Automotive NVH Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430080 | Date : Nov, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Automotive NVH Materials Market Size

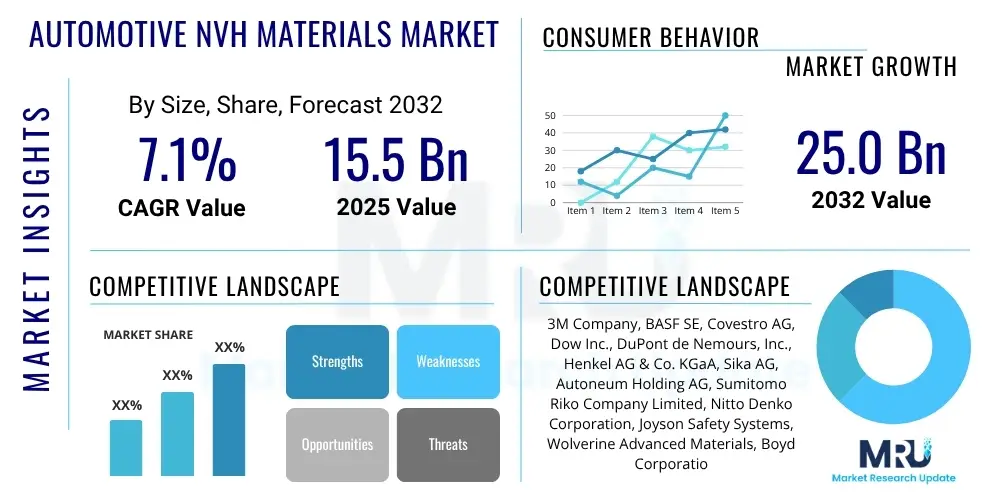

The Automotive NVH Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2025 and 2032. The market is estimated at USD 15.5 Billion in 2025 and is projected to reach USD 25.0 Billion by the end of the forecast period in 2032.

Automotive NVH Materials Market introduction

The Automotive NVH (Noise, Vibration, and Harshness) Materials Market stands as an indispensable segment within the global automotive industry, playing a critical role in defining vehicle quality, occupant comfort, and overall driving refinement. These specialized materials are meticulously engineered to counteract and minimize undesirable acoustic and vibrational phenomena emanating from various vehicular sources, including the engine and powertrain, the intricate interactions between tires and road surfaces, aerodynamic forces generated during movement, and structural resonances inherent in the vehicle chassis. By effectively isolating or mitigating these disturbances, NVH materials profoundly contribute to a serene and comfortable cabin environment, directly influencing consumer perception of luxury, reliability, and brand prestige. The continuous evolution of automotive technology, particularly the accelerated global transition towards electric vehicles (EVs), is placing unprecedented demands on NVH solutions, necessitating ongoing innovation and the rapid development of more sophisticated materials to address novel acoustic challenges.

The product landscape within this dynamic market is exceptionally diverse, offering a comprehensive suite of material solutions, each precisely formulated to achieve specific NVH mitigation objectives. This extensive portfolio includes, but is not limited to, highly effective viscoelastic damping materials such as butyl rubber sheets, asphaltic pads, and specialized polymer compounds, all designed to efficiently convert structural vibrational energy into imperceptible heat. Complementary to these are a wide array of sound absorption materials like open-cell polyurethane foams, lightweight melamine foams, and various fibrous felts and textiles, which are adept at trapping and dissipating airborne sound waves, thereby reducing cabin reverberation. Furthermore, robust sound insulation barriers, often comprising heavy layer compounds and multi-layer laminates, are deployed to effectively block noise transmission. Advanced composite structures, offering both damping and structural reinforcement, are increasingly being adopted to tackle complex NVH issues, frequently incorporating thermal management properties to enhance overall vehicle efficiency and comfort. The selection of these materials is a meticulous process, contingent upon factors such as the frequency and intensity of the noise/vibration, stringent weight reduction targets, cost-efficiency parameters, and overarching environmental sustainability goals.

The application of Automotive NVH materials is ubiquitous, extending across virtually every component and vehicle type within the industry. In the context of passenger cars, these materials are extensively integrated into floor pans, door panels, roof liners, trunk compartments, engine bay firewalls, wheel arch liners, and interior trim elements to cultivate an exceptionally quiet and refined cabin experience. For commercial vehicles, NVH solutions are paramount for reducing driver fatigue during long-haul operations, enhancing cabin ergonomics, and ensuring compliance with stringent operational noise limits, thereby improving productivity and safety. The rapidly expanding electric vehicle (EV) segment, comprising Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs), presents a particularly critical growth area. The inherent quietness of electric powertrains magnifies other noise sources, such as tire noise and aerodynamic whistle, leading to an intensified demand for bespoke, lightweight, and highly effective NVH materials specifically optimized for EV architectures. The cumulative benefits derived from these advanced materials are extensive, encompassing significant enhancements in acoustic comfort, substantial reductions in driver and passenger fatigue, a bolstered perception of vehicle quality, and assured adherence to increasingly stringent global noise and safety regulations, all of which serve as powerful driving forces sustaining robust market expansion.

Automotive NVH Materials Market Executive Summary

The Automotive NVH Materials Market is currently undergoing a transformative period marked by vigorous expansion and profound strategic shifts, underpinned by dynamic global business trends, evolving regional automotive landscapes, and distinct segment-specific developments. From a business perspective, a pivotal trend is the industry's unwavering commitment to lightweighting solutions. This drive is fueled by escalating regulatory mandates for improved fuel efficiency in internal combustion engine (ICE) vehicles and the critical imperative to extend the range of electric vehicles (EVs), where every kilogram reduction directly translates to enhanced energy economy. Consequently, this has spurred intense research and development into novel, low-density NVH materials and multi-functional solutions that simultaneously deliver superior acoustic performance and significant mass reduction. Furthermore, the market is witnessing a notable trend towards consolidation among key players and an increase in strategic collaborations between material suppliers, Tier 1 component manufacturers, and automotive OEMs. These partnerships facilitate integrated design processes, accelerate the commercialization of innovative NVH technologies, optimize intricate value chains, and sharpen competitive positioning. The growing imperative for sustainable manufacturing practices and adherence to circular economy principles is also profoundly influencing material selection, favoring the adoption of recyclable, bio-based, and responsibly sourced NVH components across the industry, reshaping procurement strategies and product lifecycle management.

Regionally, the Automotive NVH Materials Market exhibits diverse growth trajectories and strategic priorities tailored to local economic and regulatory environments. Asia Pacific unequivocally maintains its position as the largest and most dynamic market, primarily propelled by the region's colossal automotive manufacturing output, particularly in rapidly industrializing nations such as China, India, Japan, and South Korea. The escalating demand for personal vehicles, coupled with a burgeoning middle class demonstrating a strong preference for enhanced comfort and premium features, serves as a significant impetus for NVH material consumption. Europe and North America represent highly mature yet intensely innovative markets, characterized by their stringent environmental and noise regulations, a strong consumer preference for luxury and high-performance vehicles, and pioneering adoption rates of electric vehicle technologies. These regions are at the forefront of advanced material development, sustainable NVH solutions, and the integration of smart technologies, thereby influencing global industry benchmarks and driving technological advancements. Emerging markets in Latin America, the Middle East, and Africa also present growing opportunities, driven by increasing automotive production capacities, infrastructure development, and gradually evolving consumer expectations, although often with a stronger emphasis on cost-effective and readily available NVH solutions adapted to regional specificities.

Segment-specific trends further elucidate the market's evolving dynamics, highlighting several key areas of growth and technological concentration. The demand for acoustic absorption materials is experiencing a substantial surge, particularly critical within the rapidly expanding electric vehicle segment. In EVs, the absence of engine noise renders other sounds, such as tire noise, wind noise, and road vibrations, significantly more perceptible, thus underscoring the indispensable role of highly efficient absorption materials in creating a quiet cabin. Vibration damping materials, conversely, retain their universal importance across all vehicle types, remaining essential for mitigating structural resonance and ensuring superior ride smoothness and structural integrity. There is a discernible and accelerating shift towards specialized NVH solutions specifically engineered for electric vehicles, which often necessitate distinct material properties and application methodologies compared to those for ICE vehicles, due to fundamental differences in noise sources, vibrational characteristics, and thermal profiles. The Original Equipment Manufacturer (OEM) segment continues to represent the largest consumer of NVH materials, driven by continuous new vehicle production cycles, while the aftermarket segment exhibits steady growth, fueled by demand for replacement, upgrade, and customization solutions for existing vehicles. The overarching imperative across all segments is the relentless pursuit of superior NVH performance, achieved through groundbreaking material innovation, sophisticated application techniques, and integrated system design, ultimately impacting vehicle aesthetics, functionality, and crucial market appeal.

AI Impact Analysis on Automotive NVH Materials Market

The burgeoning integration of Artificial Intelligence (AI) and machine learning (ML) is poised to fundamentally revolutionize the Automotive NVH Materials Market, directly addressing core user questions about how advanced computational methods can profoundly enhance the design, development, and application of noise and vibration solutions. Industry stakeholders, from material scientists to automotive engineers and end-consumers, are keenly interested in how AI can facilitate faster and more accurate material characterization, optimize complex NVH system designs for diverse vehicle architectures, and enable sophisticated predictive analytics for in-vehicle performance. The central expectation is that AI will propel NVH engineering beyond conventional empirical and iterative trial-and-error processes, ushering in an era of more intelligent, adaptive, and highly optimized material solutions that deliver superior acoustic comfort and structural integrity more efficiently, rapidly, and at reduced costs, ultimately elevating the overall passenger experience across all vehicle categories by providing quieter, smoother, and more refined rides.

AI's transformative influence extends across multiple critical phases of the NVH materials lifecycle, from the initial conceptualization and material discovery stages to sophisticated in-service monitoring and predictive maintenance. In the design and simulation phase, AI-powered algorithms are capable of analyzing vast and intricate datasets encompassing material properties, complex vehicle geometries, diverse environmental conditions, and real-world performance data to predict NVH behavior with unprecedented levels of accuracy and speed. This advanced capability empowers engineers to virtually test and evaluate countless material combinations, structural configurations, and assembly methods, rapidly identifying optimal solutions that not only meet stringent performance and weight targets but also comply with evolving regulatory standards. Such data-driven insights significantly reduce the reliance on expensive and time-consuming physical prototyping. Furthermore, AI can actively assist in generative design processes, exploring novel material structures with tailored acoustic properties and uncovering design spaces that would be prohibitively complex or impractical for human engineers to investigate manually, thereby accelerating breakthroughs in material innovation and pushing the boundaries of what is acoustically and vibrationally achievable in vehicle design.

- AI-driven generative design and topology optimization algorithms to develop lightweight, high-performance NVH components with optimized geometries.

- Advanced predictive NVH performance modeling and simulation capabilities, enabling rapid virtual testing, iteration, and significantly reduced physical prototyping cycles.

- Accelerated discovery and comprehensive characterization of novel NVH materials through AI-powered materials informatics, computational chemistry, and data mining of material databases.

- Optimization of manufacturing processes for NVH components, leveraging AI for improved material utilization, enhanced quality control, defect reduction, and minimized waste.

- Development of smart, adaptive NVH systems that integrate AI sensors and algorithms to continuously monitor and actively counteract noise and vibration in real-time within the vehicle cabin.

- AI-enhanced data analytics and machine learning for root cause analysis of complex NVH issues identified from field data, leading to more precise and effective design improvements and troubleshooting.

DRO & Impact Forces Of Automotive NVH Materials Market

The Automotive NVH Materials Market operates within a dynamic ecosystem shaped by a complex interplay of internal and external forces, meticulously categorized into Drivers, Restraints, Opportunities, and broader Impact Forces that collectively determine its growth trajectory and evolutionary path. A paramount driver is the escalating global demand for enhanced passenger comfort and vehicle refinement, as modern consumers increasingly prioritize a serene, quiet, and smooth driving experience, especially prevalent in the burgeoning premium and luxury vehicle segments. This heightened consumer expectation directly translates into an amplified need for highly effective noise and vibration reduction solutions across all vehicle types. Furthermore, the unprecedented and accelerating surge in global electric vehicle (EV) production acts as a monumental catalyst; in the absence of the conventional internal combustion engine's masking sound, other noise sources such as tire-road interaction, aerodynamic turbulence, wind whistle, and auxiliary component sounds become significantly more perceptible and intrusive. This mandates the development and adoption of highly specialized and often more sophisticated NVH solutions specifically tailored for unique EV architectures. Additionally, increasingly stringent regulatory standards for vehicle noise emissions and occupant safety in numerous countries worldwide compel automotive manufacturers to integrate advanced NVH materials and comprehensive systems to ensure strict compliance, providing a continuous, non-negotiable impetus for sustained market expansion and profound innovation.

Despite these powerful drivers, the Automotive NVH Materials Market encounters several notable restraints that pose significant challenges to its unbridled growth and development. The persistent volatility and increasing cost of raw materials, particularly for specialized polymers, advanced composites, and bio-based feedstocks essential for high-performance NVH solutions, can exert considerable pressure on manufacturing costs and ultimately impact vehicle pricing and affordability. The inherent technical complexity involved in researching, developing, and manufacturing multi-functional, lightweight, and often bespoke NVH solutions demands substantial R&D investment, specialized expertise, and sophisticated production capabilities, thereby creating significant barriers to entry for new market players and potentially slowing the pace of innovation for established ones. Furthermore, growing environmental concerns and increasingly stringent regulatory pressures regarding the recyclability, biodegradability, and overall sustainability of certain NVH materials, especially those derived from petrochemicals, present substantial hurdles. The industry is under increasing pressure to invest heavily in developing environmentally friendly alternatives and to embrace circular economy practices for material lifecycle management. Lastly, persistent global supply chain disruptions, as acutely demonstrated in recent years by geopolitical instability, trade conflicts, and global health crises, can severely impact the availability and pricing of essential components, affecting production schedules, lead times, and overall market stability across the automotive sector.

Amidst these formidable challenges, substantial opportunities for growth, innovation, and strategic differentiation abound within the Automotive NVH Materials Market. The most significant opportunities lie in intensified research and development efforts aimed at creating novel lightweight NVH materials, which not only dramatically enhance acoustic performance but also crucially contribute to overall vehicle energy efficiency and extended EV range. The burgeoning electric vehicle market, with its unique acoustic profile and engineering demands, offers a particularly fertile ground for bespoke NVH solutions, necessitating entirely new approaches to noise management that extend beyond conventional methods. The accelerated development and commercialization of bio-based, recyclable, and inherently sustainable NVH materials represent a major opportunity, driven by burgeoning environmental consciousness, evolving regulatory frameworks, and increasing consumer demand for eco-friendly products. Moreover, emerging automotive markets in Asia Pacific, Latin America, and the Middle East and Africa present considerable growth potential as vehicle production continues to increase and consumer preferences for comfort, quality, and advanced features mature. The broader impact forces influencing the market are predominantly characterized by rapid technological advancements in material science, sophisticated manufacturing automation, and the integration of advanced predictive analytics. These forces, coupled with ever-evolving global regulatory landscapes and dynamically shifting consumer expectations towards quieter, more comfortable, and environmentally responsible vehicles, collectively propel the market towards the development and adoption of advanced, integrated, and highly sustainable NVH solutions that redefine the automotive experience.

Segmentation Analysis

The Automotive NVH Materials Market is meticulously and comprehensively segmented to provide a granular and in-depth understanding of its intricate structure, allowing for precise market analysis, informed strategic planning, and targeted product development. This detailed segmentation is absolutely crucial for all stakeholders, enabling them to accurately identify specific market niches, understand nuanced demand patterns across various applications, and adapt effectively to the rapidly evolving technological and regulatory landscape of the global automotive industry. The inherently complex and multifaceted requirements for managing noise, vibration, and harshness in modern vehicles necessitates a multi-dimensional approach to market classification, accurately reflecting the diverse range of material solutions, advanced technologies, and application methodologies currently employed to address these pervasive challenges with optimal effectiveness.

The market's primary classifications are thoughtfully delineated by several key attributes, each offering unique and actionable insights into the industry's dynamics. Segmentation by material type categorizes the market based on the fundamental chemical composition, physical properties, and structural characteristics of the NVH solutions, spanning a wide spectrum from various types of foams and rubbers to advanced textiles and sophisticated composites. This differentiation is critically important as each material inherently possesses distinct acoustic absorption, vibration damping, and thermal insulation characteristics, rendering them suitable for specific applications and performance requirements. Further segmentation by application highlights the specific functional roles these materials perform within a vehicle, such such as primary sound absorption, effective vibration damping, or robust thermal insulation, recognizing that many cutting-edge NVH solutions are often designed to serve multiple purposes simultaneously, offering multi-functional benefits. The market is also segmented comprehensively by vehicle type to meticulously account for the unique NVH requirements, production volumes, and design constraints of passenger cars, commercial vehicles, and the rapidly expanding and strategically vital electric vehicle sector, each presenting distinct engineering challenges and material demands. Finally, segmentation by end-use clearly distinguishes between original equipment manufacturers (OEMs) and the aftermarket, reflecting the varied supply chains, distinct purchasing behaviors, and specific product specifications relevant to each of these pivotal industry segments.

- By Material Type: This segment classifies Automotive NVH materials based on their fundamental composition and physical properties, which are critical determinants of their effectiveness in specific applications.

- Foams: Includes a wide range of materials such as Polyurethane foam, Melamine foam, EPDM foam, Nitrile Rubber foam, and other open-cell or closed-cell polymeric foams extensively utilized for superior sound absorption and effective insulation within vehicle cabins and structures.

- Rubbers: Comprising Butyl rubber, EPDM rubber, Natural rubber, Silicone rubber, and other elastomeric compounds that are primarily employed for their excellent vibration damping properties, effective sealing applications, and sound isolation capabilities.

- Textiles: Encompasses various fibrous materials such as Felt (both natural and synthetic), Woven and Non-woven fabrics, Glass fibers, and other engineered textile composites used for acoustic absorption, thermal insulation, and aesthetic purposes.

- Composites: Advanced multi-layer laminates, fiber-reinforced plastics (FRPs), and other engineered combinations offering enhanced damping characteristics, increased structural stiffness, and critical lightweight properties for modern vehicle designs.

- Heavy Layer Compounds: Dense, visco-elastic materials typically formulated from polymer bitumen or specific rubbers heavily filled with inert fillers, applied for effective mass loading, superior sound blocking, and efficient vibration damping on body panels and structures.

- Asphaltic Sheets: Bitumen-based sheets commonly utilized for their cost-effectiveness and good performance in vibration damping and general sound insulation, particularly in larger areas like floor pans and vehicle body panels.

- Others: This category encompasses a variety of specialized materials including sprayable damping coatings, liquid applied sound deadeners (LASD), constrained layer damping (CLD) systems, specialized acoustic felts, and innovative encapsulated materials.

- By Application: This segment categorizes NVH materials based on their primary functional role within the vehicle's acoustic and vibrational management system.

- Sound Absorption: Materials specifically designed to absorb airborne sound waves, effectively reducing reverberation, echo, and overall noise levels within the vehicle cabin (e.g., foams, porous textiles).

- Vibration Damping: Materials engineered to dissipate structural vibrations, preventing the generation of undesirable noise and reducing fatigue in various vehicle components and structures (e.g., rubber sheets, heavy layer compounds).

- Sound Insulation: Materials that create a robust barrier to block the transmission of sound from one area to another, providing effective soundproofing (e.g., multi-layer mats, dense barriers).

- Thermal Insulation: While primarily focused on heat management, many NVH materials also possess excellent thermal insulation properties, contributing significantly to overall cabin comfort, energy efficiency, and occupant well-being.

- By Vehicle Type: This segment differentiates the market based on the specific NVH requirements and production characteristics of various vehicle categories.

- Passenger Cars: Includes a comprehensive range of vehicles such as sedans, SUVs, hatchbacks, coupes, and luxury vehicles, all of which demand exceptionally high levels of NVH refinement for superior occupant comfort and perceived quality.

- Commercial Vehicles: Comprises Light Commercial Vehicles (LCVs), and Medium and Heavy Commercial Vehicles (M&HCVs) like trucks and buses, where NVH solutions are crucial for improving driver comfort, mitigating fatigue, and ensuring compliance with operational noise limits.

- Electric Vehicles (BEV, PHEV, FCEV): Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, and Fuel Cell Electric Vehicles require distinct and highly specialized NVH strategies due to their silent powertrains amplifying other non-engine noise sources significantly.

- By End-Use: This segment distinguishes between the different purchasing channels and ultimate consumers for Automotive NVH materials.

- Original Equipment Manufacturer (OEM): Materials supplied directly to automotive manufacturers for seamless integration into new vehicle production lines and assembly processes during initial manufacturing.

- Aftermarket: Materials sold for vehicle repair, maintenance, customization, or enhancement purposes after the initial sale, catering to independent workshops, specialty installers, and individual consumers.

Value Chain Analysis For Automotive NVH Materials Market

The value chain for the Automotive NVH Materials Market is an intricate and multi-tiered network, commencing with highly specialized upstream activities involving the rigorous sourcing, initial processing, and precise formulation of diverse raw materials. This foundational segment of the value chain is populated by a sophisticated array of chemical manufacturers and raw material producers who supply critical inputs such as polyurethane precursors, EPDM rubber, butyl rubber, and various synthetic resins. Additionally, specialized producers contribute natural and synthetic fibers, including felt, glass fibers, and other engineered textile components. Metal suppliers also play a crucial role, providing specialized foils and components integral to certain composite NVH structures. These upstream entities meticulously transform basic chemical feedstocks and natural resources into high-grade compounds, polymers, and fibrous materials, which are then precisely formulated and prepared to meet the stringent performance criteria and exacting specifications required for advanced NVH applications. The consistent quality, reliable availability, and increasingly, the sustainable sourcing of these primary inputs are absolutely paramount, as they directly influence the effectiveness, durability, environmental footprint, and cost-efficiency of the final NVH product, thereby underscoring the critical importance of continuous innovation and responsible practices at this initial stage of the value chain.

Proceeding further along the value chain, the intermediate stages encompass the highly specialized manufacturing and intricate conversion of these processed raw materials into automotive-grade NVH components. This segment typically involves Tier 2 and Tier 1 suppliers who possess deep expertise in advanced material science, precision engineering, and sophisticated manufacturing processes. These companies undertake the complex task of transforming raw polymers into highly effective acoustic foams, processing various rubbers into specialized damping sheets and pads, and fabricating fibrous materials into high-performance insulation felts or multi-layer acoustic barriers. A diverse array of advanced processing techniques is employed, including injection molding, extrusion, calendering, vacuum forming, precise cutting, lamination, and specialized spraying methods, all to produce components meticulously tailored to specific vehicle architectures and NVH targets. These specialized NVH components are subsequently supplied either directly to automotive Original Equipment Manufacturers (OEMs) for seamless integration into new vehicle production lines, or, more commonly, to Tier 1 automotive suppliers who expertly incorporate these NVH materials into larger sub-assemblies such as interior trim panels, headliners, full body-in-white structures, or complete chassis systems. The predominantly direct nature of this relationship with OEMs and Tier 1 suppliers emphasizes the critical need for stringent quality control, just-in-time delivery systems, and collaborative research and development efforts to optimize material integration, performance, and overall vehicle assembly efficiency.

The downstream segment of the value chain meticulously focuses on the efficient distribution and ultimate application of Automotive NVH materials to various end-users. For the Original Equipment Manufacturer (OEM) market, the distribution channel is predominantly direct, characterized by long-term strategic contracts, highly synchronized supply logistics, and robust inventory management systems designed to support continuous and high-volume vehicle assembly operations. OEMs rely heavily on close, collaborative partnerships with NVH material suppliers to ensure that materials meet precise specifications for noise reduction, weight, durability, thermal performance, and ease of installation throughout the demanding vehicle production process. In contrast, the aftermarket segment typically utilizes more indirect distribution channels, involving an extensive network of wholesalers, regional distributors, specialized automotive parts retailers, and independent specialty installation shops. These channels serve a broader and more diverse customer base, including independent vehicle repair facilities, dedicated vehicle customization businesses, and individual vehicle owners seeking to upgrade, replace, or enhance their vehicle's NVH performance, often focusing on supplementary soundproofing or targeted acoustic improvements. The efficiency and effectiveness of both direct and indirect distribution networks are absolutely critical for achieving optimal market penetration, ensuring widespread availability of NVH solutions, and ultimately driving customer satisfaction. The entire value chain is perpetually driven by a relentless pursuit of innovation, exceptional cost-effectiveness, and dynamic responsiveness to evolving automotive design trends, with an increasing and imperative emphasis on circular economy principles and end-of-life recycling for sustainable material management throughout the entire product lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.5 Billion |

| Market Forecast in 2032 | USD 25.0 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, BASF SE, Covestro AG, Dow Inc., DuPont de Nemours, Inc., Henkel AG & Co. KGaA, Sika AG, Autoneum Holding AG, Sumitomo Riko Company Limited, Nitto Denko Corporation, Joyson Safety Systems, Wolverine Advanced Materials, Boyd Corporation, Saint-Gobain S.A., Trelleborg AB, Evonik Industries AG, Federal-Mogul LLC, Recticel NV, Zotefoams plc, Hanwha Advanced Materials, AcoustiShield, HushMat, Dynamat, Faurecia SE, Fuxin Dare Automotive Parts Co. Ltd., Mitsubishi Chemical Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive NVH Materials Market Key Technology Landscape

The Automotive NVH Materials Market is profoundly shaped by an exceptionally dynamic and continuously evolving technology landscape, driven by the relentless pursuit of superior acoustic performance, significant weight reduction, and enhanced environmental sustainability across the automotive sector. A cornerstone of this technological evolution is the pioneering development of advanced lightweight NVH solutions. This crucial trend includes the engineering of innovative composite materials, such as sophisticated fiber-reinforced plastics and multi-layer laminates, which are specifically designed to offer exceptional damping and sound absorption capabilities at significantly reduced mass compared to traditional materials. Furthermore, the precise application of micro-perforated films, highly engineered porous structures, and advanced cellular materials allows for meticulous acoustic tuning without adding substantial weight to the vehicle. This lightweighting imperative is critically important for improving fuel efficiency in internal combustion engine vehicles and, even more so, for extending the crucial driving range of electric vehicles, where every gram saved directly contributes to enhanced energy economy and overall performance.

Regional Highlights

- North America: This region is characterized by a technologically advanced automotive market with a profound emphasis on premium and luxury vehicle segments, thereby driving a robust and continuous demand for high-performance, sophisticated, and innovative NVH materials. The presence of stringent regulatory standards concerning vehicle noise emissions, meticulously enforced by governmental bodies, coupled with consistently elevated consumer expectations for a serene, quiet, and highly refined cabin experience, continuously compels automotive manufacturers to adopt and integrate the most advanced NVH solutions available. Furthermore, the rapid and substantial expansion of electric vehicle manufacturing across North America is a particularly potent catalyst for significant market growth, as EVs intrinsically require specialized NVH technologies to effectively manage non-powertrain noise sources such as tire roar, wind noise, and road vibrations, which become considerably more prominent and intrusive in silent cabins. Significant investment in sustainable, lightweight, and bio-based materials also represents a key and accelerating trend, reflecting broader industry priorities for environmental responsibility and resource efficiency.

- Europe: Europe stands as a highly innovative, technologically advanced, and intensely regulated market for automotive NVH materials, fundamentally distinguished by its rigorous environmental policies and comprehensive vehicle noise regulations. These stringent mandates necessitate ongoing and substantial investment in research and development to produce cutting-edge, ultra-lightweight, environmentally friendly, and exceptionally effective NVH solutions. The region's robust presence of world-renowned luxury, high-performance sports, and premium vehicle manufacturers ensures a consistent and high-value demand for bespoke and highly efficacious NVH systems that deliver unparalleled refinement. Moreover, Europe is at the forefront of the global electric vehicle transition, with substantial governmental and private sector investments driving the rapid adoption and localized production of EVs. This, in turn, critically fuels the demand for NVH solutions specifically engineered to address the unique acoustic characteristics and challenges posed by electric powertrains, fostering a dynamic, competitive, and highly innovative market environment.

- Asia Pacific (APAC): The Asia Pacific region undeniably represents the largest and most rapidly expanding market for automotive NVH materials globally. This exponential growth is primarily attributed to the region's colossal automotive production volumes, particularly in economic powerhouses like China, India, Japan, and South Korea, which serve as major global manufacturing hubs. Rapid urbanization, a burgeoning middle class, and steadily increasing disposable incomes across these nations are translating into a significant surge in demand for personal vehicles that offer enhanced comfort, superior safety, and elevated perceived quality, thereby directly boosting NVH material consumption across all vehicle segments. Moreover, the APAC region is unequivocally at the vanguard of electric vehicle adoption, manufacturing, and technological development, attracting substantial investments in developing and integrating advanced NVH technologies meticulously tailored for EV platforms, making it an indispensable hub for both high-volume production and profound innovation in the global market.

- Latin America: This emerging automotive market is experiencing steady, albeit more gradual, growth in demand for Automotive NVH materials. The region's expanding automotive production capacity and incrementally increasing consumer purchasing power are significantly contributing to the uptake of NVH solutions, particularly as vehicle refinement, comfort, and safety become increasingly important considerations for buyers. While cost-effectiveness often remains a crucial determinant in material selection and adoption, the market is progressively influenced by global trends towards enhanced comfort features, advanced safety systems, and improved acoustic performance. Sustained investments in local manufacturing capabilities, coupled with the gradual adoption of modern vehicle technologies and evolving regulatory frameworks, are expected to further stimulate and accelerate the demand for advanced NVH materials in the coming years, positioning Latin America as a market with considerable and developing potential for future expansion.

- Middle East and Africa (MEA): The MEA region is witnessing growing and strategic investments in its automotive industry, encompassing both localized manufacturing operations and increasing vehicle imports, both of which actively contribute to the market's expansion. Although currently a smaller market in comparison to more established regions, the ongoing economic development, significant infrastructure projects, and the increasing presence and influence of international automotive players are progressively driving the demand for NVH materials. This demand is particularly notable in new vehicle sales and in concerted efforts to modernize and upgrade existing vehicle fleets. As consumer expectations regarding vehicle comfort, quality, and technology continue to evolve, and as the regional vehicle parc steadily grows, the adoption rate of advanced NVH technologies is anticipated to accelerate, especially in rapidly expanding urban centers and oil-rich economies actively investing in diverse industrial growth and technological advancement within the automotive sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive NVH Materials Market.- 3M Company

- BASF SE

- Covestro AG

- Dow Inc.

- DuPont de Nemours, Inc.

- Henkel AG & Co. KGaA

- Sika AG

- Autoneum Holding AG

- Sumitomo Riko Company Limited

- Nitto Denko Corporation

- Joyson Safety Systems

- Wolverine Advanced Materials

- Boyd Corporation

- Saint-Gobain S.A.

- Trelleborg AB

- Evonik Industries AG

- Federal-Mogul LLC

- Recticel NV

- Zotefoams plc

- Hanwha Advanced Materials

- AcoustiShield

- HushMat

- Dynamat

- Faurecia SE

- Fuxin Dare Automotive Parts Co. Ltd.

- Mitsubishi Chemical Corporation

- Rogers Corporation

- Armacell International S.A.

- L&L Products Inc.

Frequently Asked Questions

What are Automotive NVH materials and what is their primary function in modern vehicles?

Automotive NVH (Noise, Vibration, and Harshness) materials are highly specialized engineering solutions, including foams, rubbers, textiles, composites, and damping sheets, designed to absorb, damp, or block undesirable noise and vibrations within vehicles. Their primary function is to significantly enhance passenger comfort, elevate the perceived vehicle quality, and contribute to overall driving refinement and safety by effectively mitigating acoustic and structural disturbances originating from sources such as the engine, road interactions, wind, and various vehicle components. This leads to a quieter and smoother cabin environment.

How do Electric Vehicles (EVs) specifically influence the demand and technological evolution of NVH materials?

Electric Vehicles profoundly influence the demand and technological evolution of NVH materials because the inherent quietness of their electric powertrains fundamentally alters the vehicle's acoustic profile. With the absence of conventional engine noise, other sound sources—such as tire-road interaction, aerodynamic drag, brake squeal, and accessory operation—become significantly more prominent and potentially intrusive to occupants. Consequently, EVs require highly advanced, often lightweight, and specially engineered NVH solutions to deliver a premium, exceptionally quiet, and refined cabin experience, thereby driving extensive innovation and early adoption of novel NVH technologies in the market.

What are the key drivers propelling the growth of the Automotive NVH Materials Market, and what are the main restraints?

The primary drivers for market growth include escalating consumer expectations for superior vehicle comfort and refinement, the rapid and extensive global expansion of electric vehicle production, and increasingly stringent governmental regulations concerning vehicle noise emissions and occupant safety. Additionally, the industry's continuous focus on vehicle lightweighting for enhanced fuel efficiency and extended EV range is a significant catalyst. However, key restraints involve the volatility and high cost of essential raw materials, the inherent complexities and substantial R&D investments required for developing advanced NVH solutions, and escalating challenges associated with the recyclability and sustainability of certain traditional materials.

What pivotal role does sustainability play in the current development and future trajectory of NVH materials?

Sustainability plays an increasingly critical and pivotal role in the current development and future trajectory of NVH materials. The automotive industry is prioritizing eco-friendly solutions, leading to a strong focus on utilizing bio-based polymers, incorporating higher percentages of recycled content, and designing materials that are inherently easy to recycle or biodegrade at the end of a vehicle's life cycle. This strategic shift is driven by a confluence of factors, including evolving environmental regulations, robust corporate social responsibility initiatives, and growing consumer preferences for more sustainable automotive components and manufacturing processes, guiding future material innovation.

Which geographical region currently holds the largest market share in the Automotive NVH Materials Market, and what are the underlying reasons for this dominance?

The Asia Pacific (APAC) region currently holds the largest market share in the Automotive NVH Materials Market. This significant leadership is primarily attributed to its immense automotive production volumes, particularly in major manufacturing hubs such as China, India, Japan, and South Korea, which collectively produce a substantial portion of the world's vehicles. Rapid urbanization, a burgeoning middle class, and steadily increasing disposable incomes across these nations are directly translating into a robust surge in demand for personal vehicles that offer enhanced comfort, superior safety, and elevated perceived quality, thereby fueling extensive NVH material consumption throughout the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager