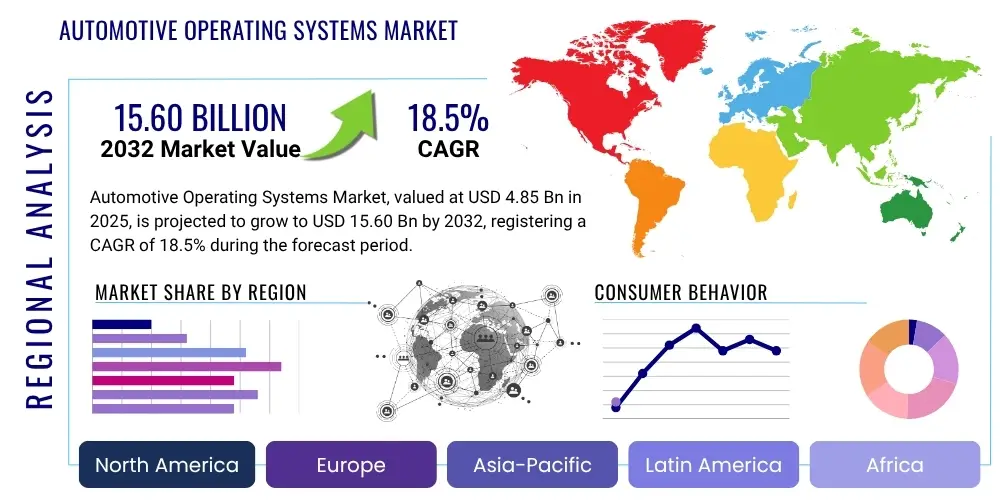

Automotive Operating Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430733 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Automotive Operating Systems Market Size

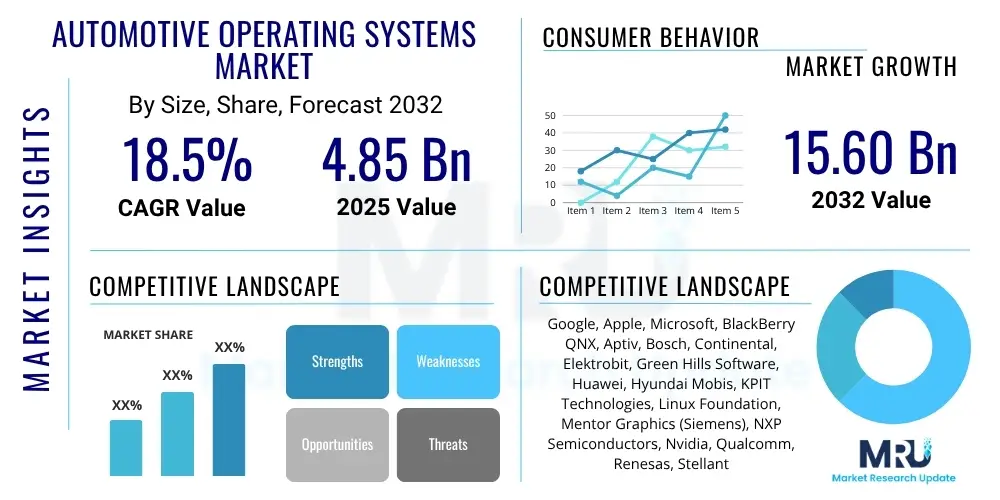

The Automotive Operating Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 4.85 Billion in 2025 and is projected to reach USD 15.60 Billion by the end of the forecast period in 2032.

Automotive Operating Systems Market introduction

The Automotive Operating Systems (AOS) market encompasses the sophisticated software platforms that serve as the foundational backbone for various electronic systems within modern vehicles. These operating systems manage everything from basic vehicle functions to complex infotainment systems, advanced driver-assistance systems (ADAS), and fully autonomous driving capabilities. They enable the integration of diverse hardware components and facilitate seamless communication between different vehicular modules, enhancing both performance and user experience.

The primary applications of automotive operating systems span across critical vehicle domains, including in-vehicle infotainment (IVI), telematics for connectivity, ADAS for safety and convenience, and control systems for powertrain and chassis. Benefits derived from advanced AOS include enhanced vehicle safety through robust control mechanisms, improved fuel efficiency via optimized engine management, a superior user experience with intuitive interfaces and personalized settings, and the crucial enablement of over-the-air (OTA) updates, allowing for continuous feature enhancements and bug fixes. Key driving factors for this market include the global push towards software-defined vehicles (SDVs), the rapid adoption of electric vehicles (EVs), the increasing demand for connected car features, and advancements in autonomous driving technologies, all of which necessitate highly sophisticated and secure operating environments.

Automotive Operating Systems Market Executive Summary

The Automotive Operating Systems market is experiencing a transformative period, driven by the shift towards software-defined vehicles and increasing consumer expectations for advanced in-car experiences. Business trends indicate a move towards deeper collaboration between automotive original equipment manufacturers (OEMs) and technology providers, alongside significant investments in developing proprietary and open-source operating systems. Consolidation among software vendors and strategic partnerships are becoming commonplace as companies seek to offer comprehensive, integrated solutions that cover the entire vehicle lifecycle, from development to after-sales services and updates.

Regional trends highlight North America and Europe as significant innovators and early adopters, particularly in ADAS and autonomous driving applications, bolstered by stringent safety regulations and strong technological infrastructure. The Asia Pacific region, led by China, Japan, and South Korea, is emerging as a critical growth engine due to its massive automotive production volumes, rapid adoption of electric vehicles, and strong governmental support for smart mobility initiatives. Emerging markets in Latin America, the Middle East, and Africa are gradually increasing their adoption, primarily driven by increasing urbanization and demand for connectivity features in entry-level and mid-range vehicles.

Segment trends reveal robust growth in the infotainment and ADAS application segments, fueled by consumer demand for connectivity, personalization, and safety features. Embedded and Linux-based operating systems currently dominate, but Android Automotive is gaining significant traction due to its familiar interface and vast developer ecosystem. The increasing complexity of software architectures is also boosting demand for sophisticated hypervisors and secure operating environments, emphasizing security and functional safety as paramount concerns across all segments.

AI Impact Analysis on Automotive Operating Systems Market

Common user questions regarding AI's impact on automotive operating systems often revolve around how artificial intelligence enhances vehicle safety, what new functionalities it enables for drivers and passengers, and the underlying challenges related to data privacy, cybersecurity, and the ethical implications of autonomous decision-making. Users are keen to understand if AI will truly make cars smarter and safer, how it will personalize the driving experience, and the complexities involved in integrating sophisticated AI models into critical vehicle systems. Concerns frequently arise about the reliability of AI in real-world scenarios, the necessity for robust validation, and the potential for system failures or security breaches, alongside inquiries into the long-term implications for vehicle ownership and human-machine interaction.

- Enhanced autonomous driving capabilities through improved perception, decision-making, and path planning algorithms.

- Personalized in-car experiences, including adaptive infotainment, predictive climate control, and proactive driver assistance based on user habits and preferences.

- Predictive maintenance and diagnostics, utilizing AI to monitor vehicle health and anticipate potential failures, reducing downtime and costs.

- Advanced natural language processing (NLP) for more intuitive voice commands and intelligent virtual assistants within the vehicle.

- Optimized energy management in electric vehicles, leveraging AI to improve range prediction and battery performance.

- Robust cybersecurity measures, with AI-driven anomaly detection and threat response mechanisms embedded within the OS.

- Improved traffic flow and congestion management through real-time data analysis and vehicle-to-infrastructure (V2I) communication.

- Facilitation of new business models, such as subscription services for AI-enhanced features and on-demand mobility solutions.

DRO & Impact Forces Of Automotive Operating Systems Market

The Automotive Operating Systems market is primarily driven by the paradigm shift towards software-defined vehicles (SDVs), where software dictates vehicle functionality and user experience, rather than hardware. This trend, coupled with the rapid growth of electric vehicles, which inherently rely more on software for control and management, and the increasing demand for advanced connectivity features and autonomous driving capabilities, significantly propels market expansion. These drivers necessitate robust, secure, and highly adaptable operating systems capable of managing unprecedented levels of complexity and data. The desire for seamless integration of digital lifestyles into the vehicle environment, offering personalized experiences, advanced infotainment, and continuous feature upgrades via Over-The-Air (OTA) updates, further reinforces the market's upward trajectory.

However, the market faces several significant restraints. The substantial cost associated with developing, integrating, and validating complex automotive-grade operating systems presents a barrier, especially for smaller players. Furthermore, the inherent cybersecurity risks associated with highly connected and software-reliant vehicles, coupled with data privacy concerns regarding the vast amount of user data collected, necessitate continuous and expensive investment in security measures. Interoperability challenges between different hardware components, software layers, and diverse vendor ecosystems also complicate development and deployment. Additionally, the fragmented and evolving global regulatory landscape, with varying standards for functional safety and data protection across different regions, poses significant hurdles for market participants striving for global scalability.

Opportunities in this market are abundant, particularly with the emergence of new business models, such as subscription-based services for advanced software features and personalized content, and the expansion into electric and shared mobility platforms, which demand flexible and scalable OS solutions. The increasing adoption of Over-The-Air (OTA) update capabilities across vehicle fleets presents a massive opportunity for continuous revenue generation and enhanced customer satisfaction. The development of unified software platforms that can manage the entire vehicle's electronic/electrical (E/E) architecture, from low-level control to high-level infotainment, offers a path toward streamlined development, reduced costs, and improved vehicle performance. The impact forces shaping this market include continuous technological innovation in areas like AI, IoT, and cloud computing, evolving regulatory frameworks, shifting consumer preferences towards more connected and autonomous vehicles, and dynamic supply chain considerations impacting component and software availability.

Segmentation Analysis

The Automotive Operating Systems market is extensively segmented to reflect the diverse applications, vehicle types, and technological requirements prevalent in the automotive industry. This segmentation allows for a granular understanding of market dynamics, growth opportunities, and competitive landscapes across various niches. Analyzing these segments provides insights into which areas are experiencing the most rapid adoption and where future innovation is likely to be concentrated, guiding strategic decisions for market participants.

- By Type:

- Embedded Operating System

- Real-Time Operating System (RTOS)

- Linux-based

- Android Automotive

- Others

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- By Application:

- Infotainment Systems

- Advanced Driver-Assistance Systems (ADAS)

- Telematics

- Body & Comfort

- Powertrain

- Chassis & Safety

- Others

- By Communication:

- V2V (Vehicle-to-Vehicle)

- V2I (Vehicle-to-Infrastructure)

- V2P (Vehicle-to-Pedestrian)

- V2D (Vehicle-to-Device)

- In-Vehicle Communication

Value Chain Analysis For Automotive Operating Systems Market

The value chain for the Automotive Operating Systems market is complex and highly collaborative, involving multiple layers of specialized entities working in tandem to deliver integrated software solutions. At the upstream level, critical contributions come from semiconductor manufacturers, who provide the microprocessors, microcontrollers, and system-on-chips (SoCs) that form the hardware foundation upon which operating systems run. Alongside them are independent software vendors (ISVs) and open-source communities contributing base operating system kernels, libraries, and development tools, such as the Linux Foundation or specialized RTOS providers. These entities are foundational, providing the essential building blocks for higher-level software development.

Midstream, Tier 2 and Tier 1 suppliers play a pivotal role. Tier 2 suppliers often specialize in specific software components or middleware, which are then integrated by Tier 1 suppliers. Tier 1 suppliers, such as major automotive electronics companies, integrate these diverse software and hardware components to develop complete electronic control units (ECUs), infotainment modules, or ADAS platforms. They often customize operating systems to meet specific OEM requirements, adding their own proprietary software layers, development kits, and application programming interfaces (APIs). Their role involves extensive testing, validation, and optimization to ensure functional safety, security, and performance. The distribution channel predominantly involves direct sales and long-term partnerships between these Tier 1 suppliers and automotive OEMs.

Downstream, automotive Original Equipment Manufacturers (OEMs) are the ultimate integrators and primary customers. They take the pre-integrated solutions from Tier 1 suppliers and further customize them with their brand-specific user interfaces, proprietary applications, and vehicle-specific calibrations. OEMs are increasingly focusing on developing their in-house software capabilities to gain more control over the user experience and enable new revenue streams through software features. The indirect channel involves dealerships and service centers that handle software updates and maintenance throughout the vehicle's lifecycle, often facilitated by over-the-air (OTA) capabilities managed by the OEMs. The entire chain is characterized by deep partnerships, intellectual property licensing, and a continuous feedback loop to adapt to evolving technological demands and regulatory landscapes.

Automotive Operating Systems Market Potential Customers

The primary potential customers for Automotive Operating Systems are the automotive Original Equipment Manufacturers (OEMs). These companies, ranging from traditional automakers to emerging EV manufacturers, are increasingly recognizing the strategic importance of sophisticated software for differentiating their vehicles and enabling new functionalities. They seek operating systems that offer robustness, security, scalability, and flexibility to support a wide array of in-car applications, from infotainment and connectivity to advanced driver-assistance and autonomous driving features. OEMs are either looking for off-the-shelf solutions, customizable platforms, or partners for co-development to build proprietary OS architectures tailored to their specific brand and vehicle lines.

Beyond OEMs, Tier 1 automotive suppliers represent a significant segment of potential customers. These suppliers develop critical automotive electronic systems and modules, such as infotainment units, ADAS sensors, and telematics control units, which require a reliable and efficient operating system as their core. They often license or integrate existing operating systems and then add their specialized software and hardware components to create integrated solutions for OEMs. Other potential buyers include fleet operators and ride-sharing companies, who require highly manageable and secure vehicle software for operational efficiency, remote diagnostics, and the deployment of advanced services. Lastly, software developers and technology companies focusing on automotive applications also act as indirect customers, leveraging these operating systems to create innovative in-car services and features that eventually benefit end-consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.85 Billion |

| Market Forecast in 2032 | USD 15.60 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google, Apple, Microsoft, BlackBerry QNX, Aptiv, Bosch, Continental, Elektrobit, Green Hills Software, Huawei, Hyundai Mobis, KPIT Technologies, Linux Foundation, Mentor Graphics (Siemens), NXP Semiconductors, Nvidia, Qualcomm, Renesas, Stellantis, Volkswagen |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Operating Systems Market Key Technology Landscape

The Automotive Operating Systems market is characterized by a dynamic and evolving technology landscape, with several core technologies underpinning its development and functionality. At the fundamental level, embedded operating systems and Real-Time Operating Systems (RTOS) are crucial for managing time-critical functions in vehicles, such as powertrain control, braking systems, and advanced driver-assistance features, where deterministic performance and low latency are paramount. These systems are highly optimized for specific hardware and are designed for maximum reliability and safety, often adhering to strict automotive functional safety standards like ISO 26262. Their lightweight nature and efficiency make them indispensable for deeply embedded applications.

Parallel to these, Linux-based operating systems, including Android Automotive, are gaining significant traction, particularly for infotainment, digital cockpit, and advanced connectivity solutions. Linux offers open-source flexibility, a vast developer community, and robust networking capabilities, making it ideal for features that require rich user interfaces, extensive third-party application support, and seamless integration with cloud services. Android Automotive builds upon the Android Open Source Project (AOSP), providing a familiar environment for app developers and a platform that can be customized by OEMs. The rise of hypervisors is another critical technological trend, enabling multiple operating systems (e.g., RTOS for safety-critical functions and Linux for infotainment) to run concurrently on a single System-on-Chip (SoC), isolating them for security and reliability while consolidating hardware. This approach is fundamental to the software-defined vehicle architecture.

Furthermore, the integration of cloud platforms and edge computing is becoming increasingly important for data processing, advanced analytics, and enabling over-the-air (OTA) updates for continuous software improvement and new feature deployment. Cybersecurity technologies are deeply integrated into these operating systems, encompassing secure boot, encrypted communication, intrusion detection systems, and robust authentication mechanisms to protect against evolving threats. Advanced hardware components from semiconductor giants, including high-performance SoCs with dedicated AI accelerators, are also pivotal, providing the computational power necessary to run these complex operating systems and their applications efficiently. The interplay of these technologies defines the current and future capabilities of automotive operating systems, pushing towards more intelligent, connected, and autonomous vehicles.

Regional Highlights

- North America: A leader in automotive technology innovation, particularly in ADAS, autonomous driving research, and the development of connected car ecosystems. Strong presence of tech giants and established automotive OEMs drives significant R&D investments.

- Europe: Characterized by stringent safety regulations and a focus on premium and luxury vehicles, leading to high demand for advanced and secure operating systems. Germany and the UK are key markets with strong automotive engineering capabilities.

- Asia Pacific (APAC): The largest and fastest-growing market, driven by high vehicle production volumes, rapid adoption of electric vehicles, and significant government support for smart mobility initiatives, especially in China, Japan, and South Korea.

- Latin America: An emerging market with growing demand for connected features in vehicles, influenced by increasing urbanization and the expansion of middle-class consumers. Adoption is steadily increasing but lags behind more developed regions.

- Middle East and Africa (MEA): Gradually adopting advanced automotive technologies, primarily in the luxury and premium segments. The region's focus on smart cities and infrastructure development is expected to drive future growth in connected vehicle solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Operating Systems Market.- Apple

- Microsoft

- BlackBerry QNX

- Aptiv

- Bosch

- Continental

- Elektrobit

- Green Hills Software

- Huawei

- Hyundai Mobis

- KPIT Technologies

- Linux Foundation

- Mentor Graphics (Siemens)

- NXP Semiconductors

- Nvidia

- Qualcomm

- Renesas

- Stellantis

- Volkswagen

Frequently Asked Questions

What is an Automotive Operating System?

An Automotive Operating System (AOS) is the foundational software that manages all electronic systems and functions within a modern vehicle, from engine control and safety features to infotainment, navigation, and autonomous driving capabilities.

Why are Automotive Operating Systems becoming so important?

AOS are critical because they enable software-defined vehicles, facilitate advanced connectivity, support autonomous driving, allow for Over-The-Air (OTA) updates, and deliver personalized, rich in-car user experiences, distinguishing modern cars from older models.

What are the main types of Automotive Operating Systems?

Key types include Embedded Operating Systems and Real-Time Operating Systems (RTOS) for critical functions, and Linux-based systems like Android Automotive for infotainment and user-facing applications, often operating concurrently via hypervisors.

What challenges does the Automotive Operating Systems market face?

Major challenges include high development costs, ensuring robust cybersecurity and data privacy, managing interoperability between diverse components, and navigating complex and evolving global regulatory frameworks for safety and data protection.

How does AI impact Automotive Operating Systems?

AI significantly enhances AOS by enabling advanced autonomous driving, personalized in-car experiences, predictive maintenance, intelligent voice assistance, optimized energy management, and stronger cybersecurity measures through integrated smart algorithms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager