Automotive Infotainment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429812 | Date : Nov, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Automotive Infotainment Market Size

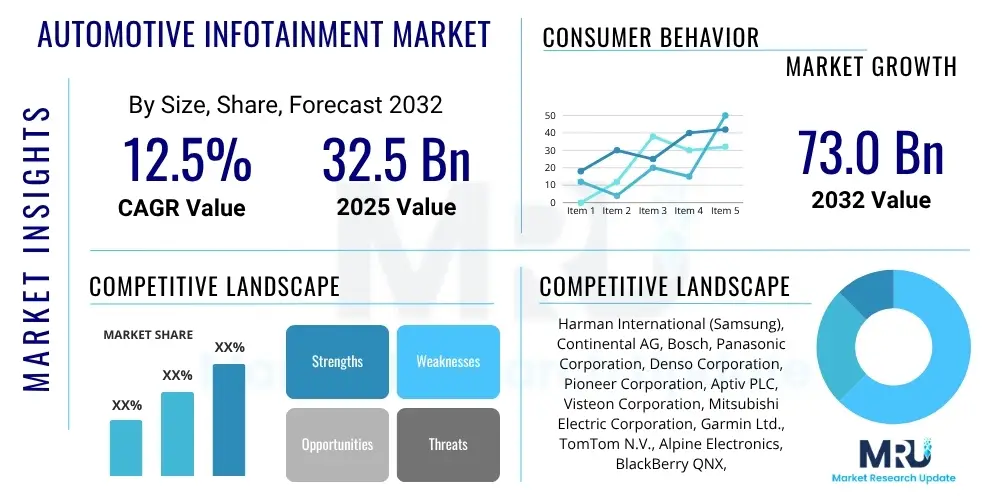

The Automotive Infotainment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2025 and 2032. The market is estimated at USD 32.5 Billion in 2025 and is projected to reach USD 73.0 Billion by the end of the forecast period in 2032.

Automotive Infotainment Market introduction

The Automotive Infotainment Market encompasses a broad range of in-vehicle systems designed to provide drivers and passengers with entertainment, information, communication, and navigation functionalities. These sophisticated systems integrate various hardware and software components to enhance the overall driving experience, transforming the vehicle cabin into a connected and personalized environment. Modern infotainment systems go beyond traditional radio and CD players, offering advanced features that cater to the evolving digital lifestyle of consumers.

The core products within this market include head units, display screens, connectivity modules (e.g., Bluetooth, Wi-Fi, 4G/5G), navigation systems, audio-video players, and voice control interfaces. Major applications span across passenger cars, commercial vehicles, and electric vehicles, providing essential services such as real-time traffic updates, media streaming, smartphone integration (Apple CarPlay, Android Auto), hands-free calling, and vehicle diagnostics. The primary benefits derived from these systems are improved convenience, enhanced safety through features like advanced navigation and emergency calling, and a richer, more engaging user experience during commutes or long journeys.

The market is predominantly driven by several key factors, including the increasing demand for connected car technologies, the proliferation of smartphones and their seamless integration into vehicle ecosystems, and the rising consumer expectation for in-car digital services. Furthermore, the rapid adoption of electric vehicles (EVs), which often incorporate large, advanced infotainment displays as a standard feature, alongside advancements in sensor technology and artificial intelligence, are significantly propelling market growth. Regulatory pushes for enhanced vehicle safety and connectivity also contribute to the expanding landscape of automotive infotainment.

Automotive Infotainment Market Executive Summary

The Automotive Infotainment Market is experiencing robust growth, fueled by the accelerating convergence of automotive technology and digital consumer electronics. Key business trends indicate a shift towards software-defined vehicles, where infotainment systems are becoming highly customizable and capable of over-the-air (OTA) updates, extending vehicle lifecycles and enabling new revenue streams through subscription services. Original Equipment Manufacturers (OEMs) are increasingly focusing on developing proprietary operating systems and user interfaces to differentiate their offerings and control the in-car experience, fostering strategic partnerships with tech giants for advanced content and connectivity solutions. This competitive landscape is driving innovation in display technologies, processing power, and user interaction methods, including advanced voice recognition and gesture control.

Regional trends highlight Asia Pacific as the leading and fastest-growing market, primarily due to the high volume of vehicle production and sales in countries like China, India, and Japan, coupled with a strong consumer appetite for advanced technology. North America and Europe also represent significant markets, characterized by early adoption of premium features, stringent safety regulations, and a focus on integrating infotainment with advanced driver assistance systems (ADAS). Emerging markets in Latin America and the Middle East and Africa are gradually expanding, driven by increasing disposable incomes and improving digital infrastructure, though adoption rates may vary based on economic conditions and local preferences.

Segment trends reveal a pronounced move towards integrated, multi-functional systems that combine navigation, communication, and entertainment into a cohesive unit. The connected car segment is particularly buoyant, with a growing demand for features such as real-time diagnostics, remote vehicle access, and personalized digital services. There is a clear premiumization trend, where larger, higher-resolution displays, immersive audio systems, and advanced connectivity options are becoming key differentiators, especially in luxury and electric vehicle segments. Furthermore, the integration of artificial intelligence and machine learning is transforming infotainment into intelligent platforms capable of predicting user preferences and enhancing safety through driver monitoring and contextual awareness.

AI Impact Analysis on Automotive Infotainment Market

User questions regarding the impact of AI on the Automotive Infotainment Market frequently revolve around how AI can personalize the in-car experience, enhance safety features, improve voice control accuracy, and what potential data privacy implications might arise from these advanced capabilities. There is significant interest in AI's role in making infotainment systems more intuitive and proactive, moving beyond reactive commands to anticipating driver and passenger needs. Concerns often center on the security of personal data collected by AI-powered systems and the potential for distractions caused by overly complex interfaces, while expectations are high for seamless integration, predictive functionalities, and enhanced entertainment options through intelligent content recommendations.

- Enhanced Voice Assistants: AI significantly improves natural language processing, making voice commands more accurate and conversational, reducing driver distraction.

- Personalized User Experience: AI algorithms analyze user preferences, driving habits, and common routes to customize interface layouts, music recommendations, and navigation suggestions.

- Predictive Navigation and Traffic: AI-driven systems leverage real-time data to offer highly accurate predictive traffic information and optimize routes based on historical patterns and current conditions.

- Adaptive Interfaces: AI enables infotainment systems to dynamically adjust display content and functionality based on driving conditions, time of day, or driver fatigue levels.

- Driver Monitoring Systems: AI can analyze driver behavior, detect drowsiness or distraction, and integrate with infotainment to provide alerts or suggest breaks, enhancing safety.

- Over the Air (OTA) Updates: AI facilitates intelligent management of software updates for the infotainment system, ensuring continuous improvement and feature additions without physical visits to service centers.

- Contextual Awareness: AI helps systems understand the vehicle's environment and occupants' needs, for instance, adjusting climate control or infotainment content based on passenger count or weather.

- Advanced Content Recommendations: AI powers sophisticated recommendation engines for music, podcasts, and video streaming, tailoring content to individual preferences and moods.

- Cybersecurity Enhancements: AI algorithms can detect and prevent potential cyber threats to the infotainment system, safeguarding vehicle and personal data.

- Integration with Smart Home Devices: AI enables seamless connectivity between in-car infotainment and smart home ecosystems, allowing for remote control of home devices from the vehicle.

DRO & Impact Forces Of Automotive Infotainment Market

The Automotive Infotainment Market is significantly shaped by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers propelling market expansion include the surging consumer demand for sophisticated in-car connectivity and digital services, mirroring the capabilities found in modern smartphones. The ongoing proliferation of electric vehicles (EVs) and autonomous driving technologies also plays a crucial role, as these vehicles often feature advanced, large-format infotainment systems as standard. Furthermore, the continuous evolution of digital ecosystems, enabling seamless integration of navigation, communication, and entertainment, fuels consumer adoption and market growth, complemented by regulatory mandates focusing on enhanced vehicle safety and telematics.

Conversely, several restraints impede the market's full potential. The high cost associated with developing and integrating advanced infotainment systems remains a significant barrier, particularly for entry-level and mid-range vehicle segments. Cybersecurity vulnerabilities pose a critical challenge, as connected systems are susceptible to breaches, raising concerns about data privacy and vehicle security. The inherent complexity of integrating diverse hardware and software components from multiple vendors often leads to development delays and compatibility issues, while the fragmented regulatory landscape across different regions for data handling and feature deployment adds another layer of constraint for global OEMs.

Despite these challenges, substantial opportunities exist for market participants. The widespread rollout of 5G technology promises to unlock new possibilities for ultra-fast in-car connectivity, enabling richer content streaming and more reliable real-time services. The integration of augmented reality (AR) for navigation and heads-up displays presents an immersive user experience opportunity, while the growth of subscription-based services for premium features offers recurring revenue streams for OEMs and software providers. Moreover, the convergence of infotainment with advanced driver assistance systems (ADAS) and eventually autonomous driving platforms provides a fertile ground for innovation, creating highly integrated, intelligent cockpit solutions.

The impact forces influencing this market extend beyond direct drivers and restraints, encompassing technological advancements that continually reshape product offerings, such as the miniaturization of components and the rise of edge computing. Consumer expectations for personalized, seamless digital experiences exert constant pressure on manufacturers to innovate rapidly. The intensely competitive landscape among traditional automotive suppliers, technology giants, and new entrants fosters a dynamic environment for innovation but also creates pricing pressures. Finally, the evolving regulatory environment around data privacy, safety standards, and spectrum allocation significantly influences product design, deployment strategies, and market access, making adaptation to these external forces crucial for sustained success.

Segmentation Analysis

The Automotive Infotainment Market is comprehensively segmented to provide a detailed understanding of its diverse components, applications, and end-user adoption patterns. This segmentation allows for precise analysis of market dynamics, identification of high-growth areas, and strategic planning for market participants. The market can be dissected based on various parameters, including component type, vehicle type, connectivity, operating system, display size, and sales channel, each revealing distinct trends and opportunities within the broader automotive ecosystem. This granular view helps stakeholders tailor products and services to specific market needs and preferences.

- By Component

- Head Unit

- Display Unit

- Amplifier

- Speakers

- Antenna

- Microphone

- Connectivity Module

- Software and Services

- By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Electric Vehicles (EV)

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Hybrid Electric Vehicles (HEV)

- By Connectivity

- Embedded

- Tethered

- Integrated

- By Operating System

- Android

- QNX

- Linux

- Apple iOS

- Other Proprietary OS

- By Display Size

- Less than 7 inches

- 7 to 10 inches

- Greater than 10 inches

- By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

- By Application

- Navigation

- Entertainment

- Communication

- Information Services

- Driver Assistance

Value Chain Analysis For Automotive Infotainment Market

The value chain for the Automotive Infotainment Market is intricate, involving multiple layers of specialization and collaboration, from fundamental component manufacturing to final consumer delivery. Upstream analysis reveals a critical dependence on suppliers of semiconductors, microcontrollers, display panels (LCD, OLED), audio components, memory chips, and wireless communication modules. These specialized component manufacturers form the bedrock, providing the core technological building blocks. Software development firms and platform providers (like Google for Android Auto, Apple for CarPlay, or QNX for embedded systems) also play a significant upstream role, offering operating systems, middleware, and application frameworks that enable infotainment functionalities.

Moving downstream, the value chain centers primarily on the integration of these components and software into complete infotainment systems by Tier 1 suppliers, who then deliver them to Original Equipment Manufacturers (OEMs). These Tier 1 suppliers (e.g., Bosch, Continental, Harman) often undertake the complex task of system design, integration, and testing, ensuring compatibility and performance within the vehicle architecture. OEMs then incorporate these systems into their vehicles during the manufacturing process, tailoring them to specific vehicle models and branding requirements. The downstream also includes aftermarket providers who offer standalone or upgrade solutions directly to consumers, catering to vehicles not equipped with advanced infotainment from the factory or those seeking enhanced features.

Distribution channels for automotive infotainment systems are primarily direct, especially in the OEM segment, where Tier 1 suppliers directly engage with automotive manufacturers through long-term contracts and strategic partnerships. For the aftermarket segment, distribution is more varied, involving a mix of direct sales through authorized dealerships, independent automotive electronics retailers, online e-commerce platforms, and professional installers. Both direct and indirect channels are crucial; direct channels ensure seamless integration and quality control for new vehicles, while indirect channels provide accessibility and choice for consumers looking to customize or upgrade their existing vehicles, expanding the market reach and customer base beyond initial vehicle purchase.

Automotive Infotainment Market Potential Customers

The primary potential customers for automotive infotainment systems are broadly categorized into two main groups: vehicle manufacturers and end-users. Vehicle manufacturers, or Original Equipment Manufacturers (OEMs), constitute the largest segment, acting as the direct buyers of integrated infotainment solutions from Tier 1 suppliers for installation into new vehicles. These OEMs, ranging from mass-market brands to luxury carmakers, constantly seek innovative, feature-rich, and cost-effective infotainment systems to differentiate their products, meet evolving consumer demands for connectivity, and comply with safety and environmental regulations. Their purchasing decisions are driven by factors such as system reliability, integration capabilities, brand perception, user experience, and overall cost of ownership.

The second significant customer group comprises the end-users or direct consumers who purchase either new vehicles equipped with advanced infotainment systems or opt for aftermarket solutions for their existing vehicles. These individuals are driven by a desire for enhanced convenience, entertainment, safety, and connectivity features during their daily commutes and travels. Their preferences are shaped by personal lifestyle, digital habits, budget, and the perceived value of features like smartphone integration, high-definition displays, advanced navigation, and immersive audio. As consumers increasingly view their vehicles as extensions of their digital lives, the demand for sophisticated, personalized, and seamlessly integrated infotainment experiences continues to rise across various demographic and socio-economic segments.

Beyond individual consumers, fleet operators and ride-sharing companies also represent a growing segment of potential customers. These entities often require robust, easy-to-manage infotainment systems that can enhance driver productivity, provide navigation and communication tools, and potentially offer passenger entertainment options for improved service quality. The decision-making for these customers often involves considerations such as durability, ease of maintenance, cybersecurity, and the ability to integrate with fleet management software and telematics services, making them distinct buyers with specific operational requirements compared to individual vehicle owners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 32.5 Billion |

| Market Forecast in 2032 | USD 73.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Harman International (Samsung), Continental AG, Bosch, Panasonic Corporation, Denso Corporation, Pioneer Corporation, Aptiv PLC, Visteon Corporation, Mitsubishi Electric Corporation, Garmin Ltd., TomTom N.V., Alpine Electronics, BlackBerry QNX, Gentex Corporation, Marelli (CK Holdings Co. Ltd.), LG Electronics, Apple Inc., Google LLC, Baidu Inc., Huawei Technologies Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Infotainment Market Key Technology Landscape

The Automotive Infotainment Market is characterized by a rapidly evolving technological landscape, driven by the relentless pursuit of enhanced user experience, seamless connectivity, and robust performance. Central to this evolution are advanced operating systems such as Android Automotive OS, Apple CarPlay, Android Auto, QNX, and various Linux-based platforms, which provide the foundational software for intuitive user interfaces and application integration. These operating systems facilitate the execution of complex tasks, from navigation and media playback to communication and vehicle diagnostics, often leveraging cloud-based services for real-time updates and data processing. The integration of smartphone mirroring technologies like Apple CarPlay and Android Auto remains a critical feature, bridging the gap between mobile device functionality and in-car systems, while also enabling a consistent user experience.

Connectivity technologies are paramount, with the adoption of 4G LTE and the accelerating rollout of 5G transforming in-vehicle data speeds and reliability. This enables high-quality media streaming, over-the-air (OTA) software updates, and reliable vehicle-to-everything (V2X) communication, which is crucial for advanced driver assistance systems and future autonomous driving capabilities. Display technologies have also seen significant advancements, moving towards larger, higher-resolution touchscreens, including OLED and curved displays, which offer superior visual clarity and aesthetics. Haptic feedback and gesture control interfaces are gaining traction, providing more tactile and intuitive ways for users to interact with the infotainment system, minimizing visual distraction.

Furthermore, the incorporation of sophisticated voice recognition and natural language processing (NLP) powered by artificial intelligence is a game-changer, allowing drivers to control various functions through conversational commands, significantly improving safety and convenience. Advanced processors and graphics units are becoming standard, enabling faster response times, complex 3D mapping, and multi-tasking capabilities. The industry is also witnessing an increasing focus on cybersecurity solutions to protect these connected systems from external threats, and the adoption of personalized digital assistants tailored for the automotive environment, which learn driver preferences and anticipate needs, thereby creating a truly intelligent and adaptable in-car experience.

Regional Highlights

- North America: A mature market characterized by early adoption of advanced infotainment features, strong demand for premium and connected car technologies, and significant investments in autonomous driving research. The presence of major automotive OEMs and tech companies drives continuous innovation.

- Europe: Focuses on safety-centric features, stringent regulatory compliance, and a preference for sophisticated, integrated systems. Germany, France, and the UK are key contributors, with a growing emphasis on electric vehicles and sustainable mobility solutions that incorporate advanced digital cockpits.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily driven by high vehicle production and sales volumes in China, India, and Japan. Rapid technological adoption, increasing disposable incomes, and a strong consumer appetite for connectivity and advanced features are fueling expansion.

- Latin America: An emerging market with increasing penetration of connected cars, though adoption is influenced by economic stability and infrastructure development. Brazil and Mexico are leading the growth, with a rising demand for affordable yet feature-rich infotainment solutions.

- Middle East and Africa (MEA): A nascent but growing market, propelled by urbanization, infrastructure improvements, and increasing adoption of luxury vehicles. Demand for high-end infotainment systems with advanced connectivity is emerging, particularly in the GCC countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Infotainment Market.- Harman International (Samsung)

- Continental AG

- Robert Bosch GmbH

- Panasonic Corporation

- Denso Corporation

- Pioneer Corporation

- Aptiv PLC

- Visteon Corporation

- Mitsubishi Electric Corporation

- Garmin Ltd.

- TomTom N.V.

- Alpine Electronics

- BlackBerry QNX

- Gentex Corporation

- Marelli (CK Holdings Co. Ltd.)

- LG Electronics

- Apple Inc.

- Google LLC

- Baidu Inc.

- Huawei Technologies Co. Ltd.

Frequently Asked Questions

What is automotive infotainment?

Automotive infotainment refers to in-vehicle systems that provide a blend of entertainment, information, communication, and navigation functionalities to drivers and passengers, enhancing the overall driving experience.

What are the key drivers of the Automotive Infotainment Market growth?

The primary drivers include increasing consumer demand for connected car features, seamless smartphone integration, the rapid adoption of electric vehicles, and advancements in AI and sensor technologies.

How does AI impact automotive infotainment systems?

AI significantly enhances infotainment systems through improved voice recognition, personalized user interfaces, predictive navigation, driver monitoring for safety, and intelligent content recommendations, making the in-car experience more intuitive and adaptive.

What are the main challenges faced by the Automotive Infotainment Market?

Key challenges include the high cost of advanced systems, cybersecurity risks, integration complexities with diverse vehicle architectures, and fragmentation of regulatory standards across different global regions.

What are the future trends in automotive infotainment?

Future trends involve further integration of 5G connectivity, augmented reality features, increased adoption of subscription-based services, deeper convergence with autonomous driving systems, and the development of highly personalized, AI-powered digital cockpits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Infotainment Testing Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Mid Range Fpga Field Programmable Gate Array Market Size Report By Type (Less Than 28 NM, 28-90 NM, More Than 90 NM, SRAM, Flash, Antifuse), By Application (Telecommunications, Wireless communication, Wired communication, 5G, Consumer Electronics, Smartphones and tablets, Virtual reality devices, Others, Test, Measurement, and Emulation, Data Centers and Computing, Storage interface controls, Network interface controls, Hardware acceleration, High performance computing, Military & Aerospace, Avionics, Missiles & munition, Radars & sensors, Others, Industrial, Video surveillance systems, Machine vision solutions, Industrial networking solutions, Industrial motor control solutions, Robotics, Industrial sensors, Automotive, ADAS, Automotive infotainment and driver information systems, Sensor fusion, Healthcare, Imaging diagnostic systems, Wearable devices, Others, Multimedia, Broadcasting), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Driver ICs Market Statistics 2025 Analysis By Application (Mobile Computing Devices, TVs, Automotive Infotainment Systems, Others), By Type (LCD Drivers, LED Display Drivers, LED Lighting Drivers, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- OLED Display Driver IC Market Statistics 2025 Analysis By Application (Mobile Computing Devices, TVs, Automotive infotainment systems), By Type (8 channel, 16 channel, 32 channel, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Digital Accessories Market Statistics 2025 Analysis By Application (Residential, Commercial), By Type (Mobile Phone Accessories, Camera Accessories, Computer Accessories, Automotive Infotainment Accessories), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager