Automotive Optical Sensor IC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429217 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Automotive Optical Sensor IC Market Size

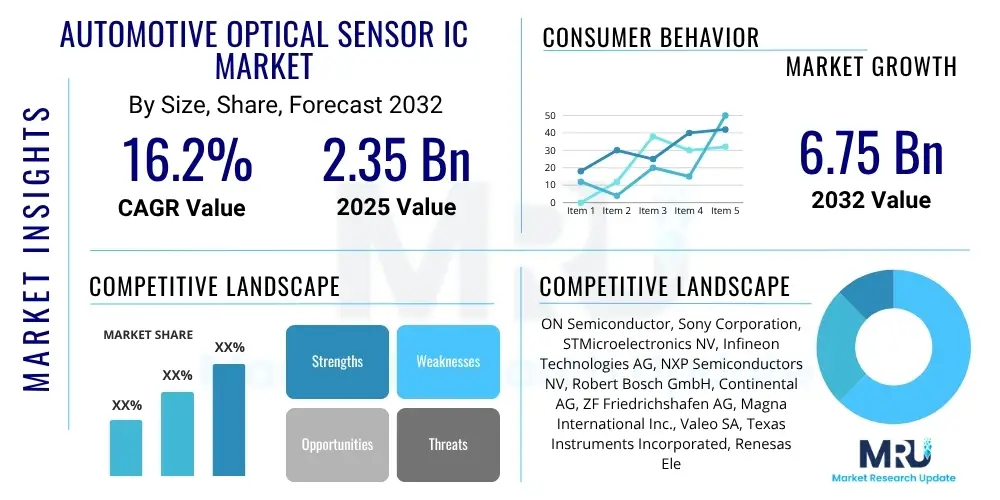

The Automotive Optical Sensor IC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.2% between 2025 and 2032. The market is estimated at USD 2.35 Billion in 2025 and is projected to reach USD 6.75 Billion by the end of the forecast period in 2032.

Automotive Optical Sensor IC Market introduction

The Automotive Optical Sensor IC Market encompasses highly integrated circuits designed to detect and interpret light signals within various vehicular systems. These sensors are foundational components for modern automotive advancements, enabling critical functions spanning safety, driver assistance, and passenger comfort. They leverage sophisticated optical principles to gather environmental data, monitor cabin conditions, and facilitate interactions between the vehicle and its occupants.

Optical Sensor ICs integrate light-sensing elements, such as photodiodes, phototransistors, and charge-coupled devices (CCDs) or Complementary Metal-Oxide Semiconductor (CMOS) image sensors, with signal processing circuitry onto a single chip. This integration allows for compact, energy-efficient, and highly reliable solutions capable of precise light detection, ranging, and imaging. The products range from simple ambient light sensors to complex high-resolution camera modules and LiDAR systems, each tailored for specific automotive needs.

Major applications of these sensors include Advanced Driver Assistance Systems (ADAS) for features like automatic emergency braking, lane keeping assist, and adaptive cruise control, where camera vision and LiDAR are indispensable. Beyond safety, they are crucial for infotainment systems, cabin monitoring for driver fatigue and gesture recognition, automatic headlight and wiper controls, and increasingly, for the foundational perception layers of autonomous driving platforms. The primary benefits include enhanced vehicle safety through superior environmental awareness, improved driver and passenger experience via intelligent interfaces and automated controls, greater energy efficiency by optimizing lighting, and significant contributions to the ongoing evolution of intelligent and self-driving vehicles, driven by stricter safety regulations and consumer demand for advanced features.

Automotive Optical Sensor IC Market Executive Summary

The Automotive Optical Sensor IC Market is undergoing profound transformations, driven by an escalating demand for intelligent and safe vehicles. Key business trends indicate a strong focus on miniaturization, enhanced integration of AI and machine learning capabilities for superior data interpretation, and the development of cost-effective, high-performance solutions that meet stringent automotive qualification standards. Semiconductor manufacturers are increasingly collaborating with Tier 1 suppliers and Original Equipment Manufacturers (OEMs) to co-develop custom solutions, ensuring seamless integration and optimized performance within complex vehicle architectures. The pursuit of higher resolution, faster response times, and robust operation in diverse environmental conditions remains a central theme across product development initiatives, reflecting the critical nature of these components in modern vehicle design and the strategic importance of reliable sensing solutions.

Regionally, Asia Pacific stands as the leading market, primarily propelled by its dominant position in global automotive production, aggressive adoption of electric vehicles (EVs), and substantial government investments in smart transportation infrastructure, particularly in countries like China, Japan, and South Korea. Europe is characterized by stringent vehicle safety regulations, suchated by Euro NCAP, which mandate the inclusion of advanced ADAS features, thereby stimulating demand for sophisticated optical sensor ICs in premium and mainstream vehicle segments. North America showcases robust growth, fueled by significant research and development in autonomous driving technologies, coupled with a strong consumer preference for high-tech features and safety advancements in passenger vehicles. Emerging markets in Latin America and the Middle East and Africa are witnessing gradual adoption, primarily in high-end vehicle segments and through governmental initiatives promoting smart city development, indicating future growth potential as vehicle penetration and technology awareness increase across these regions.

Segment trends highlight the burgeoning importance of CMOS image sensors, which are fundamental to ADAS camera systems for vision-based perception, and LiDAR sensors, which are gaining traction for precise 3D mapping and object detection in autonomous driving applications. Infrared sensors are experiencing increased demand for in-cabin monitoring, enabling features such as driver attention sensing and gesture control, enhancing both safety and convenience. The integration of various sensor types into sensor fusion platforms is a critical trend, allowing for a more comprehensive and reliable understanding of the vehicle's surroundings. This multi-modal sensing approach, often facilitated by advanced optical ICs, is essential for improving the robustness and redundancy required for advanced autonomous functionalities, ensuring vehicle operation under varying environmental conditions and enhancing overall system integrity and performance.

AI Impact Analysis on Automotive Optical Sensor IC Market

Common user inquiries concerning the impact of Artificial Intelligence on the Automotive Optical Sensor IC Market often revolve around how AI can enhance the processing and interpretation of raw sensor data, leading to more accurate and reliable environmental perception. Users frequently express interest in AI's role in reducing false positives from sensor outputs, improving object detection and classification in complex scenarios, and enabling predictive capabilities for autonomous navigation. There is also significant curiosity regarding the integration challenges between AI software and existing sensor hardware, the potential for AI to drive new sensor designs or optimize existing ones for specific tasks, and the implications for overall system cost and power consumption. Expectations are high for AI to unlock unprecedented levels of intelligence and adaptability in automotive sensing, especially for higher levels of autonomous driving, where real-time, robust decision-making is paramount.

- Enhanced data interpretation for complex driving scenarios, improving recognition of pedestrians, cyclists, and road signs under varied conditions.

- Improved object detection and classification accuracy by leveraging deep learning algorithms to process large volumes of visual and LiDAR data.

- Real-time decision-making capabilities in autonomous systems, enabling faster responses to dynamic changes in the driving environment.

- Personalized cabin experience through advanced gesture and eye-tracking, interpreting user intent with greater precision and responsiveness.

- Predictive maintenance for sensor systems, identifying potential failures or performance degradation before they impact vehicle safety.

- Reduction in latency for critical safety functions by optimizing data pathways and processing cycles within the sensor-to-ECU pipeline.

- Facilitation of sensor fusion, where AI algorithms combine data from multiple optical sensors (cameras, LiDAR) to create a more comprehensive and robust environmental model.

- Development of self-calibrating and adaptive sensor systems that can automatically adjust to changing light conditions or environmental factors.

DRO & Impact Forces Of Automotive Optical Sensor IC Market

The Automotive Optical Sensor IC Market is primarily driven by the escalating proliferation of Advanced Driver Assistance Systems (ADAS) in vehicles across all segments, propelled by increasing consumer demand for safety and convenience features, alongside stricter global automotive safety regulations. The rapid advancement and deployment of autonomous vehicle technologies, which rely heavily on sophisticated optical sensors for environmental perception, serve as a significant catalyst. Furthermore, the global shift towards electric vehicles (EVs) often integrates more advanced electronics and sensor arrays to differentiate product offerings and enhance efficiency. Government mandates and initiatives aimed at improving road safety and reducing accidents further reinforce the demand for these critical components. These factors collectively create a robust growth environment, pushing innovation and market expansion for optical sensor ICs.

Despite robust growth, the market faces several significant restraints. The inherently high cost associated with developing and integrating advanced optical sensor ICs, particularly those utilized in LiDAR and high-resolution camera systems, poses a barrier to broader adoption, especially in cost-sensitive vehicle segments. Complex integration challenges arise from the need to interface diverse sensor types with vehicle electronic control units (ECUs) and software stacks, requiring extensive calibration and validation. Cybersecurity concerns related to potential vulnerabilities in sensor data streams and communication networks represent a critical challenge, demanding robust security solutions. Furthermore, the lack of universal standardization across different manufacturers and regions complicates development and deployment efforts, while potential supply chain disruptions, as recently experienced in the semiconductor industry, can severely impact production and market availability.

Opportunities for market growth are abundant, particularly with the emergence of novel sensing technologies, such as solid-state LiDAR, which promises more compact, reliable, and cost-effective solutions compared to traditional mechanical systems. The expansion of infotainment and comfort systems within vehicle cabins, requiring advanced gesture recognition, eye-tracking, and ambient light control, presents new avenues for optical sensor applications. Integration with Vehicle-to-Everything (V2X) communication technologies offers potential synergies, enabling sensors to share and receive data from other vehicles and infrastructure, enhancing collective perception. Moreover, the increasing market for aftermarket upgrades and customization, where consumers seek to enhance older vehicles with modern ADAS and safety features, provides a supplementary revenue stream. These opportunities underscore a dynamic market landscape poised for continued innovation and diversified application.

Segmentation Analysis

The Automotive Optical Sensor IC Market is systematically segmented to provide granular insights into its diverse components and applications. This segmentation allows for a detailed analysis of market dynamics across various product types, specific automotive applications, different vehicle categories, and distinct sales channels. Understanding these segments is crucial for identifying key growth areas, tailoring product development strategies, and optimizing market entry approaches, reflecting the multifaceted nature of the automotive electronics ecosystem.

- By Product Type:

- Image Sensors (CMOS Image Sensors, CCD Sensors)

- LiDAR Sensors (MEMS-based LiDAR, Flash LiDAR, Optical Phased Array LiDAR)

- Infrared Sensors (Near-Infrared NIR Sensors, Thermal Infrared Sensors)

- Ambient Light Sensors

- Proximity Sensors

- Gesture Recognition Sensors

- Photodiodes and Phototransistors

- By Application:

- Advanced Driver Assistance Systems (ADAS)

- Safety Systems (Blind Spot Detection, Lane Departure Warning, Forward Collision Warning)

- Infotainment and Telematics (Display Brightness Control, Gesture Control)

- Body Electronics (Automatic Headlights, Rain-Sensing Wipers, Auto Dimming Mirrors)

- Cabin Monitoring Systems (Driver Drowsiness Detection, Occupant Sensing)

- Autonomous Driving

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks, Luxury Cars)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles, Buses, Trucks)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Automotive Optical Sensor IC Market

The value chain for the Automotive Optical Sensor IC Market begins with the upstream segment, which involves the foundational stages of material sourcing and component manufacturing. This includes suppliers of critical raw materials such as high-purity silicon wafers, specialized optical components like lenses and filters, and various chemicals required for semiconductor fabrication. Following this, the design houses, comprising both fabless semiconductor companies and integrated device manufacturers (IDMs), develop the intricate architectures and intellectual property for the optical sensor ICs. Foundries then undertake the complex manufacturing processes, converting designs into functional silicon chips. This upstream collaboration between material providers, design innovators, and fabrication experts is essential for producing the high-quality, high-performance sensor components demanded by the automotive industry.

Moving downstream, the value chain progresses through several layers of integration and assembly. Chip manufacturers supply the bare optical sensor ICs to module manufacturers, who then integrate these chips with other components such as lenses, imaging processors, and packaging to create complete sensor modules (e.g., camera modules, LiDAR units). These modules are subsequently acquired by Tier 1 automotive suppliers, who are responsible for designing, developing, and manufacturing larger automotive systems, such as ADAS units, infotainment platforms, or complete sensing packages. Tier 1s then deliver these integrated systems to automotive Original Equipment Manufacturers (OEMs), who incorporate them into the final vehicle assembly. This layered integration ensures that specialized components are bundled into functional subsystems before being fitted into the vehicle, streamlining the OEM assembly process.

Distribution channels for automotive optical sensor ICs are primarily categorized into direct and indirect routes. Direct sales are common for large-volume contracts, where chip manufacturers or module suppliers engage directly with major Tier 1 suppliers or automotive OEMs. This approach often involves highly customized solutions, long-term partnerships, and extensive technical support. Indirect channels primarily involve specialized distributors who act as intermediaries, supplying smaller automotive manufacturers, niche vehicle segments, or the burgeoning aftermarket. The aftermarket segment involves the sales of replacement parts, upgrades, or retrofit solutions, often through authorized dealers, independent garages, and online retailers. Both direct and indirect channels play crucial roles in ensuring the broad availability and efficient integration of optical sensor ICs across the diverse landscape of the automotive industry, catering to different scales of demand and levels of customization.

Automotive Optical Sensor IC Market Potential Customers

The primary potential customers and end-users of Automotive Optical Sensor ICs are diverse, reflecting the broad integration of these technologies across the automotive ecosystem. At the forefront are global automotive Original Equipment Manufacturers (OEMs) who are the ultimate buyers incorporating these advanced components into their vehicles during the design and manufacturing phases. These OEMs encompass a wide range of vehicle types, from passenger cars to commercial trucks and buses, including traditional internal combustion engine vehicles, electric vehicles, and hybrid models. Their demand is driven by the need to meet regulatory safety standards, introduce competitive ADAS features, and differentiate their offerings through technological innovation and enhanced driver and passenger experiences.

Another significant customer segment comprises Tier 1 automotive suppliers, which act as crucial intermediaries between semiconductor manufacturers and OEMs. Companies such as Bosch, Continental, ZF, Magna, and Valeo purchase optical sensor ICs from chipmakers, integrate them into complex modules and subsystems (e.g., complete camera systems, LiDAR units, radar modules, or in-cabin monitoring systems), and then supply these fully validated solutions to OEMs. These Tier 1 suppliers are instrumental in the value chain, handling the intricacies of sensor integration, software development, and system validation. Additionally, companies specializing in aftermarket solutions, independent garages, and research and development institutions focused on pioneering autonomous driving technologies and advanced vehicle safety systems also represent vital potential customers, continually seeking innovative optical sensor ICs for their projects and product portfolios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.35 Billion |

| Market Forecast in 2032 | USD 6.75 Billion |

| Growth Rate | 16.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ON Semiconductor, Sony Corporation, STMicroelectronics NV, Infineon Technologies AG, NXP Semiconductors NV, Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Magna International Inc., Valeo SA, Texas Instruments Incorporated, Renesas Electronics Corporation, Himax Technologies Inc., OmniVision Technologies Inc., ams OSRAM AG, Luminar Technologies Inc., Velodyne Lidar Inc., Mobileye (Intel Corporation), Sensata Technologies, Melexis N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Optical Sensor IC Market Key Technology Landscape

The Automotive Optical Sensor IC Market is characterized by a dynamic and evolving technology landscape, with continuous innovation driving performance enhancements and cost reductions. A cornerstone of this landscape is Complementary Metal-Oxide Semiconductor (CMOS) Image Sensor technology, which has become dominant due to its ability to provide high-resolution imaging with excellent low-light performance, crucial for ADAS camera systems. Advancements in pixel architecture, noise reduction, and high dynamic range (HDR) capabilities are continuously improving the fidelity of visual data captured, enabling more accurate object detection and scene understanding under challenging lighting conditions. The integration of on-chip processing and AI accelerators within CMOS image sensor ICs further enhances real-time image analysis, reducing latency and computational load on central ECUs, which is vital for quick decision-making in autonomous applications.

Another pivotal technology area is LiDAR (Light Detection and Ranging), which is rapidly evolving from bulky mechanical systems to more compact and robust solid-state solutions. Technologies such as Micro-Electro-Mechanical Systems (MEMS)-based LiDAR offer a balance of performance and size, enabling precise 3D mapping and ranging with fewer moving parts. Flash LiDAR, which illuminates an entire scene simultaneously, and Optical Phased Array (OPA) LiDAR, which uses phased arrays to steer light electronically without mechanical components, are at the forefront of development, promising further miniaturization, increased durability, and reduced cost. Time-of-Flight (ToF) sensors, both direct and indirect, are also gaining traction for proximity detection, gesture recognition, and accurate depth mapping, particularly for in-cabin applications and short-range obstacle detection, leveraging their simplicity and effectiveness in measuring distances.

Furthermore, the technology landscape includes sophisticated infrared LED and photodiode arrays, which are integral to gesture recognition systems and advanced cabin monitoring. These sensors utilize near-infrared light to detect movements, expressions, and even vital signs, enhancing both safety through driver attention monitoring and comfort through intuitive user interfaces. The increasing adoption of integrated photonics is paving the way for advanced optical systems, allowing for the consolidation of multiple optical components onto a single chip, leading to unprecedented levels of integration and performance. Moreover, the convergence of these diverse optical sensing technologies with powerful AI-powered sensor fusion algorithms is defining the next generation of automotive perception systems. These algorithms combine data from multiple optical sensors to create a more comprehensive, robust, and reliable environmental model, overcoming the limitations of individual sensor types and enabling higher levels of autonomous driving capabilities in complex and dynamic real-world scenarios.

Regional Highlights

- North America: This region is a significant driver for the Automotive Optical Sensor IC Market, characterized by early adoption of advanced ADAS features and substantial investment in autonomous vehicle research and development. The strong presence of technology giants and automotive innovators, particularly in the United States, fosters a culture of rapid technological integration. Consumer demand for high-tech safety features and connected vehicle experiences further propels market growth.

- Europe: Europe represents a mature market with stringent vehicle safety regulations, such as those imposed by Euro NCAP, which mandate the inclusion of advanced active safety systems. This regulatory environment directly stimulates the demand for sophisticated optical sensor ICs. The region also boasts a robust premium vehicle segment and a rapidly growing electric vehicle market, both of which integrate a high proportion of advanced sensing technologies for differentiation and compliance.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for automotive optical sensor ICs, primarily due to its position as the global hub for automotive manufacturing. Countries like China, Japan, South Korea, and India are witnessing aggressive adoption of electric vehicles and significant government support for smart mobility initiatives and autonomous driving pilots. This region benefits from a large consumer base, rapid urbanization, and a strong drive for technological leadership in the automotive sector, leading to substantial market expansion.

- Latin America: As an emerging market, Latin America shows increasing adoption of basic safety features in new vehicles, driven by evolving regional regulations and consumer awareness. The market for advanced optical sensor ICs is growing gradually, primarily within the mid-to-high-end vehicle segments. Future growth is anticipated as economic conditions improve and the penetration of modern vehicles equipped with ADAS features increases across the region.

- Middle East and Africa (MEA): The MEA region is characterized by gradual adoption of automotive optical sensor ICs, largely concentrated in luxury vehicle segments and through smart city initiatives in countries like the UAE and Saudi Arabia. Investments in infrastructure development and efforts to modernize transportation systems are expected to drive demand for advanced vehicle technologies, including optical sensors, in the long term, albeit from a smaller current base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Optical Sensor IC Market.- ON Semiconductor

- Sony Corporation

- STMicroelectronics NV

- Infineon Technologies AG

- NXP Semiconductors NV

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Magna International Inc.

- Valeo SA

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- Himax Technologies Inc.

- OmniVision Technologies Inc.

- ams OSRAM AG

- Luminar Technologies Inc.

- Velodyne Lidar Inc.

- Mobileye (Intel Corporation)

- Sensata Technologies

- Melexis N.V.

Frequently Asked Questions

What are the primary applications of Automotive Optical Sensor ICs?

Automotive Optical Sensor ICs are primarily used in Advanced Driver Assistance Systems (ADAS), safety systems like blind spot detection, infotainment for gesture control, cabin monitoring, and autonomous driving platforms for environmental perception and navigation.

How is AI impacting the Automotive Optical Sensor IC Market?

AI significantly enhances sensor data processing, improving object detection accuracy, enabling real-time decision-making, and facilitating advanced sensor fusion. It allows for more sophisticated perception and predictive capabilities crucial for autonomous vehicles.

What are the main challenges faced by this market?

Key challenges include the high cost of advanced sensors, complex integration requirements with vehicle systems, cybersecurity vulnerabilities, a lack of universal standardization across manufacturers, and potential disruptions in the global supply chain.

Which region holds the largest market share for Automotive Optical Sensor ICs?

The Asia Pacific region currently holds the largest market share, driven by its extensive automotive manufacturing base, rapid adoption of electric vehicles, and significant government investments in smart transportation technologies.

What emerging technologies are influencing the market growth?

Emerging technologies such as solid-state LiDAR, advanced CMOS image sensors with integrated AI, Time-of-Flight (ToF) sensors for depth sensing, and integrated photonics are significantly influencing market growth by offering more compact, reliable, and cost-effective solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager