Automotive Kinetic Energy Recovery System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429015 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Kinetic Energy Recovery System Market Size

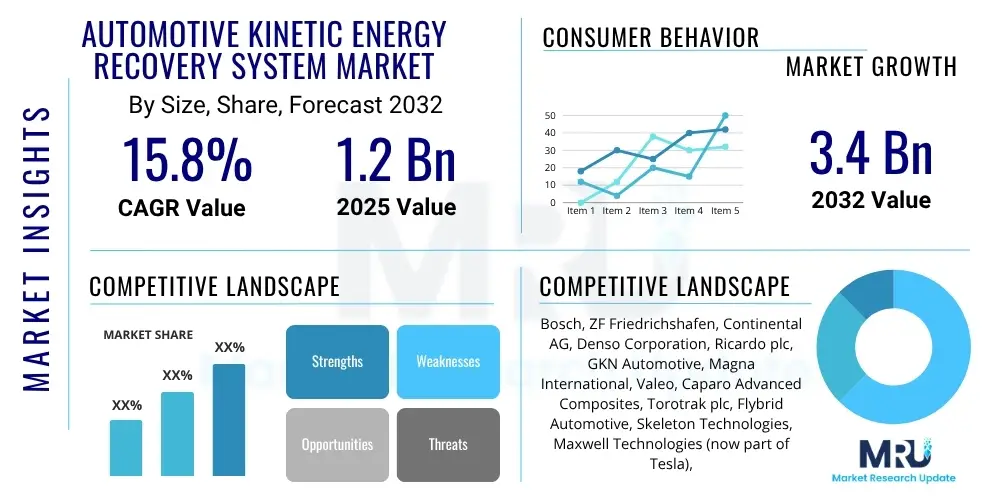

The Automotive Kinetic Energy Recovery System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2025 and 2032. The market is estimated at USD 1.2 Billion in 2025 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2032.

Automotive Kinetic Energy Recovery System Market introduction

The Automotive Kinetic Energy Recovery System (KERS) market encompasses technologies designed to capture and store kinetic energy lost during vehicle deceleration and braking, subsequently converting it into usable power for propulsion. This innovative system aims to enhance vehicle fuel efficiency, reduce emissions, and improve overall performance by reusing otherwise wasted energy. KERS represents a critical advancement in sustainable automotive engineering, addressing global demands for greener transportation solutions.

The core product involves mechanical, electrical, or hydraulic mechanisms that absorb kinetic energy during braking. Electrical KERS systems typically use a motor-generator unit to convert kinetic energy into electrical energy, stored in batteries or supercapacitors. Mechanical KERS often employs a flywheel that spins up to high speeds to store energy, while hydraulic systems utilize a pump to compress fluid into an accumulator. These systems find major applications across various vehicle types, including hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), battery electric vehicles (BEVs), and even high-performance conventional internal combustion engine vehicles, especially in motorsports.

The primary benefits of KERS include significant improvements in fuel economy, reduced CO2 emissions, and enhanced acceleration, particularly in stop-and-go traffic scenarios. For performance vehicles, KERS provides a temporary power boost, commonly known as "push-to-pass" in racing. Driving factors for market growth include increasingly stringent global emission regulations, rising fuel prices, growing consumer awareness and demand for fuel-efficient and environmentally friendly vehicles, and continuous technological advancements in energy storage and conversion systems. The shift towards electrification in the automotive industry further amplifies the relevance and adoption of KERS technologies.

Automotive Kinetic Energy Recovery System Market Executive Summary

The Automotive Kinetic Energy Recovery System market is experiencing robust growth, primarily driven by the global imperative for sustainable transportation and stringent environmental regulations. Business trends indicate a strong focus on integration with advanced powertrain technologies, particularly in hybrid and electric vehicles, as manufacturers seek to optimize energy management and extend vehicle range. Strategic collaborations between KERS technology providers and major automotive OEMs are becoming prevalent, fostering innovation and accelerating market penetration. Furthermore, there is a growing emphasis on developing lighter, more compact, and cost-effective KERS units to facilitate broader adoption across different vehicle segments, from luxury performance cars to urban transit buses.

Regional trends reveal Europe and Asia Pacific as frontrunners in KERS adoption. Europe benefits from early regulatory pushes for emissions reduction and a strong luxury and performance vehicle market that values advanced automotive technologies. Asia Pacific, particularly China and Japan, is witnessing rapid expansion due to aggressive government incentives for electric vehicles, a burgeoning manufacturing base, and increasing consumer demand for fuel-efficient cars. North America also shows significant potential, driven by the expansion of EV infrastructure and a growing market for performance-oriented and commercial electric vehicles. Emerging economies in Latin America, the Middle East, and Africa are gradually adopting KERS solutions as their automotive markets evolve and environmental concerns gain prominence.

Segment trends highlight the dominance of electrical KERS systems due to their flexibility and compatibility with electric powertrains, though mechanical flywheel systems maintain a niche in high-performance applications. Passenger cars continue to be the primary end-user segment, with increasing adoption in premium and mid-range hybrid and electric models. However, the commercial vehicle segment, including buses and heavy-duty trucks, is expected to exhibit significant growth as fleet operators seek to reduce operational costs and comply with emissions standards. The aftermarket segment, though smaller, is showing signs of growth as enthusiasts and specialized workshops look to enhance vehicle performance and efficiency through KERS retrofits. Overall, the market is characterized by continuous innovation aimed at improving energy storage density, conversion efficiency, and system reliability.

AI Impact Analysis on Automotive Kinetic Energy Recovery System Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the efficiency and integration of Kinetic Energy Recovery Systems. Common questions revolve around AI's ability to predict optimal energy recovery moments, personalize energy management based on driving styles, and enhance KERS system reliability through predictive maintenance. There is also significant interest in how AI can facilitate the seamless integration of KERS with other vehicle subsystems, ensuring optimal energy flow and overall vehicle performance. Users expect AI to move KERS beyond a reactive system to a proactive, adaptive, and highly intelligent component of the modern vehicle architecture.

- AI enables predictive control of KERS, optimizing energy capture and release based on real-time traffic data, driver behavior, and topographic information.

- Machine learning algorithms can personalize KERS performance, adapting energy management strategies to individual driving styles for maximum efficiency gains.

- AI-driven diagnostics and prognostics improve KERS reliability by monitoring system health, predicting potential failures, and scheduling preventative maintenance.

- Seamless integration of KERS with vehicle control units (VCUs) is enhanced by AI, ensuring harmonious operation with braking, powertrain, and battery management systems.

- AI contributes to the development of smarter energy storage solutions, dynamically managing charge and discharge cycles of batteries and supercapacitors for extended lifespan and optimal performance.

- Optimization of KERS in autonomous vehicles, allowing for more consistent and efficient energy recovery strategies without human driving variability.

DRO & Impact Forces Of Automotive Kinetic Energy Recovery System Market

The Automotive Kinetic Energy Recovery System (KERS) market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, shaped by broader industry impact forces. Key drivers propelling market expansion include the increasingly stringent global emission regulations, such as Euro 7 and CAFE standards, which compel automotive manufacturers to integrate advanced fuel-saving technologies. The continuous escalation of fuel prices worldwide makes KERS an attractive solution for improving vehicle efficiency and reducing operational costs. Furthermore, the rapid growth of the electric vehicle (EV) and hybrid electric vehicle (HEV) markets inherently favors KERS adoption as it directly complements their energy management strategies. The pursuit of enhanced vehicle performance, particularly in sports cars and motorsports, also acts as a strong driver for mechanical and electrical KERS systems, offering instant power boosts and improved acceleration.

Despite these significant tailwinds, the KERS market faces several notable restraints. The high initial cost of implementing KERS technology, especially for more advanced electrical and mechanical systems, can be a deterrent for manufacturers looking to maintain competitive pricing in mass-market segments. The inherent complexity of integrating KERS into existing vehicle architectures, requiring significant redesign and calibration, presents engineering challenges and adds to development costs. Moreover, the added weight of KERS components can sometimes offset the fuel efficiency gains, particularly in smaller vehicles where weight optimization is critical. Limited consumer awareness and understanding of KERS benefits beyond performance applications in certain regions also pose a challenge to broader market acceptance.

Opportunities for market growth are abundant, primarily driven by ongoing advancements in energy storage technologies, such as higher-density batteries and more efficient supercapacitors, which can improve KERS performance and reduce size. The burgeoning market for autonomous vehicles offers a unique avenue for KERS optimization, as AI can precisely control energy recovery without human driving variability, leading to unprecedented efficiency. Expansion into new application areas, such as heavy-duty commercial vehicles, public transport buses, and even off-highway equipment, presents substantial untapped potential. Furthermore, the development of modular and standardized KERS units that can be more easily integrated across different vehicle platforms could significantly reduce costs and accelerate adoption. The overall impact forces shaping the market include strong competitive rivalry among established automotive suppliers and new technology startups, the bargaining power of major automotive OEMs as buyers, and the threat of substitutes from other efficiency-enhancing technologies, though KERS offers a unique solution for kinetic energy recapture.

Segmentation Analysis

The Automotive Kinetic Energy Recovery System market is segmented across various critical dimensions, providing a granular view of its structure and growth dynamics. These segmentations are crucial for understanding market trends, identifying lucrative opportunities, and formulating targeted business strategies. The primary segmentation categories include the type of KERS system, the vehicle type it is integrated into, the end-use application, and the sales channel through which products reach consumers. Each segment exhibits distinct growth patterns and competitive landscapes, reflecting the diverse requirements and technological preferences across the automotive industry.

- By System Type

- Electrical KERS: Utilizes motor-generator units, supercapacitors, and batteries to store and release energy. Dominant due to compatibility with hybrid and electric powertrains.

- Mechanical/Flywheel KERS: Employs a high-speed flywheel to store kinetic energy as rotational energy. Niche application in performance and racing vehicles.

- Hydraulic KERS: Uses hydraulic pumps and accumulators to store energy by compressing fluid. Emerging in heavy-duty commercial vehicles.

- By Vehicle Type

- Passenger Cars: Subdivided into Hatchbacks, Sedans, SUVs, Luxury Vehicles, and Sports Cars. Represents the largest market share.

- Commercial Vehicles: Includes Buses, Trucks (Light-duty, Medium-duty, Heavy-duty), and Vans. Growing segment driven by efficiency and emissions targets.

- By End-Use

- OEM (Original Equipment Manufacturer): Systems integrated during vehicle manufacturing. Primary market segment.

- Aftermarket: KERS kits or components sold for post-production installation or upgrades. Smaller but growing segment.

- By Sales Channel

- Direct Sales: Manufacturers selling directly to automotive OEMs.

- Indirect Sales: Sales through distributors, retailers, and specialized aftermarket channels.

Value Chain Analysis For Automotive Kinetic Energy Recovery System Market

The value chain for the Automotive Kinetic Energy Recovery System market begins with the upstream suppliers of raw materials and specialized components. This stage involves the sourcing of critical materials such as high-strength steel and aluminum alloys for structural components, advanced composite materials for flywheels, rare earth elements for permanent magnets in electrical motors, and specialized chemicals for battery electrolytes and supercapacitor dielectrics. Manufacturers of specific KERS components, including electric motors, generators, power electronics (inverters, converters), energy storage units (batteries, supercapacitors, hydraulic accumulators), and high-precision mechanical gears, form a vital part of this upstream segment. The quality and availability of these materials and components directly impact the performance, cost, and reliability of the final KERS product.

Moving downstream, the value chain progresses to the KERS system integrators and module assemblers. These entities procure the various components and integrate them into complete, functional KERS units. This stage often involves sophisticated engineering and testing to ensure compatibility, efficiency, and safety. A significant portion of these integrated systems are then supplied directly to Original Equipment Manufacturers (OEMs) within the automotive industry. OEMs typically incorporate KERS into their vehicle design during the manufacturing process, optimizing its integration with the powertrain, braking system, and vehicle control unit. This direct sales model to OEMs is the predominant distribution channel, driven by the complex nature of KERS integration and the stringent quality and performance requirements of vehicle manufacturers.

Beyond the OEM integration, the value chain also includes the aftermarket segment and various distribution channels. While direct sales to OEMs constitute the primary route for initial adoption, indirect channels play a role in the aftermarket. This involves specialized distributors, automotive parts retailers, and performance tuning shops that offer KERS retrofit kits or replacement components. These indirect channels cater to vehicle owners seeking to upgrade their vehicles' efficiency or performance after purchase. The service and maintenance segment, which ensures the long-term functionality and repair of KERS units, also forms an important part of the downstream value chain. This comprehensive value chain highlights the interdependence of various stakeholders, from raw material providers to end-users, in the successful development and deployment of Automotive KERS.

Automotive Kinetic Energy Recovery System Market Potential Customers

The primary potential customers for the Automotive Kinetic Energy Recovery System market are diverse, encompassing various segments within the automotive industry. At the forefront are major Automotive Original Equipment Manufacturers (OEMs) across the globe. These manufacturers, including producers of passenger cars (from mass-market to luxury and high-performance brands) and commercial vehicles (buses, trucks, vans), are increasingly integrating KERS into their new vehicle designs to meet stringent emission standards, improve fuel economy, and enhance vehicle performance. OEMs represent the largest customer base due to the complex integration requirements of KERS and the scale of vehicle production.

Beyond the initial manufacturing stage, fleet operators for commercial vehicles constitute another significant customer segment. Companies managing large fleets of buses, delivery trucks, or logistics vehicles are actively seeking solutions to reduce their operational costs, primarily fuel expenses, and comply with environmental regulations. KERS offers a tangible benefit in urban and stop-and-go driving conditions, making it an attractive investment for these operators to achieve greater efficiency and sustainability across their fleets. This customer group often evaluates KERS based on return on investment (ROI) through fuel savings and reduced maintenance.

Furthermore, the market includes niche customers such as motorsports teams and performance vehicle enthusiasts. In competitive racing, KERS provides a crucial performance advantage through instant power boosts, making it an indispensable technology. High-performance vehicle owners or customizers also look to KERS for enhancing their vehicles' acceleration and overall dynamic capabilities. While smaller in volume compared to OEMs, this segment drives innovation and often serves as a proving ground for new KERS technologies. Finally, government agencies involved in public transportation may also emerge as customers, investing in KERS-equipped buses or municipal vehicles to advance their green initiatives and reduce public fleet emissions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2032 | USD 3.4 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, ZF Friedrichshafen, Continental AG, Denso Corporation, Ricardo plc, GKN Automotive, Magna International, Valeo, Caparo Advanced Composites, Torotrak plc, Flybrid Automotive, Skeleton Technologies, Maxwell Technologies (now part of Tesla), Siemens, BorgWarner Inc., Schaeffler AG, Toyota Boshoku Corporation, Hitachi Astemo, LG Chem, Hyundai Mobis |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Kinetic Energy Recovery System Market Key Technology Landscape

The Automotive Kinetic Energy Recovery System market is underpinned by a sophisticated array of technologies, continuously evolving to enhance efficiency, reduce costs, and improve system integration. At the core of electrical KERS systems are advanced motor-generator units (MGUs) that efficiently convert kinetic energy into electrical energy during deceleration and vice versa for propulsion. These MGUs rely on cutting-edge permanent magnet technologies and power electronics, including high-frequency inverters and converters, to manage power flow with minimal losses. The energy storage component is crucial, with lithium-ion batteries and high-power density supercapacitors being key technologies, offering rapid charge and discharge capabilities necessary for effective kinetic energy recovery and deployment. Battery Management Systems (BMS) are integral for optimizing battery performance, safety, and longevity within KERS applications.

Mechanical KERS systems, though less prevalent, leverage high-speed flywheels made from advanced lightweight and high-strength materials such as carbon fiber composites. These flywheels operate in vacuum enclosures to minimize aerodynamic drag and are coupled with sophisticated gearboxes or continuously variable transmissions (CVTs) to transfer energy efficiently to and from the drivetrain. Hydraulic KERS systems utilize high-pressure hydraulic pumps and accumulators, which store energy by compressing hydraulic fluid. This technology demands robust pump designs, highly efficient accumulators, and advanced fluid management systems capable of handling extreme pressures and rapid cycling.

Across all KERS types, sophisticated control algorithms and software play a pivotal role. These control units are responsible for intelligently deciding when and how much kinetic energy to recover, store, and release, based on real-time vehicle dynamics, driver input, road conditions, and GPS data. Predictive analytics, increasingly incorporating AI and machine learning, are becoming vital for optimizing KERS performance by anticipating driving scenarios. Furthermore, the overall trend towards lightweighting in automotive manufacturing impacts KERS, driving the adoption of advanced materials for enclosures and structural components to minimize the system's impact on vehicle mass, thereby maximizing the net efficiency gains. The synergy of these technologies continues to push the boundaries of energy recovery and utilization in modern vehicles.

Regional Highlights

- Europe: This region is a leading market for Automotive KERS, driven by stringent emission regulations such as Euro 7 standards and a strong consumer preference for fuel-efficient and high-performance vehicles. Countries like Germany, the UK, and France are at the forefront of KERS adoption, particularly in the luxury and premium automotive segments and motorsports. The presence of major automotive OEMs and a robust R&D ecosystem further accelerate market growth.

- Asia Pacific (APAC): APAC is experiencing rapid growth in the KERS market, primarily fueled by the accelerating adoption of electric and hybrid vehicles, particularly in China, Japan, South Korea, and India. Government initiatives promoting sustainable transportation, increasing disposable incomes, and a large consumer base contribute to market expansion. China, with its massive EV market, is a significant driver, while Japan and South Korea lead in advanced automotive technology integration.

- North America: The KERS market in North America is steadily expanding, influenced by rising fuel efficiency standards and a growing interest in electric and hybrid vehicles, especially in the US and Canada. The region exhibits strong demand for performance-oriented vehicles where KERS can offer a competitive edge. Increased investment in commercial vehicle electrification also contributes to market growth.

- Latin America: This region represents an emerging market for KERS. While adoption is currently lower compared to developed regions, increasing environmental awareness, evolving emission regulations, and a gradual shift towards hybrid and electric vehicles are creating opportunities. Brazil and Mexico are key countries with potential for future growth as their automotive industries mature.

- Middle East and Africa (MEA): The MEA region is at an nascent stage for KERS adoption. Growth is anticipated with increasing government focus on diversifying economies away from fossil fuels, investments in smart cities, and the gradual introduction of greener transportation policies. The UAE and Saudi Arabia are showing early signs of interest in advanced automotive technologies as part of their sustainability visions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Kinetic Energy Recovery System Market.- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- Denso Corporation

- Ricardo plc

- GKN Automotive (now part of Melrose Industries)

- Magna International Inc.

- Valeo S.A.

- Caparo Advanced Composites

- Torotrak plc (now part of Allison Transmission)

- Flybrid Automotive (now part of GKN Automotive)

- Skeleton Technologies

- Maxwell Technologies (now part of Tesla, Inc.)

- Siemens AG

- BorgWarner Inc.

- Schaeffler AG

- Toyota Boshoku Corporation

- Hitachi Astemo, Ltd.

- LG Chem (for battery components)

- Hyundai Mobis Co., Ltd.

Frequently Asked Questions

What is a Kinetic Energy Recovery System (KERS) in automotive applications?

A Kinetic Energy Recovery System (KERS) is an automotive technology designed to capture kinetic energy generated during vehicle braking or deceleration, store it, and then reuse it to provide additional power for propulsion. This process significantly improves fuel efficiency, reduces emissions, and can enhance vehicle performance, particularly in hybrid and electric vehicles.

How does KERS contribute to vehicle fuel efficiency and emissions reduction?

KERS improves fuel efficiency by preventing kinetic energy from being wasted as heat during braking. Instead, this energy is captured and reused to supplement engine power or assist electric motors. This reduces the workload on the internal combustion engine or extends the range of electric vehicles, leading to lower fuel consumption and a corresponding decrease in harmful exhaust emissions.

What are the main types of KERS available in the market?

The primary types of KERS include Electrical KERS, which uses a motor-generator unit to convert kinetic energy into electrical energy stored in batteries or supercapacitors; Mechanical KERS, utilizing a high-speed flywheel to store energy as rotational force; and Hydraulic KERS, which stores energy by compressing fluid in an accumulator using a pump. Each type offers distinct advantages for specific vehicle applications.

Which vehicle types are currently adopting KERS technology?

KERS technology is predominantly adopted in hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) to optimize their powertrains. It is also increasingly found in battery electric vehicles (BEVs) for regenerative braking and energy optimization. Additionally, high-performance sports cars and racing vehicles, particularly in Formula 1, have historically utilized KERS for performance enhancement.

What are the major drivers for the growth of the Automotive KERS market?

Key drivers include stringent global emission regulations mandating lower carbon footprints for vehicles, rising fuel prices that increase the appeal of fuel-efficient technologies, and the rapid growth of the electric and hybrid vehicle markets. Consumer demand for greener, more sustainable, and performance-enhanced vehicles also significantly contributes to market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager