Automotive Pedestrian Protection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428481 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Automotive Pedestrian Protection System Market Size

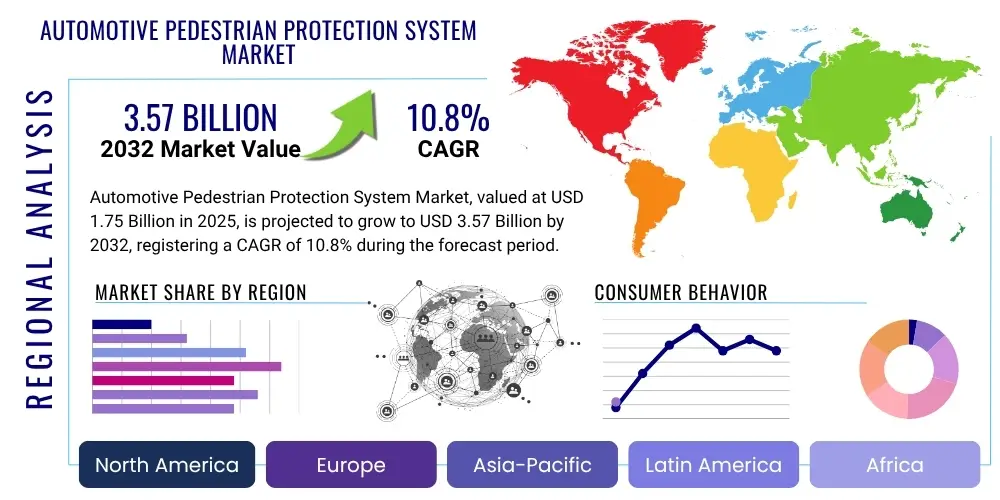

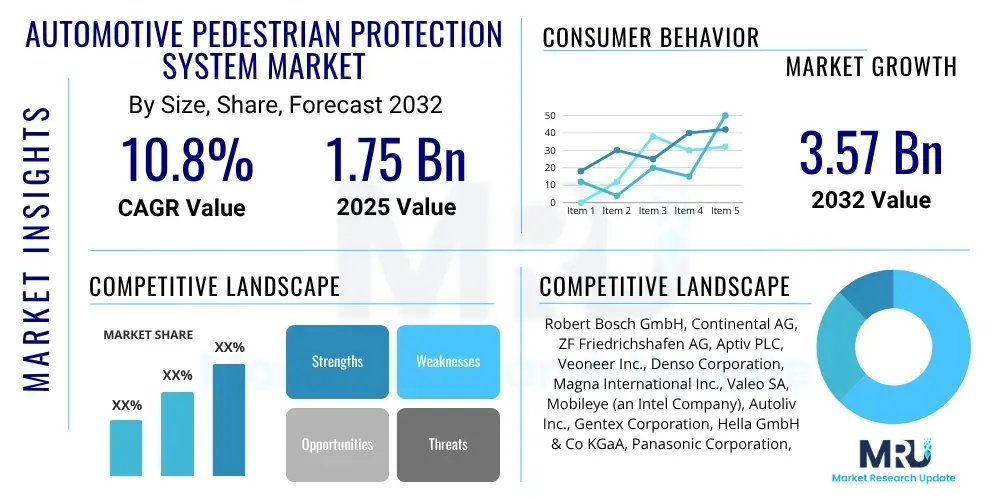

The Automotive Pedestrian Protection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2025 and 2032. The market is estimated at USD 1.75 Billion in 2025 and is projected to reach USD 3.57 Billion by the end of the forecast period in 2032.

Automotive Pedestrian Protection System Market introduction

The Automotive Pedestrian Protection System (APPS) market encompasses advanced safety technologies designed to mitigate injuries or prevent collisions between vehicles and pedestrians. These systems leverage a combination of sensors, sophisticated software, and actuators to detect the presence of pedestrians and initiate protective measures. The primary objective is to enhance pedestrian safety, a critical concern given the increasing urbanization and traffic density globally. APPS solutions are becoming an integral part of modern vehicle safety architecture, driven by stringent regulatory frameworks and growing consumer awareness regarding vehicle safety standards.

Products within this market range from active systems that alert drivers and intervene to avoid collisions, to passive systems that deploy upon impact to reduce injury severity. Active systems typically include radar, lidar, camera vision, and ultrasonic sensors that continuously monitor the vehicle's surroundings. Upon detecting a potential collision, these systems can provide audible or visual warnings, initiate automatic emergency braking (AEB), or assist the driver in steering to avoid the pedestrian. Passive systems, on the other hand, are designed to minimize harm if a collision is unavoidable. These often involve deployable safety features such as pop-up bonnets that create a crumple zone, external airbags, or specially designed bumper structures.

Major applications of Automotive Pedestrian Protection Systems are predominantly found in passenger vehicles across all segments, including sedans, SUVs, and luxury cars, with increasing adoption in commercial vehicles like trucks and buses. The benefits extend beyond direct injury reduction, encompassing improved vehicle safety ratings, compliance with international safety standards like Euro NCAP, and a significant reduction in insurance claims related to pedestrian accidents. Key driving factors propelling market growth include escalating road accidents involving pedestrians, particularly in developing economies, the relentless push for advanced driver assistance systems (ADAS) integration, and the continuous technological advancements in sensor fusion and artificial intelligence that enhance system reliability and performance.

Automotive Pedestrian Protection System Market Executive Summary

The Automotive Pedestrian Protection System market is experiencing robust growth, fueled by a convergence of business, regional, and segment trends that highlight an accelerating global emphasis on road safety. Business trends indicate a strong move towards integrated ADAS solutions, where APPS is a core component. Automotive Original Equipment Manufacturers (OEMs) are increasingly incorporating these systems as standard features, moving beyond premium vehicle offerings. There is also a significant trend towards strategic collaborations between sensor manufacturers, software developers, and Tier 1 automotive suppliers to innovate and improve system accuracy and cost-effectiveness. The aftermarket is also emerging as a viable segment, catering to older vehicle models and regions with less stringent OEM mandates.

Regional trends reveal Europe and North America as pioneers in APPS adoption, largely due to stringent pedestrian safety regulations such as those enforced by Euro NCAP and the National Highway Traffic Safety Administration (NHTSA). These regions demonstrate high penetration rates and continued investment in research and development for next-generation systems. Asia Pacific, particularly countries like China, Japan, and India, represents a rapidly expanding market. This growth is driven by increasing vehicle production, a rise in disposable incomes, growing awareness of road safety, and government initiatives to curb pedestrian fatalities. Latin America and the Middle East and Africa regions are expected to follow suit, albeit at a slower pace, as infrastructure development and safety standards evolve.

Segment trends within the APPS market show a clear progression towards more sophisticated active systems that utilize advanced sensor fusion technologies. Camera-based systems, often combined with radar and lidar, are gaining prominence due to their ability to provide comprehensive environmental perception. The focus is on improving detection capabilities in challenging conditions such as low light, adverse weather, and complex urban environments. Furthermore, there is a growing demand for systems that can differentiate between various objects (pedestrians, cyclists, animals) and predict their trajectories more accurately. Passive systems, while crucial, are evolving to be more intelligent, with rapid deployment mechanisms triggered by advanced pre-crash sensing. The integration of APPS with autonomous driving platforms is also a significant segment trend, as these systems are fundamental for safe autonomous vehicle operation.

AI Impact Analysis on Automotive Pedestrian Protection System Market

Common user questions regarding AI's impact on the Automotive Pedestrian Protection System market frequently revolve around its ability to enhance detection accuracy, minimize false positives, and enable predictive capabilities. Users are keen to understand how AI contributes to differentiating between humans and other objects, operating effectively in diverse weather and lighting conditions, and ultimately improving overall system reliability. Concerns also arise regarding the ethical implications of AI decision-making in critical situations, the security of vehicle data, and the complexity and cost associated with integrating advanced AI algorithms into existing vehicle architectures. Expectations are high for AI to deliver robust, intelligent systems capable of anticipating pedestrian movements and interacting seamlessly with other ADAS features for holistic safety.

- AI significantly enhances pedestrian detection accuracy and classification through deep learning algorithms trained on vast datasets of pedestrian images and movements.

- Predictive analytics powered by AI allows systems to anticipate pedestrian trajectories and potential collision risks, enabling earlier and more effective intervention.

- AI-driven sensor fusion algorithms combine data from multiple sensor types (camera, radar, lidar) to create a more robust and reliable environmental model, reducing false positives.

- Machine learning models enable APPS to adapt and improve performance over time, learning from real-world scenarios and varying environmental conditions.

- AI facilitates the development of intelligent braking and steering assistance systems that can make more nuanced and context-aware decisions in critical pedestrian-involved situations.

- It supports the integration of APPS with vehicle-to-everything (V2X) communication, allowing vehicles to receive information about pedestrians from external sources, enhancing situational awareness.

- AI plays a crucial role in validating and testing complex APPS scenarios, enabling more efficient development and certification processes.

DRO & Impact Forces Of Automotive Pedestrian Protection System Market

The Automotive Pedestrian Protection System market is propelled by strong drivers, faces notable restraints, and presents significant opportunities, all influenced by various impact forces shaping its trajectory. A primary driver is the global escalation in road traffic fatalities and injuries involving pedestrians, which has spurred governments and regulatory bodies worldwide to mandate the integration of advanced safety features. Increasing consumer awareness about vehicle safety ratings, coupled with a demand for safer vehicles, also significantly contributes to market expansion. The continuous evolution and integration of Advanced Driver Assistance Systems (ADAS) further bolster the APPS market, as pedestrian protection is a fundamental component of autonomous driving capabilities. Furthermore, technological advancements in sensor technology, processing power, and artificial intelligence are enabling more effective and reliable systems.

However, the market is constrained by several factors. The high cost associated with implementing sophisticated APPS, particularly in entry-level and mid-range vehicle segments, remains a significant barrier to widespread adoption. The complexity of integrating multiple sensor types and intricate software algorithms into vehicle architectures poses technical challenges for OEMs. Additionally, the performance of these systems can be hampered by environmental factors such as heavy rain, fog, snow, or direct sunlight, leading to potential sensor limitations and false positives or negatives. Consumer perception regarding the reliability of autonomous emergency braking in all conditions can also be a restraint, necessitating extensive public education and demonstrable performance.

Opportunities for growth are abundant within the APPS market. The expansion into emerging automotive markets, where road safety regulations are progressively becoming more stringent, offers significant potential. The development of next-generation autonomous vehicles inherently requires robust pedestrian protection, opening avenues for advanced AI-driven solutions and sensor fusion. Furthermore, the aftermarket segment presents an opportunity for retrofitting older vehicles with basic APPS functionalities, enhancing safety for a broader installed base. Innovation in V2X (Vehicle-to-Everything) communication technology, allowing vehicles to communicate with pedestrians via smartphones or wearables, could also create new opportunities for preemptive protection. Impact forces on the market include evolving regulatory landscapes, technological innovation cycles, shifting consumer preferences towards safety, competitive pressures among automotive manufacturers, and the overall economic conditions influencing vehicle sales and R&D investments.

Segmentation Analysis

The Automotive Pedestrian Protection System market is comprehensively segmented to provide a detailed understanding of its diverse components and applications. These segmentations allow for a granular analysis of market dynamics, technology adoption rates, and regional preferences, offering insights into key growth areas and competitive landscapes. The market can be broadly categorized based on the type of system employed, the specific components that constitute these systems, the different vehicle types they are integrated into, and the primary sales channels through which they reach end-users. Each segment plays a crucial role in defining the market's structure and future growth trajectories.

- By Type

- Active Pedestrian Protection System (P-APS)

- Passive Pedestrian Protection System (P-APS)

- By Component

- Sensors (Radar, Lidar, Camera, Ultrasonic, Infrared)

- Electronic Control Units (ECUs)

- Actuators (Brakes, Steering, Deployable Hoods, External Airbags)

- Software & Algorithms

- By Technology

- Automatic Emergency Braking (AEB)

- Pedestrian Detection with Steering Assist

- Head-Up Display Warnings

- Pop-up Bonnets

- External Airbags

- Reversible Actuation Systems

- By Vehicle Type

- Passenger Cars (Sedans, SUVs, Hatchbacks, Luxury Vehicles)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Automotive Pedestrian Protection System Market

The value chain for the Automotive Pedestrian Protection System market is intricate, involving multiple stages from raw material sourcing to end-user deployment and ongoing service. The upstream segment of the value chain is dominated by highly specialized component manufacturers and raw material suppliers. These entities provide critical inputs such as semiconductors for ECUs, specialized materials for sensor housings, optical lenses for cameras, and advanced alloys for actuators. Companies in this segment focus on innovation in materials science and microelectronics, ensuring the foundational technologies for APPS are robust, miniaturized, and cost-effective. Their ability to deliver high-quality, reliable components directly impacts the performance and cost of the final APPS.

Moving downstream, the value chain involves Tier 1 suppliers who integrate these components into complete APPS modules, and then the automotive OEMs who incorporate these modules into their vehicles. Tier 1 suppliers, such as Continental, Bosch, and ZF, play a pivotal role in system design, software development, sensor fusion, and calibration. They develop the complex algorithms that process sensor data to detect pedestrians and initiate protective actions. OEMs then integrate these sophisticated systems into their vehicle platforms, often customizing them to align with their brand's safety philosophy and vehicle architecture. The distribution channel primarily involves direct sales from OEMs to consumers through dealerships, where APPS are offered as standard or optional features. Indirect channels include the aftermarket, where specialized suppliers and installers provide APPS upgrades or replacements, though this segment is comparatively smaller due to the complexity of integration.

The interplay between upstream and downstream participants is characterized by close collaboration and stringent quality control. Direct channels dominate the market as most advanced APPS are factory-installed during vehicle production, ensuring optimal integration and calibration with other vehicle systems. Indirect channels, while smaller, cater to consumers looking to enhance the safety features of their existing vehicles or replace damaged components. This segment often relies on specialized installers and authorized service centers that possess the technical expertise required for complex system integration. The entire value chain is driven by continuous innovation, regulatory compliance, and the relentless pursuit of enhancing pedestrian safety through advanced technological solutions.

Automotive Pedestrian Protection System Market Potential Customers

The primary potential customers for Automotive Pedestrian Protection Systems are multifaceted, encompassing a wide range of entities with varying needs and purchasing motivations. At the forefront are automotive Original Equipment Manufacturers (OEMs), who integrate these systems directly into new vehicles during the manufacturing process. These OEMs are driven by stringent safety regulations, the desire to achieve high safety ratings (e.g., Euro NCAP, NHTSA), and a competitive need to offer advanced safety features to consumers. Their procurement decisions are influenced by technological sophistication, cost-effectiveness, reliability, and the ability to seamlessly integrate APPS with other ADAS and autonomous driving functionalities. Their focus is on delivering comprehensive vehicle safety packages to enhance their brand reputation and meet market demands.

Beyond OEMs, individual vehicle owners constitute a significant end-user segment. While many APPS are factory-installed, there is a growing segment of consumers who actively seek out vehicles equipped with these advanced safety features due to increasing awareness of road safety and personal well-being. This demographic is often willing to pay a premium for enhanced protection, driven by concerns for their own safety and that of their families, as well as a desire to mitigate accident risks. For these individuals, the benefits of reduced injury risk, potentially lower insurance premiums, and peace of mind are key purchasing drivers. They might also explore aftermarket solutions for their existing vehicles, although this currently represents a smaller portion of the market due to installation complexities.

Fleet operators, including ride-sharing companies, logistics firms, public transportation providers, and government agencies managing vehicle fleets, also represent a substantial customer base. These entities prioritize APPS to reduce operational risks, minimize accident-related downtime, lower insurance costs, and protect their drivers and the public. For fleet managers, the deployment of APPS translates into tangible economic benefits through reduced liability and improved fleet safety records. Furthermore, regulatory bodies and road safety organizations indirectly influence demand by establishing safety standards and promoting public awareness, thereby pressuring OEMs and consumers towards adopting these protective technologies. The continuous evolution of safety mandates ensures that APPS remains a critical consideration across all these customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.75 Billion |

| Market Forecast in 2032 | USD 3.57 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Aptiv PLC, Veoneer Inc., Denso Corporation, Magna International Inc., Valeo SA, Mobileye (an Intel Company), Autoliv Inc., Gentex Corporation, Hella GmbH & Co KGaA, Panasonic Corporation, Hyundai Mobis, NXP Semiconductors N.V., Infineon Technologies AG, Texas Instruments Incorporated, Analog Devices Inc., Aisin Seiki Co Ltd, Fujitsu Ten Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Pedestrian Protection System Market Key Technology Landscape

The Automotive Pedestrian Protection System market is characterized by a dynamic and rapidly evolving technology landscape, with continuous advancements aimed at improving detection accuracy, reliability, and response times. The core of these systems relies on sophisticated sensor technologies, primarily radar, lidar, and camera vision systems. Radar sensors are highly effective in detecting objects and determining their distance and speed, even in adverse weather conditions. Lidar technology offers precise 3D mapping of the environment, crucial for object recognition and classification, though its performance can be affected by fog or heavy rain. Camera vision systems provide detailed visual information, enabling the identification of pedestrians, their posture, and direction of movement through advanced image processing algorithms, often supported by artificial intelligence and machine learning.

Sensor fusion is a pivotal technological development within APPS, where data from multiple sensor types are combined and processed to create a comprehensive and robust understanding of the vehicle's surroundings. This integration helps to overcome the individual limitations of each sensor, enhancing overall system accuracy and reducing the likelihood of false positives or missed detections. Advanced Electronic Control Units (ECUs) and high-performance processors are essential to handle the massive amounts of data generated by these sensors and execute complex algorithms in real-time. Machine learning and deep learning algorithms are increasingly employed to train systems to recognize various pedestrian behaviors, differentiate between pedestrians and other objects, and predict their future trajectories with greater precision, thus enabling more intelligent and proactive safety measures.

Beyond detection, the technology landscape also includes various actuation mechanisms designed to prevent or mitigate impact. Automatic Emergency Braking (AEB) systems utilize hydraulic or electric brakes to autonomously apply stopping force when a collision is imminent and the driver fails to respond. Steering assist systems can subtly adjust the vehicle's path to avoid a pedestrian if there is sufficient space. Passive protection technologies, such as deployable or pop-up bonnets and external airbags, are designed to reduce the severity of injuries upon impact by creating a softer landing zone or cushioning the pedestrian. Furthermore, the integration of V2X communication (Vehicle-to-Everything) and connectivity solutions is emerging as a critical technology, allowing vehicles to receive information about pedestrians from connected devices or infrastructure, offering an additional layer of preemptive protection.

Regional Highlights

- North America: This region is a significant market for Automotive Pedestrian Protection Systems, driven by a strong focus on advanced driver assistance systems (ADAS) and high consumer demand for safety features. Regulations from agencies like the National Highway Traffic Safety Administration (NHTSA) and initiatives by organizations like the Insurance Institute for Highway Safety (IIHS) encourage the adoption of these technologies. The presence of major automotive OEMs and Tier 1 suppliers, along with robust R&D infrastructure, further supports market growth.

- Europe: Europe leads the global market in terms of APPS adoption, largely due to stringent pedestrian safety regulations enforced by Euro NCAP, which heavily incentivizes car manufacturers to include advanced pedestrian detection and collision avoidance systems to achieve high safety ratings. Countries like Germany, France, and the UK are at the forefront of implementing these technologies. High consumer awareness and a strong push towards autonomous driving also contribute to market expansion.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate in the APPS market, fueled by rapid urbanization, increasing vehicle production and sales, and a rising incidence of road accidents involving pedestrians in countries like China, India, and Japan. Governments in these nations are increasingly implementing stricter safety regulations and promoting ADAS adoption. The growing middle class and increasing disposable incomes also contribute to the demand for safer vehicles.

- Latin America: This region is an emerging market for APPS, with gradual adoption driven by improving economic conditions and a growing awareness of vehicle safety. While regulatory frameworks are still developing compared to more mature markets, the influence of global safety standards and the entry of international OEMs are pushing the integration of pedestrian protection systems in new vehicle models.

- Middle East and Africa (MEA): The MEA region is expected to witness steady growth in the APPS market. This growth is primarily influenced by increasing investments in road infrastructure, a rising automotive market, and a gradual shift towards stricter vehicle safety standards, particularly in affluent Gulf Cooperation Council (GCC) countries. The demand for premium and luxury vehicles, which often feature advanced safety systems as standard, also contributes to market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Pedestrian Protection System Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Aptiv PLC

- Veoneer Inc.

- Denso Corporation

- Magna International Inc.

- Valeo SA

- Mobileye (an Intel Company)

- Autoliv Inc.

- Gentex Corporation

- Hella GmbH & Co KGaA

- Panasonic Corporation

- Hyundai Mobis

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Texas Instruments Incorporated

- Analog Devices Inc.

- Aisin Seiki Co Ltd

- Fujitsu Ten Limited

Frequently Asked Questions

What is an Automotive Pedestrian Protection System?

An Automotive Pedestrian Protection System (APPS) is a safety feature designed to either prevent collisions with pedestrians or mitigate the severity of injuries if an impact occurs. It comprises active components like sensors and automatic emergency braking, and passive elements such as pop-up bonnets and external airbags.

How does AI enhance Automotive Pedestrian Protection Systems?

AI significantly enhances APPS by improving detection accuracy and classification of pedestrians, enabling predictive analysis of trajectories, and facilitating robust sensor fusion for better environmental perception. This leads to fewer false positives and more intelligent, timely interventions.

What are the primary types of Automotive Pedestrian Protection Systems?

The primary types are Active Pedestrian Protection Systems, which use sensors to detect and prevent collisions (e.g., Automatic Emergency Braking), and Passive Pedestrian Protection Systems, which deploy upon impact to reduce injury severity (e.g., pop-up bonnets, external airbags).

What are the key drivers for the growth of the Automotive Pedestrian Protection System market?

Key drivers include stringent global safety regulations, a rising number of pedestrian fatalities, increasing consumer awareness about vehicle safety, and the continuous integration of these systems into broader Advanced Driver Assistance Systems (ADAS).

What are the main challenges in implementing Automotive Pedestrian Protection Systems?

Main challenges involve the high cost of advanced components, the complexity of integrating diverse sensor technologies and software, limitations in sensor performance under adverse weather conditions, and the potential for false positive or negative detections.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager