Automotive Key Interlock Cable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430595 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Automotive Key Interlock Cable Market Size

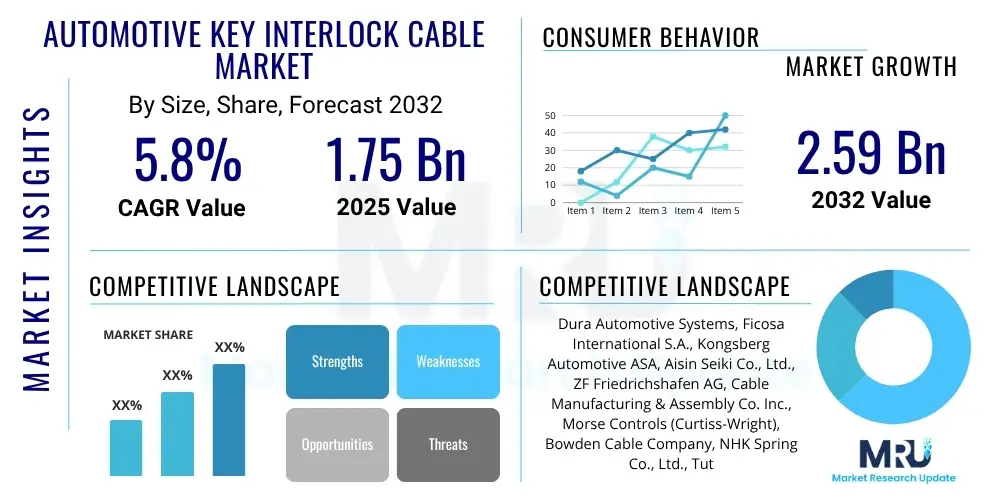

The Automotive Key Interlock Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at $1.75 Billion in 2025 and is projected to reach $2.59 Billion by the end of the forecast period in 2032.

Automotive Key Interlock Cable Market introduction

The Automotive Key Interlock Cable Market encompasses the production and supply of essential safety components that prevent inadvertent gear changes or key removal in vehicles, primarily those equipped with automatic transmissions. This crucial safety device mechanically links the ignition switch, the automatic transmission shifter, and sometimes the parking brake, ensuring that the vehicle can only be started in Park or Neutral and that the ignition key cannot be removed unless the vehicle is in Park. The primary application of these cables is to enhance vehicle safety and prevent roll-away incidents, which can occur if a vehicle is left in gear without proper engagement of the parking mechanism. They serve as a foundational element in vehicle safety systems, mandated by regulations in various regions globally to mitigate driver error.

The product, an automotive key interlock cable, is a robust, flexible mechanical cable typically comprising an inner core wire, a protective casing, and end fittings designed for specific vehicle models. Its core function is to ensure that the gear selector is locked in the Park position before the ignition key can be fully removed, and conversely, that the vehicle cannot be shifted out of Park unless the brake pedal is depressed and the ignition is on. This intricate mechanical interaction provides a fail-safe mechanism, significantly reducing the risk of accidental vehicle movement. Major applications are predominantly found in passenger cars and light commercial vehicles with automatic transmissions, where they form a critical part of the vehicle's passive safety architecture.

The benefits derived from these cables are paramount, primarily revolving around enhanced driver and passenger safety, regulatory compliance, and anti-theft capabilities. By preventing keys from being removed while the car is in gear, they deter potential vehicle roll-aways and ensure vehicles are properly secured. Driving factors for this market include the global increase in automatic transmission vehicle sales, stringent government safety regulations, and a heightened consumer awareness regarding vehicle safety features. Furthermore, the steady growth in overall automotive production, particularly in emerging economies, continues to fuel demand for these indispensable components.

Automotive Key Interlock Cable Market Executive Summary

The Automotive Key Interlock Cable Market is characterized by steady growth driven by global automotive production trends, particularly the increasing adoption of automatic transmission vehicles, and the persistent emphasis on vehicle safety and regulatory compliance. Business trends indicate a focus on material innovation to enhance durability and reduce weight, as well as process optimization among manufacturers to meet OEM demands for cost-effectiveness and high-volume production. The market is moderately consolidated, with key players investing in R&D to develop more integrated and reliable interlock systems. The shift towards electric vehicles (EVs) is also influencing design considerations, as interlock mechanisms adapt to new powertrain architectures, though the fundamental safety function remains crucial even in electric and hybrid models where a physical park mechanism is still present.

Regional trends reveal Asia Pacific as the dominant and fastest-growing market, primarily due to robust automotive manufacturing bases in China, India, and Japan, coupled with a surging demand for automatic transmission vehicles among a burgeoning middle class. Europe maintains a strong market presence, driven by its stringent safety standards and the high volume of premium vehicle production, while North America represents a mature yet stable market, characterized by consistent demand and a high penetration of automatic transmissions. Latin America and the Middle East & Africa are emerging regions, showing significant growth potential as vehicle ownership increases and safety regulations become more formalized and enforced, leading to greater adoption of standard safety features like key interlock cables.

Segmentation trends highlight the dominance of the automatic transmission segment, which is the primary application for these cables. Within vehicle types, passenger cars account for the largest share, although light commercial vehicles also contribute significantly. The OEM channel remains the largest distribution route, reflecting the integration of these cables as original equipment during vehicle assembly. However, the aftermarket segment is also vital for replacements and repairs, driven by vehicle longevity and maintenance needs. Future trends point towards interlock systems becoming more sophisticated, potentially integrating with advanced driver-assistance systems (ADAS) or smart cabin features, though the core mechanical safety function of the cable is expected to endure as a reliable fail-safe.

AI Impact Analysis on Automotive Key Interlock Cable Market

Common user questions regarding AI's impact on the Automotive Key Interlock Cable Market frequently revolve around whether AI will render mechanical interlocks obsolete, how AI can enhance their function, and if AI will influence the manufacturing process or material science for these components. Users often express concerns about the safety implications of fully autonomous vehicles and how traditional safety mechanisms will integrate with, or be replaced by, AI-driven systems. The central theme emerging from these queries is a desire to understand the longevity and evolution of conventional safety components in an increasingly intelligent and automated automotive landscape, specifically how AI might either complement or disrupt the role of a purely mechanical safety device like the key interlock cable.

- Enhanced integration with advanced safety systems: AI can provide intelligent monitoring, using sensor data to predict and prevent potential unsafe conditions before a mechanical interlock is even engaged, or to verify its proper functioning.

- Predictive maintenance for cable longevity: AI-powered analytics can monitor usage patterns and environmental factors to predict the lifespan of mechanical components like interlock cables, signaling maintenance needs proactively.

- Automated and optimized manufacturing processes: AI and machine learning can streamline the production of interlock cables, improving efficiency, reducing defects, and optimizing material usage through robotic automation and predictive quality control.

- Smart cabin integration for interlock override scenarios: While mechanical cables provide a failsafe, AI could manage complex scenarios requiring temporary override or integration with features like remote parking, ensuring safety protocols are maintained.

- Data analytics for design improvements: AI can analyze performance data from millions of vehicles, identifying stress points or failure modes in interlock cables, leading to more robust and durable designs.

- Cybersecurity considerations for connected interlocks: If interlock systems were to become electronically controlled and connected, AI would be crucial in ensuring their cybersecurity against malicious interference.

DRO & Impact Forces Of Automotive Key Interlock Cable Market

The Automotive Key Interlock Cable Market is significantly influenced by a confluence of drivers, restraints, and opportunities, all shaped by various impact forces. The primary drivers include global automotive safety regulations, which increasingly mandate fail-safe mechanisms to prevent roll-away incidents, coupled with the rising consumer preference for automatic transmission vehicles worldwide. The continuous growth in overall vehicle production, particularly in emerging economies, also directly fuels the demand for these essential safety components. Moreover, the inherent anti-theft benefits and the general emphasis on driver and passenger safety by both consumers and regulatory bodies act as strong underlying forces propelling market expansion, ensuring their continued relevance as a standard safety feature in new vehicles.

Despite robust drivers, the market faces several restraints. Cost pressures from original equipment manufacturers (OEMs) remain a significant challenge, pushing suppliers to optimize production and material costs without compromising quality or safety. The increasing complexity of vehicle architectures, including the integration of advanced electronics and the gradual shift towards drive-by-wire systems for gear selection in some high-end vehicles, presents a design and integration challenge for purely mechanical interlocks. Furthermore, volatility in raw material prices, such as steel and plastics, can impact production costs and profit margins for cable manufacturers. These factors necessitate continuous innovation in materials and manufacturing processes to maintain competitive pricing and ensure seamless integration with evolving vehicle designs.

Opportunities within the market largely stem from the growing automotive sectors in developing regions, which are witnessing a rapid increase in vehicle ownership and the adoption of automatic transmissions. The ongoing evolution of automotive safety standards globally provides a continuous impetus for product refinement and innovation, encouraging manufacturers to develop more robust and reliable interlock systems. Additionally, the electrification trend, while sometimes perceived as a disruptor, also presents opportunities for adapting interlock mechanisms to electric vehicles, particularly concerning park-lock safety and key retention. The aftermarket segment also offers steady growth opportunities for replacement cables as the global vehicle parc ages. Regulatory compliance remains a powerful impact force, often dictating design and adoption, while technological advancements in material science and manufacturing processes offer avenues for product differentiation and cost reduction. Economic cycles and geopolitical stability also play a role, influencing overall automotive production and consumer purchasing power.

Segmentation Analysis

The Automotive Key Interlock Cable Market is comprehensively segmented to provide a detailed understanding of its various facets, enabling stakeholders to analyze specific market dynamics, target audiences, and growth opportunities. The segmentation strategy typically considers factors such as the type of transmission, the kind of vehicle, the materials used in cable construction, and the sales channel through which these components are distributed. This detailed breakdown allows for a nuanced perspective on market demand, competitive landscapes, and regional variations in product adoption and preferences.

- By Transmission Type

- Automatic Transmission

- Manual Transmission (less common for key interlocks, but some configurations exist)

- By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles (limited application)

- By Material Type

- Steel Cables

- Composite Cables

- Hybrid Material Cables

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Key Interlock Cable Market

The value chain for the Automotive Key Interlock Cable Market begins with upstream activities involving the sourcing and processing of raw materials. This stage typically includes suppliers of high-tensile steel wire for the inner core, various plastics and elastomers for the outer casing and protective sleeves, and specialized lubricants to ensure smooth operation and longevity. Manufacturers in this segment focus on providing materials that meet stringent automotive specifications for durability, flexibility, and resistance to environmental factors like temperature extremes, moisture, and chemicals. The quality and cost-effectiveness of these raw materials directly impact the final product's performance and price point, making strong supplier relationships crucial for cable manufacturers.

Further along the value chain, component manufacturers play a vital role, transforming raw materials into specialized parts such as connectors, fittings, mounting brackets, and specific mechanisms that interface with the ignition and shifter systems. These Tier 2 and Tier 3 suppliers often leverage precision molding, extrusion, and stamping processes to create components that adhere to tight tolerances and design specifications. Their products are then supplied to Tier 1 suppliers or directly to automotive key interlock cable assemblers. The integration of these components requires expertise in mechanical engineering and quality control to ensure seamless functionality within the complex vehicle assembly. Quality assurance at this stage is paramount, as any defect can lead to critical safety issues in the final application.

Downstream analysis primarily focuses on the key interlock cable manufacturers who assemble these components and cables into finished products ready for integration into vehicles. These manufacturers act as Tier 1 suppliers to the automotive industry. Their distribution channels are predominantly direct to automotive original equipment manufacturers (OEMs), where the cables are integrated into new vehicles during the assembly process. This direct relationship is characterized by long-term contracts, rigorous quality audits, and just-in-time delivery systems. The indirect channel involves the aftermarket, where these cables are distributed through wholesale parts distributors, automotive retailers, and independent service centers for replacement and repair purposes. This aftermarket segment is crucial for maintaining the safety and functionality of vehicles throughout their lifecycle, contributing a stable revenue stream for manufacturers beyond initial OEM sales.

Automotive Key Interlock Cable Market Potential Customers

The primary potential customers and end-users of automotive key interlock cables are the major global automotive original equipment manufacturers (OEMs). These include large-scale passenger car manufacturers such as Toyota, Volkswagen, General Motors, Ford, Honda, Hyundai, and Stellantis, as well as manufacturers of light commercial vehicles like vans and pick-up trucks. OEMs procure these cables in large volumes as standard safety components for their production lines, integrating them into the design and assembly of new vehicles, particularly those equipped with automatic transmissions. Their demand is driven by new vehicle production schedules, adherence to regulatory mandates, and the continuous push for enhanced vehicle safety features across their model ranges.

Beyond the new vehicle manufacturing sector, another significant segment of potential customers resides in the automotive aftermarket. This includes a diverse array of buyers, such as wholesale automotive parts distributors, independent automotive repair shops, authorized service centers, and even do-it-yourself enthusiasts. These customers purchase key interlock cables for replacement purposes, either due to wear and tear, accidental damage, or system malfunctions in existing vehicles. The aftermarket demand is influenced by the size and age of the global vehicle parc, maintenance cycles, and the availability of replacement parts. As vehicles age, the need for replacement components like interlock cables becomes more prevalent, ensuring a steady, albeit different, demand stream for manufacturers and distributors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $1.75 Billion |

| Market Forecast in 2032 | $2.59 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dura Automotive Systems, Ficosa International S.A., Kongsberg Automotive ASA, Aisin Seiki Co., Ltd., ZF Friedrichshafen AG, Cable Manufacturing & Assembly Co. Inc., Morse Controls (Curtiss-Wright), Bowden Cable Company, NHK Spring Co., Ltd., Tuthill Corporation, Pricol Limited, U.S. Tsubaki Power Transmission, Sonnax Industries Inc., Jiangsu Jinyi Automotive Parts Co., Ltd., Sanwa Kogyo Co., Ltd., Flex Cable Co., Ltd., TRW Automotive, Hella GmbH & Co. KGaA, Continental AG, Bosch. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Key Interlock Cable Market Key Technology Landscape

The technology landscape for the Automotive Key Interlock Cable Market is continuously evolving, driven by the demand for enhanced safety, durability, and cost-effectiveness. A key area of technological advancement involves material science. Manufacturers are increasingly utilizing advanced steel alloys and polymer composites to create cables that offer superior tensile strength, greater flexibility, and reduced friction, thereby extending the lifespan and improving the operational smoothness of the interlock mechanism. Innovations in coating technologies are also crucial, providing enhanced corrosion resistance and protection against environmental degradation, which is essential for components exposed to varying automotive conditions.

Precision manufacturing processes represent another critical technological facet. Techniques such as advanced extrusion, precision molding, and automated assembly are employed to ensure consistent quality, tight tolerances, and efficient production of both the cables and their associated fittings and connectors. These processes are vital for creating components that integrate seamlessly into complex vehicle systems and meet rigorous OEM specifications. Furthermore, the development of lightweight cable designs is a significant trend, aligning with the broader automotive industry's push for vehicle weight reduction to improve fuel efficiency and reduce emissions, necessitating innovations in material selection and cable architecture.

While the core function of key interlock cables is mechanical, there is a growing trend towards integrating these systems with electronic components for enhanced safety and monitoring. This includes the use of position sensors to provide feedback on the interlock's status to the vehicle's electronic control unit (ECU), allowing for more sophisticated safety diagnostics and potentially enabling features like intelligent override in emergency situations. Although the mechanical cable provides a robust fail-safe, its integration into a 'smart' system allows for better diagnostics and compliance with evolving automotive safety standards, bridging the gap between traditional mechanical components and advanced vehicle electronics. The continuous development in these areas ensures that key interlock cables remain relevant and effective within modern vehicle architectures.

Regional Highlights

- North America: A mature market characterized by a high penetration of automatic transmission vehicles and stringent safety standards, particularly in the United States and Canada. The region exhibits steady demand, driven by vehicle replacement cycles and a focus on robust safety features. Manufacturers here often emphasize compliance with federal motor vehicle safety standards (FMVSS).

- Europe: This region is marked by a strong emphasis on passenger safety and environmental regulations, leading to continuous innovation in automotive components. Countries like Germany, France, and the UK contribute significantly to the demand, with a growing shift towards automatic transmissions, particularly in premium and luxury segments.

- Asia Pacific (APAC): The largest and fastest-growing market, primarily fueled by the substantial automotive manufacturing bases in China, India, Japan, and South Korea. Rapid economic growth, rising disposable incomes, and increasing adoption of automatic transmission vehicles across various segments are key drivers. The region is a major production hub for global OEMs and a significant consumer market.

- Latin America: An emerging market experiencing consistent growth in vehicle production and sales. Countries like Brazil and Mexico are leading the expansion, driven by increasing vehicle ownership and evolving safety regulations. The demand for key interlock cables is on an upward trajectory as the market matures and automatic transmission vehicles become more common.

- Middle East and Africa (MEA): This region is characterized by a growing automotive sector, both in terms of local assembly and vehicle imports. While smaller in market size compared to other regions, increasing urbanization, infrastructure development, and a rising focus on vehicle safety are expected to drive gradual growth in demand for key interlock cables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Key Interlock Cable Market.- Dura Automotive Systems

- Ficosa International S.A.

- Kongsberg Automotive ASA

- Aisin Seiki Co., Ltd.

- ZF Friedrichshafen AG

- Cable Manufacturing & Assembly Co. Inc.

- Morse Controls (Curtiss-Wright)

- Bowden Cable Company

- NHK Spring Co., Ltd.

- Tuthill Corporation

- Pricol Limited

- U.S. Tsubaki Power Transmission

- Sonnax Industries Inc.

- Jiangsu Jinyi Automotive Parts Co., Ltd.

- Sanwa Kogyo Co., Ltd.

- Flex Cable Co., Ltd.

- TRW Automotive

- Hella GmbH & Co. KGaA

- Continental AG

- Bosch

Frequently Asked Questions

What is an automotive key interlock cable and why is it important?

An automotive key interlock cable is a mechanical safety device that prevents the removal of the ignition key unless the vehicle's automatic transmission is in "Park." It is crucial for preventing roll-away accidents and enhancing vehicle security.

How is the automotive key interlock cable market growing?

The market is experiencing steady growth, projected at a CAGR of 5.8% from 2025 to 2032, driven by increasing automatic transmission vehicle sales and stringent global safety regulations.

Will electric vehicles (EVs) still require key interlock cables?

While EVs do not have traditional transmissions, many still incorporate a physical park-lock mechanism. Therefore, a similar interlock system, often a cable, is required to prevent key removal or vehicle movement when not in "Park," maintaining fundamental safety protocols.

What are the primary drivers of demand for these cables?

Key drivers include global automotive safety regulations mandating roll-away prevention, the rising consumer preference for automatic transmission vehicles, and the continuous growth in overall vehicle production worldwide.

How do technological advancements impact this market?

Technological advancements focus on material science for greater durability and lighter weight, precision manufacturing for reliability, and the integration of smart sensors to enhance system diagnostics and compliance with evolving safety standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager