Automotive OEM Telematics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431168 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Automotive OEM Telematics Market Size

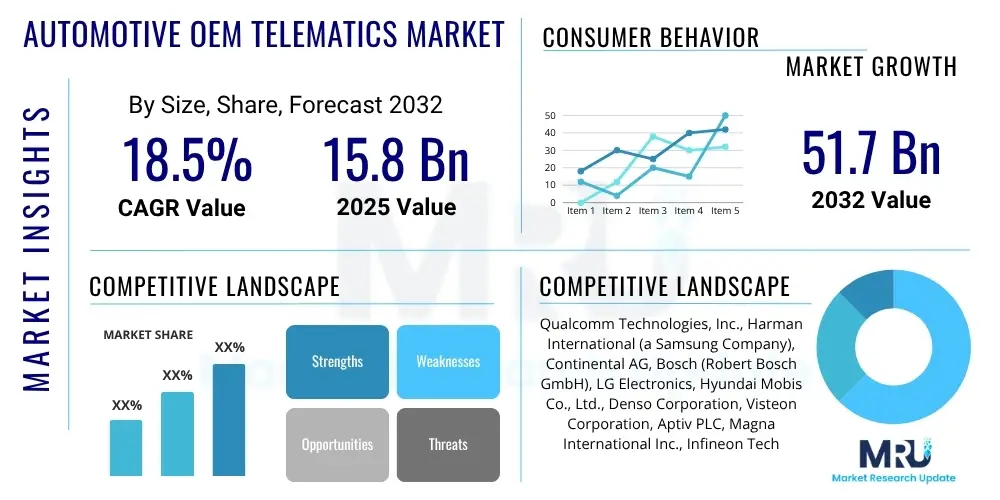

The Automotive OEM Telematics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at $15.8 Billion in 2025 and is projected to reach $51.7 Billion by the end of the forecast period in 2032.

Automotive OEM Telematics Market introduction

The Automotive OEM Telematics Market encompasses the advanced integration of telecommunication and informatics within vehicles, directly implemented and managed by original equipment manufacturers (OEMs). This sophisticated system is fundamentally designed to provide comprehensive connectivity, enabling a wide array of services that significantly enhance vehicle safety, operational efficiency, and driver convenience. At its core, OEM telematics refers to solutions embedded into vehicles during the manufacturing process, establishing a direct link between the vehicle and external networks for data exchange. This inherent integration ensures optimal performance and reliability, distinguishing it from aftermarket solutions.

The product description for OEM telematics involves a complex architecture comprising dedicated hardware components, advanced software platforms, and robust connectivity modules. Key hardware elements include the Telematics Control Unit (TCU), which acts as the central processing unit for data management and communication, Global Navigation Satellite System (GNSS) receivers for precise location tracking, and various sensors that monitor vehicle parameters. The software layer facilitates data processing, application execution, and user interface interactions, often supported by cloud-based backend infrastructure for data storage and analysis. Major applications span critical areas such as emergency services (eCall, bCall), comprehensive vehicle diagnostics, advanced navigation with real-time traffic updates, remote control functionalities, in-car infotainment systems, and efficient fleet management solutions for commercial applications.

The benefits derived from OEM telematics are multifaceted, offering substantial value to both consumers and manufacturers. For drivers, these systems translate into enhanced safety through immediate emergency response capabilities, increased security with features like stolen vehicle tracking, and unparalleled convenience via remote access and personalized services. For OEMs, telematics opens avenues for new revenue streams through subscription services, enables valuable data collection for product improvement and market insights, and strengthens brand loyalty through a superior connected car experience. Driving factors underpinning this market's robust growth include the increasing global regulatory push for mandatory safety features, evolving consumer expectations for seamless digital integration, the rapid proliferation of electric and autonomous vehicles which rely heavily on sophisticated connectivity, and the immense potential for data monetization that OEMs are keen to leverage for competitive advantage.

Automotive OEM Telematics Market Executive Summary

The Automotive OEM Telematics Market is currently experiencing a dynamic evolution driven by profound shifts in business models, significant regional advancements, and diversified segment growth. Key business trends highlight a decisive move towards software-defined vehicles, where telematics is an integral enabler, allowing for extensive customization, upgradability, and the introduction of new functionalities post-purchase. This paradigm shift is fostering the adoption of recurring revenue models, such as subscription services for advanced features and connectivity, alongside sophisticated data monetization strategies where anonymized vehicle data provides valuable insights for urban planning, insurance, and other industries. Strategic partnerships between traditional automotive players, tech giants, and telecommunication providers are becoming foundational for developing comprehensive, secure, and future-proof telematics ecosystems, fostering innovation and accelerating market penetration.

Regional trends reveal distinct market characteristics and growth catalysts across major geographies. Europe maintains a leading position, primarily propelled by the widespread implementation of the mandatory eCall system, which has established a robust baseline for telematics adoption. The region also emphasizes stringent data privacy regulations like GDPR, driving the development of secure and transparent data handling solutions. North America demonstrates a strong appetite for advanced telematics services, including sophisticated infotainment, navigation, and convenience features, supported by continuous infrastructure development for 5G connectivity. The Asia Pacific region, particularly China and India, is emerging as a high-growth epicenter, fueled by surging vehicle sales, rapid urbanization, government-backed smart city initiatives, and an accelerating integration of telematics into the burgeoning electric vehicle segment, often catering to unique local demands and preferences.

Segmentation trends indicate a robust and expanding demand across various telematics solutions. Embedded telematics solutions continue to dominate due to their superior reliability, deep vehicle integration, and enhanced security, becoming a standard feature in many new vehicles. There is a marked increase in the uptake of predictive maintenance and remote diagnostics, as these services offer tangible benefits in reducing vehicle downtime, optimizing service schedules, and lowering overall operational costs for both individual owners and fleet managers. Furthermore, the infotainment and navigation segments are experiencing significant innovation, driven by consumer desires for an immersive and personalized in-car digital experience, paving the way for advanced V2X communication applications and more sophisticated safety features, further cementing telematics as a cornerstone of modern automotive technology.

AI Impact Analysis on Automotive OEM Telematics Market

Common user questions related to the impact of AI on the Automotive OEM Telematics Market frequently revolve around how artificial intelligence can profoundly enhance personalization, improve the accuracy of predictive capabilities, and address inherent concerns regarding data privacy and cybersecurity within increasingly complex systems. Users are keenly interested in understanding how AI will transform telematics from a reactive service into a highly proactive and intelligent ecosystem, enabling functionalities such as anticipating driver needs, preempting vehicle faults, and optimizing routes dynamically. There is also significant discourse surrounding the ethical implications of AI in autonomous decision-making processes, particularly in safety-critical scenarios, and the potential for AI-driven systems to introduce new vectors for cyber threats, necessitating advanced security protocols. Expectations are high for AI to deliver a more seamless, intuitive, and ultimately safer connected vehicle experience.

- AI enhances predictive maintenance by analyzing vast datasets from vehicle sensors to foresee potential mechanical failures, allowing for proactive servicing and minimizing downtime.

- AI personalizes the in-car experience by learning driver preferences for climate control, infotainment content, seating positions, and navigation routes, creating a highly customized environment.

- AI significantly improves safety through advanced driver assistance systems (ADAS) by processing real-time sensor data to identify hazards, recommend actions, and even intervene in critical situations.

- AI optimizes fleet management operations by predicting optimal routes based on traffic, weather, and cargo, alongside monitoring driver behavior for efficiency and safety compliance.

- AI enables sophisticated natural language processing for voice assistants, allowing drivers to interact with telematics systems intuitively and hands-free, reducing distraction.

- AI strengthens cybersecurity measures within telematics systems by detecting unusual patterns in vehicle data, identifying potential vulnerabilities, and preventing unauthorized access.

- AI supports the development and deployment of autonomous driving by processing complex environmental data, enabling real-time decision-making, and facilitating vehicle-to-everything (V2X) communication.

- AI assists in developing dynamic, usage-based insurance (UBI) models by accurately assessing driving risk profiles based on aggregated telematics data, offering tailored premium structures.

- AI aids in managing electric vehicle battery health and charging optimization, predicting range and recommending charging points based on driving patterns and grid availability.

DRO & Impact Forces Of Automotive OEM Telematics Market

The Automotive OEM Telematics Market is propelled by a robust set of drivers that are fundamentally reshaping the automotive industry. A paramount driver is the increasing stringency of global regulatory mandates, particularly those focused on enhancing road safety and emergency response, such as the eCall system in Europe and similar initiatives worldwide. These regulations compel OEMs to integrate telematics systems into new vehicles, establishing a baseline for market growth. Concurrently, a burgeoning consumer demand for advanced in-car connectivity and personalized digital experiences, spanning from sophisticated navigation and streaming services to remote vehicle control and tailored diagnostics, is a powerful catalyst. The accelerating global adoption of electric vehicles (EVs) and the ongoing development of autonomous driving technologies further fuel market expansion, as these advanced vehicles inherently rely on robust and intelligent telematics for optimal operation, battery management, and safe, interconnected mobility. Moreover, the immense potential for OEMs to generate new revenue streams through the monetization of aggregated vehicle data offers a significant strategic incentive.

Despite significant growth potential, the market contends with several formidable restraints. A primary hurdle is the substantial initial investment required for the research, development, and seamless integration of sophisticated telematics hardware and software into diverse vehicle platforms. This capital intensiveness can pose challenges for smaller OEMs or those with tighter R&D budgets. Paramount cybersecurity concerns represent a critical restraint; as vehicles become more connected, they become increasingly vulnerable to cyberattacks, necessitating continuous investment in advanced security protocols and real-time threat detection to protect sensitive vehicle and personal data. Data privacy regulations, such as GDPR and CCPA, impose strict guidelines on data collection, storage, and usage, adding layers of complexity and cost for OEMs. Furthermore, the inherent complexities of integrating disparate telematics systems with existing legacy vehicle architectures and the lack of universally standardized interoperability protocols across the industry create significant technical and logistical challenges.

Opportunities for expansion and innovation within the OEM telematics market are abundant and transformative. The global rollout of 5G networks presents a generational opportunity, promising ultra-low latency, unprecedented bandwidth, and enhanced reliability, which are critical for enabling next-generation services like real-time Vehicle-to-Everything (V2X) communication, high-definition streaming, and sophisticated cloud-based autonomous driving functionalities. The increasing demand for highly personalized and contextual services, which adapt to individual driver preferences, environmental conditions, and specific travel needs, offers OEMs a powerful avenue for market differentiation and customer loyalty. Moreover, the symbiotic relationship between telematics and the burgeoning autonomous driving ecosystem creates vast opportunities for data exchange, cooperative perception, and remote assistance. Expanding into rapidly developing economies with nascent but quickly growing automotive markets, particularly those with increasing rates of new vehicle sales and infrastructure investment, also provides significant avenues for market penetration and long-term growth for OEM telematics providers.

Segmentation Analysis

The Automotive OEM Telematics Market is meticulously segmented across various crucial dimensions, offering a granular and comprehensive understanding of its intricate structure, underlying dynamics, and diverse growth trajectories. These segmentations are fundamental for dissecting market performance, identifying niche opportunities, and analyzing competitive landscapes based on specific product offerings, technological solutions, communication methods, vehicle types, and end-user applications. This detailed breakdown allows stakeholders to craft targeted strategies, allocate resources effectively, and develop highly tailored products and services that resonate with specific market needs, thereby optimizing investment returns and fostering sustainable market expansion. The structural categorization provides clarity on where innovation is most impactful and where demand is concentrated, guiding strategic decision-making.

- By Offering

- Hardware (Telematics Control Unit (TCU), GNSS Modules, Antennas, Sensors, Display Units)

- Software (Operating Systems, Application Software, Cloud & Platform Software, Cybersecurity Solutions)

- Services (Subscription Services (e.g., connectivity, navigation updates), On-demand Services (e.g., concierge, roadside assistance), Value-added Services (e.g., usage-based insurance, stolen vehicle recovery))

- By Solution

- Infotainment & Navigation (Real-time traffic, POI search, music/video streaming, app integration)

- Safety & Security (Automatic Crash Notification (ACN/eCall), Breakdown Call (bCall), Stolen Vehicle Tracking (SVT), Geo-fencing, Roadside Assistance)

- Fleet Management (Vehicle Tracking & Monitoring, Diagnostics, Fuel Management, Driver Behavior Monitoring, Route Optimization, Asset Utilization)

- Diagnostics & Maintenance (Remote Diagnostics, Predictive Maintenance, Over-The-Air (OTA) Updates for software and firmware)

- V2X Communication (Vehicle-to-Vehicle (V2V), Vehicle-to-Infrastructure (V2I), Vehicle-to-Pedestrian (V2P), Vehicle-to-Network (V2N))

- Other Solutions (Concierge Services, Payment Services, Personalization Features)

- By Communication Type

- Embedded Telematics (Factory-installed, integrated TCU with dedicated SIM)

- Tethered Telematics (Requires smartphone connection for data transmission, relies on car's antenna)

- Integrated Telematics (Leverages smartphone's processing and connectivity via MirrorLink, Apple CarPlay, Android Auto)

- By Vehicle Type

- Passenger Cars (Sedans, SUVs, Hatchbacks, Luxury Vehicles, Sports Cars)

- Commercial Vehicles

- Light Commercial Vehicles (LCV - Vans, Pickups)

- Heavy Commercial Vehicles (HCV - Trucks, Buses, Construction Vehicles)

- By Electric Vehicle Type

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Hybrid Electric Vehicles (HEV)

- By Connectivity Type

- 4G LTE (Current dominant standard, reliable high-speed data)

- 5G (Emerging standard, ultra-low latency, massive connectivity, high bandwidth for V2X)

- Satellite (Used for remote areas, global coverage for emergency services where cellular is unavailable)

- Others (Bluetooth, Wi-Fi for local connectivity, Dedicated Short-Range Communication (DSRC) for V2X in some regions)

- By Service Type

- Subscription Services (Monthly or annual fees for ongoing connectivity, navigation updates, premium content, emergency services)

- On-demand Services (Pay-per-use model for specific functionalities like concierge requests, roadside assistance on an as-needed basis)

Value Chain Analysis For Automotive OEM Telematics Market

The value chain for the Automotive OEM Telematics Market commences with a critical upstream segment, involving foundational component suppliers and specialized technology developers. This initial stage is crucial for innovation and the provision of core building blocks. It includes manufacturers of semiconductors, which are vital for Telematics Control Units (TCUs) and other processing components, as well as suppliers of GNSS modules, advanced sensors, and robust antennas. Furthermore, specialized software development firms provide essential operating systems, communication protocols, and cloud infrastructure platforms that form the digital backbone of telematics systems. Key players in this segment are often global technology companies and niche specialists whose expertise in hardware miniaturization, software efficiency, and secure communication directly influences the capabilities, reliability, and cost-effectiveness of the final telematics solutions integrated into vehicles, laying the groundwork for subsequent stages of the value chain.

Midstream in the value chain, the automotive Original Equipment Manufacturers (OEMs) assume the central role of integration and product development. This phase involves the intricate process of incorporating the various hardware and software components sourced from upstream suppliers into the vehicle's electrical and electronic architecture during the manufacturing cycle. OEMs are responsible for designing the overall telematics system, customizing software to align with their brand identity and feature sets, and conducting extensive testing to ensure seamless functionality, interoperability, and adherence to stringent automotive safety and quality standards. Moreover, OEMs establish the proprietary telematics platforms and develop the user interfaces that define the in-car experience. Their ability to manage complex supply chains, perform sophisticated engineering, and ensure regulatory compliance is paramount in transforming disparate technologies into a cohesive, market-ready connected vehicle offering, thereby adding significant value.

The downstream segment of the value chain focuses on distribution channels and direct engagement with the end-users. Automotive OEMs predominantly leverage their extensive global dealership networks to market and sell telematics-enabled vehicles, where sales and service personnel educate customers on the available features, subscription models, and benefits. This direct channel ensures a personalized customer experience and supports post-sale services. Beyond vehicle sales, the value chain extends to the ongoing delivery of telematics services, which often involves strategic partnerships with telecommunication service providers for continuous data connectivity, and collaboration with third-party application developers or content providers to enrich the infotainment and convenience offerings. This integrated approach, encompassing direct vehicle sales, subscription management, and indirect sales through fleet operators or insurance partners, ensures broad market reach and sustained revenue generation throughout the vehicle's operational lifecycle, fostering long-term customer relationships and continuous value delivery.

Automotive OEM Telematics Market Potential Customers

The Automotive OEM Telematics Market caters to a diverse and expanding base of potential customers, each driven by distinct needs and expectations from connected vehicle services. The largest and most immediate segment comprises individual car owners and private consumers who increasingly view telematics features as essential differentiators in their vehicle purchase decisions. These end-users prioritize enhanced safety provisions like automatic emergency call systems and stolen vehicle recovery, alongside convenience features such as remote vehicle diagnostics, advanced navigation with real-time traffic updates, and seamless integration of in-car infotainment. The desire for personalized digital experiences, peace of mind regarding vehicle security, and access to roadside assistance on demand are key motivators for this customer group, leading them to gravitate towards vehicles with comprehensive OEM-integrated telematics solutions that offer reliability and ease of use directly from the manufacturer.

Another critically important customer segment consists of commercial fleet operators, encompassing a wide array of businesses including logistics and transportation companies, rental car agencies, public transport providers, and utility services. For these organizations, OEM telematics systems are invaluable tools for optimizing operational efficiency and managing large vehicle assets. Their primary requirements include real-time vehicle tracking for logistics and security, fuel management to reduce operational costs, driver behavior monitoring for safety and compliance, route optimization to enhance delivery efficiency, and predictive maintenance scheduling to minimize vehicle downtime. The robust and integrated nature of OEM telematics offers these fleet managers sophisticated data analytics and comprehensive control over their mobile assets, translating directly into significant cost savings, improved service delivery, and enhanced safety for their drivers and cargo, making telematics an indispensable component for modern fleet operations.

Beyond direct vehicle owners and fleet managers, the market also serves a range of indirect but highly influential buyers, including insurance providers, emergency services, and urban planning authorities involved in smart city initiatives. Insurance companies are increasingly leveraging telematics data to develop and offer innovative usage-based insurance (UBI) policies, rewarding safe driving behavior with lower premiums, thus creating a mutually beneficial ecosystem. Emergency services rely on telematics for automatic crash notifications and precise location data to expedite response times, saving lives. Furthermore, smart city developers integrate aggregated telematics data to analyze traffic patterns, manage congestion, enhance public safety, and optimize urban infrastructure, contributing to more efficient and sustainable urban environments. These diverse end-users and beneficiaries collectively underscore the wide-reaching impact and essential nature of OEM telematics across various sectors of modern society.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $15.8 Billion |

| Market Forecast in 2032 | $51.7 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm Technologies, Inc., Harman International (a Samsung Company), Continental AG, Bosch (Robert Bosch GmbH), LG Electronics, Hyundai Mobis Co., Ltd., Denso Corporation, Visteon Corporation, Aptiv PLC, Magna International Inc., Infineon Technologies AG, Sierra Wireless (Semtech Corporation), Vodafone Group Plc, Verizon Communications Inc., AT&T Inc., Geotab Inc., Trimble Inc., TomTom N.V., Huawei Technologies Co., Ltd., Queclink Wireless Solutions Co., Ltd., HERE Technologies, Ericsson AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive OEM Telematics Market Key Technology Landscape

The Automotive OEM Telematics Market is fundamentally shaped by a sophisticated and rapidly advancing technological landscape, which serves as the bedrock for delivering its diverse array of connected services and functionalities. At its core, precise positioning is achieved through advanced Global Navigation Satellite System (GNSS) technologies, integrating multiple constellations such as GPS, GLONASS, Galileo, and BeiDou, ensuring highly accurate location tracking for navigation, emergency services, and geo-fencing applications. This is seamlessly complemented by robust cellular communication technologies, predominantly 4G LTE, and increasingly 5G, which provide the high bandwidth, low latency, and reliability essential for real-time data exchange, remote software updates, high-definition streaming, and the critical enablement of Vehicle-to-Everything (V2X) communication, allowing vehicles to interact intelligently with their surroundings and other entities.

Beyond connectivity, the market leverages powerful computing and data analytics infrastructures. Cloud computing platforms are indispensable for scalable data storage, complex data processing, and delivering scalable telematics services, allowing OEMs to manage vast amounts of vehicle-generated information. Big data analytics and advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms are deployed to extract actionable insights from this data, facilitating predictive maintenance by anticipating component failures, personalizing the in-car experience based on user behavior, and optimizing fleet management operations. The integration of embedded systems, particularly the Telematics Control Unit (TCU), which acts as the intelligent gateway for all vehicle communications, demands state-of-the-art microprocessors and memory, alongside robust operating systems designed for automotive environments, ensuring reliability and real-time performance within demanding operational conditions.

Moreover, critical to the continuous evolution and security of OEM telematics is the development of advanced cybersecurity protocols and Over-The-Air (OTA) update capabilities. Cybersecurity measures are paramount to protect sensitive vehicle data, safeguard against unauthorized access, and ensure the integrity and reliability of connected systems, employing encryption, secure boot processes, and intrusion detection systems. OTA updates enable OEMs to remotely deploy software enhancements, security patches, and entirely new features to vehicles, significantly extending product lifecycles and reducing the need for physical dealership visits, thereby improving efficiency and customer satisfaction. The convergence of these technologies, including sensor fusion, edge computing for localized processing, and intuitive human-machine interfaces (HMIs), is collectively driving the market forward, pushing the boundaries of what is possible in intelligent, connected mobility and fundamentally transforming the user experience within modern vehicles.

Regional Highlights

- North America: This region stands as a highly mature and influential market for automotive OEM telematics, characterized by a substantial consumer base with high expectations for cutting-edge in-car technology. Growth here is primarily propelled by a strong demand for advanced infotainment and navigation systems, robust safety and security features, and seamless integration with personal mobile devices. The continuous rollout of 5G infrastructure is significantly enhancing connectivity capabilities, enabling more sophisticated services like enhanced ADAS and V2X communication. Furthermore, the presence of major automotive players and leading technology innovators drives continuous research, development, and market penetration, particularly in the United States and Canada, where regulatory frameworks also support the expansion of connected car services.

- Europe: Europe represents a pivotal market for OEM telematics, largely driven by mandatory regulatory compliance. The widespread implementation of the eCall system across the European Union has established a foundational level of telematics adoption in all new vehicles, ensuring automatic emergency assistance. Beyond regulatory push, the region exhibits a strong commitment to data privacy and cybersecurity, influenced by the General Data Protection Regulation (GDPR), which necessitates robust and transparent data handling solutions. Innovation is also fueled by significant investments in sustainable mobility, including electric vehicles, and intensive research into Vehicle-to-Everything (V2X) communication technologies, aimed at enhancing road safety, optimizing traffic flow, and supporting smart city initiatives across countries like Germany, France, and the UK.

- Asia Pacific (APAC): The APAC region is recognized as the fastest-growing market for automotive OEM telematics globally, experiencing exponential expansion driven by rapid economic development, increasing disposable incomes, and accelerating urbanization, particularly in emerging economies such as China, India, and ASEAN countries. Government initiatives promoting smart infrastructure and the rapid adoption of electric vehicles are significant accelerators for telematics integration. Consumers in this region are increasingly demanding comprehensive solutions that offer a blend of safety, convenience, and advanced infotainment, often tailored to local language and cultural preferences. Japan and South Korea also contribute significantly with their advanced technological landscapes and early adoption of new automotive innovations, fostering a dynamic and competitive telematics market.

- Latin America: This region is an emerging but steadily growing market for automotive OEM telematics, where initial adoption has been primarily concentrated on fundamental safety, security, and vehicle tracking services. These features are particularly valued by commercial fleet operators due to prevalent concerns over vehicle theft and the need for efficient logistics management. As economic stability improves and automotive penetration increases, there is a gradual but noticeable shift towards more advanced connected services, including basic navigation and remote diagnostics. Infrastructure development and proactive government support for smart mobility solutions are crucial factors that are expected to further stimulate market expansion and encourage broader consumer adoption of telematics in countries like Brazil and Mexico.

- Middle East and Africa (MEA): The MEA region is experiencing progressive growth in the OEM telematics market, with demand primarily influenced by two key segments: the luxury vehicle market, where high-end telematics features are a significant selling point, and the commercial vehicle sector, driven by a strong need for robust vehicle tracking and security applications due to regional security concerns and challenging operating environments. Government efforts to modernize transportation infrastructure and enhance road safety, alongside increased digital transformation initiatives, are contributing to the broader adoption of telematics solutions. However, the market faces challenges such as diverse regulatory landscapes and varying levels of technological infrastructure development across the region, necessitating flexible and adaptable solutions from market players in countries such as the UAE, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive OEM Telematics Market.- Qualcomm Technologies, Inc.

- Harman International (a Samsung Company)

- Continental AG

- Bosch (Robert Bosch GmbH)

- LG Electronics

- Hyundai Mobis Co., Ltd.

- Denso Corporation

- Visteon Corporation

- Aptiv PLC

- Magna International Inc.

- Infineon Technologies AG

- Sierra Wireless (Semtech Corporation)

- Vodafone Group Plc

- Verizon Communications Inc.

- AT&T Inc.

- Geotab Inc.

- Trimble Inc.

- TomTom N.V.

- Huawei Technologies Co., Ltd.

- Queclink Wireless Solutions Co., Ltd.

- HERE Technologies

- Ericsson AB

Frequently Asked Questions

What are the primary benefits of OEM telematics for consumers?

OEM telematics systems provide significant benefits to consumers, primarily enhancing vehicle safety through automatic crash notification and emergency assistance. They also offer unparalleled convenience via remote vehicle access, advanced navigation with real-time updates, and personalized infotainment experiences, all integrated directly by the vehicle manufacturer for optimal performance and reliability.

How do OEM telematics systems contribute to vehicle safety and security?

OEM telematics significantly boosts vehicle safety and security by incorporating features like automatic emergency calls (eCall) that alert emergency services after a collision, providing precise location data for rapid response. Additionally, services such as stolen vehicle tracking, geo-fencing, and remote diagnostics ensure proactive monitoring and protection against theft or malfunctions, directly linking the vehicle to critical support networks.

What is the impact of 5G technology on the future development of automotive telematics?

The advent of 5G technology is profoundly impacting automotive telematics by enabling ultra-low latency, exceptionally high bandwidth, and massive connectivity. This advancement is crucial for facilitating real-time Vehicle-to-Everything (V2X) communication, supporting advanced autonomous driving functions, delivering faster Over-The-Air (OTA) updates, and providing superior in-car streaming and entertainment experiences, ultimately transforming vehicle connectivity and intelligence.

What are the main challenges facing the automotive OEM telematics market?

Key challenges for the automotive OEM telematics market include the substantial initial investment required for research, development, and seamless integration of complex hardware and software systems. Furthermore, pervasive cybersecurity threats and stringent data privacy regulations pose significant hurdles, alongside the complexities of integrating diverse technologies and the ongoing need for universal standardization across different vehicle models and manufacturers.

How is Artificial Intelligence (AI) transforming the capabilities of telematics services?

Artificial Intelligence (AI) is revolutionizing telematics services by enabling predictive maintenance through advanced data analytics to anticipate vehicle faults, personalizing the in-car experience based on individual driver behavior, and enhancing safety features with intelligent driver assistance systems. AI also optimizes fleet management operations and improves the accuracy and responsiveness of voice command systems, making telematics platforms far more intuitive and proactive.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager