AI can facilitate faster innovation cycles, automate quality control, and contribute to the development of highly customized thermal solutions tailored for specific vehicle models and powertrain types.

- AI-driven generative design algorithms dramatically accelerate the conceptualization and optimization of heat exchanger geometries, identifying novel structures that offer superior thermal performance and lighter weight than traditionally designed components.

- Predictive analytics powered by machine learning models analyze operational data from vehicle sensors to anticipate potential failures or performance degradation in heat exchangers, enabling proactive maintenance and reducing downtime.

- AI enhances the efficiency and responsiveness of in-vehicle thermal management systems by dynamically adjusting cooling and heating strategies based on real-time driving conditions, ambient temperatures, and battery state-of-charge, optimizing energy consumption.

- Machine learning aids in advanced material selection and characterization, identifying optimal alloys or composite materials for specific heat exchanger applications based on desired thermal, mechanical, and cost attributes.

- AI integration in manufacturing processes, such as smart robotics and computer vision systems, improves precision, quality control, and efficiency in the production of heat exchanger components, minimizing defects and waste.

DRO & Impact Forces Of Automotive Heat Exchanger Market

The Automotive Heat Exchanger Market is propelled by a confluence of potent drivers that underpin its expansion and innovation. A primary catalyst is the relentless global surge in the adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), which inherently require sophisticated and highly efficient thermal management systems for their battery packs, electric motors, and power electronics to ensure optimal performance, range, and longevity. Simultaneously, increasingly stringent governmental regulations worldwide concerning vehicle emissions (such as Euro 7 in Europe and evolving CAFE standards in North America) and fuel economy are compelling manufacturers of internal combustion engine (ICE) vehicles to develop more efficient engines that produce fewer pollutants, necessitating advanced heat exchange solutions like improved EGR coolers and intercoolers. Furthermore, the rising consumer demand for enhanced in-cabin comfort, rapid climate control capabilities, and superior safety features in vehicles across all segments is consistently fueling the demand for high-performance HVAC (Heating, Ventilation, and Air Conditioning) systems, which heavily rely on efficient heat exchangers.

Despite these robust growth drivers, the market faces several notable restraints that can impede its expansion. The significant capital investment and high research and development (R&D) costs associated with designing, testing, and manufacturing advanced, lightweight, and highly efficient heat exchangers pose a substantial barrier, particularly for smaller and emerging players. Developing solutions for complex thermal architectures in modern vehicles, especially for multi-functional EV systems, requires extensive engineering expertise and validation. Additionally, the market is susceptible to the volatility of raw material prices and supply chain disruptions for critical metals such as aluminum, copper, and stainless steel. Geopolitical factors and trade disputes can further exacerbate these material availability and cost challenges. Moreover, the inherent complexity of integrating diverse thermal management systems within the increasingly compact and space-constrained designs of modern vehicles presents significant engineering hurdles, leading to longer development cycles and higher integration costs for automotive OEMs.

Amidst these challenges, considerable opportunities exist for innovation and market expansion within the automotive heat exchanger industry. The ongoing development and adoption of advanced materials, including lightweight composites, nano-materials, and improved aluminum alloys, offer promising avenues for creating heat exchangers that are not only lighter and more compact but also exhibit superior thermal performance and durability. Opportunities are also abundant in the realm of miniaturization and the creation of highly integrated thermal management modules that combine multiple cooling and heating functions into a single, cohesive, and energy-efficient unit. The emergence of smart thermal management systems, leveraging an array of sensors, IoT connectivity, and artificial intelligence (AI) for real-time monitoring, predictive maintenance, and adaptive control, represents a transformative growth area. Furthermore, the expanding global automotive aftermarket, driven by an aging vehicle parc and the increasing complexity of thermal systems, provides a consistent and lucrative revenue stream for manufacturers and distributors specializing in replacement and upgrade components, reinforcing the market's long-term potential.

Segmentation Analysis

The Automotive Heat Exchanger Market is meticulously segmented to offer comprehensive insights into its multifaceted structure, enabling a nuanced understanding of market dynamics across various dimensions. This granular breakdown is crucial for stakeholders to pinpoint specific areas of growth, identify prevalent technological preferences, and formulate targeted strategies for product development and market penetration. The segmentation framework typically considers the fundamental design principles of the heat exchangers, the primary materials utilized in their construction, their specific functional application within a vehicle, and the overarching vehicle type they are designed to serve. This analytical approach reflects the intricate ecosystem of automotive thermal management and highlights the evolving trends that dictate demand and supply within each sub-segment, ensuring a holistic view of market opportunities and challenges.

- By Design Type: This segment categorizes heat exchangers based on their structural configuration and heat transfer mechanism.

- Plate Heat Exchanger: Known for compact design and high thermal efficiency, often used in HVAC and oil cooling.

- Fin Heat Exchanger (Plate Fin, Bar and Plate): Widely used for air-to-fluid applications like intercoolers and radiators due to large surface area.

- Tube and Shell Heat Exchanger: Versatile and robust, suitable for various fluid-to-fluid heat transfer applications, particularly in heavy-duty vehicles.

- Microchannel Heat Exchanger: Offers superior heat transfer performance and reduced refrigerant charge in compact designs, increasingly popular in condensers and evaporators.

- Tubular Heat Exchanger (Serpentine, Straight Tube): Basic and reliable, primarily used in radiator cores and other fluid cooling tasks.

- By Material Type: This segment differentiates based on the primary material composition, influencing weight, cost, and thermal properties.

- Aluminum: Dominant due to its lightweight nature, excellent thermal conductivity, and corrosion resistance.

- Copper/Brass: Valued for superior thermal conductivity and durability, though heavier and less common in modern lightweight designs.

- Stainless Steel: Used in high-temperature or corrosive applications, such as EGR coolers, due to its robustness.

- Other Alloys: Including specialized alloys for niche high-performance or specific environmental resistance requirements.

- By Application: This segment focuses on the specific function or system within the vehicle where the heat exchanger is utilized.

- HVAC (Heating, Ventilation, and Air Conditioning) System: For cabin climate control, including condensers, evaporators, and heater cores.

- Engine Cooling System (Radiators, Intercoolers): Essential for managing engine temperature and enhancing turbocharger efficiency.

- Oil Cooler (Engine Oil, Transmission Oil): Maintains optimal lubrication temperatures for engines and transmissions.

- Battery Thermal Management System: Critical for maintaining EV/HEV battery performance, safety, and lifespan.

- Fuel Cell Heat Exchanger: Specific to hydrogen fuel cell vehicles for managing stack temperatures.

- EGR (Exhaust Gas Recirculation) Cooler: Reduces NOx emissions by cooling exhaust gases before recirculation into the engine.

- By Vehicle Type: This segment classifies the market based on the vehicle category in which the heat exchangers are installed.

- Passenger Cars (Sedans, SUVs, Hatchbacks): Largest segment, driven by high production volumes and diverse thermal needs.

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles, Buses): Demands robust and high-capacity heat exchangers for heavy-duty use.

- Electric Vehicles (BEV, HEV, PHEV): Fastest-growing segment, requiring specialized and highly efficient thermal solutions for electrification components.

Value Chain Analysis For Automotive Heat Exchanger Market

The value chain for the Automotive Heat Exchanger Market begins with the upstream activities, which are foundational to the production process. This stage primarily involves the sourcing and processing of essential raw materials. Key materials include aluminum, particularly in its various forms like sheets, tubes, and fins, due to its excellent thermal conductivity and lightweight properties. Copper and brass are also procured for specific applications, especially where superior heat transfer or corrosion resistance is required, albeit at a higher cost and weight. Stainless steel is sourced for components demanding high-temperature resistance and durability, such as Exhaust Gas Recirculation (EGR) coolers. These raw materials are typically acquired from global metal suppliers and specialized foundries. The quality, availability, and cost fluctuations of these primary materials significantly influence the overall production costs, supply chain stability, and final product performance of heat exchangers. Strong relationships with reliable material suppliers are critical for manufacturers to ensure a consistent and cost-effective supply, often requiring complex global logistics and hedging strategies to manage commodity price volatility.

The midstream segment of the value chain encompasses the design, manufacturing, and assembly of the heat exchanger components. This stage is characterized by high levels of engineering expertise and technological sophistication. Automotive heat exchanger manufacturers leverage advanced computer-aided design (CAD) and computer-aided manufacturing (CAM) tools, alongside sophisticated simulation software such as Computational Fluid Dynamics (CFD) for fluid flow analysis and Finite Element Analysis (FEA) for structural integrity, to develop optimized and custom-engineered designs. The manufacturing processes involve precision techniques including brazing, welding, stamping, and tube forming, often performed on highly automated production lines to ensure consistent quality and high volume output. The integration of advanced manufacturing technologies like additive manufacturing (3D printing) is gradually emerging, allowing for the creation of intricate internal geometries that enhance heat transfer efficiency and reduce weight. Rigorous quality control and testing, including leak tests, pressure tests, and thermal performance validation, are indispensable at this stage to ensure that components meet the stringent durability, performance, and safety standards mandated by the automotive industry and regulatory bodies. This segment is highly competitive, driven by continuous innovation in design, materials, and production techniques to deliver superior thermal solutions.

Downstream activities focus on the distribution, sales, and aftermarket support of automotive heat exchangers. Distribution channels are bifurcated into two primary segments: direct sales to Original Equipment Manufacturers (OEMs) and indirect sales through the aftermarket. For OEMs, heat exchanger manufacturers establish direct, long-term partnerships, often co-developing components and ensuring just-in-time delivery to support high-volume vehicle assembly lines. These relationships are critical, involving extensive technical collaboration and adherence to strict quality and logistical requirements. The aftermarket segment, on the other hand, involves a vast network of independent distributors, wholesalers, and retailers who supply replacement heat exchangers to garages, independent workshops, franchised service centers, and individual consumers for maintenance and repair purposes. This indirect channel is characterized by a strong emphasis on product availability, competitive pricing, and brand reputation, as end-users seek reliable components for vehicle longevity. Service providers, including certified technicians and automotive repair shops, complete the downstream value chain by offering expert installation, diagnosis, and maintenance services, playing a crucial role in ensuring the proper functioning and longevity of heat exchanger systems in vehicles throughout their operational life. Effective management of both direct and indirect channels is essential for comprehensive market penetration and sustained revenue growth.

Automotive Heat Exchanger Market Potential Customers

The Automotive Heat Exchanger Market primarily serves global Original Equipment Manufacturers (OEMs) as its largest and most critical customer base. These OEMs, which include renowned names in passenger cars, light commercial vehicles, heavy commercial vehicles, and the rapidly growing electric vehicle sector, integrate heat exchangers directly into their new vehicle production lines. Their demand is driven by the need for high-performance, durable, and cost-effective thermal management solutions that seamlessly align with their specific vehicle designs, stringent quality standards, and often complex assembly processes. OEMs seek suppliers who can offer innovative designs, adhere to strict production timelines, provide consistent quality, and support large-scale manufacturing volumes. Successful engagement with OEMs typically involves long-term supply agreements, extensive technical collaboration, and sometimes co-development initiatives, making these relationships deeply integrated and strategically important for heat exchanger manufacturers.

Beyond the new vehicle assembly market, a substantial and growing customer segment exists within the automotive aftermarket. This segment encompasses a diverse range of buyers, including independent parts distributors, large automotive wholesalers, retail chains specializing in vehicle components, and online auto parts stores. These entities serve the ultimate end-users: independent repair shops, franchised service centers, fleet operators, and even do-it-yourself (DIY) vehicle owners who require replacement heat exchangers for maintenance, repairs, or upgrades of their existing vehicle fleet. The demand in the aftermarket is primarily driven by the aging vehicle parc, wear and tear of original components, and the need for reliable parts to restore vehicle functionality and extend its lifespan. For this customer group, factors such as broad product availability across various vehicle makes and models, competitive pricing, ease of installation, and strong brand reputation built on reliability and durability are paramount. Ensuring an efficient and responsive supply chain to this fragmented market is key for manufacturers looking to capture a significant share of aftermarket revenue.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | 25.3 Billion USD |

| Market Forecast in 2032 | 39.4 Billion USD |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Denso Corporation, Mahle GmbH, Valeo S.A., Hanon Systems, Modine Manufacturing Company, Sanden Corporation, BorgWarner Inc., Marelli (formerly Calsonic Kansei), Gentherm Inc., T.RAD Co., Ltd., Eberspächer Group, Dana Limited, Boyd Corporation, Thermal Systems Inc., KPS Industries, Subros Ltd., Banco Products (India) Ltd., G&P Group, Zhejiang Yinlun Co., Ltd., Jiangsu Wenzhou Heat Exchanger Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Heat Exchanger Market Key Technology Landscape

The technology landscape for the Automotive Heat Exchanger Market is marked by relentless innovation, driven by the need for enhanced efficiency, reduced weight, improved durability, and smarter thermal management capabilities in modern vehicles. A significant area of advancement is in material science and manufacturing processes. The widespread adoption of brazed aluminum technology remains a cornerstone, enabling the production of complex, lightweight, and highly efficient heat exchanger cores with excellent thermal conductivity and corrosion resistance. Beyond traditional aluminum, there is considerable research and development into advanced composite materials, specialized coatings (e.g., anti-corrosion, anti-fouling), and surface treatments designed to further reduce weight, improve heat transfer coefficients, and extend component lifespan, particularly in harsh operating environments. The push for miniaturization and compact designs is also driving the proliferation of microchannel heat exchangers, which offer significantly improved heat transfer performance in a smaller footprint, crucial for space-constrained vehicle architectures and the growing demand for highly integrated thermal modules.

Digitalization and smart technologies are increasingly integrated across the entire lifecycle of heat exchangers, from conceptual design to in-vehicle operation. Sophisticated engineering tools such as Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) software are indispensable for simulating fluid flow, heat transfer, and structural integrity under various operating conditions. These simulations allow engineers to optimize designs virtually, predicting performance and identifying potential weaknesses before physical prototyping, thereby accelerating development cycles and reducing costs. The advent of 3D printing (additive manufacturing) is revolutionizing prototyping and enabling the creation of highly intricate and optimized internal geometries that were previously impossible with conventional manufacturing methods. This allows for bespoke designs that maximize heat exchange surface area while minimizing material usage. Furthermore, the incorporation of advanced sensors (e.g., temperature, pressure, flow rate) and Internet of Things (IoT) connectivity into heat exchanger systems facilitates real-time monitoring of thermal performance, enabling predictive maintenance, fault diagnosis, and adaptive control strategies that optimize energy efficiency.

For electric vehicles (EVs), the technology landscape is evolving rapidly to meet unique thermal management challenges. This includes the development of highly efficient liquid cooling systems for high-voltage battery packs, often employing specialized dielectric fluids and intricate manifold designs to maintain precise temperature uniformity across battery cells. Similarly, advanced cooling solutions for electric motors and power electronics are critical to prevent overheating and ensure optimal performance. The trend towards integrated thermal management modules is particularly strong in EVs, where a single, intelligent unit may manage cooling for the battery, motor, cabin HVAC, and power inverter, simplifying vehicle architecture and improving overall energy efficiency. Moreover, for internal combustion engine (ICE) vehicles, advancements continue in Exhaust Gas Recirculation (EGR) coolers, with new designs focusing on improved robustness against thermal fatigue and corrosive exhaust gases to meet tightening emission standards. These technological advancements collectively highlight the market's trajectory towards more sophisticated, intelligently controlled, and environmentally conscious thermal solutions that are crucial for the future of automotive mobility.

Regional Highlights

- North America: This region exhibits a robust demand for automotive heat exchangers, primarily fueled by stringent environmental regulations, a significant shift towards electric vehicle adoption, and a strong presence of both domestic and international automotive manufacturers. The United States and Canada are leading the charge in EV infrastructure development and production, necessitating advanced thermal management solutions for battery cooling and powertrain electronics. There is also a consistent demand for high-performance and durable heat exchangers for heavy-duty commercial vehicles, reflecting the region's vast transportation sector. Investments in research and development for innovative, lightweight, and efficient thermal systems are prominent, driven by both regulatory compliance and consumer expectations for vehicle performance and fuel economy.

- Europe: Europe stands as a mature yet highly dynamic market, characterized by its pioneering role in automotive engineering and a strong emphasis on sustainability. Countries like Germany, France, and the UK are at the forefront of developing advanced internal combustion engines and luxury electric vehicles, demanding sophisticated and highly efficient heat exchangers. Strict emission standards, such as Euro 7, and ambitious decarbonization targets are compelling manufacturers to adopt cutting-edge thermal management technologies. The region's robust automotive manufacturing base, coupled with a well-developed aftermarket network and a strong consumer preference for premium, technologically advanced vehicles, ensures sustained growth and continuous innovation in the heat exchanger sector.

- Asia Pacific (APAC): The APAC region currently holds the largest share in the Automotive Heat Exchanger Market and is projected to experience the fastest growth during the forecast period. This exponential growth is primarily attributed to the massive scale of vehicle production in countries like China, India, Japan, and South Korea, coupled with rapid urbanization, rising disposable incomes, and aggressive governmental support for electric vehicle adoption through subsidies and infrastructure development. China, in particular, is a global leader in EV manufacturing and sales, creating immense demand for specialized EV thermal management systems. The region also serves as a significant manufacturing hub for global automotive suppliers, benefiting from cost-effective production capabilities and a large, skilled labor force.

- Latin America: The market for automotive heat exchangers in Latin America is experiencing moderate but steady growth, primarily influenced by improving economic conditions, increasing vehicle parc, and expanding automotive manufacturing capabilities, particularly in Brazil and Mexico. While the pace of electric vehicle adoption is slower compared to developed regions, there is a consistent demand for conventional heat exchanger components for passenger cars and light commercial vehicles. The market is characterized by a strong focus on cost-effectiveness, durability, and reliability, catering to the specific needs and climatic conditions of the region. Opportunities in the aftermarket segment are significant as the average age of vehicles on the road gradually increases.

- Middle East and Africa (MEA): The MEA region represents an emerging market for automotive heat exchangers, driven by expanding vehicle fleets, urbanization, and ongoing investments in automotive infrastructure. Growth is relatively gradual, with demand primarily concentrated in conventional vehicle segments. Countries rich in oil and gas contribute to higher vehicle sales, particularly premium models, where efficient thermal management is valued. The harsh climatic conditions in many parts of the region, characterized by high temperatures, necessitate robust and high-performing cooling systems, creating specific demand for durable heat exchangers. Opportunities are emerging in the aftermarket as the vehicle parc grows and in catering to localized needs for extreme temperature resilience.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Heat Exchanger Market.- Denso Corporation

- Mahle GmbH

- Valeo S.A.

- Hanon Systems

- Modine Manufacturing Company

- Sanden Corporation

- BorgWarner Inc.

- Marelli (formerly Calsonic Kansei)

- Gentherm Inc.

- T.RAD Co., Ltd.

- Eberspächer Group

- Dana Limited

- Boyd Corporation

- Thermal Systems Inc.

- KPS Industries

- Subros Ltd.

- Banco Products (India) Ltd.

- G&P Group

- Zhejiang Yinlun Co., Ltd.

- Jiangsu Wenzhou Heat Exchanger Co., Ltd.

Frequently Asked Questions

What is an automotive heat exchanger and its primary function?

An automotive heat exchanger is a crucial thermal management device in a vehicle designed to efficiently transfer thermal energy between two or more fluids that are at different temperatures. Its primary function is to maintain optimal operating temperatures for various vehicle systems, including the engine, transmission, air conditioning, and crucially for electric vehicles, the battery pack and power electronics. This ensures peak performance, enhances fuel efficiency, reduces emissions, improves component longevity, and contributes significantly to passenger comfort and vehicle safety.

Why are heat exchangers particularly important for Electric Vehicles (EVs)?

Heat exchangers are paramount for Electric Vehicles (EVs) because they are essential for precise thermal management of high-voltage battery packs, electric motors, and power electronics. They prevent these critical components from overheating during demanding operations like rapid acceleration or fast charging, and also ensure they operate within an optimal temperature range for maximizing battery range, extending battery lifespan, and maintaining consistent vehicle performance. Efficient thermal regulation in EVs is directly linked to overall efficiency, safety, and driver satisfaction.

What are the most common materials used in manufacturing automotive heat exchangers?

Aluminum is the most prevalent material used in automotive heat exchangers due to its exceptional lightweight properties, high thermal conductivity, and good corrosion resistance, making it ideal for radiators, condensers, and intercoolers. Copper and brass alloys are also employed, particularly in applications requiring superior heat transfer capabilities and durability, though they are heavier and generally more expensive. Stainless steel is utilized for specialized components, such as EGR coolers, where high-temperature resistance and robustness against corrosive exhaust gases are critical requirements.

How does Artificial Intelligence (AI) influence the design and performance optimization of automotive heat exchangers?

Artificial Intelligence significantly influences the design and performance optimization of automotive heat exchangers by leveraging advanced algorithms for generative design, allowing engineers to explore and identify novel, highly efficient geometries that optimize heat transfer while minimizing material usage. In terms of performance, AI-driven predictive analytics utilize sensor data to anticipate potential component failures, enabling proactive maintenance. Furthermore, machine learning algorithms can dynamically optimize thermal control systems in real-time, adapting to various driving conditions and environmental factors to enhance energy efficiency and overall thermal management effectiveness.

What are the key future trends expected to shape the Automotive Heat Exchanger Market?

Key future trends include the accelerating demand for sophisticated thermal management systems driven by the global shift towards electric and hybrid vehicles, leading to innovation in battery and power electronics cooling. Other trends involve the miniaturization and integration of multiple thermal functions into compact modules, the increasing adoption of advanced lightweight materials and manufacturing techniques like 3D printing, and the widespread incorporation of smart technologies such as IoT sensors and AI for real-time monitoring, predictive maintenance, and adaptive thermal control within vehicles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager