Automotive Logistics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428330 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Automotive Logistics Market Size

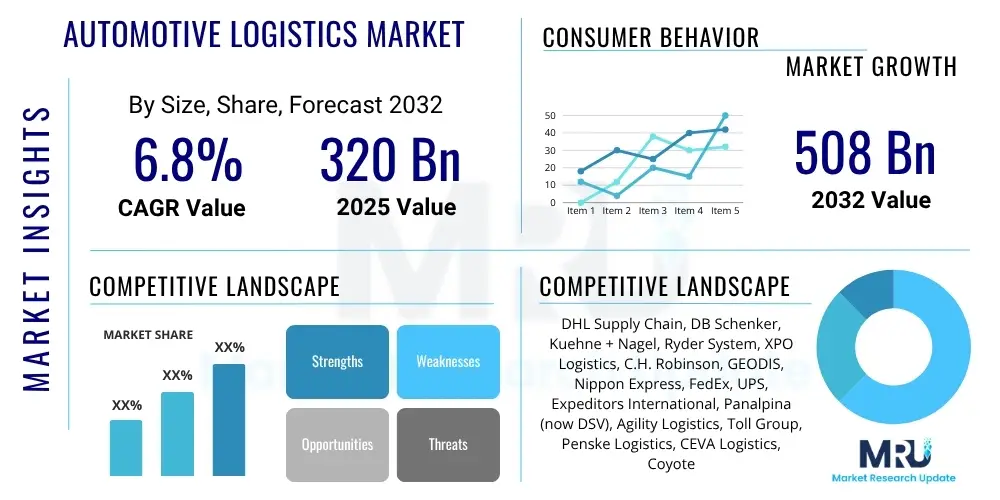

The Automotive Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at 320 Billion USD in 2025 and is projected to reach 508 Billion USD by the end of the forecast period in 2032.

Automotive Logistics Market introduction

The automotive logistics market encompasses the entire supply chain management process for the automotive industry, from sourcing raw materials and components to delivering finished vehicles to dealerships and handling aftermarket parts. This intricate network involves a multitude of specialized services designed to ensure the efficient, timely, and cost-effective movement of goods across various stages of vehicle manufacturing and distribution. Key activities include inbound logistics, managing the flow of parts to assembly plants; outbound logistics, concerning the distribution of completed vehicles; and aftermarket logistics, supporting the supply of spare parts and accessories to service centers and end-users.

Product descriptions within automotive logistics range from specialized transportation solutions for delicate components and vehicles, to advanced warehousing and inventory management systems that optimize storage and retrieval. Benefits derived from robust automotive logistics include significant reductions in operational costs, enhanced supply chain visibility, minimized lead times, and improved overall operational efficiency. These benefits are critical for automotive manufacturers striving to maintain competitive pricing and meet global demand. Major applications span original equipment manufacturers (OEMs), their extensive network of tier suppliers, and the expansive aftermarket sector, which increasingly relies on efficient logistics for parts distribution and warranty services.

The market's growth is predominantly driven by several critical factors. These include the increasing global production and sales of vehicles, particularly in emerging economies, which necessitate complex cross-border logistics operations. The rising adoption of electric vehicles (EVs) and autonomous vehicle technologies also introduces new logistical challenges and opportunities, requiring specialized handling and infrastructure. Furthermore, the imperative for automotive companies to achieve greater supply chain resilience and flexibility, especially in response to geopolitical shifts and technological advancements, continues to propel innovation and investment within the automotive logistics sector. The shift towards just-in-time (JIT) and just-in-sequence (JIS) manufacturing further intensifies the demand for highly synchronized and efficient logistics services.

Automotive Logistics Market Executive Summary

The automotive logistics market is undergoing significant transformation, characterized by dynamic business trends, evolving regional demands, and sophisticated segment-specific developments. Key business trends indicate a strong push towards digitalization, sustainability, and automation to enhance operational efficiencies and reduce environmental impact. Companies are investing heavily in advanced analytics, artificial intelligence, and IoT technologies to optimize route planning, warehouse management, and inventory forecasting, thereby addressing the complexities of global supply chains. There is also a growing emphasis on collaborative logistics and partnership models to leverage shared resources and expertise, improving service quality and market reach.

Regional trends reveal diverse growth trajectories and strategic priorities. Asia-Pacific continues to be a dominant force, fueled by burgeoning vehicle production and a rapidly expanding consumer base, particularly in China and India. This region demands robust infrastructure development and efficient cross-border logistics solutions. North America and Europe, while mature markets, are leading the charge in adopting sustainable logistics practices, electric vehicle logistics, and advanced digital solutions. Latin America and the Middle East & Africa are emerging as significant markets, driven by increasing disposable incomes and investments in manufacturing capabilities, though they still face challenges related to infrastructure and regulatory frameworks.

Segmentation trends highlight distinct growth patterns across various service types and modes of transport. Inbound logistics, crucial for managing the flow of components to assembly lines, remains a foundational segment, increasingly leveraging real-time tracking and predictive analytics. Outbound logistics is adapting to diverse vehicle types and distribution channels, with specialized transport for EVs gaining traction. Aftermarket logistics is experiencing significant growth, driven by the expanding global vehicle parc and the increasing complexity of spare parts distribution, often facilitated by e-commerce platforms. The shift towards multimodal transportation, integrating road, rail, sea, and air, is also a prominent trend aimed at optimizing cost and speed while minimizing environmental footprint.

AI Impact Analysis on Automotive Logistics Market

The integration of Artificial Intelligence (AI) within the automotive logistics market is a pivotal development, addressing common concerns among stakeholders regarding efficiency, cost, and operational visibility. Users frequently inquire about how AI can optimize complex supply chains, reduce human error, and provide predictive capabilities to mitigate disruptions. The primary expectations revolve around AI's ability to automate mundane tasks, enhance decision-making through data-driven insights, and create more resilient and adaptive logistics networks. There is a strong focus on AI's potential to transform inventory management, route optimization, and demand forecasting, ultimately leading to significant cost savings and improved service levels for both manufacturers and end-consumers. Furthermore, discussions often touch upon the ethical considerations and potential job displacement associated with increasing automation, prompting a need for transparent strategies for workforce reskilling and upskilling.

- Predictive Analytics: AI algorithms analyze vast datasets (e.g., historical sales, weather patterns, traffic data) to forecast demand, predict potential delays, and proactively adjust logistics plans, minimizing disruptions and optimizing inventory levels.

- Route Optimization: AI-powered systems dynamically calculate the most efficient routes for transportation, considering real-time traffic, weather conditions, delivery schedules, and vehicle capacity, leading to fuel savings and faster delivery times.

- Autonomous Logistics: Integration of AI in autonomous vehicles (AGVs, self-driving trucks) and robotics for warehouse operations automates material handling, sorting, and last-mile delivery, increasing speed and reducing labor costs.

- Inventory Management: AI optimizes stock levels across the supply chain, preventing overstocking or stockouts, and automating reordering processes based on predicted consumption patterns, thereby reducing carrying costs and waste.

- Warehouse Automation: AI-driven robotics and automated storage and retrieval systems (AS/RS) enhance warehouse efficiency, precision, and safety, facilitating faster order fulfillment and better space utilization.

- Quality Control & Inspection: AI-powered computer vision systems can inspect vehicles and components for defects more rapidly and accurately than manual processes, ensuring high-quality standards throughout the logistics chain.

- Enhanced Supply Chain Visibility: AI platforms aggregate data from various sources (IoT sensors, ERP systems) to provide real-time tracking and comprehensive visibility of goods, enabling proactive problem-solving and improved decision-making.

- Customer Experience Improvement: AI chatbots and intelligent virtual assistants provide instant support, tracking updates, and personalized recommendations, enhancing the overall customer experience for aftermarket services.

- Sustainability Optimization: AI can identify opportunities to reduce carbon footprint by optimizing routes, reducing empty mileage, and managing energy consumption in warehouses, contributing to greener logistics operations.

DRO & Impact Forces Of Automotive Logistics Market

The Automotive Logistics Market is shaped by a confluence of powerful drivers, challenging restraints, and promising opportunities, all influenced by various impact forces. A primary driver is the continuous growth in global vehicle production and sales, particularly in emerging economies, which necessitates sophisticated and extensive logistics networks. The increasing complexity of automotive supply chains, driven by modular manufacturing and global sourcing, also fuels demand for specialized logistics services. Furthermore, the persistent need for cost efficiency and optimized operational performance within the highly competitive automotive sector compels manufacturers to outsource logistics to expert third-party providers, leveraging their technological advancements and economies of scale. Technological integration, including IoT, AI, and big data analytics, acts as another significant driver, enabling greater visibility, predictive capabilities, and automation.

However, the market faces several significant restraints. Geopolitical tensions and trade protectionism, exemplified by tariffs and sanctions, can disrupt established supply chains, increase costs, and create uncertainty. Infrastructure limitations, particularly in developing regions, impede efficient movement of goods and add to logistical challenges. The high initial capital investment required for adopting advanced logistics technologies and automation can be a barrier for smaller players. Additionally, labor shortages, especially for skilled workers in trucking and warehousing, pose operational challenges, while stringent environmental regulations and varying international customs procedures add layers of complexity and compliance costs to cross-border operations.

Despite these restraints, numerous opportunities are poised to propel market expansion. The rapid global shift towards Electric Vehicles (EVs) and autonomous vehicles presents a novel landscape for specialized logistics, including battery transport and charging infrastructure integration. The burgeoning e-commerce sector for automotive parts and accessories is creating new avenues for last-mile delivery and reverse logistics. Furthermore, the growing emphasis on sustainable logistics solutions, such as green warehousing and alternative fuel vehicles, offers a competitive advantage and aligns with corporate social responsibility goals. Digital transformation initiatives across the automotive industry, fostering greater integration and data sharing, will continue to unlock efficiencies and create demand for innovative logistics services. Emerging markets, with their expanding middle classes and increasing vehicle ownership, represent untapped potential for logistics service providers.

Segmentation Analysis

The automotive logistics market is a multifaceted industry, segmented across various dimensions to cater to the distinct needs of its diverse stakeholders. These segmentations allow for a granular understanding of market dynamics, enabling logistics providers to tailor their services and automotive manufacturers to optimize their supply chain strategies. Each segment, whether defined by service type, mode of transport, vehicle type, activity, or application, represents unique operational requirements, technological demands, and growth opportunities within the broader automotive ecosystem.

- Service Type: This segment categorizes logistics offerings based on the specific services provided.

- Transportation

- Warehousing

- Inventory Management

- Packaging

- Cross-docking

- Customs Brokerage

- Value-Added Services (e.g., sequencing, kitting, light assembly)

- Mode of Transport: This segmentation differentiates services by the primary method of conveyance used for goods.

- Roadways (Trucking, car carriers)

- Railways (Freight trains)

- Seaways (Ocean freight, container shipping)

- Airways (Air cargo)

- Vehicle Type: This categorizes logistics services based on the type of vehicle being transported or supported.

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Trucks, Buses, Vans)

- Activity: This segment focuses on the specific stage of the supply chain process where logistics services are applied.

- Inbound Logistics (Component delivery to manufacturing plants)

- Outbound Logistics (Finished vehicle delivery from plants to dealerships)

- Aftermarket Logistics (Spare parts distribution)

- Application: This segmentation defines the end-use context or industry sector benefiting from the logistics services.

- Manufacturing (OEMs and Tier Suppliers)

- Aftermarket (Retailers, Service Centers)

- E-commerce Logistics (Online sales of parts and accessories)

Value Chain Analysis For Automotive Logistics Market

The value chain of the automotive logistics market is intricate, involving multiple stages and numerous stakeholders, each adding value to the final product's journey from raw material to end-user. At the upstream end, the process begins with the sourcing and transportation of raw materials such as steel, aluminum, plastics, and rubber, alongside countless electronic components, from their origins to Tier 2 and Tier 3 suppliers. These suppliers transform raw materials into sub-components, which are then shipped to Tier 1 suppliers who assemble them into larger modules like engines, transmissions, and interior systems. Efficient inbound logistics, often managed by 3PLs, are critical at this stage to ensure timely delivery, maintain lean manufacturing principles (like just-in-time or just-in-sequence), and manage complex international customs and freight operations.

Moving downstream, these modules and components are transported to original equipment manufacturers (OEMs) for final vehicle assembly. This phase demands highly synchronized logistics, often involving cross-docking and specialized handling to prevent damage and ensure assembly line continuity. Once vehicles are manufactured, outbound logistics takes over, moving finished cars from assembly plants to distribution hubs, dealerships, and sometimes directly to end-consumers. This typically involves specialized car carriers (road), rail transport, or ocean freight for international shipments. The downstream segment also encompasses aftermarket logistics, which manages the distribution of spare parts, accessories, and warranty items to a global network of dealerships, independent repair shops, and online retailers, a segment that is increasingly complex due to a wider range of vehicle models and longer product lifespans.

Distribution channels within automotive logistics are varied, encompassing both direct and indirect approaches. Direct distribution primarily involves OEMs transporting finished vehicles directly to their franchised dealerships or large fleet buyers. Indirect distribution, which is more prevalent, heavily relies on third-party logistics (3PL) providers and fourth-party logistics (4PL) providers. These logistics partners manage a broad spectrum of services, including freight forwarding, warehousing, customs brokerage, and value-added services such as kitting, sequencing, and even light assembly. The choice of channel depends on factors like geographical reach, cost efficiency, speed of delivery, and the specific requirements for different vehicle types or parts. The increasing role of e-commerce also creates new indirect channels for aftermarket parts, necessitating robust parcel and last-mile delivery networks.

Automotive Logistics Market Potential Customers

The potential customers for automotive logistics services are diverse, spanning the entire automotive value chain, from component manufacturing to vehicle sales and post-sales support. Original Equipment Manufacturers (OEMs) are primary consumers, requiring extensive logistics support for both inbound raw materials and components, and outbound finished vehicles. They seek partners capable of managing complex global supply chains, ensuring just-in-time (JIT) delivery, and providing real-time visibility and cost efficiencies. OEMs also often demand specialized handling for sensitive components, batteries for electric vehicles, and high-value finished cars, making reliability and expertise paramount.

Beyond OEMs, the vast network of Tier 1, Tier 2, and Tier 3 suppliers constitutes another significant customer base. These suppliers are responsible for manufacturing various components and modules, ranging from engine parts and electronic systems to interior trim and tires. They rely on logistics providers for efficient transportation of raw materials to their facilities and for the timely delivery of their manufactured components to assembly plants or other suppliers further up the chain. Their demand often centers on precise scheduling, inventory optimization, and robust warehousing solutions to support continuous production flows and avoid costly disruptions.

Further downstream, automotive dealerships represent a critical segment of potential customers, requiring efficient inbound logistics for new vehicle deliveries and robust aftermarket logistics for spare parts. Fleet operators, car rental companies, and public transport agencies also engage logistics providers for vehicle acquisition, maintenance parts supply, and sometimes even vehicle disposal. The growing e-commerce sector for automotive parts and accessories has also opened up new customer segments, including online retailers and individual consumers who depend on efficient last-mile delivery services for their automotive needs. Additionally, independent repair shops and service centers are consistent buyers of aftermarket logistics services for regular inventory replenishment and urgent part orders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | 320 Billion USD |

| Market Forecast in 2032 | 508 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DHL Supply Chain, DB Schenker, Kuehne + Nagel, Ryder System, XPO Logistics, C.H. Robinson, GEODIS, Nippon Express, FedEx, UPS, Expeditors International, Panalpina (now DSV), Agility Logistics, Toll Group, Penske Logistics, CEVA Logistics, Coyote Logistics, J.B. Hunt Transport Services, Inc., Rhenus Logistics, DSV |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Logistics Market Key Technology Landscape

The automotive logistics market is rapidly integrating advanced technologies to enhance efficiency, visibility, and responsiveness across its complex supply chains. The cornerstone of this technological evolution includes the Internet of Things (IoT), which enables real-time tracking of vehicles, assets, and inventory through sensors and connected devices. This provides invaluable data on location, condition, and environmental factors, allowing for proactive management and immediate response to deviations. Coupled with this, Big Data Analytics and Artificial Intelligence (AI) and Machine Learning (ML) are paramount for processing the massive influx of data. These analytical tools derive actionable insights, enabling predictive maintenance, demand forecasting, optimal route planning, and identifying bottlenecks before they impact operations, thereby moving from reactive to proactive logistics management.

Automation technologies are also transforming physical operations within automotive logistics. Robotics and Automated Guided Vehicles (AGVs) are increasingly utilized in warehouses and distribution centers for tasks like picking, packing, and material handling, significantly improving speed, accuracy, and worker safety while reducing labor costs. Beyond the warehouse, autonomous vehicles are on the horizon for long-haul transportation and last-mile delivery, promising further efficiencies and cost reductions. Blockchain technology is emerging as a critical tool for enhancing supply chain transparency and security, creating immutable records of transactions and movements, which can mitigate fraud, improve traceability, and streamline customs processes, particularly in international logistics where multiple parties are involved.

Furthermore, robust digital platforms are essential for orchestrating these disparate technologies. Cloud-based platforms provide scalable infrastructure for data storage and processing, enabling seamless collaboration among various stakeholders across the supply chain. Telematics and GPS systems offer real-time location tracking, driver behavior monitoring, and fleet management capabilities, optimizing vehicle utilization and fuel efficiency. Advanced Warehouse Management Systems (WMS) and Transportation Management Systems (TMS) serve as the operational backbone, integrating planning, execution, and optimization of all warehousing and transport activities. These systems, often enhanced with AI capabilities, ensure synchronized operations, optimize resource allocation, and provide a unified view of the entire logistics network, moving towards a truly smart and interconnected automotive logistics ecosystem.

Regional Highlights

- North America: This region is characterized by a mature automotive industry and a strong focus on technological adoption and sustainability. The United States and Canada are pivotal, driven by significant vehicle production, a robust aftermarket, and the accelerating transition towards electric vehicles. Logistics providers in North America emphasize intermodal solutions, advanced telematics, and automation in warehouses to address labor shortages and environmental regulations. Cross-border logistics with Mexico also remains a critical component, fueled by integrated supply chains.

- Europe: A leader in automotive innovation, Europe benefits from advanced infrastructure and a strong emphasis on regulatory compliance and sustainable practices. Germany, the UK, France, and Italy are key markets, focusing on efficient inbound and outbound logistics for both traditional and electric vehicle manufacturing. The region is actively investing in green logistics, digital platforms, and collaborative networks to optimize freight movement across diverse national regulations and intricate supply chains.

- Asia Pacific (APAC): The fastest-growing region, APAC is propelled by robust vehicle production and sales in China, India, Japan, and South Korea. This region presents immense opportunities due to a burgeoning middle class, increasing urbanization, and significant investments in manufacturing capabilities. Logistics demands here are driven by large volumes, complex cross-border trade, and the rapid expansion of e-commerce for automotive parts, necessitating scalable and flexible logistics solutions, often with a focus on multimodal transport.

- Latin America: Countries like Brazil and Mexico are the primary drivers in this region, fueled by increasing domestic demand and their roles as manufacturing hubs for global exports. While facing infrastructure challenges, the market is growing due to rising vehicle ownership and expanding industrial bases. Logistics operations in Latin America often involve navigating complex customs procedures and adapting to varied geographical terrains, with a growing emphasis on efficient and secure transportation networks.

- Middle East and Africa (MEA): This region is an emerging market with growing investments in infrastructure and manufacturing, particularly in countries like UAE, Saudi Arabia, and South Africa. The demand for automotive logistics is driven by increasing disposable incomes, urbanization, and a developing vehicle parc. Logistics providers in MEA focus on developing robust supply chain networks, often leveraging strategic geographical locations for re-export and catering to a growing consumer base for both new vehicles and aftermarket services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Logistics Market.- DHL Supply Chain

- DB Schenker

- Kuehne + Nagel

- Ryder System

- XPO Logistics

- C.H. Robinson

- GEODIS

- Nippon Express

- FedEx

- UPS

- Expeditors International

- DSV (Panalpina)

- Agility Logistics

- Toll Group

- Penske Logistics

- CEVA Logistics

- Coyote Logistics

- J.B. Hunt Transport Services, Inc.

- Rhenus Logistics

- Wallenius Wilhelmsen

Frequently Asked Questions

What is the current estimated market size of the Automotive Logistics Market?

The Automotive Logistics Market is estimated at 320 Billion USD in 2025, demonstrating substantial economic activity within the global automotive supply chain.

What are the key drivers for the growth of the Automotive Logistics Market?

Key drivers include increasing global vehicle production, the growing complexity of automotive supply chains, the imperative for cost efficiency, and continuous technological advancements in logistics.

How is AI impacting the Automotive Logistics Market?

AI significantly impacts the market through predictive analytics for demand and delays, optimized route planning, automation of warehouse operations, and enhanced supply chain visibility, driving efficiency and cost savings.

Which regions are prominent in the Automotive Logistics Market?

North America and Europe are mature markets leading in innovation, while Asia Pacific, especially China and India, is the fastest-growing region due to high production volumes and expanding consumer bases.

What challenges does the Automotive Logistics Market face?

Challenges include geopolitical tensions, infrastructure limitations, high initial investment for new technologies, labor shortages, and stringent regulatory compliance requirements, all of which can disrupt supply chain efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager